AGM Alts Weekly | 11.3.24: You gotta believe

AGM Alts Weekly #76: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good morning from Washington, DC. I’m back from a trip to San Francisco where I spoke at the Tiburon CEO Summit.

It was 7:36 p.m. ET last Sunday night when I heard my phone buzz. Taking my eyes off the TV, I saw a one-word text from my best friend: “Disaster.”

It did feel like a disaster, at least as a Commanders fan. After leading the 4-2 Chicago Bears for 59 minutes and 35 seconds of the 60-minute game, the 5-2 Commanders had just conceded the go-ahead touchdown.

With 25 seconds left and 76 yards to go, the Commanders were on the brink of an excruciatingly painful loss at home in a game they had seemed likely to win.

“Barring a miracle, this is honestly a shocking loss for Commander faithful,” said CBS broadcaster Jim Nantz.

Only a miracle could change things.

“It comes down to one last play … here comes the Hail Mary with the game on the line …” Nantz said, delivering the play-by-play.

“… and the ball is caught! It’s a miracle!” Nantz couldn’t believe his eyes as he called the final play.

5-2 became 6-2. But it was so much more.

Miracles don’t happen overnight

One moment can be a miracle, but the moments that lead up to a miracle can be just as crucial. They just might not seem like it at the time.

The odds were stacked against the Commanders on the final drive. The grey line on the ESPN Analytics chart, which had the Bears at a 96.4% win probability leading up to that final play, highlights that sentiment.

Perhaps some players would phone it in at that point. What are the odds of a Hail Mary pass working? Generally, success on this play is so improbable that most fans would leave for the parking lot to get a head start on beating the post-game traffic.

But the Commanders did everything right up to that moment.

The play before the last play was arguably just as consequential as the Hail Mary play itself. If not for the play before the last play, the Hail Mary might have never happened.

It would have been easy for players to check out mentally, understanding the improbability of the situation. But not these Commanders. They were locked in on the task at hand. The play before the last play? QB Jayden Daniels completing a quick 13-yard pass to WR Terry McLaurin to position the team to be able to attempt a Hail Mary pass.

They did their job. On to the next play. Maybe, just maybe, if they could give themselves a shot, they would have a chance at a miracle.

On the next (and final) play, if not for 5’9” 200 lbs running back Austin Ekeler (see bottom left of the screenshot below) making a block on the much bigger 6’4” 280 lbs defensive end DeMarcus Walker bearing down the blindside of quarterback Jayden Daniels, the Hail Mary might never have happened.

For a team that could barely do anything right on and off the field for the 24 years of embattled former owner Dan Snyder’s reign, this seemed like a complete departure from the past.

But miracles don’t happen overnight.

The turnaround

The turnaround started when Maryland native, Apollo Co-Founder, and $26B AUM 26North Founder Josh Harris bought the Commanders in 2023. Harris formed and led a consortium of investors, including another Maryland native, Danaher Co-Founder Mitch Rales and Hall of Fame NBA player and entrepreneur Earvin “Magic” Johnson, who collectively paid the highest price ever for a sports team: $6.05B.

At the time, some questioned the move. It was an expensive purchase, they said, wondering how many NFL teams would eventually cross the $10B valuation threshold.

Sure, NFL teams are valuable properties, in large part due to the media rights. As I discussed in the 3.31.24 AGM Alts Weekly, sports media deals have features that provide a steady stream of long-dated, annuity-like revenues, not too dissimilar from enterprise software contracts.

That, along with features of monopolistic content and the physical and offline adjacencies with sports (like real estate), make sports an attractive investment that could even be seen as being relatively uncorrelated from other assets.

But $6B? For a team where fans could count on one hand the number of times they had made the playoffs in the last 24 years? Some deemed that to be a bit rich.

