👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a private membership network built for accomplished investors to discover direct, esoteric, peer-sourced deals and compound hard-earned financial wisdom and expertise.

3i members are exited founders and family offices who leverage the network to co-invest (without any additional fees) in private equity, private credit, specialty finance, real assets and gain access to our monthly deal meeting, community due diligence, member-expert database, international events and retreats, strategy specific masterclasses, asset allocation workshops, an online forum and more.

Learn more about becoming a member here.

Good morning from Washington, DC and happy Memorial Day Weekend. I’m in town to record a bunch of podcasts (some exciting podcasts and guests coming up!) before heading to London and Berlin for SuperReturn, SuperVenture, and live podcast recordings in London the week of June 10, including a live podcast and discussion in collaboration with Pangea on June 12.

An evergreen question

Private markets exposure for the wealth channel is becoming an evergreen question — literally. Working with wealth is on the minds of many in the alternative asset manager world. This topic came up in a number of conversations I had this week with traditional asset managers, alternative asset managers, and service providers in the space.

Should the wealth channel have some exposure to private markets? Many would likely agree with that sentiment, particularly in a new world order of investing, as Apollo CEO Marc Rowan highlighted in his talk at the Norges Bank Investment Management Investment conference a few weeks ago.

The question of wealth working with private markets has moved from why to how.

What is an increasingly large puzzle piece of the how? Evergreen funds.

In the 1.14.24 edition of the AGM Alts Weekly, I wrote about the growing importance of evergreen funds as the wealth channel becomes the new “institutional LP” for alternative asset managers.

A convergence between liquid and illiquid?: There’s a bigger trend at play here. Traditional asset managers are converging on private markets’ territory by building or buying alternative asset managers to offer to their individual and institutional clients. Alternative asset managers are moving beyond closed-end fund structures to create semi-liquid and registered products to cater to the emerging wealth channel client.

Liquid is going semi-illiquid. And illiquid is going semi-liquid. Both groups appear to believe that the juice is definitely worth the squeeze.

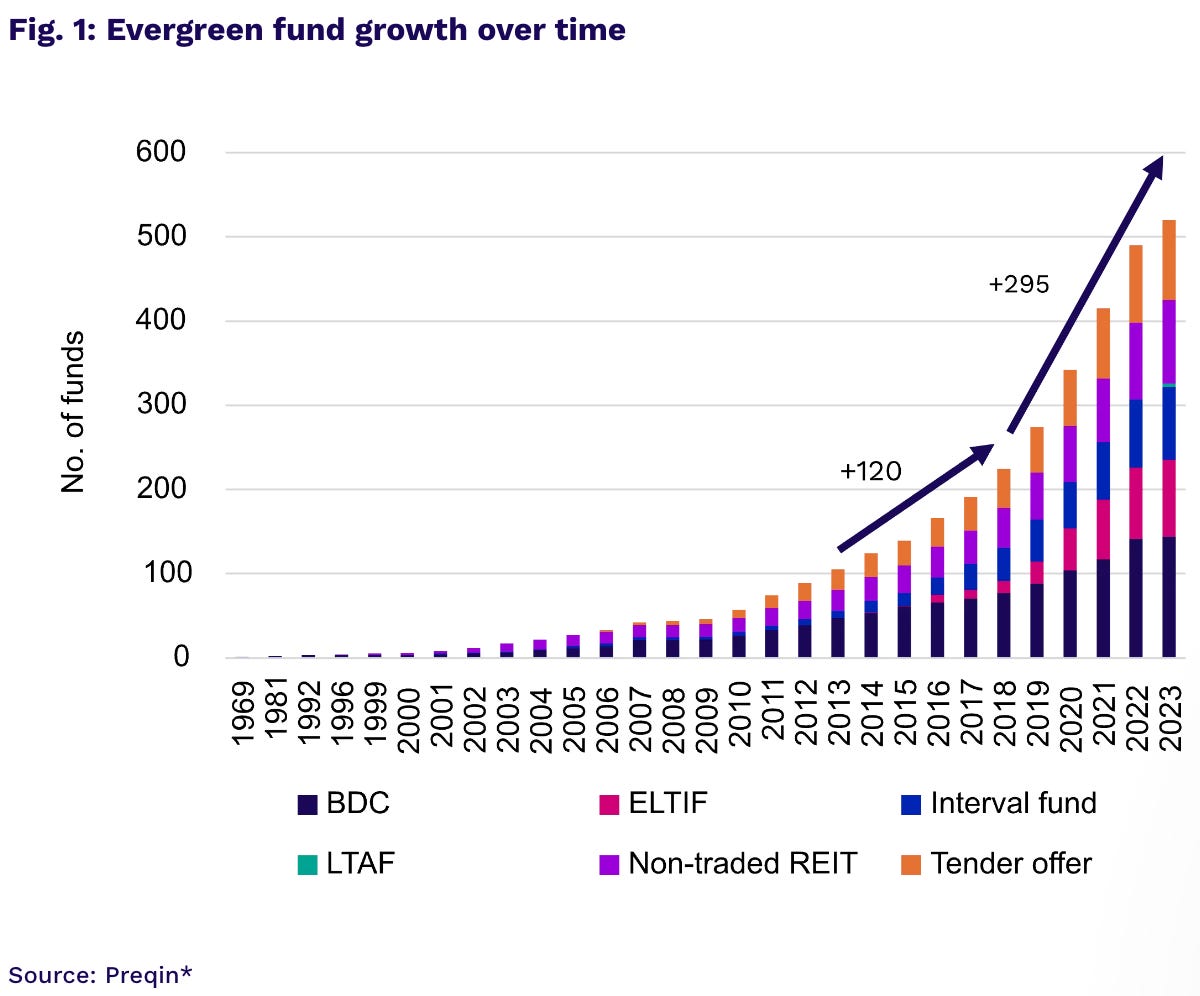

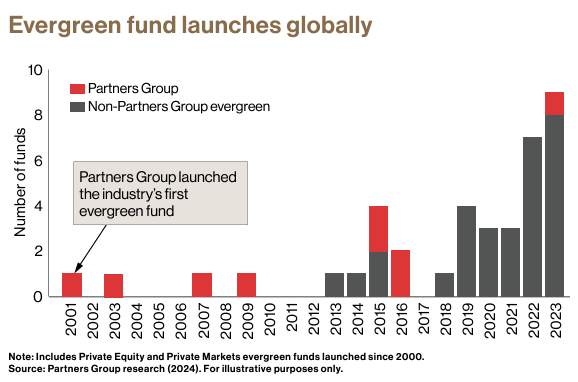

Preqin data from a few months ago illustrates just how much evergreen funds have become a feature of private markets. The total number of evergreen funds has nearly doubled in the last five years.

