AGM Alts Weekly | 11.24.24: Defining contributions

AGM Alts Weekly #79: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good afternoon from London, where I was here for a week of meetings, presentations, interviews, and podcasts.

This week’s conversations centralized around marketing and branding for many of the large alternative asset managers. It goes hand-in-hand with wealth channel distribution. At an event organized by Citywire, I spoke to a group of CMOs and Global Heads of Private Wealth Marketing. Brand and marketing were top of mind — and for good reason.

Brand-building is inextricably linked with two major trends behind the growth in private markets: a push to work with the wealth channel and creating and structuring the right products for individual investors, principally different forms of evergreen funds that both meet the unique needs of the wealth channel and operational challenges for alternative asset managers.

Another topic that came up too many times to ignore? Where does private equity fit into pension schemes, particularly defined contribution plans.

A newer contribution to private markets

The discussion of private equity coming into pension plans is a timely one, particularly as evergreen funds continue their product innovation.

This week saw two big announcements in the evergreen fund space: iCapital expanding its Model Portfolio suite to launch its Growth Model Portfolio and Fidelity International announcing that they will integrate private markets assets via a Long-Term Asset Fund (LTAF) into its £16.9B FutureWise default investment strategy for UK-based workplace pension schemes.

FutureWise’s investment strategy, which utilizes a “target date fund” (TDF) approach to invest members’ savings, will allocate to Fidelity International’s Diversified Private Assets LTAF when the fund launches. FutureWise plans to increase exposure over the next three years to 15% allocation to private markets assets via the LTAF, a figure that more closely mirrors institutional investors’ allocation to private markets.

Fidelity said in a statement that exposure to these new investment opportunities for the pension scheme aims to “enhance diversification, improve risk-adjusted returns, and improve overall member outcomes.”

Fidelity International’s Global Head of Platform Solutions Stuart Warner captured the significance of investing pension scheme assets into private markets in Fidelity’s statement: “For our DC members whose investment horizon is measured in decades not years, we believe there is strong alignment in the benefits of private markets investments and member objectives.”

Decades, not years

That concept is critical when it comes to understanding the power of private markets. Macro hedge fund investor Passport Capital Founder and Nimble Partners Founder John Burbank said as much in his Alt Goes Mainstream podcast, noting that “duration is the most important thing an investor can have.”

Taking a long-term view on holding an investment — or the power of patience — contributes to the ability to compound capital over a period of time.

The key is finding the right construct in which to hold these assets. Regulatory hurdles, investor risks, and political challenges aside, retirement vehicles are, conceptually speaking, a good fit for private markets holdings. The inability to do anything other than go long duration can benefit investors.

From the other side, Rob Collins from Partners Group noted the difference between managing an evergreen structure and a closed-end fund, saying in his Alt Goes Mainstream podcast that an evergreen fund is “an infinite responsibility.”

Evergreen structures are, for the most part, just starting to take shape in private markets as a way for investors to gain exposure to the space.

Perhaps it will take time for track records to be built and adept management of evergreen funds to be proven out for those that are newer entrants to the space, but it might not be long before evergreen funds make their way into retirement accounts in some way.