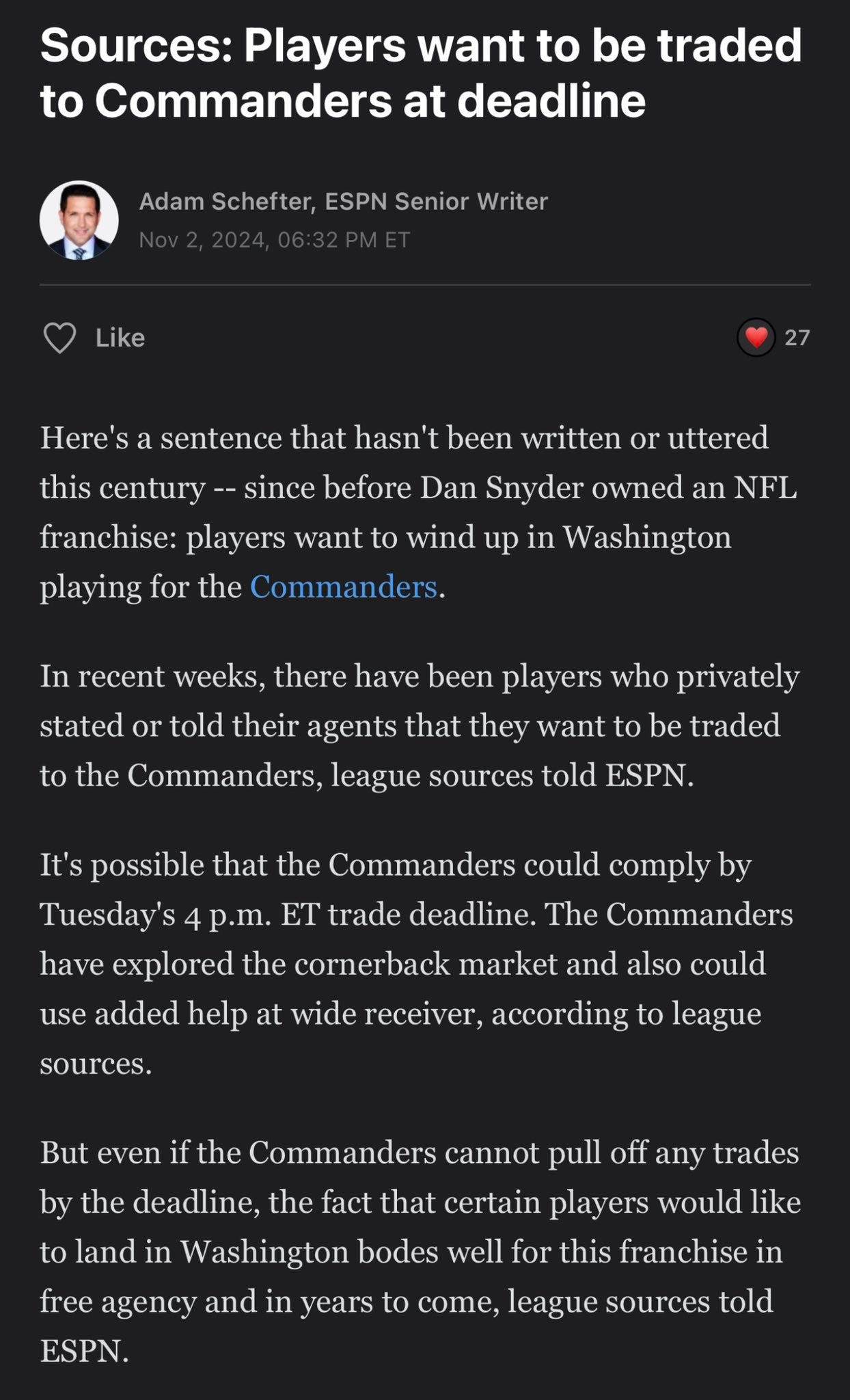

Since taking over the team, Harris & Co. have made all the right moves. Harris employed a private equity-like approach, focusing on bringing in experienced, capable executives and building the right culture. Installing Adam Peters, one of the most well-regarded executives in football, as GM and Dan Quinn, a coach who has players and coaches from all over the league wanting to play for him in Washington, have proved to be masterstrokes. Together, they’ve built a staff and football operation that people want to be a part of, so much so in fact, that coaches were willing to take jobs with lesser titles than they had in years prior. In the startup world, they call this “just get[ting] on” the rocket ship.

It’s not just coaches; it’s players, too.

Perhaps it’s not surprising that private equity and operating executives in Harris and Rales have figured out how to come in and reorient the team’s operations, transforming the culture in the process.

