👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London. I’m in town for meetings, to attend the Goldman Sachs EMEA Tech Conference, and to moderate a panel on asset-backed lending at SuperReturn Private Credit on the 12th.

News this week would suggest that the fundraising soil here in Europe continues to become firmer, particularly for the industry’s largest firms.

Another day, another record private equity fundraise in Europe

Following news of CVC’s record-breaking fundraise for its largest buyout fund in firm history in 2023 (€26B), this week, EQT announced its largest buyout fundraise to date at €22B.

This figure in and of itself is impressive, particularly in a time period when all funds, no matter how big or small, faced fundraising headwinds. While it took EQT two years to complete the fundraise, they handily beat its numbers. The firm hurdled over their €20B target for its fund and bested their prior fund size by nearly 40%.

EQT’s achievement with their latest fund continues to hammer home the point that larger funds are having the lion’s share of success fundraising. LPs appear to be favoring larger funds and platforms over smaller funds.

This trend, in part, could be due to a data point that was buried towards the end of the Financial Times’ article on EQT’s fundraise: “The firm said that an ‘increasing share’ of its fund investors came from wealthy individuals as the group seeks to diversify the types of investors that commit to its funds. In total, private wealth channels accounted for about 10% of the fund.”

At a €22B figure, EQT raised around €2B from the private wealth channel. That is a staggering figure when, just years ago, that number would have seemed out of reach. And EQT is far from the only large firm to achieve these types of results. Lexington Partners raised a similar figure from the wealth channel for their recent $22.7B secondaries fundraise. KKR is reportedly raising $500M per month into their evergreen K-Series products as around $75B of their $553B in assets now come from the wealth channel.

The participation from the wealth channel in EQT’s fund highlights just how important the wealth channel will be to funds going forward when considering the source of net new LP dollars. Bloomberg reported that 70% of EQT X’s funds came from existing investors, mainly institutional LPs who re-upped. So it was private wealth that helped drive both increased commitments from that channel and, ultimately, a larger fund size.

