👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from Washington, D.C., where I’m back from yet another New York trip where we spent time with a number of fund managers.

Fundamentals over flash. That’s been the recurring theme that’s kept emerging in our conversations.

Fundraising is about telling a story. And narratives sell. Unsurprisingly, sometimes narratives matter more than reality. That was certainly the case in both startup investing and fund investing over the past few years. The companies and funds that garnered the attention were the ones that told the most compelling stories. But did they have the fundamentals?

In my view, the narrative has changed.

As the public markets have shifted from a focus on underwriting growth to a focus on underwriting cashflows, so too have private markets. Investors and founders are now focused on investing in efficient businesses that can ultimately get to profitability.

Perhaps many venture capitalists were always focused on underwriting businesses to this outcome, but the past few years of high multiples and a zero interest rate environment got the best of many as investors were willing to fund companies at 50-100x ARR multiples with the idea that companies would grow into their valuations.

This reset has meant that many companies from the past few years will struggle to grow into their lofty valuations, which will adversely impact fund performance from the past few vintages for many.

It’s no secret that VC fundraising has come to a screeching halt this year. Pitchbook’s Q1 estimates show that 2023 capital committed to VC funds figures are projected to be almost 75% lower than 2022.

How can funds and LPs navigate this very different — and difficult — fundraising environment?

We invest in both FinTech companies and VC funds, where we’ve focused on emerging managers across strategies and geographies. Some of those managers, like Goodwater Capital, started out as emerging managers and have now emerged (see below for more on their $1B fundraise announced this week, bringing total AUM to over $3.3B).

As we meet with this next generation of fund managers, the ones who have been standing out to us are the ones who are focused on the fundamentals over flash.

To us, fundamentals mean discipline in process and pricing, repeatability of process, an understanding of business models that will yield the best multiples and exit values, and focusing on building out a demonstrable, enduring, and defining edge through either investing, operating, or data backgrounds, which may not be making that dopamine hit or logo chasing investment, but rather uncovering the companies that can create long-term, enduring enterprise value based on their cashflows.

It’s been great to see an explosion of emerging managers over the past decade — and innovation in private markets technology has enabled that to happen. But manager selection is so critical in VC due to dispersion of returns between top quartile and median managers that LPs can’t afford to miss (see chart below from Cambridge Associates). They need to find VCs who understand the fundamentals of VC, finance, and investing. Because at the end of the day, process matters, portfolio construction matters, deployment schedules matter, and, most of all, DPI (distributed to paid-in capital) matters.

Investing in private markets is about uncovering strategies, managers, and companies who can generate alpha — and over the long run, it will be fundamentals, not flash, that drives alpha.

Fund managers who are able to tell this story well should have success fundraising.

Let’s make discipline, experience, and fundamentals cool again. I’m excited to back managers with these features because I believe these funds will outperform in the long run.

Last week, we asked readers if they believe that Latin America represents a compelling investment opportunity. 73% of readers said yes.

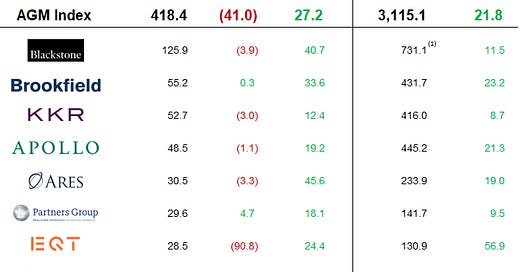

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

AGM News of the Week

Articles we are reading

📝 Why are PE firms snatching up asset managers at a record clip? | Jessica Hamlin, Pitchbook

💡 The PE buying binge of asset managers continues — through July 20, there were 39 deals totaling $13B in value which is already $2.6B higher than the previous high in 2021 per PitchBook. Notably, TPG acquired Angelo Gordon for $2.7B, taking on $73B in assets and increasing TPG’s total AUM to $200B+. Much of the deals, however, focus on asset managers that target the middle market. For example, HighVista Strategies acquired Abrdn’s US markets business to boost exposure to the lower middle market. There was a 13% jump in strategic alliances of asset managers in financial services and other sectors from 2019 to 2022, according to EY. Asset managers are aiming to diversify their product offerings, moving away from the single-strategy specialist aims of the past. Part of this push for a multi-strategy approach stems from multiple arbitrage — smaller, more niche players trade on a fee related earnings multiple of about 20x; while large multi-strategy asset managers trade closer to 28x or 29x, according to Greg McGahan, a deals partner at PwC. Another important factor driving the consolidation amongst asset management firms is succession planning and liquidity for founders as they reach retirement age. This trend is expected to continue over the course of the next decade or so – as more large asset managers prioritize multi-strategy and growing through acquisitions while more small asset manager leadership looks to gather liquidity as they enter retirement.

