AGM Alts Weekly | 10.13.24

AGM Alts Weekly #73: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Designed with GPs at heart and LPs in mind, the bunch operating system, coupled with an advanced workflow management tool, is designed to streamline and automate cumbersome back-office processes and become the single source of truth for you to collaborate with your service providers.

With over 50 fund clients and $3 billion in committed transactions across five jurisdictions in Europe, bunch has a proven track record of freeing up valuable time for fund teams by taking over the fund administration so you can focus on what truly matters: maximizing returns and enhancing the LP experience.

Good afternoon from London, where I’ve spent the week in meetings, speaking at Preqin’s Future of Alternatives conference, interviewing Blackstone’s Global COO of Private Wealth Solutions Todd Myers at a fireside chat hosted by the Finimize team, and joining Citywire’s Selin Bucak in their studio for an interview on the wealth channel’s participation in private markets.

A recurring theme threaded throughout the week’s conversation: the increasingly important role of the wealth channel in private markets. That in and of itself isn’t a surprise. The wealth channel is one of the top — if not the top — priority for many of the industry’s largest alternatives and traditional managers, as evidenced by Blackstone’s concerted effort to build out a 300+ person team to serve wealth globally or Apollo’s recently revealed goal of hitting $150B AUM from the wealth channel by 2029, which would be 50% of their annual third-party capital raising volume.

What struck me, though, was a thoughtfully worded question from Selin about the investors that alternative asset managers are focusing on within the wealth channel. She asked, “we talk about the democratization push in private markets, but how much are you seeing firms focus on wealthy individuals versus actual retail investors?”

Words matter. A few weeks ago, in the 9.22.24 AGM Alts Weekly, I wrote about how the words that alternative asset managers are using is shaping the change we are seeing in private markets. Apollo CEO Marc Rowan referenced this shift in a recent CNBC interview when he said:

“I think we are going to start to change our nomenclature.”

What we call things impacts how we think about things.

And, how we define things matters too. That is why we need to understand and unpack the differences between “wealth” and “retail.”

Wealth and Retail

The topic of wealth and retail came up in virtually all of my conversations and events this week. What they mean, however, could determine the future of private markets fundraising.

This was a topic that was covered at length in the conversation that Preqin’s Cameron Joyce deftly moderated between Blue Owl’s Cara Griffiths, Bain Capital’s Tom Sargeant, and myself at Preqin’s Future of Alternatives event.

Preqin’s CEO Christoph Knaack and Global Head of Research Insights Cameron kicked off the day by sharing their annual window into the future of private markets fundraising. $29.2T AUM by 2029 and $30T AUM by 2030, up from $16.8T AUM at the end of 2023 is what their research projects.

The question Cameron asked is a critical one to understanding the future of private markets: Where will the growth in AUM come from?

Cara and Tom, both of whom work at some of the largest alternative asset managers in the industry and have a window into what the largest LPs are thinking and doing, questioned whether institutions will continue to allocate increasing amounts of capital to private markets from the exposure levels they have today. Surely, institutions are a critical and major part of private markets, but it appears that the growth will come from the wealth channel.

The question, then, is what is the wealth channel? And how much will the wealth channel contribute to private markets AUM.

Will it be this much?

… or this much?

What is the wealth channel?

What exactly is the wealth channel?

Institutional LPs are certainly not monolithic either — and are far from easy to sell to — but I’d argue that it’s an easier and more well-defined sales process for alternative asset managers than is the wealth channel.

While the sales process for institutional LPs is easier and more well-defined than that of the wealth channel, institutional LPs’ investment process and allocation behavior may differ based on size, investment team, geography, and investment mandate / goals. In many cases, the educational curve is lower and a large distribution or IR team isn’t always required to cover these types of LPs.

That’s far from the case with the wealth channel. Why?

Yes, the size of the wealth channel rivals that of the institutional channel, as the Bain & Company Global Private Equity Report from 2023 illustrated.

The wealth channel is a more disaggregated set of investors who require different service models and products based on the investor type.

It’s important to unpack the definitions of wealth and retail — both for the purposes of product creation and product distribution.

Creating proper definitions and categorizations will help move the space forward. It will enable firms to figure out where they want to strategically position themselves, where they want to spend meaningful time, resources, and dollars on marketing and distribution, where they want to build product and how they want to build it, and where they want to acquire firms.

Categorizing wealth

Let’s break down the wealth channel.

While the majority of the wealth channel is completely un- or under-allocated to private markets, there are pockets of the wealth channel that have been major allocators to private markets. That’s the UHNW and family office category.

UHNW and Family Offices

UNHWs and family offices often have the size and scale to allocate to private markets. While there are varying definitions and characterizations of a family office, having a family office generally means that there are $100M+ of investable assets. These offices could either be a single-family office, which represent a single principal or asset owner, or a multi-family office, which spans a group of families. Some family offices are more sophisticated than others. Some spend millions per year on hiring a team and building out infrastructure to have a CIO and investment team that look more akin to an institutional allocator. Others might be the principal and one or two team members handling investments, even at hundreds of millions or billions in AUM. As the saying goes, “when you know one family office, you know one family office.”

