AGM Alts Weekly | 3.24.24: Private markets are eating the world

AGM Alts Weekly #44: Making private markets more public, every week.

👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

At Alt Goes Mainstream, we aim to be the meeting place for private markets. Our core tenets consist of content, community, and capital. We are thrilled and honored to introduce our first sponsor, 3i Members, an organization that stands for those same things.

3i Members is an investing network built on community, collaboration, and capital. They bring together experienced and successful entrepreneurs and financial services professionals to leverage their collective network to build relationships and help their members uncover and diligence high-quality investment opportunities. Organizations like 3i Members are part of what will make alts go mainstream — bringing together investors to educate, collaborate, and invest in private markets. I’ve had the pleasure of getting to know the founding team at 3i — Mark Gerson, Billy Libby, and Teddy Gold — and it’s exciting to see what they are building for their community of members and the broader private markets ecosystem.

Please give a warm welcome to 3i Members as Alt Goes Mainstream’s first sponsor.

Presented by

3i Members is an investing network of 400+ investors — all who have exited a company or lead a family office. Members participate in monthly deal meetings, regional events, diligence discussions, and more.

3i deal flow is characterized by its high-yielding nature (15-20%+ IRRs), underwritable, uncorrelated, and off-market alternatives with asymmetric return profiles.

Learn how 3i sources & diligences investment opportunities and how to get involved as a member here.

Good morning from New York. I’m in town for the taping of our next Monthly Alts Pulse with iCapital Chairman & CEO Lawrence Calcano, where we bring on a special guest from the wealth management world to join us.

Private markets are eating the world.

I concluded last week’s newsletter about the rise of asset-based finance and private credit by stating that private markets are eating the world.

Private markets now reach into many aspects of the economy. Private equity finances and owns businesses, from data centers to dating apps, that help make up the fabric of our consumer and business lives. Private credit helps companies tap into capital markets to access financing, often when banks aren’t able to extend credit. Venture capital provides risk capital to moonshot projects that foster innovation and push the boundaries of what’s possible. Real estate and infrastructure investing builds the world we live in.

As I wrote the sentence, “private markets are eating the world,” last week, my mind traveled back to Marc Andreessen’s article from 2011, where he wrote “why software is eating the world.”

Cardo AI’s Altin Kadareja caught the reference and said it well in a LinkedIn post last Sunday: “just as software has become fundamental to all companies, finance, driven by private markets, is poised to play a similar role.”

Despite a “stalled” market for private equity, as Bain & Company’s Chairman of the Global Private Equity Practice Hugh MacArthur characterized the 2023 private equity market in Bain’s annual Global Private Equity Report, private markets are in the early innings of becoming a mainstream part of the financial services world.

Private markets are eating into the global financial services pie.

Let’s unpack this phenomenon.

The private markets tsunami

More companies are private and they are staying private longer

Research from Hamilton Lane finds that in 2022, there were a mere 2,800 public companies in the US with annual revenues greater than $100M. That figure pales in comparison to the 18,000 private companies with north of $100M, meaning that investors who can only participate in public markets investing have access to only 13% of the companies in the US with over $100M in revenue.

So, the majority of attractive or investable ($100M+ revenue companies) reside in private markets. Yet, historically, private markets have only been accessible to a small fraction of investors. This problem becomes much bigger when it’s combined with the fact that private companies are staying private longer.

There has been a secular decline in listed public companies in the US in the past 30 years. Data from iCapital highlights just how steep this tapering has been: the number of public company listings today is roughly half of what it was in 1996.

The value creation and growth occurring for companies in private markets makes an allocation to private markets necessary for investors if they want to access the majority of the market. This feature is compounded by the fact that there’s increasing concentration of returns in the largest public company stocks, making it even more critical for investors to have exposure to growth in equity value through private markets.

iCapital’s post by Nick Veronis shares other salient figures about just how much of the market investors are missing out on if they lack access to private markets.

There are seven million private U.S. companies.

