👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a membership network for accomplished private investors made up of 400+ investors—all of whom have exited a company or lead a family office.

Recently, I welcomed their Co-Founder, Mark Gerson, to the Alt Goes Mainstream podcast.

In this episode, we discussed how the community at 3i Members approaches deal generation and assessment of private market opportunities through a unique crowdsourcing model.

🎙️Listen to the episode here to learn the benefits of investing in networks and learn more about becoming a member here.

Good afternoon from New York City, where I’m in town for meetings and to record the next episode of the Monthly Alts Pulse with iCapital.

This week’s AGM Alts Weekly is a special edition. Today’s newsletter marks the 52nd consecutive week of writing — one year of sharing thoughts, news, and views on private markets and the intersection of alts and wealth.

The goal with AGM has been to make private markets more public by bringing the industry opinions, views, and unique thoughts that provide different perspectives and help push private markets forward. It’s been fun cracking open my laptop every weekend and thinking deeply about the topics and trends that you all would like to see discussed and analyzed.

I’d love to hear from you about what you’d like to hear more on going forward. We have much more to come with AGM that I’m excited to share with my subscribers over the coming months.

If you’ve enjoyed AGM thus far or gotten value from the work I’ve shared, I’d love for you to share the newsletter with others so we can continue to educate and bring the industry together as we all move private markets forward.

The “Canadian model”

Canadian pension funds and institutional investors have long been some of private markets’ most sophisticated and innovative participants in private markets. In some respects, it was the Canadian pension plans that helped pioneer the concept of institutional investors building out direct investing teams in private markets strategies. They were also some of the earlier institutional allocators to adopt increased exposure to private markets through the build-out of in-house investment teams, a co-investment model with alternative asset managers, and direct investments.

Canadian pensions, led by the “Maple-8,” were so innovative in their governance, sizable allocation to private markets, internal management, and focus on long-term value creation that the industry coined the term “The Canadian model” to represent how forward thinking they were in their approach to private markets.

CPP, amongst the pioneers of the shift to internal management, decided to make a concerted effort to move into direct private equity investing in 2006. The chart below highlights the evolution of their investment strategy from passive to active. In an article they wrote in 2016, ten years into their shift to active, they stated that they created $17B in dollar value add which would otherwise not have been available through a passive portfolio.

Many of the industry’s largest alternative asset managers took notice of this shifting behavior, making it a point to forge deep partnerships with the Maple-8.

Silver Lake was amongst the beneficiaries of the more direct approach of a firm like CPP. They teamed up, along with newly formed venture capital firm Andreessen Horowitz, to buy a 65% stake in Skype in 2009 for $1.9B. The partnership yielded early results. Microsoft purchased Skype for $8.5B two years later. Silver Lake has continued to partner with the deep-pocketed pension plan, recently teaming up with the C$590B pension plan to buy Qualtrics for $12.4B.

It’s not just Silver Lake that has looked north for deals and investment partnerships. A 2023 Benefits and Pensions Monitor article notes that Canada is Blackstone’s third largest market for capital deployment, trailing only the US and UK.

Just getting started

However, while Canadian institutional investors have been long-standing and sophisticated participants in private markets, the Canadian wealth channel is just getting started.

Green shoots are beginning to emerge. Some of the industry’s largest alternative asset managers have turned a focus to providing access to private markets for the Canadian wealth channel.

Blackstone planted a flag in Toronto, growing its distribution team dedicated to the Canadian market to 10 professionals by 2023. Carlyle and Partners Group partnered with BMO to create funds specifically designed for the wealth channel. Hamilton Lane has been a long-standing participant in the Canadian market, with meaningful asset growth to show for that work and effort of being on the ground.

The industry’s technology platforms are also investing in both people and technology to serve the Canadian wealth market. iCapital hired the former CEO and Head of Canada for UBS Asset Management and President of CI Institutional Asset Management Tom Johnston to run the Canadian market. Obsiido, an end-to-end investment product and technology solution for the Canadian market, launched its platform to provide Canadian wealth advisors access to private markets products and software to invest in and manage alternatives.