Defining contributions

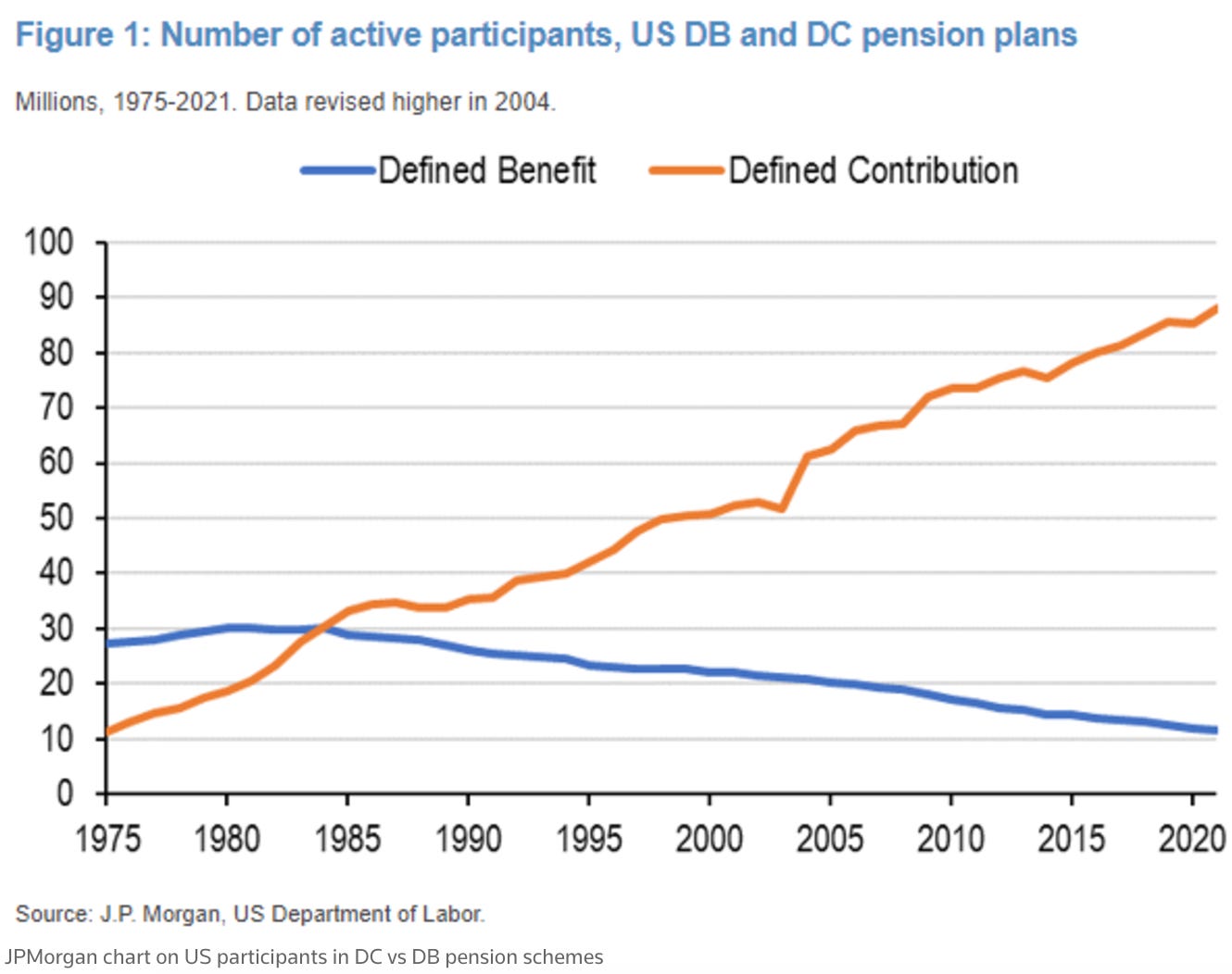

The shift in retirement assets from defined benefit plans to defined contribution plans has been on a secular growth trend for the better part of the past 40 years.

A chart from a June 2024 Reuters article highlights just how many participants have changed from defined benefit participants to defined contribution participants.

The shift to defined contribution plans gives rise to a crucial question for plan sponsors, employers, and employees: will employees have enough money for retirement?

According to the European Insurance and Occupational Pensions Authority, not many employees do. A Northern Trust paper that cited the European Insurance and Occupational Pensions Authority study noted that only 37% of employees without a pension feel confident in having enough money for a comfortable retirement.

The retirement question is only exacerbated by recent market trends. Concentration of returns in the Mag 7, the rise of passive investing, the trend of private companies staying private longer, and questions about equity market returns going forward all pose a challenge to retirement assets — and mean that many pensioners’ assets are only exposed to a small (and increasingly smaller) universe of company value creation.

One answer to these questions for pensioners? Exposure to the value creation and diversification that private markets can offer.

Private markets investment strategies in certain types of retirement products are not an entirely new phenomenon. For years, Partners Group has built tailored offerings for the defined contributions pension markets in the US, UK, and Australia. Structuring funds to meet the requirements of the DC pension system is not trivial. Partners Group — and others who have structured funds for DC pension plans — have had to fulfill the highly standardized purchase and redemption procedures that are required as part of the DC pension system. Partners Group’s funds are also structured to create daily liquidity and pricing.

