👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from DC. I’m on my way to New York for a week of meetings and co-hosting a private markets dinner.

Earlier this week, I was scrolling through my LinkedIn feed, and a post by Goldman Sachs Asset Management popped up. “Alternatives, seen differently,” it read.

I clicked the link, which took me to the landing page for the Alternatives business at Goldman Sachs Asset Management.

The numbers popped off the page.

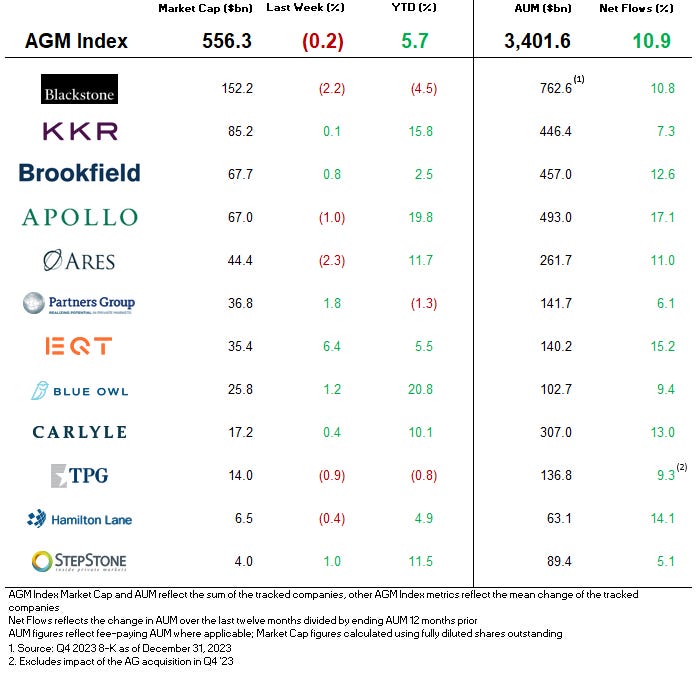

Every week, the AGM Index (below) publishes a list of publicly traded alternatives managers. The AUM figures from these publicly traded firms range from $60B+ to over $760B.

One firm that is not included in the AGM Index? Goldman Sachs.

Unlike the alternative asset managers included in the AGM Index, Goldman Sachs’s alternatives effort is one piece of a broader asset and wealth management unit and a co-habitant with an investment bank. While we’ve discussed the theme of alternative asset managers like Blackstone, Apollo, KKR, Carlyle, Ares, and others encroaching on the territory of Wall Street banks, particularly in areas like credit, they are still very much alternative asset managers at their core. Therefore, an alternatives platform that’s part of an investment bank can’t be included in this Index.

But it doesn’t mean that Goldman’s alternatives unit is considered an afterthought in alternatives. In fact, they should be anything but.

And it’s a business that the firm is maniacally focused on growing.

A sleeping giant in alternatives

With over $456B AUM and $251B raised into alternatives funds from 2019-2023, Goldman’s AUM figures and fundraising capabilities make them one of the industry’s larger alternatives players.

From 2019 to 2022, Goldman has held the distinction of being a top five alternatives manager in cumulative gross fundraising, trailing only Blackstone, Apollo, KKR, and Brookfield.

Goldman’s fundraising success has driven the firm to new heights. They’ve grown management fee revenues at 16% CAGR 2019-2023, going from $1.2B to $1.8B, notching record management fee revenues.

Their focus on manufacturing and distributing alternatives products aligns with the firm’s broader key priority: grow management fees.

Goldman’s CEO David Solomon and new Global Asset & Wealth Management Head Marc Nachmann both view the alternatives business — and the broader activities of the AWM division — as a vehicle for the firm to drive more stable, durable revenues and steady margins.

Nachmann noted this theme in a Bloomberg article from October 2023, referencing the importance of steady management fees to Goldman’s value: “Do you want to be in the client business or do you want to be in the principal business?” Nachmann said. “It certainly seems right now that investors prefer predictability and consistency over volatility.”

Their focus appears to be working. In 2023, Goldman surpassed their $225B in gross alternatives fundraising by the end of 2023 to reach over $251B across both internal and open-architecture (i.e. 3rd party fund managers) strategies.

