AGM Alts Weekly | 6.9.24: Has it all gone Pete Tong?

AGM Alts Weekly #55: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a community of private investors sharing deals, insights, and contacts.

They pursue esoteric private market deals sourced exclusively from members without any economic interests in the deals presented, and prioritize uncorrelated, off the run, emerging strategies that generate asymmetric and high yielding return profiles.

3i deals also often come with more favorable terms and lower minimums than if an individual invested outside of the network.

Learn how 3i sources & diligences investment opportunities and how to get involved as a member here.

Good afternoon from London, where I’ve just returned from a week in Berlin at the SuperReturn and SuperVenture conferences.

This week’s newsletter is a reverse mullet … a party in the front, business in the back.

Has it all gone Pete Tong?

I learned about Pete Tong the other night.

I love electronic music, probably from my time at uni in London going to Ministry of Sound, but despite my love for the likes of Above & Beyond, Tomas Skyldeberg, Paul Kalkbrenner, Armin van Buuren, and others, I was not as familiar with English DJ Pete Tong. At the risk of aging myself, it sounds like he was popular at Ministry of Sound in the 90s, which was just a few years (😉) before my time living in London.

Tong came up in conversation at a dinner on Wednesday night in Berlin as I was sitting next to Anthony Garton, a Partner at Lexington Partners. Thankfully, Anthony is British (and a wonderful conversationalist), so he was able to give me a rundown on the history of Pete Tong (sorry, Anthony, for aging you).

It so happened that Tong was also in Berlin, headlining Evercore’s event on Wednesday night, where the private markets industry gathered for its annual conference, SuperReturn.

Tong, who had an illustrious career spinning tracks around the world, including at Pacha in Ibiza in the early 2000s, is also famous due to the British saying, “It’s all gone Pete Tong,” as in it’s all gone wrong.

Perhaps Evercore struck a chord with the current tone of private markets.

The 2004 mockumentary-drama “It’s All Gone Pete Tong,” about a DJ who goes completely deaf and watches his career unfold into a downward spiral before he again finds love in both music and life, might be an apt metaphor for the state of the private equity industry.

The tone of SuperReturn appeared to be sober and realistic. The industry has gone through a gestation period over the past 12-24 months of coming back to reality, a theme that was punctuated in Berlin by many of the industry’s largest players.

Private markets look as though it could be singing to a different tune going forward, as Apollo Co-President Scott Kleinman said in Berlin this week.

I’m no Pete Tong, but I thought it would be fitting (and fun) to spin some tracks from my Spotify Playlist to match themes that were discussed in Berlin this week at SuperReturn.

AGM spinning tracks, SuperReturn EP

“Today begins for you anew”

Today, Simon Erics, Lazarusman, The Palindromes

Apollo Co-President Scott Kleinman told Bloomberg this week that “it will be tougher to see the type of returns that investors have seen in the past.”

Speaking to Bloomberg in Berlin, Kleinman shared a sobering reality with the industry:

“I’m here to tell you everything is not going to be ok. The types of PE returns it enjoyed for many years, you know, up to 2022, you’re not going to see that until the pig moves through the python. And that is just the reality of where we are.”

Kleinman’s comments echo those of his colleague, Apollo CEO Marc Rowan, who said comments a few weeks ago to the effect that investing has entered a new world order.

Rowan said at the Norges Bank Investment Management investor conference that “the past 40 years have been a period of tailwinds for financial markets.” He then called into question whether or not “any of those four things are true going forward.”

If Kleinman and Rowan are correct that private markets have entered a new phase (and there’s little to dispute their assertions), then today is a new day in private markets. Perhaps that’s been the case for over a year now as private markets have begun to digest the new normal of higher interest rates, more limited liquidity options, a slower IPO and exit market, and tougher fundraising, but Kleinman’s comments this week in Berlin do punctuate that sentiment.

And if today is a new day in private markets, then “today chances will be made.” Kleinman said as much in his Bloomberg interview. Despite the new normal in private markets, Kleinman did note that blue-chip companies will still need capital to finance their businesses as they encounter big industry and geopolitical shifts, such as “digitization, deglobalization, and the energy transition.” Private capital, in Kleinman’s view, can provide the creative solutions necessary to help these companies access capital. He sees a flight to quality, which means that larger deals might get done, as Apollo did this past week with their $11B financing deal of Intel’s new Ireland factory. A flight to quality would suggest that the decks are stacked in favor of larger firms that have the scale to deploy capital into the biggest companies and investment opportunities (something WestCap’s Laurence Tosi also said on his recent Alt Goes Mainstream podcast).

