AGM Alts Weekly | 7.6.25: "Excess return per unit of risk"

AGM Alts Weekly #110: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Some testimonials about the AGM Sunday Alts Weekly newsletter include:

“When it comes to the intersection of alternative investments and wealth management, Michael just gets it.” CIO, $18B AUM RIA.

“This is our primary resource for learning and reading about alts.” Head of Marketing, $250B AUM alternative asset manager.

“If you want timely and informative insights on everything private markets, Michael Sidgmore and Alt Goes Mainstream weekly update and podcast are fantastic resources.” CIO, $47B AUM RIA.

“The only email I never delete when clearing my inbox.” Senior distribution professional, $330B+ AUM asset manager.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends at the intersection of private markets and wealth management and navigate this rapidly changing landscape.

Presented by

For too long, private equity funds have relied on manual processes — spreadsheets, scattered documents, disjointed data — to track complex investment and ownership structures. It’s slow, error-prone, and not scalable. And when regulators, investors, or auditors come knocking, it’s a fire drill every time.

At DealsPlus, we help private equity funds digitise investment and ownership structures, eliminating data silos. Our software helps power key workflows such as: quarterly reporting, audits, compliance, and exits.

Good morning from New York.

We ended last week’s AGM Alts Weekly with a preview of what Apollo CEO Marc Rowan and Morningstar CEO Kunal Kapoor discussed in their talk at the Morningstar Investment Conference.

The conversation was so rich with views on where private markets might be headed that I thought it would be worth breaking it down.

Kunal asked Marc great questions that took the conversation to the heart of many of the most pressing issues and questions with public and private markets today.

Marc’s talk with Kunal provided both a number of thought-provoking takeaways and a window into the future of where private markets may be headed.

Have public markets managers grown too big and lost their edge?

Kunal asked Marc if traditional asset managers have grown too big, losing their edge in the process.

Quite an interesting and thought-provoking question as the largest alternative asset managers have grown to a size and scale where they have become one-stop-shops for investors — and the wealth channel in particular. The growth of the private markets industry also comes against the backdrop of traditional asset managers moving into private markets in a big way, as BlackRock has done through its acquisitions of HPS and GIP, and as firms like Vanguard have now joined in on adding private markets capabilities to their offerings.

Marc said that he thinks that traditional asset managers have been impacted by a change in market structure more than anything else.

Marc said:

“It’s not clear to me that size has been the reason why people have lost their edge. I actually think market structure has changed. If you look at the stats, some 90% of traditional asset managers — whether debt or equity, active manager — have failed to beat the index for 20 years. It doesn’t sound like these people got stupider because I don’t think they have. I think they are plenty smart. It sounds like the structure of our market has changed. With everything now being indexed and correlated, it’s very hard over a short period of time for traditional asset managers to apply their craft.”

He then shares a perspective that should resonate with asset allocators — and possibly give rise to a debate.

“We think of public markets in their entirety as beta.”

Marc doesn’t spare private markets from this perspective, either. He says: “In private markets, we used to have something which we call the illiquidity premium. I’m not sure that really exists either. The way we see the market is you get paid to diligence and structure something.”

He believes that edge in origination is prevalent in both debt and equity markets. The firms that are able to originate high-quality investment opportunities at scale have the ability to win.

Surely, that’s why Apollo has focused on building a “proprietary machine to originate” as a way of manufacturing an edge.

Related to this point, he said that he believes credit is an area where alternative asset managers like Apollo can play for scale and still generate “excess return per unit of risk.”

A slide from Apollo’s March 2024 Investor Presentation illustrates how much there is to play for in credit.

Apollo views the private credit market as a $40T addressable market.

It’s not just credit where Apollo views there to be a massive market opportunity. In a presentation outlining the rationale behind the firm’s acquisition of real estate investment firm Bridge Investment Group, Apollo highlights the size of the addressable markets across a number of megatrends, such as energy transition, power and utilities, and digital infrastructure.

