👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a community of private investors sharing deals, insights, and contacts.

3i pursues esoteric private market deals sourced exclusively from members without any economic interests in the deals presented.

Uncorrelated, off the run, emerging strategies that generate asymmetric and high yielding return profiles are prioritized.

3i deals often come with more favorable terms and lower minimums than if an individual invested outside of the network.

Learn how 3i sources & diligences investment opportunities and how to get involved as a member here.

Good afternoon from London, where I’m in town for the weekend before heading to SuperVenture and SuperReturn in Berlin next week. If you will be in Berlin and would like to meet, drop me a line.

I’m still thinking about the electric scenes from last night’s UEFA Champions League match at Wembley Stadium between Real Madrid and Borussia Dortmund, where Real made the most of its chances and lifted the trophy with a 2-0 victory.

The Champions League is the pinnacle moment in European club football. It’s why the best players in the world go to Europe — for a chance to play in the match that defines a European club’s season.

This year’s zenith of European football also happened to welcome the world’s highest-valued club and player to last night’s pitch.

Hey Jude

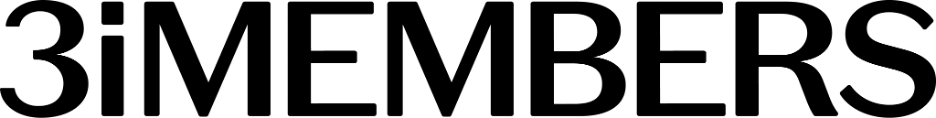

Last night’s match featured the world’s most expensive player, according to International Center for Sports Studies (CIES).

Jude Bellingham, the 20-year-old English sensation who moved to Real Madrid from his former team — and last night’s opponent — Borussia Dortmund for £115M last summer, is considrered by CIES to be the highest-valued player in the world. Perhaps comparisons to French superstar Zinedine Zidane explain why.

Real’s roster is stacked with some of the world’s highest-valued players. It’s not just Bellingham who is part of the nine figure club. Data from CIES shows that Real had five players — Vinicius (“Vini”) Junior, Rodrygo Goes, Federico Valverde, and Eduardo Camavinga, in addition to Bellingham — valued at over £100M at this past January’s transfer window period.

Perhaps it’s fitting that the world’s most valuable club has the largest number of the world’s priciest players.

Not always does the “Superclub” model produce results on the pitch. But strong business performance certainly ties into the ability for clubs to splash the cash to bring in the best talent.

Teams that generate revenue are afforded the flexibility to spend on player transfers. That strategy pays off with results like last night, where a top club benefits from both the global exposure and additional revenue that comes from playing in a Champions League final match.

A lot on the line

Former Blackstone and Airbnb CFO and Founder and Managing Partner of WestCap Laurence Tosi said on a recent Alt Goes Mainstream podcast that “scale begets scale.”

Well, in sports, that quote could be translated into “success begets success.”

That’s certainly the case for clubs that advance through the stages of the Champions League.

Diario AS recently shared a chart that illustrates the lucrative nature of Champions League participation.

At each stage, clubs generate revenue for their participation in matches. Clubs that continue to advance add more revenue to their coffers the further they progress through the tournament.

The €20M match

The prize for winning last night’s match? €20M.

That’s on top of the payouts for each preceding match, the coefficient payout, which an article by Sporting News pegs at an additional 30% of the prize money (€600M) split and paid out to participating teams ranked 1-32 based on a number of factors, and the broadcast market payout, which adds a portion of the additional 15% of the prize money (€300M) to club revenues.

A win last night meant that Real would pocket a total cash prize of around €118.5M. A win for Dortmund would bring home €102.1M, according to Diario AS.

Add €100M in additional revenues to the club’s income statement and those figures start to look incredibly meaningful. Real, which is the world’s second most valuable club according to a Sportico analysis, generated $844M in the 2022-2023 season. The incremental revenues from winning the Champions League, not to mention the additional global exposure, merch sales, and increased attractiveness of the club for players on transfer, add real value to success in an elite competition like this. This run to the Champions League finals has arguably been even more impactful for Dortmund, which took in $439M in revenues in 2022-2023.