Benefitting from the bank

What’s even more interesting about their success in fundraising in alternatives is that almost 40% of the $251B in capital raised over the past four years comes from their Wealth Management division.

Yes, this data point could certainly spark a heated debate about incentives — and the merits of how an open architecture independent advisory firm chooses alternatives allocations for clients in contrast with how a Wall Street private bank may do so.

But one thing is clear: Goldman’s alternatives business will benefit from the ties that bind. With its in-house wealth management unit a quick elevator ride away in 200 West, the two businesses don’t need to go far to discuss ways to collaborate. And the growth of its alternatives and wealth management businesses go hand in hand.

Boasting over $1T in total wealth management client assets, Goldman’s wealth business has tended to focus on the UHNW segment, catering to clients with, on average, $60M in assets at the firm.

Wealth clients of this size (and larger) are often heavily invested in alternatives. Goldman’s family office survey from May 2023 found that, of the 166 families surveyed, they had an average asset allocation of 44% to alternatives. With family office and UHNW clients often able to handle a longer-term investment horizon and illiquidity, alternatives funds can make for a good match for their portfolios.

Goldman and other alternatives units that sit alongside private banks / wirehouses have an advantage that other alternative asset managers might not possess: an ability to understand a wealth client’s entire portfolio. We’ve discussed in a past AGM Weekly the importance of how a holistic window into a client’s portfolio can help alternative asset managers better position their strategies and funds as part of a consultative sale to a wealth manager and the end client. While adding a specific fund or strategy to a client’s portfolio still requires convincing and an analysis by the wealth manager, there’s less friction to effectuate a sale with a private bank’s construct than it is with an independent wealth advisor.

Not to mention, this relationship between Asset and Wealth Management units also provides the opportunity for the private bank to generate additional fees from engaging in lending to wealth clients against their alternatives holdings.

A major reason why alts are going mainstream is because of this very intersection between wealth and alts. Growth in alts is coinciding with an understanding that the 60/40 portfolio needs to be re-architected to include meaningful private markets exposure. It’s innovation in wealth management and portfolio construction tools (as well as post-investment administrative mechanisms) that is driving this trend.

Goldman’s alternatives fundraising numbers — particularly given its capital raising success from its Wealth Management business — surface an interesting question: will other alternative asset managers look to buy a wealth management business so they have a way to distribute their products?

Playing catch-up, but not far behind

Goldman’s alternatives business isn’t at the size and scale of some of the industry’s largest players, like Blackstone and Apollo. However, its growth in alternatives AUM is nonetheless impressive to witness. In 2020, Goldman raised $40B into alternatives funds. By 2023, that figure was $251B.

Goldman’s alternatives business will forever be burdened by the bank when it comes to how it is valued. It will be difficult for their stock price and valuation multiple to reflect similar numbers to alternatives managers like Blackstone or Apollo. That is reflected in its market capitalization. Goldman, at $127B market cap at the time of writing, is playing catch up to Blackstone’s $153.97B market cap. The differences in their business structure likely mean that the two firms, as a whole, will not be valued on similar multiples, as it should be the case.

But Goldman’s alternatives business could be an engine for steady revenue growth. And their ~$2B in revenues from management fees are nothing to sneeze at. To put that number in context, Ares, which ended 2023 with $418.8B in total AUM and $261.7B in total fee-paying AUM, generated $2.55B on management fee revenues.

The road ahead for Goldman isn’t without its challenges. The firm recently saw some of its senior leadership depart to alternative asset managers. AWM CIO and Partner Julian Salisbury left for Sixth Street, joining fellow Goldman alums Alan Waxman and Marty Chavez to build the $75B AUM firm into an alternatives powerhouse. Global Co-Head of Client Solutions, former Co-Head of Alternatives Capital Markets Strategy, and Partner Chris Kojima recently joined General Atlantic to continue the buildout of their $96B AUM platform.

