👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a membership network for accomplished private investors made up of 400+ investors—all of whom have exited a company or lead a family office.

Recently, 3i surveyed their network to assess members' investment trends.

The notable change? Private equity reached its highest point in 12 months, hitting 34%.

3i actively curates opportunity sets by considering member preferences and market cycles over time, and in their most recent Monthly Deal Meeting, they showcased two deals within the private equity space.

Good afternoon from Washington, D.C. Happy Mother’s Day. I’m excited to spend today celebrating my mom — she’s our rock and a truly extraordinary person in every way. I’m getting ready to head to Toronto to speak at Obsiido’s IRL conference on Tuesday to share thoughts on how and why alts are going mainstream.

Big bets

News of Silver Lake’s latest fundraise is certainly noteworthy. This past week, Silver Lake announced they’ve raised $20.5B for its seventh private equity fund. That figure bested their $20B 2021 fund.

What was even more interesting is their investment strategy and portfolio construction for their new fund.

Co-CEOs Egon Durban and Greg Mondre told Antoine Gara of the Financial Times that they learned from the past few years that it was a focus on their largest investments that drove returns.

Mondre characterized a number of smaller, pandemic-era investments as “the regret zone.” Durban echoes Mondre’s sentiment, noting that Silver Lake has “eliminated subscale, passive, minority growth investing.

The reason? Better performance when investing at scale. Mondre said that “[they] are at [their] best when [they] are investing at scale,” with “the returns [being] substantially higher when the bets are bigger.”

$70B in gains

When the bets have been big, Silver Lake has certainly delivered. Perhaps no deal is more emblematic of this than Dell Technologies and Silver Lake’s $67B takeover of tech conglomerate EMC in 2016. The crown jewel asset in the EMC acquisition happened to be an 81% stake in VMware, a cloud computing company that sold to Broadcom for $92B in November 2023.

That sale delivered over $14B in cash to Silver Lake and Michael Dell, resulting in over $70B in gains to the two investors. According to Financial Times calculations, Silver Lake generated $15B in returns on a total of $1.8B invested into Dell Technologies and VMware (note: across multiple funds).

It’s big bets like the Dell and EMC deals that have propelled Silver Lake’s returns. According to Silver Lake’s announcement of their new fundraise, since the beginning of 2023, distributions to Silver Lake’s investors will hit $20B, supported by the sale of Silver Lake portfolio company VMware to Broadcom. These distributions have helped Silver Lake deliver returns to its investors: over the past 15 years, Silver Lake’s flagship funds have, in aggregate, generated a 21% rate of return, net of fees.

Silver Lake’s success with their takeover of EMC has provided a blueprint for the firm to replicate a strategy that bore such significant fruit for them and their LPs. With a challenged technology landscape and falling valuations in 2022, Silver Lake has completed a number of takeovers. They recently agreed to acquire Software AG for $2.6B, completed a take-private of Qualtrics in an all-cash transaction valued at close to $12.5B, a $6.4B equity re-investment with DigitalBridge in Vantage Data Centers, and an agreement to take Endeavor private at an equity value of $13B and a consolidated enterprise value of $25B.

The average size of investment across seven takeovers or take privates? $3.5B.

Concentration is king

In investing, it is often the large outcomes that drive returns. When there’s concentration in those investments, it can drive outsized returns for an investor’s portfolio.

A concentrated investment strategy can certainly carry more risk than a more diversified one. To have success with a concentrated investment strategy in large part relies on an investor’s ability to know more or do something better than others.

Warren Buffett shared this sentiment in his 1993 annual letter to Berkshire Hathaway shareholders:

"Portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it."

"If you are a know-something investor, able to understand business economics and to find five to ten sensibly-priced companies that possess important long-term competitive advantages, conventional diversification makes no sense for you. It is apt simply to hurt your results and increase your risk."

A “know-something investor” is one of the operative terms of Buffett’s quote. An investor who has a deep understanding of a business and an industry might want to make a concentrated bet if they have a unique edge or thesis and the ability to drive value for the company.

That sentiment appears to be shared by Apollo CEO Marc Rowan, who believes that private equity is entering a new era. What kind of era? One where private equity firms will be forced “to go back to investing in the old-fashioned way. They’ll actually have to be very good investors,” he said in August 2023.

Rowan recently said at the Norges Bank Investment Management conference that a number of features that defined markets over the past 40 years are no longer true today. Investors will indeed be required to employ a different set of skills in this new world order of investing.