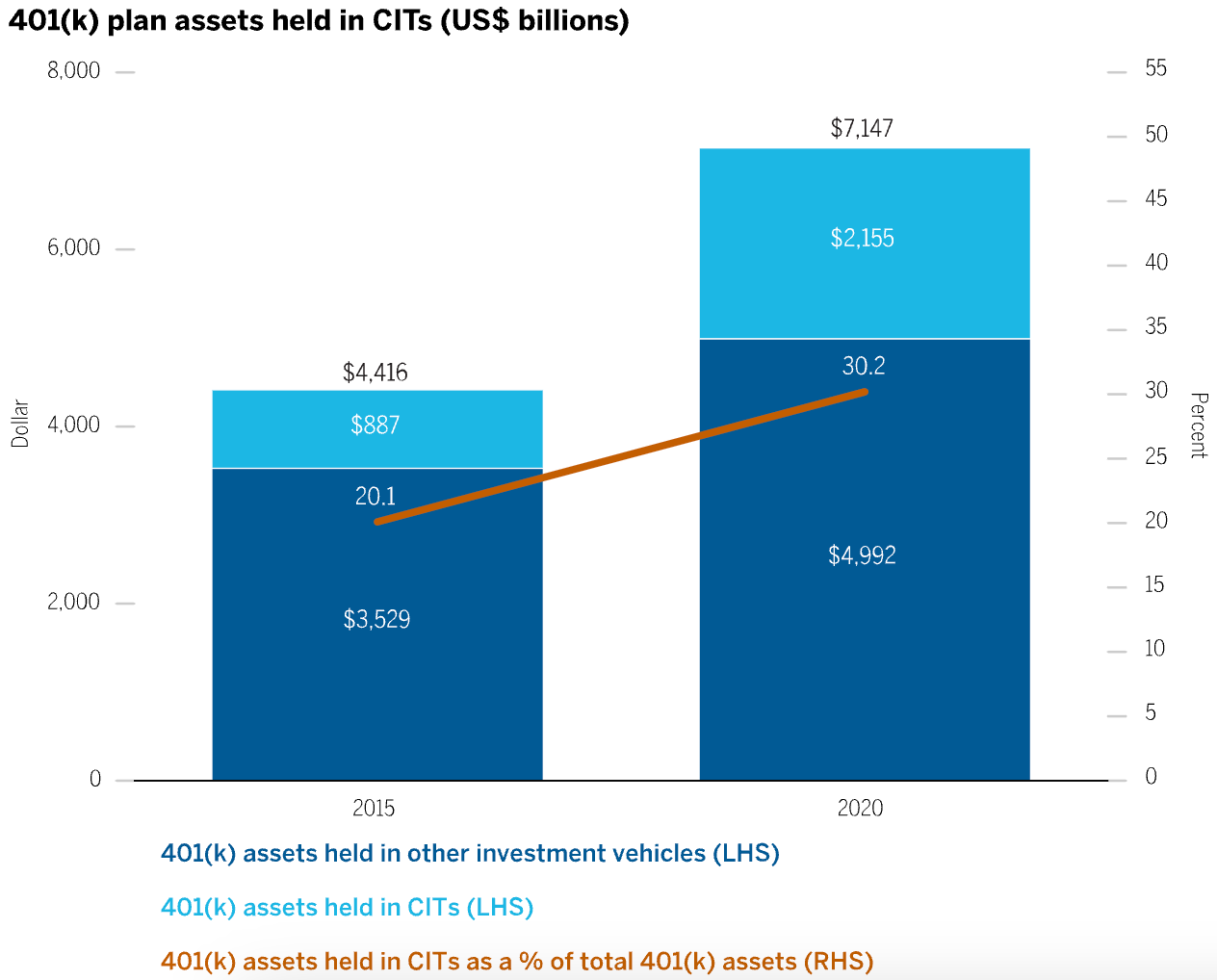

Collective Investment Trusts (CITs) are another vehicle that can hold private markets investments.

CITs are regulated by the OCC, where the sponsoring bank or trust company is federally chartered. CITs are also exempt from registration with the SEC under the 40 Act and 33 Act, which some, like Wellington and State Street (and see a graphic below from their overview of CITs), believe that this results in a more cost-effective vehicle option for participants.

According to Wellington, CITs, which can house alternative investments, are growing in popularity. This is in large part due to their ability to manage institutional-quality investment strategies, product flexibility, and lower fees.

It’s not easy to structure and manage private markets funds that are designed for retirement plans, but the juice might be worth the squeeze for both fund managers and retirees.

An analysis by Georgetown University’s Center for Retirement Initiatives (CRI), in conjunction with CEM Benchmarking, found that when back-testing returns from 2011-2020, adding up to a 10% private equity sleeve to DC target-date funds in place of public equities increased net returns by 22 basis points per year.

Adding up to 10% in real assets in place of US large cap stock and core bonds would net an additional 11 basis points per year. And combining these two approaches — up to a 10% alts sleeve comprised equally of private equity and real assets — would net these funds an extra 15 basis points per year, even after accounting for all the extra costs of alternatives funds.