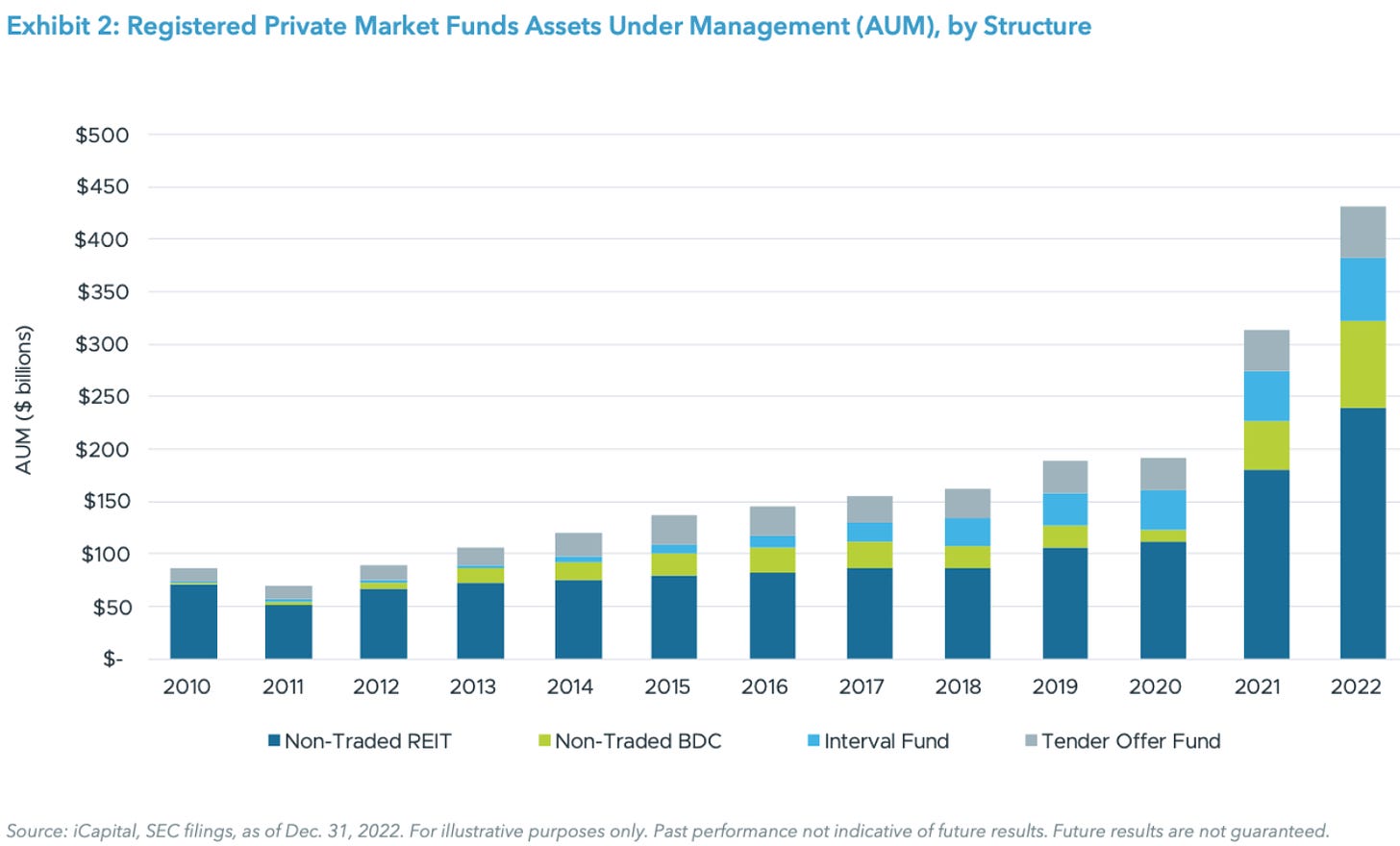

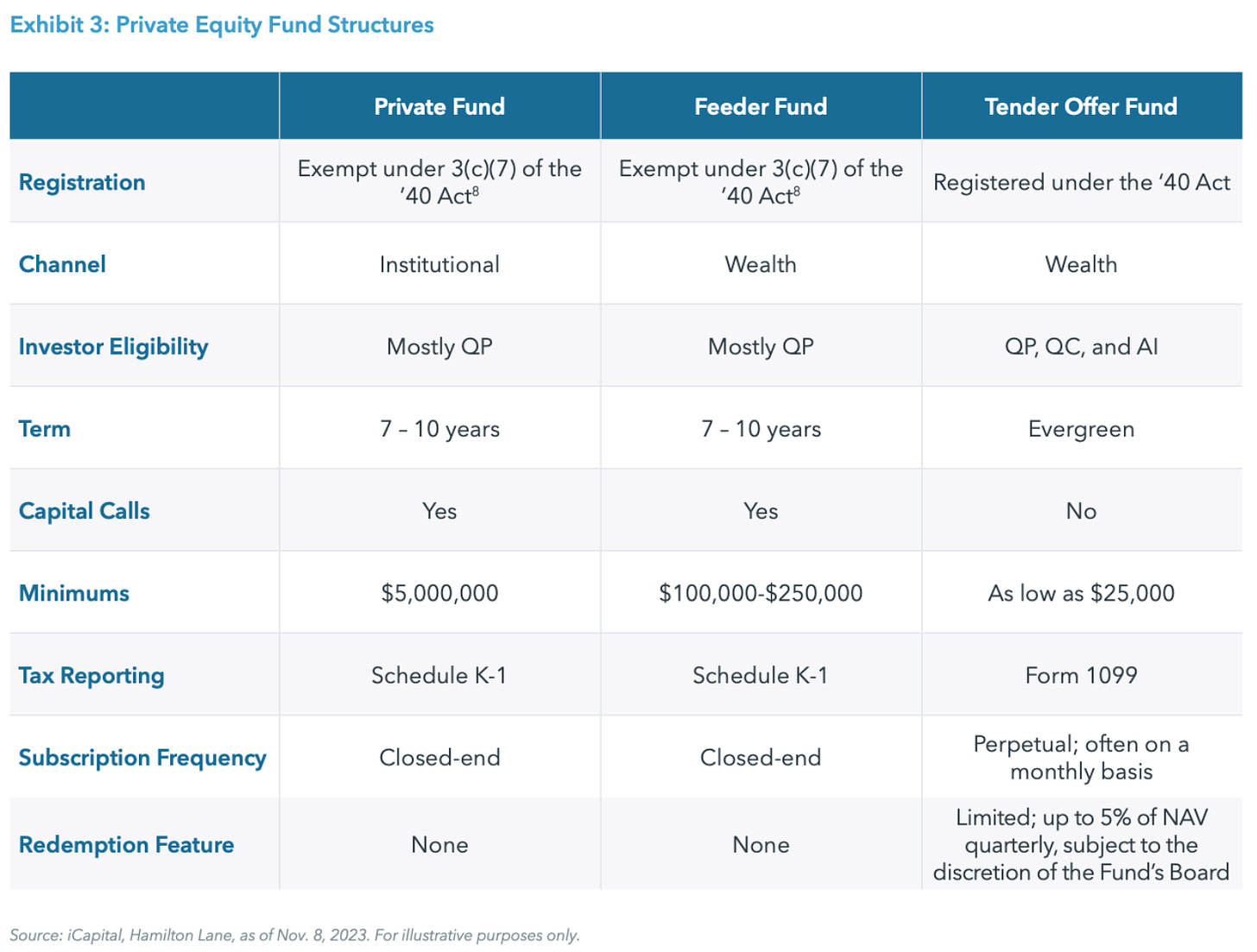

Registered fund AUM has witnessed astronomical growth in recent years. Across Non-Traded REITs, BDCs, Interval Funds, and Tender Offer Funds, iCapital and Hamilton Lane found that registered fund AUM had grown to almost $450B by the end of 2022.

These figures shouldn’t come as a surprise, as the growth of evergreens coincides with the increasing involvement of the wealth channel in private markets.

What might come as a surprise is the returns of evergreen structures relative to the more traditional, closed-end vehicles that have been a staple of private equity since the creation of the industry.

KKR released a report this week comparing returns between evergreen vehicles and drawdown funds.

The data was eye-opening.