The top 246 private companies alone have combined revenues of approximately $1.9 trillion and employ four million people.

There are nearly 200,000 middle market businesses, which represent one-third of private sector GDP and employ approximately 48 million people, totaling more than $10 trillion in annual revenue. About 91% of these companies are private.

And yet, the vast majority of eligible investors have little to no exposure to this market. Instead, they are invested in crowded passive public strategies, with an estimated $5.75 trillion dollars indexed to the S&P 500 alone. By comparison, the entire US private equity industry, which invests in tens of thousands of companies, had only $4.6 trillion in assets under management, including dry powder, at the end of 2022.

The trend of private companies staying private longer does not appear to be abating anytime soon. Thus, private markets must make up a portion of investors’ allocation to their equity exposure if they want to have access to diversification across equity markets and tap into growth within both equity markets and their portfolios.

Regulatory environment means that alternative asset managers are taking over bank’s activities

Another secular trend that has accelerated the development of private markets firms is the fallout from the 2008 financial crisis. Post-2008, private equity firms began to replace banks as the go-to provider of corporate loans. Asset-based finance has been next.

Private credit is an increasingly integral part of the market in which alternative asset managers are playing. A chart from a recent Wall Street Journal article by Matt Wirz highlights just how much alternative asset managers have crept into banks’ territories by completing large-scale asset-based finance deals.

These activities are all part of the growing pie that is private credit.

As I noted in last week’s newsletter, private credit used to represent a very specific area of the fixed-income world: middle-market sponsor lending. That wasn’t a small market by any means. Preqin measured private debt AUM to be a $1.5T addressable market as of December 2022. However, private credit has become a much larger part of private markets. Apollo’s investor presentation measures the opportunity in private credit to be a $40T addressable market, ranging from auto loans and residential mortgages, to equipment finance, aviation finance, railcar leasing, and even music royalties.

It’s firms that were formerly seen as private equity shops, occupying a sliver of the global financial services world across equity and credit, that are now financing consumers on one side (with their growing private credit businesses) and enabling them to invest into private markets on the other side (with their LPs that range from insurance companies, captive insurance businesses like Apollo’s Athene and KKR’s Global Atlantic, to the global wealth channel). These firms have created marketplaces, as Apollo’s Marc Rowan has stated, which are where investors and borrowers are choosing to go to access capital or investment opportunities.

These activities highlight that alternative asset managers are eating into what used to be part of the traditional financial services pie.

The wealth channel is being unlocked

Private markets AUM has experienced marked growth over the past 20 years. AUM now stands at roughly $14T, up from $1T in 2005. The lion’s share of the AUM to date has come from the institutional investor community.