These markets each represent trillions of dollars in addressable market opportunity. And something else Marc said — the importance of scale — is particularly important here.

Apollo is far from the only firm to experience this trend of firms choosing private as a way to finance their business.

Blue Owl’s 2025 Midyear Outlook highlights why many upper middle-market companies see private credit as a “critical source of financing.” Blue Owl’s Craig Packer writes in the Credit section of the Outlook that private credit’s features of stability and partnership — even if it happens to be more expensive at times — make it a choice for companies.

This trend is illustrated by two charts from Blue Owl’s Outlook.

As the chart below highlights, private credit continues to finance a growing portion of LBOs relative to the broadly syndicated loan markets.

And a greater number of bigger ($1B+) direct lending transactions have become an increasingly common occurrence.

What accounts for edge?

First, ability to originate, as Marc says.

An article from The Wall Street Journal by Miriam Gottfried that profiles Sixth Street and Alan Waxman delves further into the market structure evolution that’s occurring in private credit.

Gottfried profiles $115B AUM Sixth Street with an interview of the firm’s CEO Alan Waxman. Waxman discusses the “factory” model, which he says many of his firm’s peers have embraced, as he shares the view that private credit is transitioning from a bespoke type of investing with relatively high returns into a commoditized, lower-returning (and lower fee) business that will grow due to scale.

Scale matters

What enables an edge in origination? In part, scale. We’ve discussed the importance of scale, particularly in credit, a number of times on Alt Goes Mainstream (as we did here).

