AGM Alts Weekly | 3.10.24: Shopping in the alts supermarket

AGM Alts Weekly #42: Making private markets more public, every week.

👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London. Big week — we crossed 4,000 members! Thanks for all your support as we work to make alts go mainstream!

Marketplace musings

Marketplace. It’s a word as old as time, particularly in business. Marketplaces were where buyers and sellers met to transact, albeit in a town square rather than online.

This weekend, I re-listened to the podcast I just released with former Blackstone and Airbnb CFO and Managing Partner & Founder of WestCap, Laurence Tosi (L.T.).

I asked L.T. about his most important learning from building Blackstone and Airbnb, and having a hand in building a number of companies defining market structure across asset classes, from Ipreo, iLevel, and Tradeweb, to iCapital (a WestCap investment).

His answer was fascinating.

L.T.: I think it all starts with understanding products and the value that they're creating. And almost everything that I've invested in, built, and operated has been some sort of marketplace. Maybe that's the last piece. That marketplaces, I believe, are an undersized portion of early stage investing, but they're an outsized portion of public companies.

Michael: Let’s break that down. Marketplaces are so foundational to most markets. Financial services have their own marketplaces in the form of exchanges and otherwise. You can even look at Blackstone in a sense as a marketplace. How do you conceptualize what a marketplace is in financial services?

L.T.: It's funny when I often write the business plans of a business or something we're building, I always try to break it down to a very simple graphic. And that graphic usually has the buyer on one side, the seller. Now the names may be different. So, in the case of, as I said, Airbnb, its hosts meet guests with Airbnb in the middle. If you think about one of our largest investments in StubHub, that would be ticket seller, ticket buyer, StubHub in the middle. And for Blackstone, it's companies. Blackstone in the middle, managing them and managing the investments, and the other side is the investors and their capital. I think it's interesting in investing, especially in technology, only about 12 percent of early stage investments are in marketplaces, but they're 30 percent of public companies and 25 percent of unicorns, which is a really interesting stat to show you the power of marketplaces.

Blackstone as a marketplace? Now that’s interesting. While some might not think of an investment firm as a marketplace, L.T. provides a clear rationale as to how and why an investment firm is a marketplace.

L.T.: Now, that's a really great question, Michael. I think it really comes down to an overused word, but I'll try to define it — define it the right way, which is network effect. In the end, the best marketplaces create a network effect.

I define the network effect as in each incremental customer or stakeholder on either side of the marketplace creates more value for the other marketplace participants because they create more liquidity. For example, the more funds that Blackstone has, the more places they can raise capital against, and the more places they can put that capital against ideas [author emphasis] — everything from an infrastructure project to a private equity investment to a real estate investment. The best thing about marketplaces is, and we measure this and we've got 25 years worth of analytics on it, you can measure the effectiveness of a marketplace simply by that flywheel or network effect that's created that more buyers mean more sellers. More sellers mean more buyers. And I think that's the magic of marketplaces.

Marketplaces have become popularized in tech parlance. And for good reason. As L.T. points out, many of tech’s most valuable companies are marketplaces. Amazon? A marketplace. Airbnb? A marketplace. The list goes on because, as L.T. states, these companies were able to successfully create both liquidity and network effects to the point where liquidity begets more liquidity.

But an alternative asset manager as a marketplace? Firms like Blackstone, Apollo, and others don’t spring to mind as marketplaces as technology companies like Amazon and Airbnb do. But not so fast. Perhaps there’s more to this than first meets the eye.

Let’s take this even a step further and extend the concept of marketplaces to financial services.

Marketplace finance as the future of finance

When I was on the Principal Strategic Investments team at Goldman Sachs in 2012, I was fascinated by marketplaces. How could marketplaces disintermediate traditional financial services firms?

I dove into the concept of marketplaces disrupting traditional financial services and took to the way that Charles Moldow, a Partner at Foundation Capital and an early investor in marketplace lending pioneer, Lending Club, approached the evolution of banking. Banks, he said in a report in 2013 titled “A Trillion Dollar Market By The People, For The People: How Marketplace Lending Will Remake Banking As We Know It”, served as intermediaries, matching savers with borrowers, taking a spread in the process. Charles specifically discussed how technology and innovation made possible a new generation of financial services in lending that was more affordable and accessible. He called this phenomenon “marketplace lending.”

Struck by the power of marketplaces, when I had the chance to join them, I did. I joined Mosaic, a residential home solar lending platform now backed by Warburg Pincus, as the first sales hire partly because I viewed the marketplace lending model as a disruptive force in finance. I was right on the trend, but wrong on the timing because many consumer-focused marketplaces often need to go through the arc of institutionalization in order to reach size and scale before being able to circle back to the end consumer. Mosaic’s peer-to-peer ambitions initially paved the way for the institutionalization of the marketplace to match borrowers with institutional warehouse facilities on the way to $14B in home solar loan originations.