But there’s something that’s being underestimated when it comes to investing in sports — and with the approach that Harris has taken when rebuilding his hometown team.

The power of community.

Harris talked about the importance of community in a recent interview with Carlyle Co-Founder David Rubenstein on The David Rubenstein Show.

He noted how special it is to be with the fans and how it’s a “shared experience, a community.”

When teams win, the significance extends well beyond the scoreboard.

Yes, winning leads to more tickets being bought, sponsorships being secured, and jerseys being sold.

But winning does even more than that.

Winning breathes life into a fanbase. Winning instills belief in a community.

Maybe winning — and sports in general — can even be a net positive for public health.

Winning off the field

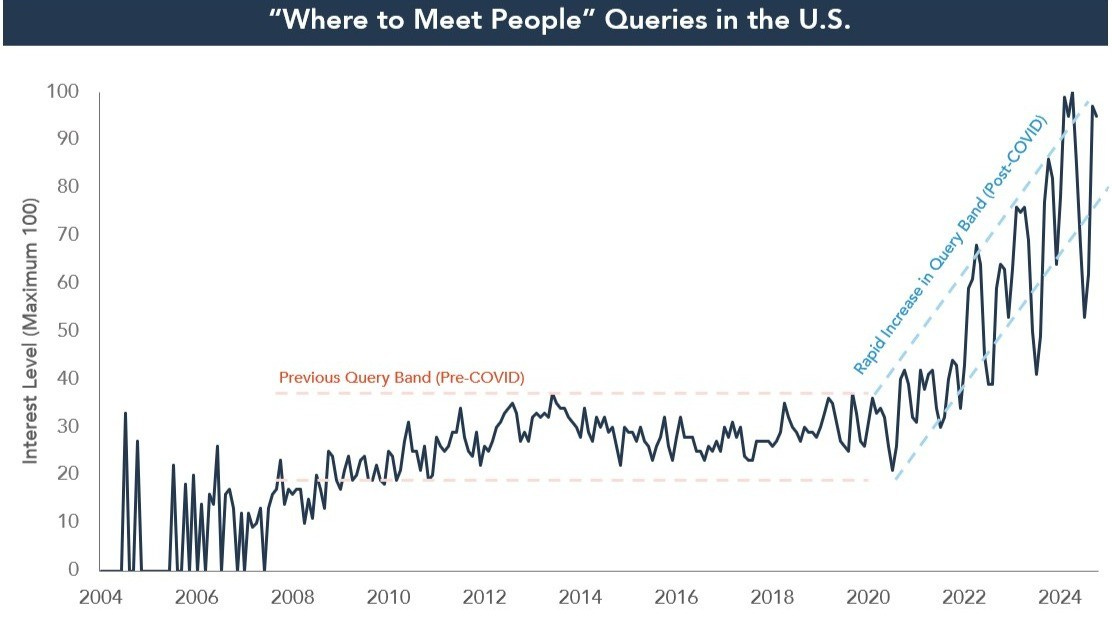

Arctos, a ~$7B AUM alternative asset manager focused on investing in sports teams, posted about the epidemic of loneliness in their most recent “Chart of the Week” on LinkedIn.

Isolation and loneliness have reached shocking levels. As society becomes increasingly dependent on engaging in the virtual world online, so too do people become isolated and lonely. So much so, it seems, that online search queries in the US for “where to meet people” have skyrocketed in recent years.

Isolation can have devastating physical and mental impacts, according to U.S. Surgeon General Vivek Murthy. In 2023, Dr. Murthy released a Surgeon General Advisory on our epidemic of loneliness and isolation.

Physical health experiences adverse impacts from insufficient connection. There’s a 29% increased risk of heart disease, a 32% increased risk of stroke, a 50% increased risk of developing dementia for older adults, and an increase in the risk of premature death by more than 60% when social connection is lacking. The risk of developing depression is more than double for someone who reports feeling lonely than for those who rarely or never feel lonely.

Dr. Murthy’s Advisory notes that there’s one remedy that is accessible: social connection.

Arctos notes in their LinkedIn post that many people attend sports games due to a desire for social connection. According to Activate Consulting’s 2025 Tech and Media Outlook, social connection is the top reason for attending a sports game.