Campden Wealth / Titanbay’s UHNW Private Equity Investing Report from 2023 highlights how much exposure, roughly speaking, 120 UHNW investors’ portfolio asset allocation was in 2023.

Only 36% was in public equities (26%) and fixed income (10%). 20% was allocated to private equity, another 5% to private debt.

These investors within the wealth channel have often long allocated to private markets. They have the liquidity and long-term investing horizons, often generations, to go long duration and illiquidity in exchange for potentially higher returns.

Many family offices have been able to access alternative asset managers’ funds, either directly or through private bank relationships, but these investors still require their own coverage model. That’s why it shouldn’t be surprising that firms like Apollo staffed up to build a dedicated family office coverage team in 2023, hiring Brian Feurtado from BlackRock to lead the initiative along with assembling a ten-person team. Feurtado said at the time of joining that: “We’ve had family office clients here over the years since the founding of Apollo, but the family office client base has grown to a point where we decided to have a dedicated team. So many wealthy families are still underweight in private assets.”

Private banks

Private banks also vary in terms of their resources and sophistication level in private markets. Some of the largest private banks have had concerted efforts — and large menus of products — for their HNW and UHNW clients to access alternative asset managers.

But while even the most active private banks are allocators to the industry’s largest funds, sometimes to the tune of raising billions of dollars for a single fund, even they are under-penetrated when it comes to advisor adoption of private markets products amongst the majority of their advisor population.

I made the comment this week that it’s probably not even the 80/20 rule (where 80% of the flows / dollars allocated from private bank advisors are made by 20% of the advisors). The response I got from someone who has been in both a private bank seat and an alternative asset manager seat? “It might not even be 95/5.”

The sentiment that many advisors have yet to adopt private markets products is very real amongst those at both alternative asset managers and private banks. Even the largest wirehouses have meaningful whitespace in terms of widespread advisor adoption of private markets products.

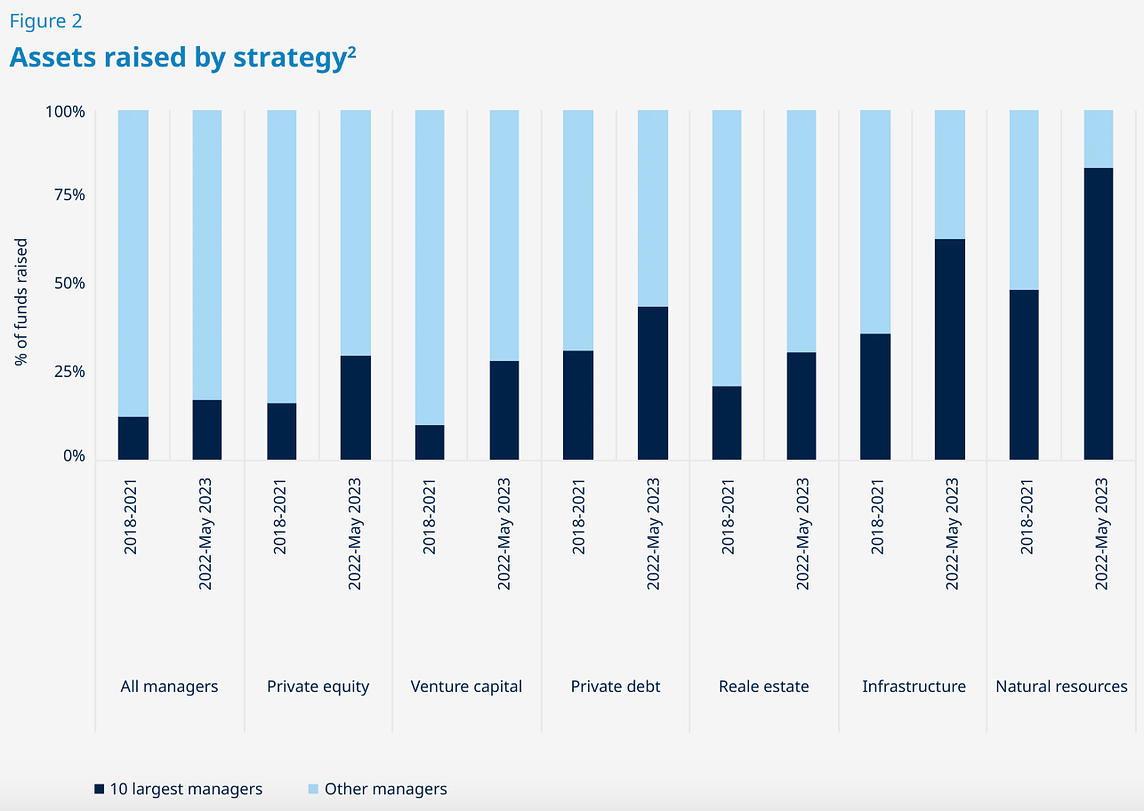

The benefit will likely accrue to the alternative asset managers that have the most recognizable brands and the biggest (and most experienced and educated) distribution teams. This notion favors the largest firms. They will likely raise a disproportionate amount of the capital from the wealth channel, as Cara noted on the panel, citing research they’ve done at Blue Owl that finds that the top ten alternative asset managers in each strategy have raised the majority of the capital.

This doesn’t mean that managers that aren’t the publicly traded firms or the scaled platforms can’t have success with private banks.

