AGM Alts Weekly | 7.7.24: BlackRock's evolutionary revolution of private markets

AGM Alts Weekly #59: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good morning from New York City.

It has been a bit under a year since I sat down to write about MSCI’s acquisition of Burgiss for $1B in the August 20, 2023 AGM Weekly.

At the time, I wrote: “data done right will transform alts market infrastructure and the industry’s biggest players are putting their money where their mouth is. So follow the money … actually, follow the “smart money.”

A year ago, the question on people’s minds was who would be the next big company to acquire private markets data capabilities?

This week, BlackRock answered that question.

The “smart money,” a firm that happens to be the world’s largest asset manager with $10.5T AUM, acquired Preqin, one of the most comprehensive providers of private markets data, for $3.2B as part of its push to create further standardization and indexation of the more opaque counterpart to public markets.

Today’s newsletter is not the first time I’ve written about BlackRock’s continued expansion of its private markets capabilities.

What was said in their 2023 Investor Day presentation was notable for the continued development of private markets. So much so that I broke down why and how private markets was becoming a centerpiece of their growth strategy.

BlackRock Chairman & CEO Larry Fink’s comments this week about what the future could hold after their acquisition of Preqin make that point even clearer.

When asked about the acquisition of Preqin, Fink said he “believe[s] we could index the private markets. Just as index has become the language of public markets, we envision we could bring the principles of indexing even iShares to the private markets.”

An index, you say, now that’s interesting.

An index company, literally?

In June 2023’s AGM Weekly, I posited that BlackRock has effectively been “an index company for public markets.”

From 6.18.23 AGM Weekly: The growth of BlackRock’s AUM and product suite in liquid markets has enabled more people to invest into public markets. Now, they appear poised to run a similar playbook in private markets.

I’ve written about Index Companies in the past — and believe that businesses who own both the infrastructure and distribution will be defining companies in private markets. The most successful public and private alts companies will own their customers and grow their AUM through product distribution and toll-taking infrastructure / rails that enable institutional investors, wealth managers, and individuals to access alternatives.

BlackRock has owned both infrastructure (ETF / Index product manufacturing, Aladdin) and distribution in liquid markets, despite being in a highly fragmented asset management world. Now, can BlackRock do the same in private markets?

A year ago, BlackRock was well-positioned to make big moves in private markets. They owned components of both infrastructure (product manufacturing in private markets and Aladdin / eFront) and distribution.

This week, BlackRock’s comprehensive platform — or “Platform as a Service (PaaS)” in asset management, as they call themselves — became even more formidable and complete.

Their acquisition of Preqin adds a robust “piece to the puzzle” across the value chain from pre- to post-investment in private markets.

Preqin’s deep datasets on private markets funds and their performance furthers BlackRock’s abilities to standardize data in private markets. When Preqin is added to Aladdin and eFront’s capabilities, the standardization of data and the enhanced ability to standardize workflows makes BlackRock start to look like an end-to-end solution for investors.

The other key components of Preqin’s business, content and community, only serve to enhance the network effects for both their eFront and Aladdin businesses. Preqin’s global coverage of 190,000 funds, 60,000 fund managers, and 30,000 private markets investors creates a nice flywheel for their eFront business. More fund managers means more data can be captured and analyzed. More data and enhanced analytics means more fund managers and LPs will want to join the network and leverage the workflows created from an end-to-end platform solution.

Content, data, education, and community also serve to grease the flywheel of distribution. So, adding a data, content, and network business like Preqin should also enhance BlackRock’s distribution capabilities within its private markets investment teams, enabling it to grow AUM in the process.

BlackRock’s evolutionary revolution of private markets

BlackRock’s acquisition of Preqin signals the next evolution in their revolution of private markets.

Standardization is a critical component in achieving Fink’s endgame of the “indexation” of private markets.