Historically, valuations of private assets have been a challenge. However, technology innovation in private markets data and valuation businesses might finally be catching up. Evergreen fund growth and product innovation are ushering in a wave of technology innovation to meet the needs of evergreen fund valuation requirements, which are much more frequent than traditional closed-end fund vehicles.

Private markets products make a lot of sense in retirement accounts. Innovations in product structuring, particularly with advancements in evergreen funds and model portfolios that the likes of BlackRock / Partners Group and iCapital have created, should go a long way in making it easier to place private markets strategies into retirement structures.

It just needs to go more mainstream.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Partners Group posted on LinkedIn about the opportunity to invest into mid-market infrastructure secondaries.

Why is the mid-market in infrastructure secondaries the most compelling segment of the market? Partners Group’s Co-Head of Infrastructure Partnership Investments Marc Meier and Infrastructure Partnership Investments Investments team member Melk Bucher (Ph.D) discuss the features of the middle market:

Largest segment of the market.

Least competition amongst buyers, creating a significant pricing advantage of up to 5-7% over large-cap transactions.

Partners Group believes transaction volume could grow 5x by 2030 to over $60B in volume due to increased adoption of secondaries and overall growth of infrastructure AUM.

Their whitepaper on mid-market infrastructure secondaries is here.

AGM News of the Week

Articles we are reading

📝 Europe to account for 45% of unlisted infrastructure AUM by 2026 – Reach Capital | Will Bennett-Lynch, Preqin

💡Preqin’s Will Bennett-Lynch dives into Reach Capital’s “Infrastructure Equity Study 2024” to find that infrastructure managers are turning a focus to opportunities in Europe. Reach’s study expects that the proportion of AUM held by funds focused on Europe will grow to 45% by 2026, growing from 31% in 2015 and surpassing the total value of North America-focused funds. The fundraising market appears to tell the story of the data. Three of the largest five infrastructure fund closes in 2023 were in Europe, and 2024 witnessed a similar trend. Funds managed by Pantheon, DIF Capital Partners (acquired by CVC in 2024), and Igneo Infrastructure Partners were amongst the six largest fund closes in 2024 YTD, according to Preqin data. Reach Capital Managing Partner William Barrett said “globally, $15T of further investment is required by 2040 to meet infrastructure demands, and we expect private markets to play an essential role in bridging this gap.” Bennett-Lynch notes that amended regulatory frameworks are also making Europe a more attractive destination for infrastructure managers. Renewable energy currently constitutes 23% of energy production, according to a paper published by the European Union last year. A revised directive, the Renewable Energy Directive, adopted in 2023, has raised the EU’s binding renewable energy target for 2030 from 32% to 42.5%. The energy transition is the big area of focus for infrastructure investment. The Reach report said that the energy and transportation sectors have accounted for over 65% of all infrastructure investments since 2018. The energy sector, where the largest number of deals are in renewables, topped 60% of infrastructure deal volume last year.

💸 AGM’s 2/20: Some of the big megatrends, decarbonization and digitalization, require massive infrastructure investment in order for governments, societies, and companies to play the long game. This trend appears to be particularly important in Europe, where governments are looking to intensify their focus on renewable energy investing. It’s possible that this also aligns with the requirements and desires of institutional investors. Recent research from UK investor and insurer, Legal & General (L&G), found that impact and sustainable mandates are forecast to represent nearly half (45%) of UK institutional investors’ private markets allocations within two years. This marks a shift upward from the current allocation of 37%, with the research noting that asset owners believe they can achieve greater environmental outcomes through private markets investments. L&G surveyed 150 institutional investors, including defined contribution and defined benefit pension schemes that collectively manage over £7.6T in assets. 77% of investors highlighted environmental outcomes as key priorities, with social outcomes, such as affordable housing and healthcare, also high on the list. DC pensions are expected to invest heavily into this category, with sustainable mandates comprising 50% of their portfolios by 2026. Insurance companies and DB schemes aren’t far behind, with projected allocations of 47% and 45%. Energy and renewable infrastructure are high atop investors’ environmental agenda, with 81% prioritizing these areas as they seek to address the climate transition and decarbonization. Sustainable transport and green real estate are also key areas of focus for institutional investors, with 53% of those surveyed planning to increase allocations to infrastructure investing over the next few years. This data positions infrastructure funds well for the future, making it no surprise that larger alternative asset managers have looked to position themselves to be in a position to capture this interest. That’s why it shouldn’t come as a shock that large players like BlackRock (acquiring GIP), CVC (acquiring DIF), and Bridgepoint (acquiring ECP) have all looked to augment their private markets capabilities by adding specialized infrastructure investors that have long track records and deep relationships with institutional investors. I’d only anticipate this trend to continue as alternative asset managers look to capture the large pools of capital looking to fund the energy transition, particularly in Europe, where the need to decarbonize and move off of a reliance on oil and natural gas is exceedingly acute in today’s geopolitical landscape.