There’s a universe of private banks outside of the UBS’s, Merrill Lynch’s, Goldman Sachs’, JP Morgan’s, and Morgan Stanley’s. There are smaller, more boutique private banks and regional banks (across the US) that will need to continue to find ways to attract and retain wealth clients.

Perhaps smaller firms and more niche strategies or the promise of exclusivity to that specific bank could resonate with wealth firms that are looking to differentiate.

RIAs / wealth managers

A few months ago, I wrote that the wirehouses will continue to produce the lion’s share of the asset flows into private markets. There are structural reasons as to why that’s the case.

In the 3.3.24 AGM Alts Weekly, I wrote:

Wirehouses will continue to provide the lion’s share of asset flows into alternative asset managers. Structural reasons persist. Alternatives are still very much sold rather than bought — and the structure that wirehouses have to diligence, onboard, approve, offer, and distribute private markets products through their advisor channels is much more uniform and structured than it is in many parts of the independent RIA channel. A September 2023 whitepaper and survey on advisor adoption of alternatives by Invesco, Cerulli Associates, and IWI highlight that the majority of branch network advisors are more likely to have access to an alternative investments portal (54% of advisors) than are independent advisors (21%).

Structural differences like the ones above illustrate that it’s easier for alternatives products to be distributed through wirehouse / private bank channels.

It also shouldn’t be lost on advisors (and those selling to advisors) the power of a “recommended list.” Many advisors want to make fewer choices, not more. And, they also have to spend a large portion of their time focused on other activities that grow or maintain their business, like new client development, client service, and managing entire investment portfolios that span both public and private markets investments. Many independent advisor practices, particularly those that are smaller independent firms and even larger practices that may only have a few resources dedicated to manager research or private markets, aren’t equipped to handle the breadth and depth of the alternatives space across managers and strategies. Wirehouses and private banks certainly make it easier for advisors to find, evaluate, and allocate to alternatives products by providing a recommended list of curated products, education, research and diligence support, and an investment portal. Sure, there are good arguments as to why an advisor would choose to go independent and why a client would want to work with an independent advisor. But in terms of alternatives distribution, wirehouses are plugged into all the right pieces of the alternatives puzzle to unlock flows into private markets products.

These structural considerations make it harder for alternative asset managers to cover the RIA channel. That’s, in part, why the biggest and most well-resourced alternative asset managers have focused their efforts on the private bank channel with much success.

But it doesn’t mean that the RIA channel won’t feature prominently going forward.

The RIA market is large, growing, and consolidating. Cerulli estimates that there’s over $8T (as of 2021) residing in RIAs. This figure should only continue to grow as the independent wealth space continues on its upward trajectory.

In fact, there’s a subset of RIAs, the large platforms, that will require a sales process that resembles that with the private banks.

On 3.3.24, I wrote:

Despite the fact that the wirehouse channel has structural features that make it easier for advisors to allocate to alternatives, the RIA channel is far from impenetrable. There is a class of RIAs — rollup platforms (i.e., Focus, HighTower, Dynasty, etc.), hybrid platforms (i.e., Osaic, Arax, etc.), and “super RIAs” (i.e.e, Rockefeller, Captrust, Cerity, Cresset, NewEdge, etc.) — that have the size and scale to create the infrastructure that resembles a wirehouse structure. These platforms provide many of the same features for independent advisors they were afforded at wirehouses: a recommended list, diligence infrastructure, and an investment portal.

Wealth management continues to consolidate into a cohort of large platforms, not too dissimilar from the evolution of the business of alternative asset management itself, so alternative asset managers will benefit from centralization of diligence functions and larger-scaled platforms as they develop the appropriate strategy for their firm to cover the RIA channel.

Again, signs point towards the largest alternative asset managers having the most success with the scaled RIA platforms. The larger alternative asset managers have the resources to deploy more “troops,” as $99.9B AUM / AUA Pantheon Partner Susan McAndrews said in a written interview in the 7.14.24 AGM Alts Weekly, so firms will have to “pick [their] bets and then hire the best troops [they] can find” to cover this channel successfully.

But could other entrants succeed? After all, it’s the traditional asset managers that have the relationships with large swathes of the RIA and wealth channel. I wouldn’t bet against BlackRock, which continues to be making a major push into private markets, following multi-billion dollar acquisitions of GIP and Preqin with a possible acquisition of $117B private credit firm HPS Partners. Franklin Templeton, which had meaningful success in the wealth channel with the most recent $22B fund of secondaries firm, Lexington Partners, which they acquired for $1.75B in 2021, is also proof that traditional asset managers could be prominent players in the RIA market due to their distinct, long-standing relationship and brand advantages with this channel.

This part of the market might be few winners take most, but it won’t be winner-take-all due to the disaggregated and independent nature of RIAs and platforms. Each platform will look to differentiate, which means that no one alternative asset manager (or traditional asset manager — for that matter) will own this space. Still, firms that have both the coverage models and the ability to insert their products into model portfolios — or partner to build model portfolios, as BlackRock and Partners Group are doing, could tilt odds in their favor.

Affluent and Mass-Affluent

The affluent and mass-affluent market is one of the biggest opportunities for alternative asset managers but also one of the hardest to crack.