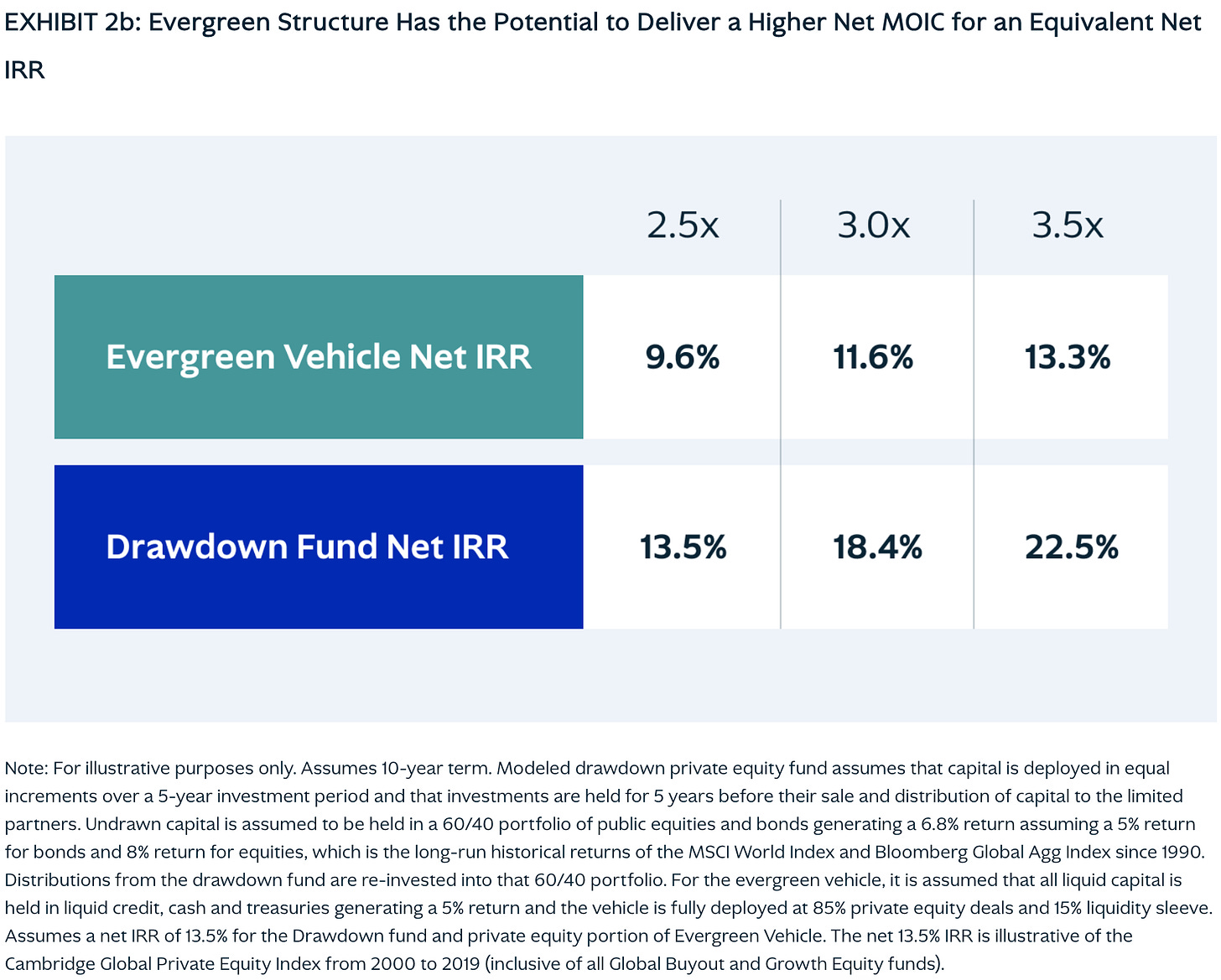

Returns on evergreen private equity structures on both a net IRR and net MOIC basis have the potential to be significantly higher than in a drawdown structure. KKR finds that an investor can possibly achieve higher compounded returns (MOIC). To achieve a net MOIC of 3x over a 10-year period, a typical drawdown fund would need to generate an 18.4% net IRR. An evergreen fund’s net IRR required for a 3x net return? 11.6%.

Why could this be the case? Evergreen funds are invested much more quickly than a drawdown fund, which has a defined term for an investment period. With capital invested on day one, investors are able to compound their returns faster than in a drawdown fund. It’s worth noting it’s assumed that in a drawdown structure investors will keep their committed capital in liquid investments to be able to draw that capital when required to fund their capital call. An evergreen fund makes a single capital call upfront, enabling more capital to be put to work in private markets much faster.

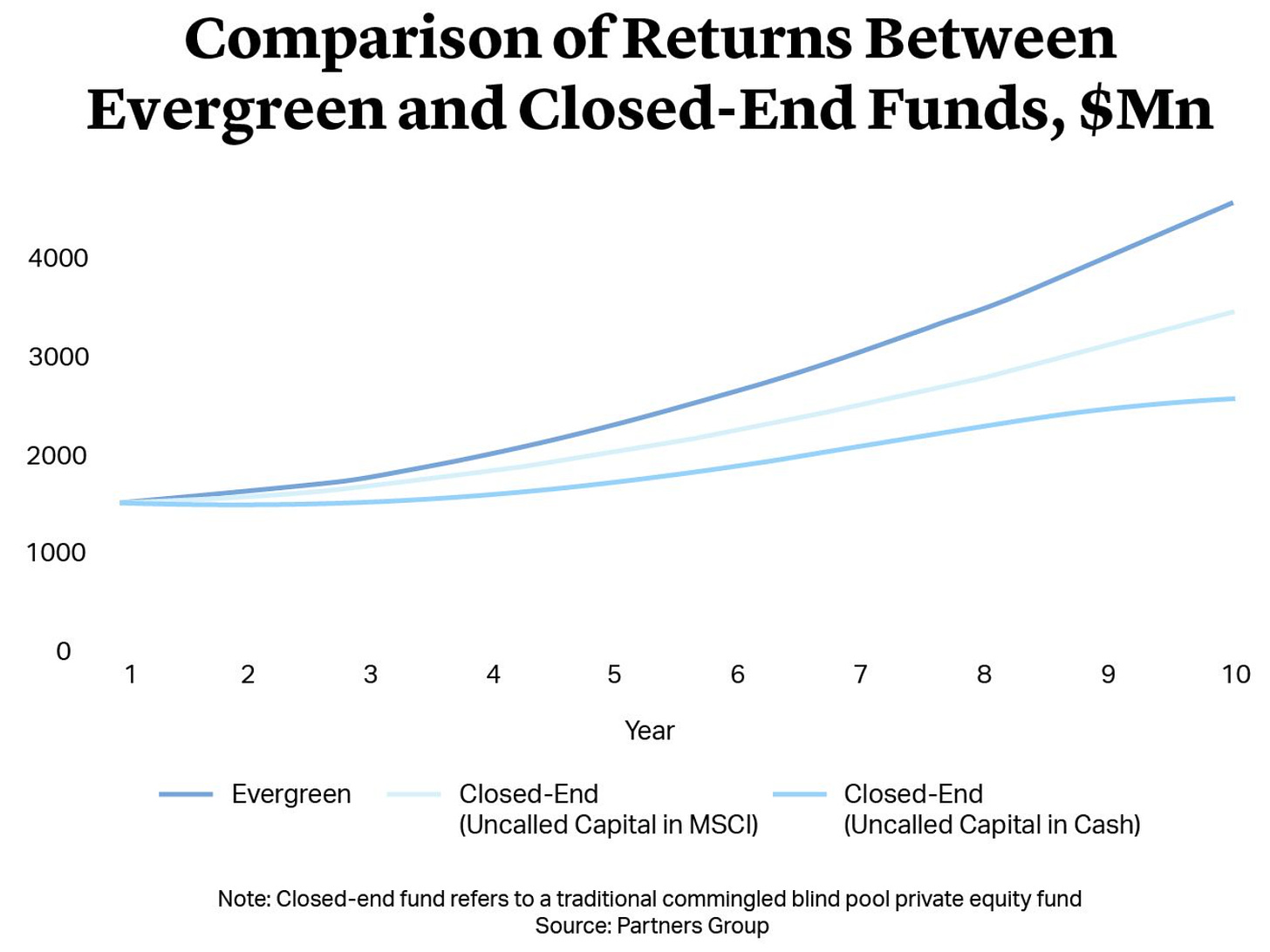

A chart from Partners Group (via a Cleary Gottlieb whitepaper) illustrates the difference that can be achieved when investors allocate to an evergreen fund in lieu of a closed-end fund with uncalled capital invested in either the MSCI or cash.

Why are evergreen funds becoming a favored structure for the wealth channel and GPs?

Growing in popularity

The conceptual framework of an evergreen structure or something similar is not new. The concept of buy-and-hold is not new. Warren Buffett and Charlie Munger created this type of investment vehicle with Berkshire Hathaway. An increasing number of alternative asset managers have — in their own ways — created permanent capital structures either by owning insurance companies or BDC structures. Others, like HgCapital, have created a publicly traded closed-end fund vehicle, HgTrust.

However, the rise of evergreen private equity and private markets funds is a relatively newer phenomenon. Partners Group was a pioneer of this concept. They launched their first evergreen fund 23 years ago in 2001.

With the wealth channel underinvested in private markets, certainly, relative to institutional counterparts, it’s not a surprise that evergreens have become an increasingly popular way for them to gain exposure to private markets in a relatively quick, turnkey, and operationally efficient manner.