Standardization

When combined, standardization of data and standardization of workflows, both of which Preqin, Aladdin and eFront cover for pre- to post-investment, bring the industry closer to a convergence of public and private markets.

How so?

There are a few major developments in private markets that make this convergence possible. Most notable among them are the inclusion of model portfolios in investors’ toolkits and the reshaping of investors’ views on asset allocation. To do this, data must be more real-time and standardized, and reporting must be quicker and more robust. Standardization of data could lead to better benchmarking of funds and performance.

Funds and technology providers also must “meet investors where they are,” as iCapital Chairman & CEO Lawrence Calcano has said in the past. This feature provides an explanation for why BlackRock built Aladdin and acquired eFront and Preqin to complement Aladdin’s workflows and why iCapital partnered with Morningstar.

iCapital’s partnership with Morningstar illustrates the power of providing advisors with the tools — all in one place and on one workflow — to evaluate and add alternatives to a client’s portfolio. As their joint announcement stated, “the integration equips Advisor Workstation's more than 170,000 users with alternative investment research and tools to evaluate private assets side by side with traditional investments. Coupled with investment proposal and report capabilities in Advisor Workstation, the solution empowers advisors to offer holistic recommendations and build diversified portfolios that include alternative assets for clients.”

Making it easy for advisors and clients to integrate alternatives into a client portfolio should make it easier for investors to allocate to alternatives …

Distribution

BlackRock’s private markets platform now enables for even better distribution of data and investment products.

Preqin’s data will now reach a significantly greater number of investors, both institutional and individual.

Content, data, and education create an engaged community of GPs and LPs, which Preqin has impressively built since its founding over 20 years ago.

Now, combined with BlackRock’s $330B AUM alternatives platform, content and data can create a distribution flywheel, equipping LPs with the information and knowledge to better understand private markets and the data and frameworks to include alternatives strategies in their portfolios.

Data is the predecessor to distribution. Better data will provide investors with the ability to make better and more well-informed allocation decisions. That should serve BlackRock’s interests, as well as the interests of the broader industry.

Indexation

Standardization of data can lead to standardization of products. The ecosystem of tools and technologies that are being built to service private markets are paving the way for a more transparent, real-time, and cost-effective alts product universe. It will take time, but the industry is evolving to offer products for more investors in more ways.

Evergreen funds appear to be a step in the direction towards indexation. Evergreens themselves are in the early days of their own evolution. Only now are many asset managers and alternative asset managers beginning to create, structure, launch, distribute, and manage evergreen funds. There are questions about how firms will fare managing these funds — and just how liquid they actually are when investors require liquidity.

Fink takes the evolution of private markets product to their end state. Could we see the indexation of private markets, just as we have in public markets? Possibly, but there are a number of structural challenges with features of private markets that will make the road to indexation more difficult.

There are even philosophical questions that strike at the heart of private markets itself. Would an index of private markets mean that funds are marked to market on a daily basis? If so, should funds be marked on a daily basis? Would that be good for funds and the operators running private companies? Part of the value of operating in private markets for both funds and operators is that the absence of a daily or monthly value placed on the company has enabled them to be patient and manage through more difficult short-term periods to generate more enterprise value and better returns in the long-term. Transparency is a net positive for investors, particularly individual investors, in many respects. However, private markets may stand to lose some of its alpha-generating capabilities in a world that enables investors to have more transparency and the ability to trade in and out of positions more freely.

We may be some time away from the ability to create index products for private markets, but BlackRock is very likely playing the long game.

And the acquisition of Preqin is a chess move that puts the pieces in place for them to be well-positioned to own an investor’s portfolio from public to private markets allocations.

Revolutions happen in evolutionary ways

I’m of the belief that end-to-end platforms will win in private markets, whether they be asset managers, technology platforms, or both. If that’s the case, BlackRock is in an advantageous spot since it can cover an investor’s asset allocation framework.