Surely, in the right categories and with ample dry powder, “chances will be made.” The question for LPs at SuperReturn? How many firms do they want to partner with, and do they have the liquidity to take the chances?

“You keep on waiting for another time. Can you keep it down, hold yourself alive?”

Keep On Waiting, Napkey, Tez Cadey

Liquidity is top of mind for LPs. That was no exception here in Berlin. LPs and GPs alike understand the challenges that face the industry with a slower pace of distributions. That sentiment was echoed by a few LPs on the panel I moderated at SuperVenture, with KfW’s Dr. Joerg Goschin, Legal & General’s Chris Hopkins, British Patient Capital’s Christine Hockley, and Heliad AG’s Ibrahim Koran all noting that liquidity is top of mind for them as they manage their portfolios of existing manager relationships and look to work with new managers.

With distributions at their lowest levels in a decade, LPs are losing patience. Perhaps the refrain from “Keep On Waiting” is playing in LPs heads. They are indeed “waiting for another time” with liquidity low and very few exits on the horizon.

The question is when will that time come? Will it come soon enough where LPs can continue to fund new commitments for GPs to “hold [themselves] alive?”

There are, however, solutions emerging. Secondaries funds are having some of their best periods of fundraising in recent years. Early this year, Lexington Partners completed a record-breaking fundraise of $22.7B for their latest flagship secondaries fund, with the current Fund X coming in at 60% bigger than its predecessor fund.

Continuation vehicles are also coming en vogue. So much so that firms like Lexington have launched a dedicated team and strategy to complete single-asset continuation vehicle transactions at scale.

Lexington has seen massive growth in the CV market in recent years. According to data from Lexington, secondary intermediaries estimate that $70B of single-asset CV transactions were completed in the past three years. More volume is on the way, with an additional $30B forecasted for 2024. Lexington, for its part, has participated in some large CV deals recently, including the $4B CV of Belron by Clayton, Dubilier, & Rice, the $3.4B CV of Apex Service Partners by Alpine Investors, and the $1.6B CV of Precisely by Clearlake Capital.

With Bain & Co. predicting 2024 to be the second-worst exit market since 2016 and over $3.2T tied up in aging privately held companies, according to Preqin data, perhaps secondaries and CVs will be what keeps the industry alive.

Despite hope in certain corners of private markets, many industry leaders are being realistic — and even careful — about returns going forward.

“Be careful whose advice you buy”

Wear Sunscreen, Mau Kilauea

The theme of wearing sunscreen can apply to many aspects of the current state of private markets.

As new investors, like the wealth channel, begin to allocate to private markets more actively, the concept of protection is important. There are a number of reasons why the wealth channel should have exposure to private markets. Certainly, many could make the case that a good portion of individuals should have more exposure than they currently do. But private markets done right for the wealth channel means that individuals and their advisors should tread carefully, particularly as many alternative asset managers are looking to build investment products to bring the wealth channel into the space.

Some of the lyrics from Mau Kilauea’s song ring true, particularly for the wealth channel and their wealth managers:

“Be careful whose advice you buy, but be patient with those who supply it.

Advice is a form of nostalgia. Dispensing it is a way of fishing the past from the disposal, wiping it off, painting over the ugly parts and recycling it for more than it's worth.”

As each firm aims to sell its wares, sharing why it believes its strategy, process, or product construct is best, it’s worth remembering to “be careful whose advice you buy.”

HgT’s Chairman of the Board Jim Strang made quite an important point about investors in his recent Alt Goes Mainstream podcast. He said that “consulting is about what you know, whereas investing is about what you think.” As LPs evaluate GPs, it’s worth understanding what’s unique and special about what they think. How can LPs do this well? Part of that answer is being careful about whose advice to buy.

Kleinman’s quotes in Berlin (mentioned above) are also a form of GPs applying sunscreen to their own firms and the broader industry. Investing, in some respects, is about expectations. Set expectations properly and allocators can justify underwriting an investment. Kleinman’s statements serve as protection for GPs from a world of possibly lower returns.

I noted the same about Marc Rowan’s comments at the Norges Bank Investment Management conference when he said: “Investors who have looked to private markets for rate of return will now look to private markets for diversification.”