When the going gets tough

What should both GPs and LPs make of this new world order in investing?

Private equity is going to get harder

The industry as a whole will face more headwinds, but the good firms should thrive. With record dry powder figures in the buyout industry, the pressure is on GPs to find good deals amidst a competitive environment.

Bain & Company’s 2024 Private Equity Report finds that the global buyout industry has over $1.2T in dry powder. Even more crucially, 26% of that dry powder is over four years old or older, meaning that funds will have to deploy that capital soon as the investment period comes to a close.

Growing competition for deals could force GPs to do a few things. One, they will have to rely on their edge to both find and win deals. Two, they might choose to go down the path that Silver Lake paved so successfully: concentrate their investments into fewer companies with bigger bets. If a firm has the ability to make fewer big bets and do it well, then it could pay off for both them and their LPs.

A flight to quality for LPs

A challenged private equity market will mean a flight to quality for LPs. The data already suggests that LPs are focused on the larger funds that have exhibited consistent performance over a number of vintages and market cycles. Bain & Company’s 2024 Private Equity Report highlights just how stark this difference is for the haves and have-nots in fundraising. The chart below illustrates the degree to which the top 20 funds raised over half the entire $448B of global buyout capital raised in 2023.

Larger funds appear to be the beneficiary of this LP flight to quality. More capital provides these funds with more dry powder to concentrate their capital into the best companies and into their winners, which firms like Silver Lake plan to do.

Scale matters

There might be a rhyme to LPs’ reason for focusing on bigger funds. While small can be beautiful, size and scale do have their advantages. Perhaps this era of company-building will be defined by big tech winning because of size and scale.

In the FT’s article about Silver Lake, JPMorgan Chase’s CEO of Asset and Wealth Management Mary Erdoes made a comment that stood out:

“[We] might be in one of those time periods where the large tech companies that can do the big things are going to be the winners.”

Erdoes could very well be on to something. I hold the view that, in many respects, the largest companies will benefit the most from innovations in technology and AI. If data is the new oil, then those with the most data — and the most resources to harness that data — will have the ability to use scale to their advantage to create moats that give them escape velocity relative to competitors.

Investing into companies with scale requires meaningful capital. The upper hand goes to firms like Silver Lake in that regard. Silver Lake recently made a $6.4B equity investment into Vantage Data Centers, which manages properties where tech companies store their AI data. Scale could also be a reason why Silver Lake is keeping its $10B holding in Dell: “We expect it will be a massive beneficiary of the new AI tailwinds,” remarked Durban.

A lot of money will be lost in emerging categories like AI. But there are areas where the odds are in favor of investors. One of those categories? “Picks and shovels” of AI infrastructure. Any time a new industry is formed or is growing, it’s usually the picks and shovels that will benefit, irrespective of the companies that duke it out to own the mindshare of the consumer or enterprise customer. It will take size and scale to be able to invest into areas like data centers, which look to be a massive beneficiary of the explosion of AI. It’s not just Silver Lake that’s betting big on the picks and shovels of the AI revolution. Blackstone’s $10B investment to own data center operator QTS in 2021 highlights just how big this opportunity could be. With demand for data reaching fever pitch, Blackstone has said that QTS could be one of its best investments ever.

There are plenty of ways to play an investment thesis. Blackstone’s (and other peer firms’) investments into data centers through their real estate investment business illustrate that having a multi-strategy investment platform enables firms to benefit in different ways, not just through a single-threaded investment strategy.

Continuation vehicles (“CV”) offer another form of concentration

The challenging public market environment over the past few years has resulted in fewer exits than expected. GPs might have expected to be able to generate distributions for LPs, but the barren exit market has staved off plans to water the fruits of liquidity. However, despite LP demands for returns, GPs may not want to loosen the grasp on their best assets that they believe could drive returns in the right exit market.