But Goldman always seems to find ways to innovate and reinvent itself. Alternatives is yet another example of the firm doing so. I wouldn’t bet against them.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Private credit propels asset growth of major PE firms | Selin Bucak, Tania Mitra, Margaryta Kirakosian, Citywire

💡Private credit has been a major driver of growth for alternative asset managers, enabling them to counter a challenging fundraising environment in 2023, report Citywire’s Selin Bucak, Tania Mitra, and Margaryta Kirakosian. Success in fundraising for six of the largest asset managers has been due to private credit carrying the day for them. Blackstone ended the year with over $1T in assets, with the largest proportion of their inflows coming from its credit and insurance division, which attracted over 1/3 of its $150B total ($62B). On the heels of this success in fundraising for credit strategies, Blackstone is now preparing to launch its fifth private credit opportunistic strategy, where the firm is targeting $10B fund size. Other firms saw similar success. Carlyle raised $9B in private credit strategies out of its overall $17B in capital raised; KKR saw credit and liquid strategies comprise of almost 66% of its capital raised in Q4. Apollo, which has a major footprint in private credit, expects to grow its private credit offering across direct lending and asset-backed finance in 2024.

Growth from private credit fundraising has coincided with major pushes from these firms into working with the wealth channel. The largest four alternative asset managers collectively manage over $450B in assets from private wealth. Blackstone has over 25% of its assets from private wealth, Ares now has almost 20% of its AUM from the wealth channel, and Apollo raised over $8B from wealth investors, up 30% YoY. A good portion of capital raised from the wealth channel for many of these firms came from non-traded BDC products or evergreen funds. KKR’s recently launched K-Series of products, specifically designed for the wealth channel, accounted for $6.5B of the firm’s wealth assets, which totals $75B.