From the 5.5.24 AGM Weekly: A more cynical but interesting take on Marc’s comment about pushing private markets as a diversification tool for investors? That he recognizes that more capital flowing into private markets means that returns could come down, so he’s future-proofing his firm and private markets more broadly by touting its features as a diversifier away from liquid markets rather than a pure alpha-generating investment strategy. Even if that’s the case, it’s hard to argue against the notion that private markets will likely — and probably should — become a larger part of investors’ portfolios.

“Freed from desire, mind and senses purified”

Freed from Desire, Gala Rizzatto

Across town from SuperReturn in the heart of Mitte, Berlin’s vibrant startup hub, excitement about the ability to innovate on private markets processes was abound. I spent part of the day on Wednesday with our Broadhaven Ventures portfolio company, bunch, the one-stop shop solution for founders, investors, and funds to set up and manage private markets investment vehicles.

I did a Lunch & Learn Q&A session with bunch co-founder Levent Altunel, during which we discussed a variety of topics about the mainstreaming of alternatives and how infrastructure solutions can play major role in taking private markets to the next level.

The passion in the room from the bunch team about their opportunity to innovate on private markets infrastructure was palpable.

Innovation occurs when there’s an ability to look beyond what already exists. Private markets are unique in that, in many respects, industry collaboration is required in order to move things forward. That’s certainly the case — and it’s one of the big learnings from the success of iCapital.

Evolutions power revolutions. Evolutionary change is required in order to create industry-altering revolutions.

The meaning of “Freed from Desire” according to the intent of its creator, Gala, also dovetails well with what many firms in private markets aim to achieve. Gala said in a 2024 interview with The Guardian that, to her, the song “represents resilience and alignment with your passion.” That passion intersects with the purpose that many founders and companies have to transform private markets and unlock access for more investors.

Even the larger firms in private markets have that passion to bring investment solutions to more investors. Detractors will argue that they themselves generate a lot of money in the meantime and take in fees aplenty. That might be the case, but it shouldn’t take away from the intent of what these firms’ investment solutions are meant to achieve. Apollo’s brand transformation into a “retirement solutions provider” is one such example of alignment with passion and helping investors achieve results that help them save in retirement. Apollo’s Marc Rowan talked about the importance of helping to generate returns for retirees in his remarks on a February 2024 earnings call:

These are the people in our country who need returns the most, and we force them to be daily liquid for 50 years. Why? I don't know why. I don't think there's a good reason why. And we're beginning to see cracks even in the 401(k) market of an allocation to private, which is different than an allocation to risk. But again, I think this is a very powerful trend that bodes well for our firm and for our industry.

Unsurprisingly, private wealth is a major focus for Apollo and its peers. Rowan said this past week at the Bernstein Strategic Decisions Conference that they plan to find a way to offer all sorts of investment products to the wealth channel:

“We built a third-party insurance business and then we built a third-party institutional business, a fixed-income replacement business, and you will watch us do this in retail. You will watch us do this in interval funds. You will watch us do this in ETFs.”

Yes, Apollo (and their peers) will generate meaningful revenue in the process of working with wealth. But they will also provide investors with access to investment opportunities that could be helpful additions to their portfolios at a time when the investable universe in public markets is only seeing more concentration and indexation.

Perhaps the industry realignment and a more challenging environment that now faces investors, as Marc Rowan said months ago, will help investors go back to basics, be “freed from desire, with mind and senses purified” about their goals and intentions for their end LP clients.

This week in Berlin was about the coming together of people who are passionate about moving private markets forward, whether they were startups in Mitte or the world’s largest alternative asset managers.

As the space continues to grow and as more investors become involved in private markets, will they stay invested in private markets even as the industry undergoes a realignment?

HgT’s Jim Strang remarked on his AGM podcast that “private markets are like Hotel California: you can check out any time you like, but usually you never leave.”

“You can check out any time you like, but you can never leave”

Hotel California, Eagles

Strang has a point. The fact that many investors choose to continue investing in private markets once they have invested in private markets says something about the investment profile and its returns.

That’s why this week proved that despite current challenges in the industry and significant headwinds with fundraising for many, the soul of private markets can never be taken.

