AGM Alts Weekly | 6.23.24: Private markets, 15 years from now

AGM Alts Weekly #57: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London.

Last night, we celebrated my cousin’s 21st birthday (Happy Birthday, Sara!). It’s quite remarkable to think how much can change over the course of decades. Seventeen years ago, I moved to London and would spend time with her and her family. She was just starting kindergarten at the time. Today, she’s an exceptional, driven, and mature young adult who has just graduated from Imperial College with a bright future ahead.

When we are in the moment, it can be hard to think how much things can change over time. Time may appear to move slowly in the moment. But her birthday served as a reminder that people and things can change in remarkable ways over the course of longer periods of time.

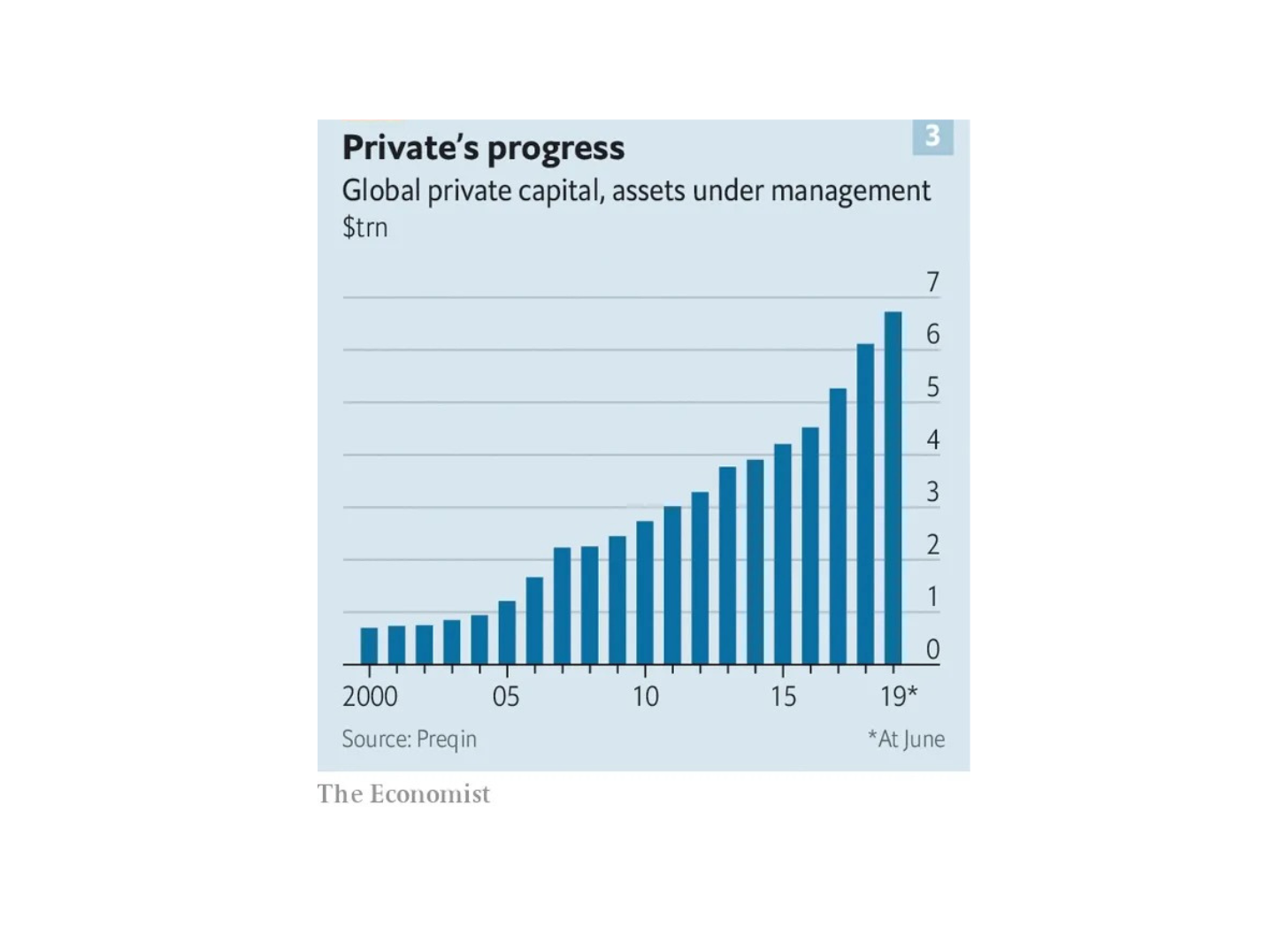

Fifteen years ago, when I was a university student at the London School of Economics running the LSE Alternative Investments Conference, I don’t think many could have foreseen just how big private markets would become. Blackstone was two years removed from its landmark IPO, so perhaps there were some early hints of a bigger industry in the making. But it would be hard to squint into the horizon to imagine the size and scale of private markets 15 short years later.

According to data from a 2020 Economist article, private markets AUM stood just over $2T in 2007.

At that point in history, Blackstone had just gone public at a market capitalization of $33.48B in August 2007 with AUM of close to $80B. The financial crisis of 2007-2009 was just months away from its early days. Today, their AUM stands over $1T.

Apollo provides another such example of how much has changed in private markets over the past 15 or so years.

Apollo CEO Marc Rowan’s remarks on the company’s recent earnings call offer an illuminating window into just how astounding their growth has been.

We've just come back from our Partners Retreat, where all 201 Apollo partners get together and we discuss the outlook. And I began those remarks by anchoring people in history. In 2008, we were $44 billion of AUM. If you fast forward, we've grown 14 times; that's faster than Apple's revenue, that's faster than Microsoft's revenue, that's faster than semiconductors. Truly extraordinary [author emphasis].

People and industries can see tremendous growth when they think in decades rather than days and months. The power of compounding is often hard to grasp in the short term, but its strength lies in the ability to demonstrate patience and consistency.

Scale begets scale. Success begets success.

Private markets, what could come next

As private markets reaches a new era, it’s an interesting thought experiment to think about what could come next.

It’s easy to focus on the relative near-term. And there’s plenty to focus on here. Private markets is certainly undergoing tremendous degrees of change, both in terms of technology innovation that’s unlocking greater access to private market and product innovation that’s providing a tailwind for firms to accelerate their growth. Themes like increased involvement of the wealth channel as a new institutional LP and the rise in popularity and creation of evergreen structures provides opportunity for meaningful industry transformation.