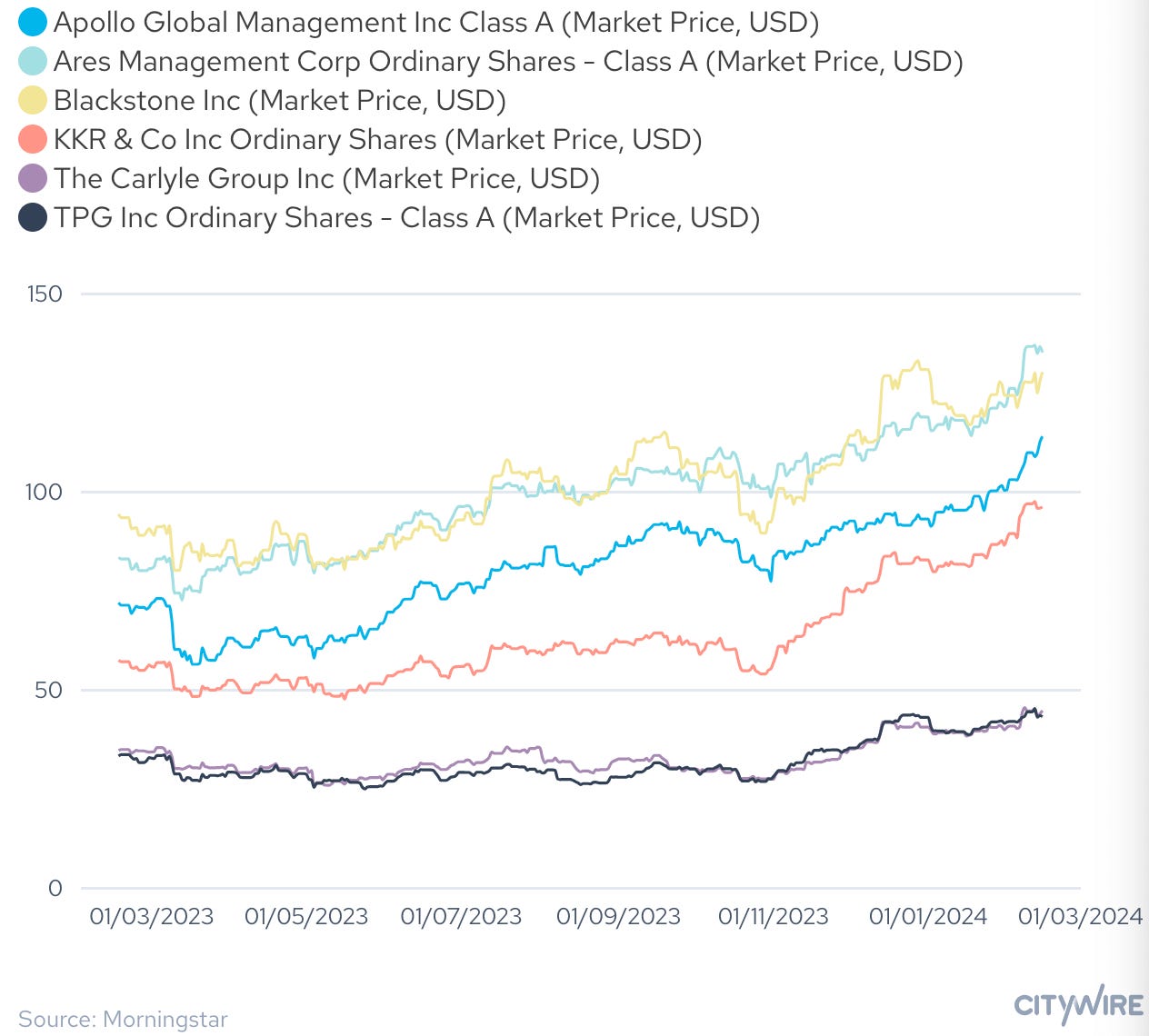

💸 AGM’s 2/20: The wealth channel is propelling alternative asset managers to new heights. A concerted effort to properly productize and distribute alternatives products through this channel is not only enabling firms to grow their AUM but is also doing wonders for their stock price.

Each of the alternatives managers mentioned in the Citywire article — Apollo, Ares, Blackstone, KKR, Carlyle, and TPG have all watched their share price increase over the past year, in large part due to success in raising capital. The firms deserve credit for coming up with both the right product and distribution methods to capture the interest of the wealth channel. The lion’s share of the capital raised from the wealth channel has been done via evergreen structures or non-traded BDCs. Both structures offer more liquidity to investors than do traditional closed-end funds — and help these managers in terms of how the market may value their AUM / revenue, which positively impacts their stock price. Interest in private credit doesn’t appear to be waning much, which means that these managers should be the beneficiaries of further AUM growth as the wealth channel continues to increase its focus and allocation to private markets. The question remains: will interest rates stop these firms from their continued success in private credit?

📝 Big LPs secure increasingly bespoke terms amid tight fundraising | Marie Kemplay, PitchBook

💡PitchBook’s Marie Kemplay reports that LPs hold the cards in a challenging fundraising market. Many large LPs are using this leverage to secure bespoke terms from funds. It appears that LPs are returning to “fund of one” structures or separately managed accounts in order to secure more favorable arrangements with GPs. Fund lawyers are seeing an uptick in this trend. “In the last 12 to 18 months we have seen a marked increase in the number of these arrangements being negotiated,” said Vincent Ip, a Partner in law firm Ropes & Gray’s Asset Management group. “And because the dollar amounts tend to be high, it has been very noticeable.” Billy Zhang, counsel in Ropes & Gray’s asset management group, notes that not only has there been an increase in SMAs but also in the amount of tailoring that is being sought through them: “Everything becomes negotiable.” Many LPs are able to drive lower fees, fee structures that are only charged on invested rather than committed capital, deal flow covenants, and more control and oversight over the deals a GP pursues. In a difficult fundraising environment, particularly for emerging managers, these are trades GPs might be willing to make. Availability of capital, even if it comes at a cost, often proves paramount because it enables funds to deploy, build a track record, and stay in market.

Conceding on fees and terms is becoming increasingly important in an environment where LPs are consolidating their GP relationships. Many placement firms are observing a trend of consolidation, with LPs shrinking the number of GP relationships they have and looking to deploy larger tickets at more favorable terms. “Bigger commitments naturally means that relationships tend to be deeper and more strategic, and can involve SMAs or agreements of that nature for the larger ticket LPs,” Monument Group Partner Karl Adam said. “So, they have become more prevalent, although the structure itself is not new.” Adam cited the Middle East LP base as a driver of increased SMA use, something we saw in the news recently with Blue Owl partnering with Lunate on its new $2.5B middle-market GP stakes fund.