AGM’s 2/20: Private markets is undergoing an industry transformation as we speak, with many corners of private markets moving from smaller, more niche or cottage industries to cornerstones of the industry. Private credit, which has grown to over $1.5T of AUM in recent years, venture capital, and secondaries, are chief amongst them. Many asset managers are looking to expand into alts to capture the opportunity of cross-selling LPs on different investment products and strategies as they move to become a one-stop shop for LPs. Consolidation seems the likely next step for an industry that continues to mature — and it will not be shocking to see the industry evolve as banking did in the past. Part of what’s driven such growth for the diversified alternatives platforms is that they’ve successfully expanded their investment strategies to capture either larger wallet share of existing LPs through cross-sell or grown their LP base by expanding into new strategies. If asset managers think about their customers as enterprise (institutional investors, who have more or less defined sales cycles) and mid-market / SMB (private banks, wealth platforms), they need to find ways to cater to each customer base with both investment product and pricing that fits each customer type. The ones who do this well will find ways to successfully cross-sell investment products, increasing the customer LTV. That’s part of the reason why multi-strategy platforms can garner higher FRE multiples than niche strategies.

📝 Sequoia Capital cuts back fund for crypto investments| George Hammond, Financial Times

💡Silicon Valley-based venture capital firm, Sequoia Capital, has made significant cutbacks to two of its funds in response to a downturn in private markets. The cryptocurrency fund, raised last year with $585M in commitments, has been reduced to $200M after Sequoia returned part of the committed capital. The ecosystem fund, which backs smaller venture funds or solo investors, has been halved from $900M to $450M. These changes were made to “sharpen our focus on seed-stage opportunities and to provide liquidity to our limited partners,” according to Sequoia. The venture capital firm has faced challenges amidst the broader downturn in private technology companies, with some limited partners experiencing a liquidity crunch. Sequoia's downsizing comes as venture capitalists exercise caution due to rising interest rates and falling economic confidence. Additionally, cryptocurrency investment has suffered an 80% decline between Q1 2022 and Q1 2023. Sequoia's most prominent investment in the sector, FTX, faced a collapse and led to a complete write-down of its $214M investment. Now, Sequoia plans to channel its reduced funds into early-stage companies while keeping open the possibility of crypto investment through other funds.

AGM’s 2/20: Sequoia’s changes — both at the team level (reported last week) and at the firm level — are emblematic of a broader industry shift in both venture and crypto. A slowdown in venture has meant that funds have had to re-evaluate fund size. No sector has had to go through its moment of re-evaluation more than crypto. Many traditional firms raised crypto specific funds or earmarked a meaningful portion of capital to invest into crypto from their main funds. But with investment in cryptoassets and projects falling 80% between Q1 2022 and Q1 2023, funds have had to re-think how much capital they can put to work in the space. I’d expect we’ll see the current market environment lead to many VCs getting back to basics, focusing on fundamentals, and investing in strategies or geographies that are core to their specialty, strategy, or background rather than “venture” into corners of the market they know less well. While it’s a difficult gestation period for VCs, many of whom need to re-evaluate their firm’s future both from a talent / succession planning perspective and an investment strategy perspective, it’s probably a healthy reset for the market. And LPs will undoubtedly reward managers who were disciplined through the past few years or have a focus on investing in companies that have a clear path to generating cashflows in the future.

📝 Exclusive: Goodwater Capital snags $1B across two new funds, despite cooling interest in consumer tech | Connie Loizos, TechCrunch

💡 Goodwater Capital, one of the few firms to focus solely on consumer tech investments, has closed on $1B in capital commitments across its fifth early-stage fund and third growth stage fund. The Burlingame, CA firm, which manages over $3.3B in AUM, delivered on a successful fundraise in a challenging environment for many firms looking to raise capital, in part because of a number of notable exits and investments that the firm, led by former Kleiner Perkins Partner, Chi-Hua Chien, and Maverick Capital Head of Private Investments, Eric Kim, has achieved over the past 9 years since its inception. Goodwater, which has invested in the likes of grocery delivery company Getir, Korean neobank Toss, UK neobank Monzo, Musical.ly (sold to ByteDance for $1B), Photomath (sold to Google), Care/Of (sold to Bayer), and many others, remains committed to consumer at a time when many venture firms have scaled back their interest and activity in consumer tech investing. Goodwater invests globally and their definition of consumer tech, which Kim and Chien call the “seven categories of human flourishing,” encompasses housing, healthcare, food, financial services, transportation, education, and entertainment. “We think about it from a first principles basis,” says Chien. “If you ask a billion people around the world what they need, every single one of them needs housing, health care, food, financial services, transportation, education, and entertainment . . . and we think there are massive unsolved problems in bringing better access to higher-quality, lower-cost versions of all of those things throughout the world.” Goodwater has also been a pioneer of leveraging data science to source and evaluate companies. Goodwater has a platform team composed of “dozens of engineers, data scientists, product leaders, and ML experts that are building a customized set of services,” according to Kim, that put companies on their radar from across the globe, with more than half of their capital allocated to companies outside of North America.