However, it’s still very early days in terms of advisor adoption of alternatives products. Across Canada’s two primary advisor channels, usage of alts is still less than 5% (as of 2022, according to an Investment Executive chart). It’s also worth noting that it’s the brokerage advisor channel, which is compensated through selling products, that had a higher usage of alts than the dealer advisor channel.

A tipping point?

Excitement amongst both alternative asset managers and wealth managers was palpable at an event organized by Obsiido in Toronto this week, where I participated in a keynote fireside chat with Obsiido Co-Founder & CEO Nimar Bangash.

Obsiido gathered around 80 stakeholders across GP and wealth management worlds to discuss the state of private markets in Canada and how the region can see increased adoption of alternatives.

While allocations to alternatives amongst the majority of wealth managers in Canada are minimal, the foundation appears to be set for increased activity and investment flows amongst the advisor community.

The $168B AUM asset management arm of BMO certainly seems to agree. A few years ago, they launched a concerted effort to create and offer alternative investments to their clients and the broader wealth channel in Canada. They’ve since built out their platform by partnering with some of the industry’s largest alternative asset managers, including Partners Group and Carlyle, to unlock access to alternatives for the Canadian wealth client.

BMO and other funds in the market wouldn’t make such efforts if not for both the data and the belief that there would be demand for private markets investments from the wealth channel. However, alternatives managers and product distributors do face some headwinds.

Wealth Professional’s Steven Randall reported that many individual investors in Canada are unfamiliar with alternatives. A 2023 survey from Harbourfront Wealth Management found that 60% of Canadian consumers are unfamiliar with private investments.

Harbourfront’s CIO Christine Tessier told Wealth Professional, “Most Canadians aren’t very familiar with private investments, which have been a major component of the pension fund toolkit for years. Corporate-defined benefit plan availability is decreasing. Canadians need a broader toolkit, that includes private investments, to plan for their futures.”

This data point isn’t surprising when the majority of Canadian wealth managers don’t have meaningful allocations to private markets. Panelists at the 2022 Alternative Investment Management Association (AIMA) Wealth Advisor Summit cited that less than 20% of wealth advisors had invested in alternatives, with the average allocation among advisors with exposure being 4%.

But that could change based on survey data from EY that highlights investor preferences with their wealth manager.

Data from a recent EY study would seem to indicate that wealth managers will have to differentiate their offerings in a fiercely competitive market. According to EY, Canadians are two times more likely to change wealth managers compared to their global counterparts. Amongst the top areas that appeal to clients? Investment performance and range of product.

Both investment performance and range of product would appear to play into the hands of increased adoption of alternatives. In a more challenging investment environment, particularly for local Canadian equities, advisors could look to turn to private markets to generate returns. It also looks like advisors will need to find ways to differentiate from their peers by offering access to alternatives.

That’s precisely the argument Hamilton Lane’s Managing Director - Head of Canada Mike Woollatt made in a 2023 article. Woollatt highlighted the success that Canadian pensions, the pioneers we referenced above, had by allocating to alternatives during a challenging 2022 for public equities.

Woollatt noted a quote from OMERS’ 2022 annual report: “Protecting our return from these losses were our significant allocations to private investments.”

Woollatt went on to write the following:

And it wasn’t just OMERS, which returned 4.2% in 2022 overall and has 17.5% allocated to private equity alone (which returned 13.7% in 2022):

BCI: up 3.5%, with a 13% allocation to private equity, which returned 5%

CDPQ: down 5.6%, with a 20% allocation to private equity, which returned 3%

CPPIB: up 1.3%, with a 33% allocation to private equity, which returned 5%

Ontario Teachers: up 4.0%, with a 24% allocation to private equity, which returned 6%

PSP: up 4.4%, with a 15% allocation to private equity, which returned 3%

I don’t think I have to tell you what their public or fixed income portfolios did last year. But it is safe to say private markets were a key driver of returns. In fact, BCI’s report went so far as to say: “With the chaos in public markets, our diversification into private assets again played an important role in driving BCI’s outperformance against key benchmarks.”