“You can crack my stones and melt my steel, But you can never take my soul”

Northern Soul - Spencer Brown Remix, Above & Beyond, Richard Bedford, Spencer Brown

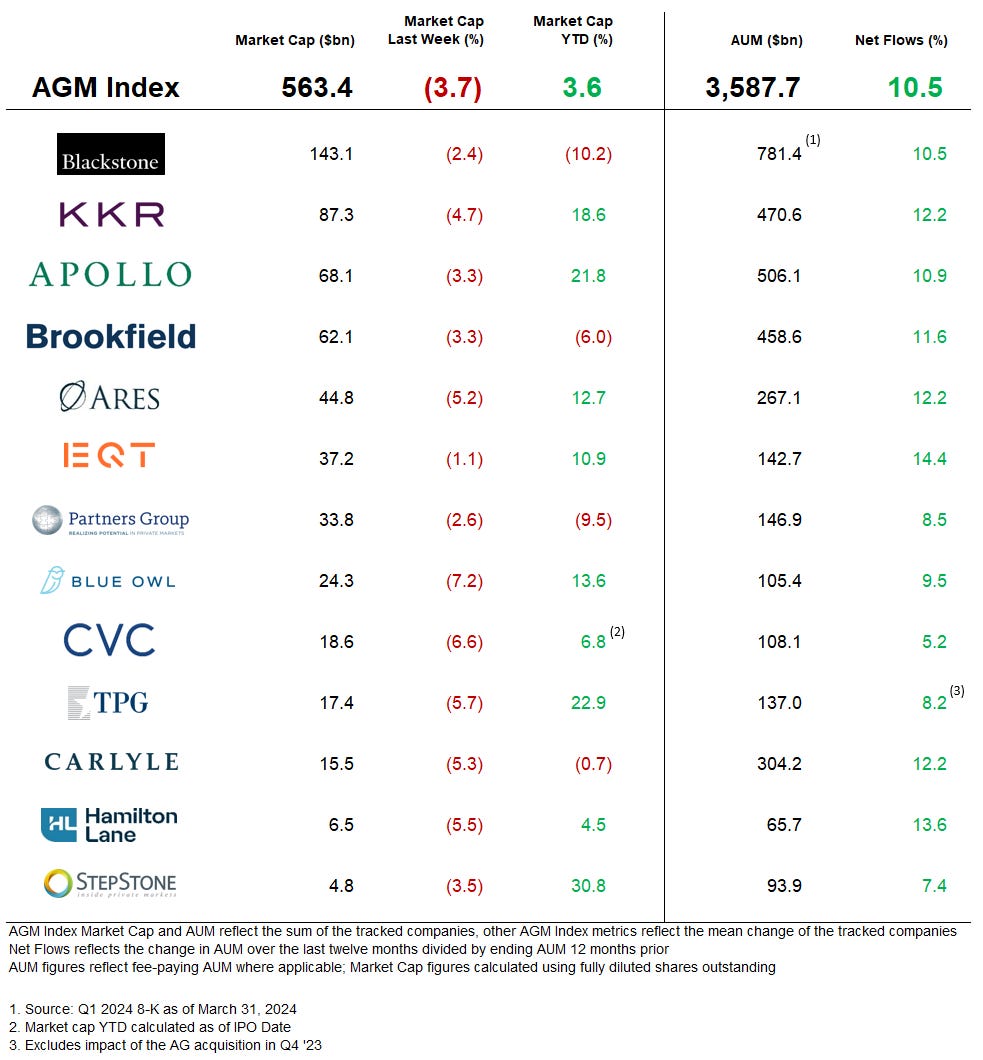

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Congratulations to KKR for entering the S&P 500. This milestone is yet another newsworthy event that points to alts continuing to move into the mainstream.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Financial data group Preqin exploring a sale | Arash Massoudi, James Fontanella-Khan, Will Louch, Maria Heeter, Financial Times

💡Financial Times’ Arash Massoudi, James Fontanella-Khan, Will Louch, and Maria Heeter report that private markets financial data and content company Preqin is exploring a sale that could value the company at over £1B. Among the firms looking at buying Preqin include some of the financial services industry’s players, including data company S&P Global and BlackRock. Preqin is apparently interested in exploring a deal with a larger rival or strategic buyer rather than being sold to a private equity firm. It’s not a surprise that larger data companies or asset managers (BlackRock also doubles as a software and data business with their Aladdin and eFront products) would be interested in Preqin, given how valuable data is in private markets. There’s likely a premium placed on private markets data due to the opacity of the market. Preqin, founded over 20 years ago by UK entrepreneur Mark O’Hare, was built to provide data on the private capital industry, including performance tracking of private equity and hedge funds, private markets data, analytics, insights, and content. Preqin claims to have the “biggest and most robust data set of private capital performance” with 48,000 customers, a research team of 500 staff, and over 200,000 professionals that use the platform. According to Companies House filings, their scale has resulted in revenues of £134M in 2022, up from £92M the year prior.