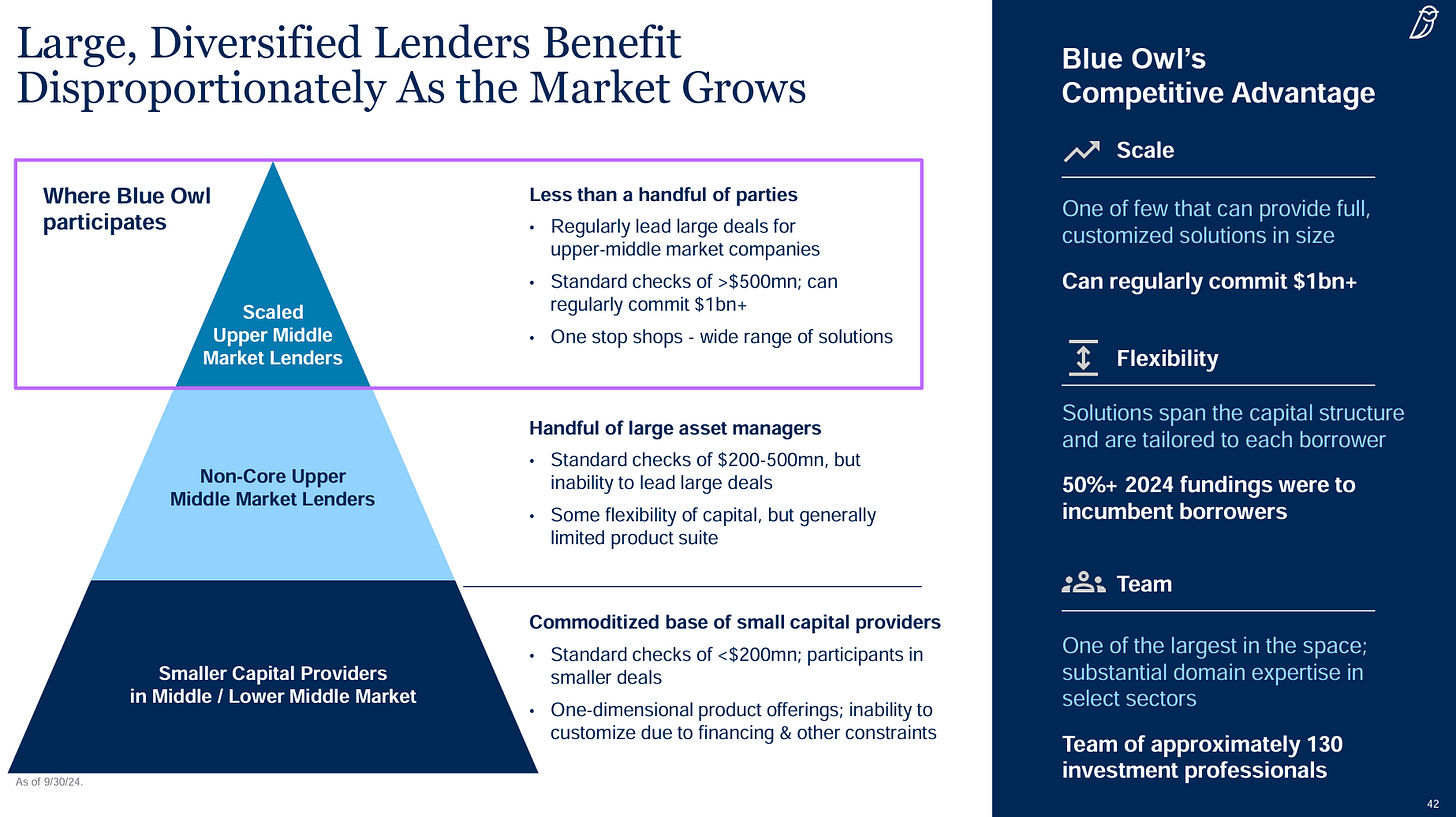

Firms that have the ability to deliver large checks in size, scale, and speed have the ability to win deals, particularly in credit. This below chart from Blue Owl’s 2025 Investor Day presentation illustrates a feature that can also extend to its peers in the credit space: scale matters and scale wins, particularly in the upper end of the credit market.

Blue Owl’s slide below highlights an important feature of scale: “can regularly commit to $1B+” financings.

Scale matters in financing deals. It also matters in fundraising. The importance of scale is increasingly reflected in fundraising efforts, as this chart from the GP Stakes section of Blue Owl’s 2025 Market Outlook illustrates.

Marc referenced the importance of scale in a different context: he noted that “private markets is [primarily] private credit.”

He said that while he considers Apollo’s private equity business to be a “great business,” it’s a $100B business today and it will be a $100B business in 5 years.” Credit, on the other hand, is a “$600B business today that can double in 5 years.”

His point? Credit is a market where alternative asset managers can continue to grow in size and generate “excess return per unit of risk,” so long as firms are still able to effectively originate high-quality investment opportunities.

Private markets are eating the world

All of these trends point to something that Alt Goes Mainstream wrote in March 2024:

Private markets are eating the world — in three ways:

(1) Private markets are eating into the 60/40 portfolio.

(2) Private markets are eating public markets.

(3) Private markets are eating how companies are financed.

Private markets are eating into a number of aspects that Marc referenced in his talk at Morningstar.

Private markets are eating into the 60/40 portfolio

The 60/40 portfolio has long been a framework with which many asset allocators have approached investing.

Marc noted that asset allocation frameworks are changing. He said that people “buy exposures” now. The 60/40 portfolio might now comprise of 2/3 public equity and 1/3 private equity. The same would go for credit. Marc’s colleague, Apollo’s Chief Client and Product Development Officer and Partner Stephanie Drescher echoed a similar sentiment on her Alt Goes Mainstream podcast.

How would this be constructed and delivered to investors? Marc’s view is that portfolios will be constructed via structures that will include public and private markets exposure bundled together.

This is where Marc sees a convergence of public and private.

Private markets are eating public markets

This trend is reflected by the growing influence that alternative asset managers have as financing partners for companies across equity, credit, and infrastructure, which is ultimately being expressed in alternative asset managers becoming a larger part of the market capitalization of financials stocks.