Will this chess move by BlackRock make some of their alternative asset manager counterparts consider an acquisition of or merger with a traditional asset manager (or launch liquid products of their own) so that they, too can cover an investor’s portfolio from end to end? There are very valid questions about the business case from an enterprise value perspective for alternatives managers as traditional asset managers trade at lower multiples than alternative asset managers due to fee structures and fee compression, but this question now must occupy mindshare in the board rooms and C-suites of the largest alternative asset managers.

Why? Because fee structures may look different in private markets than they do today.

Perhaps if we peer into a future where fees on alternatives products go down as the market becomes more standardized and productized for the individual investor (read: evergreens and index funds), then perhaps this strategic decision could make more business sense as public and private markets converge.

Revolutions happen in evolutionary ways. BlackRock’s acquisition of Preqin could one day be looked upon as being one of the early indications of how and why private markets became unlocked for more investors to make private markets truly mainstream.

If so, the price that BlackRock paid for Preqin, despite some calling it expensive today, will seem like a small price to pay for the asset inflows they will have helped themselves and the broader industry achieve.

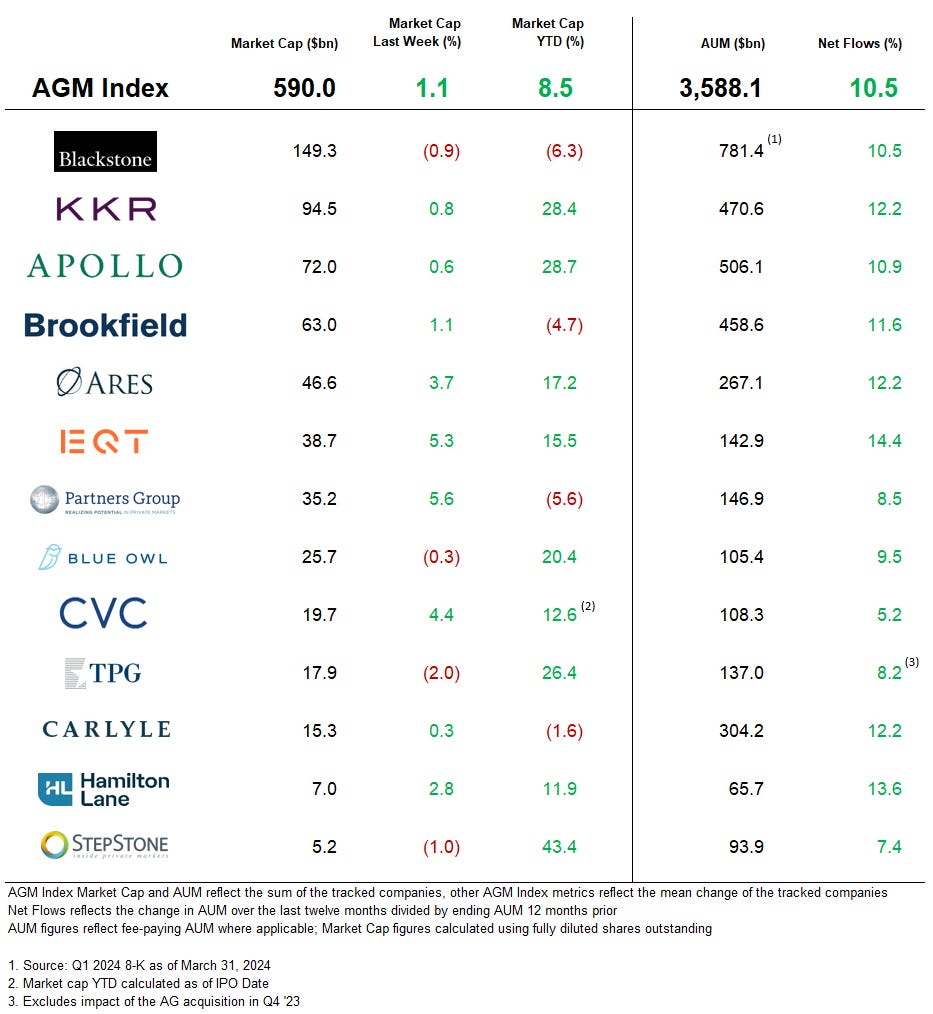

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 The optimal portfolio for the next decade | Christian Mueller-Glissman, Goldman Sachs for The Financial Times