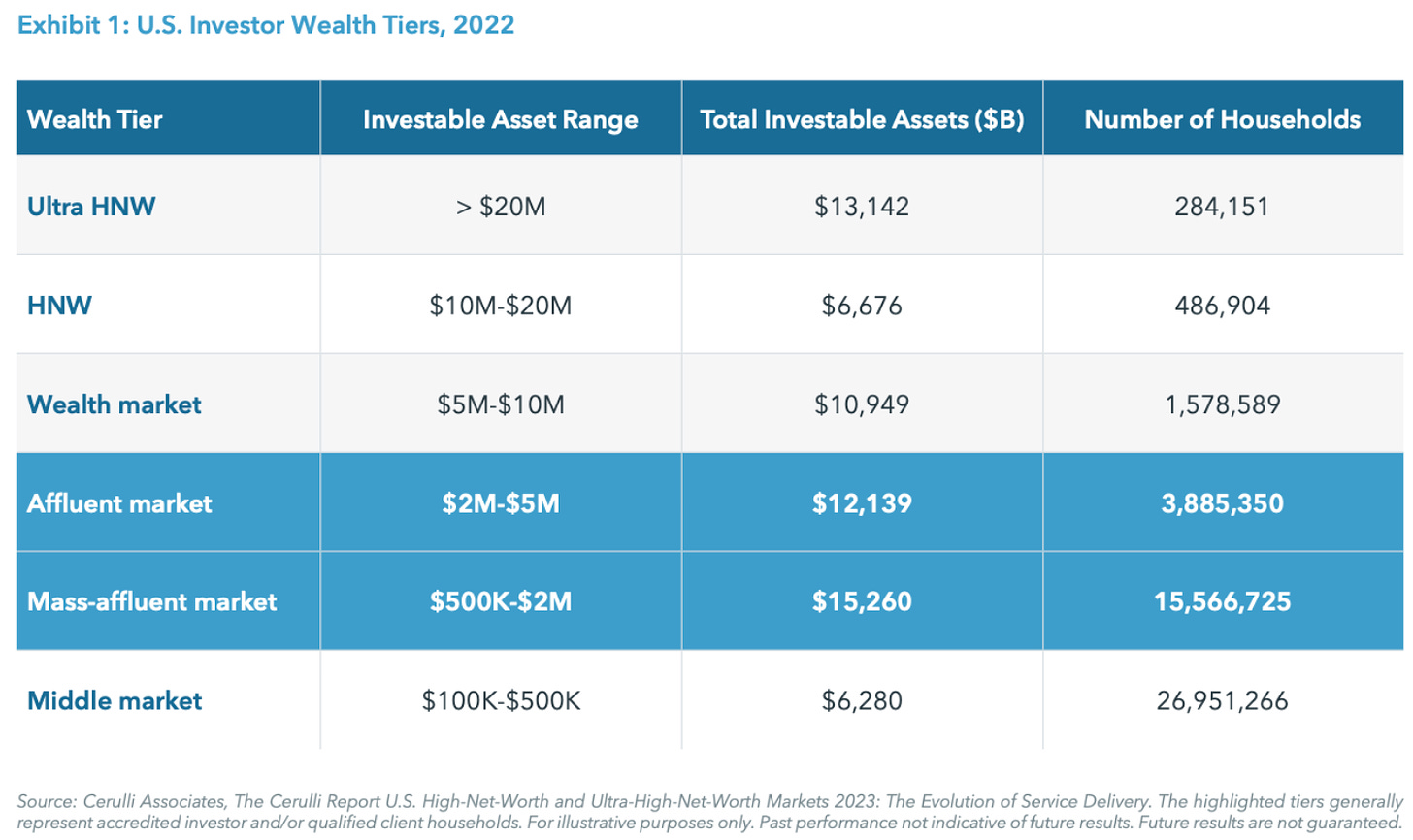

And when there’s a roughly $27.4T universe of investable assets across the affluent and mass-affluent markets in the US (according to an iCapital and Hamilton Lane whitepaper), it’s understandable that the alternative asset manager community is looking to create innovative and welcoming structures to enable more investors to access private markets.

It makes sense why evergreens fit well with the wealth channel. The compelling nature of the structure, as KKR highlights above, is just one reason they can make sense for individual investors.

Get invested: Evergreens enable investors to be invested on day one. It removes the structural J-curve for them since an existing portfolio of assets offers investors immediate exposure.. The single capital call nature of evergreen structures also means that virtually all of their capital is deployed at the outset. They don’t need to keep any additional capital liquid as they would with a drawdown vehicle. For investors who lack meaningful exposure to private markets, an evergreen structure can provide a quick and turnkey way for them to have an allocation.

Make it easy: Evergreens have generally made it easy for advisors and individual investors to access private markets. Evergreens often have lower minimum investment sizes, with many at $25-50,000 minimums, simplified and straightforward tax reporting instead of the onerous process of K-1s, and a single capital call.

The power of compounding: With capital deployed on day one, investors have more time for their capital to compound. Their capital is working for them. This structure also removes the need for redeployment risk since drawdown structures return capital, and then investors need to wait until when the next fund is open to redeploy returns and maintain private markets asset allocation targets.

There are, however, questions that remain about evergreen structures.

Liquidity

How will liquidity work with evergreen structures when there’s a scenario where many investors are seeking to redeem? Evergreen vehicles offer more agency on liquidity for the LP. These structures often make it easier for investors to redeem capital at various points in the structure’s life relative to a closed-end fund, which only allows for liquidity when there is an exit from an underlying portfolio company (in a private equity or venture fund).

Redemption features vary by fund, often up to 2% of NAV on a monthly basis or 5% of NAV on a quarterly basis (as the iCapital and Hamilton Lane white paper illustrates in the chart below). Crucially, certain evergreen funds have liquidity features that are subject to the discretion of the Fund’s Board. Does this mean there’s truly liquidity or the mere illusion of liquidity? Well, in a scenario where investors want to redeem or need liquidity, they may not actually be able to withdraw capital from the fund if the Fund’s Board rules against redemptions. This situation is playing out right now with Starwood’s $10B SREIT. Investors have requested redemptions, but with what Bloomberg reports as $752M in available liquidity at the end of April, Starwood determined that it made sense to cap monthly withdrawals at 0.33% of net asset value (~$33M in April). This figure is significantly smaller than the 2% withdrawal limit.

There are certainly benefits to providing investors with the option of liquidity. Particularly so for individual investors who may have life events or different cashflow requirements than institutional investors. Overall, that’s likely a net positive in terms of creating a structure fit for purpose for the majority of the wealth channel investors.

However, two large liquidity questions loom. One is the above question about redemptions and how a fund handles a scenario where a large portion of investors and AUM are all looking for liquidity at the same time.

Another is whether the option of liquidity could actually hurt an investor if they choose to take liquidity at an inopportune time. One of the features of an illiquid private market investment is that it can save investors from themselves. Sometimes, the best thing to do is nothing. A closed-end vehicle provides an LP with that feature. An evergreen vehicle, to some extent, does not. With an evergreen vehicle, there’s a risk that an investor loses out on the positive compounding effect by seeking liquidity prematurely.

Approach and psychology to evergreen allocations

How will investors conceptualize the framework of investing in evergreens? If it becomes well-established that an investor benefits from the compounding effects of an evergreen fund, then, in theory, they should never want to redeem.

How will investors approach their asset allocation strategy to private markets? Will they still think about private equity fund allocations in rolling 10-year periods but access their exposure through evergreens? Or will they change their view of liquidity and think about the performance of evergreens relative to more liquid benchmarks, like the MSCI World or S&P. Given that evergreen funds often strike monthly NAVs, it could be easier for investors to compare an allocation to an evergreen relative to a public markets investment.

Will they then continue to add more capital to that evergreen fund over time since they can subscribe with additional allocations, or will they look to diversify their fund manager relationships? I wonder if investors will centralize their commitments with a smaller number of managers because of the possibility that their private markets exposure grows over time as their capital compounds from an evergreen structure. That should benefit the large, established brands in the evergreen space. The bigger firms with recognizable brand value should attract the most capital.

But that leads to another question …

What happens if evergreen funds grow in such size and scale that they can’t deploy all the capital into enough high-quality investment opportunities? There’s certainly an incentive question here. When evergreen funds raise large amounts of capital, they could be pressured to deploy the capital in order to avoid the cash drag from not deploying, which would drag down returns. That could lead to poor investment performance if they are forced to invest into substandard assets. On the flip side, when liquidity is insufficient to meet redemption requests, managers may be forced to sell assets they’d otherwise hold to meet liquidity demands.

The industry around evergreens is being built for purpose

For evergreens to go mainstream, the infrastructure from pre- to post-investment will need to continue to be built out to make it as efficient and cost-effective as possible for investors.

There are a number of companies focused on providing products and services to private markets that could have a big role to play in the rise of evergreens.

Fund administration is both crucial and more challenging with evergreen structures. Evergreens require significantly more work from fund administrators than closed-end private equity funds.

