AGM Alts Weekly | 7.21.24: A long-term time horizon in a short-term world

AGM Alts Weekly #61: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good evening from London, where I’ve just arrived from New York.

Straddling complexity and simplicity

The hard parts of private markets are in the nuances. LPs face a number of seemingly simple questions that, in actuality, have so many layers to them. How much should you invest? When should you invest? When should you exit? When should you reinvest?

Investing is hard, but it can also be made simple. The art of investing lies somewhere between complexity and simplicity. The best investors and allocators seem to understand just how hard it is to invest well but also seem find a way to make it simple.

One of the simplest things investors can do is allow their capital to compound. It’s also the hardest thing to do.

Partners Group’s Rob Collins said as much in his recent podcast on Alt Goes Mainstream:

Partners Group Rob Collins [14:33]: “And it gets to compounding. So the most important thing Mr. Munger would say is the first rule of compounding, never interrupt it unnecessarily. This is what it's about. If you're compounding with an evergreen fund consistently, it is extremely attractive relative to that commingled fund.”

Generating 12% average annual returns isn’t easy. But over a 10-year time period, a 12% annual IRR would be a 2.9x multiple on invested capital, according to the above chart from Partners Group, a $147B AUM alternative asset manager that has been a pioneer in evergreen fund strategies.

The best investors in the world are the best in the world for a reason — and it still remains difficult for them to consistently generate mid-teens returns. But it is possible.

Private equity has tended to generate mid- to high-teens returns, as this chart below from Blackstone highlights. This return profile is particularly so for the highest quality fund managers and brands.

Evergreens are not always the answer for every investor at every moment in time, but employing evergreens as a way to both gain immediate exposure to private markets and compound capital can certainly become part of a private markets investing strategy. It’s increasingly becoming a tool of choice for the wealth channel to gain access to private markets in a simplified, streamlined fashion.

Much of the power of evergreen funds lies in their structure. We’ve talked about the how and the why of evergreen structures in the past (here and here).

Evergreens are now being adopted by both individual investors and institutional investors alike. That’s now becoming a defining feature of private markets today.

I think both alternative asset managers and wealth advisors understand the intent behind evergreen structures and why they can make sense for investors.

Infinite time, infinite responsibility

I want to elevate the conversation on evergreen structures to a different, more conceptual level. They represent perspective. They represent something infinite.

At least for me, the power of evergreen structures really lie in their ability to force us to think about the meaning of time.

What if we thought about time differently? Rob from Partners Group captured this concept so eloquently in his AGM podcast:

Rob Collins, Partners Group [23:38]: If you think about the responsibility a manager has with an evergreen fund, it's not a three-year investment period or four-year investment period. I call it an infinite responsibility. We're being entrusted for decades with this capital. So we have to have the flexibility and the scale and the discipline to do that. We're taking in capital on a regular basis and we have to be able to put that capital to work in the right part of the market, every minute, every hour, every day, every week, every month. We have to be thinking about what's the best use of those dollars that are coming from clients or coming off the existing portfolio. And then we have to diversify that. We have to keep it invested, diversified consistently through time. That's not for every fund manager. So you need to have flexible investment engine. You need to marry that investment acumen in terms of selecting the right companies, the right assets with portfolio management capabilities, which you didn't really have to deal with, with a commingled fund. You need to tackles all of the operational considerations, whether that's valuation policy or just capital flows. enormous differences. I think that's why you've seen many of the earlier movers have come from, the larger platforms that have the resources, the capabilities to invest in the business to build out maybe the missing capability here or there that they need to have in order to deliver evergreen funds.

Evergreens have an infinite time horizon. That comes with an infinite responsibility for the fund manager.

A long-term time horizon in a short-term world

But how should fund managers and investors think about a long-term time horizon in a short-term world?

Increasingly, younger investors expect short-term gratification and short-term gain. The data on retail trading tells a story. During the first six months of 2020, individual investors accounted for 19.5% of all shares traded in the US stock market, according to a WSJ article that cites data from Bloomberg’s Head of Market Structure Research Intelligence Larry Tabb. This figure is almost double that number from a decade prior. The early part of 2023 saw even more activity than the pandemic from retail traders. JPMorgan data found that retail investors represented 23% of total trading volume from January 25 to February 1, 2023, according to a Forbes article.

Social media and the gamification of financial services with beautifully designed and engaging mobile apps that allow for trading might not explain this entire trend, but they are certainly responsible for part of this investor behavior.