Although it’s still early days, sentiment amongst advisors could be shifting towards increasing their allocations to alts. Research from Ninepoint Partners discovered that 83% of Canadian financial advisors plan to allocate more to alts in client or model portfolios over the next 12 months.

One such example could provide signs of emerging interest. Hamilton Lane’s Global Private Assets Fund has grown to over C$5.6B. According to data from Investment Executive, Hamilton Lane’s evergreen fund has seen meaningful asset growth every year in Canada. Perhaps this shouldn’t come as a surprise since data from Ninepoint’s study would corroborate interest in private credit, private equity, real estate, and infrastructure as the strategies of most interest to Canadian financial advisors.

Funds and investment platforms working with the Canadian market should be encouraged by the potential market growth to meet increased demand for private markets products.

An Investor Economics report from 2021 highlighted the potential asset growth in the Canadian wealth segments. Investor Economics projected asset growth to almost double from 2020-2030 to almost $10T. Even a 2-3% allocation to private markets by the majority of the affluent market would be a needle mover. That allocation percentage would peg the total dollars allocated to private markets at close to $200-300B by 2030. The overall dollars allocated to alts today? I don’t know the exact figure, but I’d venture to guess that it’s sub $20B.

Growth is certainly feasible, provided that the right structures are in place to enable distribution. Liquid alts provides an example of a product that was able to scale AUM to meet investor interest. In the three years between 2019 to 2022 since the structure was launched, liquid alts saw inflows of C$21B.

How can the Canadian market develop?

What levers can asset managers and technology providers pull to enable growth in the Canadian alts market?

(1) Education: An investment in education from the alternatives managers and the private banks / wealth platforms has been one of the major drivers in private markets adoption amongst the wealth community in the US. The playbook for Canada would appear to be similar. Based on survey data, advisors seem to have a desire to increase their allocations to private markets. There may also be an imperative for them to do so if the data around clients switching advisors holds true. Alternatives firms are investing in the requisite education to move the market forward. As part of their initiative to put boots on the ground in the Canadian market, Blackstone has also held Blackstone University sessions. Hamilton Lane, amongst the other managers who are aiming to grow their presence in the market, has also been investing heavily in education to lay the groundwork for allocations in the years to come. As we’ve seen in more developed markets like the US and Europe, it can take years to educate the wealth channel. The US market still requires significant education of advisors and end clients — and will continue to do so as even more mature markets like the US have meaningful under allocation to private markets relative to institutional counterparts. The Canadian market could well follow suit, particularly as the country’s largest banks and wealth platforms, like BMO, make a concerted effort to build and invest into private markets funds.

(2) Built for purpose: There have been clear structural challenges with the Canadian market for advisors to access private markets investment products easily. Regulatory, governance, and operational standards hurdles have made it difficult for advisors to invest in private markets. Investor Economics offers one such example in their 2021 white paper on retail distribution of alts in Canada: for a Canadian investor to access a US or Cayman Island-based limited partnership (LP) in a way that avoids tax reporting and administrative challenges, dealers would need to set up a Canadian-registered feeder fund vehicle that invests in a foreign vehicle. The feeder would require a minimum amount of committed capital due to the costs and administrative burdens of setting up the vehicle, which would put the dealer between a rock and a hard place: risk setting up a feeder with sub-scale assets and paying exorbitant fees or lose credibility with the foreign manager. Infrastructure must be put in place in order to make it easier for the wealth channel to allocate to private markets. BMO has created a very compelling structure from a fee perspective, choosing to keep fees at a minimum for clients in order to grow their asset flows. The fact that iCapital is in the market is encouraging, as is the founding of regionally-focused player Obsiido. I’d also expect Canadian robo-advisor Wealthsimple, which recently built a partnership with LGT, a manager of $114B of alternative assets, to gain traction given the existing install base they have from their broader wealth platform.