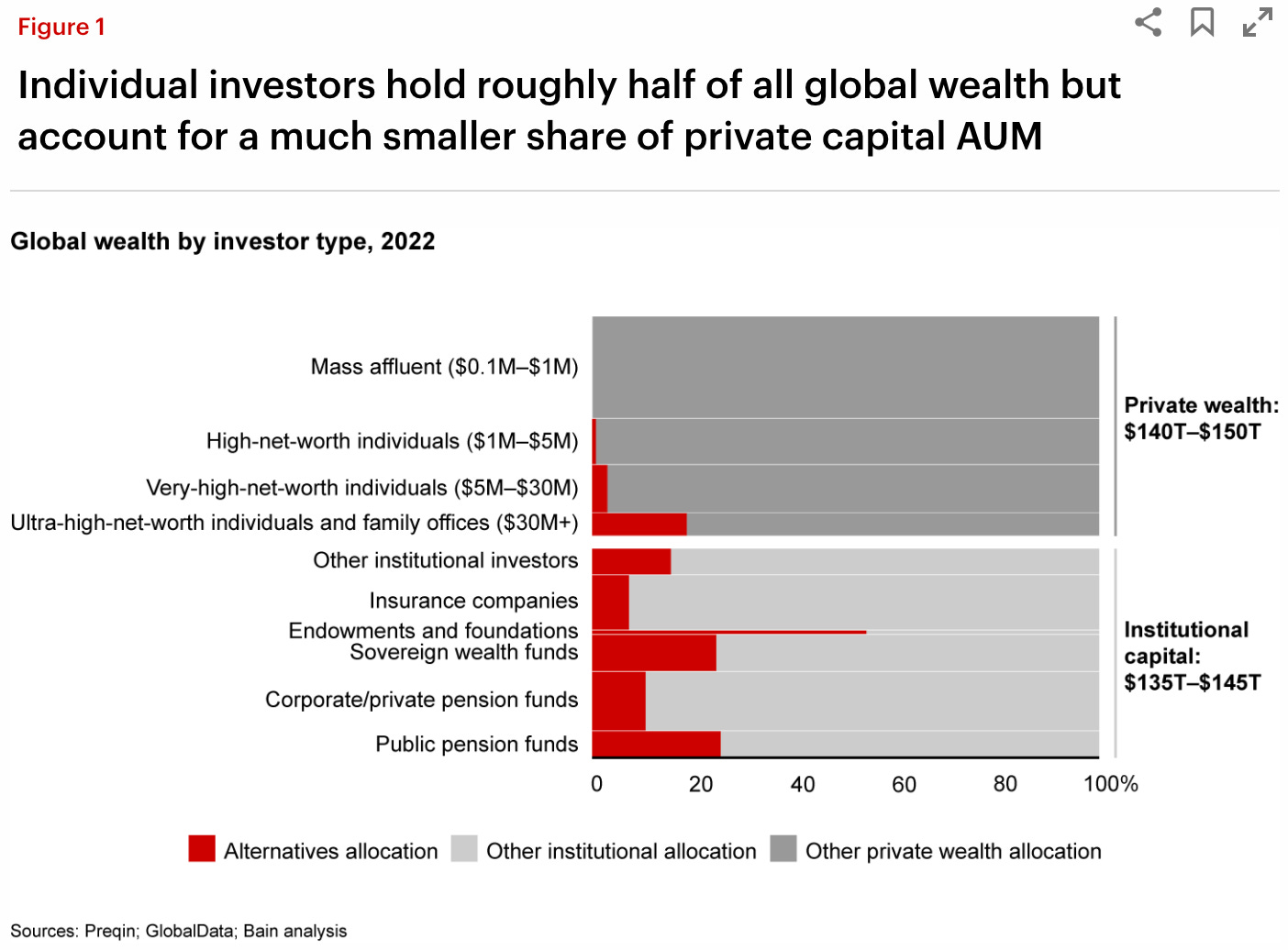

The wealth channel is in its infancy of allocating capital to private markets on both a relative and absolute basis to private markets. Much of the wealth channel, a pool of capital that represents between $140-150T of AUM, is significantly underallocated to private markets, relatively to the similarly sized institutional capital cohort, as Bain & Company’s 2023 Global Private Equity Report highlights.

If the wealth channel begins to move even just a few percentage points of capital into private markets, trillions of dollars will flow into alternatives in the coming years. That’s the expectation, according to both Preqin and Goldman Sachs estimates on the projected size of private markets AUM going forward.

More dollars flowing into private markets means that an increasing amount of capital will need to be allocated to private markets opportunities. This phenomenon should only serve to reinforce the sentiment that private markets will be increasingly important in finance going forward.

A rearchitected portfolio allocation model that incorporates an increasing allocation to alternatives could also make a difference. The expanding allocation to private markets for the wealth channel, much of whom have historically had their portfolio allocated in the 60/40 model, would mean that private markets would also be eating into investors’ portfolios.

Private markets are on the menu

Private markets are eating the 60/40 portfolio

A rearchitected portfolio allocation model that incorporates an increasing allocation to alternatives is eating the traditional way that investors, particularly those in the wealth channel, have invested in the past.

The expanding allocation to private markets for the wealth channel, much of whom have historically had their portfolio allocated in the 60/40 model, means that private markets are taking up a larger portion of investors’ portfolios.

