👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a deal-sharing network that originated from a simple yet powerful realization — the best alternative investments are all in the same place.

They are in the portfolios of the best alternative investors.

Every month, 3i Members source over 100 deals from the network and select 3 to present.

These deals are high-yielding, underwritable, and uncorrelated with asymmetric return profiles.

Members come together to diligence these opportunities, negotiate terms, and decide whether to invest.

Click here to see two sample deals from 3i Members.

Good afternoon from London, where I have just finished a week of meetings and private markets events before I head to DC.

The world is small.

Last week, I boarded a train at New York’s Penn Station for the three hour trip to Washington DC. I sat in the window seat, cracked open my laptop, and started to work.

Shortly after I sat down, a sharply dressed man took the seat next to me. He, too, pulled out his laptop and started working. When he asked if he could use the computer outlet next to the window, I couldn’t help but notice his British accent.

We struck up a conversation.

“What brings you to the US?” I asked. He introduced himself as Andy (Dawson) and said he and his business partner were in the US meeting with prospective LPs for their fund’s latest capital raise.

“What fund?” I inquired, wondering if I’d know the firm.

“bd-capital,” he replied, assuming it unlikely that I’d heard of them.

“bd-capital,” I said to myself. Yes, I did know bd-capital. Recently, Graham Elton, Bain & Company Partner and Chairman of the European Private Equity Practice (and Alt Goes Mainstream podcast guest) had told me that he is a Senior Advisor to bd, as well as Chair of the firm’s Operator’s Club.

Andy and I couldn’t believe the coincidence. He went on to share that he was the Co-Founder of bd along with his Partner Richard Baker. I told him that Graham and I have known each other for 14 years dating back to when I was at LSE organizing the LSE Alternative Investments Conference. Graham and the Bain & Co. PE team had helped us organize and masterfully structure the agenda for the conference.

We continued on talking for the next hour and a half about bd, what it was like to leave his role as a Partner at Advent to build a new lower-middle market PE fund, fundraising, creating an edge as a fund manager, helping build businesses, and life. The time flew by as fast as the train whizzed by each house and building along the train tracks.

The chance meeting with Andy was far from a pitch of bd, yet we had a chance to naturally dig into what Andy believes makes their firm special. They have a unique, Operating Partner-centric model where they have a stable of successful and experienced business builders and executives, like Graham, who work closely with the investment team to evaluate companies and help advise and guide them once they invest. I loved hearing Andy articulate with such thoughtful consideration and care to what he thinks is bd’s edge, which we dug into further after spending time together at their office in London this week.

Small seemed to be the theme of my week in London. And small can be beautiful in the world of investing.

On Wednesday, I joined a group of angels and early-stage fund managers in Shoreditch to speak at the Angel Unconference, organized by newly minted emerging manager Pietro Invernizzi, who recently founded firedrop, and Fred Destin (also an Alt Goes Mainstream podcast guest) and Gabbi Cahane of Stride VC.

At Alt Goes Mainstream, we talk a lot about the big getting bigger. That’s certainly a driving force behind the growth in private markets. And for good reason. As former Blackstone and Airbnb CFO and WestCap founder Laurence Tosi said on an Alt Goes Mainstream podcast, “scale begets scale … and scale begets skill.” Scale can be a major advantage both for investment teams and for fundraising. The large firms are transforming into “one-stop shops,” which certainly can benefit them from a fundraising perspective as they begin to work with the wealth channel in particular. However, size can also be the enemy of outperformance, particularly in certain corners of private markets, like lower-middle market private equity and venture capital.

Small can be impactful. Both for companies adding high-impact angels and early-stage investors to their cap table early on in their company building journey to help accelerate growth or customer adoption, as well as for LPs to drive outperformance.

Small can be beautiful

Small can be beautiful, particularly for an LP looking to generate outsized returns in lower-middle market private equity and venture.

PitchBook recently released a fantastic report that dove into returns of emerging vs. established managers across asset classes in private markets.

Across buyout and VC, emerging managers tend to outperform their larger peers (albeit with more volatility between quartiles of performance).

As PitchBook data highlights, emerging manager buyout funds tend to have slight outperformance in most vintages.

PitchBook also finds that emerging manager VC funds tend to outperform and have larger interquartile dispersion (in most vintages) than larger, established funds.

Now, the devil is certainly in the details of emerging managers that tend to have more success in their fundraising efforts.