Interest in private markets and capital markets data companies has picked up in recent years. Preqin wouldn’t be the first data business in these markets to become acquired since 2020. Permira bought Reorg, a financial data vendor specializing in debt restructuring, for $1.3B in 2022, MSCI bought private markets data and analytics provider Burgiss in 2023 for over $1B, and S&P Global bought IHS Markit for $44B in 2020.

💸 AGM’s 2/20: Data is a huge piece of the puzzle if private markets are to continue to expand into the mainstream. Data is still relatively hard to come by in private markets. There is a lack of uniformity in data, imperfect datasets, and challenges with efficiency and quality of data. This can become particularly challenging for GPs and LPs in activities such as fundraising and performance evaluation. Firms that are able to both gather high-quality data on funds and fund performance and bring LPs and GPs together to drive efficiency in fundraising activities can be very valuable businesses. News of a potential Preqin sale serves to highlight this sentiment.

When MSCI acquired Burgiss in August 2023, I wrote about the value of data in the AGM Weekly. Data is very much the new oil in private markets.

From the AGM Alts Weekly 8.20.23: “Data is the new oil,” declared British mathematician Clive Humby in 2006. Like oil, data itself may not be useful in its raw state. But that doesn’t mean it lacks value. Like oil, data needs to be refined and processed to be made into something useful. Like oil, data’s value lies in its potential. And this week, MSCI made a move that signals the potential of data for private markets.

We saw one of the world’s largest financial data companies, MSCI, a $41B company, make a big bet on private markets.

We now have yet another unicorn alts business: MSCI bought Burgiss for over $1B.

Burgiss, which boasts over 1,000 clients, provides investors with private asset data, analytics, and software. Offering coverage of over 13,000 funds that have collectively invested $15T across various private markets strategies, Burgiss is a leader in private markets data and analytics.

This week’s transaction, where MSCI acquired the remaining 66% of Burgiss for over $697M, represents a major development for private markets.

For private markets infrastructure to continue its evolution that will ultimately look more like public markets, data and analytics must be at the center of this transformation (see here for an infographic from MSCI’s presentation on the acquisition).

Standardization of data and performance in private markets will make it easier for investors to evaluate, allocate, and monitor alternative investments. This, in turn, enable investors to make better and more informed decisions around asset allocation across public and private markets.

Continued investment in and innovation around private markets data solutions will streamline the process of evaluation and investment into alternative investments. It’s also worth noting that content has value here, too. Education of investors is another important piece of the puzzle for the continued evolution of private markets. Data and analytics factor heavily into the ability to educate investors on private markets. News of a potential Preqin sale only furthers this notion, as data companies or even large asset managers like BlackRock could continue to build out their expansive capabilities in private markets by acquiring a firm like Preqin.

Congratulations to the Preqin team on the valuable and important business they’ve built. It’s an integral piece of private markets and will continue to play an important role in the growth of alternatives.

📝 13% of VC firms aren’t planning to raise another fund | Rosie Bradbury, PitchBook

💡PitchBook’s Rosie Bradbury discusses data from PitchBook’s semiannual VC Tech Survey of 53 VC investors that finds 13% of venture GPs don’t plan to raise another fund. In the midst of a challenging fundraising environment, PitchBook’s survey, where 50% of the managers that participated have AUM <$50M, reveals that many funds pushed back their plans to re-enter the fundraising process — and double the number of GPs don’t plan to raise a new fund compared to H1 2023, when 6% said they didn’t plan to raise another fund. Bradbury notes that many of the GPs who have pushed back or scuttled plans to raise a new fund were emerging managers who came into the venture market in 2019 and 2020 when LP sentiment and liquidity were different than today.

Even firms that are out raising are generally having a more difficult time. Many managers have been attempting to raise funds without cash distributions. The corresponding activity has been an uptick in the secondaries venture market as GPs look to show returns as they go out to fundraise.