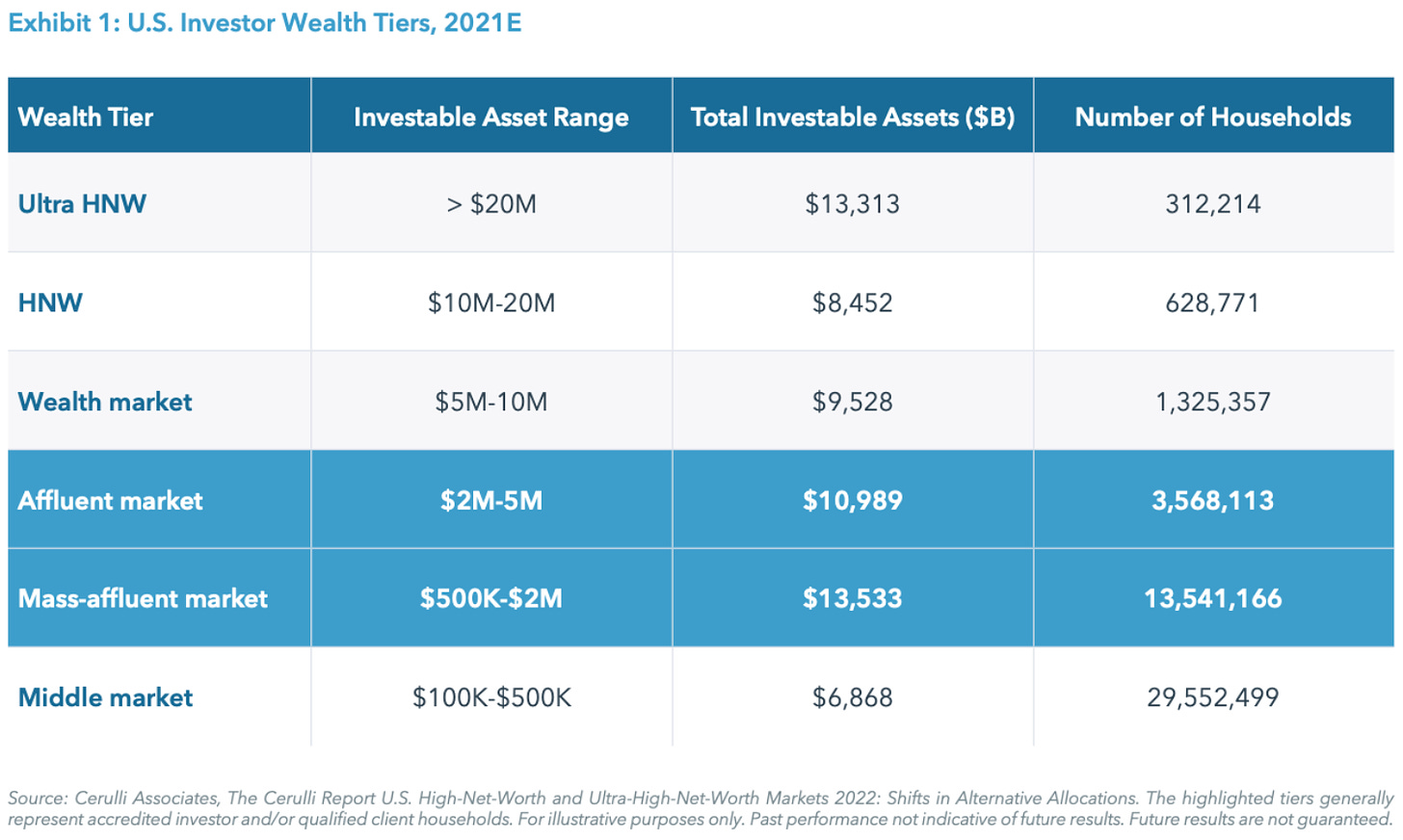

This market overlaps with the RIA / wealth channel. Some, if not many, in the affluent market ($2-5M in investable assets) and some in the mass-affluent market ($500K-2M in investable assets) will have advisors, and their investment decisions and asset allocation will be advisor-directed. Others, increasingly so, particularly younger cohorts, might look to their brokerage platforms like Fidelity or Schwab or digital neo-brokers / neo-banks like SoFi, Revolut, and others to gain access to private markets products.

The challenge for alternative asset managers is that they need to have the resources and scale to invest in product innovation and distribution. This channel will likely access private markets through evergreen and semi-liquid funds. Building, productizing, and distributing these products requires a serious lift of both distribution and marketing / branding efforts. Again, the benefits of scale mean that the largest funds will likely have the most success here, particularly those that are publicly traded, as they will have the brand that will resonate with the mass-affluent investor and the currency to invest in distribution resources.

There’s a lot to play for. $24.5T across 17M US households, according to iCapital and Hamilton Lane, as they wrote in their paper The Future is Evergreen.

