AGM Alts Weekly | 7.28.24: Distribution dilemmas

AGM Alts Weekly #62: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good evening from London, where I’ve just concluded a week of meetings and hosted two Alt Goes Mainstream community dinners with leaders in private markets from GP, LP, and technology perspectives.

Permanent capital is chief amongst the topics of conversation in private markets — for both LP and GP communities. And for good reason. The power of permanent capital is very real — and it’s possibly one of the biggest drivers of the transformation in private markets for how investors allocate to private markets and how alternative asset managers construct their businesses going forward.

BCG recently published a report on how alternative asset managers can tap into the growing demand from private wealth and retail channels for alternatives. Permanent capital vehicles were a centerpiece of their report. BCG highlighted how alternatives managers are turning an increasing focus to securing permanent capital via various permanent capital vehicle (PCV) structures both to serve LPs and to fortify their business and its enterprise value.

Permanent capital vehicles shed light on two trends inextricably intertwined in the evolution of private markets: the growing focus on the wealth channel as a meaningful LP and the continuing transformation of alternative asset managers into businesses that are shaping financial services.

The alternative going mainstream

Permanent capital is far from a new concept in investing. But it is a relatively new phenomenon in the world of private markets. For years, Partners Group was the industry’s first and only firm to have an evergreen private equity fund. Not until 2013 did other firms start to launch evergreen private equity funds.

The traditional structure for many alternatives managers has been the closed-end fund structure with defined fund lives. This structure has featured as the main way for managers to run their business and partner with LPs. They would raise capital every few years as they made their way through the investment period of a fund, growing AUM with each successive fundraise. This process remains the case today, for some firms more than others.

Many of the larger alternatives managers want to work with the wealth channel for reasons we’ve discussed on at length on Alt Goes Mainstream. However, closed-end fund structures are not always the best way for an alternatives manager to do so.

Managers have had to create an alternative. That alternative? The permanent capital vehicle structure.

Structure is one of the operative words when it comes to working with the wealth channel. Much of the impediment to increased wealth channel participation in private markets has come down to structure. Structural product innovations have unlocked the floodgates for wealth channel capital to begin to flow into private markets products.

BCG highlighted some of the considerations for working with the wealth channel that makes evergreen vehicles (e.g., non-traded REITs, BDCs, interval funds) a better structural fit for wealth investors.

But structure alone won’t solve the capital raising questions for GPs into PCVs.

Distribution dilemmas

While structure can help to increase the likelihood of wealth channel participation in private markets, these products still require significant education and distribution efforts to achieve success in growing AUM. BCG dives into the nuances of the distribution of evergreen products to the wealth channel.