The wealth channel is the new institutional LP

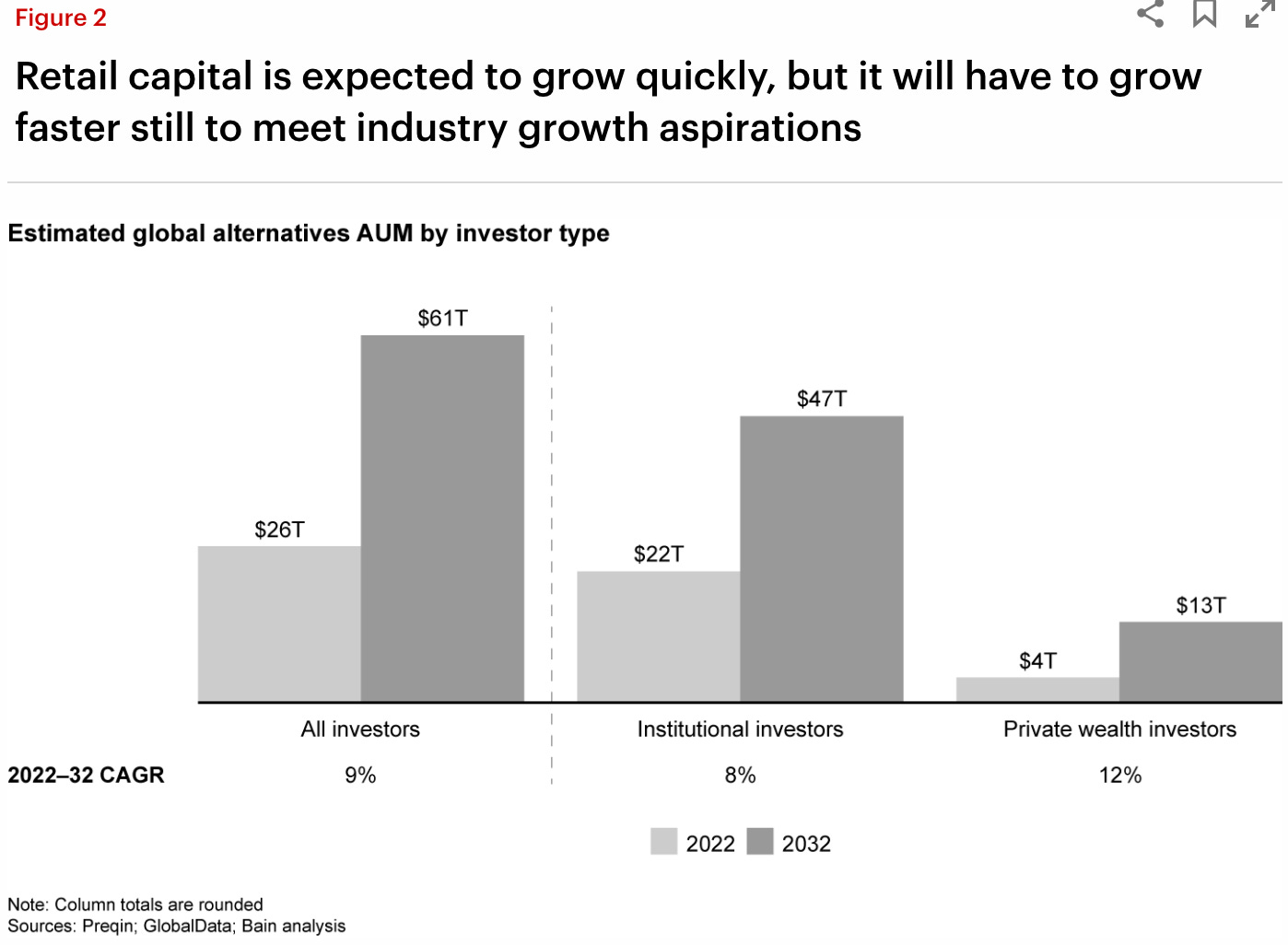

The wealth channel is becoming an increasingly prominent LP in the eyes of GPs. And for good reason. In fact, the wealth channel is projected to grow alternatives inflows into alts faster than institutional investors, as this chart from Bain & Company below illustrates.

While institutional investors are expected to remain the lion’s share of estimated alternatives AUM, the wealth channel is projected to grow from 15% of global alternatives AUM as of 2022 to 21% of global alternatives AUM by 2032. With the success that many large alternative asset managers are having in bringing inflows from the wealth channel and the innovation in product structuring for the wealth channel, it’s possible that share could be even higher than projected when it’s all said and done.

I wrote in January about how the wealth channel is becoming the new institutional LP. This is not new news to the industry.

However, there are nuances to the wealth channel’s participation in private markets — and those nuances will drive how alternative asset managers approach their gameplan of working with the wealth channel.

Growth, from where?

We know wealth channel assets flowing into alts will grow, but from where? And what trends will drive how alternative asset managers work with the wealth channel?

The wires are plugged in

Wirehouses will continue to provide the lion’s share of asset flows into alternative asset managers. Structural reasons persist. Alternatives are still very much sold rather than bought — and the structure that wirehouses have to diligence, onboard, approve, offer, and distribute private markets products through their advisor channels is much more uniform and structured than it is in many parts of the independent RIA channel. A September 2023 whitepaper and survey on advisor adoption of alternatives by Invesco, Cerulli Associates, and IWI highlight that the majority of branch network advisors are more likely to have access to an alternative investments portal (54% of advisors) than are independent advisors (21%).

Structural differences like the ones above illustrate that it’s easier for alternatives products to be distributed through wirehouse / private bank channels.

It also shouldn’t be lost on advisors (and those selling to advisors) the power of a “recommended list.” Many advisors want to make fewer choices, not more, and also have to spend a large portion of their time focused on other activities that grow or maintain their business, like new client development, client service, and managing entire investment portfolios that span both public and private markets investments. Many independent advisor practices, particularly those that are smaller independent firms and even larger practices that may only have a few resources dedicated to manager research or private markets, aren’t equipped to handle the breadth and depth of the alternatives space across managers and strategies. Wirehouses and private banks certainly make it easier for advisors to find, evaluate, and allocate to alternatives products by providing a recommended list of curated products, education, research, and diligence support, and an investment portal. Sure, there are good arguments as to why an advisor would choose to go independent and why a client would want to work with an independent advisor, but in terms of alternatives distribution, wirehouses are plugged into all the right pieces of the alternatives puzzle to unlock flows into private markets products.