Arctos goes on to write:

Sports bring people together. Sports are tribal, shared, communal, meaningful. Entire communities come together to support their teams, creating shared traditions and lasting bonds, irrespective of geographies, cultural and political differences, gender and racial differences.

We believe the underlying financial attractiveness of sports leagues and franchises can ultimately be traced back to human connection: attending games in-person, watching games with friends and family, or even simply discussing the weekend’s games with colleagues on Monday morning. Sports continue to be the greatest aggregator of audiences for media, a durable live entertainment product, and — in our opinion — a leading community builder.

Arctos deftly connects the community ties that sports produce to how fan engagement aggregates audiences for media. Yes, sports teams and leagues require lucrative and long-dated media contracts to make them investable opportunities for investors, but it could very well be the ability to foster community that creates the substantial financial opportunity for owners and investors.

Boosting communities

What can sports do to boost the social and economic fabric of a community?

Quite a lot, it turns out. An EY study of the Premier League’s economic contribution to the UK economy in 2021/22 highlights the impact of sport on society.

£8B of value was added to the UK economy during the 2021/22 season, in part due to the 90,000 jobs that the Premier League supported.

It’s not just jobs and ample tax revenues that a league can bring to a country or a town. It’s also the socioeconomic impact that reverberates throughout the team’s city.

Wrexham AFC’s Chairman of the Board Shaun Harvey discussed “the Wrexham effect” on his Alt Goes Mainstream podcast. Injecting a dose of celebrity — in the right way — to the club and the town with Ryan Reynolds and Rob McElhenney’s purchase of Wrexham AFC has had a material impact on the town’s socioeconomic status. An AP article on the “Rob and Ryan effect” shows just how real this impact can be.

What was an unlikely tourist destination in the UK saw tourism revenue balloon to $235M, up 20% from the year prior, up from $65M in 2020, and up almost 50% from pre-pandemic levels.

It’s exciting to see smaller towns like Wrexham generating a massive boost in revenues due to the success of their football club.

But what happens when big money — and institutional money — comes into sports?

The Athletic’s Michael Walker penned a fascinating article in August titled, “Is Premier League football disappearing from the North?”

Walker examined the geographic makeup of the Premier League and found that for the first time in the 20-team league’s history, there are only five clubs from the traditional “North” of England: Everton, Liverpool, Manchester City, Manchester United, and Newcastle.

Gone are the days when clubs like my favorite childhood team, the Bolton Wanderers, located in a 296,000-person town nestled in the foothills of the West Pennine Moors sitting outside Greater Manchester, are part of the world’s biggest football league. For a town like Bolton, which, was a 19th Century boomtown thanks to its status as one of the largest and most productive cotton mills during the heyday of the Industrial Revolution, has been undeniably impacted by the club’s exit from the Premier League. No longer having fans from around the UK come in droves to matches every week has had an impact on a town that is yearning for brighter days. According to LSOA 2022 population estimates, 26% of the Bolton population live in an area that is among the 10% most deprived nationally — and 45% of the population live in an area that is among the 20% most deprived nationally.

Perhaps it shouldn’t come as a surprise that as Premier League football attracts international and institutional investors’ interest that capital allocators would look to teams in a major metropolis to place a bet. There’s likely more potential for ticketing revenue and jersey sales. Higher socioeconomic areas mean that fans can likely spend more on ticket prices, merch, and concessions. Sponsors will likely spend more money to showcase their brand. Bigger towns don’t just have fan density; they have talent density to hire business and operations executives.

In sports, market matters.

Walker’s article highlights this point with a quote from NPP’s Chief Economist Andrew McPhillips.

“You would expect the largest number of clubs to be centred on the areas with the greatest population, so in that sense, it’s no surprise London has so many Premier League clubs,” says NPP’s chief economist Andrew McPhillips. “At the same time, that might make you ask a question about Sheffield or Bristol (in the south west). So it’s not just as simple as population. It’s a hard question to answer.

“In terms of raising finance, clubs in London and the south east probably benefit from being able to find additional revenue streams, such as corporate hospitality. As great as Burnley Football Club is, the town doesn’t have endless businesses that can go and spend thousands on a corporate hospitality day. For a global brand like Manchester United or Liverpool, that’s less of an issue.”