I joined iCapital as an early pre-product employee to help build the distribution team because I believed in the power of marketplace finance. How could we efficiently and transparently connect an investor (the wealth channel) who has never had access to a large and growing part of the investment universe (alternative funds)?

In 2014, I wrote a blog post for iCapital titled “The Future of Finance is Marketplace Finance.” I aimed to build on Charles’ foundational “marketplace lending” report and extend his concept to “marketplace finance.”

In the post, I wrote:

I think that Charles’ concept of “marketplace lending” can, in fact, be extended to other areas of finance beyond lending. Just as marketplace lending creates platforms to connect borrowers and lenders, marketplace finance platforms like AngelList, Fundrise, and iCapital Network efficiently connect capital providers with capital users. Thus, I think it’s apt to describe the growing trend of online financial technology platforms using marketplace dynamics to connect capital providers with capital users as “marketplace finance.”

In many respects, I think we are in the early innings of marketplace finance businesses architecting the future of finance. Only now are we in the midst of the first wave of marketplace finance businesses in the same way that the late 1990s witnessed the first wave of consumer marketplaces like eBay and Amazon.

iCapital works with the intermediaries of capital providers (wealth managers and private banks), but the foundations of the marketplace were built over the past ten years. Only recently did iCapital launch its Marketplace. The wait was for a good reason. They needed to aggregate enough liquidity for the flywheel to spin at scale. With over 100,000 financial advisors on iCapital’s platform and hundreds of funds using iCapital to connect with the wealth channel, iCapital has the network effects to create more value for each incremental user on the marketplace.

Marketplace maxims

The power of marketplace models lies in the features they possess as businesses. Let’s unpack each of the features of marketplace models that I wrote about in my post in 2014 and tie it into how it fits into the businesses of alternative asset managers today.

Trust

[From my post in 2014] Trust is essential to building out a marketplace. Marketplaces must engender two layers of trust so that customers turn into repeat buyers: (1) trust between the marketplace and users: each user group must trust that the marketplace will offer high-quality products and services to them, and (2) trust between user to user: each user group must trust each other, which is a function of the marketplace vetting users through some form of curation. Lending Club’s rigorous credit analysis has, in Charles’ words, “out-FICO[ed] FICO,” by creating robust data sources and algorithms to evaluate potential borrowers, which makes lenders comfortable in transacting on their platform.

Trust is foundational to the investment business. Investment managers are selling returns, but ultimately, investment managers are selling trust. They aim to be stewards, risk managers, and sound decision-makers of the money that capital providers entrust them to match with good ideas.

For years, alternative asset managers have built relationships of trust with institutional investors. Now, as alternative asset managers work with the wealth channel we are witnessing them aim to engender trust with individual capital providers by brilliantly humanizing private markets, themselves, and their firms, whether it be through holiday videos or LinkedIn and Twitter interviews.

Curation

[From my post in 2014] Curation matters. Users only trust a marketplace — and trust each other — when a marketplace has created guidelines and quality control for accepting users onto the platform. Whether in the form of regulatory compliance by verifying investors’ income levels and net worth or in the form of asset quality of borrowers (Lending Club) or real estate developments (Fundrise), it is imperative for marketplace finance platforms to have a defensible due diligence and onboarding process for users.

Curation and trust go hand in hand. Marketplace users only trust platforms that have the quality controls in place to make sound decisions about which assets to put on their platform. This feature is particularly important in financial services, where the risk of offering a poorly underwritten investment far outweighs including an investment opportunity that may go awry.

In the case of alternative asset managers, this means having the proper diligence and underwriting processes combined with the requisite talent to match the right capital with the right ideas to generate returns. The largest alternative asset managers are working to manage both scale and niche expertise. L.T. talks about how scale can benefit investment marketplaces like Blackstone (more on that below).

Transparency

[From my post in 2014] Transparency begets trust. Trust begets transactions. Watsi, a global crowdfunding marketplace for healthcare treatments, has benefitted from being radically transparent. They post a downloadable document of each patient’s health record on their website and have seen donors instantly trust and then transact on the Watsi platform as a result. The result has been over a 1,000% increase in donations processed from 2013 to 2014. In the same vein, Lending Club investors are comforted by the fact that they can analyze data on prospective borrowers before extending a loan.

Transparency and trust. More transparency enables more transactions. Alternative asset managers recognize the importance of transparency as they welcome more investors into private markets, some for the first time. Alternative asset managers have made education a paramount priority. It’s no surprise that firms like KKR title their educational programs “Alternatives Unlocked.” Education pushes the frontier on transparency. And transparency creates more trust in these investment firms.