PitchBook finds that emerging VC fund managers who tend to successfully raise their funds more often than not come from firms that have historically outperformed. PitchBook cites a few recent examples, like Tomasz Tunguz, a former Redpoint Ventures Partner who spun out to start his own firm, Theory Ventures, and achieved an oversubscribed first fund. News this week of three GPs from established brands — Connie Chan from Andreessen Horowitz, Mark Goldberg from Index Ventures, and Ethan Kurzweil from Bessemer — teaming up to form a new fund provides another example of experienced VCs spinning out to launch a new brand.

This data from PitchBook, which finds that spinout managers that successfully raise their own funds tend to come from firms that historically have outperformed, is not terribly surprising, for a number of reasons. Emerging VC managers who have successful fundraises likely had a track record at their prior firm. This enabled them to both build experience and a brand, in addition to an attributable body of work that LPs can evaluate when determining if an emerging manager will do well on their own.

How can LPs discern which types of emerging managers to back? Perhaps PitchBook’s data can provide some insight.

PitchBook finds that the top decile and top quartile emerging specialist managers tend to generate performance that far outstrips established ($1B+ AUM) established generalists, emerging generalists, and even established specialists.

The topic of generalists versus specialists was what conference organizer and firedrop GP Pietro Invernizzi and I spoke about at this week’s Angel Unconference.

In some respects, the data from PitchBook on outperformance by emerging specialists is surprising. One question surely on the minds of LPs who back specialists and GPs whose carry is tied to a specific industry or sector is whether or not a specialist has enough shots on goal in any given vintage to hit on enough $B+ outcomes that will drive fund returns. After all, only so many $B+ companies are created in any given year. The universe of investable companies shrinks when a manager only focuses on a specific sector or category.

On the other hand, a specialist VC’s strength could lie in their ability to pick. As we discussed last week, the art of picking is the most challenging aspect of investing. But also perhaps the biggest driver of value. Specialists, in theory, should be able to better evaluate the founder, market, product, and competitors when they have deep knowledge and familiarity of the nuances of an industry.

Where decision-making in VC (from both an LP and a GP perspective) can be tricky is when it becomes difficult to see around corners. There are times when knowing too much can be the enemy of making a risk bet on the potential of an outlier company or idea that seems too non-obvious and non-consensus to be right in the future.

How should LPs approach this conundrum? The punchline of PitchBook’s report is that balance might be the answer: LPs should aim to tap into the possible upside of emerging managers while also capturing the stability, consistency, and lower downside risk of more established funds.

There’s no single right answer to an allocator’s approach. Yes, LPs certainly endeavor to generate the best possible returns they can with the mandate they are tasked with. However, investing also takes into consideration risk, diversification, liquidity, and other factors in addition to returns.

The answer might come down to a certain question: what game do you want to play as an LP?

VenCap’s David Clark, the CIO at VenCap, a 37-year-old firm that has allocated to over 300 venture capital funds in its history, recently tweeted about how to balance risk and return.

Clark highlights that different investors might be playing different games.

A re-architecting of risk

Speaking of playing different games, that’s what I want to cover in this week’s thought piece on AGM.

Apollo CEO Marc Rowan shared thoughts on the evolution of private markets in his talk at the Norges Bank Investment Management Investment Conference last week.

Whether or not one agrees with Marc or sees his views as promoting Apollo (and private markets products more broadly), this talk is a must-listen.

The game on the field has undeniably changed. The playbook that has worked in the past will very likely not work in the future. A fresh game plan for a new world order in investing is required. The question is how will allocators adapt.

A lot is at stake. Allocators’ answer to investing in this new world is crucially important — helping investors save for retirement is an increasingly acute challenge, yet one that is critically important. Public markets alone may not be able to secure investors’ futures. That’s why Marc’s questions are so important for us as an investment community to be thinking about and devising answers.

He prompts the most important question of all: why?

Marc’s talk is as thought-provoking as it gets. He provides us with a lot to think about for the future.

Some of my thoughts on a few of his quotes from the talk that stand out:

“Don’t be defensive; be curious”

How can investors be defensive in a market where change is constant? Markets have changed dramatically, particularly over the past 18 months, as interest rates have taken a sharp upward turn. This change means that what worked in the past for investors may not work in the future. It also means that both GPs and LPs alike should question what strategies and frameworks for investing will fit a new financial market structure (which he covers in his talk as well) and play offense rather than defense to a different investing landscape.