(3) Investment in boots on the ground: Alternatives managers that invest in building dedicated local distribution teams have tended to succeed. That’s certainly been true in the US. Blackstone’s team of almost 300 professionals on the private wealth side has resulted in almost 1/4th of their $1T in AUM coming from the wealth channel. Blackstone’s peers have followed suit to build robust and highly-functioning wealth distribution teams that have been able to effectively education, engage, and build trust with wealth advisors as part of their efforts to increase allocations. From conversations with executives who lead distribution efforts at alternative asset managers, there’s clear value in investing in the human capital required to effectively cover a market. In a market with 140,000+ registered financial advisors, according to a 2019 ISS MI Investor Economics report, boots on the ground will be required to engage properly financial advisors to build the requisite trust, brand awareness, and product knowledge of alternative asset managers’ firms and products. The fact that many of the industry’s largest managers — Blackstone, Apollo, KKR, Carlyle, Brookfield, Blue Owl, Hamilton Lane, amongst others — have spent time, energy, and resources building out relationships and products for the Canadian market is a signal that they believe there’s value in being in the region.

(4) Thinking like the Maple-8: Canadian institutional investors have been among the most innovative private markets allocators. Just beginning to participate in private markets will be table stakes for the Canadian wealth channel. But they could do well to look at their institutional counterparts to see how to approach private markets and the value of alternatives in an investor’s portfolio.

The Canadian wealth management market may not have been a pioneer in private markets like its institutional peers, but that doesn’t mean that it can’t be innovative going forward in how and where it compliments client portfolios with private markets exposure.

I’m certainly excited to see how this market unfolds.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Assets managed by RIAs have grown 227% since 2009, SEC data shows | Payton Guion, Citywire

💡Citywire’s Payton Guion reports that the independent wealth channel has witnessed dramatic growth in size and scale over the past 15 years. Data released this week by the Securities and Exchange Commission (SEC) highlights just how much the industry has grown in the RIA market. According to the SEC’s annual report on RIAs, based on aggregate Form ADV data, the number of SEC-registered RIA firms grew 35% from 2009 to 2023, hitting over 15,441. The assets these firms manage have also increased dramatically, swelling from $39.4T in client assets in 2009 to $128.8T in 2023, a 227% increase. Although RIAs have seen meaningful asset growth, the majority of RIAs remain smaller relative to the larger firms across the industry. 90% of RIAs had fewer than 1,000 clients, and less than 2% had more than 10,000+ clients. Those figures don’t differ much from 2009, when 94% of RIAs had fewer than 1,000 clients. The larger firms manage the lion’s share of the industry’s assets. Despite only representing 2% of the industry in terms of the number of RIAs, firms with 10,000+ clients manage over $39.3T, almost 1/3 of the industry’s assets.

💸 AGM’s 2/20: This data on the RIA industry is fascinating for a number of reasons, many of which are inextricably linked at the intersection of the continuing evolution of alts and wealth. Private equity’s focus on the RIA channel is leading to continued consolidation. This consolidation, either by rollups or technology platforms, is driving the trend of the big becoming bigger. As firms become larger, they sometimes end up centralizing their investment research and diligence functions, which is one of the drivers of the wealth channel’s increased participation in private markets. Many advisors and wealth platforms understand the rationale for clients gaining exposure to private markets in thoughtful, scalable ways — and now, the wealth platforms, technology providers, and product structures from alternative asset managers have evolved to the point of meeting the demands and requirements of many wealth platforms.

Interestingly, the trend of the big getting bigger in wealth management is coinciding with the big getting bigger in alternative asset management. These two trends are going hand in hand. Scaled platforms can build scaled solutions. Many of the largest alternative asset managers understand the importance of the growth in the RIA channel and have been resourcing their distribution teams to properly service the wealth channel. I know that the independent platforms are different from the wirehouses in a number of respects, but I’ve called these scaled wealth platforms “Super RIAs,” the new wirehouses, because alternative asset managers can partner with them in a way that’s most similar to how they work with wirehouses. Yes, the compensation model, incentives, and diligence processes may differ from how alternative asset managers work with wirehouses, but the ability to work with a scaled platform has its similarities. And that’s a beneficial trend for the ability of the wealth channel to adopt private markets. The less disaggregated and fragmented the wealth space becomes, the more seamless it becomes for alternative asset managers to work with the wealth channel. Growth in the independent channel appears to be far from abating. Some in the industry believe that there could be a meaningful projected increase in the number of $B+ RIAs.