There are also questions about how the industry will handle the challenges of increased participation from the wealth channel. How will funds manage their pipelines and investment opportunities in evergreen structures to balance both fundraising success and the availability of quality investments? How will evergreens funds handle liquidity needs from investors while trying to navigate more attractive investment periods in the absence of an inability to deploy capital?

There are also a handful of structural mega-trends that could change the shape of private markets.

Legal & General recently highlighted four trends that could define private markets by 2030. Their predictions illustrate that the categories that shape private markets might look very different than it does today.

L&G noted some key features that are rearchitecting the global economy:

Demographics

Decarbonization

Digitalization

Deglobalization

These trends could have an indelible impact on how allocators create portfolios of the future.

L&G’s illustration of how portfolios and investment strategies could change to adapt to the four mega-trends they see shaping the future of private markets might impact how investors allocate capital. Certain industries and mega-trends will require different types of financing and risk capital in order to finance their growth. Take decarbonization as an example. Large-scale structural shifts will require meaningful capital to be invested into capital-intensive projects like battery storage, EV charging, heat pumps, and more. These projects won’t just require one type of financing structure to be completed at scale or to build and establish a market. Sometimes, they will require multiple types of financings across the capital structure. This could make allocators approach investing into these trends across the capital structure of equity and debt solutions, knowing that they could complement each other from a risk and return perspective and enable the continued development of a market.

Private markets, 15 years from now

It’s relatively easy to look out a few years on the horizon to focus on some of industry’s bigger trends and questions. It’s much harder to look out 10-15 years into the future.

But what about further out on the horizon? What could private markets look like 15 years from now?

Private markets will be greater than three times its current size today, growing to $42-45T+ by 2040

If there’s one lesson to learn from the past 15 years in private markets, it’s that the industry has grown faster and to greater scale than many would have likely predicted. Yes, certain areas of private markets may experience slower growth, and private markets certainly doesn’t have the tailwinds of lower rates that propelled much of the last decade of growth, but private markets have some features in its favor for continued growth.