Many institutional investors have employed an allocation model that included a large allocation to alternatives. Some endowments and institutions, such as Yale, Harvard, and CalSTRS, have had upwards of 30-40% of their portfolios allocated to alternatives. In some cases, this asset allocation strategy has driven outsized returns, in part due to the performance of alternatives and their ability to manage illiquidity and go long duration.

Part of the explanation for why most individual investors have not been able to architect an asset allocation model similar to endowments and institutions is due to a lack of access. Now, access is being unlocked through both regulatory change, technology innovation, and product innovation (i.e. evergreen funds, interval funds) that are all creating ways for investors to participate in private markets in a meaningful way. With these changes comes the ability for individual investors to reshape their portfolios — and private markets will eat (or, in some respects, already has eaten) the 60/40 portfolio.

Private markets are eating public markets

2023 concluded with two seminal moments, amongst others, for private markets. Blackstone, which was started under 39 years ago, became the first alternative asset manager to cross the $1T AUM threshold. They also became the first alternative asset manager to join the S&P 500.

Private markets crossed a chasm when a number of firms went public. With the likes of Blackstone, Apollo, KKR, Carlyle, Ares, Blue Owl, TPG, and others, going public, it became clear that private markets — and their business models — were here to stay.

Blackstone, with a ~$156B market cap, now boasts a larger market cap than Morgan Stanley (~$150B), Goldman Sachs (~$132B), and Citigroup ($116B).

Public markets investors clearly believe that there are businesses that operate in private markets that will continue to grow AUM. A decision to buy the stock of an alternative asset manager is, in many respects, a belief that an alternative asset manager will grow AUM. This sentiment is increasingly true as these firms are focused more on fee-paying AUM than on carry, even reorienting their comp structures away from carry to stock awards and focusing on growing products (like evergreen funds) to meet that view. The larger these firms become, the more they eat into public markets.

Given the growth of the industry and the expanding size of many of these firms, I wouldn’t be surprised to see other alternative asset managers cross the vaunted gates of the S&P 500 soon.

Private markets are eating how companies are financed

In years past, companies would have to go to a collection of capital providers to finance the growth of their business, either via equity or debt. Now that alternative asset managers have expanded well beyond the scope of private equity, where the roots of many started, a company can go to an alternative asset manager to access a number of different financing options.

Apollo’s Marc Rowan encapsulated the current environment well when he recently said, “Everywhere in the world, people are choosing more from the investment marketplace, less from the banking system.” This phenomenon appears to be the case in private credit in particular, where alternative asset managers are filling the gap left by banks.

Private markets are extending its reach even further, into areas like sports. There have been a number of alternative asset managers that have set up dedicated sports funds to address the growing opportunity in sports. Many of these firms see the opportunity as investing in entertainment assets replete with contractually obligated and growing, TV rights deals in addition to other monetization streams that are growing due to increased interest in sports. Private equity firms have taken minority stakes in NBA teams, invested into top-tier soccer clubs that represent global brands, and more recently, invested in the growing women’s soccer league, the NWSL, in the US (Sixth Street and Carlyle both recently invested in clubs in the league).

Alternative asset managers are also innovating on their own structure and product structures to enable them to finance companies in different ways. Apollo’s acquisition of Athene, an insurer, to give them access to permanent capital, has enabled them to raise capital and finance companies with a different time horizon in mind. Other alternative asset managers have followed in Apollo’s footsteps, either buying insurance companies or investing in insurers to gain access to a similar structure. Other firms, like Blue Owl, have found a way to utilize a permanent capital structure to help them both raise capital and finance companies. The advent of evergreen fund structures means that alternative asset managers can not only raise capital in a continuous fashion but also hold on to private equity investments longer than the hold period of a traditional 10-12 year closed-end private equity fund. This feature has enabled firms to win over entrepreneurs, particularly family businesses that may want to access private equity capital but also may not want to be tied to the mast of the exit timeline of a traditional private equity fund structure.