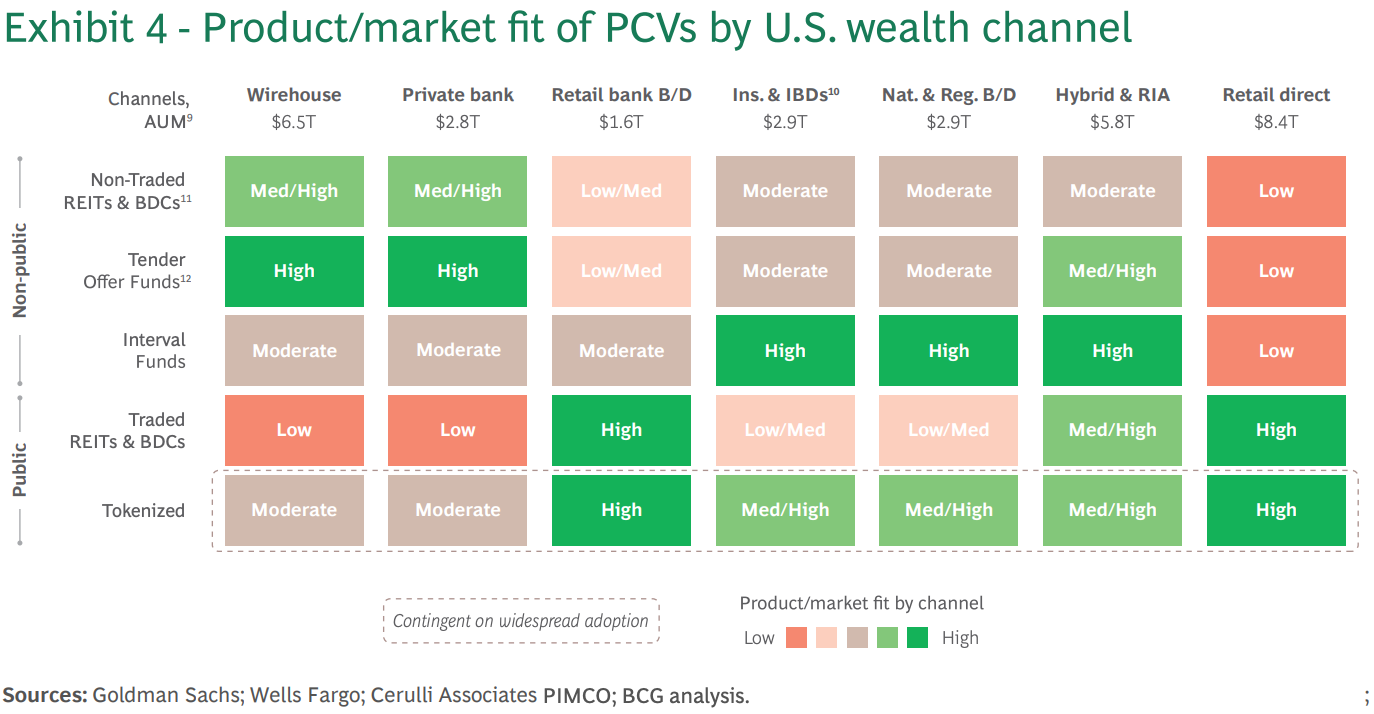

Developing a channel strategy is core to successful selling into the wealth space. Different investors in the wealth channel have varying needs — and therefore require specific mechanics when it comes to pre- and post-investment needs across the spectrum of fees, capital calls, liquidity / illiquidity, cash management, investor reporting, and more.

Pantheon Partner Susan Long McAndrews highlighted the channelization of selling into the wealth channel in her comments in the 7.14.24 AGM Weekly.

Pantheon’s Susan Long McAndrews in the 7.14.24 AGM Weekly: The concept of investor channel didn’t exist in private markets for several decades — investors wanted the same thing (alpha) and were willing and able to commit to the exact same limited partnership with a $10mn minimum. Today, more and different investors are looking for more and different options. Insurance companies may prefer rated or unrated feeders or evergreen SMAs. RIAs may prefer registered funds offering liquidity and a $50,000 minimum. Wirehouses no longer want feeders and want direct access. If you don’t have a distribution strategy from the air, you will spend a lot of money in a lot of places or, worse, just the wrong places.

Adopting a channel strategy is crucial to success in the wealth channel. As the below chart from BCG illustrates, different types of products have varying levels of product-market fit across the wealth space. What works with wirehouse customers may not work well with RIAs or direct retail customers.

Working with the wealth channel requires such a large investment of time, people, marketing, and brand-building that it must be part of a well-defined and expertly executed strategy.

The dilemma lies not so much as whether to work with the wealth channel. Capital will come aplenty from individual investors into private markets over the coming years. BCG estimates that private wealth and retail investment in private markets, approximately $2 trillion in 2022, will expand at a 10–17% CAGR through 2032.

The dilemma presented with alternative asset managers is how they structure and orient their firms to work with the wealth channel.

The business imperative that lies in the (ever)green

The wealth channel represents a relatively greenfield growth opportunity for alternative asset managers.

The prize is large. Tikehau’s June 2024 presentation highlighted just how big the revenue capture opportunity is for alternatives managers.

Alternatives are expected to represent 23% of global AUM by 2028, yet they will capture 57% of global revenues.

That’s where ambition comes in. “Everyone’s got it,” as HgTrust Chairman of the Board Jim Strang said in his Alt Goes Mainstream podcast, but the question is how do they orient and align on that ambition.

At the heart of unpacking the very concept of growth ambitions? Business structure, which starts with alignment of both ambition and firm structure.