“The past 40 years have been a period of tailwinds for financial markets”

Marc rattles off four major tailwinds that have benefitted investors over the past 40 years: rates going from high to low, governments printing a lot of money, markets borrowing forward a lot of demand, and the benefit of globalization. “Are any of these four things true going forward?” he asks. It’s fair to assume that many of these characteristics will not feature going forward. If that’s the case, what does that mean for investors going forward? In Marc’s view, it means that investors may have to approach their decision-making with the notion that the past may not inform the future.

“Is there any value to track record over the last 10 years?”

Given that Marc believes that the features that defined the past in investing have changed, does it make sense for investors to use past performance and prior frameworks for evaluating the skill and approach of investment managers to determine if they will perform well in this new financial market structure? It’s a very fair question and one that should make LPs’ minds turn. How should they evaluate managers? How can they test their decision-making frameworks if the future will be different from the past? How should allocators re-architect their portfolio construction? These should be the questions that LPs should be asking in their board rooms and their investment committees.

I’m firmly with Marc that it’s going to take a different outlook and a fresh set of perspectives in order to succeed in the new financial world order. In some senses, this should favor emerging managers. Who is to say that managers who have performed well in the past will continue to have persistence in the future? Yes, brand certainly matters, but if the world is going to be as different as Marc says it is, then perhaps prior performance, frameworks, and brand count for less going forward.

“Are public markets liquid?”

Marc makes the point that public markets (outside of equities) might not be as liquid as one thinks. Marc cites the example of how it takes five days to sell a highly rated corporate bond from outside the top 20 issuers. If public markets lack the liquidity that many have leaned on for the comfort of safety, then does the difference between public and private matter as much as it used to? Further, Marc asks the question: do investors need liquidity in many parts of their portfolio? The $12T 401k market in the US is effectively allocated to daily liquid index funds, yet they sit in those products for 50 years, he says. This feature of markets becomes even more of an issue for these investors when he rattles off a few concerning trends in public markets: increased indexation and correlation in public markets. 83% of the US equities market comprises of the S&P 500, of which ten stocks make up 35% of the returns. These stocks trade around a 45x price/earnings. That means many investors are missing out on the diversification (and, possibly, returns) that private markets can offer.

“Investors who have looked to private markets for rate of return will now look to private markets for diversification”

Marc believes that investors will aim to escape the indexation of public markets with diversification in private markets. His view is that the universe of 8,000 public companies in the US that has shrunk to 4,000 public companies might become even smaller, not larger. That means investors only exposed to public markets are missing out on the diversification that private markets — across both equities and fixed income — can offer.

A more cynical but interesting take on Marc’s comment about pushing private markets as a diversification tool for investors? That he recognizes that more capital flowing into private markets means that returns could come down, so he’s future-proofing his firm and private markets more broadly by touting its features as a diversifier away from liquid markets rather than a pure alpha-generating investment strategy. Even if that’s the case, it’s hard to argue against the notion that private markets will likely — and probably should — become a larger part of investors’ portfolios.

“I grew up thinking public is safe, private is risky”

The investing world Marc grew up in is very different from the current investing world he paints for us. With the universe of public companies shrinking, an increasingly concentrated public market for investors, and a secular trend of de-banking, what if public is no longer as safe as it once was? “What if private is both safe and risky and public is both safe and risky,” Marc challenges us to think.

Risk, concentration, correlation, and liquidity take on a different meaning when thinking about the characteristics of today’s markets. Further, why shouldn’t the type of capital that’s required to fund certain markets or projects match the illiquidity profiles that investors have? Marc references energy transition, climate change, and infrastructure as projects and markets that need long-term horizons on capital invested. Why would it make sense for those markets to be funded on a daily liquid basis? The same goes for retirement accounts. If investors are not likely to need liquidity in those investment products until retirement, why wouldn’t it make sense for those investment products to be invested into private markets?

If investors are able to re-architect how they think about investing, perhaps it also reshapes their portfolio construction. While portfolios may still yet to be reoriented, the discussion has moved well beyond the notion of the 60/40 portfolio. I’ve written about how we’ve moved from pieces of the pie to buckets and spectrums.

AGM Alts Weekly 1.14.24: Are we moving towards a world where allocators live in buckets and spectrums rather than slices of a pie? What I mean by this is that allocators will look at their equity bucket across the spectrum of public equity and private equity and allocate accordingly rather than think about their private equity exposure as a different piece of the pie than equities. Same with credit.