These set of features are even more protracted in markets like Europe and Asia, which are dominated by private banks rather than independent wealth advisors, so alternatives firms that are able to proactively cover these markets and private banks will be well-positioned to attract assets from these promising markets.

Therefore, it’s not a surprise that the larger alternative asset managers are better equipped to plug into private banks, both because they have the brand name and because they have the infrastructure and salesforces to most effectively work with wirehouses. How alternatives firms are able to effectively sell into wirehouses will be a major determinant of how much the wealth channel participates in private markets going forward.

Super(RIA)man flies in

Despite the fact that the wirehouse channel has structural features that make it easier for advisors to allocate to alternatives, the RIA channel is far from impenetrable. There is a class of RIAs — rollup platforms (i.e., Focus, HighTower, Dynasty, etc.), hybrid platforms (i.e., Osaic, Arax, etc.), and “super RIAs” (i.e.e, Rockefeller, Captrust, Cerity, Cresset, NewEdge, etc.) — that have the size and scale to create the infrastructure that resembles a wirehouse structure. These platforms provide many of the same features for independent advisors that they were afforded at wirehouses: in terms of a recommended list, diligence infrastructure, and an investment portal.

While these firms are structurally independent, they have some similar features and functions of a wirehouse.

Super RIAs will be the next “wirehouses” for alternative asset managers, so these firms will be the next battlegrounds for alternative asset managers who are looking to work with the private wealth channel.

Less is more

Wealth managers, generally speaking, want to make fewer decisions, not more. Enter the one-stop shop alternative asset manager. As discussed above, wealth managers have a number of pressing needs competing for their time. Alternatives allocations are one item on the menu, but not always the main course. In fact, they are not often the main course given that many advisors have 1-5% allocations to alts on behalf of their clients.

Alternative asset managers can give advisors the easy button: provide a one-stop shop. This feature is only possible for certain types of alternatives managers, namely the largest firms or traditional asset managers who are now adding alternatives capabilities, but firms that are able to do so should be the beneficiaries.