Winning the Champions League isn’t entirely about dollars and cents, but it certainly makes sense to focus on achieving this goal for clubs in this echelon. The additional €100M+ revenues earned from Champions League success is far from immaterial when put in the context of the combined revenue from the top 20 earning clubs in the world, according to Deloitte’s Football Money League 2024.

The top 20 clubs generated over €10.5B in the 2022-2023 season. €100M in additional revenue from Champions League glory is 1% of the revenue generated by the top 20 clubs — and it’s zero-sum revenue. The winner earns prize money that other clubs don’t generate. That’s meaningful in an era where more private equity funds are turning their eyes to sports teams as investable assets.

Institutional investors see this value. So perhaps it’s not a surprise that private equity is taking notice.

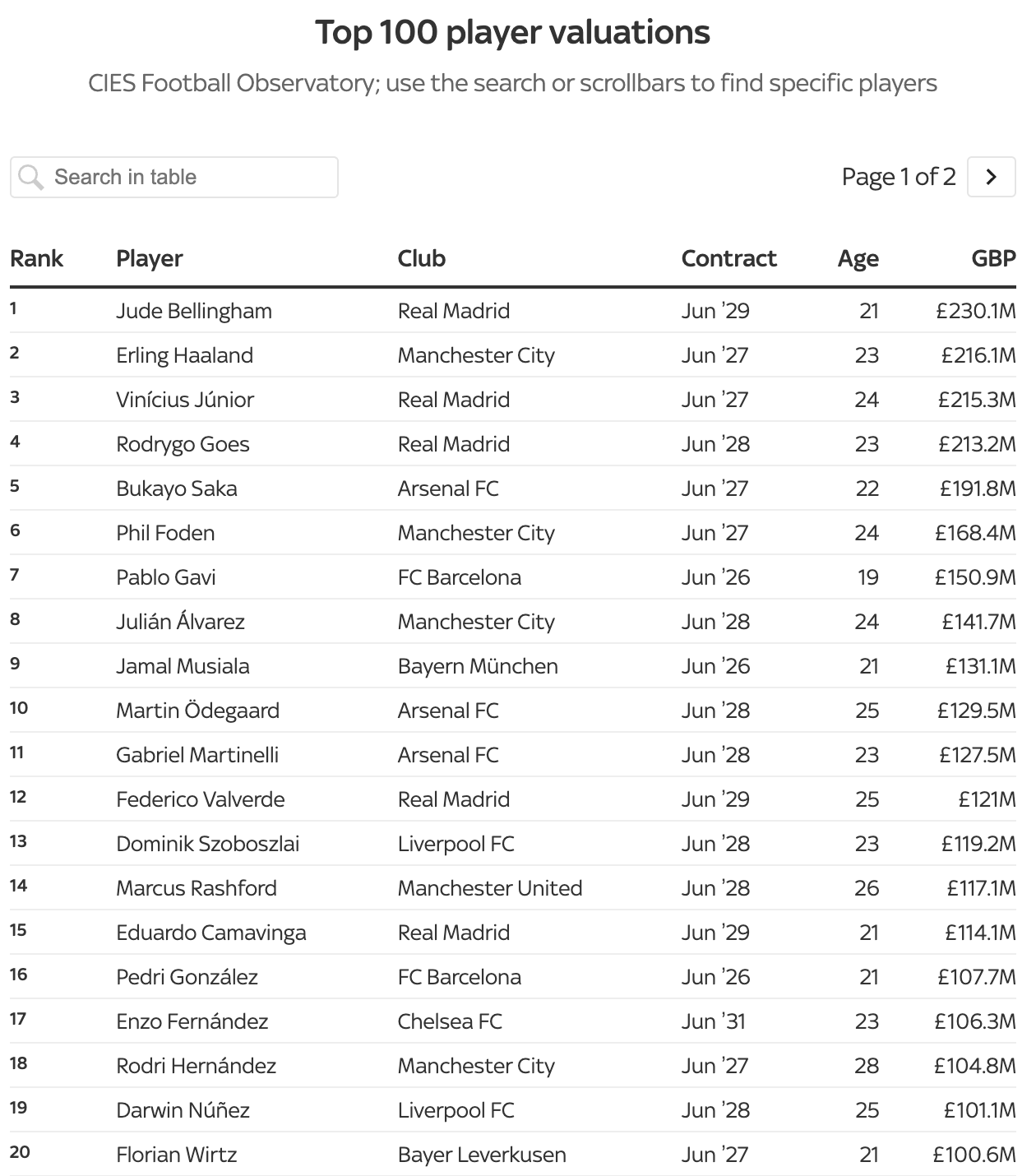

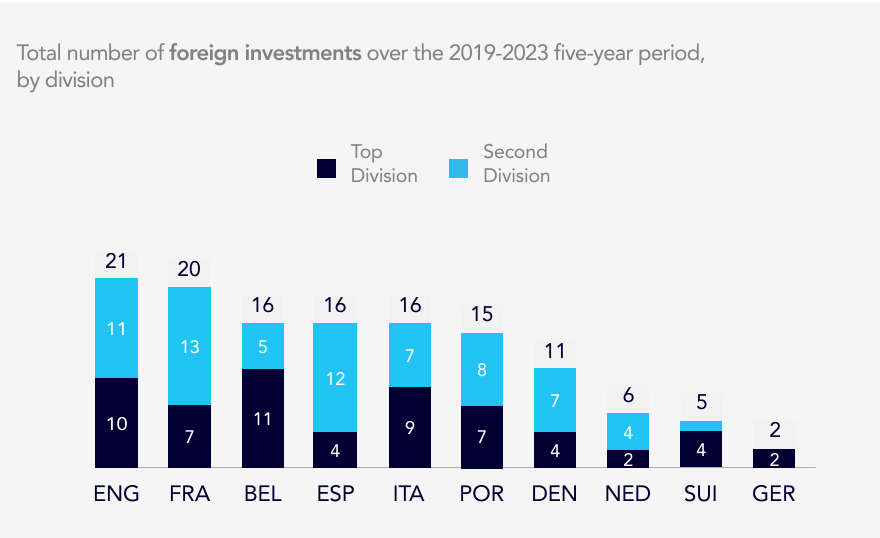

CIES data found that the past five years, a number of clubs across Europe take in foreign investments.

Interestingly, the leagues at the top of the table with foreign investments are not the leagues that were represented in yesterday’s Champions League match. That’s partly due to league structures, ownership rules, and broadcast deals. But it’s noteworthy if we are following the capital that’s being invested into teams. I’m sure many of the investors who invested in an English or French club were hoping that Champions League success would follow given the revenue prize.

Many of those investors happen to be American. A total of 77% of the private capital related deals identified by CIES were found to have originated in the US. That figure increased to 87% for deals in 2023.