If Marc is right that investors’ views on daily liquidity is going to change, then there will be a fundamental reshaping of the definitions of investments. It’s not at all far-fetched to think that Marc’s description of private equity as “equity that is private” will come to define how investors characterize certain types of investments.

With changing definitions will come re-architected portfolios. Portfolios reshaped on new definitions of alpha and beta, liquidity and illiquidity, risk and return.

A new world order

Marc is effectively asking the question: “How do we have success as investors when a series of things no longer exist?”

This thought experiment is one of the most important questions those in private markets on both sides of the GP / LP table can answer.

The new financial market structure that Marc details could very well be the most significant shift in our lifetimes for the next era of investing.

No longer is it just about proponents of private markets wanting alts to become more mainstream. Alts might have to go mainstream to provide many investors with both returns and diversification in a new world order.

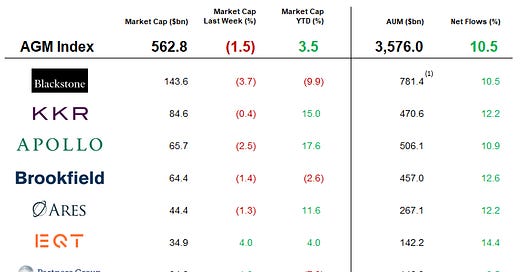

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Blue Owl affirms $13bn target for latest GP stakes fund | Kirk Falconer, Buyouts Insider

💡Buyouts Insider’s Kirk Falconer reports that the biggest firm in the GP stakes market, Blue Owl, confirmed that they have set the target for a new record target for their next flagship GP stakes fund. Blue Owl CFO Alan Kirshenbaum said on their recent quarterly earnings call that they expect to hit their $13B target for GP Stakes VI. Successfully closing on this figure would mean that Blue Owl’s sixth fund would best its predecessor fund that closed in 2022 at $12.9B. Blue Owl’s fifth fund, GP Stakes V, is the largest GP stakes fund on record. Blue Owl has already had traction with LPs for the fundraise, securing $2.1B in an initial close they held towards the end of 2023. They also reported on their earnings call that they added an additional $400M of sidecar co-investment capital to complement the vehicle. With $55.8B AUM (and $31.8B of fee-paying AUM), Blue Owl’s GP Strategic Capital platform has taken minority equity stakes in many of the industry’s leading alternative asset managers. Firms in their portfolio collectively oversee nearly $1.8T of AUM. On the earnings call, Blue Owl Co-CEO Marc Lipschultz highlighted why he believes the strategy is attractive; managers backed by the flagship strategy “continue to benefit from two meaningful secular trends: growing allocations to alternatives and GP consolidation.”

Blue Owl has also expanded into the increasingly competitive middle market stakes space. Earlier this year, they consummated a partnership with Lunate, backed by Abu Dhabi sovereign wealth fund ADQ, to acquire minority equity interests in alternative asset managers with less than $10B AUM. According to Kirshenbaum, the fund, called Advantage Fund, held an initial close of around $600M in the first quarter. An additional $100M in capital came into the fund in the first close alongside the $500M in seed capital provided by Lunate. According to a recent Bloomberg report, Blue Owl is apparently seeking up to $2.5B for the Advantage Fund. Blue Owl’s move into the middle market is part of a broader trend that is seeing a number of middle-market-focused GP stakes firms fill the supply / demand imbalance with far more possible investment targets than funds raised for the middle-market. Falconer lists funds such as Bonaccord Capital Partners, Hunter Point Capital, Investcorp Strategic Capital Group, and RidgeLake Partners as having dedicated funds focused on the middle market. Recently, Azimut Alternative Capital Partners has joined the fray, reportedly looking to raise $1B for a debut mid-market GP stakes fund.

Blue Owl also covered the performance of its GP stakes funds on the earnings call. Falconer notes that GP Stakes V was earning a 34.1% gross IRR as of March, according to first-quarter documents. GP Stakes IV was earning a 64.9% gross IRR.