Evergreen structures preach the power of patience and inaction. Retail brokerage apps encourage action and activity. But is the short-term dopamine hit really worth it? Evergreen structures may prove to save investors from themselves with the very nature of their long-term time horizon, enabling compounding that is much less likely to occur from trading in and out of assets.

The bigger question? What should fund managers do to market their funds to this next-generation investor?

Funds that are trying to raise capital through evergreen structures aren’t just up against selling the performance of their fund and their brand against other evergreen funds.

They are competing with the habits and boredom of investors, many of whom have grown up “social,” expecting dinner to be delivered to their door in minutes, a car to pull up to the curb in seconds, friends and followers to like their posts right away. These investors are conditioned to experience the dopamine hit of gratification in an instant. How can they possibly think about doing something in the present and waiting 20 years to realize the results?

It will only be a matter of time before younger individual investors start to invest in private markets. Yes, I recognize that it’s possible that investors — even younger ones — will be able to bucket their investing activities into short-term trading and long-term investing.

Despite the possibly different behavior of younger individual investors, I’m not worried about alts managers’ ability to attract meaningful wealth channel capital into evergreen structures. The majority of the flows will come from private banks and advisor-led activity. But, managers need to think about how to build the right brand to appeal to the individual investor, who will undoubtedly have the indelible imprint of a more volatile financial market and social investing experience that they cannot escape.

The paradox of time

Evergreen structures also give rise to another juxtaposition with the meaning of time.

Evergreens are in theory infinite. They are timeless. From a conceptual framework, there is no end date. They favor those who have the power of patience on their side.

But how do we balance patience with urgency?

Nothing lasts forever — at least in the physical sense. Unfortunately, our family experienced that this week. My 94-year-old grandfather, who, even at his age, went to work in his antique store every day. He would ask me for daily updates on Alt Goes Mainstream. He would call every Sunday to talk about what I wrote about that week. Today, I won’t get that call.

How do we have an infinite time horizon and have the patience to wait for the power of compounding — in investing and in life — to take hold, but also balance that mindset with the awareness of a finite time period?

Steve Case, Founder of AOL and Revolution, summed it up so eloquently in his podcast on Alt Goes Mainstream, when he was talking about his late brother, Dan, the CEO of pioneering venture firm and investment bank Hambrecht & Quist:

Steve Case, Revolution [56:00]: I think it should be a reminder to all of us that we need to play the long game, but we also have to make sure we don't take for granted that we'll be here forever. And that creates a little bit more urgency, I think, for all of us to have the kind of impact and whether it be in our families and our communities and in our businesses and whatever organizations we get involved in. And be optimistic about the future, but don't be presumptuous that you're going to have an unlimited future.

If we knew the end date, how would we invest differently — and, even more importantly, how would we live life differently today?