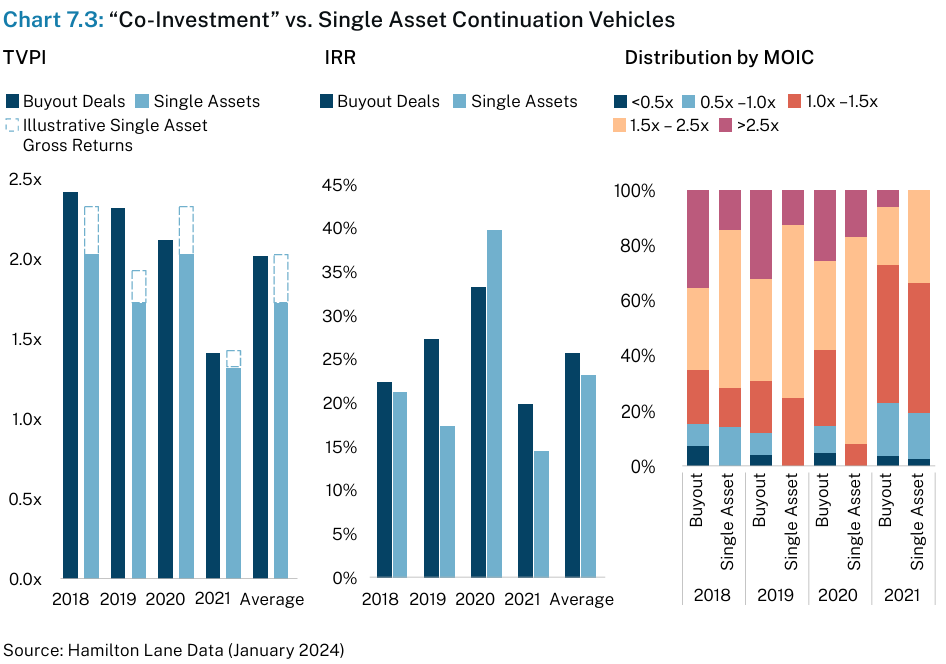

With the right assets, CVs can outperform. This is particularly true if the CV holds a high-quality single asset. Data from Morgan Stanley finds that not only do the upper quartile of CVs outperform secondaries funds (1.7x vs. 1.6x) and buyout funds (1.7x vs. 1.5x), but the upper quartile of a single-asset CV versus a multi-asset CV has a 400 basis point (4%) difference in performance in favor of single-asset CVs.

Data from Hamilton Lane shows that single CVs also tend to have lower risk than co-investments, as their data shows that they have lower loss ratios.

LPs will concentrate their relationships

Concentration isn’t just a strategy that GPs like Silver Lake will employ to drive returns. It’s also something that LPs will do to manage their asset allocation strategy and aim to drive pricing power on fees with GPs.

As PitchBook’s Marie Kemplay highlighted in an article in February 2024, placement agents have observed that LPs have been consolidating their GP relationships. Laura Leyland, MD at placement agent Asante Capital, remarked in Kemplay’s article that concentration is a defining theme of the GP / LP relationship in today’s fundraising market: “We’re seeing a concentration theme, where LPs are working with a smaller cluster of GPs but seeking to do more with them—so larger tickets and more meaningful relationships.”

Concentration stands to benefit the larger GPs. If LPs focus on a smaller number of higher-value relationships with GPs, they will likely look to do more with less. Data from Ares’ 2023 Annual Letter (highlighted in the 4.7.24 AGM Alts Weekly) illustrates what concentration of LP relationships means for the business of larger GPs.

AGM Alts Weekly 4.7.24: What was striking about their letter was the growth in both their relationships with institutional investors and the penetration of wallet share amongst this category. They grew their institutional investor base by 19% year-over-year, from 1,935 to 2,300 institutional investors.

What is perhaps even more impressive is how much they grew their relationships with existing investors across the Ares platform. The data reflects that Ares has figured out how to penetrate more wallet share of existing investors: in 2018, over half of direct institutional AUM was only invested in one investment product with Ares. Now, more than two-thirds of AUM is with investors who invest in at least two or more investment groups.

Ares grew its institutional investor base by 19% YoY, with over two-thirds of its $419B AUM coming from investors who invest in at least two or more investment groups. And, as the data suggests, with the largest funds raising the majority of the capital in each private markets strategy, Ares is far from the only firm where this trend is playing out.

This theme of consolidation bodes very well for the business performance of GPs — if GPs are able to maintain and grow these LP relationships. Deeper relationships with LPs mean that GPs are able to drive AUM growth and grow the lifetime value of an LP customer. With long-dated, recurring contracts on management fees, the theme of LP consolidation should benefit the GPs that can expand their relationships with LPs.