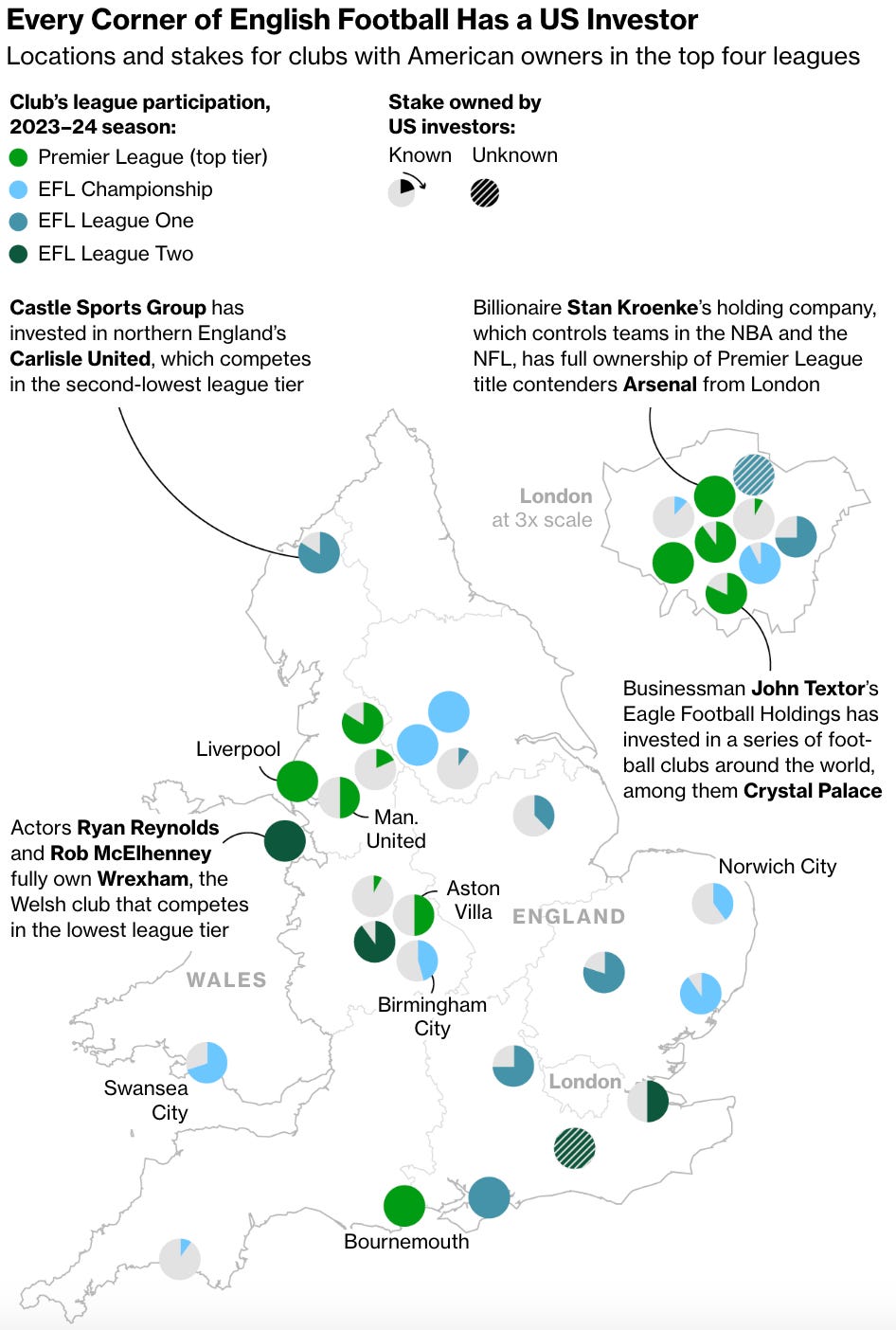

Take English football, for example. Every professional league in England is home to at least one American owner, according to a recent Bloomberg article.

Most will recognize the Glazers ownership of Manchester United (the Glazers also own the NFL’s Tampa Bay Buccaneers), Todd Boehly and Clearlake’s ownership of Chelsea (Boehly also owns the MLB’s Los Angeles Dodgers), and Fenway Sports Group’s ownership of Liverpool. But American investors also own teams like Crystal Palace (owned by John Textor and Blackstone’s David Blitzer, amongst others), Norwich City (owned by Mark Attanasio, who also owns the MLB’s Milwaukee Brewers), newly-promoted Premiership club Ipswich Town (Bright Path Sports Partners and Arizona’s PSPRS pension plan) and Wrexham AFC (owned by Rob McElhenney and Canada’s Ryan Reynolds — listen to AGM’s podcast with Wrexham AFC Board Director Shaun Harvey here).