First, the framework of liquidity is changing. Many investors (and alternative asset managers) are questioning liquidity in a portfolio. If investors change their mindset on liquidity, then they could increase their exposure to private markets.

Second, structural challenges for banks in private credit are giving way to private credit. And private credit firms are taking advantage of the opportunity. Apollo’s investor presentation measures the opportunity in private credit to be a $40T addressable market, ranging from auto loans and residential mortgages, to equipment finance, aviation finance, railcar leasing, and even music royalties.

Third, private markets strategies like infrastructure and real estate require meaningful capital to deploy into growing opportunities. Megatrends like decarbonization (i.e., energy transition) and digitalization (i.e., data centers) will consume large amounts of capital to finance big investment projects.

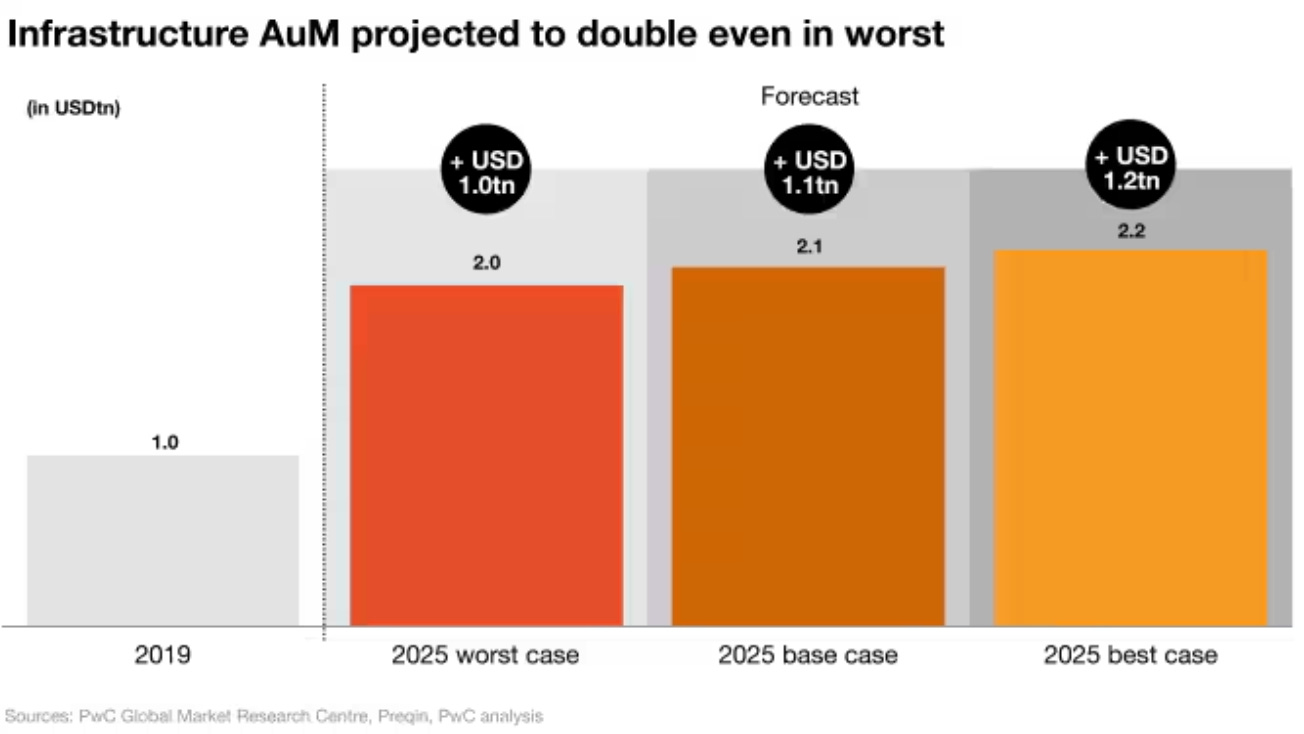

Infrastructure will become a much bigger asset class than the $1.3T it stands at today

Infrastructure has become an increasingly popular strategy in private markets for investors. KKR has outlined a number of reasons why investors find infrastructure an attractive addition to their portfolios. The growing need to match the capital demand with the supply of opportunity in digitization and decarbonization should result in a meaningful growth in AUM.

