We started Broadhaven Ventures five years ago with the idea that utilizing our shared experience building and investing in FinTech unicorns, and running this in partnership with our financial services investment bank and our fantastic colleagues in that business, we could help great founders build things that matter.

The result: 122 portfolio companies and funds, including 13 exits and 16 fund investments, and the opportunity to work with incredible founders and funds.

After quietly building over the past five years, we have been lucky to have been part of the journey of companies at the center of multiple market structure evolutions.

Today, we are thrilled to announce the launch of our website, Broadhaven.vc.

Evolutions power revolutions

We see the world through the lens of market structure evolutions. We believe that evolutions in underlying financial infrastructure power consumer and enterprise financial services revolutions.

A well-functioning market works when there is efficient and effective data and technology across the lifecycle of a trade or investment. As new markets are built, market structure requires technology innovation to create transactional efficiencies. A functioning market structure enables investors to have price discovery, invest or trade efficiently, and process, custody, and value trades and investments.

As market structure evolves, so too does its liquidity. More participants come to a market that functions better. Liquidity begets liquidity and the market grows. It happened with equities. It happened with listed derivatives.

It is happening with crypto. We have invested into some of the core market structure and on-ramps for crypto (examples: Bitso, CoinList, Republic, Shakepay, Sorare*, Rainbow*).

It is happening with alts. We helped build and have invested into some of the core market structure to unlock access to alternative assets (example: iCapital*, Republic, Carta, Forge*, Alt, Allocate, CoinList).

Each evolution in market structure has unlocked a new level of access to financial services for more market participants.

Viewing innovation in financial services through market structure evolutions has enabled us to spot certain trends early.

We have spotted trends before they are big

#LongLatAm —> #LongGlobal: We started investing in Latin America in 2015 and led our first deal in 2017, being one of the earlier US based VCs to commit significant capital, resources, and time to Latin America. We now have a portfolio of 18 companies in the region, including Nowports, Bitso, Kovi, Credijusto, Pomelo, and many more. We saw that consumers and businesses were woefully underserved by traditional financial institutions. We held the belief that if financial services solutions could be built to better serve individuals and businesses, then it could change the trajectory of an entire region. We now see a similar phenomenon of financial services innovation occurring in all corners of the world, mirroring the trajectory of innovation and capital inflows we saw in Latin America. We’ve been following those inflows with another 15 investments across emerging regions in both Asia and Africa.

Alts go mainstream: We invested in and built alts platforms before alts had gone mainstream. We observed that private companies were staying private longer — and meaningful value was being created in private markets. Liquidity and access would need to be unlocked in order to enable more investors to participate in markets that had historically only been accessible to the select few. As investors — both institutional and individual — wanted to move beyond a 60/40 portfolio, we held the belief that investors would demand access to alternative investments. Alts — from startups to funds to crypto to sports cards to art — have begun to feature more in investors’ portfolios as culture has become finance and finance has become culture. And it’s largely thanks to innovations in financial infrastructure that have enabled more investors to access alternative investments. We have been passionate believers in unlocking access to investing for everyone — so that’s why we’ve helped build and invest in the likes of iCapital*, Mosaic*, Republic, Forge*, CoinList, AngelList, Alt, Allocate, and Caplight,

Investing in funds as the new angel investing: We started investing in funds and emerging managers in both VC and crypto (and helped those funds with LP introductions, company introductions, etc.) before it became a popular thing to do. We recognized a trend of smaller, more specialized managers providing outsized value to entrepreneurs early in their journey. We also viewed VCs as founders who are building businesses. From our experience building the investor networks at iCapital and Mosaic and helping to seed hedge funds, we understand how to help put fund managers in business and raise capital. We saw an opportunity to bet on emerging managers early as if they were seed stage founders — so we have partnered with a number of early-stage fund managers across VC and crypto, from Polychain* to Boost VC* to Goodwater Capital* to 6th Man Ventures* to 776. We are also excited about the tools that are helping fund managers grow their businesses as alts continue to go mainstream. That’s why we’ve backed the likes of iCapital, Republic, AngelList, and Allocate.

Dream until it’s your reality

Innovation in financial services has been possible thanks to fearless entrepreneurs who have a dogged determination to turn their dreams into reality.

Visionaries across traditional financial services and digital financial services believe that financial services can — and should — be better.