The challenge for clubs in smaller towns is that having a Premier League team could make or break their local economy.

“But if you’re in Bradford, Middlesbrough or Huddersfield, for example, whose clubs have flirted with the Premier League and fallen away again, I wonder if that access to additional revenue plays a part and that will reflect the make-up of your local economy.”

But in an era of sports investing, where teams are trading at higher and higher prices — and the stakes are ever higher for investors — how can clubs in smaller towns attract the investors who have the money to really invest in clubs?

“What’s changed over the last 30 years or so is that you could have a rich individual who could sustain a club in a northern town, whereas now you might get lucky and have a year or two in the Premier League if things go in your favour. But you can’t sustain that based on one relatively successful person, in local terms. It takes billionaires, doesn’t it?”

Maybe there are still gems to be unearthed in lower leagues and with teams that have storied histories. Bolton, which has struggled on and off the pitch being saddled with debt and finding it hard to climb its way back up after a precipitous fall down the league pyramid, has a rich history. They were one of the founding members of the Football League in 1888. There could be a great story in there somewhere for an investor to build a narrative — and a strong team — around.

Other locales have caught people’s eye. Lance Uggla, the entrepreneur behind the wildly successful IHS Markit, which sold to S&P Global for $44B in 2022, decided to buy a 51% stake in National League outfit York City. It’s likely that the city of York was part of the appeal. A bunch of people from the South have bought properties in York, and the city center appears to be vibrant and prosperous. Can Uggla oversee a successful climb up the football league pyramid like Wrexham AFC? Only time will tell, but the application of the entrepreneur and private equity mindset of business building to sports teams could yield results.

Show me the money

Undoubtedly, sports will have to make money for the asset class to continue to be attractive to allocators. This becomes increasingly important as individual investors become more active investors in sports funds.

This trend of increasing involvement of private equity funds in sports begs the question: will teams and towns in smaller markets suffer due to the increasing institutionalization of sports teams as an investable asset?

It could very well be the case, as Walker’s article highlights. And it might be an inevitable feature of institutionalization and globalization.

But I hope that even with more private equity involvement, sports continues to breathe life into towns and cities, particularly smaller ones where the economic and social impact is felt at the local level.

Why? Because sports gives us something that transcends dollars and cents. Sports gives us hope.

Last week’s Commanders game gave the fanbase something that they didn’t think was possible until Josh Harris took the helm: belief.

This Commanders team has done something more than win games. They’ve breathed life into a fanbase. They’ve instilled belief in a community.

It might be hard to measure the return on hope, but the Commanders taught us one of the greatest lessons of all last week: “You gotta believe.”

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Morningstar’s post on LinkedIn highlights some tactical steps on how asset managers can get in front of — and stay top of mind — advisors. With “factsheets and sandwiches growing stale for asset managers,” Morningstar’s recent Voice of the Advisor survey finds that advisors prefer strategic, big-picture discussions focused on objective analysis and holistic portfolio construction rather than product pitches.

What does this mean? It’s the era of the Product Specialist role.

AGM News of the Week

Articles we are reading

📝 US investment group Ares on course to raise $80bn | Eric Platt, Financial Times