Bloomberg finds that over 1/3 of the 92 clubs across the top four professional leagues in England now have some form of American ownership.

Now the €100M question: will any of them see Champions League glory?

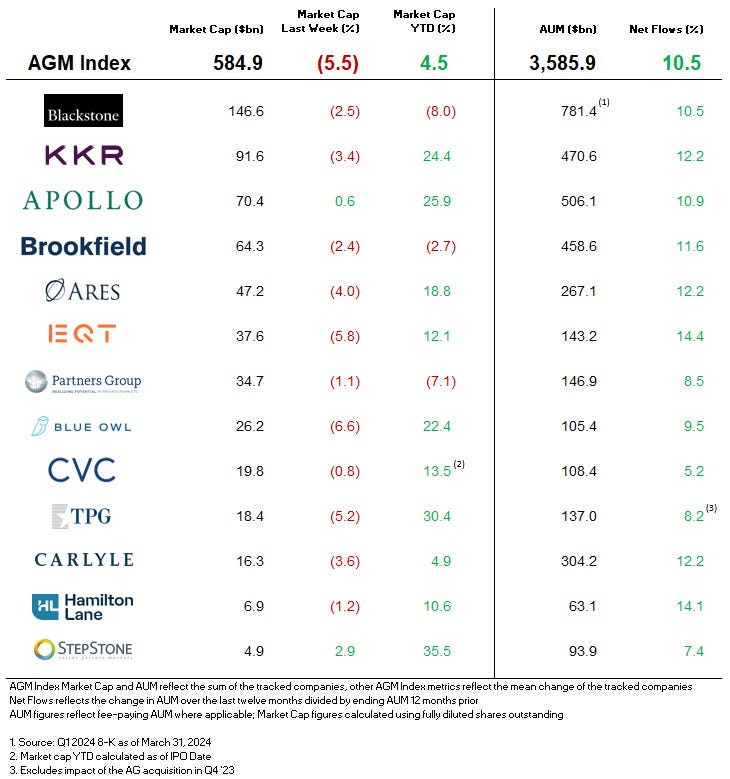

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 How More Asset Managers Are Getting Their Claws Into Insurance Portfolios | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher dives into how insurance companies are increasing their allocations to private markets. Thrasher finds that insurance company assets outsourced to asset managers have more than doubled over the past decade, reaching $3.6T. That figure also marks a $400B increase from 2022 and well more than the $1.4T that asset managers managed on behalf of insurers in 2014, according to the latest annual report on the topic by software company Clearwater Analytics. These numbers are also buttressed by market returns and the number and types of survey participants, but nonetheless, it highlights a growing trend of insurers allocating to asset managers. Alternatives strategies have been on the menu for insurers. According to Clearwater Analytics, insurers’ allocations to private assets grew to $602B over the past two years, a 40% increase. This trend line illustrates that insurers have been swapping out public securities in favor of alternatives strategies, with private asset classes gaining 5% of total assets. A big reason for this shift? Insurers moving out of investment grade bonds, according to Sandeep Sahai, CEO of Clearwater Analytics. “As investors diversify to increasingly complex asset types, they invest the time to understand these asset classes with the support of experts represented in our guide. We have seen increased alternative investments among the 800-plus insurance clients on the Clearwater platform and their money managers,” Sahai said. There appears to be a trend towards outsourcing asset allocation for many insurers. “The trend of insurers moving towards external asset management speaks volumes about the expertise and scale that external managers offer,” Steve Doire, a strategic advisor at Clearwater Analytics and owner of DCS Financial Consulting, said in the report. “The sheer variety of specialty asset managers now available to insurers is a testament to the evolution of the industry.”

The question going forward? Will insurers continue to outsource to managers or build their own capabilities in-house, given the size and scale of their asset bases?