Jim said it eloquently in his podcast:

[15:08] The other one, which is, you see this quite a lot when you work with these firms, is alignment. And this is like where things start to get interesting because most private equity firms are set up as partnerships. And partnerships are not the governance model of choice for alignment because it's a bit like the Knights of the Round Table. You have to get everybody agreeing to want to go on a path. First, you've got to have the path clear, but then you're going to get everybody agreeing. And if you're thinking, what's the worst way I could set myself up to stop that happening? It would be a partnership. So solve that one. Certainly, with some of the things I do with Bain, that's one of the things we always do first is say, okay, have we got a clear sense of ambition, and can we write it down in words? And, really, everybody knew that. And then are we agreed? And that's often very insightful. And it stops things happening. That's one of the challenges.

Firms that have growth ambitions likely need to work with the wealth channel if they want to scale. But firms require the size and scale necessary to be able to create, launch, and distribute evergreen structures to the various channels within the wealth space. Further, people are required to distribute products successfully to the wealth channel, even if platforms like iCapital or CAIS are leveraged for either distribution or infrastructure.

Crucially, there needs to be alignment within the firm on the how and the who of wealth channel distribution.

The How: Which channel and strategy is right for a firm to pursue within wealth?

The Who: How many people, platforms, and partners will be required to distribute effectively in the wealth channel?

The process of answering the how and the who leads to an even bigger set of strategic questions and decisions for a firm as they think about the trajectory of the productization and manufacturing of their processes and products.

Here, all roads lead to the trend that is the evolution of funds becoming firms.

If firms have the desire to grow, they will likely need the capital to do so. Scale requires investment. Investment requires taking in outside capital to help achieve that growth ambition.

Many of the industry’s largest firms — and those who have the ambition to scale AUM — have faced these strategic questions. For some, the answer has been to take outside capital.

But, there’s often been an elephant in the room for LPs. It’s a concern that I hear when talking with LPs. Does a manager selling a part of their stake negatively impact incentives and investment performance?

Does the business evolution of asset managers impact performance?

A number of the industry’s largest firms have either gone public, sold stakes, or thought about selling a stake. The proof is in the data.

Coller Capital’s Private Equity Findings write-up on a recently released academic paper, Selling Private Equity Fees, authored by Minmo Gahng and Blake Jackson on the growth of the GP stakes industry, highlights this growing trend: the fraction of PE industry AUM overseen by GPs that have sold stakes increased from 6.3% in 2000 to 31.8% in 2021.

LPs have often been apprehensive about GPs selling stakes or taking their firms public. They will cite the ambition to grow as evidence of a shifting focus from generating returns to generating fees on AUM.

While it’s fair for LPs to hold GPs’ feet to the fire to unpack why a GP is selling a stake and what the proceeds of the stake are being used for, the argument may not have significant merit. Interestingly, the academic paper finds that the firms selling stakes tend to be among the industry’s best performers and tend to report above average LP performance.

The paper finds that “if anything, firms create more value — in absolute terms — for their LPs after selling GP stakes” in the cases where “sophisticated buyers [of GP stakes] seem to do a good job of selecting PE firms where selling a small stake won’t have a sufficiently dilutive effect” on the GP / team incentives.

Incentives. That’s a topic worth unpacking. When GPs sell a stake to a minority investor, does it often represent a “cash out” event?

Blue Owl recently shared an interview between their President & CEO of Global Wealth Sean Connor and GP Strategic Capital MD Michael Conley. In the interview, they discussed the merits of GP stakes for private wealth investors and unpacked why GPs are choosing to sell a stake in their firm.

They note that a “common misperception of a stake sale is that it is a “cash out,” when in fact it really is a “cash in,” according to Conley. He said that “these firms are doubling down on their business and reinvesting more money back into their funds alongside their LPs.” Conley cited an important driver of this trend: as the private markets asset class has grown from $3T to over $13T since 2010, the average GP commitment has grown from ~1% to ~5%, representing a ~20x increase by dollar amount. Oftentimes, GPs are taking on a stake not just to invest in more resources to grow the investment and distribution functions but also to invest more of their own capital alongside LPs.

So, if the business imperative of growth doesn’t impact performance significantly, then how should investors approach this evolution in private markets?