Innovation on business model and fund structure is dramatically changing how companies can be financed, eating into the traditional ways in which private equity operated.

The future is private

Private markets are eating into every corner of finance. Private markets firms are widening in scope, and as a result, growing in size and influence. So much so that even traditional financial services firms are marshaling capital and resources to build, grow, or acquire their private markets capabilities.

There’s still work to be done. The industry needs to continue to find ways to give more people more of the private markets pie. More investors need to be able to participate in private markets. More employees of private companies also need to be included in the growth stories of private companies CalSTRS CIO Chris Ailman would argue as he did a few weeks ago when he said private equity firms would do well to share more of the wealth with employees of the companies they invest into.

It’s still early days for private markets eating the world. Software innovation, including AI, will bring untold efficiencies to many aspects of private markets and how firms analyze, diligence, track, and enable more investors to access investments. So much of the individual investor channel does not have a meaningful piece of their portfolio’s pie in private markets. That’s about to change, and that’s one of the big opportunities in alternatives which stands to benefit the industry at large.

In a nod to how Marc Andreessen ended his piece in 2011, “I know where I’m putting my money,” I’ll say the same. I’m putting my money where my mouth is.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Offloading credit was ‘one of the best decisions’ EQT ever made, says Sinding | Hannah Zhang, Private Equity International

💡Private Equity International’s Hannah Zhang reports that EQT has no qualms about selling off its private credit business despite the popularity of private credit in the current fundraising environment. Speaking to Private Equity International, EQT CEO Christian Sinding characterized the 2020 sale as “one of the best decisions” the firm has ever made, in part because they needed the size and scale to compete in that market. “We were subscale in that business and didn’t think we could be one of the long-term winners in that space,” Sinding said. “Therefore, we divested and that enabled us to be laser-focused on active ownership.” EQT has focused much of its efforts on its private equity strategies, with its fundraising success in that arena reflecting that sentiment. EQT is the world’s third-largest PE firm by capital raised over the past five years, according to the latest PEI 300 ranking, with the firm achieving a successful February close of its 10th flagship fund, EQT X, a €22B fund, surpassing its €20B target. Sinding noted that their focus is equity investments because they have deep experience “owning, developing, and adding value to a company … and driving changes with the capabilities that [they] have.” EQT does not plan to move back into the credit space, in part because Sinding believes that they “have lots of growth left in [their] private capital business in Europe, in the US and in Asia.” EQT’s focus on its core competency has enabled it to focus on areas of growth, such as the private wealth channel. They currently receive 9% of client commitments from the private wealth channel. Sinding aims to grow this figure to 15-20% in the future, noting that the launch of EQT Nexus, its first strategy for individual investors, could help grow that proposition. “We have plans to launch a number of other strategies that are structured for different regions with different regulations,” Sinding said. “We are now present in 22 different countries around the world. We are planning to have [private wealth] distribution in all those countries.” Sinding also anticipates increasing consolidation in the PE industry as specialists will look to leverage the benefits of a larger platform while being differentiated. He said. “My prognosis is that the niche firms, whether they are a specialist in a sector or in a certain geography, can be successful because they’ll be able to track capital and have competence in that area.”