💸 AGM’s 2/20: Insurance companies have a major role to play in the continued evolution of private markets. Their large asset bases mean they can be meaningful allocators to private markets themselves out of their General Accounts. That in and of itself can result in large pools of assets allocated to private markets.

The past 40 years of investing have been a major driver of this shift, which has been characterized by what Apollo CEO Marc Rowan said recently at the Norges Bank Investment Management investment conference as “rates going from high to low, governments printing a lot of money, markets borrowing forward a lot of demand, and the benefit of globalization.” Surely, these characteristics of the investing landscape have driven insurers to roll out of some of their exposure to fixed-income investing and into private markets, namely private credit. A StepStone report from 2021 highlighted just how large this pool of assets was: StepStone found that American insurance companies alone held $6T AUM, of which 80% of their assets were invested in fixed-income related investments. Only 5% was invested into alternatives and private market investments (including real estate) at that time. That has begun to change as insurers have been looking for ways to generate returns outside of public market and fixed-income securities. StepStone goes on to state in their report that “insurance companies are natural buyers of assets with longer investment horizons. This is especially true for life insurance companies. Private market investments are therefore well positioned to meet the asset liability requirements while capturing the inherent illiquidity and asset class specific premia.” Moody’s Analytics recently quantified the risks and possible range of return outcomes by adding private markets investment products to insurance companies’ asset allocation mix. Leveraging their PFaroe product analytics, Moody’s finds that a combination of cashflow matching and proper allocation to alternative assets can help insurers achieve increases in yield with a limited impact on current capital requirements.

However, General Account allocation to private markets is only part of the story. Many insurers are looking beyond their General Account to continue to build out their private markets platforms. Insurers that have distribution capabilities to the wealth channel through the activities of selling insurance products to wealth managers are presented with a compelling opportunity to also create investment products specifically designed for the HNW channel. Allianz Global Investors’ 2023 launch of their Core Private Markets Fund is one such example. AllianzGI created an evergreen / semi-liquid fund structure that combined private equity, corporate private debt, infrastructure equity and debt investments into a single vehicle to serve the wealth channel. At the time, Allianz was targeting €3B for this fund. Allianz’s fund is just one example of insurers creating and manufacturing investment products tailored for the wealth channel. I expect that we’ll see insurers continue to manufacture investment products tailor-made for the wealth channel.

The other interesting and overlapping trend of note with insurers is that many of them are ramping up their private markets capabilities and efforts. Manulife made quite a notable hire recently, bringing on Anne Valentine Andrews to be the Global Head of Private Markets. Andrews was most recently the Global Head of Infrastructure and Real Estate at BlackRock, where she was responsible for a business unit that managed over $80B of assets. At Manulife, she’s taking the helm of a private investments platform that already has $120B of assets across real estate, infrastructure, timber, agriculture, private equity, and credit. Not only will she be driving the General Account’s asset allocation in private markets, but she will also be responsible for working with both the CIOs from each asset class and the global product group to drive the continued evolution and creation of private markets products across institution, individual / retail, and retirement channels. PGIM, the $1.27T global investment management business of Prudential Financial, has made a number of notable hires and appointments in the past year and a half into its alternatives strategies that are responsible for managing over $300B in AUM. In 2023, PGIM appointed Eric Adler as CEO of PGIM Private Alternatives. More recently, they brought on Laurie Chan to lead the development and distribution of PGIM Investments alternatives solutions for the wealth channel. Chan came over from Citi, where she was Global Head of Alternative Investments Sales, leading a team of 25 alternative investment specialists representing over $32B in alts AUM.