A holistic approach to the private markets growth trend

Let me lay out a few maxims of the market:

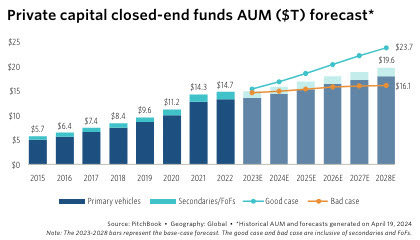

(1) Private markets are undergoing secular growth: Private markets are in the midst of a growth trend that’s only going in one direction. Whether that number is $16T, $19T, or ~$24T by 2028, according to Pitchbook projections, private markets will increase its AUM by trillions over the coming years. Even in a more muted fundraising environment that could be a result of a continued lag in distributions and liquidity, trillions of dollars of AUM adds meaningful assets to private markets.

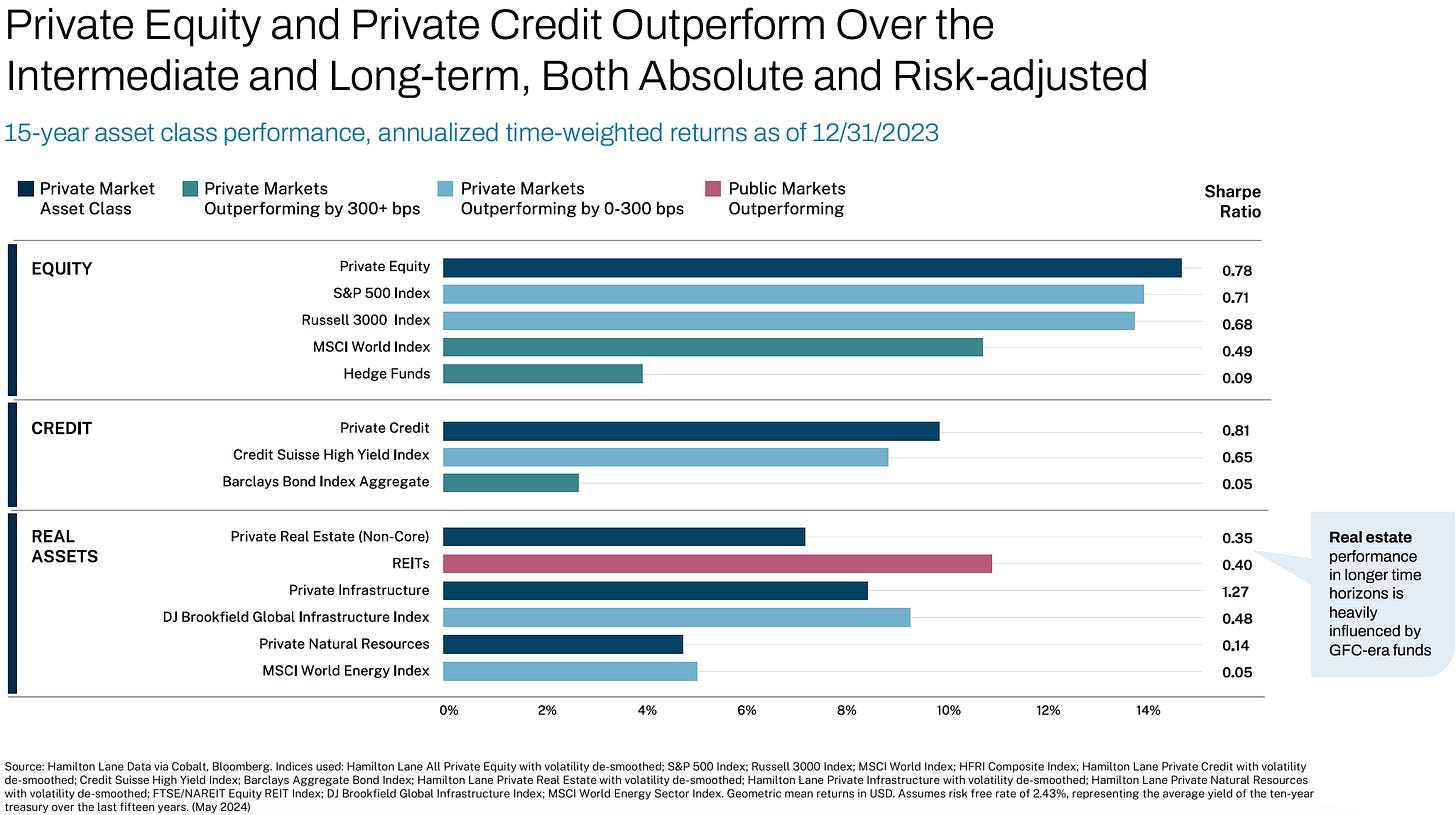

(2) Returns and diversification are drivers of a shift to private markets: In a world with increasing indexation and concentration of returns (and risk) in public markets, investors will require private markets exposure in order to achieve both returns and diversification in their portfolio.