💸 AGM’s 2/20: Sinding’s comments come at an interesting time in the evolution of the alternative asset management industry and give rise to thought-provoking questions about the future of firm-building for both multi-product alternative asset management platforms as well as niche, single-strategy funds. EQT’s decision to exit out of the private credit business at a time when (1) private credit has both been a popular strategy from a fundraising perspective and as an investment opportunity and (2) as multi-product platforms look to continue to expand their investment strategies to grow their enterprise value may come at a surprise on the surface. However, Sinding offers salient points as to why EQT is focused on its equity strategies. Adding different strategies means bringing in new teams and possibly reorienting both the firm’s culture and brand in the process. That’s easier said than done. Firms that can do this well stand to benefit, as I do believe that the alts space is evolving to favor one-stop shop alternatives firms, both from an investment and capital raising perspective, particularly from the wealth channel. Wealth channel buying behavior would suggest that once wealth management firms trust and like a brand, they will likely allocate to multiple products from that firm, as in many cases, wealth firms lack both the time and resources to make more decisions rather than less. Note that this won’t always be the case for wealth management firms and platforms, but given all the different pressures on their time, attention, and resources, combined with the fact that alternatives are just one sliver of their investment activities, alternative asset managers would do well to make the purchase of alternatives by wealth firms as easy and streamlined as possible. That said, there are only a handful of alternative asset managers that will be able to successfully execute on the one-stop-shop business model, so focusing on core competencies makes sense. It’s also worth noting that wealth distribution is very much a localized challenge and a regional game, so alternative asset managers will need to have the resources and capabilities to build out a presence in regions where they want to attract capital — also not an easy feat. Sinding’s comments on consolidation also ring true. My belief is that alternative asset management will barbell — firms either have to be niche specialists or large, multi-strategy / multi-product platforms if they want to succeed in the new world order. Niche specialists will trade the possibility of expanding the platform for the aim of being a best-in-class manager in performance and eventually have the opportunity for enterprise value creation through consolidation with a larger platform that wants to add that capability and enhance their distribution throughput. The question for the niche managers will then be. With additional distribution firepower and the ability to grow their AUM, will performance remain the same with their strategy?

📝 Expansion draft: Why the National Women’s Soccer League is scoring with private equity | Rafael Canton, PE Hub

💡PE Hub’s Rafael Canton highlights Carlyle and the MLS’ Seattle Sounders recent acquisition of the NWSL’s Seattle Reign FC to dive into why there’s so much investable interest in women’s soccer. Carlyle and Seattle Sounders’ 97% acquisition of Seattle Reign for $58M is the latest in a string of deals by venture capital and private equity firms to gain exposure to a rapidly growing corner of the sports world: women’s soccer. The acquisition of the Reign represented a ~18x increase from the $3.51M valuation the firm had in 2019. The NWSL’s most recent deal comes on the heels of major private equity firms or principals of private equity firms buying teams in the leagues. Sixth Street, a $75B AUM private equity firm, backed the launch of the expansion franchise, Bay FC, last year. Monarch Collective, a new LA-based VC firm focused on women’s sports, made a minority investment in 2023 into the expansion franchise in Boston that’s set to launch in 2026. Earlier in March of this year, Levine Leichtman Capital Partners founders Lauren Leichtman and Arthur Levine bought the San Diego Wave FC for $113M, which is the largest NWSL club sale to date. Canton unpacks why the NWSL is seeing an inflection point in franchise values across the league. The new TV deal and rising franchise values have made private equity take notice. The NWSL’s new broadcast deal is 40 times the value of their prior deal. The league and teams agreed to a four-year, $240M contract with CBS Sports, ESPN, Prime Video, and Scripps Sports to broadcast 118 matches nationally, up from six in the prior deal. The league also saw a 36% increase in the number of fans that attended regular season games in 2023, with over 1.4 million fans attending a game last year. Sponsors are also supercharging growth in the NWSL. In 2022, Ally Bank made a pledge to equal its media spend in men’s and women’s sports by 2027, and teams like Angel City FC have secured sponsors with brand name companies such as DoorDash and Klarna.