PwC projects infrastructure AUM to — in the worst case — hit $2T by 2025, which would represent a doubling in assets since 2019.

Preqin finds that many LPs are interested in increased allocation to infrastructure. In a survey of of LPs, Preqin found that infrastructure and private debt topped the areas of investment focus in the next 12 months.

The near term represents an attractive opportunity for infrastructure, but it might become even bigger than we could imagine over the long term. Preqin’s Alex Murray made the interesting observation that infrastructure allocations are eating into real estate AUM. Funds are responding in kind, with many alternative asset managers figuring out how to either leverage their real estate investment strategies to allocate to certain forms of infrastructure investments (like data centers) or raise dedicated infrastructure funds.

The recent $25B investment partnership between KKR, BlackRock’s GIP, and Indo-Pacific Partnership in Asia highlights the capital requirement to finance in large-scale infrastructure projects. I’d expect more of this to come, which will lead to meaningful AUM growth in this strategy.

An alternative asset manager will become a $500B+ company in the next 15 years

Could an alternative asset manager become a $1T company in the next 15 years? Possible, but that might be a big bet.

Could an alternative asset manager become a $500B company in the next 15 years? A bold bet, but not entirely out of the question. Right now, Blackstone might have the best shot. At $1T of AUM, could they grow their AUM to $4T within the next 15 years? That would be ~8-9% of the industry’s overall projected AUM if my $42-45T overall industry AUM projection holds true. They are around 7% of the industry’s total AUM today. If they could grow their AUM by 4x over the next 15 years and generate an additional $15B or so of EBITDA to the ~$5B TTM EBITDA today, then could they end up at $400B+ enterprise value? Not easy, but not impossible.

Landmark transactions between large alternative asset managers and long-only managers could happen

One way for a large alternative asset manager to grow and own more of an investor’s portfolio would be to expand into traditional asset management. They could benefit from the distribution, financial advisor relationships, and scale that a traditional asset manager could offer.

We’ve seen the inverse occur — for a number of reasons that make sense. BlackRock acquired GIP for $12.5B to add $100B+ in AUM and infrastructure capabilities to their already large and expansive private markets platform that will continue to drive value for them as a business. Franklin Templeton did the same with Lexington Partners in the secondaries space, and T. Rowe Price did the same with Oak Hill Advisors in private credit.

It’s less clear as to whether or not an alternative asset manager would acquire or merge with a traditional asset manager, mainly from a business perspective. Alternatives managers trade at meaningfully higher revenue and EBITDA multiples. Why disrupt that? That would be a good argument; however, if private markets become more about diversification than purely returns and alternative asset managers continue to be focused on valuing themselves on the stable and steady metric of management fee-related earnings, then it’s worth going through the thought experiment of a larger alternatives manager seeing value in owning more of an investor’s portfolio. The growth in evergreen structures could also play a role in this thought experiment. These products could sit well in a wealth client’s portfolio, so having an expansive advisor and wealth client network to distribute into could be an attractive proposition. After all, distribution is king, and in a world where AUM growth is a critical component to business success, alternatives managers will evaluate all options to grow the size and scale of their distribution network.

This thought experiment raises a bigger question: What do alternative asset managers want to be when they grow up? They are increasingly encroaching on bank’s territories in areas like private credit.

How far do they want to go? How far will they go?

Emerging categories and strategies like GP stakes and sports investing will evolve into full-fledged asset classes

GP stakes and sports investing are in the early innings of their evolution as asset classes.

There are now enough dedicated funds in both GP staking and sports investing strategies to consider categorizing them by area of focus.

GP stakes represents one example where categorization and focus is starting to occur. There are a handful of market-leading funds that focus on “large cap” alternative asset managers. Blue Owl / Dyal is the largest firm that focuses on investing in the industry’s biggest alternative asset managers. They have $55.8B AUM, mainly investing in some of the industry’s most established alternatives managers. More recently, firms focused on the middle-market and lower-middle market have emerged, such as Hunter Point, Investcorp, Bonaccord, Armen, Cantilever, Kudu, and Blue Owl’s new mid-market focused fund, and others.