As we’ve said before on AGM, “scale begets scale.” And there are plenty of reasons to believe why concentration will drive returns for both GPs and LPs in private markets.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Why CVC’s “Eat What You Kill” Pay Model Stands Out | Marc Rubinstein, Net Interest for Bloomberg Opinion

💡Net Interest’s Marc Rubinstein (and recent Alt Goes Mainstream podcast guest) dives into the nuances of different compensation models across Wall Street and private equity for Bloomberg Opinion. Rubinstein hones in on the latest alternative asset manager to join the ranks of the public markets, CVC, in his quest to unpack the debate over how best to motivate financiers. Rubinstein discusses CVC’s “eat what you kill model,” which awards dealmakers at the firm a fixed share of the profits they generate. CVC’s IPO prospectus highlights how their carry compensation model works: “if an investment is exited successfully, the investment team members benefit personally from the crystallization of the gain on that investment.” Rubinstein expounds on what exactly this means for investment professionals at the firm. CVC estimates that based on target returns, its private equity funds could generate between €15.1 billion ($16.1 billion) and €27.6 billion of carried interest over their remaining lives. With roughly 40% of that carried interest reserved for investment team professionals, average compensation among the 277 staff involved could reach as high as €40 million ($43 million). Of course, in this model, when a specific deal team generates returns on their deal, they could end up making significantly more. Other peer firms have charted a different path. Rubinstein notes that KKR has a shared carry pool that eschews the “eat what you kill” model. At a recent investor day, Rubinstein writes, KKR Founder Henry Kravis reflected on the origins of his firm: “We came out of Bear Stearns and, for better or for worse, Bear Stearns was an “eat what you kill” culture. Everybody ran around and said, I did this, I did that.” He and Co-Founder George Robert determined it would be best to set a culture where “everybody is compensated on how well the firm does, and it’s paid off the balance sheet. And there’s a reason for that — it’s a very important reason — and that is that everybody will help each other.” Apparently, KKR does reserve a share of carry for investment teams similar to CVC, but it doesn’t stipulate how much goes to specific investment teams. One question that Rubinstein hangs onto is how an “eat what you kill” model handles and manages losses. CVC’s solution is to put negative offsets in place so that losses are netted against gains when calculating the amount of carry an investment professional receives. With a 1.1% loss ratio across three of its recent private equity funds, this hasn’t been a issue. Dealing with losses is perhaps a bigger challenge for different businesses on Wall Street. Investment banks, particularly those with trading divisions, have to be cognizant of these features. Rubinstein goes on to highlight other models across Wall Street, ending with the punchline that much of Wall Street has evolved towards a structure that promotes firmwide cooperation. His question for CVC: can the “eat what you kill” model work at scale?

💸 AGM’s 2/20: As the Charlie Munger saying goes, “you show me the incentive and I’ll show you the outcome.” Compensation structures are having their moment in the sun, particularly as an increasing number of alternative asset managers enter the public markets. How firms compensate their investment professionals can have critical ramifications on investment performance. As alternative asset managers continue to grow in terms of size and scale, the question of compensation becomes even more complicated for GPs, LPs, and shareholders of these firms. Some firms, like Ares, recently announced that their executives would be shifted to a stock-based compensation model. Presumably, that means their incentive-based compensation will be tied to the firm’s growth in AUM rather than on carry-based compensation. Ares recently announced that CEO Mike Arougheti and Credit Head Kipp deVeer would receive restricted stock units in exchange for a reduction in certain incentive fees. Arougheti, deVeer, and senior professionals in the credit group will be awarded 1.6M RSUs over a multi-year vesting period. This change in compensation highlights the trend that alternative asset managers are moving beyond their private equity buyout roots and, therefore, should rethink their compensation models. Apollo and KKR have also chosen to reconfigure their compensation model. Bloomberg’s Allison McNeely reported in November 2023 that the firms have shifted compensation to give more fee-related earnings from management fees to shareholders while the firm’s investors would get a larger share of the carried interest. KKR said employees would see their share of fee-related revenue decline to 15% to 20%, from 20% to 25%, while their take of carried interest — the profits from selling assets — would increase to 70% to 80%, from 60% to 70%. Some research analysts harbored “mixed feelings” about this change. Oppenheimer Analysts Chris Kotowski and Kevin Tripp wrote in a note that they had concerns about what this would mean for shareholders since “private equity carry is the most undervalued asset that investors can buy in the public markets.”