The move to different product structures, like evergreen products, and a number of firms going public are also pushing transparency to the forefront of private markets. The ability for these firms to leverage AI will be both to their advantage and their LPs’ advantage in pre- and post-investment processes. Alternative asset managers are now reporting on investment funds on a more regular basis. Technology innovation both within these firms and outside, from companies that are enabling better, more real-time, and transparent access to valuations, like 73 Strings and Canoe, are ushering in a new era of transparency.

Lower cost

[From my post in 2014] A marketplace done right creates disruptive economics. The business model should create inherent cost advantages versus the incumbents. Lending Club is a poster child for a marketplace finance business that has created significant cost advantages versus their brick-and-mortar banking peers by virtue of using an online platform instead of physical bank branches. As a result, Lending Club is able to enjoy a 425 basis point cost advantage over traditional lenders and spend their money in other areas, like online marketing.

Scale provides another interesting second-order effect: the ability to lower costs but still grow a business.

The alternatives industry has moved away from the 2/20 fee structure for some time now. If the industry was not growing, alternative asset managers would see trouble on the horizon as their business model would be challenged by fee pressure. However, with scale, the sheer size of capital coming into the space can make up for lower cost. In fact, the liquidity and scale of a marketplace done right can enable firms to be proactive on lowering costs for the marketplace participants so that they want to transact on their platform instead of other competitors.

The alternatives space appears to be heading in the direction of lower fees. Alternatives managers who are able to make up for this in size and scale will win. The answer? Becoming a marketplace that has features of a one-stop shop. Amazon is a winner because they are able to aggregate enough buyers to entice as many sellers to come to its marketplace. Alternative asset managers that will win are those that will be able to aggregate enough investment opportunities to penetrate the increasing wallet share of capital providers as they become one-stop-shops.

Efficiency

[From my post in 2014] Marketplaces disintermediate the middleman to create more efficient connectivity between buyers and sellers. Marketplaces provide the critical underlying infrastructure to directly connect buyers and sellers — often removing middlemen from the transaction — which enables a greater portion of the returns to be passed to investors.

At scale, marketplaces remove the need for a middleman to create an efficient connective tissue for buyers and sellers. The alts space is undergoing this transition with platforms that efficiently provide this service for alternative asset managers, both large and small, and investors. The largest alternative asset managers are also building their own in-house functionality, both with people and technology to remove middlemen from the equation. Placement agents have been the first to be impacted. There’s still a role for placement agents in private markets, but their role will continue to change, in part because of the technology innovation occurring.

Better user experience

[From my post in 2014] The consumer should have a decidedly better user experience on the platform than they would otherwise. As Bill Gurley of Benchmark Capital says, “great marketplaces do not simply aggregate a market; they enhance it. They leverage the connective tissue [of the internet] to offer the consumer a user experience that simply was not possible before the arrival of this new intermediary.” In the same way that OpenTable enables the consumer to search reservation availability across hundreds and hundreds of restaurants in a matter of seconds, iCapital Network has created a powerful online platform to enable investors to search and analyze the universe of private equity funds that are raising capital within seconds.

Marketplaces find ways to enhance the market. The advantage alternative asset managers and technology marketplaces in private markets have at scale is a data advantage. The reams of data that large firms have due to the breadth and depth of their reach affords them the opportunities to leverage data and information to (1) create data advantages both in sourcing and investment analysis, (2) give themselves the chance to generate better investment returns, (3) build a strong brand around both better investment performance and the pitch that they have an advantage due to their scale. Larger platform firms also would likely argue that their reach across multiple asset classes and strategies gives them an information advantage not afforded to smaller, monoline firms who only focus on a single market or strategy. All of this should, in theory, create a better user experience for the capital provider, the investor, in the form of better returns and better information. Now, it’s worth noting that in certain investment strategies, scale is the enemy of returns. But many GPs also understand the type of LP customer they are serving — either the large institution that has to deploy large amounts of capital or the wealth channel, which benefits from simplicity and ease of access that larger firms can provide.

Network effects

[From my post in 2014] Network economics create a virtuous cycle for marketplace businesses. In a two-sided marketplace, the platform’s value to any given user often depends on the number of users on the network’s other side. Value increases as the platform matches demand from both sides. Platforms become more successful at scale since users will pay more for access to a bigger network, and the incremental cost to acquire users becomes lower. The same platform-based approach that creates network effects also fosters product creation to be built on top of the platform itself. Equity funding platforms like AngelList and Funders’ Club have created a platform for a next-generation “fund of funds” tool with their Syndicates and Partnerships features, respectively. AngelList and Funders’ Club first focused on the “retail” user, but now that they have the critical mass, it is possible for users to build their own products on top of the AngelList and Funders’ Club platforms. AngelList Syndicates, where a high profile angel investor forms a syndicate of investors to invest in startups and takes a management fee and carry, in essence, becoming their own micro VC fund manager.