As GP stakes evolves, investors will look at the space as a full-fledged asset class where they might seek to gain exposure across lower-middle market, middle-market, and upper-end of the market to access the different strategies and risk / return characteristics of the entire space. Just like we see investors gain exposure to large-cap, mid-cap, and small-cap stocks in traditional equities and buyout and lower mid-market companies in private equity, we’ll see investors access GP staking in the same manner, allocating to funds specialized in each category of the market.

A similar phenomenon will occur in sports. The space will grow to a size and scale where managers will look to specialize in specific strategies or categories — some managers will focus on equity, others will focus on debt. Some will focus on major leagues and teams, others will focus on emerging leagues and teams. Some firms will scale to do both. Others will stick to a specialization. Investors will try to access sports by investing across the spectrum of opportunities.

Private markets investments will make their way into retirement accounts

The major remaining frontier beyond insurance companies and the wealth channel is retirement accounts. The $12T sitting in 401(k) plans represents a massive opportunity for private markets to grow AUM.

Retirement accounts are the type of structures that make logical sense to be invested in private markets. Their hold period matches the illiquidity of many private markets investments. Rather, it’s been regulation that has prevented many retirement accounts from accessing private markets.

Unlocking access to retirement accounts would transform flows into private markets, marking trillions of dollars in additional capital going into private markets.

A related category of exposure to private markets could come from retail brokerage platforms. Schwab’s recent announcement about providing alts to their clients could also unlock floodgates for many individual investors. Other retail brokerage platforms and digital banks may also look to bolt on access to alternatives to their solutions. As there’s increasing innovation in product structuring and regulatory frameworks, such as the ELTIF structure (and new ELTIF 2.0 regulation) in Europe, we might see more alternatives options embedded into more traditional fintech solutions.

Big questions for the future

Private markets is just starting to figure out some of its defining questions going forward.

GPs have appeared to zero in on the next cadre of “institutional LPs” — the wealth channel and insurance companies. There are, however, questions about the staying power of the wealth channel, particularly if their first experience with private markets doesn’t go well.

Will the wealth channel continue to be a large and growing LP for GPs? For private markets to grow to the size and scale that many are predicting, the wealth channel will have to become a centerpiece of the private markets LP world. Given how underallocated the wealth channel is currently, there’s plenty of room to run — and plenty of time for the wealth channel to increase its allocation to private markets.

A related question to increased participation from the wealth channel is the evolution of asset management as a business. How much will traditional asset managers and alternative asset managers overlap going forward? Will traditional asset managers use their size and scale — and breadth and depth of wealth channel relationships — to snap up market share and AUM in private markets? There’s certainly a business case to be made for them to do so. And, as productization, particularly for the wealth channel, continues to evolve, traditional asset managers may liken the evolution of private markets to that of ETFs and mutual funds.

The coming years in private markets won’t be easy for traditional asset managers or alternative asset managers to navigate.

It’s now a new world order in investing.

The interest rate regime is different than in the past. Private companies appear to be on a secular trend of staying private longer. Increasing geopolitical tensions and deglobalization look to threaten the stability of financial markets or at the very least, make it more unpredictable. New regions of the world, which require investment in critical infrastructure and real estate, could change where capital flows and money goes. All of these features could impact the size and shape of private markets fifteen years from now. It’s hard to know what will happen that far into the future, but it’s safe to say that things will look vastly different — and likely a much bigger market — than we can imagine today.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

Building bridges between LPs and GPs: infrastructure summaries

📝 Is Infrastructure Overvalued? The Biggest Allocators Don’t Think So | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher shares views from allocators on why they believe that despite the rapid increase in capital inflows into infrastructure, they are still bullish on the space. Five years ago, the infrastructure market had just reached $500B in AUM. Today, infrastructure stands at double that figure and could double again in the coming years. BlackRock CEO Larry Fink is certainly optimistic. In his annual letter, he wrote, “In my nearly 50 years in finance, I’ve never seen more demand for energy infrastructure. And that’s because many countries have twin aims: They want to transition to lower-carbon sources of power while also achieving energy security.” That could help explain BlackRock’s landmark acquisition of Global Infrastructure Partners, the $100B AUM firm that was one of the world’s biggest independent investors in infrastructure. The acquisition was BlackRock’s largest acquisition in 15 years and have tripled its infrastructure AUM from $50B to $150B.