As I noted in the 3.24.24 AGM Alts Weekly:

Private markets now reach into many aspects of the economy. Private equity finances and owns businesses, from data centers to dating apps, that help make up the fabric of our consumer and business lives. Private credit helps companies tap into capital markets to access financing, often when banks aren’t able to extend credit. Venture capital provides risk capital to moonshot projects that foster innovation and push the boundaries of what’s possible. Real estate and infrastructure investing builds the world we live in.

A chart from Apollo’s 2024 Investor Day illustrates just how large alternative asset managers have become over the past ten years.

And private markets firms are still small relative to their public markets counterparts. But if the trend of public going private continues to persist, then private markets will become an increasingly important part of the investment universe.

That’s certainly what Apollo believes, particularly in credit, where the secular trend of debanking moves assets off a bank balance sheet and into the hands of alternative asset managers and their investors.

Yes, there will be arguments on both sides about what it means to transfer risk to private credit firms, which can result in increased exposure to private credit for insurance companies and individual investors. There are valid points on both sides of this equation as to what this means for risk to the financial services ecosystem and for investors.

Private markets are eating how companies are financed

As Marc noted several times in his talk with Kunal, companies can choose private markets instead of public markets to finance their business.

Marc discussed that companies are choosing the private investment marketplace, particularly for credit transactions.

Marc referenced recent deals that Apollo has completed in investment grade credit — $4B to AT&T, $11B to Intel, $6B to AB InBev. He cited those transactions as examples of private debt being “just another tool” for companies alongside bank debt and public debt.

If alternative asset managers can continue to be solutions providers to companies, then perhaps companies will continue to choose private instead of public. This has certainly been a secular trend in equity markets — the number of public companies has almost halved since the late 1990s. Perhaps credit will go the same way.

Private markets are far from perfect, but do they need to eat (into) the world of investing?

One of the profound punchlines of Marc’s talk was why private markets are important.

It all comes down to returns — and that matters for individuals and savers when it comes to their retirement.

Private markets are far from perfect. And it’s even more important for allocators to pick the right managers in private markets as the cost of picking the wrong managers penalizes investors even more. Access also needs to continue to improve for investors. But the promise of additional returns should be appealing, particularly if it helps solve an even bigger problem for individual investors: saving for retirement.

Marc noted that a “1.5% excess return in private markets creates a 50-100% better outcome in retirement.”

He’s not the only one who shares this sentiment. Earlier this week, The Investment Association CEO Chris Cummings said in the Financial Times that “exposure to private markets at somewhere between 5 [and] 10 percent of their portfolio would be sufficient to make a profound difference to their pension when they come to retire.” IA is a significant player in the UK pension ecosystem — the organization represents fund groups, wealth managers, and private equity firms that oversee £9.1T in assets.

Speaking of pensions, it’s quite notable that Apollo-backed Athora Holding, a savings and retirement services group, acquired Pension Insurance Corporation Group this week for £5.7B from Reinet, CVC, ADIA, and HPS. Pension Insurance Corp. (“PIC”) is a specialist insurer that has become a leader in the UK pension risk transfer market through its consolidation and management of UK pension plans. PIC manages over £50B, paying pensions for almost 400,000 policyholders. PIC has had meaningful exposure to private markets, with almost 20% of its portfolio allocated to private credit.

Although Apollo is only a minority owner of Athora, owning 25% of the firm, the intent appears clear. PIC makes for another good partner for Apollo to serve up its higher-yielding private markets investments, particularly private credit and infrastructure investments that it originates as it looks to help savers generate returns for retirement.

Part of the view about a shift to private revolves around a new world order in investing.

If, as Marc says, the things about the market that are true today are, in fact, different than the past 40 years, then investors and allocators need to play the current game on the field in this new world order of investing.

The big question for investors comes down to risk.

What risks are investors willing to take?

Marc cites four types of risks that investors can take:

Credit risk.

Duration risk.

Equity risk.

Liquidity risk.

Marc asks a thought-provoking question: if investors have a 30-day to 30-year investment horizon, why can’t they take liquidity risk and get paid with “excess return?”