Insurers are highly sophisticated and thoughtful investors. If anything, they are only becoming more institutionalized in terms of how they approach private markets, whether through an increasing focus on private markets exposure or through senior and experienced hires, as mentioned above. Insurers have a full deck of cards to play in private markets. They can invest in a meaningful way out of their General Account, taking on the appropriate amount of illiquidity risk where they are compensated with commensurate returns. They have the capital to either anchor funds in private markets or seed new private markets strategies on their own platforms. They they can build out sophisticated alts programs to distribute to the wealth channel. A few months ago, I said that the wealth channel is the new institutional LP. That’s certainly part of the story of alts going mainstream, but the narrative wouldn’t be complete without saying that the other meaningful entrant to private markets in a big way (and in a number of ways, as Apollo and KKR have illustrated with their ownership and ability to leverage insurers Athene and Global Atlantic to evolve their own businesses further) are insurers, which will play a main character role in the story of the evolution of private markets.

📝 “I expect there to be problems”: Jamie Dimon warns about private credit | Alex Steger, Citywire

💡Citywire’s Alex Steger reports on JP Morgan CEO Jamie Dimon’s warning call about private credit. Steger discusses Dimon’s comments at the AllianceBernstein Strategic Decisions Conference this past Wednesday, where Dimon cautioned that there could be issues in some parts of the private credit market. Dimon warned that “there may be problems there” and that “there could be hell to pay” if individual investors get burned by missteps in private credit. Dimon’s concern stems from his belief that individual investors may not fully understand the liquidity and lockup period of these private credit funds. “You have to ask the question, “Do you want to give access to retail clients to some of these less liquid products?” The answer is, probably. But don’t act like there is no risk in that,” he said. Dimon went on to say, “You have illiquid products, maybe they are not properly marked, they have not been properly stress tested. Do people really fully understand about interest rates affecting what these things are worth? Do they? And if a little old lady finds out that she can’t get her money back … retail clients tend to circle the block and call their senators and congressmen, there could be hell to pay.” Dimon’s comments come at a time when the private credit fund market AUM has swelled. The market has grown from around $500B in 2015 to $1.7T in 2023. The backdrop of this growth has, in part, been due to bank retrenchment after the financial crisis and due to a changing regulatory environment. Steger highlights that a proliferation of evergreen and semi-liquid funds has helped drive the growth in private credit AUM.

Dimon did note that there were lots of benefits to private credit, but that it would only take a few bad actors to cause issues. He said, “I’ve seen a couple of these deals which were rated by a ratings agency and I have to confess it shocked me what they got rated. It reminds me a little bit of mortgages [prior to 2008] … so there may be problems here. I don’t think its systemic, but I do expect there to be problems.” Dimon’s comments come a week after it was reported that JP Morgan was looking to acquire a private credit firm. Bloomberg covered JP Morgan’s exploration of acquiring $19B AUM Chicago-based private credit firm Monroe Capital. On this topic, Dimon said that he wanted JP Morgan “to be agnostic” about how it lends money, with the client choosing. “We’ll do A, we’ll do B, we’ll do C. And we’ll tell you the pros and cons of each. We’re in the mix. There are people raising big funds. We haven’t done that yet.”

💸 AGM’s 2/20: Dimon’s comments on private credit come at an interesting time both for the industry and for JP Morgan. JP Morgan’s actions in private credit, looking to acquire private credit firm Monroe Capital, highlight the strategic importance of the space for both bank and non-bank actors. Yes, it’s true that banks are subject to increasing regulation, which makes it challenging for them to compete in the growing private credit market. Yes, alternative asset managers like Blackstone, Apollo, KKR, Ares, Blue Owl, Carlyle, Brookfield, TPG, Sixth Street, HPS Investment Partners, and many others are filling the gap left by banks in private credit. And yes, both banks and alternative asset managers are finding ways through both product innovation (evergreens) and distribution to bring more investors (read: the wealth channel and insurers) into the private credit universe. It can also be true that whenever there’s a market that undergoes rapid growth in financial services, like private credit, there’s the potential for something to go awry. While Dimon makes that warning call in his remarks this week, his firm’s actions tell the story that they, too, understand the strategic importance of participating in the private credit market in a meaningful way. Other banks appear to have a focus on the space, too. Goldman Sachs just announced that they’ve raised over $20B to invest in private credit, including $13.1B from external investors into its fifth and largest senior direct-lending fund, West Street Loan Partners V. With a continued focus on private credit and managing large sums of external money to do so, which result in stable fee-based revenues that public markets investors like, Goldman has jumped out to an early lead against their competition of other banks. Peers like Barclays and Wells Fargo have gone the partnership route with asset managers to expand their capabilities in private credit. JP Morgan and Bank of America have yet to build or buy in this category. Perhaps JP Morgan’s recent actions will speak louder than their words, and they will enter the race of private credit by having a fund of their own. But they’ll have a formidable foe in Goldman Sachs to keep pace with. Goldman aims to double its private credit business over the next five years, hoping to increase AUM from $130B today to $300B. The race is on. Perhaps the larger question is whether or not the race course of the private credit industry as a whole will stay intact to enable these firms to achieve their ambitions.