💡Head of Asset Allocation Research at Goldman Sachs Christian Mueller-Glissman shared views with The Financial Times on how investors should consider moving beyond the 60/40 portfolio. Mueller-Glissman notes that the surge in inflation over the past few years led to one of the largest losses for multi-asset portfolios in over a century. The 60/40 portfolio strategy of investing 60% in equites and 40% in bonds may no longer deliver the same performance for investors over the coming decade. Mueller-Glissman unpacks Nobel Prize winner Harry Markowitz’s modern portfolio theory, which Mueller-Glissman uses as a starting point for analyzing the “optimal portfolio,” the highest return relative to risk while taking into account diversification, since 1900. The 60/40 portfolio did, in fact, deliver the highest risk-adjusted returns since 1900, but Mueller-Glissman observes that over 10-year rolling investment horizons, the optimal portfolio construction was never exactly 60/40. What would have been the optimal portfolio over the past decade? Well, with poor bond performance and strong equity returns, a portfolio close to 100% equities would have been the optimal portfolio. The value of long-term bonds continues to be a question as uncertainty on inflation, risk from fiscal policies, and higher government debt to GDP ratios loom over bond returns. Yet, it would be imprudent and likely irresponsible for an investor to only have exposure to equities in a portfolio, particularly with concentration in the largest stocks and elevated equity valuations. Yet, expected equity risk premia, the prospective excess returns for equities versus bonds, are at the lower end of their historical range. Perhaps this reflects investor sentiment about positive views on long-term growth. Goldman’s view is that technology revolutions like generative AI and new weight loss drugs, as well as the high profitability of the US tech sector, could lead to equity outperformance over bonds for long periods of time.

Going long equities isn’t without its risks, notes Mueller-Glissman. Deglobalization, decarbonization, risk of commodity supply shocks, demographic trends like lower population growth, higher levels of dependent people, and income inequality all pose real threats to equity returns.

So what’s Goldman’s recommendation? A 33/33/33 portfolio is optimal, Mueller-Glissman says, with 1/3 equities with a bias to “growth” stocks, 1/3 bonds, and 1/3 real assets. This portfolio construction offers “value in being more balanced again” and this “broader diversification is necessary to diversify structural risks.”

💸 AGM’s 2/20: The 60/40 portfolio has come under fire in recent years — and private markets have become a part of the solution. Mueller-Glissman lays out the reasons why the 60/40 will likely have its challenges going forward. That seems to be well-understood by many allocators and can provide an explanation for why alternatives are coming into focus as a major ingredient of an investor’s portfolio construction. Some allocators, like former CalSTRS CIO Chris Ailman, have long departed from the 60/40 portfolio. Ailman said on his Alt Goes Mainstream podcast that many institutional investors are “really managing an 80/20 portfolio (80% equity or equity-like and 20% fixed income or fixed income-like).” Others who are proponents of private markets, like Hamilton Lane’s Mario Giannini, have said that a portfolio could one day look like 50/50 — 50% public markets and 50% private markets exposure. If the definition of private markets exposure encompasses real assets (infrastructure, real estate), then it’s certainly possible to see a portfolio that looks more like what Giannini states going forward. One of the questions that emanates from Mueller-Glissman’s analysis is that of growth. Where will growth in equities come from? Surely, the biggest companies, particularly those that focus on AI or the picks and shovels of AI (like Nvidia), are positioned to capture the growth of a major trend, but with research from Hamilton Lane in 2022 finding that 87% of U.S. companies with >$100M in revenue reside in private markets, how will investors access the growth that Mueller-Glissman references? Investors will likely have to access private markets in order to tap into that growth, particularly in equities. It’s worth reading the tea leaves about Goldman’s actions in order to understand their views on private markets. Back in February 2024, I wrote about how Goldman is a “sleeping giant in alternatives.” With $251B AUM raised into private markets funds from 2019-2022, Goldman has held the distinction of being a top five alternatives manager in cumulative gross fundraising, trailing only Blackstone, Apollo, KKR, and Brookfield.