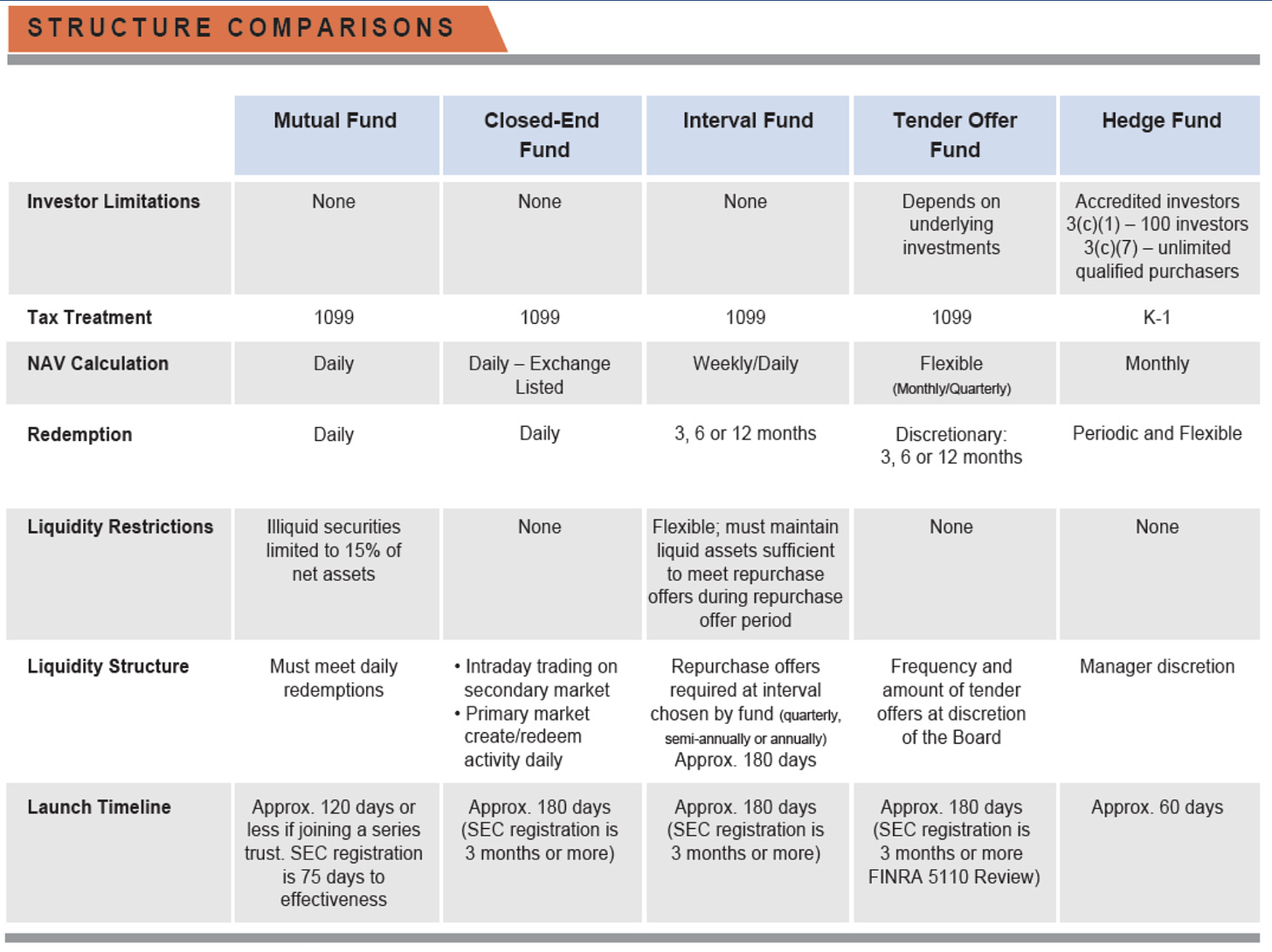

As the below chart from Ultimus Fund Solutions, one of the largest independent fund administrators in the US with over $500B AUA, illustrates, interval funds and tender offer funds have frequent NAV calculations, often on weekly / daily (interval funds) or monthly / quarterly (tender offer funds).

Administrators like Ultimus, who have domain expertise in registered funds, will play a big role in enabling the growth of evergreen funds.

Innovation in the technology to make fund administration more efficient will also be critical to continued innovation in evergreen funds.

iCapital’s announcement earlier this week about launching its first fund leveraging distributed ledger technology (“DLT”) is a landmark moment for private markets. Investors’ experience will remain the same, but the ledger technology will enable seamless data sharing and transaction processing, eliminating 100,000+ activity reconciliations over the life of a private capital fund. iCapital noted that their DLT is expected to save clients thousands of hours of manual data reconciliation and version sharing, create meaningful cost savings and productivity, and reduce risks from manual data entry.

iCapital Chairman & CEO Lawrence Calcano said that iCapital is “dedicated to optimizing the entire alternative investing experience, enabling fund managers and wealth advisors to operate with efficiency, precision, and ease.” It appears that will be the case: all fund lifecycle activities, including subscriptions, capital activities, reporting, and liquidity for the fund, will be orchestrated through iCapital’s DLT, which automates data and document connectivity between firms and minimizes manual data reconciliation.

Administrative burdens — and the risk of manual data reconciliation — might become less challenging in one sense because there’s no K-1s for investors, but other forms of investor communication will become more frequent.

Companies like 73 Strings, which provide portfolio monitoring and valuation software for GPs and LPs, will play a key role in helping evergreen funds fulfill their frequent NAV reporting requirements. No longer can valuation reporting be done manually. A growing evergreen fund market will require real-time analytics and reporting all the way down to the individual asset / company level that leverages machine learning to report on a faster cadence to their funds.

Where does the evergreen fund industry go from here?

There are a number of interesting questions for the future of evergreens. What happens next?

(1) Are certain types of assets best for evergreen fund structures?

Sports teams, which private equity is taking a keen interest in, could make sense for evergreen or perpetual capital structures. Rather than investing into a sports fund out of a closed-end vehicle with a defined fund life, making the fund a forced seller of a sports asset, perhaps team ownership stakes would be better off residing in an evergreen structure. Some sports investors have already done so. I’d expect to see more.

Private equity, GP stakes, and infrastructure funds also could make sense for evergreen structures. These are longer-duration assets that could make sense for all parties to hold beyond a defined fund life.