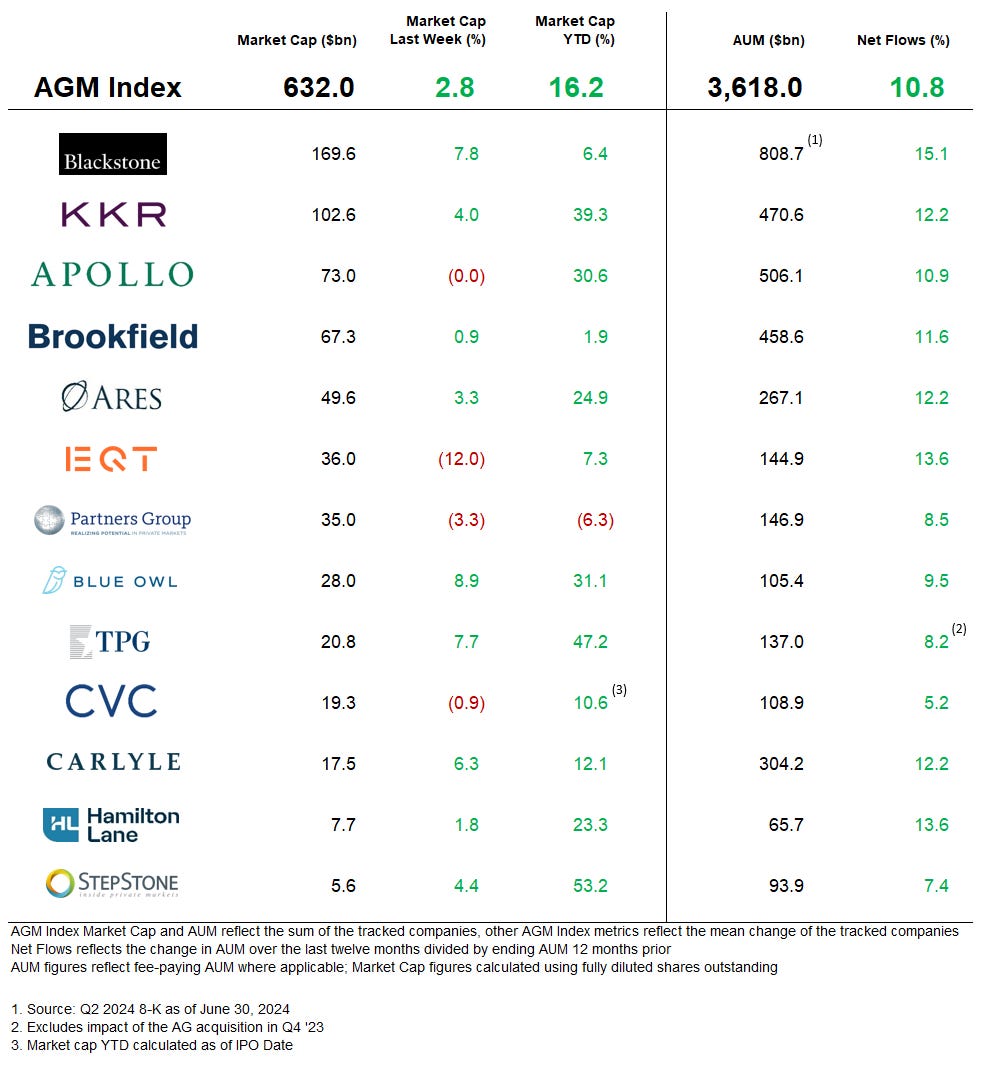

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Blue Owl to Buy Atalaya in Deeper Push Into Private Credit | Sonali Basak, Sridhar Natarajan, Gillian Tan, Bloomberg

💡Bloomberg’s Sonali Basak, Sridhar Natarajan, and Gillian Tan report on another major acquisition in the alternative asset management space. This week, Blue Owl acquired credit manager Atalaya Capital Management, a $10B AUM firm, for an initial $450M and up to $800M in total consideration. Blue Owl’s purchase of Atalaya is their third significant acquisition as they continue to build out their $174B AUM platform, representing a total of $1.7B spent on acquisitions (including earnouts). Blue Owl’s Co-CEO Marc Lipschultz highlighted the importance of their continued quest to comprehensively cover private credit. This deal, along with their acquisitions of insurance asset manager Kuvare and real estate finance firm Prima Capital Advisors, is “about positioning Blue Owl to be a full service provider, the full spectrum provider, across the private credit marketplace,” Lipschultz said on a Bloomberg TV interview on Tuesday. The acquisition of Atalaya represents a big move into the asset-backed credit market. Lipschultz characterizes the space as a “very big market … the marketplace for asset-backed credit is about $7 trillion. So mathematically it is bigger than the syndicated loan market.” Atalaya’s Founder Ivan Zinn, who will become Blue Owl’s Head of Alternative Credit, said they “view Blue Owl as an ideal strategic partner to support the next stage of [their] growth.” This tie-up with Blue Owl is not Atalaya’s first relationship with the acquiring firm. Atalaya was already part of the Blue Owl ecosystem, selling a minority stake in 2017 to Dyal Capital Partners, which is now part of Blue Owl as the GP Strategic Capital division. Since their minority stake sale, Atalaya’s assets have quadrupled. This acquisition means a further foray into asset-based finance for Blue Owl. The ABF market is quickly becoming a major area of focus for funds in private credit, and the Atalaya acquisition, which will add 115 employees to Blue Owl’s platform, will bring Blue Owl’s total headcount to almost 1,000 employees.

💸 AGM’s 2/20: Blue Owl’s acquisition of Atalaya marks another major development for private markets. Two signals of significance come out of this acquisition. One, the acquisition illustrates an intensifying focus on a big and growing area of private credit: asset-based finance. ABF is a large component of the $40T addressable market in private credit that Apollo’s March 2024 Investor Presentation illustrates.