If that’s the case, then perhaps there is no alternative for some portion of an investors’ portfolio to be allocated to private markets in order to capture that additional return if the private markets allocation does come with the “excess return per unit of risk” as Marc noted a number of times in his talk with Kunal.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM Post of the Week

A recent LinkedIn post from Blackstone discusses volatility in public credit and private credit.

AGM News of the Week

Articles we are reading

📝 Tech venture firms deploy private equity “roll-up” strategy | George Hammond | Financial Times

💡 Financial Times’ George Hammond dives into the trend of top venture capital firms borrowing a strategy from the private equity playbook: roll-ups. Private equity has employed the model of rolling up companies in industries where consolidation can create sector winners and firms can benefit from centralized operations or scale. Hammond notes that among those utilizing the roll-up approach is Thrive Capital, a large backer of OpenAI and Stripe, which is involved with wealth management startup Savvy Wealth, a firm that just announced a $72M funding round this past week. Part of the capital from the financing round raised by Savvy will go towards acquiring smaller financial advisory firms and hiring individual advisors, in addition to embedding artificial intelligence into the company’s operations.

Thrive isn’t the only VC firm to pursue a roll-up strategy. General Catalyst, a $35B+ AUM venture capital firm, has reportedly earmarked at least $1.5B to pursue roll-ups in areas from call centers to legal services and property lettings. General Catalyst also recently bought a hospital, Summa Health, within their Health Assurance Transformation Company (HATCo) to combine traditional businesses with technology operating systems. According to the FT, VC firms such as Khosla Ventures, Bessemer Venture Partners, and 8VC, amongst others, are also pursuing roll-up strategies. Hammond observes that this approach mirrors strategies deployed by private equity investors, which have built large businesses in fragmented industries such as healthcare, waste management, or building services by combining businesses and centralizing operating costs. This move signals a new direction for VCs, which have traditionally looked to fast-growing technology startups in emerging industries. Hammond notes that perhaps the roll-up strategy creates an avenue for VCs to generate liquidity and cashflows for their portfolios at a time when initial public offerings and dealmaking have slowed. Private equity firms have, at times, used debt and cost-cutting measures to create strong margin profiles for roll-ups, whereas VCs claim improvements to efficiency and margins will come from integrating technology and AI into the companies.

Savvy, for example, is employing AI to offload back office tasks from humans, such as pulling data from forms that might otherwise be needed for a transaction. Kareem Zaki, a Partner at Thrive, said Savvy’s approach was made possible by AI, which “is able to handle much more complicated tasks in a much more accurate and complex way. Older technology struggled to provide a very personalized service.” Savvy Founder and CEO Ritik Malhotra noted that a roll-up strategy makes sense with his business and in his sector of wealth management: “highly fragmented businesses, like financial advisory or real estate, make sense for roll-ups.”

General Catalyst-backed Dwelly is taking a similar approach to the British property rental market, acquiring three lettings agencies across the UK, growing its stable of properties to over 2,000 properties across the country. The firm plans to automate the process of matching tenants and landlords, property management, and rent collection. “It’s the best of both worlds, PE and VC: on the venture side it’s an extremely exciting time to be in AI. On the PE side, there’s a lot of consolidation in these industries, said Marc Bhargava, who leads the strategy at GC.

Not everyone is a believer in this strategy. “I would be skeptical of any strategy that involved transforming a pre-AI business into an AI-based business,” said the Head of Investment at one US foundation. “It’s a classic case of the innovator’s dilemma, because it would require the corporate equivalent of a brain transplant, re-architecting everything about the way the business develops, sells and operates. I’m not saying it would be impossible to pull off but it would be very difficult.”

💸 AGM’s 2/20: There are a number of interesting themes and trends to unpack here that touch on both the evolution of VC as an industry and how private equity will evolve, too.