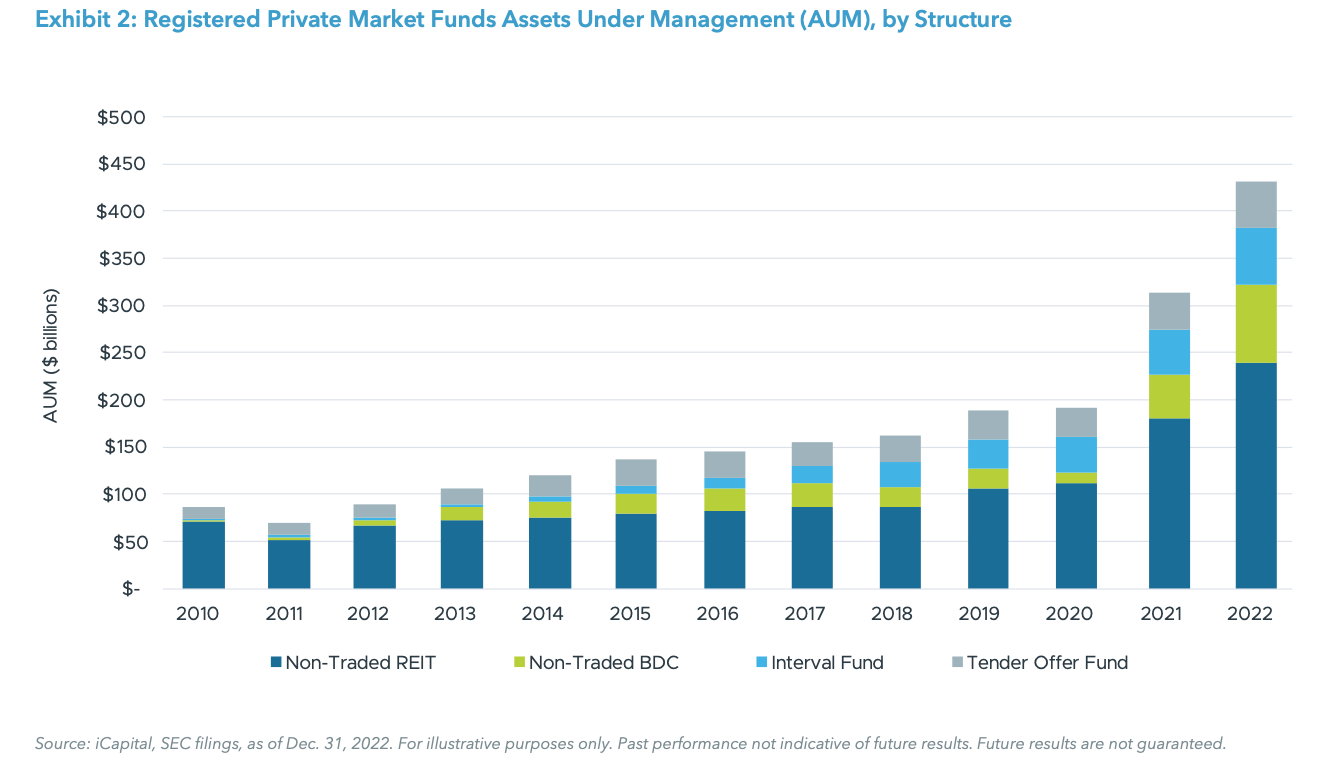

It’s no surprise that the rise in registered products has seen marked growth in order to address this market. A chart from iCapital and Hamilton Lane’s paper highlights this market’s rapid ascent.

Where wealth and retail intersect

The affluent and mass-affluent market is where wealth and retail intersect.

This part of the wealth channel likely covers both “wealth” and “retail” in terms of how this part of the market needs to be served.

Alternative asset managers will need to cover the wealth managers that cater to this affluent and mass-affluent client population. But for much of this channel, they will also need to invest to build their brand with the end client, almost thinking of this as a “consumer” or “retail” sales effort from a marketing perspective.

Building a brand requires its own focus and upskilling effort. This initiative won’t be for every alternative asset manager — and that’s fine. It will likely reside in the domain of the largest alternative asset managers that have chosen to go public or have grown so big in AUM as a privately held firm that they have built a recognizable brand.

Traditional asset managers also have an edge here. They’ve spent decades, in many cases, building a brand with the wealth and retail channels. That investment and effort may bear fruit in the coming years as the lines between private and public become more blurred.

The brokerages that could go for broke

The firms that could completely change the dynamics of asset flows into private markets are the firms that are just beginning to dip their toes into the water. They represent trillions in AUM of self-directed assets.

Over the course of this year, Schwab and Fidelity have announced the buildouts of their private markets platforms. Vanguard already moved into the space a few years ago, partnering with HarbourVest to offer access to a HarbourVest fund to the HNW portion of their client base.

Charles Schwab has ~$9.41T AUM and ~36.5M active brokerage accounts.

Vanguard has ~$8.6T in managed assets and over ~50M active accounts.

Fidelity has ~$5.3T AUM and over ~50M active accounts.

They own the customer. They enable self-directed activity in brokerage accounts. They have conditioned independent investors to click to buy single stocks and ETFs.

Why couldn’t the same happen with private markets products? What if Schwab, Fidelity, and Vanguard embedded the ability to click-to-buy private markets strategies into their brokerage platforms?