📝 Has Hargreaves Lansdown seen the light? | David Stevenson, Financial Times and Hargreaves Lansdown shares surge on rejection of £5bn private equity takeover bid | Emma Dunkley, Financial Times

💡A Hargreaves Lansdown commentary in two parts, as its recent takeover bid reported by The Financial Times’ Emma Dunkley and commentary by The Financial Times’ David Stevenson combine to tell a story that relates to private markets. The evolution of traditional asset managers is a big topic for private markets. Secular trend lines and the features that now define public markets have made the waters more choppy for the businesses of traditional asset managers. They’ve had to look to private markets — or at least contemplate what it would mean to buy alternative asset managers or build private markets capabilities to supplement their current offerings. Hargreaves Lansdown, the UK’s biggest investment platform, is one such firm that is thinking about the evolution of its business amidst the backdrop of a challenging run of form over recent years and its traditional asset manager peers moving into private markets in various ways.

Financial Times’ David Stevenson shared his opinions on Hargreaves Lansdown’s latest move: launching a portfolio service providing a risk-rated fund of index-tracking fund. The UK’s champion of active fund management, with £149B of AUM and almost 1.9M active clients, has decided to offer passive investment products through a partnership with BlackRock.

💸 AGM’s 2/20: This in and of itself isn’t the most notable news when it comes to private markets. However, when taken with reports last week that Hargreaves Lansdown rejected a £4.67B takeover approach alternative asset manager CVC Capital Partners, Nordic Capital, and a subsidiary of Abu Dhabi’s sovereign wealth fund, it starts to become more relevant. Hargreaves Lansdown’s share price has had a rocky ride in recent years, in part because of a more difficult market for public equities and in part due to more efficient and cost-effective digital challengers. This takeover bid underscores the importance of wealth management as a category for private equity firms. It also begs the question as to whether private equity firms see Hargreaves Lansdown, with almost 2M customers, as a prime candidate to grow its business by adding private markets products.

If that’s the vision for the bidding private equity firms, it would match the trend. Just last week, Charles Schwab announced the launch of its alternative investment platform for individual investors for this year. This news follows firms like BlackRock acquiring $100B AUM infrastructure alternative asset manager GIP for $12.5B, Franklin Templeton acquiring secondaries firm Lexington Partners for $1.75B, and T. Rowe Price acquiring Oak Hill Advisors, amongst other acquisitions in this space. Traditional asset managers are determining their strategic imperatives across the build, buy, and partner constructs. Capital Group announced a partnership with KKR to offer private markets products to their customer base of 220,000 financial advisors.

Every traditional asset manager is thinking about how they can continue to evolve their business given the pressures on their core business. It’s highly likely that part of CVC’s interest in Hargreaves Lansdown includes the potential they see for Hargreaves to move into private markets to add to their business over time.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Fund Accountant. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Analyst. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 LemonEdge (Fund accounting) - Implementation Manager. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Director of Data Strategy. Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Net Interest Publisher & Writer, Net Interest & Retired Partner, Lansdowne Partners Marc Rubinstein provide an in-depth tour of financial markets. Listen here.

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.