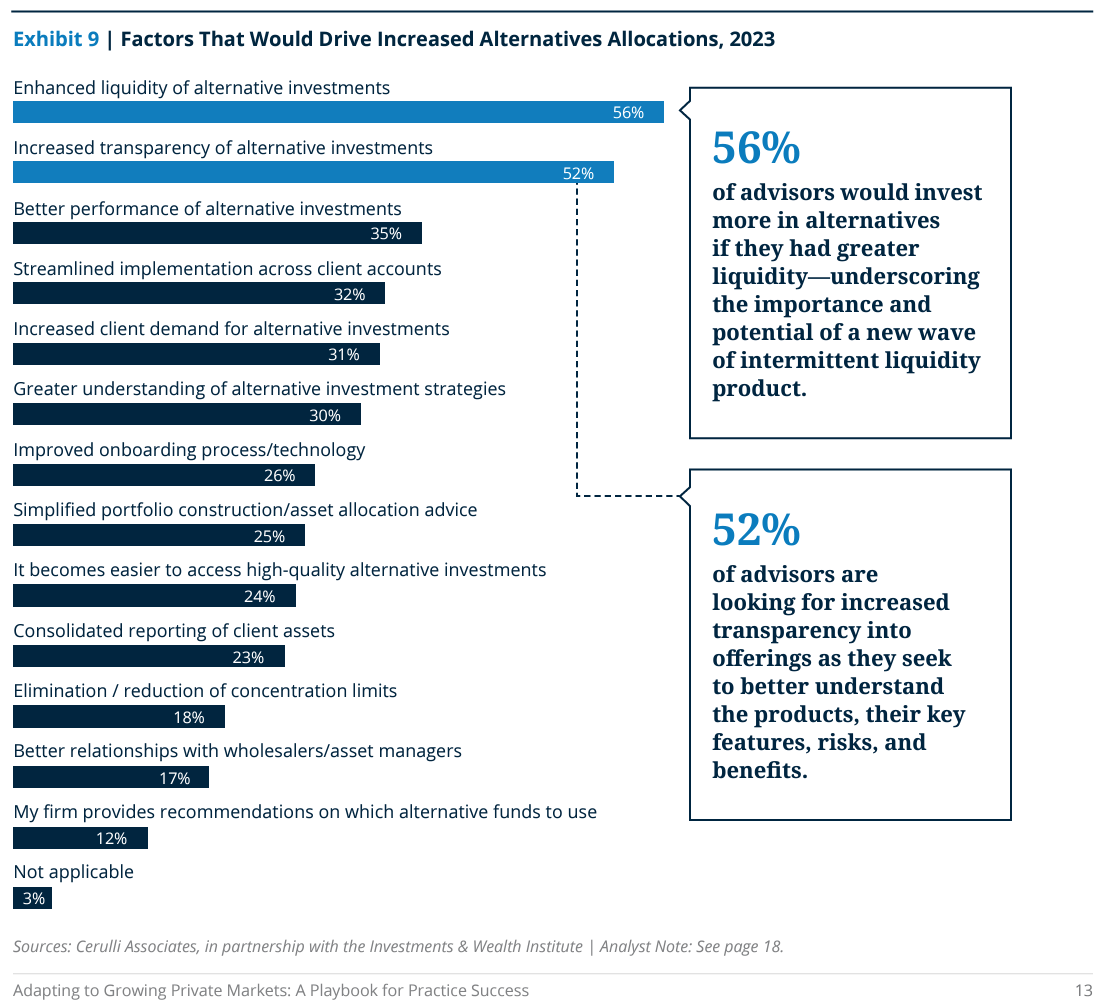

Product innovation by many of the largest alternatives firms, that are creating various types of evergreen or semi-liquid funds to enable the wealth channel to seamlessly allocate to alternatives across their client base, is also driving the space forward. These products cover a number of important features and preferences harbored by advisors. 56% of the advisors surveyed by Cerulli cited enhanced liquidity as the main driver for increased alternatives allocations. Increased transparency and streamlined implementation followed closely in advisors’ order of priorities. These features are solved for by evergreen / semi-liquid funds.

Perhaps its no surprise that many large alternative asset managers are looking to expand across strategies to serve clients. Not only do they recognize that their valuation multiple as an asset manager improves by being multi-strategy rather than single-strategy, but they also realize that a multi-strategy platform and AUM growth should go hand-in-hand.

The haves and have-nots

As larger alternatives managers staff up to tackle the wirehouse and Super RIA customer cohorts and expand into multi-strategy managers, private markets are bifurcating into the haves and the have nots. Larger managers will accrue the most benefits from increased participation in alternatives by the wealth channel.