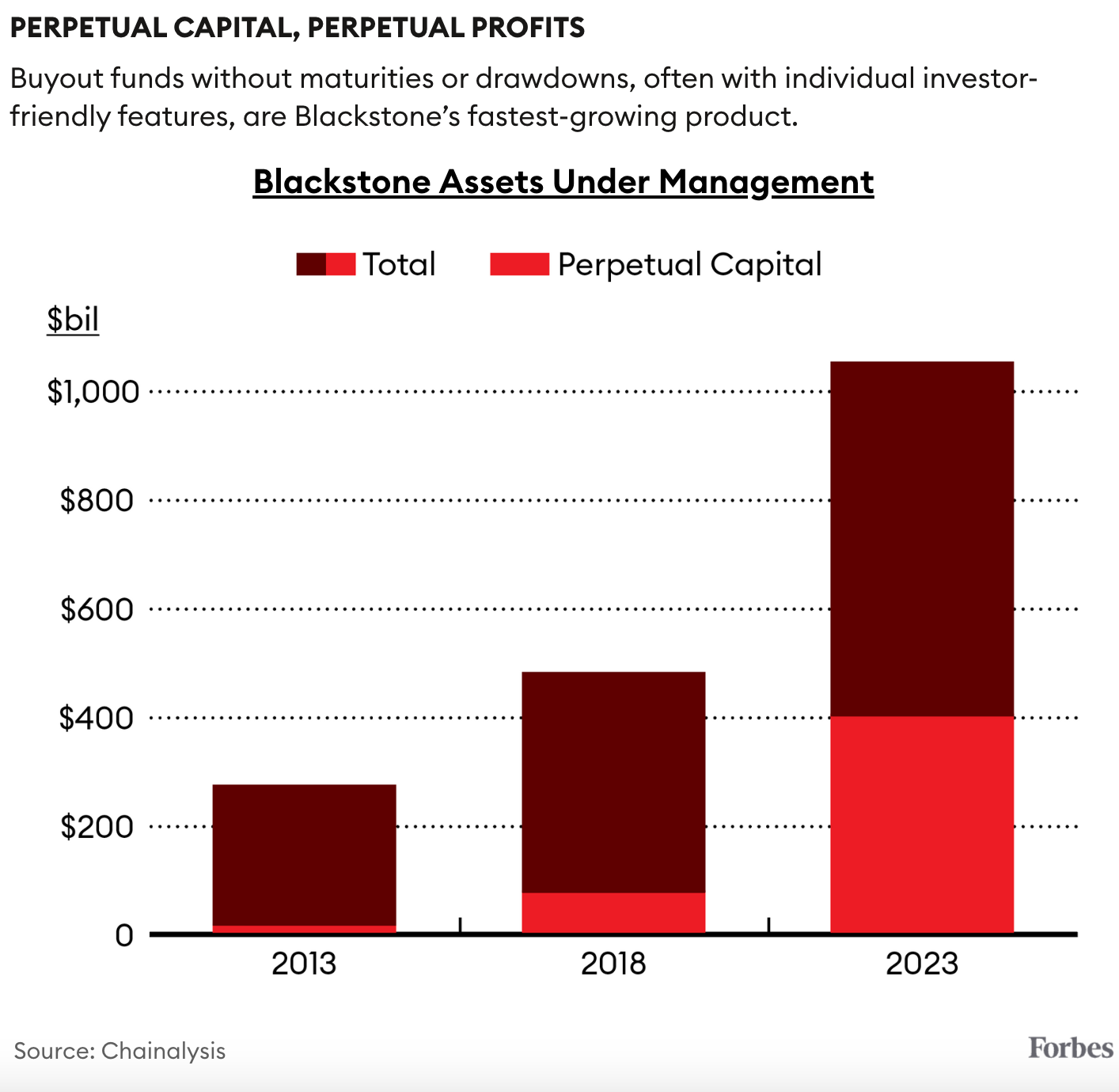

In a Forbes article a few months ago, a quote by Blackstone President Jon Gray about the power of evergreen fund structures stood out:

Like private credit and real estate, perpetuals will play a big role in Blackstone’s quest for world domination. Don’t think for a minute that these novel funds are merely old wine in new bottles—a clever device to vacuum up the cash of wealthy investors. Perpetuals are changing Blackstone’s operating model itself, away from transactional, toward long-term buy-and-build. They’re also helping the firm win deals.

“We partnered with the family that owned Carrix, the largest port operator in the U.S and Mexico. And with the Benetton family on the privatization of Mundys [formerly Atlantia], which is the largest transportation infrastructure company in the world with a bunch of roadways in Spain and France, and the Rome and Nice airports,” Gray says, referring to deals in Blackstone’s $40 billion infrastructure group. “These families love the idea of partnering with a perpetual vehicle. Because if we tell them we’re gonna buy it and in three years we gotta sell, they’re like, ‘I don’t want that.’ ”

Evergreens have grown in size and scale for Blackstone. They now account for 38% of Blackstone’s $1 trillion in assets under management and even more of its fee income.

If evergreen fund structures change the way that private equity works, then these types of funds will no doubt grow in popularity and become a mainstay of the industry.

(2) How will smaller funds and newer entrants to private markets think about employing evergreen structures?

Larger funds, like Blackstone, have the size and scale to build the infrastructure required to launch and manage evergreen funds. Not every fund is so lucky. But does it mean they can’t launch evergreen structures? General Atlantic has been an evergreen structure from the start. Perhaps we’ll see more funds at smaller sizes contemplate an evergreen structure, given its features for both the GP and the LP.

It’s also worth mentioning that any fund manager looking to work with the wealth channel will likely consider an evergreen fund structure. The product features are, in many respects, purpose-built to enable the wealth channel to access alts in a streamlined, cost-effective, and simple way.

Some firms may consider partnerships instead of buy or build. That’s exactly what $2.6T AUM manager of equity and fixed income assets Capital Group did this past week. They announced a partnership with KKR, who will work with Capital Group to make hybrid public-private markets investment solutions available to investors. The first two strategies will be a combined public-private fixed-income offering designed for financial professionals and their clients. As an increasing number of traditional asset managers contemplate how they plan to approach alternatives, I anticipate that we’ll see more firms explore build (as Schwab announced this week that they will launch an alternatives platform later this year), buy (as Franklin Templeton did by acquiring secondaries firm Lexington Partners and T. Rowe Price did with Oak Hill Advisors), or partner (as Capital Group did with KKR).

(3) How will firms reorient their marketing strategies?

The focus on the wealth channel from the industry’s largest alternative asset managers has resulted in a complete strategic shift in marketing. Blackstone and Apollo’s 2023 holiday videos provide illuminating examples of how alternative asset managers are positioning themselves as consumer brands. They want to make sure that consumers understand who they are and what they do — and how they are doing it is brilliant.

Blackstone’s website sheds light on how they are positioning themselves to the end consumer, the individual investor. Take a look at their LinkedIn page and you’ll see short video clips of President Jon Gray being peppered with questions about how his day is going or how the quarterly earnings call went, aiming to provide investors with an inside view into an industry that has seemed closed for so long.

Firms across the industry are humanizing their teams and the work they do, all in an effort to help the end investor (likely the potential buyer of an evergreen fund) understand who they are as a firm.

(4) How does it become even easier for evergreens to be sold and bought?

Private equity’s old adage is that it’s sold, not bought. That still remains true, although perhaps that changes in the future with the likes of iCapital’s Marketplace and further understanding of private markets by the wealth channel.

For the uptake of evergreens to continue, there will have to be ways to make it easier for investors to understand the swathe of options in the market, the differences between each respective fund, and what assets they hold.

The Stanger Report helps the industry get there. They provide information and return history on interval funds, REITs, BDCs, and other alternative investments, as well as a rating for each fund. This certainly helps. What can continue to speed up the velocity of allocators’ decision-making and the quality of their decisions? As evergreens feature more prominently, I anticipate that market data providers will look to create solutions that help these funds be sold — and eventually bought.

(5) Are evergreens good for LPs or are they just good for GPs?

There is a list of features that make evergreens suited for the wealth channel. However, the cynic might look at evergreens as a boon for the businesses of alternative asset managers. That wouldn’t be entirely inaccurate either. The majority of publicly traded alternative asset managers generate most of their revenues from fee-related earnings. Evergreen vehicles are fantastic structures for generating fee-related earnings (“FREs”), in part because they make it easier for the wealth channel to allocate to private markets and in part because they can grow to massive size, in many cases larger than would be the case if the GP were to raise a closed-end fund.

Public markets investors like FREs because they like predictable revenue streams. That’s partly why many of the alternative asset managers have been loved in public markets as of late. Most of the publicly traded alternative asset managers generate the majority of their revenues in FREs. Therefore, it could be a strategic decision to continue to push forward with evergreen structures since management fees could grow in size and scale as evergreens become more popular.

However, both the KKR report on evergreen fund returns and the aforementioned Forbes article on Blackstone illustrate that evergreens could be good for LPs, too. Returns could, in fact, be better with evergreen structures, and evergreen structures might actually help GPs win deals and hold on to their best assets without being a forced seller.

There’s a lot to be excited about with evergreens. Let’s just see how the liquidity question unfolds.

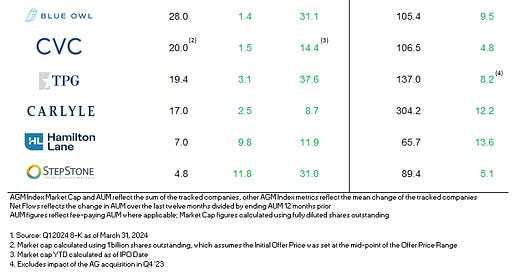

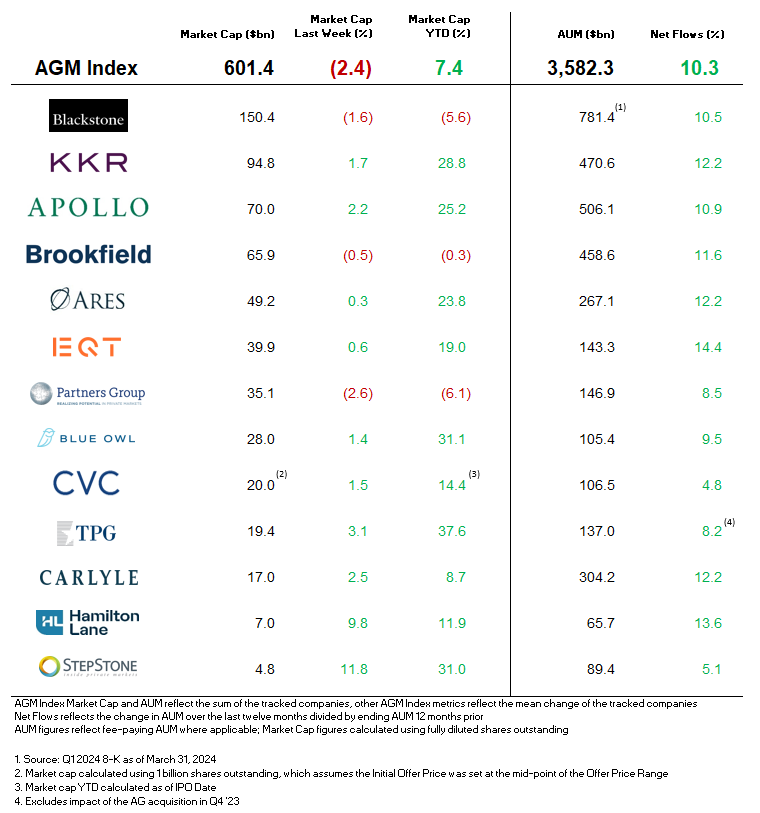

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

Build, buy, or partner?