(1) VC is, in some respects, becoming more like private equity. VC is experiencing a tale of two cities evolution. There are large, multi-stage mega platforms like GC, Thrive, Sequoia, a16z, Lightspeed, and others that extend from seed to late stage investing, and sometimes (like a16z and Sequoia, to name a few) even hold public securities. These firms can do everything from incubate companies, as GC and Thrive are leaning into, to financing large, later-stage private companies, as Thrive did in 2024 with a $1B investment as part of a $6.6B round that valued OpenAI at $157B. Companies that want to stay private longer may choose to work with a multi-stage investment platform like one of these aforementioned firms because they can provide one-stop-shop financing solutions to their business, which might require significant capital needs over long periods of time. This trend of companies choosing to stay private longer could favor larger multi-stage VC platforms that can be financing partners for companies over multiple rounds. This shift in financing also makes the value proposition of VC investing different for LPs. A large, multi-stage investment platform that is investing checks at size into later stage companies is a very different risk profile than pre-seed or seed stage investing. I wrote about this trend in the 2.4.24 AGM Alts Weekly, as VC has been undergoing a shift from a cottage industry to an institutionalized asset class.

VC, like private equity, is also in need of exits and new avenues for liquidity. Secondaries are becoming an answer in an industry that has seen a slow down in distributions, in part due to a muted IPO market in recent years, as this below chart from the Financial Times illustrates.

Perhaps multi-stage VC platforms will fill the gap, providing financing to late-stage companies that might choose to stay private longer if there’s the ability to continue to finance these companies in private markets.

(2) As VC evolves into an asset class where there are mega-funds can play across stages, this will likely impact how these firms fundraise — and who they fundraise from. The large VCs will likely begin to partner with the wealth channel, if they haven’t already. Many of the large VC fund platforms have begun to look to the wealth channel for a portion of their fundraise. One recent example is Coatue, which launched an interval fund that will combine private and public equity investments into a single vehicle. The $70B AUM firm, which has investment strategies that span both public equities and private equity / growth and venture, recently introduced the Coatue Innovation Fund (CTEK), which was launched with a $1B commitment from Bezos Expeditions, Jeff Bezos’ family office, and DFO Management, LLC, the family office of Michael Dell.

This trend will continue as large VC platforms continue down the path of institutionalization that their private equity counterparts have done over the past 15 years.

(3) This fundraising trend is not dissimilar from private equity, where mega-platforms have raised the lion’s share of the capital, as this chart from Blue Owl’s 2025 Midyear Outlook illustrates.

This trend is — and will likely continue to be — particularly apparent in the wealth channel. Many allocators in the wealth channel want less decisions, not more. To make decisions in a scalable, efficient way in many cases means buying a brand or buying a platform and allocating across that firm’s different offerings. This doesn’t mean that some wealth management firms and family offices will only choose big platforms and brands. In fact, many sophisticated and active allocators to private markets will figure out how to balance scalability with customization and differentiation, as I wrote in the 5.11.25 AGM Alts Weekly.

(4) VCs might achieve success by leveraging AI to streamline operations and create leverage in portfolio companies. But so too could private equity firms. In fact, private equity might be an even bigger beneficiary of AI than venture capital. Private equity is (generally) in the business of investing in profitable companies and making them better (sometimes). If private equity firms are able to do what Hg’s Martina Sanow said on her recent Alt Goes Mainstream podcast — “we invest in good companies and make them great companies” — then private equity might benefit as much — or even more — from applying AI to its companies than venture firms will.

This concept has already begun to be proven in action. A profile in Bain & Company’s 2025 Global Private Equity Report on Vista Equity Partners provides a proof point that AI could take good companies and make them even better, to the point where the famed “Rule of 40” might become the “Rule of 50 or 60.” As I wrote in the 3.9.25 AGM Alts Weekly:

“Some firms, like Vista Equity Partners, have made it a priority for their portfolio companies to adopt AI. Bain’s report mentioned a profound viewpoint: over the next three to five years, Vista expects AI’s impact on a software company’s top and bottom line will reframe the famed “Rule of 40” (growth rate plus free cash flow rate should be 40% or greater) in SaaS to make the new standard for revenue growth plus free cash flow to be 50-60%.