Hamilton Lane’s recently released Private Wealth Perspectives Report highlights some of the data behind the risk and return characteristics of private markets relative to public markets.

These data points should make investors, particularly those who are newer entrants to private markets, at least consider the merits of allocating a portion of capital to private markets strategies to insulate their portfolios from a tougher road ahead for public markets due to their structural dynamics. It might take longer for investors to allocate to private markets for a number of reasons, but It’s also hard to envision a world where they don’t add increasing exposure over time.

(3) The biggest firms will capture the lion’s share of the AUM: The largest alternative asset managers have the size, scale, brand, and resources to raise more capital than their smaller peers.

The proof is in the data. Blue Owl’s GP stakes interview highlights just how stark capital raising success is between the have’s and the have-not’s. Funds greater than $1B in size have raised the majority of capital, increasingly so in recent years.

The “so what”

What’s the “so what” for investors?

If firms are growing, shouldn’t investors want to own a piece of the AUM growth in the industry?

One way to approach the growth of private markets is to invest in the firms themselves. This can either take the form of investing into the publicly traded managers (as shown in the AGM Index below) or investing in a GP stakes fund that takes minority stakes in large and growing alternative asset managers.

Investing in a portfolio of managers — whether private or public — in addition to investing into closed-end or evergreen strategies can provide investors with a way to be exposed to the growth of the industry and many of its largest players across strategies, vintages, and manager size. Further, firms with permanent capital vehicles, which is being driven by the shift to evergreen funds, will be outsized beneficiaries of this trend.

After all, if we believe in the secular trend of growth in private markets and the continued mainstreaming of alts, perhaps this is one of the best ways to index exposure to the growth of private markets.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

The currency of consolidation — for both alternatives managers and traditional managers

📝 Private credit shops put themselves up for sale as smaller players get squeezed | Liz Hoffman, Semafor

💡Semafor’s Liz Hoffman dives into the continued evolution within the private credit industry. She highlights the increasing trend of consolidation as scale has led to a world of have’s and have-not’s. Hoffman notes that growth has been concentrated at the biggest firms, and smaller players are being squeezed. The rapid increase in private credit AUM has led to consolidation in the industry, with at least half a dozen private credit firms reportedly running sales processes. Hoffman reports that Crestline, with $18B AUM, is in the market for a buyer. Apparently, so too are Waterfall, a $12.5B AUM firm, and MGG Investment Group, a $5.5B AUM firm. This news comes on the heels of last week’s acquisition of $10B AUM Atalaya which was bought by Blue Owl to help buttress their asset-based finance capabilities. Hoffman observes that the world of private credit has expanded beyond loans focused on middle-market companies, particularly for private equity-backed companies. That is changing as private credit firms expand to cover much more of the activities that traditionally sat on a bank’s balance sheet.

💸 AGM’s 2/20: Credit is a scale game, as Hoffman correctly notes, so that’s perhaps an explanation for the increasing trend of consolidation amongst larger players like Blue Owl and mid-sized firms with niche strategies like Atalaya. An area like asset-based finance is a hot topic in the private credit world, which is not surprising given the size and scale of the market, according to Atalaya CEO Ivan Zinn, who recently said the ABF market is $7T, with private credit firms only representing a 5% market share. The industry consolidation is a trend that we should expect to continue, but is it because niche strategies can’t compete, or is it more an acknowledgment that multi-strategy firms want to continue to expand into other corners of private markets so that they can become a one-stop shop for both GPs and LPs and grow their valuations? As we’ve discussed, multi-strategy firms tend to command higher valuations at the enterprise value level than single-strategy specialists, as there’s a ceiling for single-threaded firms to grow in many cases. The answer is it’s probably a bit of both, but I believe that the latter is a bigger driver of this consolidation trend rather than niche strategies are unable to compete. A $10B firm is a very respectable business in its own right — and if the performance is there, then LPs will continue to come back for more. But it’s also true that private credit is an area where scale matters, so it could be in the best interests of a specialized niche player to team up with a larger platform to benefit from the synergies on the deal sourcing and the fundraising sides while monetizing the equity value of their business in the process.