Network effects create a powerful flywheel, as L.T. notes in his quote above. It’s this flywheel phenomenon that enables marketplaces to not only scale, but earn the right to build on top of the foundation of the marketplace. Marketplaces done right create the opportunity to build other products and services (either first- or third-party) on top. To do this, network effects and liquidity are required as the jumping off point for the adoption of additional value-added products or services. Airbnb, for example, became a way for real estate entrepreneurs to build a portfolio of rental homes. AngelList became a platform for investors to build a portfolio of micro VC managers by investing in a number of Syndicates.

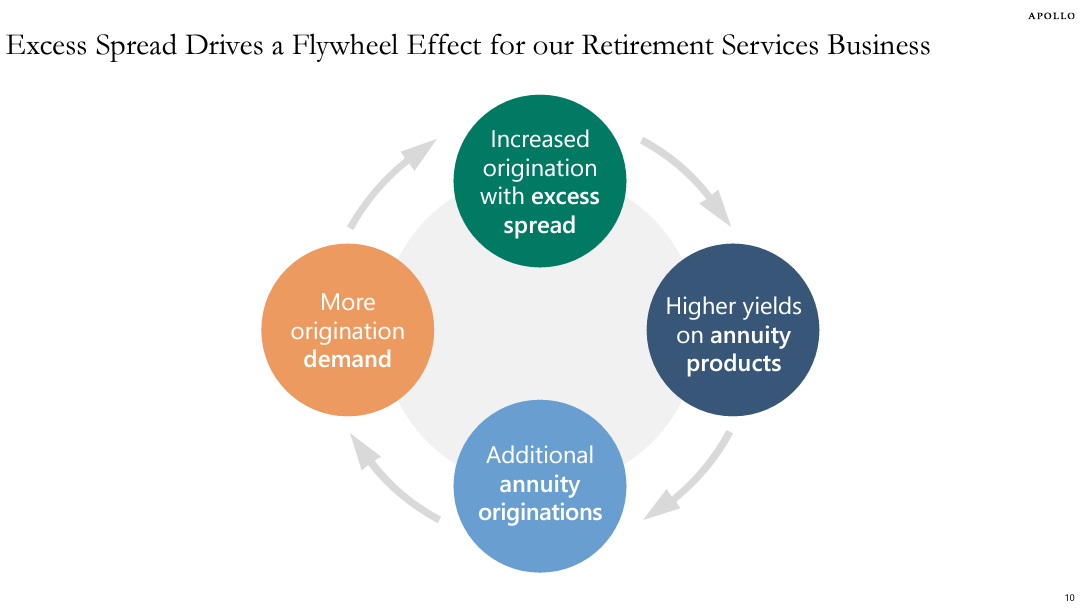

In a sense, Apollo has perfected the art of network effects as an alternative asset manager. They have layered on partial or full ownership of origination platforms on top of the foundation of the private equity firm they built years ago. Their origination platforms, which range from standalone companies like insurer Athene to mortgage businesses, afford them with both spread-related earnings in the form of equity and debt deployment and fee-related earnings in the form of management fees and syndication fees.

The magic of marketplaces

Marketplaces have a magical component to them that differentiates them from other businesses. They can change both the nature of a market (as explained above) and the nature of competition.

Marketplaces enable companies and products to be built on top of the foundation of the marketplace itself in a way that can reshape competition and even turn competition into collaboration or cooperation (however begrudgingly it may be done).

[From my post in 2014] In many respects, finance has entered a “new world order.” To borrow a political science analogy, we live in a multipolar world more than ever, with no hegemonic power, like a large banking institution controlling all verticals of financial market structure. Now, we see an increasing number of smaller players creating disruptive business models in specific, highly verticalized markets, exerting influence, and gaining market share.

Just look at companies like Lending Club, which has originated over $4 billion in loans in the past seven years and has a $3.8 billion enterprise value. They have become a formidable non-bank lender for consumers in need of a loan. The same goes for Wealthfront, which has become a viable wealth management option for many investors. Wealthfront has aggregated over $1 billion in AUM as a low-fee, automated online wealth manager in three short years, which is three years less than it took Charles Schwab to reach the $1 billion milestone in the 1970s. The rise of companies like Lending Club and Wealthfront has forced consumer lending banks and wealth management firms to rethink their respective strategies. In fact, the next evolution in financial market structure could very well be product distribution platforms built on top of marketplace companies like Lending Club and Wealthfront are emerging as viable platforms today. It would not be a surprise to see a Kayak-like product aggregator — or lower cost fund supermarket — that uses predictive analytics to help investors choose their financial products from these highly verticalized marketplaces [author emphasis].