As banks are structurally hindered from lending activities, private credit firms are stepping in to fill the gap vacated by banks. This feature of the market means that private credit firms are all vying to grow their market share, which makes sense of Blue Owl’s acquisition of Atalaya. There’s a second component to the foray from alternative asset managers into private credit — and ABF in particular. Their risk and return characteristics are appealing to investors. The characteristics of ABF — secured assets that offer portfolios of cash-flowing assets — are popular amongst investors. This statement is supported by the fundraising data points. The majority of the $1.8B of fee-related revenues generated by Blue Owl in the 12 months through March came through credit. The acquisition of Atalaya should only serve to strengthen Blue Owl’s capabilities in private credit. The firm has made more than 500 investments in asset-based deals, and has done a lot of investing in consumer credit card receivables and auto loans. Atalaya closed on $1B of a $2.5B fund in June 2024 that included a number of institutional investors, including pensions like San Francisco Employees’ Retirement System, the Florida Retirement System Pension Plan and the Public Employees Retirement Association of New Mexico.

Another aspect of the acquisition is notable. It relates to Lipschultz’s comments about aiming to continue Blue Owl’s transformation into a “full spectrum provider in the private credit marketplace.” Blue Owl’s recent acquisitions illustrate that they intend to continue to try to expand their platform. This strategy would align with two aspects of why being a multi-strategy firm makes sense: one, it enables for better cross-sell of LP relationships, allowing for the ability to own more of the LP’s wallet share allocated to alts and, ultimately, further AUM growth. The industry is continuing down a path of platformization, where one-stop shops will succeed in the business building aspects of private markets. Multi-strategy firms also tend to command better valuation multiples than single-strategy firms, so continued expansion of their platform should only serve to strengthen their enterprise value.

📝 Bob Iger and wife Willow Bay strike record deal for US women’s football club | Sara Germano, Financial Times

💡Financial Times’ Sara Germano reports that earlier this week, Disney CEO Bob Iger and his wife, Willow Bay, agreed to buy a controlling stake in the US National Women’s Soccer League (NWSL) club Angel City FC at a valuation of $250M. This deal represents a record price paid for a women’s soccer club, making it the world’s most valuable women’s sports team. The deal highlights the increasing popularity of sports investing, particularly with women’s sports. As an increasing number of sports teams take in financing from institutional investors, this deal follows investments from funds Sixth Street, who committed $125M to buy Bay FC, including a $53M expansion fee, and Carlyle, who paid a valuation of $58M to purchase the Seattle Reign FC. LA-based Angel City FC was founded in 2020 and was the NWSL’s ninth franchise. Since then, the league has grown to 14 clubs and has already approved a number of other expansion teams. Bay, the dean of the University of Southern California Annenberg School for Communication and Journalism, will serve and control Angel City’s board of directors and represent the club at the NWSL board of governors. Bay and Iger will invest an additional $50M to “support the club’s future growth,” according to a team statement. Iger’s involvement is certainly interesting from a media perspective. He rejoined Disney as Chief Executive in 2022, having previously served as CEO from 2005 to 2020. Disney owns the sport-focused cable network ESPN and free-to-air ABC and was the largest provider of linear sports content in the US last year. The NWSL, which recently closed a new media rights agreement, has agreements with ESPN, Paramount’s CBS, Amazon Prime Video, and Scripps Sports.

💸 AGM’s 2/20: Sports investing appears to be going from strength to strength. This is particularly so for women’s sports. The rapid rise in women’s sports valuations is largely due to the untapped opportunity that individual and institutional investors see in front of them. Take it from $29B AUM Palmer Square Capital’s Co-Founder Chris Long, who also bought the NWSL’s Kansas City Current, who said on a recent Alt Goes Mainstream podcast that “it’s like buying the Boston Celtics in the 1960s.” Franchise values have skyrocketed in recent years. Carlyle’s acquisition of Seattle Reign FC for $58M represented an ~18x increase from the club’s $3.51M valuation in 2019. As I wrote in the 3.31.24 AGM Weekly, investors are taking because the numbers are making dollars and sense.

The NWSL’s new broadcast deal, which will show 118 matches nationally this year, up from six in the prior deal, is 40 times the value of the previous agreement. The four-year, $240M contract with CBS Sports, ESPN, Prime Video, and Scripps Sports will mean that matches are shown much more frequently and much more prominently than in years past.

That’s music to sponsors’ ears. Sponsors now have a front-row seat to marketing to a new demographic, one that happens to be loyal, digitally native, and engaged.