Fund advisors are seeing LP behavior differ from the past. In the past, according to Ropes & Gray’s Zhang, LPs tended to commit capital to a sponsor’s flagship fund and then negotiate a sidecar vehicle. Now, large LPs will often ask for an SMA first and then agree to put a smaller sum of capital into their flagship fund to build the relationship. Newer firms may be more open to this type of relationship, as it enables them to get off the ground. Sachin Mitra, Global Co-Head of Relationship Management at private markets advisory firm Aviditi, said deeper LP relationships, including SMAs, can be particularly beneficial for newer PE firms or emerging managers “as a way to create track record and demonstrate their ability to source deals before raising more traditional funds from a wider group of investors.” He added, “For the investor too, it puts them in prime position to be a partner of choice for the long term.”

💸 AGM’s 2/20: A more challenging fundraising environment means that many GPs have to compromise. Fundraising timelines are now stretching longer and LP capital is becoming more selective, so GPs have to make hard choices. They can choose to concede on terms if they can find larger LPs who are willing to commit a scaled check but at favorable terms. Or, they can proceed down a more challenging path, which could yield success but will likely mean a longer fundraising effort. GPs who believe they can scale their firm will likely choose the former route. They could very well understand that starting to deploy the capital, even at less favorable terms for them, means they are in market and will enable them to be back in market for a new fund sooner, possibly at more favorable terms. The current environment also gives large LPs, particularly institutions that are in a position to deploy capital, a big advantage. They can selectively build LP relationships at more favorable economics (or even owning a part of the firm in some cases) that will enable them to enhance their returns beyond what many LPs may otherwise be able to do. This shift in the market coincides with the increase of capital flowing into funds from the wealth channel.

If the wealth channel is the new institutional LP, then the institutional LP is increasingly becoming the strategic LP that can work with funds in more bespoke ways. The question is whether or not the wealth channel can fill enough of the void created by institutional LPs to where GPs gain some of the balance of power back from LPs.

Reports we are reading

📝 European VC Valuations Report | Navina Rajan, PitchBook

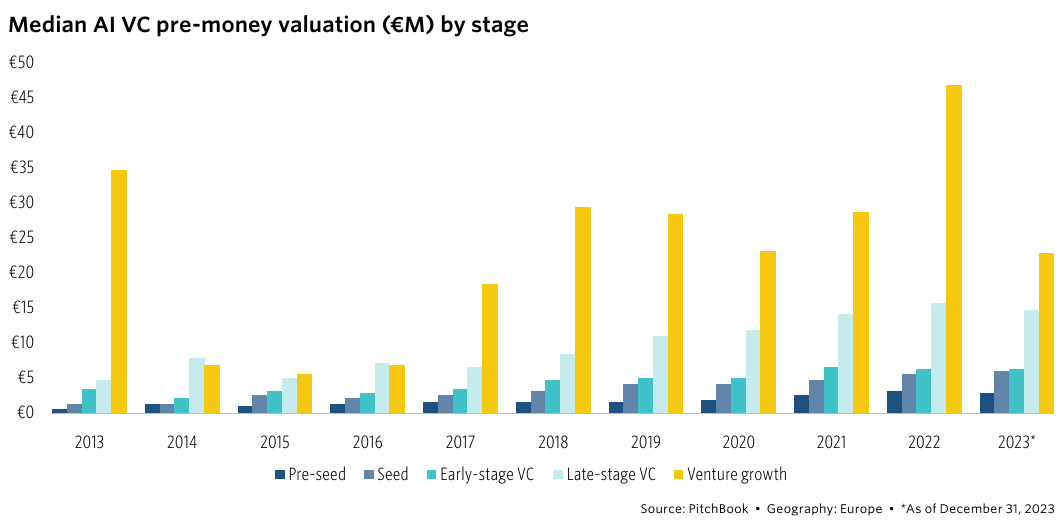

💡PitchBook’s Navina Rajan dives into European startup valuation data to find that there’s more resilience in the market than it might appear at first blush. Rajan highlights three R’s that PitchBook believes will define European VC in 2024: rates, recovery, and rationalization. Despite what appears to be a dampened sentiment on European startup values, European pre-money valuations increased YoY at all stages, other than seed and venture growth. Unsurprisingly, valuation multiples compressed, and top decile valuations witnessed a significant decline, but the market experienced more resilience than perhaps expected. It appears that European VC is defined by a few key trends:

(1) AI and cleantech valuations remain relatively high, contributing to overall resilience in European startup values. Median AI pre-money valuations (€M) for 2023 were still higher than other parts of the market and remained relatively comparable to prior years at pre-seed, seed, early-stage, and late-stage VC rounds, but 2023 valuation numbers tailed off for venture growth rounds.

(2) More rational prices (and behavior), in part due to recovery in startup values that should be aided by interest rate moves. The proportion of down rounds was at its highest figure since 2014, meaning that VCs hunted for value — or looked to reset valuations — in 2023.

While it’s unclear how central banks will deal with rate movements in 2024, it appears that VCs are readying for a decrease in rates over the course of the year. Lowered rates could have a positive impact on valuation numbers in 2024.

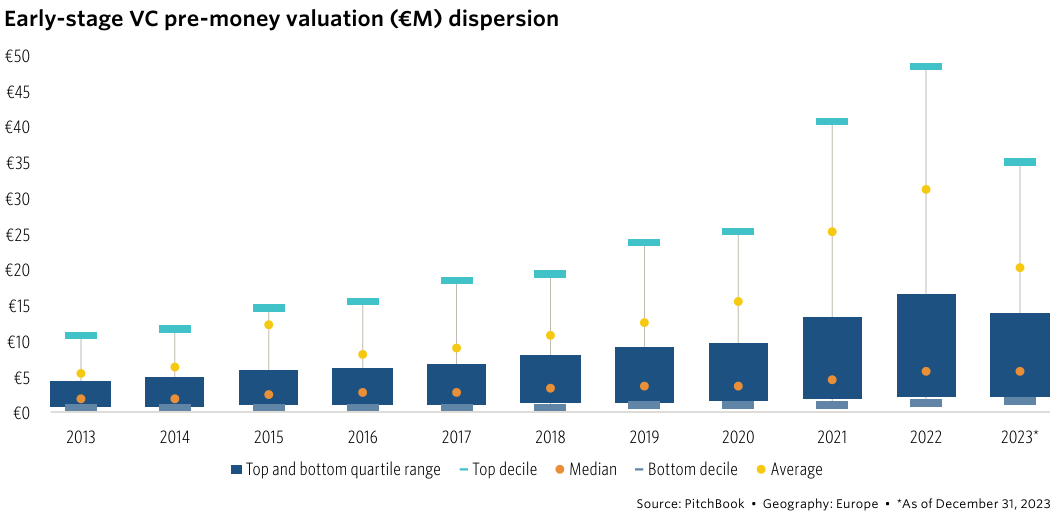

💸 AGM’s 2/20: PitchBooks’s report on European VC valuations uncovers some encouraging results. Early- and late-stage VC saw median valuations increase in 2023. Those data points prove promising for a startup ecosystem that looks to continue to grow — and benefit from increased interest by US VCs and growth funds who have established boots on the ground and an expanded footprint in Europe.

Early-stage VC witnessed a median deal value increase of 2.8% and median valuation increase of 2.5%. This figure, in part, was aided by AI startups carrying the day. Top decile of valuations decreased by 27.4% from around €50M to €35M pre-money valuation, but the data was buttressed by AI companies like Mistral AI and Helsing, which are both valued at over €1B.

Late-stage valuations also saw median deal value increase by 11.7% YoY, which represents promise for a late-stage market that had appeared to cool off.

Perhaps the most interesting data point in the report? Pre-seed emerged as one of the most resilient parts of the market. Median pre-money valuation was up 4% YoY, and median deal value increased 8.4% YoY. Taking this data with anecdotal observations on the ground in Europe, it appears that:

(1) early-stage VCs are increasingly spending more time at pre-seed, which makes sense given that firms with larger funds might want to go a bit earlier on the risk/reward spectrum by paying lower valuations than seed valuations but taking more risk. This could be a contributing factor to the increase in median deal value.