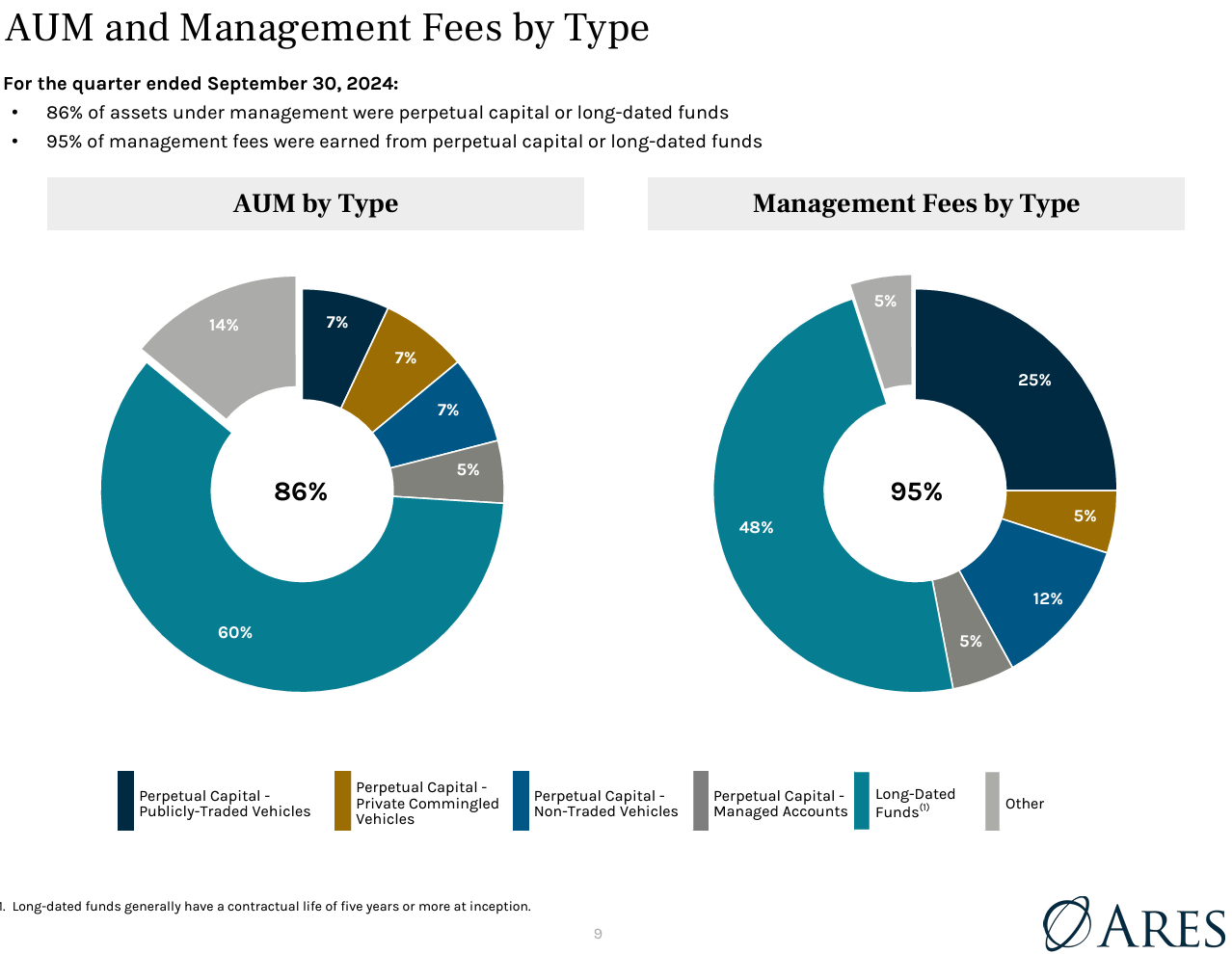

💡Financial Times’ Eric Platt reports that Ares is on course to raise more than $80B this year, a record number for one of the industry’s largest alternative asset managers. CEO Michael Arougheti said the firm was benefiting from “heightened demand” for its funds from both institutional and retail investors, particularly in private credit. This demand has translated into the fastest fundraising pace ever by Ares, including a $20.9B haul in the third quarter of this year. While private credit has been a popular strategy for allocators, Ares has sought to extend its reach to other strategies and geographies in a big way. They recently agreed to buy the international arm of real estate investment manager GLP Capital Partners for up to $5.2B. The acquisition will add $44B to Ares’s assets and move the firm closer to Arougheti’s stated goal of reaching $750B of AUM by 2028. Acquisitions like GLP continues the trend of alternative asset managers expanding their platforms to expand their platforms in order to grow AUM and both deepen and add LP relationships.

Credit has certainly been a tailwind for many alternative asset managers, Ares included. Ares deployed just under $30B in the third quarter, the majority through its credit business. This figure has put Ares on pace to hit $75B in deployed capital, which would be a record number. Kipp deVeer, who runs Ares’s credit business, said this week that the firm had seen “an acceleration” in buyout activity, and as a result, it was benefiting from a large number of new financings it could underwrite. Ares generated $339M of fee-related earnings in the third quarter, up 24% year-over-year. Management fee earnings rose 18% year-over-year to $757M.