The increased interest and AUM inflow has led some investors to question whether the returns will remain. Thrasher notes that some research suggests the market is overvalued now, but a report by Cornell University’s Program in Infrastructure Policy and Hodes Weill & Associates finds that there are tailwinds aplenty that will continue to make infrastructure an attractive investment opportunity. “We believe that the combination of abundant capital, global government support, and anticipated rate cuts, along with the benefit of the asset class’s ‘inflation participation,’ are likely to sustain current valuation and financing metrics, including discount rates. This perspective does not downplay the risks of prolonged high interest rates or slow economic growth but highlights a crucial consideration for industry participants,” the university and advisory firm’s 2024 Infrastructure Allocations Monitor says. The CPIP program surveyed 102 institutional investors across 20 countries that represent over $8.2T of total AUM and $350B in infrastructure investments. Contrary to sentiment, the survey found that this group of investors continues to invest more in the asset class and might even be underallocated to the space.

Thrasher highlights that the average target allocation to infrastructure grew by 42 basis points to 5.5% in 2024. High target allocations were driven by Canadian institutions, which reported an average of 12.6% allocation to infrastructure, up from 8.9% in 2023. In the US, the average target allocation grew to 5.4% in 2024, which is higher than institutions in all other regions. The survey uncovered that many institutions believed they were underallocated to infrastructure. Globally, institutions are an average of 1.23% short of their target allocations. Investors in EMEA were the most underallocated, currently 1.60% below their target. Public and private pension funds reported the greatest percentage of institutions currently underallocated; with 63% and 64% of institutions, respectively. Responses from insurance companies were more balanced, with 60% at target allocation. Meanwhile, 18% of sovereign wealth funds and government agencies said they were overallocated to infrastructure.

Investors have also changed how they gain exposure to infrastructure, rotating from core infrastructure assets like electric, gas and water networks, toll roads, bridges, and railroads to infrastructure debt. Institutional investors are also taking more risk, investing in higher-risk, higher-returning investment opportunities like renewable energy assets and non-regulated airports.

📝 LPs want infrastructure exposure, despite muted fundraising | Jessica Hamlin, Pitchbook

💡PitchBook’s Jessica Hamlin reports that allocators are still looking to invest in infrastructure assets despite data from PitchBook that finds muted fundraising figures. 2024 doesn’t appear to be following the same pace as 2023 when infrastructure funds raised $120.9B in capital commitments, but Hamlin notes that they do illustrate sustained investor interest in the asset class. According to PitchBook’s Q1 2024 Global Real Assets Report, LPs committed $25.6B across 13 funds in Q1 2024. Infrastructure has dominated real asset fundraising, with 95.5% of total real asset fundraising activity in Q1 2024 coming from commitments to infrastructure funds.

The biggest funds that closed this year? KKR’s Asia Pacific Infrastructure Investors II scooped up $6.4B in commitments. Stonepeak’s $3.3B fund, which is dedicated to investments in digital infrastructure, transportation and logistics, and energy, also closed in Q1. There is more to come this year, with several large infrastructure-focused fund closes, including Brookfield’s Global Transition Fund, which has already raised $10B and is expected to have a Q3 close and KKR’s $11B Global Infrastructure Investors V fund, which is targeting a $20B figure at final close.

Infrastructure didn’t suffer from the same fundraising experience QoQ and YoY as other asset classes. VC, real estate, and debt all saw their fundraising figures decline between Q1 2023 to Q1 2024, while real assets saw a 97.6% increase.

💸 AGM’s 2/20: Infrastructure appears to be top of mind for good investors. For good reason. Investors are surely aware of the trends of digitalization and decarbonization, as well as the massive need for increased infrastructure investment in many parts of the world as governments look to modernize their infrastructure and nearshore much of their production in a world that is undergoing deglobalization. Infrastructure investing means a number of different things, and there’s massive capital requirements to meet these demands. Many institutions need to find large-scale opportunities to put capital into — and infrastructure meets a lot of those requirements from a risk and return perspective. As institutions look to meet long-term return requirements, infrastructure looks to be a good place to allocate capital to meet those needs. Thus, it’s not surprising that many of the largest infrastructure funds have had success raising capital. Infrastructure is also an area where size and scale matter. The larger funds will likely be the beneficiaries of more capital flowing into the space as they will be able to finance larger investable opportunities. That should help them from an investment perspective, and also help them from a business perspective as these infrastructure funds can grow their AUM in a meaningful fashion. GP stakes funds certainly see the opportunity. Blue Owl partnered with Stonepeak in 2023 taking a minority stake when the firm was at $55.7B in AUM at the time. I expect that we’ll see more consolidation here, as we saw with CVC acquiring €16B infrastructure manager DIF in 2023, or GP stakes funds investing into infrastructure managers that are planning to grow AUM to meet the demand from investors looking to allocate to infrastructure.