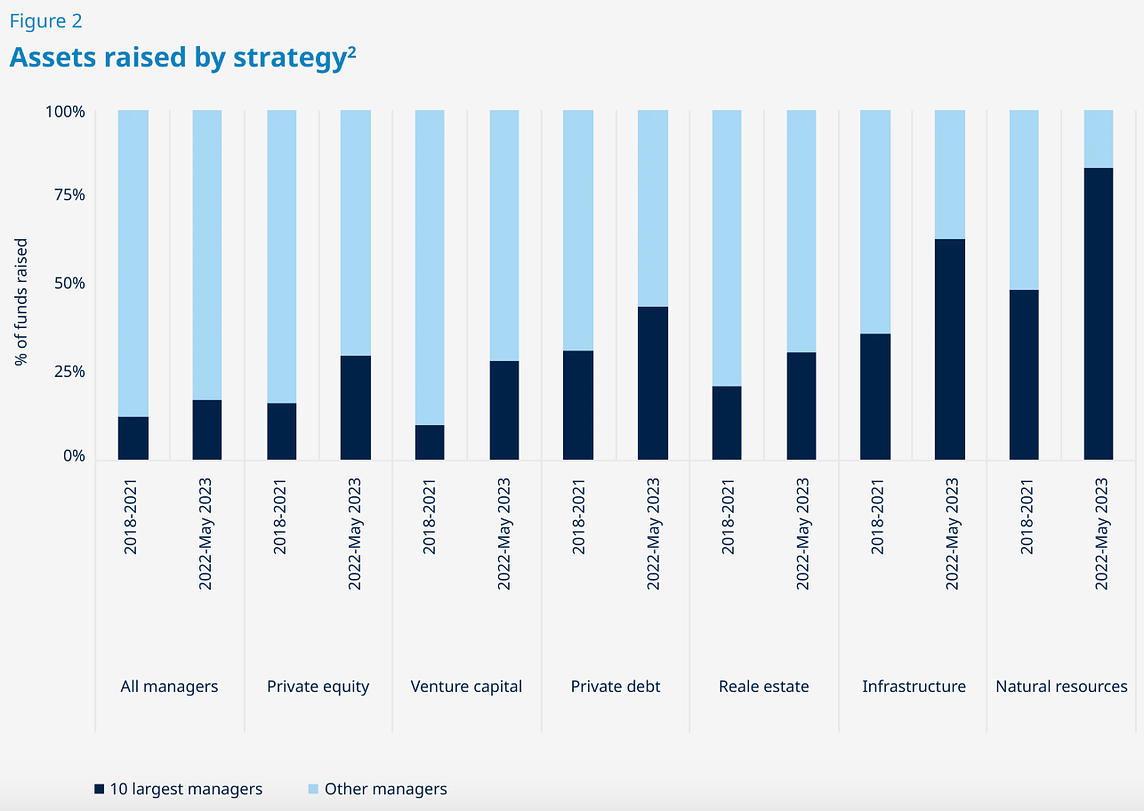

A chart in a report by Blue Owl on GP stakes illustrates how much penetration the top 10 GPs have in each strategy on overall dollars raised per strategy. Some strategies, like infrastructure, natural resources, and private debt, have witnessed an outsized portion of capital raised accruing to the top 10 largest funds. Other strategies, like venture capital, have seen this phenomenon occur less.

Larger managers are best equipped to handle the ground game required to work with the private wealth channel, both with pre-investment diligence and selling and post-investment administration and investor relations. It will be challenging for smaller managers to benefit from the growth of the wealth channel, but technology innovation creates a glimmer of hope.

Searching for (distribution) solutions

If the wealth channel is the new institutional LP, there are going to have to be new ways to deal with the needs of a relative newcomer to private markets.

There are still a number of distribution challenges waiting to be solved, particularly for smaller managers who lack the resources to work with the wealth channel en masse and at scale. If the gap between the haves and have-nots is to remain within a reasonable range, there will have to be tools that help managers of all sizes navigate working with the wealth channel. There are a number of solutions that are being built as we speak to serve both GPs and LPs as private markets becomes more accessible — and I’m excited to see the innovation that lies ahead.