Despite the fundraising challenges for GPs and a general lack of liquidity amongst the LP community, GPs polled in the PitchBook survey expect the 2023 and 2024 vintages to be the strongest return years dating back to 2019.

Some other interesting findings from the survey relate to the increased optimism of VC funding activity, particularly in the US and Europe.

💸 AGM’s 2/20: PitchBook’s survey highlights the challenges that many emerging managers are facing with a new normal in the VC world. The VC market’s reckoning over the past few years has felt the shockwaves reverberate throughout the market, with smaller and emerging managers being hit the hardest. That certainly explains why a meaningful portion of fund managers don’t plan to raise another fund.

There was one concerning response from the survey that speaks to a new world order in venture — and highlights the question of what will make a good investor going forward. 50% of respondents viewed a “decline in interest rates” as “one of the three most important factors to driving an increase in IPO activity.” Yes, a decline in interest rates could certainly lend itself to a “risk on” environment where investors might roll more exposure into higher risk but possibly higher returning equity investments. However, the fact that many of the managers surveyed listed that as one of the most important factors for IPOs and return generation calls into question something much bigger: investment skill versus market environment. Market timing, particularly around knowing when to time exits, is a particularly important skill for investors. Interest rate changes might have the most protracted impact on exit outcomes in venture (and private equity). But therein might lie an issue. The investment world is unlikely to feature the low level of interest rates that the industry saw for the past decade. Investors will have to care more about entry price on valuation and will have to focus on investing in companies that have high-quality metrics and operating efficiency. No longer can investors rely on external market forces like multiple expansion or interest rate changes to generate returns. LPs should take note of this shift as well. It will take a discerning eye to identify the VC fund managers that have the skill, not just the luck of being in the right market at the right time, to generate returns. It’s also worth noting that interest rates may not decline as fast as was previously expected in the US. Apollo’s Co-President Scott Kleinman noted this point in his talk with Bloomberg in Berlin this week. Kleinman said that the strength of the US economy despite higher rates has resulted in less action taken on lowering interest rates. That could very well continue if the US economy continues to perform, which might have an impact on the exit environment for VCs.

📝 Investors revive enthusiasm for European tech start-ups | Tim Bradshaw, Financial Times

💡Not all venture firms appear to be facing headwinds with fundraising. Financial Times’ Tim Bradshaw reports that one of the more established European VCs, Creandum, raised a new €500M fund in “record time.” It surely didn’t hurt that Creandum’s track record has included early investments in Spotify, Klarna, and Depop, amongst others. Creandum isn’t the only branded and experienced fund to raise similarly sized funds in the current environment. Creandum’s success follows Accel Europe, which closed on a $650M fund last month, and Plural, the fund founded by the founders of Wise and Songkick, which raised €400M in January. Creandum General Partner Carl Fritjofsson said that their fundraise “in record time” signals a “dramatic change in the sentiment, appetite, and activity in the industry.” Other European VCs echo Fritjofsson’s sentiment. Atomico’s Tom Wehmeier observes that the region hasn’t “fully washed through the overhang from the peak years but the green shoots are all around us. We are moving beyond the recovery phase and back into a period of growth.” Wehmeier predicts that private tech investment into European start-ups will return to growth this year. This comes after larger US crossover and growth funds like Tiger Global and Coatue pulled back on European dealmaking. Wehmeier notes that “the market is more active at any point than we’ve seen before 2021. Data suggests that there have been three successive quarters of increased investment in Series B deals (anecdotally, we’ve seen this play out at Broadhaven Ventures as well, as Flatpay, one of our portfolio companies, raised a $47M Series B in April led by Dawn Capital after raising a Series A the year prior). Bradshaw notes that some Silicon Valley investors have returned and even planted a flag in Europe in recent months, with Andreessen Horowitz and IVP opening up offices in London.

Creandum, for its part, has performed extremely well, so perhaps it shouldn’t come as a surprise to see them achieve a successful fundraise. Between 2007 and 2021, Creandum made back almost 7x what it invested. One in every six companies it has invested in has hit a $1B or greater valuation. Jon Biggs, a Partner at one of Creandum’s LPs, Top Tier Capital Partners, said that Creandum’s returns answer the question as to whether or not European VCs could generate returns that match their Silicon Valley peers. Biggs noted, “The firm is comfortably at the top table of global VCs.”