AGM’s 2/20: Goodwater, which started out as an emerging manager in 2014 with a $131M early-stage consumer fund after Kleiner Perkins Partner Chi-Hua Chien and Maverick Capital’s Head of Private Investments Eric Kim teamed up, have transformed into a global consumer tech VC investment platform with over $3.3B that invests across stages. There are a number of lessons to be learned from Goodwater’s growth and evolution as a firm that are relevant to emerging managers today. They had multiple clear and defined differentiators — Chi-Hua and Eric came from respected brands, bringing with them successful deals / exits and the knowledge and experience of how to invest and how to build a firm. As entrepreneurs, they also had a pitch that was pioneering. Their plan was to leverage data science to find, pick, win, and help the best consumer tech companies globally. With the help of top engineers, they built a product — a software platform — that’s enabled them to invest in a number of consumer tech successes globally. It worked at early stage, with their early funds performing quite well. And it works well at growth stage, where there’s a rich enough set of data and metrics to find and evaluate companies. Goodwater’s $1B raise that was announced earlier this week provides a ray of hope for the venture fundraising landscape, where managers who have performed well in prior vintages and have a clear and defined strategy for both investing and firm-building should still be rewarded for their work by LPs. Congratulations Chi-Hua, Eric, and team on the platform you’ve created and success you’ve had helping to build some of tech’s important consumer companies that impact the lives of millions around the world.

Author’s note: Full disclosure, I’m a Venture Partner at Goodwater and I’ve been a LP in Goodwater since Fund I.

📝 AngelList expands into private equity with acquisition of fintech startup Nova | Mary Ann Azevedo, TechCrunch

💡 TechCrunch’s Mary Ann Azevedo unpacks how AngelList has expanded from venture into the private equity space with its acquisition of Nova. Founded in 2010, AngelList started as a mailing list for high-quality angel investors before turning into one of the most powerful fundraising channels for early-stage startups. Over the years, it has evolved its model and today touts itself as an organization that “creates products and services for venture firms, investors, startups, and fund managers to accelerate innovation.” Nova, which was initially designed to automate subscriptions to funds with its digital workflows, has grown to over 10,000 investors with identities and institutional fund customers such as Van Eck, Pantera, Broad Street Global, Galaxy, BlockTower, and others. AngelList’s acquisition of Nova, now rebranded as AngelList Transact, comes at a time when they are shipping products for funds and investors at a rapid pace. This news comes on the heels of releasing a number of products for fund managers, including AngelList Treasury, Projector, a portfolio monitoring tool, and Relay, an AI-driven portfolio analyzer tool.

AGM’s 2/20: AngelList’s acquisition of Nova is big news for private markets because it represents something bigger than the acquisition itself — AngelList is part of the cadre of companies that are building core infrastructure for private markets across the lifecycle of an investment. AngelList is aiming to become the operating system for both companies and investors — and the Nova acquisition helps them further that goal. AngelList CEO Avlok Kohli came on the Alt Goes Mainstream podcast a few months ago to discuss just this — why private markets needs an end-to-end solution and how AngelList is aiming to build that. The broader point here is that there will be a select handful of companies that can build the end-to-end infrastructure for private markets to serve both fund managers and investors. The race is on and it will be exciting to see how this unfolds as private markets continue to become more sophisticated and automated.

📝 Here Are The Venture Capital Firms That Are Investing Much Less | Eric Newcomer, Newcomer

💡 TL;DR — Tiger, Index Ventures, and Insight dramatically slowed their capital deploying pace while Y Combinator, Sequoia, Unpopular, TechStars, and Boost VC remain active, according to data from AngelList. The startup slowdown is in its second year, and a number of prominent investors have quietly slowed their investing pace, others are becoming much pickier about their investments and a select few have maintained a healthy deal flow. This is not unrelated, however, to the prominence and rise of AI as some firms chase down the seemingly ubiquitous sector while others remain hesitant. AI companies raised $25B in the first half of this year — approximately 18% of all global funding. Some firms, like Slow Ventures, are choosing to avoid these AI investments — investments they consider to be “fool’s gold.” The changing dynamics between Seed and Series A rounds also plays a role in this slowdown. Slow ventures Kevin Colleran says “there’s little-to-no signal about what unlocks a Series A term sheet these days.” According to AngelList, the number of active investors has fallen by roughly 20% compared to what was typical in 2019 and 2020. According to AngelList, the firms with the largest slowdowns in funding include Global Founders Capital, Tiger Global Management, and Slow Ventures. On the other hand, Y Combinator, Sequoia Capital, and Unpopular Ventures have remained resilient and have continued to deploy capital at a healthy clip.