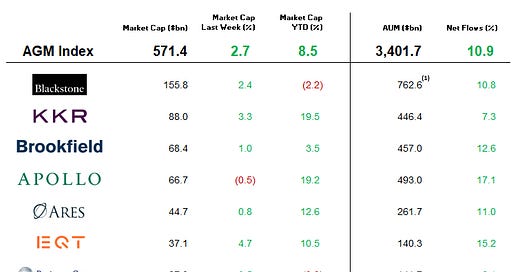

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Why Family Offices Have Little Interest in Alts Platforms | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher (who has now shifted focus to cover family offices) dives into how and why family offices are largely not relying on alternatives infrastructure platforms like iCapital and CAIS to access private markets, according to a Fidelity survey. Fidelity took the views of 83 single family offices with a collective AUM of $432B to find that the majority of family offices are not sourcing their alternative investments from CAIS or iCapital. 72% of family offices said it was their network of individual dealmakers (asset managers and investment banks,) and 25% cited external advisors, other family offices, and wealth managers as their primary source of dealflow. Single family offices are often turning to their peers to generate investment ideas, with 69% of the family offices surveyed saying other family offices were where they generated their ideas. Private equity fund managers, consultants, conferences, and investment banks were also cited as sources of idea generation. Many multi-billion dollar family offices possess both the administrative systems in place and the ability to directly source and access deals, which means they shouldn’t have to leverage an infrastructure provider to access a fund at a lower minimum and use an external solution to manage the investment. Family offices also tend to be highly fee sensitive and, depending on the size of the office, seek to access funds at preferential terms, so they often try to go direct to the fund or are of the scale where they can drive terms with a fund manager.

💸 AGM’s 2/20: These survey results aren’t surprising nor do they reflect poorly on the investment platforms like iCapital or CAIS. Family offices are a very different segment of the wealth channel compared to private banks and RIAs. Platforms like iCapital and CAIS are suited to serve as the infrastructure providers for the intermediary channel — private banks and RIAs. They are not purpose-built for family offices, nor should they be. Family offices have a unique set of needs and desires, which make it hard for any service provider or fund manager to sell into the family office channel. The breadth and depth, as well as the uniqueness of the family office market, mean that there’s no one-size-fits-all solution for family offices. That feature can make it difficult for both managers and service providers to navigate. Large family offices have the size and scale to go direct into funds, so therefore, they don’t need an infrastructure and access platform like iCapital or CAIS. Smaller family offices often handle infrastructure for managing their fund relationships in-house and / or don’t want to pay additional fees, so they also often avoid platforms. Sometimes, family offices would rather invest into smaller funds and have a direct relationship with the manager and pay lower fees than allocate to a brand name manager where they would lack any sort of special access or fee break. It is debatable at times if this is the best asset allocation strategy, but that’s also a defining feature of the family office market. As the saying goes, “when you know one family office, you know one family office.”

This article highlights the theme discussed above in the opening piece — how varied and unique the wealth channel is by investor type. Wirehouses / private banks, independent RIAs, family offices, individual HNW investors all have different ways of engaging with investing in private markets, from pre- to post-investment. This feature means that alternative asset managers and service providers need to determine which investor cohort they want to serve, how they want to serve them, and why they want to serve them. A thought exercise is required in order to understand the core competency and differentiator of the offering, particularly when it comes to selling to family offices. Although it may seem counterintuitive, it may be emerging and smaller managers who have the best product-market fit with family offices, provided they can figure out how to locate and connect with them. Many family offices like to have direct relationships with managers; they like uncovering smaller funds and like to be able to drive fees down if they are of a size that warrants a reduced fee. All of these features play into the hands of emerging managers, who are in the position to offer these services, even to family offices that aren’t the multi-billion dollar institutional family office.

I do think that we may start to see more family offices interact with iCapital and CAIS now that both firms have launched their respective marketplaces. I believe that more managers — both large and small — will list their funds on marketplaces as they will want to have as much exposure and distribution coverage as possible, so as more managers begin to list on marketplaces, we could see more family offices leverage marketplaces to search, source, and invest into funds.

📝 Apollo looks to credit and wealth to grow third-party fundraising | Tania Mitra, Citywire

💡Citywire’s Tania Mitra reports that Apollo is confident they will emerge as one of the leaders working with the wealth channel. Apollo Co-President Jim Zelter said at the UBS Financial Services Conference that he has little doubt that his firm will be “one of the folks that stand up tall” in a race to establish a presence in private wealth. Zelter cited credit and private wealth as two areas that will drive third-party fundraising for the company this year. In their most recent earnings report, Apollo stated goals of raising $50B through third-party fundraising (excluding their flagship PE fund). Last year, $8B of Apollo’s $157B came from the wealth channel. Zelter said that they are looking to increase its fundraising from the wealth channel by 30%, increasing both the number of products offered (they currently offer eight products to the wealth channel) and coverage of the channel. That would mean expanding on the 200 people working in some capacity on bringing products, educating, and distributing offerings to the wealth channel. Some products have seen a meaningful uptick in inflows, namely their non-traded BDC, Apollo Debt Solutions, which hit record inflows of $345M in January as it grew to over $9B in assets. At the conference, Zelter reflected on why these products have been successful, saying, “The world really wants robust, repeatable, yield products that are quite simple to understand. I think between Apollo Debt Solutions and the other areas of large scale lending in the US and Europe [where] we took our theme portfolio and pulled it out in terms of the alts portfolio … we’ve got seven or eight products that really fit those either flagship, or robust yield themes.” Apollo also expects over $70B of inflows from Athene, the insurance business they own. Credit appears to be in high demand from both institutional and individual investors. Zelter said that institutional channels in Asia, the Middle East, Latin America, and the US are all interested in a variety of credit products, notably asset-based finance (ABF). Apollo has invested heavily in the ABF space, purchasing a portion of the Securitized Products Group from Credit Suisse, which was rebranded to Atlas SP Partners, a credit firm focused on ABF.