💸 AGM’s 2/20: Creandum’s success shows is reflective of a broader industry trend that has appeared to be the case — both in venture and private equity. Brand matters. In a tougher fundraising environment, LPs seem to favor experience, brand, and known entities over less established firms. Creandum’s performance certainly didn’t hurt its case in fundraising. Their performance has been elite. If they can repeat that performance with this new €500M fund, then LPs will end up with the best of both worlds: top performance in a larger fund that is theoretically safer than allocating to an emerging manager or smaller fund. LPs seemingly harbored a similar sentiment with European buyout funds. Two funds, CVC and Hg, raised half the LP capital that went to European buyout funds. CVC’s record €26B fund is a staggering figure and only hammers home the theme of how much brand and scale can matter in private markets. I believe that this viewpoint will continue to persist as contraction and consolidation occur across private markets. The current environment in the industry favors brand and scale. I don’t see that going away anytime soon.

📝 Watford FC Looks to Sell 10% of Club by Offering Stake to Fans | David Hellier, Bloomberg

💡Bloomberg’s David Hellier reports that EFL Championship club Watford FC is looking to sell 10% of its club to fans and investors. This share sale is a rare case of a larger UK soccer club selling a stake to smaller investors. The club has partnered with Republic, a global investment and private markets infrastructure firm (note: Broadhaven Ventures is an investor in Republic), to facilitate the sale. While the Watford investment won’t be the first football club to raise money on the Republic platform, it will be the largest club to do so. Republic, which bought London-based crowdfunding platform Seedrs in 2022, raised capital for lower league clubs AFC Wimbledon and Dorking Wanderers FC. Allowing fans and smaller investors to own equity in a club is a newer phenomenon for many football clubs. In the past, some clubs, like Bolton Wanderers and Queens Park Rangers, have borrowed from fans in recent years, but many clubs have yet to open up their cap tables to equity investment. Watford, a former Premier League club, is no small club, and a profitable one at that. 2023 revenues were £66.2M ($84.6M), and the club made £24M in profit, including revenues from player transfers. This equity offering with Republic will value Watford, which is owned almost entirely by the Pozzo family, at £175M. The sale will be consummated via a digital token offering. Republic, which enables investors to access private markets investment opportunities at as little as $10, will leverage its digital, cross-border, and compliant investment infrastructure to enable fans to own digital equity in the form of ordinary shares in Watford FC.

💸 AGM’s 2/20: Tokenization is becoming increasingly popular as a way to enable investors to access private markets and as an efficient and cost-effective way for issuers to manage larger numbers of smaller investors. A few weeks ago, iCapital announced the launch of its distributed ledger technology. This week, it’s Republic partnering with Watford FC to enable investors to own equity in a soccer club. Such activity might suggest that we are on the cusp of more mainstream adoption of tokenized investment offerings. Certainly, for sports teams, this could be a clever way to engage fans and build community. This tokenized investment is for digitally represented equity in Watford FC, but both Republic and Watford note that it could include tokens and other exclusive offers. Sports represent one of the more interesting opportunities for tokenized investment products. Investors really haven’t been able to participate in ownership of sports clubs except in a select few cases. Now that the infrastructure’s been built to enable this to happen, and with proof points of teams consummating transactions in this way, let’s see if other sports clubs look to use tokenization as a way to build even deeper fan engagement with equity and ownership.

📝 KKR, GIP, Indo-Pacific Group Form $25 Billion Regional Infrastructure Tie-Up | Kimberley Kao, Wall Street Journal

💡WSJ’s Kimberley Kao reports that a coalition of investors led by KKR, Global Infrastructure Partners, and the Indo-Pacific Partnership for Prosperity have committed to invest $25B in infrastructure in the Indo-Pacific region. The investments will focus on large-scale projects in capital-intensive sectors like energy and environment. KKR and GIP will co-chair the initiative, which will also include investors like Singapore’s Temasek Holdings and GIC, Allied Climate Partners, BlackRock, and The Rockefeller Foundation. Initially, investments will focus on scaled infrastructure across energy, transportation, water, waste, and digital sectors. Investment activity aims to activate these investments in the emerging market economies of the Indo-Pacific Economic Framework for Prosperity (IPEF). The IPEF was formed in May 2022 as an initiative among countries, including the US, Australia, Japan, and Singapore, to help grow the economy in the region. The initiative has a focus on advancing supply chains, clean economy, and a fair trade and economy. There appears to be ample opportunity in the region to deploy capital. Singapore’s trade ministry said recently that over $23B in sustainable infrastructure investment opportunities had been identified at an IPEF investor forum that it organized, according to WSJ’s Kao. “Of these, 20 investment-ready projects worth about $6 billion were presented to investors,” the ministry said in a statement. “Remaining projects worth about $17 billion were also identified as potential investment opportunities in the future,” the ministry said.