Three articles this week highlight the strategic question that traditional asset managers, alternative asset managers, and banks face when it comes to building businesses in private markets.

Build, buy, or partner is the question that’s being discussed in the C-suite and boardrooms.

Schwab will build

📝 Charles Schwab to Launch Alternatives Platform for Individual Investors This Year | Hannah Miao, Wall Street Journal

💡 Charles Schwab has decided to build. According to a Wall Street Journal article, they will be launching an alternatives platform for self-directed, qualified individual investors (QPs with $5M net worth and above).

Schwab President Rick Wurster said, “We think it adds to the product and capabilities that we have for the ultra-high net worth clients and rounds out our offering.”

Schwab’s platform will include categories like private equity, venture capital, private credit, and hedge funds.

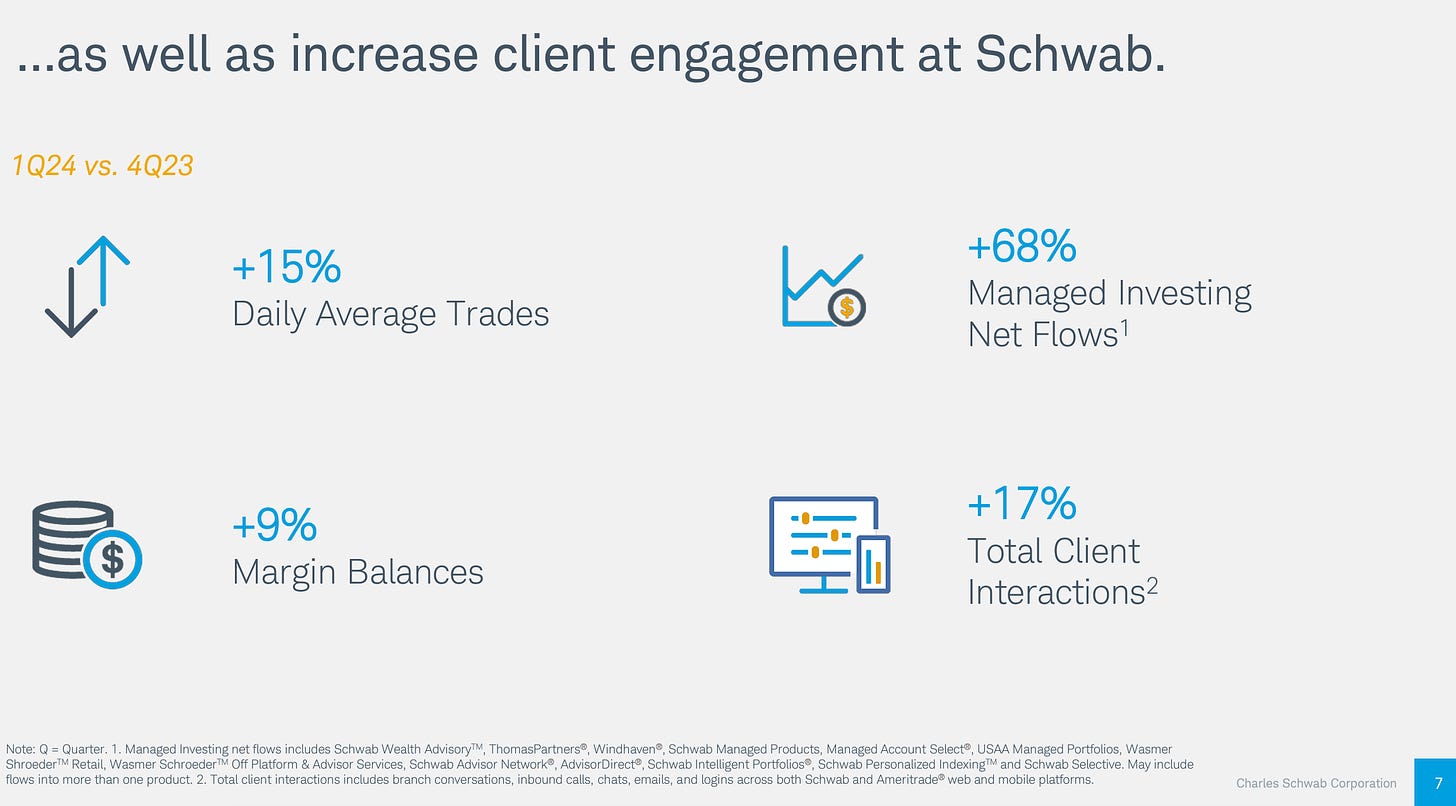

The firm’s decision to offer alternatives to its HNW client segment comes on the heels of a strong quarter. Schwab saw a marked increase in client engagement, according to their April 15 Spring Business Update presentation.

This news comes on the heels of Canadian digital wealth manager and brokerage firm Wealthsimple launching a private equity offering in partnership with LGT Capital Partners, the $100B AUM firm and official fund manager for the Royal Family of Liechtenstein.

It will be interesting to see the structure in which Schwab offers alternatives to the individual client segment. Given the simplicity of their structure, will evergreens be on the menu?

JP Morgan looked to buy

📝 JPMorgan Hunts for Private Credit Firm to Grow in Hot Sector | Hannah Levitt & Paula Seligson, Bloomberg

💡 JPMorgan’s $3.6T asset management arm reportedly looked at buying Chicago-based $18.8B AUM private credit manager Monroe Capital. Bloomberg’s Hannah Levitt and Paula Seligson report that JPMorgan is looking to augment its capabilities in an increasingly competitive part of private markets: private credit.

JPMorgan has reportedly already earmarked over $10B of the firm’s balance sheet for direct lending. They will also be partnering with asset managers to invest alongside them in private credit deals. Acquiring a private credit firm would have bigger implications. It would give the bank an accelerated path to competing directly with other alternative asset managers in private credit. Monroe, which manages almost $19B, has more AUM in private credit than JPMorgan’s Asset Management unit, which managed $17B in private credit assets at the end of 2023.

A bank buying a private credit firm would have implications for both parties. For a private credit firm like Monroe, an acquisition by the likes of JPMorgan would move them into a more regulated landscape through a direct affiliation with a bank. That may not appeal to a private credit manager, given that they have operated in a less regulated part of the financial world. A bank would also have to determine if direct ownership of a private credit manager would enable the strategy to maintain the advantages that it currently enjoys as an independent firm.

What it does highlight is that banks recognize that they need to come up with answers as alternative asset managers encroach on their territory in lending and private credit.

Capital Group has decided to partner

📝 American Funds Parent Launching Partnership With KKR to Move Into Private Assets | Justin Baer, Wall Street Journal

💡$2.6T AUM Capital Group, one of the oldest and largest investment management firms, has decided to team up with KKR to offer a series of hybrid funds to mass affluent clients.

Capital Group certainly has the reach to have a big impact in private markets. According to Capital Group CEO Mike Gitlin, 220,000 of the 290,000 financial advisors in the US hold at least one Capital Group fund.

Capital Group has found an experienced and willing partner in KKR. As of December 2023, KKR manages over $70B in wealth client assets. They are continuing to make a concerted effort to work with wealth.

Although Capital Group has made its name in the public markets, it does have a heritage in private markets. The firm helped start a venture capital fund that would later emerge as Sequoia Capital.

Capital Group has decided to stick to its knitting, however. Gitlin’s comments in Capital Group’s press release illustrate that the firm knows itself and its culture, which is ultimately why it decided to partner with KKR rather than try to build a solution in-house.

“Some of our clients want us to bring them a full investment solution including alternatives. Capital has been researching the broad alternatives market for the past two years and considered whether to buy, build or partner. Buying would disrupt our culture, building could distract our investment professionals, so partnering with a subject-matter expert to deliver a holistic investment solution for our clients was the best course of action. For many investors, private credit can be out of reach. The lens we used was a simple one – how can we help clients while staying true to our culture and maintaining our focus on what we do best.”