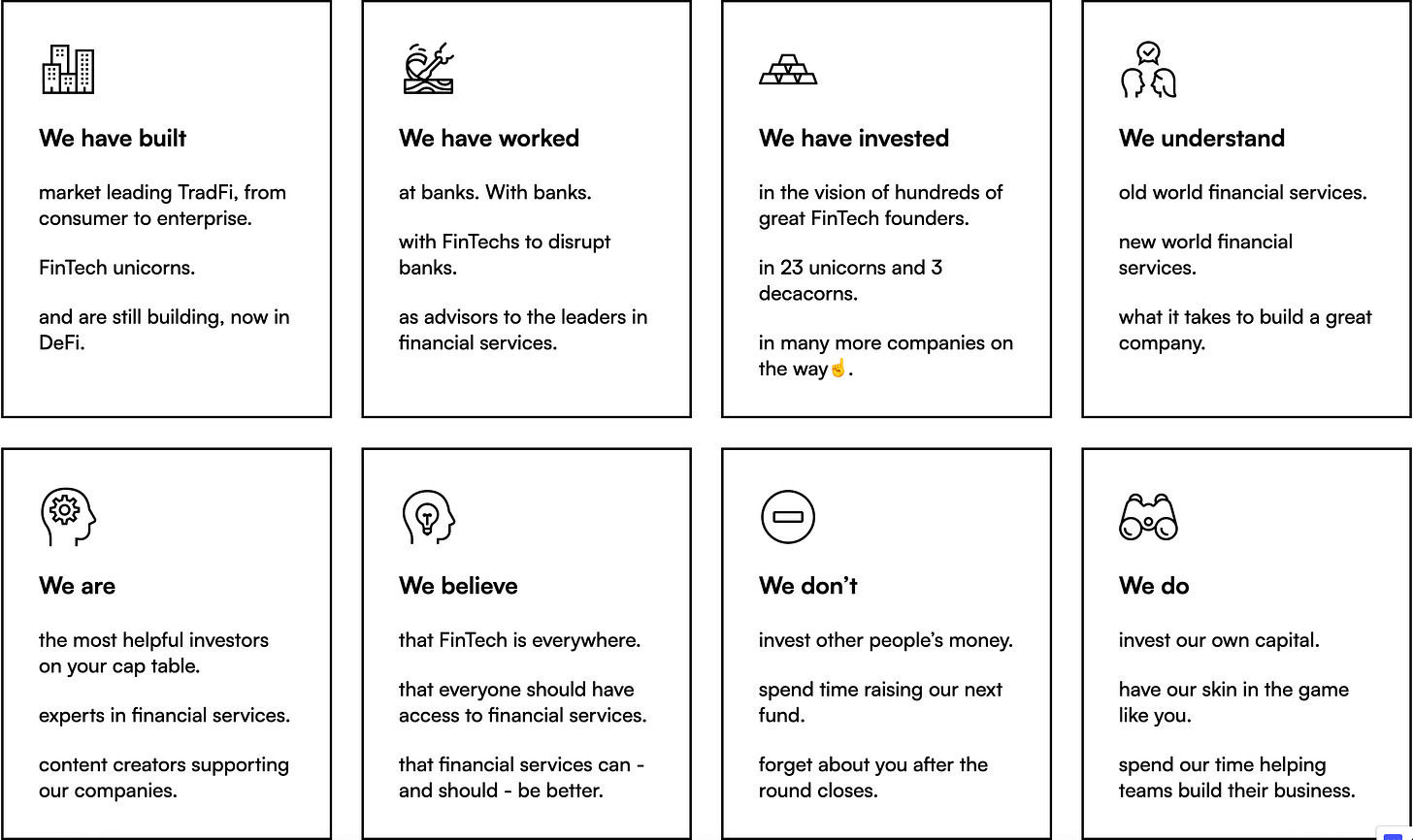

We have been in founders’ shoes, so we understand how hard it is to build a company or a fund.

We have structured our platform at Broadhaven to help founders and funds from inception to IPO.

We have incubated companies.

We have been the first seed investor.

We have been a later stage investor.

We have helped companies close their first big customer.

We have helped funds close some of their largest LPs.

We have helped fintech companies acquire banks.

We have helped fintech lenders close large credit facilities.

We have helped take our seed investments public.

We do this because we love helping founders build things that matter. We invest our own capital into both companies and funds because we want to help founders turn their dreams into reality.

Dream on. We’re excited to dream with you.

* Investments made by Broadhaven principals