Perhaps it should come as no surprise that investment firms have been formed to address this growing opportunity in the wealth management space. Ex-Emigrant Partners CEO Karl Heckenberg recently unveiled his fund, Constellation Wealth Capital, which he aims to be a $1B fund to take minority, non-controlling stakes in large and mid-size RIAs. Constellation, which has large, minority backing by Black Owl Capital Investments, the family office of Blue Owl Co-Founders and Co-CEOs Doug Ostrover and Marc Lipschultz, has already acquired stakes in AlTi Tiedemann Global (along with Allianz), Lido Advisors, AlphaCore, Perigon Wealth, and others. United Capital Financial Advisors Founder Joe Duran, who sold his business to Goldman Sachs, recently launched Rise Growth Partners, a firm aiming to take minority stakes in independent wealth managers, earlier this year. We believe that this trend will continue to persist, liking both the larger RIA platforms, which we believe will continue to accrue the benefits of scale, while also recognizing that a large portion of the industry still resides in smaller, sub-$1B RIAs. This data point was one of the reasons why we decided to invest in the seed round of Savvy Wealth, a tech-enabled wealth manager backed by Thrive Capital and Index Ventures that helps to serve the large number of advisors that lack the the modernized resources to manage their wealth practice and attract new clients to grow their business.

📝 Aflac is buying a stake in a direct lender, getting a piece of the private credit boom | Alexander Saeedy, Wall Street Journal

💡Wall Street Journal’s Alexander Saeedy reports that insurance giant Aflac is acquiring a 40% stake in Tree Line Capital Partners, a private credit firm focused on lending to small- and medium-sized companies. As banks retrench from lending activities, particularly in the middle market, other large pools of capital are looking to fill the gap. Insurance companies are one such example. Aflac is paying roughly $100M for the 40% stake in Tree Line, buying existing shares in the fund’s management company from the management team as well as its private equity backer, Stone Point Capital. Aflac has also agreed to a multi-year commitment to help fund Tree Line with some of the investable cash the company collects in the form of insurance premiums from its customers. Why did Aflac decide to invest in a private credit firm? According to WSJ’s Saeedy, Aflac was looking for both the returns that private credit offers from lending to medium-sized private companies and from the income stream of management fees from owning the management company of Tree Line.

💸 AGM’s 2/20: This deal is the latest in the line of private equity firms partnering with insurers as a way to grow their capital base. This deal is emblematic of insurance companies continuing to feature as an increasingly important ingredient in the growth of private markets. It’s easy to understand why: insurers benefit from the higher returning nature of private credit that gives them the returns to meet the promises to their policyholders and it offers alternative asset managers the opportunity to tap into large pools of capital, and, in some cases, permanent capital, to finance large deals across private credit and private equity. Both categories are becoming increasingly competitive, so firms that are able to establish partnerships with insurers could have a leg up in their ability to deploy capital into these deals. Another trend we’ve seen in private credit is the move away from more broadly syndicated deals to private credit firms going at it alone and consummating deals on their own. Partnerships with insurers are one way for alternative asset managers to size up in deals, particularly in private credit. An additional aspect of Aflac’s deal with Tree Line that was not discussed is the potential for the insurer to be an LP or co-investor into Tree Line’s funds and investments in addition to taking a stake. Often, when a deep-pocketed LP takes a stake in a fund’s management company, they also tend to invest into the fund as an LP to gain more exposure to the fund’s deals and strategies. Given the sizable pool of capital that Aflac has to invest, it wouldn’t be a surprise if they are also investing meaningful capital into the fund. It’s also worth noting that the Tree Line deal is not Aflac’s first foray into private credit. In 2021, the asset management subsidiary of Aflac, Aflac Global Investments, partnered with Denham Capital to assist with the build-out of Denham’s Sustainable Infrastructure platform. Aflac committed $2B to launch a new debt platform within Denham Sustainable Infrastructure and earmarked $100M for Denham Sustainable Infrastructure’s next equity fund (note: Broadhaven Capital Partners, the investment bank affiliated with Broadhaven Ventures, advised Denham Capital on the transaction). Denham, an infrastructure manager, fulfilled Aflac’s stated goal of finding both attractive yields on investment while advancing their ESG priorities. Given the capital requirements in areas like infrastructure, where significant resources are required to aid with the energy transition, I’d expect to see further participation from insurance companies investing in areas like infrastructure in addition to private credit.