💸 AGM’s 2/20: One of the biggest trends in private markets is traditional asset managers and banks thinking about how to enter — or make a continued push — into alternatives. Traditional asset managers have a potential distribution advantage. As Capital Group CEO Mike Gitlin highlights, they have a product relationship with the majority of financial advisors in the US. The long-standing relationship of trust and brand with financial advisors should help many traditional asset managers provide alternatives to their existing client base. But it’s not a trivial problem to solve. Alternatives require significant education for not only the customer (the advisor and end client) but also for the distribution professionals. In conversations with those looking to add alternatives capabilities to traditional alternatives platforms, it appears that the role of the product specialist is critical for distribution success. It will take time, effort, and capital to train alts distribution teams, so bringing in product specialists who can speak the language of private markets and provide consultative advice and guidance will be critical for firms that are looking to grow their private markets capabilities.

📝 iCapital Launches First Fund on Firm’s New Distributed Ledger Technology | iCapital

💡iCapital announced this week that they’ve launched their first fund leveraging distributed ledger technology (DLT) that they’ve built. Tokenization has been a topic of much discussion in private markets, however, there hasn’t been much uptake on tokenized funds from an AUM perspective. iCapital’s DLT is a milestone launch in a space where creating efficiencies in the administration and management of private funds is critical to the continued evolution and cost reduction in private markets.

iCapital’s DLT is aimed at simplifying and enhancing the lifecycle management of alternative investments. iCapital Chairman and CEO Lawrence Calcano said this is part of their effort “dedicated to optimizing the entire alternative investing experience, enabling fund managers and wealth advisors to operate with efficiency, precision, and ease.”

Their ledger technology is expected to eliminate over 100,000+ activity reconciliations over the average life of a private capital fund. It will process all activities across the lifecycle of the fund, including subscriptions, reporting, and liquidity events. Per iCapital’s press release, “iCapital’s DLT is expected to not only save clients thousands of hours of manual data reconciliation and version sharing, but also create significant cost savings and productivity gains in addition to reducing the risks associated with manual data entry.”

iCapital’s fund will be distributed by UBS Wealth Management and administered by Gen II. All lifecycle activities — including subscriptions, capital activities, reporting, and liquidity for the fund — will be orchestrated through iCapital’s DLT, which automates data and document connectivity between firms and minimizes manual data reconciliation.

Co-Head of Global Alternative Investment Solutions for UBS Global Wealth Management Jerry Pascucci said that the firm is looking for ways to “make it easier for [their] financial advisors to manage and monitor their clients’ alternative investment holdings.” He added that “this is an important step forward in creating greater efficiency and improving fund data quality.”

iCapital has been working on integrating blockchain technology for the past two years, and its DLT can now support any fund, according to iCapital’s Chief Product Officer and Managing Director Jason Broder. This fund, in partnership with UBS, is expected to be the first of further launches with other funds and firms later this year.

In a Wealth Management article about the news, Broder noted that many industry players see this as a big moment for private markets.

“Certainly, in the conversations we had with a lot of folks in the industry, people are excited about it because it will eliminate a tremendous amount of pain points and just solve a lot of operational issues [in accessing private investments],” said Broder. “A distributed ledger is a fantastic solution that can be a single source of truth in the alts ecosystem. It could begin to drive data standardization across the industry and really solve a lot of the operational inefficiencies.”

Broder also noted that iCapital partnered with UBS Wealth Management for the launch of its DLT in part because UBS has been a long-term partner whose alternative investment platform is run on iCapital’s infrastructure.

“There are a lot of firsts we’ve done together, many from a technology standpoint,” he said. “They have been very invested and very forward-thinking in this space for a long time.”

💸 AGM’s 2/20: The launch of a DLT solution is big news for private markets — and a long time coming. Blockchain technology has the power to collapse costs, create efficiencies, and reduce errors of manual entry … if it’s being employed in a way that meets users where they are. Crucially, iCapital’s DLT solution doesn’t require advisors or end clients to change the way they interact with or manage alternative investment holdings. If fund administration costs and manual workflow entry can be reduced (likely reducing the potential for errors in the process), then users will benefit as costs across the entire alts supply chain can decrease over time. This will be a boon for stakeholders at all points in the alts value chain, as they will likely be able to maintain similar — or better — margin profiles with reduced costs thanks to DLT.

Operational hurdles and requiring stakeholders to change their workflows have been some of the challenges with DLT adoption in the past. I anticipate that this announcement could be the beginning of much more to come with DLT adoption. DLT looks like it’s being employed in an accessible and practical manner here — and with collaboration from some of the largest players in the industry — so this should only be a major positive for private markets going forward.

📝 UBS Global Family Office Report 2024 | George Athanasopoulos & Benjamin Cavalli, UBS

💡UBS released their 2024 Global Family Office Report. They surveyed 320 single family offices globally, with an average net worth of $2.6B and collectively representing $600B of wealth.

Some notable data points and highlights below:

Allocations to developed market fixed income rose by the largest amount in five years.

Geopolitical concerns reign supreme. Over the coming 12 months, 58% of family offices said they are concerned the possibility of a major geopolitical conflict and the impact it could have on their financial objectives. Their outlook over a longer period of time indicates that they don’t believe the world will be less conflict-ridden, with 62% of respondents saying that geopolitical conflict will be their top concern over the next five years.

Geopolitical concerns are not, however, augmenting many family offices’ risk appetite. 61% of family offices said they are planning to take a similar amount of risk in the coming 12 to 18 months.

Asset allocation to alternatives remains high, but higher in private equity for US investors relative to the rest of the world. 2023 asset allocation for US family offices to private equity was 35% (21% to direct investments, 14% to fund / fund of funds). This figure is significantly higher than European family offices, who had 22% allocation (11% direct investments, 11% funds / fund of funds) and Middle Eastern family offices, who had 28% allocation (10% direct investments, 18% funds / fund of funds).

Respondents plan to increase allocations to North America and Asia-Pacific, with 29% of respondents saying they plan to increase investments in North America and 35% saying they plan to increase investments in APAC (excluding Greater China).

The top concern for investors in private equity over the next 12 months is a lack of exits and liquidity. 61% of family offices highlighted the slowdown in realizations and exit activity as their top concern. One US family office noted, “We want to see some realizations before people come back to raise more money. I think that is a similar thing to what most of the endowments are pushing for. I do not worry about the exits because I think they will happen eventually but if private equity firms want to raise more funds they will have to calm down.”

The slight majority of family offices surveyed invest in private equity funds (52% invested in funds as their primary way of allocating to private equity, which, notably was down 5% from the year prior), whereas 52% of family offices access real estate via direct investments in fully owned physical real estate.

Almost half (49%) of family offices view climate change as a top risk over the next five years. It’s an area that’s of keen interest for investment. And not just for impact. 66% of family offices expect to generate market-based financial returns from sustainable and impact investments. Further, 44% of family offices either take or intend to take sustainability or impact into account in their liquid investment portfolios.

💸 AGM’s 2/20: A few interesting takeaways emerge from the UBS Global Family Office Report. Family offices are quite concerned about the risks posed to their investments by geopolitical conflict and climate change. Macro must be taken into account for those investing in private markets. Geopolitical conflict could have an impact on public equities, which could in turn impact exit markets for private investments. Exits and liquidity are top of mind for family offices, with many concerned about the lack of liquidity over the coming year. That sentiment could lead to lower allocations to private equity over the coming years, particularly if exits take longer than expected. I anticipate we’ll see an increase in the number of continuation vehicles launched and further interest in secondaries funds to address the illiquidity challenges. It will also be interesting to see how family offices approach liquidity needs. Many hold direct ownership in real estate assets, which could have some challenges over the coming years. Yet, the survey also reveals that many family offices don’t want to hold much cash, eschewing cash for fixed income investments. I wonder how many family offices will look at evergreen funds across private credit and private equity to go longer private markets exposure while also maintaining some optionality with liquidity.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Fund Accountant. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Analyst. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 LemonEdge (Fund accounting) - Implementation Manager. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Director of Data Strategy. Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Net Interest Publisher & Writer, Net Interest & Retired Partner, Lansdowne Partners Marc Rubinstein provide an in-depth tour of financial markets. Listen here.

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Haig Ariyan, CEO of Arax Investment Partners, as we take the pulse of private markets on the 9th episode of our monthly show, the Monthly Alts Pulse. We discuss the evolution of wealth management and the role that alts can and should play in wealth client portfolios. Watch here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.