💸 AGM’s 2/20: Blue Owl (thanks to their legacy Dyal business) has been a pioneer in the GP stakes space. This quarter’s earnings call illustrates that they continue to set the pace as the market leader in the space. A $13B fundraise by GP Stakes VI would represent a record fund size for the stakes space, with a considerable market size to cover. More LP capital is flowing into the space, in large part due to the ability for the product structure to return cash yields relatively quickly into the investment’s life while retaining upside potential due to the equity stake in the manager. The secular trends that Blue Owl’s Lipschultz highlights, growing allocations to alternatives and GP consolidation, are massive tailwinds for the space more broadly. An increase in the industry’s AUM, which PitchBook recently pegged at over $20T, and possibly up to $24T, by 2028, would be a boon for alternative asset managers’ revenue streams — and for the GP stakes funds that invest into them.

One statistic in particular stood out from Falconer’s article: The underlying funds in Blue Owl’s portfolio represent $1.8T of collective AUM. With aggregate private markets AUM pegged at $14.7T, Blue Owl’s underlying funds have over 12% of total private markets AUM covered. That makes Blue Owl as an index of sorts for an investor who wants exposure to the broad growth in AUM in private markets.

I’m not surprised at LP interest in GP stakes funds or the growing list of competitive firms focused on the middle market GPs. Alternative asset management businesses are incredible business models that embody many features of compounders — they possess a sticky, recurring revenue from management fees that often scale with increasingly high margins since headcount often doesn’t need to scale in lockstep with growing AUM. Customer bases tend to be long-term, repeat, and have the potential to buy multiple products, as recent data from both CVC and Ares would suggest. These firms also possess meaningful upside from longer-dated carried interest. For context, CVC, which just went public last week, will likely achieve €800M in management fee earnings on an annual basis. Along with the €400-700M of projected carry-related earnings, CVC will do over €1B per year in adjusted EBITDA. These numbers should continue to grow as CVC increases its AUM.

📝 Private equity firms step up plans to edge banks out of low-risk lending | Antoine Gara, Financial Times

💡Financial Times’ Antoine Gara reports that some of the industry’s largest alternative asset managers are continuing to broach the territory once dominated by banks and public debt markets. Gara cites Apollo, KKR, Blackstone, and Brookfield amongst the groups that are competing with banks in its lending activities, particularly with investment grade companies. Apollo increased its long-term forecasts for its lending business, communicating to shareholders that it expects to originate over $200B per year in new loans. This figure is a marked increase from its projection of $150B. Last year, Apollo originated $97B in new loans, including to investment-grade credits like Vonovia and Air France-KLM. Apollo Co-President Jim Zelter noted US economic growth as a major driver for the sharp increase in Apollo’s origination volume. “When you think about what’s going on domestically … what’s going on in electric vehicles, there are many, many investment grade companies that are going to be confronted with massive growth initiatives. It’s not obvious they should do it through the traditional channels of investment grade public debt or equity.” Firms like Apollo are putting low-risk lending to investment-grade companies as a centerpiece of their growth plans. These types of financial products are increasingly attractive for firms like Apollo, which have acquired large insurers, enabling them to meet the demand for high earning investment assets. Apollo’s peers have also contributed to the growth in alternative asset managers activities in originating investment-grade corporate debt. Blackstone recently noted it was seeing a “dramatic increase in demand” from clients for loans. The firm has struck investment management partnerships with large insurers, including Allstate and AIG. Infrastructure appears to be an area of focus, with financing clean energy projects and digital communications high on the list of types of projects these firms are focused on. Blackstone President Jonathan Gray noted the attractiveness of this business activity to shareholders last month: “we believe there is a massive opportunity to deliver higher returns to clients with lower risk by moving a portion of their liquid [investment grade] portfolios to private markets.” Brookfield is another peer that has prioritized this space. The FT reported last month that the asset manager was in late-stage talks to acquire Castlelake, a specialist in originating investment grade credit backed by aircraft. Brookfield also recently closed on a €10B private investment-grade credit fund.

💸 AGM’s 2/20: Alternative asset managers continue their move into bank’s territory. Both Apollo and KKR have referenced the $40T private credit landscape (otherwise known as virtually anything that sits on a bank balance sheet) as part of the addressable market for private markets firms like Apollo, Blackstone, KKR, Ares, Blue Owl, Brookfield, and others to focus their activities on. Many of these firms see this move as part of a re-architecting of the way in which investors think about liquidity and illiquidity, as Apollo’s Marc Rowan said above. When combined with the trend of alternative asset managers either buying or forging partnerships with insurers, the path for alternative asset managers to own more of this market looks to become clearer by the day. Banks, namely JPMorgan’s Chief Executive Jamie Dimon, have argued that this activity will only come to be seen as risky and exposed in a bad market. Only time will tell the story, but the trend of de-banking appears to be marching on at full force.