💸 AGM’s 2/20: I agree with Apollo’s Jim Zelter — I wouldn’t bet against the big alternative asset managers when it comes to growing their platforms. Size and scale offer a demonstrable structural advantage for firms that possess it. It matters, both when it comes to playing in one of the fastest-growing and largest corners of private markets (credit) and when it comes to working with the wealth channel. Firms like Apollo, wich has 200 professionals dedicated to working with the wealth channel, and their peers are well-positioned to be able to work with the HNW channel and cover it properly. As mentioned in the opener, covering private banks is challenging enough. Many larger alternative asset managers would even admit that they may not be able to fully cover all the advisors at a single large wirehouse / private bank like Morgan Stanley or Merrill Lynch, much less the longer tail of private banks, international channels, and independent RIAs. That sentiment would suggest that the wealth channel has plenty of room to grow into a large LP for alternative asset managers.

📝 Big investors grow nervous about private credit boom | Sun Yu and Josephine Cumbo, Financial Times

💡Financial Times’ Sun Yu and Josephine Cumbo report that institutional investors are harboring concerns about private credit and are reducing their allocations as they become increasingly wary of the impacts of high interest rates on the $1.7T space. Fundraising figures for US-based private credit funds dropped below 2022 levels last year. According to Preqin, private credit funds in the US raised $123.1B from investors in 2023, down from $150.8B in 2022. 2024 appears to be following a similar trend. The first two months of the year saw only $11.7B of capital raised, falling far below the $30.4B raised over the same time in 2023. Not surprisingly, the average time to close has expanded meaningfully, with the average time for funds to reach their fundraising target jumping up from 25 months to 39 months. A number of pension funds seem to be pulling back on their private credit allocations. The FT reports that seven public pension funds said in recent interviews and board meetings that they or their peers are making smaller commitments to private credit or are spending more time looking for and diligencing new manager relationships. It appears that allocators are worried that more defaults could be on the horizon due to the rise in interest rates. In a board meeting last month, the $105B Ohio Public Employees Retirement System believed that “widespread defaults have not yet occurred. However, indications point towards trouble ahead.” They view growing interest expenses and “potentially depressed corporate earnings” as potential threats to borrowers’ ability to pay off debts. According to the Fed’s research, the average interest coverage ratio for private credit loans dropped from 3.1x in Q2 2022 to 2x in Q3 2023. As a result, a number of pension plans have become more cautious about their exposure to private credit. The $50B Connecticut Retirement Plans and Trust Funds had a 4.4% allocation to private credit, below the long-term target of 10%. The impact of interest rates has allocators harboring differing viewpoints on what it means for private credit. Some, like Greg Samorajaski, the CEO of Iowa’s $40B Public Employee Retirement System, believe that easing monetary policy benefits private credit as borrowers will have a lower default risk. $327B CalSTRS CIO Chris Ailman has the view that lower rates make fixed-rate income more interesting than private credit, which is often structured to be tied to interest rates. Still, some pension plans march on with their decision to allocate to private credit. Steven Meier, CIO of $264B New York City Employees Retirement System, said that the double-digit returns offered by private credit made it a “cheap asset” and believes it’s “the right time to be putting more money to work.”