According to data from Zoomph, fans of women’s sports are significantly more loyal than general sports fans to brands who invest marketing dollars into sports they follow.

Women’s sports fans are digitally native, savvy, care about purpose-driven topics, and, crucially, often control household spending.

Media rights and sponsorship have turbocharged revenue growth for many teams in the league. “You’ve got a media company, not just a sports team,” as $12.5B AUM Avenue Capital’s Co-Founder Marc Lasry said at the SALT iConnections Conference in May 2023. Lasry has a point — sports is really the last frontier of live, unscripted content, which makes it an attractive media property. It can engage fans in a number of ways — and also create a level of customer loyalty that many other companies would dream of. Between media rights, which have components of recurring revenue contracts, and engaged fandom that leads to ticket and merch sales, sports can look like an attractive investment — if investors and ownership can do it right.

📝 BlackRock’s private market ETF ambitions draw scepticism | Steve Johnson, Financial Times

💡Financial Times’ Steve Johnson covers BlackRock’s acquisition of private markets data business Preqin and asks what exchange traded products based on private markets funds or companies would look like. Johnson highlights comments from BlackRock’s CFO Martin Small, who said on an investor call about the acquisition that “in the long range … we have a great platform in iShares [BlackRock’s ETF arm] to be able to take some of this data, use it and create investable indices through … things like exchange traded products.” Johnson points out that private companies are staying longer, which is depriving mainstream investors of opportunities to invest in much of the investable universe that’s available to institutional investors and the HNW channel. But, private assets are inherently illiquid in many cases and difficult to value, making them a less obvious fit for ETF products. Johnson spoke to ETF industry figures to unpack this thought experiment. Independent industry consultant Sean Tuffy said “I can see how they’d use the Preqin data to create indexes and benchmarks for private assets. However, I’m not sure how easily that would translate into an ETF. Obviously ‘private assets’ is a broad church, so there could be some more liquid assets that could work. Still, in the main, it seems like a challenge to wrap inherently more illiquid assets into an ETF. And that’s even before you get into the ‘should this be done’ debate, as regulators are taking an increasingly dim view of liquidity mismatches in funds.” Others believe that the Preqin acquisition was more about “creating a much broader, more diversified financial service company.” Johnson surfaces one way that BlackRock could look to implement the private markets data they’ll glean from Preqin: they could use Preqin data to find ways that liquid, listed instruments can be used to mimic or replicate the returns of private investment strategies. This is a strategy that has been adopted by managed futures ETFs, which have attempted to replicate the performance of trend-following “quant” hedge funds, or CTAs. Another idea that Tuffy proposed would be to use Preqin data “to create synthetic exposure via derivatives to new private asset indexes.” Will ETFs become the wrapper?

💸 AGM’s 2/20: BlackRock’s acquisition of Preqin is certainly notable for a number of reasons, but the creation of private markets ETF products doesn’t seem like the first obvious reason why it will be a big deal for private markets. The acquisition continues to fortify BlackRock’s software and data business, Aladdin (which now includes eFront). Adding private markets data and performance metrics to the equation will only serve to strengthen their software business, which will provide stable steady revenues to balance out the AUM businesses they run. What the Preqin acquisition does do is help bring the market towards standardization. Standardization of data could lead to better benchmarking of funds and performance. Once there’s standardization of data and performance, perhaps then products can be created that track a private markets index. It will be interesting to see if something of that nature comes to fruition, as private markets are generally illiquid for a reason. And for a good reason. What the Preqin acquisition does do is help to build out a software product that arms investors with more data and information that allow them to make a better decision about how to approach private markets. That in and of itself doesn’t extend so far as enabling a transaction, but it certainly helps investors, particularly in the wealth channel, inch closer to making an allocation decision. Private markets are headed towards a place where there will be a “buy button” to purchase alts. Private markets products are still very much sold, not bought, but the focus on building out software tools and products to equip investors with more data and information bring us closer to a world where investors can feel comfortable clicking a button and purchasing alternatives products (and understanding its impacts on an entire portfolio).

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 73 Strings (Private markets data and valuation software) - Customer Success Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Operations. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear New Edge’s CEO, Managing Partner, and Co-Founder Rob Sechan and CIO Cameron Dawson discuss growing a cutting edge $44B platform to serve the wealth channel and help them navigate private markets. Listen here.

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.