(2) we’ve observed an explosion of sorts of micro VCs and solo GPs in Europe, where there are a number of smaller funds being launched to contribute to pre-seed rounds. This trend could also be a contributing factor to why the market is seeing increased round size — and a corresponding valuation bump — at pre-seed.

📝 Estimating US VC First-Time Manager Dropouts | Max Navas and Collin Anderson, PitchBook

💡PitchBook’s Max Navas and Collin Anderson take a deep dive into past trends to digest the data on first-time VC manager attrition and what it means for LP appetite in allocating to a VC’s second act. First-time funds reached a peak of $14.7B in capital raised in 2021, but the market has seen only a downward trend since.

First-time funds have been popular amongst the LP community in the US, particularly with family office, UHNWI, and specialized institutional VC fund of funds. The first-time fund manager market has witnessed an explosion of interest. The numbers reflect this popularity: since 2017, $58.5B has been committed to 1,381 first-time VC funds in the US. These figures represent a 110.8% increase in capital raised and a 67.8% increase in fund count than the prior decade (2006-2016). The boom period was followed by a precipitous drop in both interest and dollars allocated to first-time managers in 2023. Whereas fundraising was easy in 2019-2022, 2023 proved to be an uphill battle for many VCs looking to raise a new fund. The time between first-time and second-time funds increased to 2.6 years during 2023. Navas and Anderson estimate that a large number of fund managers will be unable to raise a second fund, extrapolating the follow-on rates of first-time managers from 2006 to 2018 and the availability of LP capital to allocate to funds’ sophomore acts. Using the follow-on rates of first-time managers by size bucket from 2006 to 2018 (63.0%) as a baseline for the success of first-time managers in our target period of 2019 to 2021, they estimate more than 247 of the 667 first-time managers that closed funds will be unable to raise a second fund. Initial fund size does matter. Almost 77% of first-time managers who raised over $50M for their debut fund went on to successfully close a second fund, compared with 73.1% of managers who raised funds between $10-50M and 64.6% for managers who closed their first fund with less than $10M in commitments.

Who does this impact most? VC ecosystems that are less developed and lack the availability of as much LP capital, particularly within the HNWI and family office channels. PitchBook finds that historically, only 56.7% of first-time managers outside of California, New York, and Massachusetts have gone on to raise a second fund.

💸 AGM’s 2/20: VC fundraising has entered an arctic chill. Those who will feel it the most? First- and second-time emerging managers. The dreariness is in the data. First-time fund managers, particularly those outside of the major VC hubs of California, New York, and Massachusetts, look to face the biggest headwinds as they raise a second fund. The numbers do not appear to be in their favor. Fundraising has become significantly more challenging for a number of reasons — and it doesn’t appear that will change in the near-term.