The way these marketplace finance platforms have won the smaller battles is by initially focusing on platform in specific verticals. Companies like Lending Club and Wealthfront in finance and Amazon, Apple, eBay, Google, Facebook, Uber, and Lyft in consumer services have been winning because they have put platform first, attracted the community, and captured the trust of consumers and end users by creating an engaged network of users.

There’s been a lot of talk about how alternative asset managers are encroaching on banks’ territory. That’s very much the case today — and these firms have grown to a size and scale where they can compete with banks in certain corners of private markets, like private credit. Alternative asset managers may not have known 20-30 years ago that they would end up here, but they certainly earned the right to compete in a bigger arena after winning smaller battles by initially focusing on specific verticals.

Data is the other advantage marketplace companies have in their arsenal as they scale. The biggest alternative asset managers are becoming tech companies in reverse. They started out as asset managers, leveraging a heavy services model (people), to grow and scale their business. Now that they are of a size and scale that affords them access to a large data lake, they have the ability to take full advantage of the data gleaned from the liquidity and network effects of their platforms.

Their CTOs are highly capable technologists who have to understand both technology and investing. They have to figure out how to create internal efficiencies with their own tech stack and internal data to drive better process and diligence outcomes and leverage partnerships or investments in external tech companies to create efficiencies with valuation, performance, and LP management (particularly as they work with the wealth channel).

Over time, they can use their scale to lower costs, both on the investment side with team, talent, and technology and with their fee structure, as growth in AUM can balance a lower fee structure.

Many of the scaled alternative asset managers, while not initially thought of as marketplaces, exhibit many of the very features that make marketplaces so successful.

Shopping in the alts supermarket

Many alternative asset managers are becoming one-stop-shops. They are a destination for capital providers seeking to access a spectrum of investments across private markets.

Whole Foods started as a single, niche supermarket in Austin, Texas, focused on healthy food. They have since gone global, remaining true to the brand of providing healthy food, more or less, but now doing so as a part of the world’s largest online marketplace, Amazon. Scale has been a defining feature of both Whole Foods and Amazon (which started in a single vertical, selling books, by the way). It’s interesting to think about the evolution of this supermarket in the context of capital providers shopping for alternatives.

On our podcast, I asked L.T. about how alternative asset managers can balance scale with returns. His answer was fascinating.

Michael: That brings up such a fascinating point. I think it was Steve Schwarzman who said, scale is our niche. And that's such an interesting comment when you think about investing because when I think about that, I think about how do you balance the equilibrium of scale, as many of these firms like Blackstone and others are building, and the value that's created from that liquidity, like you say, with returns. And that's the other side of that for the investors and the other side of that marketplace, and generally, returns can be harder to come by the more scale you have. Because as more capital comes into a space, it gets harder to generate returns. How do you think about scale in the context of alternative asset managers and what's happening in private markets? And then how you balance that with returns while thinking about just the building of these marketplace businesses?

L.T.: I remember when Steve said that. That scale is niche. I'm going to add a second part, Michael, to that statement, which I guess gets less covered than he would say. He would also say that scale begets skill. And the more skill you can put against creating value, the more you can justify the scale [author emphasis]. So in the early days of Blackstone, shortly after we went public, there was a lot of confusion about, well, how's this different from The '40 Act shops that do mutual funds, et cetera. And the answer was we found businesses where skill really matters, i.e., finding businesses and knowing how to turn them around. And then we found a little bit of the golden rule that the more scale that we had, the more resources we would have at Blackstone to invest in creating alpha, if you want to call it that, or value creation. And so the scale actually made us more competitive. So, if I think back to when I joined the firm, I think our private equity fund was six billion, and our real estate fund was probably three billion. Those are about now both 30. That difference in those is not just adding more assets like you would to a mutual fund or a hedge fund. Those assets have translated to deep operating teams, asset management teams that can actually help create value during the course of the whole [author emphasis]. Also, going out and finding more deals, negotiating them. The golden rule in investing is where can you find a space that the more you invest in your returns, the greater the alpha you generate was. That's the right place to scale [author emphasis]. If you don't have that, then scale doesn't create what Steve said. It’s not your niche and doesn't create value. So that was the guiding force behind how that was built out.

“Scale begets skill. And the more skill you can put against creating value, the more you can justify the scale,” L.T. said. What an interesting way to look at the value of scale. Scale can create both the liquidity and network effects — in certain investment strategies — that provide the edge that’s much more difficult to attain without the scale.