💸 AGM’s 2/20: Infrastructure appears to be an investment strategy within private markets that is at the intersection of critical need and compelling investment returns / features in the current market environment. With inflation sitting at levels higher than average, infrastructure has become an attractive inflation hedge and “shock absorber,” according to KKR. The opportunity in infrastructure could possibly be even more compelling in regions where the need for infrastructure development is pressing. That’s certainly the case in Asia, where The Asian Development Bank estimated in 2022 that approximately $1.7T would have to be invested annually into infrastructure across the region through 2030 if the region is to maintain its economic growth, battle poverty, and mitigate climate risk, according to a report by PwC. The KKR, GIP, and Indo-Pacific Partnership for Prosperity represents a quite capable tie-up to help further infrastructure in the region. That’s $161B+ of collective AUM in infrastructure managed by KKR ($61B) and GIP ($100B), so the region should benefit from experienced investors looking to finance critical infrastructure for the region. LPs have also expressed interest in infrastructure — for good reason. Infrastructure investments can be viewed as an inflation hedge. And, in certain areas and regions, there’s also the potential for upside. Infrastructure represents a natural inflation protection from investing in hard assets. According to KKR, infrastructure can also serve as a macro hedge, retaining value through various economic cycles.

Large-scale assets that have strong market positions can be hard to replicate or replace, creating big barriers to entry. It can also help when there are good relationships with government, which appears to be the case in this tie-up in Asia. Governments and sovereign wealth funds appear to be in support of this partnership, which should offer the investment firms an advantage in both sourcing and partnering with the public sector to create investment success.

An interesting question arises from this particular investment opportunity in Asia. KKR noted in their 2023 white paper on infrastructure investing that “not all infrastructure is created equal.” What do they mean by that comment? They believe that the performance of some assets is linked closely with economic expansion. That begs the question: how much of this bet on Asian infrastructure is a bet on economic expansion? Many of the economies in the region are growing economies, where some infrastructure investments, like airports, toll roads, ports, and energy, could depend on volume and usage, which are privy to economic conditions or trade activity. This could very well be a worthy bet to make on a number of levels. Asia is a region that has plenty of economic promise. As economies evolve and grow, they have real infrastructure needs, particularly around the transition to clean energy, transportation, water, waste, and digital infrastructure. That makes for both a compelling investment opportunity and one that could generate plenty of positive unintended consequences for the region and world more broadly.

Reports we are reading

📝 Hamilton Lane Private Wealth Survey Insights | Hamilton Lane

💡 Hamilton Lane surveyed 232 investment advisors on private markets to gauge their interest in private markets. Some relevant data points and interesting insights from the survey include:

Over 90% of survey respondents currently allocate client capital to private markets.

99% of surveyed investment advisors plan to allocate some portion of client assets to private markets.

52% of advisors report that they plan to allocate 10%+ of client portfolios to private markets.

70% of advisors plan to increase client allocations to private markets compared to 2023.

Top reasons for an interest in allocating to private markets? Performance and diversification.

There’s a clear knowledge gap between advisors and clients (in the eyes of advisors) about private markets. 97% of advisors report either advanced (55%) or intermediate (42%) understanding. But 50% of advisors rate clients’ knowledge about private markets as beginner level. Only 4% of advisor rated their clients’ knowledge about private markets as advanced.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Fund Accountant. Click here to learn more.

🔍 bunch (Private markets infrastructure platform) - Strategic Partnerships Manager. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Analyst. Click hear to learn more.

🔍 LemonEdge (Fund accounting) - Implementation Manager. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Director of Data Strategy. Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Net Interest Publisher & Writer, Net Interest & Retired Partner, Lansdowne Partners Marc Rubinstein provide an in-depth tour of financial markets. Listen here.

🎙 Hear Aduro Advisors Founder & CEO Braughm Ricke discuss how he built a a fund administration business and how he uncovered the emerging manager trend early on. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane, Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.