💸 AGM’s 2/20: The strong quarter by Ares is reflective of a few broader trends. Fundraising for many of the large alternative asset managers has gone from strength to strength. Why? The focus and investment in working with the wealth channel is one explanation. The popularity of credit is another. Ares’ record quarter was supported in large part by their ability to raise capital for their credit strategies, particularly US Direct Lending, which raised $5.2B in Q3.

AUM grew for Ares year over year. The firm saw a 17% YoY increase in AUM, growing $68.9B, primarily driven by capital raised for direct lending strategies and the acquisition of Crescent Point for their private equity strategy. Ares also added meaningful AUM through its acquisition of GLP, which will result in an additional $44B in AUM for the firm once the deal is complete.

The focus on perpetual capital and long-dated funds has also been a driver of growth for Ares. 86% of AUM were in perpetual capital or long-dated funds and 95% of the management fees were earned in those vehicles.

Growing perpetual capital AUM has been a major area of focus for many of the industry’s largest alternative asset mangers. Ares is no exception. When examined with the focus by Ares on expanding LP relationships to cross-sell them into other strategies and funds, Ares’s perpetual capital figures look quite attractive. They’ve found a way to forge deep — and growing — LP relationships with both institutional and individual LPs, as I discussed in the 4.7.24 AGM Alts Weekly. If they can continue to grow walletshare amongst their LPs, it should position them well in their quest to grow to over $750B AUM by 2028.

📝 iCapital seals deal to scoop up AltExchange | Leo Almazora, InvestmentNews

💡InvestmentNews’ Leo Almazora reports on iCapital’s acquisition of AI-driven data and reporting platform AltExchange. On Wednesday, iCapital entered into a definitive agreement to acquire AltExchange as part of its focus on enhancing its data management capabilities and streamlining post-investment processes with private markets investments. This news comes on the heels of its acquisition of Mirador, a technology-enabled provider of investment data aggregation and financial reporting across alternative and traditional investments, and its recently announced partnership with GeoWealth, which will enable iCapital to bring BlackRock’s custom models that integrate private markets, direct indexing, and fixed income SMAs alongside traditional ETFs and mutual funds onto its platform. All of these moves signal the focus on helping wealth managers streamline decision-making and reporting. Lawrence Calcano, Chairman and CEO of iCapital, emphasized how its newest partnership with AltExchange can help clients collect, extract, and organize their private markets investment data more efficiently. “AltExchange has developed one of the most advanced document retrieval solutions that’s connected to sophisticated mapping, routing technology and LLM-based document extraction,” Calcano said in a statement shared with InvestmentNews. “This acquisition complements the investments we are making in our internal R&D to further enhance our data management capabilities," he said. "Combined with our existing solutions, it allows us to deliver on our goal of creating reliable end-to-end data management services for all our clients.” AltExchange’s technology transforms unstructured data from various sources into structured insights, allowing for real-time reporting and improving tax workflows. Their AdvisorVue platform, designed for financial advisors, aggregates client portfolios, standardizes data, and automates reporting. AltExchange’s Digital Custodian Platform enables asset managers to standardize post-investment reporting data, automate investor reporting, and integrate data with advisors’ systems.

Reporting solutions are top of mind for advisors looking to win HNW clients, according to a March report by Cerulli. With increased demand for private markets investments by the wealth channel, it’s imperative that infrastructure platforms and advisors find ways to make it easy to aggregate, manage, and track private markets exposure. The Cerulli report noted that 98% of HNW advisor practices surveyed offered consolidated performance reporting as a service. This trend was something that AltExchange CEO Kareem Hamady noted. “We built an intuitive advisor-facing platform to manage, monitor, and report on alternative investments, offering comprehensive tools for document management, advanced alerts, and streamlined tax workflows. We are thrilled to join iCapital and offer our collective clients automated data aggregation, reporting, and direct integrations with leading asset and wealth management systems.”