Whether or not investors agree with this statement, it appears that this is where private markets are headed in many respects. Large alternative asset managers are competing to become the one-stop-shops for LPs. They can provide access to private markets across a range of strategies, just like Whole Foods can provide access to a range of healthy foods globally and in an efficient manner. Sure, some of the quality of Whole Foods may have been lost in their quest for global scale. But as a company, they’ve decidedly benefitted from the breadth and depth of their offering. So, too, have many of the largest alternative asset managers. They’ve gone big, and they’ve gone global because they’ve built thriving marketplaces that have aggregated liquidity, network effects, and data. And that’s why we are seeing an increasing number of investors shop at the alts supermarket. To succeed in the ever-changing world of private markets, alternatives firms will likely either have to be large, one-stop-shops that can transform into investment marketplaces for their capital providers or stay small as niche, specialized players. It’s the middle that will likely be missing going forward as marketplace finance features in the future of finance and the mainstreaming of alts.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Is private equity actually worth it? | Robin Wigglesworth, Financial Times

💡As the $1.6T Norwegian sovereign wealth fund, Norges Bank Investment Management (NBIM), considers its first-ever allocation to private equity, Financial Times’ Robbin Wigglesworth offers a balanced view of the pros and cons of the asset class as an investment opportunity. NBIM, effectively the world’s biggest and broadest index fund, is proposing a 3-5% allocation to private equity. This move would mean an $80B allocation to the space. As more institutional investors — and individual investors — allocate capital to private markets, Wigglesworth wanders into the debate on both sides. Is private equity worth it?

We certainly live in private equity times. The overall AUM has been on a steady growth path since the early 2000s and on an even greater slope from its humble beginnings in the late 1970s, when KKR popularized the concept of “leveraged buyouts.”

Proponents of private equity point to performance. They argue that private equity has outperformed public equities. Proponents would also cite the trends. Private companies are staying private longer, which is a problem for a public markets investor like NBIM. Only investing in public markets would shrink the available universe of quality investable companies for those not participating in private markets. All of this brings up the question of whether the stock market is as representative of the global economy as it once was.

NBIM cited this point in their letter to the Norwegian finance ministry in November 2023:

“A small portion of listed companies are accounting for an ever larger share of the listed equity market. The number of listed companies worldwide has levelled off. Since 2010, the listed equity market has not grown beyond what can be explained by movements in share prices. There are fewer IPOs in developed markets, and the companies coming to market are larger than before. This suggests that the GPFG is missing out on part of companies’ growth by not investing until after they have been floated and eventually enter the fund’s equity benchmark. These trends are not new but have become more pronounced over time.”

NBIM goes on to state that “analyses of historical returns indicate that investments in private equity could give higher returns after costs than listed equities in the long term.” Their assertion is backed up by data from both CEM Benchmarking, a Canadian firm that collects data reported by $15T worth of pensions, endowments, and other sovereigns. It found that the average annual net return of private equity has been four percentage points higher than what its clients have made on public equities over the past decade. Data from Cambridge Associates also supports this assertion.

Wigglesworth then goes on to provide the “yes, but” view on private equity returns. He surfaces quotes from AQR’s Global Co-Head of Portfolio Solutions, Antti Ilmanen, who notes that IRR measures “have got lots of problems. They are popular, but they are dangerous, very misleading.” Some academic reports, such as a 2013 paper by Andrew Ang, Bingxu Chen, William Goetzmann, and Ludovic Phalippou, argued that “private equity is, to a first approximation, a levered investment in small and mid-cap equities.” Phalippou has also called for a more apples-to-apples rather than apples-to-pears comparison of benchmarking when aiming to analyze private equity returns.

A paper by Jean-Francois L’Her, Rossitsa Stoyanova, Kathryn Shaw, William Scott, and Charissa Lai claims that returns look different if you adjust for leverage, size, and industries to get apples-to-apples comparison. The paper states, “after making these risk adjustments, we find no significant outperformance of buyout fund investments versus the public market equivalent on a dollar-weighted basis.”

Wigglesworth evaluates interesting points on both sides. He then brings up some good reminders for how to think about future returns of private equity. The industry is larger than it was, and deals are becoming larger. Interest rates are now higher than they used to be, which could have certainly aided investors in ways other than margin expansion as a driver of returns.

Despite the debate on both sides, institutional investors have appeared to find ways to make private equity work for them. By co-investing and writing large checks, they’ve been able to sufficiently lower fees to the point where it’s had a positive impact on their returns.

For those who can exert pricing power on fees, perhaps they are the ones who have the real advantage.

💸 AGM’s 2/20: Wigglesworth offers a balanced view into private equity and brings up a number of good points about what the future may look like. There’s certainly more capital that has come into private equity, which could impact returns. However, more companies are staying private longer. The cloth could cut either way on this. I’m constantly reminded of Franklin Templeton CEO Jenny Johnson’s quote on her Alt Goes Mainstream podcast that the most important number is returns net of fees. If the returns, net of fees, are better, then it justifies the investment. Private equity generally has higher fees, so it has to have the excess returns to justify its higher fees for investors. Investors ultimately vote with their wallets, so it appears that they believe this to be the case.