A trio of private credit articles that span both perspectives on the space

📝 Gatekeepers weigh the pros and cons of private credit | William Johnson, Citywire

💡Citywire’s William Johnson reports that private credit continues to dominate the attention of allocators as more investors look to access private markets. The numbers reveal the interest. According to Preqin, investment in private credit grew from just over $500B in 2015 to $1.6T as of March 2023. Crescent Grove Co-CIO and head gatekeeper Andrew Krei said, “It’s like the darling of the alts world I feel like at this point.” Private credit funds have existed for decades and have filled the void for many SMEs looking for financing as banks retrenched post-GFC, but Krei’s observation highlights a new era for private credit. Many allocators have private credit top of mind, despite some of the risks as more capital flows into the space and as interest rates fluctuate. J.P. Morgan CEO Jamie Dimon recently questioned private credit’s rapid expansion, particularly as more wealth channel investors allocate to private markets. At last month’s AllianceBernstein Strategic Decisions conference, Dimon fired a warning shot: “You have illiquid products, maybe they are not properly marked, they have not been properly stress tested. Do people really fully understand about interest rates affecting what these things are worth? Do they? And if a little old lady finds out that she can’t get her money back … retail clients tend to circle the block and call their senators and congressmen, there could be hell to pay.” But Citywire’s Johnson finds that many gatekeepers believe that the potential reward is worth the risk.

Some see strong-risk adjusted returns. MD, Investments at multi-family office FFT Wealth Management John Tassone sees “equity like returns” combined with a fixed-income profile. He pointed to higher interest rates as a key driver of private credit’s strong returns, with 5% base interest rates affording private credit funds the ability to deliver double-digit returns. He views private credit as more attractive on a risk-adjusted basis than equity investments. “When an investor can get net returns above 10% by making senior secured loans at the top of the capital stack, and frankly, most of that return is coming in the form of cash flow, we think that’s really attractive,” Tassone said. He doesn’t see rate cuts dampening the appeal of private credit. He noted that private credit’s spread relative to treasuries didn’t change much, even as rates have climbed.

Other allocators, like $8.4B RIA Cary Street Partners CIO Matthew Rubin, view private credit investments as a broader bet on the US economy. In his view, the exposure to US businesses is exposure to the US economy, where he and his firm have a constructive view and high conviction on the US from a broad GDP perspective.

Not all allocators are excited about private credit. SEI’s CIO Jim Smigiel is skeptical of the hype surrounding private credit. He calls the fever about private credit “unusual.” “We’re just kind of on the sidelines questioning the fact of why the hype has reached such a level when what we’re looking at is mid-teen, maybe low-teen kind of returns,” he said. He cited concerns over private credit, including liquidity, transparency of the underlying loans, and an oversupply of capital and funds. He sees CLOs as a more compelling alternative to private credit, but with more diversification and liquidity. “I can get very, very similar returns — mid-teen returns — in the CLO space, but I can get it with full transparency, [and] significantly more liquidity with a very active secondary market,” he said. He also called out concerns over new entrants into the private credit market. He noted that there are “a lot of players jumping into the space that really haven’t been involved in direct lending or private credit for quite some time. You just have to you have to be very specific about the managers that you utilize, because there’s going to be a lot of Johnny Come Latelys running into an area that there’s a ton of investor demand for.” This point calls into question whether or not there are enough quality investments to meet the amount of capital flowing into the space.