📝 Accel raises $650M fund for European early-stage startups | Daphne Leprince-Ringuet, Sifted

💡Sifted’s Daphne Leprince-Ringuet reports that Accel has raised its eighth fund focused specifically on Europe, holding the purse strings on a fresh $650M of capital to back European and Israeli early-stage companies. Despite a challenging fundraising environment and a European market that has experienced a cooling off period over the past two years, the firm says it remains “deeply committed to Europe.” AI appears to be a focus for the generalist firm, according to Accel Partner Harry Nelis. Accel is reportedly leading a seed round in Paris-based startup, Holistic AI, which was founded by two ex-Deepmind scientists. A source tells Sifted that it is a $200M round, including a $120M convertible note. This news would jive with the trend that Paris and the UK are emerging hubs for AI investments. “When it comes to AI, there are two key centres in Europe,” he says. “One of them is around Deepmind in the UK and the other one is around FAIR [Facebook AI Research] in Paris.” Both ecosystems have strong startup talent and high-quality universities that are training the next generation of AI developers and entrepreneurs. Accel’s new fund illustrates the firm’s strong commitment to Europe, says Nelis. European startup funding took a hit in 2023, dropping 55% relative to total capital raised from a record year in 2021, according to data from VC firm Atomico. Larger firms, particularly growth funds and crossover firms, have either scaled back their operations in Europe or pulled out of the region. Coatue is one such example. They shuttered their European office in London just two years after planting a flag in the region. Nelis sees this trend as an opportunity for Accel in Europe: “When the market gets really hot, it attracts a few players who come. They end up being tourists rather than long-term residents and then they go back home. We are super excited to be investing [in Europe] right now. If some people have gone home, so be it.” Nelis sees the departure of foreign VCs resulting in “marginally less competition” for the firm, however, he notes that winning deals in the most sought after European companies, particularly in AI, is still a tall task. Given some of the large rounds in AI that have been raised in Europe, such as Mistral AI and Wayve’s recent $1B funding round led by SoftBank with participation from Nvidia and Microsoft, it’s not surprising that VCs are facing competition to put money to work in the largest AI deals.