It’s also worth noting that perhaps returns, while certainly the most important objective, are not always the only objective. For some investors, it could be about where to allocate capital based on an investment mandate. There’s only so much capital that investors can put into public markets. Perhaps private markets can serve as a way to access a different market or company size, which achieves an investment mandate.

Private markets are also more than just private equity. Even if private equity sees a relative decline in total AUM allocated to the space, private credit (which itself has a number of different sub-categories), real estate, infrastructure, and venture capital all comprise private markets. These areas may see an uptick in asset inflows as investors think about private markets holistically.

The other point worth mentioning here is related to returns. Many believe that returns may be harder to come by in a higher interest rate world. Apollo’s Marc Rowan recently said that returns will be more challenging for investors going forward. This sentiment will certainly be true for private equity firms, but it will also be true for LPs going forward. Perhaps the end result is there will be more value placed on LPs who are skilled pickers of investment firms and funds that enable them to generate outperformance.

📝 David Rubenstein: Carlyle will try to be at forefront of retail capital push | Adam Le and Carmela Mendoza, Private Equity International

💡PEI’s Adam Le covers Carlyle Co-Founder David Rubenstein commenting on the “gigantic” opportunity that non-institutional and private wealth represents for private equity. At PEI Group’s NEXUS 2024 event, Rubenstein said that the private equity industry should work to increase access for all investors. “We should allow people who need to invest in things that get a higher rate of return because they don’t have much income.” Rubenstein called for investors to be allowed to use 401(k) accounts or individual retirement accounts to access private markets, stating that individuals should be allowed to invest 4-5% of these vehicles into alternatives. Rubenstein said that his firm aims to be a leader in providing access to individual investors: “[Carlyle] is going to try to be at the forefront with other larger private equity firms trying to make opportunities to invest in the kind of funds we have available to … individual investors.” He added that there’s a massive pool of capital that could move into alternatives. “Even if we don’t make a change in the IRA [individual retirement account], there’s still an enormous amount of money out there [from] individual investors — not only in [the US], but around the world.” Rubenstein admitted that Carlyle could have done a better job working with the wealth channel, but he also noted that they are very focused on developing products for this investor group. Carlyle is set to roll out a private equity-focused offering to the wealth channel in the coming quarters, according to Chief Executive Officer Harvey Schwartz. Carlyle has been far from non-existent in working with the wealth channel. Schwartz noted on the FY2023 earnings call that they have gathered $50B of inflows from the wealth channel since inception and have “made progress growing the strategy” over the years. Carlyle did recently launch a private equity secondaries vehicle, the Carlyle AlpInvest Private Markets Fund, for the high-net-worth channel. It appears that other vehicles will soon follow.

💸 AGM’s 2/20: With all eyes on growth, the largest alternative asset managers are squarely focused on the wealth channel. Carlyle, a private equity pioneer, is no exception. With $50B in asset inflows from the wealth channel, Carlyle is far from a novice in working with this investor group. But they also believe they can do better. It appears that their executive team believes that the wealth channel can be a major driver of growth for the firm, which, while large, has lagged behind some of their peers both in terms of market capitalization and AUM. That could change given their focus on developing products for a channel that hasn’t had much access to private markets. Their investment in the wealth channel extends beyond marketing and into hiring. The firm recently brought on a former Bridgewater Associates professional, Russell Lane, who focused on product development and distribution for the firm. He was most recently Head of GP Solutions at alternatives distribution platform Moonfare before joining Carlyle a month ago as Head of Product Development - Global Wealth. The other growth opportunity is in retirement accounts. If, as Rubenstein says, private markets investments can end up in 401(k) or IRAs, that would mean trillions of net new assets flowing into private markets. For a market that is $14T in size, asset flows from the untapped retirement account market would represent a step-function change in private markets AUM. Apollo’s Marc Rowan echoed this sentiment on the firm’s quarterly earnings call last month, citing the retirement account market as a massive opportunity for the industry. Who would be the beneficiaries? Likely the largest alternative asset managers that have built products and salesforces equipped to work with the individual investor channel.

📝 Family offices have tripled since 2019, creating a new gold rush on Wall Street | Robert Frank, CNBC

💡CNBC’s Robert Frank highlights the growth of the family office market and what that means for alternative asset managers, who are (and have been) racing to work with this large investor channel. Frank notes that the number of family offices worldwide has tripled since 2019. He cites a Preqin report that states that the number of family offices grew to over 4,500 last year. North America has the world’s largest share of family offices, being home to 1,682 firms. Additionally, over half of all family office assets, a figure that now tops $6 trillion, reside in North America. The ranks of the wealthy appear to be going from strength to strength. There are over 2,600 billionaires in the world, and the number of people globally worth $100M or more, the typical threshold for a family office, has grown to over 90,000, according to Wealth-X, an Altrata company.