AGM’s 2/20: VC is an interesting corner of the market right now from a deal activity perspective. In many respects, investors have pulled back, as the data shows, but there are sectors (like AI) where investors remain quite active. While activity has certainly slowed according to data, there might be rays of hope in the market. CRV General Partner Saar Gur commented in the article: “Our data would say the last six months are a lot more active than the 12 months before.” This brings up an interesting question about where and how to capture value in the current market. Valuations have certainly gone down at virtually all stages relatively 2021 and 2022, but there’s also less certainty of funding at Series B, C, D, etc as many growth investors have pulled back their funding pace (or are struggling with new fundraises). That said, early stages may still represent a great opportunity for investors. Boost VC’s Adam Draper says it well in Newcomer’s article: “Are there great founders right now? The answer is unanimously yes.” At the early stages, it’s very much about backing the best founders — and that seems to be alive and well.

📝 A Massive Moment for Non-Banks | Sonali Basak, Bloomberg News

💡 Private debt is slated to continue growing — Jamie Dimon said on a bank earnings call earlier this month that “hedge funds, private equity, private credit, Blackstone, Apollo, they’re dancing in the street” as banks face increasing regulatory scrutiny. Providing certain products, like exotic derivatives for example, is becoming less and less viable for the big banks and even areas like mortgages are facing more pressure. “Anything to do with financing” will be impacted according to Paco Ybarra, CEO of Citigroup’s institutional client business. Bank leaders are pointing out the capitalistic irony of the situation, as pressure mounts on regulated parts of the financial system, the money will simply move to the more unregulated segments of the system — specifically private debt. These changes in financing opportunities are not financially impactful alone — top talent from banks is also moving toward private debt and credit. For example, Julian Salisbury, formerly a GS asset management executive is moving to become co-CIO of Sixth Street. A number of notable deals across the industry have taken place of late, as Katie Koch, a Goldman Alum herself, made her first purchase as head of TCW Group, buying the ETF business of Engine No. 1. PacWest Bancorp, is merging with Banc of California Inc, thanks to equity support from Warburg Pincus and Centerbridge. Rithm Capital purchased a loan portfolio from Goldman and just days later picked up Sculptor Capital (previously Och-Ziff) for almost $640 million.

AGM’s 2/20: As banks face more restrictions from a tighter regulatory environment, non-banks are moving to fill the gap. Private credit is proving to be an example of this shift. Firms like Blackstone, KKR, Apollo, and others are ramping up lending activity and gathering AUM to go after a massive opportunity in the lending space. Banks are handcuffed by Fed’s stress tests and balance sheet requirements, so alternative investment managers are filling the void. This brings us to an interesting crossroads — alternative asset managers are beginning to look more like banks (Carlyle and KKR have capital markets divisions) that aren’t shackled with the same regulatory constraints as banks. Is this the moment where alternative asset managers begin to become the next “banks?” I don’t think we’ll see these firms want to — or — transform into banks, but I do think we will see an evolution in the alternative asset management industry that mirrored that of banks in the 1990s. The consolidation of alternative asset managers is well underway. As the big platforms become bigger and look to offer multiple products (i.e. multi-strategy) to more investors (i.e. the wealth channel), I anticipate that private markets will undergo a similar transformation to banks, with the big getting bigger and smaller, niche managers looking to stay small but a more challenging environment for those in the middle.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 73 Strings (Valuation and portfolio monitoring for alternatives funds) - EMEA Senior Sales Representative. Click here to learn more.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Growth. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - West, Regional Director, Vice President / Senior Vice President. Click here to learn more.

🔍 Allocate (VC infrastructure investment platform) - Managing Director, Alternatives (Sales). Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Alto CEO Eric Satz discuss how anyone can invest in alternatives through their IRA. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the second episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear John Avery, VP Digital Assets, Tokenization, Web3 at fintech giant FIS talk about how evolutionary changes can lead to revolutionary changes in private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear 44th Vice President of the United States and Chairman of Cerberus Global Investments Dan Quayle share his insights on geopolitics and investing. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter for his contribution to the newsletter.