Reports we are reading

📝 Getting in the Game: The Future of Sports Investing | Meena Lakdawala Flynn, Nicole Pullen Ross, DeDe Agar, Vivian Fraga Spies, Goldman Sachs

💡Goldman Sachs recently published a report on the growth and institutionalization of sports as an investment opportunity. The value of media rights has shifted into focus as consumers have prioritized live entertainment. This development has contributed to the global growth of sports and valuations. A rise in valuations has unlocked investment opportunities in the sports space, in part because it’s become increasingly difficult for a single individual to purchase control ownership — and because sports team owners might be looking to unlock some levels of liquidity. The expansion of sports as an asset class is also driving the expansion of corresponding revenue lines and investment opportunities, with things like sports betting, adjacent real estate development, athlete brands, and media expansion all supplementing the stable and predictable revenue stream of media rights.

It’s hard to ignore the broader theme of streaming as a major driver of growth in media rights and revenues. Streaming has displaced the cable bundle — and broader consumer preferences for on-demand entertainment, shorter-form content, and convenience have all contributed to a growth in sports media engagement. Over the last five years, 40% of all US subscribers rid themselves of the traditional cable bundle, leaving only 45% of households in the US with a cable subscription, a figure that’s 50% lower than at its peak, according to Goldman Sachs. Live sports have boomed in the meantime. NFL games dominated the most-watched broadcasts. Of the top 100 most-watched broadcasts in 2023, 93 were NFL games. Since sports is the primary type of live content many cable subscribers watch, advertisers have been willing to pay a significant premium to access these viewers.

Media rights have been a major reason why US sports team valuations have begun to increase in a meaningful way. Yes, valuation growth has occurred at a steady annualized CAGR, …

but it’s really been the growth of media contracts that have driven valuations to new heights.

💸 AGM’s 2/20: Sports is really the last frontier for live, unscripted content. And it’s something that many big tech companies see as something worth paying for. The proof is in the data. Streamers and big tech companies such as Amazon are playing a different game than traditional media companies. They are effectively paying to acquire customers for their other businesses by paying for the media rights. Take Amazon’s ownership of the “Thursday Night Football” game on Prime Video. The Buffalo Bills win over the Miami Dolphins averaged 14.96M viewers, the third most-watched game ever on Prime Video. This figure happened to be a 1% decrease from last year’s Thursday Night Football opener. Amazon has now had three consecutive season openers that have surpassed 13 million average viewers. A crucial stat from Amazon’s Thursday viewership? Viewership within the 18-34 demographic hit 7.44M viewers, a 36% increase over last year’s 5.49M. The median age of the game’s audience was 46, over seven years younger than the NFL average on linear networks through the first week of the 2024 season. The brilliance of Amazon (and other streamers’ models)? They require a subscription, meaning that consumers have to subscribe to Amazon Prime in order to gain access to viewing the football game. While I don’t have the data, I’d venture to say that Amazon has gained new customers who also purchase products on Amazon as a result of onboarding them to Amazon Prime Video.

It’s not just the big leagues that represent a compelling investment opportunity. $29B AUM Palmer Square Capital Management’s Co-Founder and Founder / Owner of the NWSL’s Kansas City Current Chris Long said on his Alt Goes Mainstream podcast that buying a NWSL team is like “buying the Boston Celtics in the 1960s.” A combination of monopolistic content, recurring revenue, and ability to monetize online (reality TV, such as FX’s “Welcome to Wrexham”) and offline (KC Current’s new stadium and adjacent real estate developments) all make sports an incredibly compelling — and uncorrelated — investment opportunity (read more for my 3.31.24 AGM Alts Weekly where I dive into the features of sports investing and why so many institutional investors and HNW individuals are taking the game of sports investing so seriously).

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Product Marketing, VP, EMEA. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - VP. Click here to learn more.

🔍 Northern Trust (Asset manager) - Head of Alternatives Sales Specialists. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth Strategy Senior Lead - Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Financial Administration - InvestOne. Click hear to learn more.

🔍 Arcesium (Financial data management platform) - Senior Product Consultant - PCG (Technology). Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎙 Hear Churchill Asset Management by Nuveen’s MD, Senior Investment Strategist & Co-Head of the Chicago Office Alona Gornick discuss the evolution of private credit, the power of permanent capital, and the importance of the product specialist. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.