Family offices have come into the crosshairs of alternative asset managers looking to grow their platforms. Frank notes that the family office boom has caught the attention of alternative asset managers looking to work with the wealth channel. Many of these firms have expanded their teams, funding events, and product development capabilities to better serve family offices. “The larger private equity managers are trying to compete there by putting in resources and time," said Rachel Dabora, research insights analyst at Preqin. "Ultra-high-net-worth investors and family offices are really on their radar.” While family offices have been — and continue to be — active in private markets, Preqin’s survey shows that many have been disappointed with their venture capital and private equity returns. Over half of the family offices surveyed by Preqin stated that they were unhappy with their venture capital returns, and a third were unhappy with their private equity returns. They are, however, optimistic on venture capital and private equity opportunities over the coming 12 months. Alternative asset managers like Blackstone and Apollo are ramping up their teams specifically focused on family offices to match the investor interest. Blackstone has doubled its Private Capital Group, which serves family offices, billionaires, and large, sophisticated individual investors, to 25 people over the past few years and is likely to keep growing, according to Craig Russell, Global Head of Blackstone’s Private Capital Group. Russell affirms what the data has illustrated. “We view this as a substantial and growing opportunity for Blackstone,” he said. Apollo, for its part has also focused on growing its family office presence, hiring Partner Brian Feurtado as its Head of Family Office Business away from BlackRock, where he spent 17 years leading BlackRock's Family Office, Foundation, Endowment, ad Healthcare channels.

💸 AGM’s 2/20: Family offices are a growing and attractive part of the wealth channel distribution puzzle, but they are also probably the most difficult piece to figure out. Many family offices are not like the RIAs and private banks that alternative asset managers have done well to work with. They have very different buying behaviors, firm structures, and even investment goals. I wrote last week about how family offices are a very unique and fragmented market. As the saying goes, “when you know one family office, you know one family office.” This feature can make it difficult for a private wealth team at an alternative asset manager to properly cover family offices in a scaled way. Family offices also have much more idiosyncratic decision-making structures and decision-making cycles, making them very different from a sales perspective than the much more uniform sales cycles of pensions, sovereigns, endowments, and even private banks and large wealth platforms. Family offices often don’t like to be sold to and value trusted relationships, making it very hard for a more traditional sales effort by a larger investment firm. Compounding this feature is that family offices also like to have direct relationships with managers, like co-investments, and tend to be fee-sensitive. This isn’t an issue for fund managers when they are dealing with institutional-quality multi-billion dollar family offices with professional teams and a CIO, but working with family offices of smaller sizes can be more challenging for fund managers. Many family offices want special treatment or access, which is sometimes why they favor smaller managers. Family office groups, as I’ve mentioned in the past, like 3i, Family VC, Tiger 21, and others, have stepped in to fill a void and create collaborative investment discussions and peer-to-peer sharing of deals amongst trusted members. I anticipate that alternative asset managers will look to find ways to partner with these groups. The challenge will be breaking in.

📝 Go East: Maturing PE market speeds stream of GPs opening Mideast offices | Andrew Woodman, PitchBook

💡PitchBook’s Andrew Woodman reports that a number of GPs are putting down roots in the Middle East as more firms are raising capital from the region. A handful of GPs have formed strategic partnerships with Middle Eastern sovereigns and LPs, leading to those firms opening offices. Ardian opened an Abu Dhabi office after forming a partnership with Mubadala in 2023. Tikehau also opened offices in Abu Dhabi. Blue Owl followed them into the region in September 2023 after launching a joint venture with Lunate. Other peer firms have also opened up offices in recent years. General Atlantic planted a flag in the UAE and Saudi Arabia, as did HIG, who opened an office in Dubai. CVC and Brookfield have also opened up Middle East offices. Middle Eastern LPs continue to ramp up involvement in global private equity firms, investing both in funds and co-investment opportunities or forming joint ventures, as Lunate did with Blue Owl for their $2.5B middle market GP stakes fund.

💸 AGM’s 2/20: The Middle East is planning ahead. The region’s oil-rich economies are digging deep into their well of capital to expand beyond commodities and diversify their asset exposure. It appears that they are going about their foray into private markets in a strategic way. They understand that they can be a large capital provider to GPs looking to scale a strategy or broader business, so they are finding ways to partner beyond being a passive LP. This is reflected in a raft of partnerships that Middle Eastern sovereigns and institutional LPs are executing with some of the industry’s largest GPs. It also appears that they are looking to turn the region into a financial center by encouraging firms to have a presence on the ground in the region as part of the strategic partnership. It will be interesting to see how this all unfolds.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the seventh episode of our monthly show, the Monthly Alts Pulse. We discuss why chemistry and collaboration key for the next wave of private markets and how solving distribution challenges in private markets means solving logistics problems. Watch here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.