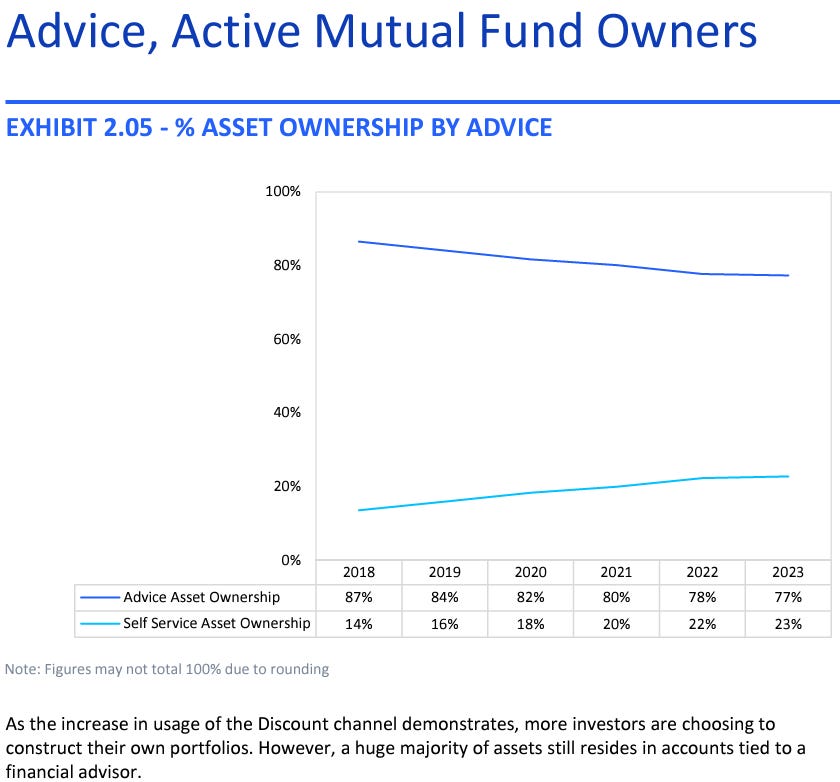

Broadridge’s 2024 study of over 40M US retail investors might shed light on where things are headed given a marked change in how Americans — across all generations — invest.

More investors are choosing to be active and construct their own portfolios. Still, however, a large majority of the assets (77%) still reside in accounts tied to a financial advisor.

However, the type of advisor that most clients use is changing. The broker-dealer channel has witnessed a 7% decline from 2018 to 2023, while the discount brokerage channel has grown 9% from 14% to 23% over the same time period.

This shift to the discount channel is not just limited to mass market and mass affluent clients who are more accustomed to digital engagement and self-directed investing. This phenomenon is true across all wealth segments.

And it’s not just digitally native younger generations that prefer self-directed investing. All generations have increased their reliance on self-service investing through the discount brokerage channel.

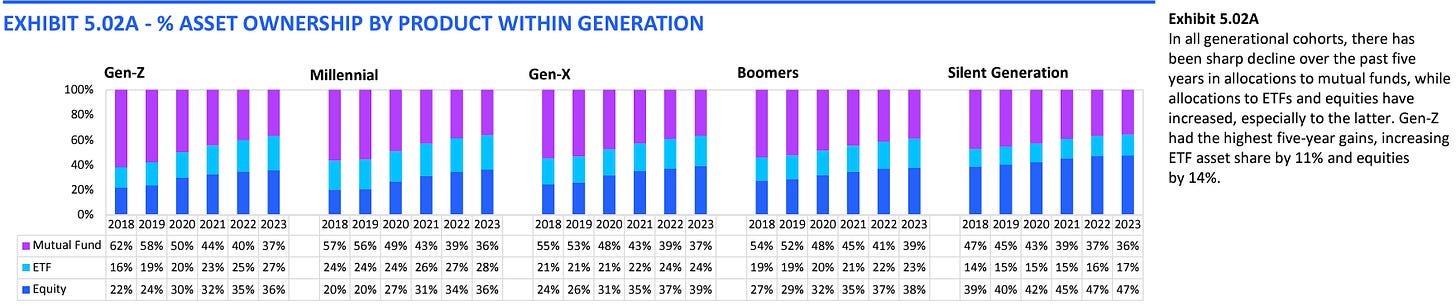

What products do investors prefer? ETFs and equities over mutual funds. This trend holds across all generations, with the youngest generations growing their share of ETF and equities investments most.

What does this data tell us? The brokerage firms are well-positioned to become a major distribution channel

Further, if we believe that Apollo / State Street’s ETF tie-up is the first of many public-private credit or equity hybrid products geared towards the mass affluent and mass market, then the likes of Schwab, Fidelity, and others would be well-positioned to either partner or manufacture these products and distribute them directly via their brokerage platforms in self-directed formats.

While advisor-led channels will likely feature model portfolios, making the imperative for alternative asset managers to be the product or strategy of choice that’s inserted into a model portfolio, the self-directed channel might feature single products — either some form of registered product or ETF — that sits directly on a brokerage platform with a “buy button” that brokerage customers are used to with their ability to buy equities or ETF products.

The dark horses in the race that will either build or embed these capabilities? The neo-brokers and neo-banks, which also want to own more of their customer’s financial life.

Private markets products serve to create a steady stream of revenue for these brokerage firms, providing an attractive balance to the more volatile brokerage revenues generated based on market activity and sentiment.