💸 AGM’s 2/20: Private credit appears to be in an interesting spot. Over the past few years, private credit has certainly been a popular strategy for LPs to allocate to and a successful strategy from a risk / reward perspective for investors. The strategy also harbors quite polarizing views from allocators, whether justified or not. Certainly, interest rates could drive return outcomes in private credit on a go-forward basis. I understand why some allocators are concerned about investing in private credit at this moment in time, where there are questions as to whether or not companies will be able to service their interest payments. Private credit, in some cases, also requires investors locking up capital at a time when they might either feel that they want strategies and products that don’t lock up capital or where they believe there’s a better risk / reward calculus, like private equity. When talking with firms that specialize in private credit, it becomes apparent that there’s much nuance to the space. Some firms, particularly those that have the size and scale to dictate terms and lend to high-quality borrowers, appear to be well-positioned even if interest rates change. Private credit may, on the margins, not be as popular now as it was a year or two ago, but I would be hard-pressed to bet against the firms who have the size and scale to be big players in the space. It will probably be the smaller firms that bear the brunt of a recalibration of interest in the space by institutional LPs.

📝 The GP stakes market is ready for a comeback | Jessica Hamlin, PitchBook

💡PitchBook’s Jessica Hamlin reports that GP stakes firms are ready to pick up the pace of their activity in 2024. The stakes market saw a retrenchment in activity in 2023, particularly with minority ownership deals, due to uncertainty with fundraising and investment performance amidst a higher interest rate environment. Minority ownership deals represented only 17.2% of the total value of deals, a steep decline from 84% of the total deal value in 2019.

It wasn’t just stakes investors who were reticent to do deals in 2023. It was also GPs who didn’t want to sell a stake at a discount amidst uncertainty of their ability to raise larger new funds. That sentiment appears to be changing for both stakes funds and GPs. Goldman Sachs’ Petershill’s Global Co-Head Robert Hamilton Kelly said they have been increasingly active. Petershill has deployed over half of its $5B Petershill IV fund since its 2022 close. The middle market is also seeing increased activity. Bonaccord Capital Partners and Hunter Point Capital took the crown for most active firms in the middle market, completing three deals each. Perhaps it is no surprise that market leader and GP stakes trailblazer Blue Owl has since launched a $2.5B middle market focused fund. 2024 has so far been defined by majority control transactions, with large GPs and asset managers executing on strategic transactions to grow their AUM, LP base, and diversify their strategies. The year started off with the largest acquisition to date, with BlackRock acquiring Global Infrastructure Partners for $12.5B. Consolidation is expected to continue, but many believe that minority stakes will increase.

💸 AGM’s 2/20: GP stakes look to rev up activity, particularly with a large amount of dry powder sitting on the sidelines ready to be deployed. With the industry’s largest firms, like Blue Owl, Petershill, and others raising funds in the past two years, expect the stakes space to heat up. While acquisitions and control transactions have defined the past year in the stakes world, I anticipate minority stakes transactions, particularly in the middle market, to heat up. There’s ample room in the middle market for deal activity to grow, given the number of firms who have yet to sell stakes relative to the amount of capital raised by middle market focused stakes funds. I’d also posit that consolidation amongst alternative asset managers also bodes well for middle market stakes funds and GPs. Stakes investors can invest ahead of what will likely be continued consolidation in the space, so they will end up seeing exits and liquidity. Liquidity is the big question in the stakes space to date - that’s the big question looming over the space. I expect that these questions will be answered in the coming years as both GPs and LPs see stakes as a viable and investable corner of private markets.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the seventh episode of our monthly show, the Monthly Alts Pulse. We discuss why chemistry and collaboration key for the next wave of private markets and how solving distribution challenges in private markets means solving logistics problems. Watch here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Carlos Rodriguez Jr., Founder, President, and COO of Driftwood Capital, discuss how they built a $3B real estate hospitality investment platform. Listen here.

🎙 Hear Tyler Jayroe, MD and Portfolio Manager in J.P. Morgan Asset Management’s Private Equity Group, discuss how one of the world’s largest financial institutions approaches private equity. Listen here.

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.