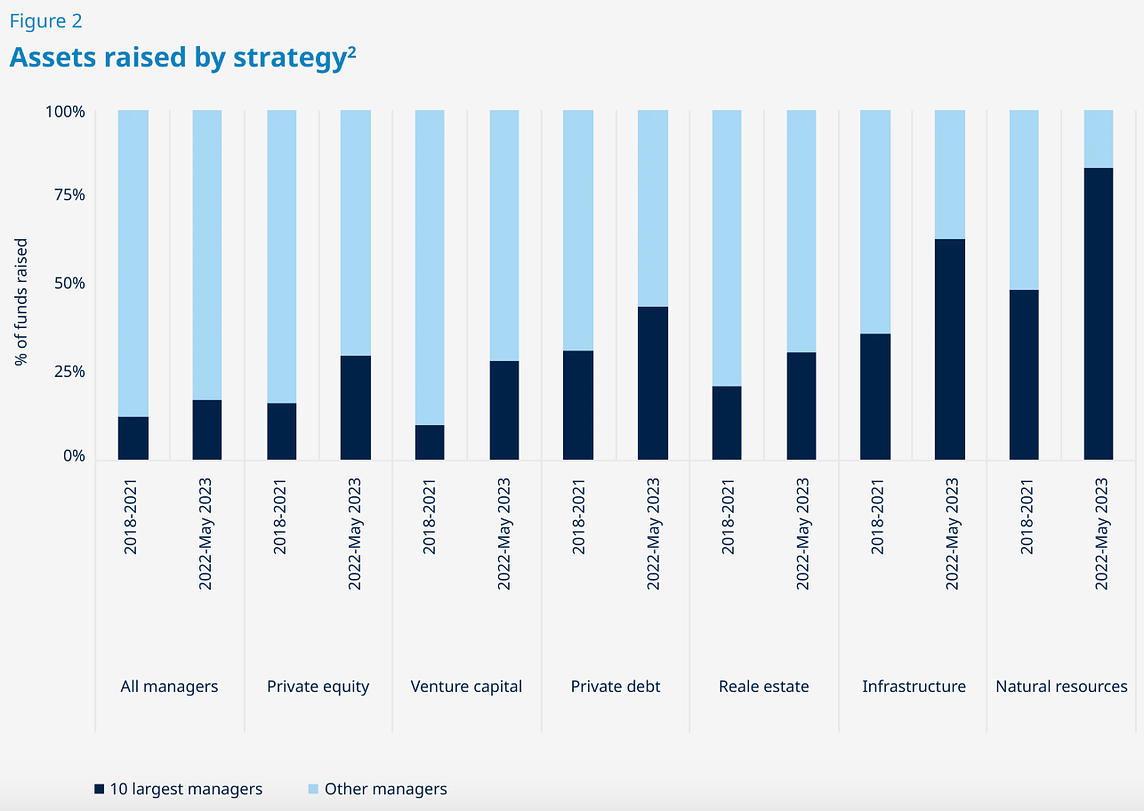

💸 AGM’s 2/20: Europe’s venture ecosystem seems to be a tale of two cities, both in terms of the funds that are able to raise capital and in terms of the types of deals being completed. The established brands, like Accel, appear to be able to raise funds in a tougher fundraising environment. Perhaps this shouldn’t come as a surprise given their track record of backing some of Europe’s biggest winners, including UiPath, Monzo, GoCardless, Blablacar, Vinted, Deliveroo, Synk, and more. This fundraising success follows the trend more broadly in VC, where the top funds are able to successfully raise from LPs and aggregate the lion’s share of capital. Data from Blue Owl highlights this broader trend, where the ten largest managers in each private markets strategy will aggregate a disproportionate amount of capital relative to other funds raising capital.

Another question worth asking is what will European LPs look to do? PitchBook reported in April that European LPs may look to invest in US funds. If that becomes an increasing trend, how will that impact the European VC ecosystem?

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Analyst. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Director of Data Strategy. Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Net Interest Publisher & Writer, Net Interest & Retired Partner, Lansdowne Partners Marc Rubinstein provide an in-depth tour of financial markets. Listen here.

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Haig Ariyan, CEO of Arax Investment Partners, as we take the pulse of private markets on the 9th episode of our monthly show, the Monthly Alts Pulse. We discuss the evolution of wealth management and the role that alts can and should play in wealth client portfolios. Watch here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Michael- I have been an avid fan and reader over the last 52 weeks, love the content.

I very much enjoyed your blog many months ago on recapping earnings of some of the largest asset managers, and think this could be good to hear on a quarterly basis.

Also, curious what you have been hearing in the space on how different alts managers are setting up and structuring their private wealth distribution teams? Especially thinking the large managers vs. small-medium sized managers that are looking to get into the space. There is a great podcast from Dakota Rainmakers that interviews Madeleine Sinclair on how she thinks about managing and driving their PWM business at Blue Owl, highly suggest a listen!