💸 AGM’s 2/20: Sports investment is on the rise and women’s sports, particularly women’s soccer, is leading the charge. It’s the numbers that are highlighting why investing in women’s sports is an attractive investment thesis — and making private equity firms take notice. Sports are proving to be investable assets. They are entertainment assets with a combination of fixed and variable revenue streams that can grow as a league grows. The TV deals offer a stable stream of revenues contractually obligated to each of the league’s teams over a number of years. As the league grows, the media contracts often become larger. Top sports leagues have benefitted from this feature, creating a “SaaS-like” recurring revenue component to their revenue stream. As leagues like the NWSL become larger and more popular, so do their fan bases, so ticketing revenue often grows as well. Given the private equity activity in the NWSL, it’s no surprise to hear KC Current’s Co-Founder and Owner Chris Long assert on his recent Alt Goes Mainstream podcast that “owning a NWSL team is like owning the Boston Celtics in the 1960s.” Sixth Street’s Alan Waxman echoed a similar sentiment in a 2023 Bloomberg article after his firm purchased Bay FC, saying, “We are all in because we think there’s unmet demand.” Waxman noted the emergence of streaming services, which has made it easier to reach viewers and know who they are, as well as the ability for social media to enable players to connect directly with their fans. Waxman said that Sixth Street expects women’s football in the US to rival the MLS in terms of franchise values, where MLS franchises are worth $500M on average, according to estimates by Sportico, within the next ten years. With the opportunity in women’s soccer — and women’s sports, as well as other emerging leagues and sports — ahead to capture a large base of the population that can now be engaged in sports in a different way than before, I expect we’ll see more sports funds launch, as Marc Lasry and Sonia Gardner’s Avenue Capital recently did with their new sports fund, and more alternative asset managers launch sports strategies or invest into teams and leagues in sports.

Listen to KC Current Co-Founder & Owner Chris Long here and Angel City Co-Founder & President Julie Uhrman here on their podcasts on Alt Goes Mainstream where they talk about the opportunity in women’s soccer and the NWSL.

Reports we are reading

📝 Global Private Equity Report 2024: Standing up to the challenge | Hugh MacArthur, Rebecca Burack, Graham Rose, Christophe De Vusser, Kiki Yang, Sebastien Lamy, Bain & Company

💡Bain & Company released its Global Private Equity Report, highlighting the year as one of the haves and the have-nots. Private equity experienced a challenging 2023, with deal value falling by 37% and exit value falling by 50%. Almost 40% less buyout funds closed. However, there were signs of life. Dollar commitments in buyouts surged as a number of high-performing funds came to market, accounting for the lion’s share of capital raised. Twenty funds accounted for more than half of all buyout capital raised. Chairman of Bain’s Global Private Equity Practice Hugh MacArthur characterized the 2023 market as “stalled.” The culprit? A steep and rapid rise in interest rates which put the brakes on both fundraising and investing. The year ahead may be more promising as signs of life are showing. Interest rates appear to have stabilized, record dry powder is ready to be deployed, and buyout companies are reaching maturity at a time when the exit market might open up again.

Bain highlights some key themes that defined 2023 and that could define the market in 2024:

Generating liquidity: With $3.2T in unexited assets sitting in their portfolios, buyout funds face the critical challenge of achieving liquidity for their companies.

Growth strategy to be exit-ready: With global exits at a 10-year low, sellers must revamp their value-creation plan to show growth.

Secondaries are coming in first: As GPs and LPs seek liquidity in a liquidity-constrained market, secondaries funds are moving to the forefront of the conversation. They also provide a good way for new LPs to private markets to achieve vintage diversification and a reduced J-curve.

An acquisitive market to tack on growth: In a market facing challenging growth prospects, buy-and-build continues to be one of PE’s most popular strategies. However, higher interest rates are making it more challenging for companies and PE firms to rely on multiple arbitrage, so they have to look for ways to achieve organic growth and margins or acquire those features.

Generative AI could change the game: Gen AI could rearchitect processes and performance in private markets, with firms leveraging this innovative technology to transform portfolio companies to create efficiencies and better margins, make investment professionals more efficient and smarter (and reduce headcount), and create better due diligence and portfolio management outcomes.

Unsold assets are piling up: With exit markets frozen, PE firms are sitting on unsold assets. Bain finds that 46% of assets have been held for four years or more, the biggest share since 2012. How do firms exit in a market where exits are hard to come by?

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP, Private Wealth Distribution Business Manager, Americas. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the 8th episode of our monthly show, the Monthly Alts Pulse. We discuss how product innovation, particularly with evergreen funds, is enabling the wealth channel to invest in private markets. Watch here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.