Vista Founder, Chairman, and CEO Robert Smith noted at the firm’s 2024 CXO Summit that ~15% of Vista’s portfolio companies have already implemented GenAI-powered customer support tooling with measurable impact.

Some of Vista’s portfolio companies have already benefitted from the adoption of AI (from Smith’s talk at their CXO Summit):

Mindbody achieved $1.25M in annual savings by integrating a GenAI-driven customer bot to help handle customer contact and by consolidating their customer experience technology stack.

Quickbase achieved a 30% increase in marketing content creation by leveraging GenAI in their marketing efforts.

Avalara has seen sales representatives respond 65% faster (a median response time of 51 seconds) thanks to Drift’s GenAI tool that drives sales efficiency.

Pipedrive has achieved a 9% increase in deployments per developer as well as a 31% decrease in total bugs thanks to implementation of an AI-assisted code generation tool.”

Private equity has already shown that they can successfully roll up companies via M&A to make an even bigger, better industry leader.

One example of this is Hg’s successful investment in Visma. Visma, which has transformed itself into one of Europe’s largest software companies, in large part through M&A, has done well over 350 acquisitions, according to Sindre Talleraas Holen, Head of M&A at Visma. Just last year alone, Visma made 11 acquisitions across Europe, including Finthesis, the fifth acquisition in the French market in 2024, and a handful of companies in the Benelux markets. This M&A strategy has propelled the company’s success, in many respects. Hg took the company private from the Oslo stock exchange in 2006 at a valuation of £380M, has grown into one of Europe’s largest software companies. The company reported €2.8B in revenues and free cashflow of €885M in 2024.

Another example of leveraging M&A to successfully consolidate an industry resides in EQT’s investment in — and subsequent M&A tuck-in strategy — with Anticimex. According to EQT, Anticimex has expanded its footprint through M&A, completing over 400 bolt-on acquisitions to grow market share. EQT Director Jolin Holmgren said that Anticimex is now “doing 40 to 50 deals a year,” with “EQT really turbocharg[ing] M&A.” M&A enabled expansion into other regions, like Asia-Pacific and North America, with the firm now operating in 21 countries. EQT, like a number of private equity firms, have leveraged the benefits of M&A to create scale and the ability to access equity and debt capital markets to continue to finance growth.

Both PE and VC can both be winners from AI and leveraging AI to create efficiencies with consolidation plays. Allocators, too, can benefit from this evolution in the market. What does it come back to? Scale, in many respects, might matter as the large platform firms might have the ability to better help portfolio companies leverage AI to their benefit — and leverage AI internally themselves to create better investment outcomes with everything from tilting the odds in their favor across finding, picking, and winning deals, in addition to helping companies achieve success. This sentiment is something that Blackstone CFO John Stecher echoed in his Alt Goes Mainstream podcast — AI might benefit larger investment firms even more than smaller investment firms.

Reports we are reading

📝 BlackRock Study: Family Offices are in risk-management mode, focused on increasing diversification and idiosyncratic sources of return | BlackRock 2025 Global Family Office Survey

💡BlackRock released findings from its 2025 Global Family Office Survey. Key takeaways included:

Private markets are increasingly important to family offices, comprising of 42% of their portfolios. This figure is up from 39% in BlackRock’s previous survey.

Geopolitical uncertainty is the most critical factor (84%) in their capital allocation decisions. Disruptions to trade and increasing fragmentation in geopolitics turned overall sentiment negative for the first time since the survey began in 2020.

“Family offices are now prioritizing diversification, liquidity, and structural reassessment of risk as they build resilience in their investment portfolios,” according to Armando Senra, Head of the Americas Institutional Business for BlackRock. As a result, family offices are in risk-management mode, with 68% focused on increasing diversification and 47% increasing their use of a variety of sources of return, including illiquid alternatives, ex-US equities, liquid alternatives, and cash.