💸 AGM’s 2/20: If you transform the process, you transform the industry. Streamlining post-investment processes and data aggregation are some of the biggest pain points in the wealth channel’s continued adoption of private markets. In some respects, structure matters just as much as anything else if the wealth channel is to increase its allocation to private markets. iCapital Chairman & CEO Lawrence Calcano has said numerous times on the Monthly Alts Pulse that “it’s critical to meet clients where they are.” That statement is key to understanding the wealth channel. Advisors and wealth channel clients might have different processes and workflows. They might have different ways in which they invest in, manage, and track their private markets investments. Therefore, it’s critical “to meet them where they are” and make it as seamless as possible for them to both understand private markets investments and where those investments fit into a broader portfolio. This point is particularly important as public and private begin to converge, as Apollo CEO Marc Rowan has said.

The industry can help to move private markets forward by reducing cost, reducing friction, and making it easy to aggregate private markets investments into overall portfolio construction and portfolio management tools. That’s why the private markets investment experience got a lot better this week with iCapital’s acquisition of AltExchange and iCapital’s partnership with GeoWealth and BlackRock to include private assets more seamlessly within unified managed accounts (UMAs). I anticipate that the continued focus on creating model portfolios, both from infrastructure providers like iCapital and large alternative asset managers, will be top of mind as firms look to increase their focus on the wealth channel.

iCapital’s acquisition of AltExchange (and their earlier acquisition of Mirador) and their partnership with GeoWealth and BlackRock also illustrate another important theme: connecting the dots between pre- and post-investment processes. Creating a connective tissue between pre-investment decision-making in a more seamless, uniform manner all the way through to extracting data from private markets investments in a more automated fashion to tracking and managing private markets investments in aggregated form brings private markets closer to the pre- to post-investment processes that investors are used to in public markets. We are not yet at the point of having a “click-to-buy” button with private markets investments, but developments from this past week move us closer. If investors can understand their exposures, their risk, and their performance all in one place, then they can start to make decisions on allocating (and, ultimately, rebalancing) in a more seamless way. As iCapital’s announcement with GeoWealth explained, there will be the ability to have “unified trade orders across multiple investment products, intelligent automation, one-stop e-signature solutions, and consolidated client communications.”

Innovation in product structure to “meet clients where they are” by building evergreen and interval fund products have been crucial to increasing adoption of private markets by a broader cohort of the wealth channel and their advisors. But that alone won’t usher in large scale wealth channel participation. Widespread adoption in the wealth channel isn’t really possible until post-investment processes improve. Data aggregation is one piece of the puzzle. There’s plenty of focus on document extraction, as there should be, since much of private markets reporting data has historically been housed in silos of unstructured data. Companies like AltExchange have been built to take that unstructured information and transform it into structured data that, in turn, enable investors to make decisions and have actionable insights. But it’s not just data aggregation. It’s fund closings and streamlining subscription document processing, which has historically been ridden with error-filled documents (“not-in-good-order”) and manual processes. It’s valuation and portfolio monitoring, processes that need to become more automated all the way down to the asset level. It’s fund accounting and fund administration, which have often required people (expensive headcount at that) and manual work. Private markets is currently in the midst of a Cambrian explosion of innovation around the post-investment processes, which is being aided by the innovation in AI and process automation. Will humans be removed from the equation? Unlikely, but innovation in automation and technology will certainly improve the human-in-the-loop processes, which should make for a more efficient and cost-effective experience for everyone in private markets. The alts tech innovation is in its early days.

This week’s news illustrates that private markets innovation continues to head in the right direction, which is exciting for the space. It’s great to see iCapital and AltExchange come together to create a differentiated end-to-end investment experience for private markets allocators.

Congrats to Co-Founder & COO Zak Boca and Co-Founder & CEO Kareem Hamady and team AltExchange in joining forces with iCapital to continue the buildout of an end-to-end operating system for private markets. Connecting the dots from pre-to post-investment is key to moving wealth channel adoption forward, so it’s exciting to see this development for the space. (Note: Broadhaven Ventures is an investor in AltExchange).

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 State Street (Asset manager) - Head of Corporate Strategy, Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting - InvestOne. Click hear to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Operations (Australia). Click here to learn more.

🔍 73 Strings (Private markets data) - Account Executive. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director of Compliance Review. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.