Multiple definitions of the wealth channel, multiple winners?

There’s no one way to win the wealth channel, in part because there’s no one definition of wealth.

What will be required is a deep diagnostic of what a firm wants to be and what type of resources they want to commit to the wealth channel, whether it’s the HNW segment or the retail segment of the market.

There are enough assets at play for winners to emerge across the board, but alternative asset managers will have to figure out who they are and who they want to be because the commitment to winning in the wealth channel is not for the faint of heart nor is it for those that want to be more economical with their distribution and operational resources.

The race is on. The fact that a firm that’s the size and scale of BlackRock is moving so swiftly and deftly to grow its private markets presence cannot be ignored. It will take years for managers — both traditional and alternative — to cover the wealth and retail channels, but the foundations laid now and the moves made today will have an indelible impact on how the space looks in six years time as private markets approaches $30T AUM.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

Private Markets, the Capital of Consolidation

📝 Private lender HPS exploring $10bn sale to bidders including BlackRock | Brook Masters, Eric Platt, Arash Massoudi, Financial Times

💡Financial Times’ Brooke Masters, Eric Platt, and Arash Massoudi report on the latest on one of private markets’ most talked about firms as of late: $117B AUM HPS Investment Partners, on the list of AGM’s Next Wave, a set of firms that could go public or consolidate into a larger platform in the near to medium term. Weeks after HPS was reportedly discussing an IPO, it appears that the world’s largest asset manager might look to consolidate them in what some in the industry are seeing as a “giant AUM land grab.”

The FT is reporting that HPS is talking with potential buyers, a list that includes BlackRock, which could value $117B AUM HPS at over $10B. If BlackRock were to acquire HPS for north of $10B, it wouldn’t be their first landmark deal in private markets this year. In January, BlackRock sent shockwaves through the industry with their $12.5B acquisition of $100B AUM Global Infrastructure Partners.

HPS appears to be in an advantageous spot. At its size and scale, it is likely seen as one of the few freestanding options for larger platforms looking to add private credit capabilities and a truckload of AUM. HPS also happens to be a major player in one of the most popular and fastest-growing areas of private markets: private credit. They are just coming off of a record fundraise for their Specialty Loan Fund that topped the fundraising league tables in private credit.

HPS has almost $100B in private credit AUM, making them one of the largest privately held private credit managers.

HPS appears to be dual-tracking their options. As firms like BlackRock and others, such as CVC circle for a possible acquisition, HPS is also considering a public listing. The firm has held early meetings with would-be investors and had initially indicated it planned to float in late September. But recently, according to the FT, the firm delayed those plans, telling investors it could list after November’s US presidential election. Some saw the move as an indication that HPS might pursue a sale instead, according to one potential investor. The firm, which was founded as a division of JPMorgan by three Goldman Sachs alumni, including current HPS CEO Scott Kapnick, a former head of investment banking at Goldman, spun out of JPMorgan in 2016 as they saw that banks were increasingly restricted in the activities they could pursue in the credit space.

💸 AGM’s 2/20: There have been a number of blockbuster acquisitions or public offerings amongst private markets managers in recent months, but few would be bigger than an event for HPS. The industry is likely waiting with bated breath to see what happens with HPS.

An acquisition by BlackRock would further solidify the notion that the world’s largest asset manager isn’t messing around when it comes to trying to be one of the industry’s largest players in private markets. Between BlackRock’s $12.5B acquisition of GIP, $3B acquisition of Preqin, and $1B acquisition of eFront, BlackRock is undoubtedly looking to position itself as a major force in private markets, leveraging their traditional asset management business and network and vast reach in their technology business to the wealth channel to extend their product and software reach into this relatively untapped segment of financial markets. But this prospective acquisition of HPS, adding another $117B AUM to their private markets arsenal, would show that BlackRock is going big. Their chess moves in private markets are not adding smaller firms, $1-2B AUM here and there — they are buying market leaders and large, scaled platforms in specific categories.

If this acquisition were to go through, the question would become: Where does BlackRock go next? They’ve built out expansive capabilities infrastructure (GIP and in-house), private credit (HPS, if that were to happen), and private equity (they built a large business there organically).

So perhaps they look to other large strategies that have the potential to scale AUM, such as real estate, secondaries, or even GP stakes?

Maybe they look to buy a manager with distinct and unique capabilities in evergreen structures, which should be popular with the wealth channel and fit in well with BlackRock’s large distribution network and brand that resonates in the wealth channel.

Could BlackRock’s partnership with Partners Group on model portfolios be a foreshadowing of something bigger down the road? Time will tell, but whatever move BlackRock makes next will likely be a big one.

📝 Ares to Build Real Estate Business With $3.7B Acquisition | James Comtois, Institutional Investor

💡Institutional Investor’s James Comtois reports on Ares’ second announced acquisition in less than two weeks as it continues to build up its real estate platform. Ares plans to acquire GCP International for $3.7B, including $1.8B in cash and the rest in stock, in a deal that will nearly double the firm’s real estate AUM. GCP International manages $44B in real assets and private equity. Once this deal is consummated, Ares Real Estate will have over $96B AUM across North America, Europe, Asia, and Latin America, bringing Ares’ total global AUM to close to $500B.