Allocations to private credit and infrastructure are increasing. Private credit and infrastructure are the most popular asset classes. 32% of family offices intend to increase their allocations to private credit and 30% to infrastructure in 2025-2026. Family offices have a clear preference for special situations / opportunistic and direct lending. In infrastructure, respondents plan to increase their infrastructure allocations to opportunistic (54%) and value-add strategies (51%).

Family offices are focusing more on ways to collaborate with external partners, particularly when it comes to private markets. More than half of respondents noted gaps in their internal expertise around reporting (57%), deal-sourcing (63%), and private-market analytics (75%). Technology companies are expected to provide value to family offices here.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 KKR (Alternative asset manager) - Global Wealth Solutions - Investor Relations - Principal. Click here to learn more.

🔍 Apollo Global Management (Alternative asset manager) - Associate or Principal, Thematic Investing. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Strategy & Corporate Development Associate. Click here to learn more.

🔍 Franklin Templeton (Asset manager) - Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

🔍 BlackRock (Asset manager) - Global Head of Product Strategy, Private Market Solutions - Managing Director. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - Vice President. Click here to learn more.

🔍 Arcesium (Private markets technology company) - SVP Business Development, Private Markets. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Asset & Wealth Management, Sustainability & Impact, Value Creation, Associate - New York. Click here to learn more.

🔍 Partners Group (Alternative asset manager) - Social Media Specialist. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Business Development. Click here to learn more.

🔍 Lincoln Financial (Insurance) - Alternative Investment Sales Specialist Account Executive. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Hg’s Partner and Head of Hg Wealth Martina Sanow discuss how Hg has unlocked opportunities for the wealth channel to invest in Europe’s largest portfolio of software and services businesses. Watch here.

🎥 Watch Goldman Sachs’ Partner and Global Co-Head of the Petershill Group at Goldman Sachs Robert Hamilton Kelly discuss the evolution of the GP stakes industry and how Goldman has become a market leading GP stakes investor. Watch here.

🎥 Watch Blue Owl’s MD, Head of Alternative Credit Ivan Zinn unpack private credit and why ABF has become a prominent part of the private credit ecosystem. Watch here.

📝 Read The AGM Op-Ed with Blue Owl Head of Alternative Credit Ivan Zinn on why “asset-based finance today mirrors the evolution of corporate direct lending from over a decade ago.” Read here.

🎥 Watch Lincoln Financial’s EVP and CIO Jayson Bronchetti discuss the role of insurance companies in private markets as he discusses how he manages a portfolio of $300B in assets. Watch here.

🎥 Watch Krilogy’s Partner and CIO John McArthur discuss how an RIA can chart a growth path by building out its private markets capabilities. Watch here.

🎥 Watch New Mountain Capital’s Founder & Chief Executive Officer Steve Klinsky discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch Arcesium’s Private Markets Head Cesar Estrada discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch GeoWealth President & COO Jack Hannah and iCapital SVP, Partnerships Michael Doniger discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Goldman Sachs’ Managing Director, Global Head of Alternatives, Third Party Wealth Kyle Kniffen discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Fortress Investment Group Managing Director & Co-Head of Private Wealth Solutions Adam Bobker discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch Constellation Wealth Capital President & Managing Partner Karl Heckenberg on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to Ted Seides, Founder of Capital Allocators, and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a Capital Allocators mini-series on Private Wealth. Listen here.

🎥 Watch BlackRock Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business Jaime Magyera and iCapital Chairman & CEO Lawrence Calcano discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch EQT Partner & Head of Private Wealth Americas Peter Aliprantis discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch the third episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss separating the forest from the trees and Glenn’s “Final Four” firms he would pick in honor of March Madness. Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Jeff Carlin, Senior Managing Director, Head of Global Wealth Advisory Services at Nuveen live from Nuveen’s nPowered conference on why “it’s all about the end client.” Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Ryan McCormack, Nick Owens, and Michael Rutter for their contributions to the newsletter.