This shift does bring up a number of nuanced questions. If executives at publicly traded firms are being compensated on stock price appreciation rather than performance, will that impact how they view what is the most important driver of enterprise value? One possible cause for LP concern is that this model will incentivize GPs to focus on growing AUM at the expense of investment performance because it will be AUM growth and the corresponding long-term, locked-in management fee revenue streams that drive stock price appreciation. Now, it’s more complicated than that. The ability to gather AUM and investment performance are inextricably linked. If a fund has strong performance, it will be more likely that they are able to attract LP capital for its future funds, all while being compensated with the carried interest for strong investment performance in the meantime. But the industry also can’t escape the fact that management fee earnings, which are contractually obligated, long-term, and steady revenues, are valued on a much higher basis than long-dated, variable carried interest revenues. At the end of the day, incentives are the biggest motivator. It will be interesting to see how this aspect of private markets continues to unfold as alternative asset managers continue to both evolve as a business model and continue their encroach on Wall Street territory in areas like private credit and real estate.

📝 iCapital launches model portfolio offering | Jake Indusrky, Citywire

💡Citywire’s Jake Indursky reports that iCapital has broken new ground in the continued push to provide the wealth channel with access to private markets. This past week, iCapital released iCapital Multi-Asset Portfolio (iMap), the first-of-its-kind model portfolio solution that enables advisors to seamlessly integrate alternative investments with traditional public market portfolios. iCapital categorized iMap, a model portfolio designed by iCapital to assist with asset allocation, as a balanced portfolio that combines income and growth across five private credit, private equity, and real asset funds, including funds from Blue Owl Capital and Nuveen.

Blue Owl Capital’s President & CEO Global Private Wealth Sean Connor highlighted why they are excited to be a part of iCapital’s first iMap portfolio and why it’s important for advisors to have model portfolios in private markets:

“We believe models are a critical tool to simplify and enhance the investment experience for advisors seeking to integrate high quality alternative investment strategies into portfolios. Private credit can deliver consistent income and capital preservation for investors and Blue Owl is one of the leaders in this asset class. iCapital Model Portfolios distill the essence of balanced portfolio theory into a practical tool that wealth managers can implement for their clients immediately.”

Envestnet Solutions Co-Chief Investment Officer and Group President Dana D’Auria noted that the iMap is “a significant innovation in portfolio management.” She said, “iCapital Model Portfolios greatly simplifies the creation of diversified portfolios with an allocation to alternatives.” Advisors are accustomed to using and building model portfolios across traditional asset classes, so the ability for them to now create model portfolios that have alternatives included in turnkey fashion is a major milestone for private markets.

iCapital Chairman & CEO Lawrence Calcano called iMap “an innovative application for wealth managers to incorporate alternative investments into their clients’ portfolios.” According to Calcano, iCapital plans to “continue to work with leading alternative asset managers to design and curate additional outcome-based models.” iCapital MD and Head of Private Asset Research and Model Portfolios Kunal Shah told Citywire that the model portfolios are a response to client requests for a framework to help them underwrite and allocate to alternatives.

Model portfolios have become a feature in public markets. A recent review from Morningstar found that from 2021 to 2023, AUM in asset manager models increased by nearly 50%, growing to over $424B. This data point makes iCapital’s Shah excited about the creation of model portfolios with alternatives:

“We are very, very bullish on the opportunity set here, largely influenced by what we have seen in the public market world around the usage of our models. We think that it could be even bigger in alternatives given the fact that there are no easy answers for a beginner investor in private markets and hedge funds.”

💸 AGM’s 2/20: The introduction of model portfolios that provide for a turnkey, streamlined solution for advisors to access alternatives in a diversified format is a significant development for private markets. Historically, access to private markets has been a deterrent to the adoption of private markets by the wealth channel. The industry appears to have hurdled over that bar with the creation of technology and product innovations that have unlocked accessibility to private markets. Yet still, many in the wealth channel have yet to allocate meaningfully to private markets because they have to figure out how and where it fits into an investors’ portfolio and how they should allocate across different strategies and funds. Many investment platforms have aimed to devise solutions that offer investors multi-manager vehicles to provide diversification. Even larger alternative asset managers have created products that combine a number of different strategies within their platforms to offer investors turnkey access to the different private markets funds. The iMap fund takes this to a different level. It represents a huge development in portfolio construction for the wealth channel as it provides a turnkey way for advisors to access a diversified set of high-quality managers across different strategies in private markets. iCapital has created a diversified portfolio based on a set of risk and return factors that offer advisors a fully-baked solution for private markets. The creation of a more robust and streamlined supply chain in private markets relies upon better technology, but it also relies on better product construction to meet the needs of advisors in their day-to-day workflows. In their 2024 private markets predictions on Alt Goes Mainstream, both Apollo Partner and Chief Client & Product Development Officer Stephanie Drescher and Hightower’s Head of Alternative Investments Robert Picard alluded to the fact that in the future, it’s possible that the wealth channel could see up to 50% of their assets allocated across strategies within private markets. The wealth channel is still a far way off from those figures, but the iMap solution is certainly a step in the right direction.