📝 Jupiter Asset Management hunts for acquisitions | Emma Dunkley, Financial Times

💡Financial Times’ Emma Dunkley reports that Jupiter Asset Management, which manages over £50B, is on the lookout for acquisitions to expand its investment offering. At a time when the traditional asset management industry is facing fee pressures and customers withdrawing money, resulting in lower revenues, firms like Jupiter are looking to make acquisitions to expand their product offerings and customer segments. Jupiter CEO Matthew Beesley told the Financial Times that the firms had “built up a war chest which could fund a ‘bolt on’ acquisition.” “We are very much on the look out for opportunities to supplement our existing investment management capabilities … I’m consistently on the lookout for new talent to join the business and whether it’s by a team lift-out or small, boutique acquisitions, we are very much open for business.” Beesley’s comments come at a time when Jupiter and its peers, Abrdn, Artemist, and Liontrust, face outflows as investors instead choose passive fund products. According to the Investment Association, retail investors withdrew £136M from active funds in May, while passive funds attracted £2.1B. This trend will likely drive firms like Jupiter to evaluate or pull the trigger on adding private markets capabilities. Vincent Bounie, a Senior Managing Director at Fenchurch Advisory, said the “next phase” of mergers and acquisitions “will increasingly feature the private markets sector.”

💸 AGM’s 2/20: Consolidation isn’t just occurring between alternative asset managers buying smaller alternative asset managers for specific capabilities. It’s also traditional asset managers buying alternatives managers to expand their reach, offerings, investor base, and revenues. News of Jupiter looking for acquisitions, particularly in the alternative asset manager landscape, is far from surprising. Other traditional managers have shown this to be a path forward — Franklin Templeton’s $1.75B acquisition of secondaries Lexington Partners and T. Rowe Price’s acquisition of Oak Hill Advisors offer two recent examples. I’d anticipate more traditional asset managers to evaluate their strategic options across the build, buy, and partner constructs.

The next question for traditional asset managers is how they should approach their foray into private markets. There are a set of questions they will need to answer in order to adjudicate which strategy (build, buy, partner) and which asset class is most aligned with their firm’s orientation.

(1) Which investment strategy will resonate most with their investors and fit into both their culture and growth story as a firm? If the asset manager has a large preponderance of retail clients, should they focus on asset classes that might appeal more to the wealth channel (like private credit) and in structures (like evergreens) that fit better with the retail investor?

(2) Is the acquisition about cross-selling these alternatives products to existing investor clients to penetrate additional wallet share, or is it about adding new clients and selling existing traditional asset management products to these new LPs from the acquisition?

(3) Is the acquisition about trying to take a niche player in private markets and scaling their AUM by virtue of the traditional asset managers’ investor and distribution network?

(4) Is the ultimate goal to become a comprehensive private markets alternatives platform or just add a few private markets strategies where they believe they can have distribution success and outperformance?

The questions about consolidation for traditional asset managers may start from a different place than they do for alternative asset managers, but they may end up in a similar place to that facing alternative asset managers, as I discussed above in the main piece.

Reports we are reading

📝 Private Wealth Perspectives: Analyzing Trends in Private Markets | Hamilton Lane

💡Hamilton Lane recently published a report replete with data on private markets for the wealth channel. A picture is sometimes worth a thousand words, so I’ll share some of the charts from their presentation below.

Private equity has far outperformed public markets over the past five years …

… and has consistently outperformed public markets over several decades.

Yes, it’s worth asking the question whether or not past performance will persist in private markets going forward, particularly as we enter a new world order for investing. But, how risky are private markets?

In fact, Hamilton Lane believes that private markets downside risk is over-emphasized compared to public markets.

You can view the entire presentation here.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 73 Strings (Private markets data and valuation software) - Customer Success Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Operations. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear New Edge’s CEO, Managing Partner, and Co-Founder Rob Sechan and CIO Cameron Dawson discuss growing a cutting edge $44B platform to serve the wealth channel and help them navigate private markets. Listen here.

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Great analysis and insights from the wealth of available content. Keep it up Michael!