Ares President, CEO, and Co-Founder Michael Arougheti said in a statement that the “combined business will create a global powerhouse in real assets.”

Embedded in the acquisition of GCP is a big bet on e-commerce. Ares and GCP are betting that e-commerce will drive long-term investor demand in the $2T industrial real estate sector. Additionally, demand for data centers is on the rise, as expected spend on cloud migration, data security, and AI is anticipated to exceed $1T in the next three years. Oppenheimer analyst Chris Kotowski told Reuters that this acquisition highlights how alternative asset managers are particularly focused on “positioning themselves in front of the multi-trillion-dollar opportunity of building out the world’s digital infrastructure.”

Ares’ GCP acquisition follows their recently announced acquisition of Walton Street Capital Mexico, a real estate asset manager with $2.1B AUM focused on the industrial sector. These moves appear to be part of a strategy of building its real estate platform by expanding in geographies and sectors and are well-positioned to capitalize on the long-term structural tailwinds in the industrial real estate sector, where they have established a portfolio of $28.1B and over 230M square feet across the US and Europe.

📝 Blue Owl Builds Infrastructure Capabilities with $1B Acquisition of IPI Partners | James Comtois, Institutional Investor

💡Ares wasn’t the only firm as of late to acquire an infrastructure manager focused on digital infrastructure. Earlier this week, Blue Owl added $10.5B in AUM with the acquisition of digital infrastructure fund manager IPI Partners, reports Institutional Investor’s James Comtois. Blue Owl agreed to buy the business of IPI Partners from an affiliate of ICONIQ Capital and an affiliate of Iron Point Partners for roughly $1B (80% stock / 20% cash). The acquisition positions Blue Owl to supplement the firm’s digital infrastructure strategy, which is part of real estate.

IPI was founded as a joint venture between ICONIQ and Iron Point and has a portfolio of 82 global properties in the data center space. Blue Owl’s Co-CEOs Doug Ostrover and Marc Lipschultz said in a statement that IPI’s investment team, investor base, and global scale will add to the Blue Owl platform: “The acquisition of IPI with its deep sector expertise complements our existing net lease strategy while providing an ideal opportunity to expand Blue Owl’s digital infrastructure strategy. There is a massive market opportunity to finance data centers, matched by an increasing investor appetite for additional strategies investing behind cloud and AI-driven secular tailwinds.”

Blue Owl, which now manages over $230B AUM, has been on an acquisition spree this year as it looks to add capabilities to its platform. Their acquisition of IPI follows their purchase of $10B AUM alternative credit manager Atalaya Capital Management, $20B AUM investment manager Kuvare for a push into insurance, $10B AUM real estate lender Prima Capital Advisors for real estate credit.

💸 AGM’s 2/20: The industry’s biggest alternative asset managers continue to make strategic moves to supplement their platforms.

A few themes thread through these acquisitions:

(1) These acquisitions are focused on expanding capabilities in growth areas, such as infrastructure, that are mega-trends and represent large and growing AUM opportunities. Digital infrastructure is a perfect example. Data center demand is growing rapidly worldwide as there’s a migration to cloud and increased use of AI.

A 2023 report from BlackRock on global spend on data center construction projects that costs will rise from $32B in 2022 to $49B by 2030.

The Ares acquisition of GCP and Blue Owl’s acquisition of IPI play directly into this trend. Both of these acquired firms focus on digital infrastructure and data centers, making their integration into larger platforms an opportunity to continue to expand their capital base to grow their presence in a space with a secular tailwind.

Further, BlackRock’s Investment Institution Transition Scenario projects that energy investment will increase from $2.2T annually to $3.5T by 2030 and $4.5T by 2040 in the US alone. A good portion of that capital will go into infrastructure, so firms will need to match that demand with the capital required to meet the growing infrastructure needs.

(2) These acquisitions grow Ares and Blue Owl’s footprint geographically. Ares’ acquisition of GCP gives them a massive footprint in Asia, which is not only a burgeoning opportunity on the infrastructure side (see KKR and BlackRock’s $25B regional infrastructure partnership for Asia) but also a fertile geography for LP interest, particularly from the wealth and private bank channels. Ares’ acquisition of Walton Street Capital does the same for them in Mexico and Latin America. With the trend for nearshoring continuing to grow, the ability to own industrial and real estate assets in a market in Mexico that is an attractive location for skilled manufacturing, according to Ares CEO and President Michael Arougheti, is an interesting strategic move for Ares.

(3) These acquisitions also expand the LP bases for these firms. According to Evercore’s Glenn Schorr, IPI has exposure to different LP channels and should complement Blue Owl’s current LP base, particularly as Blue Owl looks to roll out its triple net lease product in Europe. Ares’ acquisition of GCP accomplishes a similar goal for them in Asia. GCP’s expansive footprint in Asia gives them a strong foothold with an Asia LP base, given GCP’s $$44B AUM.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 State Street (Asset manager) - Head of Corporate Strategy, Senior Vice President. Click here to learn more.

🔍 Fidelity Investments (Asset manager) - Director, Alternatives Product Marketing - Fidelity Institutional. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting. Click hear to learn more.

🔍 73 Strings (Private markets data) - Account Executive. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.