Crescent Grove’s Krei does have some private credit funds on his recommended list, but he sees better relative value in other vehicles. He also sees high rates lowering private credit’s relative value proposition. Investors now have a number of options to generate fixed-income returns, making it harder for private credit to stand out. “Now, as you can fast forward in this environment where rates have come up pretty materially within traditional liquid fixed income markets, there’s maybe not as much advantage to be had in our view within private credit right now,” Krei said.

📝 Bobby Jain Sees Private Credit Competing for Hedge Fund Money | David Ramli, Bloomberg

💡Bloomberg’s David Ramli reports that new hedge fund manager Bobby Jain has found that private credit funds are competing for allocation dollars with hedge funds as he looks to raise his new fund. Investors who used to buy bonds to hedge volatility are now looking to other asset classes for “uncorrelated” investments, Jain said at the UBS Singapore Family Wealth Forum last week. “Private credit has taken up a lot of that,” Jain said. “The theme we’re going to capture in our fund is the same disintermediation theme.” Jain, the Credit Suisse veteran and former Co-Chief Investment Officer of Millennium Management, has had to compete with other alternatives strategies as he launches his new hedge fund. He initially had ambitions to raise $10B for his new fund, which would have been the largest-ever hedge fund startup. But a challenging fundraising environment, which Jain characterizes as “not a tail wind, it’s about a flat wind,” has muted his fundraising ambitions. Jain’s fundraise could be endemic of a broader trend in hedge fund fundraising. Only 23% of family offices surveyed by UBS for its 2024 Global Family Office Report plan to increase their allocations to hedge funds, with almost half planning to keep it flat, and 12% predicting a decrease. And private credit could gather some of those assets, given interest in the space, from the wealth channel.

📝 Lazard Hunts for Private-Credit Acquisition to Boost Asset Management | Jennifer Surane, Francine Lacqua, and Todd Gillespie, Bloomberg

💡Bloomberg’s Jennifer Surane, Francine Lacqua, and Todd Gillespie report that yet another Wall Street bank is looking to add to its asset management arm by possibly acquiring a private credit firm. The $250B asset management arm of Lazard is thinking about adding private credit to its platform. Lazard CEO Peter Orszag said in a Bloomberg Television interview last week that the firm is “in the mix, evaluating lots of options” in private markets, with private credit, infrastructure, and real estate as the most likely options. Orszag, who took over as CEO of the 175-year-old investment bank late last year, aims to double revenue by 2030. Lazard isn’t the only firm that has explored a recent acquisition in private credit. J.P. Morgan was reportedly in talks to buy $19B AUM Chicago-based private credit firm Monroe Capital earlier this year but ultimately decided against a deal. Orszag expects an increase in merger activity once the Federal Reserve begins cutting interest rates. That would certainly help their advisory business, whose revenue Orszag also looks to increase. But adding AUM-gathering strategies to their asset management arm would also do the trick.

💸 AGM’s 2/20: Private credit appears to be in an interesting spot. Some investors appear to remain very bullish on its prospects and plan to allocate to the category. That’s why it’s also no coincidence that many larger asset managers are evaluating how to either acquire or launch private credit strategies to grow their firms, increase AUM, and serve clients. There are valid viewpoints on both sides of the private credit debate. If one believes that private credit now encompasses a much larger market opportunity than what was previously thought of as private credit, as firms like Apollo and Ares have shared, then perhaps the ~$1.6-1.7T of assets in the space would pale in comparison to the $20-40T market opportunity that Ares and Apollo, respectively, highlight. The other side of the coin is that any time a space sees significant capital inflows in a relatively short period, it could be cause for concern. Are there enough investment opportunities to match the amount of capital that’s come into the space? Will interest rate cuts or increases impact returns in private credit? Is the risk / reward in private credit attractive when other features like liquidity are factored in relative to other types of fixed-income investments? These are all big questions that private credit will have to figure out as the space continues to grow and mature. It is worth noting that many large asset managers and banks are considering a major foray into private credit. Acquiring an alternative asset manager is a major signal to the market that they believe private credit is an attractive investment area. It’s also a costly proposition of time, capital, and cultural fit that a bank or asset manager can’t afford to get wrong.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Mid-Atlantic, Regional Director - Vice President. Click here to learn more.

🔍 Ultimus (Fund administrator) - Vice President - Fund Accounting. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Content Strategist. Click here to learn more.

🔍 LemonEdge (Fund accounting) - Implementation Manager. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.