📝 Private Equity Scrambles to Find an Alternative to IPOs to Unlock $3 Trillion | Bailey Lipschultz, Swetha Gopinath, Vinicy Chan, Bloomberg

💡Bloomberg’s Bailey Lipschultz, Swetha Gopinath, and Vinicy Chan dive into the challenges and impacts of a quiet IPO market. The lack of exits from private markets has caused trillions of dollars to be locked in private markets.

$3.2T of unrealized value has caused the industry to ask the question: is there really an alternative to the time-worn path of taking a company public?

Forge CEO Kelly Rodriques believes that the “systems that are being built enable them to have a private life that’s as long as they want.” This evolution has changed the way companies are financed in private markets. “The spectrum of investor capital for private companies has matured to a point where we see nearly the same types of active institutional investors in both the private and public markets,” said Karin Fronczke, Head of Global Private Equity Investments at Fidelity. “It is no longer just the VC investors on Sand Hill Road financing these businesses.”

Some private markets firms are looking for ways to hold onto their best assets in private markets beyond a fund’s life. Speaking of a topic that we talked about above, concentration, EQT’s CEO Christian Sinding said the firm would rather hold onto some of the top performing companies in its portfolio. “With the volatility and other concerns that you see around the IPO market, we do feel the need to develop alternatives,” he said. EQT is developing permanent capital structures to enable them to hold onto companies that would extend beyond a fund’s contractual life.

Some are skeptical of this trend. “LPs don’t want to be solving problems for GPs,” Sascha Pfeiffer, Head of the European Technology Group at Houlihan Lokey Inc., said at the firm’s recent tech conference in London.

Other market structure innovations are being contemplated to solve some of the liquidity challenges for both GPs and LPs. Pisces — an acronym for the UK’s proposed Private Intermittent Securities and Capital Exchange System — is a regulated market that would allow unlisted companies to go public for short, defined periods (e.g., three days) with limited disclosures. This structure appears to be a middle-way solution for investors to achieve liquidity while the company wouldn’t have to go through a full IPO process. In this structure, according to Bloomberg, a valuation would be decided in a similar way to a traditional IPO: the seller can set a price after consulting with potential investors, and then an auction will take place on the platform to determine where the stock would trade. The London Stock Exchange Group would reportedly run one of the first Pisces venue. However, there are questions as to whether or not banks who run IPO processes would buy into this model. Banks generate larger fees from big IPOs, and there’s some concern that the Pisces structure might cater to smaller companies or employees trading personal stakes in private companies.

💸 AGM’s 2/20: Private markets is going through a period of transition. The industry has big questions to grapple with — to the tune of trillions of dollars. Liquidity is on the minds of many — and it will take innovation to enable that to happen. I’ve discussed the market structure evolution that’s occurring in private markets, and the current environment is no exception. The challenge of creating liquidity for LPs is paramount if private markets are to go more mainstream. Continuation vehicles are one such innovation. Model portfolios, like iCapital has done with iMAP, are another. Exchange venues, like Forge or Pisces, could provide a solution for some companies and investors to achieve liquidity, but that comes with its own set of questions and challenges for companies and investors. It appears that the near-term solution will come from growth in popularity of continuation vehicles. Jefferies Global Secondary Market Review highlights the growth in continuation funds.

Continuation funds have been the majority of GP-led exit volume. Further, single-asset continuation funds, constituted almost half of the continuation fund volume in 2023 and look to remain a significant feature of secondary market liquidity. This week’s theme has been about concentration and making big bets to hold onto winners. Continuation vehicles thread right through that theme.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Specialist. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Director of Data Strategy. Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Net Interest Publisher & Writer, Net Interest & Retired Partner, Lansdowne Partners Marc Rubinstein provide an in-depth tour of financial markets. Listen here.

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Haig Ariyan, CEO of Arax Investment Partners, as we take the pulse of private markets on the 9th episode of our monthly show, the Monthly Alts Pulse. We discuss the evolution of wealth management and the role that alts can and should play in wealth client portfolios. Watch here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.