📝 Alaska Permanent Is Reconsidering Private Equity. Here’s What That Means for the Rest of Its Portfolio | Alicia McElhaney, Institutional Investor

💡Institutional Investor’s Alicia McElhaney reports that the almost $80B Alaska Permanent Fund Corporation (“APFC”), the state pension plan for Alaska, is considering how much it wants to continue to commit to private equity going forward. APFC has historically been an active allocator to private equity. CIO Marcus Frampton noted that private equity is under consideration for a shift in allocation sizing for the fund: “In 2012 when I came to the fund, we had invested four percent of our portfolio in private equity. We grew pretty fast up to 19 percent, but last year we reduced our pacing. Our board members wanted to revisit that.” Last year, APFC decreased its private asset allocation from 19% to 15%, believing better risk-adjusted returns could be found in fixed income and hedge funds. APFC’s private equity portfolio is worth around $15B, with its largest single exposure having a NAV of $900M, according to Frampton. Historically, APFC would make sizable allocations, as they did by putting $500M into Dyal’s (now Blue Owl) first GP stakes fund. Now, the firm is looking to make a number of smaller allocations under the guidance of current CIO Frampton. They are apparently focused on uncovering outperformers, many of whom operate in the middle market. “If you’re only writing $150M checks, you can’t really be in middle market buyout funds,” Frampton said. APFC is typically making $30-40M allocations to private equity funds and committing a total of $1B to the asset class annually. This figure is lower than a number of its pension fund peers. Frampton notes that their strategy of writing smaller tickets gives them the ability to be more diversified than a lot of their pension and endowment peers and the flexibility to get into harder to access funds. Frampton cites the example of being able to access Sequoia’s US venture fund, where they could only make a sub-$10M allocation. Most institutional allocators might pass on such an opportunity because the small check size might not move the needle on such a large portfolio, but Frampton believes they “need to shoot for the top.” Frampton is excited about fixed income with rates at current levels. He pointed out that they can earn 4.5% on Treasuries and 5.5% on investment-grade bonds. They recently brought its high-yield fixed income operations in-house to reduce the cost of these strategies by no longer having to pay outside managers in certain cases. “I’m really excited about the rate world we’re in now,” Frampton said. “It used to be that we had to rely on stocks and PE to get the returns I’m focused on.”

💸 AGM’s 2/20: Alaska Permanent is far from the only institutional investor questioning its allocation to private equity in the current investment environment. One of the industry’s largest sovereign funds, Norges Bank Investment Management, is also debating its allocation to private equity (I should note, from no allocation to PE, unlike APFC). Investment strategy is a worthwhile question, particularly in this market. As Apollo’s Marc Rowan says above, the world has changed. Therefore, approaches and strategies to navigating this environment requires a different framework than the previous market. Frampton’s comments jive with what many of the large alternative asset managers are signaling as well: that it’s not just private equity that will be a major area of focus within private markets. APFC appears to be quite focused on the investment-grade fixed-income universe, which firms like Apollo, Blackstone, KKR, and others view as a domain in which they can play an increasingly important role. Alternative asset managers that are now covering more of the private credit landscape with their product offerings and investment focus could very well be beneficiaries depending on how institutional allocators think about the balance of liquidity versus illiquidity and risk versus return. It’s also interesting to hear Frampton’s openness to writing smaller checks, particularly into venture funds. Many institutional investors have deemed it not worth the time, effort, or allocation size to invest into smaller managers because it wouldn’t be a needle-mover for the portfolio. It’s encouraging to see a deeply experienced institutional investor exhibit the willingness to do so. Perhaps they are also thinking about their private equity and venture capital investments as a balance between alpha from smaller managers and more beta-like returns from larger firms.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Inside Sales Rep for MFOs / RIAs / SFOs. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Specialist. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 73 Strings (Portfolio monitoring and valuation) - Associate Vice President - Private Credit. Click here to learn more.

🔍 Allianz SE (Asset manager) - Strategist, Group Strategy and Portfolio Management (Munich). Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Haig Ariyan, CEO of Arax Investment Partners, as we take the pulse of private markets on the 9th episode of our monthly show, the Monthly Alts Pulse. We discuss the evolution of wealth management and the role that alts can and should play in wealth client portfolios. Watch here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.