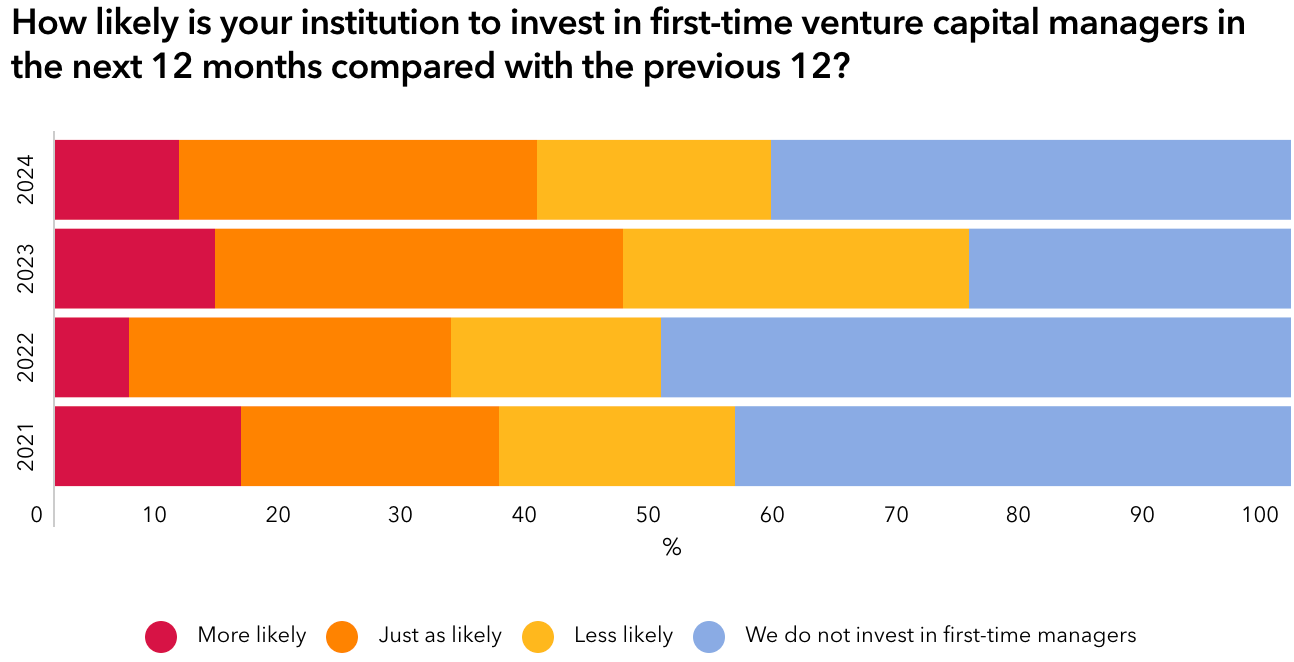

A Venture Capital Journal survey of LPs in late 2023 found that many LPs are unlikely to invest in first-time VC managers over the next 12 months. Just 10% of LPs said they were “more likely” to invest in new managers in 2024, down from 13% a year ago. And those who said they were “just as likely” to back first-time funds were down 4% from a year prior.

Many emerging managers rely on the family office and HNWI communities to be meaningful participants in their first and second funds. With demands on LP liquidity, an uncertain rate environment, and strong performance in public markets, it could be a challenging road to hoe for many first-time managers looking to raise both their first and second funds.

That’s why the innovation in private markets technology and community-building within the family office and HNWI channels is so critical to helping the emerging manager ecosystem. Investment platforms like Allocate and others that enable managers to efficiently connect with the HNW and wealth management channels should serve to aid emerging managers. Family office and HNW networks like Family VC, 3i, and 10 East should also be helpful in providing emerging managers with connectivity to the HNW community and another avenue to raise capital. VC funds, either launching fund of funds or investing into funds out of a portion of their fund, can also help to provide the emerging manager ecosystem with a much-needed boost.

That said, there probably should be a healthy contraction in the emerging manager VC landscape. The past few years represented irrational exuberance across the VC landscape — an exuberance that neither GPs or LPs were immune to. A number of emerging managers probably shouldn’t have successfully raised — or shouldn’t have raised as much as they did. The dearth of capital available now should mean that capital will be more selective in where it goes, which, while painful for many managers, is probably a healthy trend overall for the ecosystem. The knock-on effect of this is that early-stage round sizes may also be more right-sized, which in theory, should be a win for all. Smaller round sizes could mean less dilution for founders and early investors, which could lead to greater returns for shareholders and fund LPs when there’s a success. The capital contraction could also mean that the VC space starts to see some consolidation, where smaller managers join larger platforms if they can’t see a path to successfully raising their next fund(s).

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the seventh episode of our monthly show, the Monthly Alts Pulse. We discuss why chemistry and collaboration key for the next wave of private markets and how solving distribution challenges in private markets means solving logistics problems. Watch here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Carlos Rodriguez Jr., Founder, President, and COO of Driftwood Capital, discuss how they built a $3B real estate hospitality investment platform. Listen here.

🎙 Hear Tyler Jayroe, MD and Portfolio Manager in J.P. Morgan Asset Management’s Private Equity Group, discuss how one of the world’s largest financial institutions approaches private equity. Listen here.

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.