2024 has proved to be no different. Goldman recently closed on a $20B private credit fund. So, it’s worth taking a look at Goldman’s actions to understand why they believe in the future of private markets.

Questions about private credit

📝 Private Credit Funds With No Skin in Game a Worry: Credit Weekly | Neil Callanan, Bloomberg

💡Bloomberg’s Neil Callanan unpacks a report from the Bank of International Settlements to highlight how watchdogs are concerned about the “substantial” risks to investors in the private credit market after it came to light that almost 40% of funds don’t have skin in the game. The BIS called into concern the “incentive misalignment” emanating from managers avoiding putting their own capital into funds. Private credit has seen a rapid rise in AUM growth, ballooning to a $2.1T industry, according to BIS estimates, as banks have retrenched from certain types of lending following the financial crisis and the ensuing regulatory burdens placed on banks. The BIS is concerned about how this rapid rise in lending activity could impact both returns and underwriting standards. Callanan notes that regulators have turned a sharp focus to how private credit is evolving and the risks that shadow banking poses to the financial system. Regulators have started to voice concerns about how private credit deal activity could impact markets. “The part we don’t know is what goes on” when “non banks are interacting with other non bank financial institutions or ultimately with the borrowers,” Jose Manuel Campa, the Head of the European Banking Authority, said in an interview with Bloomberg Television. “That’s the bit we have to understand better, and have better discovery.” The EBA is concerned that off-balance sheet exposures could become a problem for banks if large non banks need to access credit lines simultaneously. Even those in private credit voice some concerns about the space. Wayne Dahl, Co-Portfolio Manager for Oaktree’s Global Credit and Investment Grade Solutions Strategies said on a Bloomberg Credit Edge podcast that more stress could emerge in private credit, citing “a lot of uncertainty that we’re going to see in the … market.”

🎥 Canyon’s Friedman on Explosive Popularity of Private Credit | Josh Friedman, Canyon Partners with David Rubenstein (“Bloomberg Wealth with David Rubenstein”), Bloomberg

💡Canyon’s Co-CEO, Co-Founder, and Co-Chairman Josh Friedman discussed the growing demand for private credit in a conversation on Bloomberg Wealth with David Rubenstein. Friedman notes that private credit stepped in to fill the gap vacated by banks since they could move quicker and “with more alacrity” than banks to finance these deals. Rubenstein asked Friedman if the fact that private credit is unregulated will cause problems down the line. Friedman offered a balanced, if not nuanced, answer. He said that unitranche lending has become crowded as many private credit firms have focused on this type of lending, with too much credit chasing too few deals. This feature has led to spreads falling, rates coming down, the loosening of underwriting standards, and covenants weakening. These features of the market are certainly cause for concern for Friedman, but he also notes that many private credit firms are taking much less leverage on their loans, and certainly less leverage when compared to commercial banks. Therefore, he does not foresee any challenges in private credit markets causing systemic or existential crisis to financial markets.

💸 AGM’s 2/20: Private credit’s growth is not coming without questions. Anytime an industry experiences a rapid expansion in a short period of time, it’s worth thinking about the potential risks posed by increased capital inflows. Regulators are certainly asking questions about private credit’s growth. For good reason. Risky lending, in part, caused the 2008 financial crisis, so it only makes sense that regulators would place scrutiny on private credit underwriting standards. Proponents of private credit would argue that moving this type of lending activity off balance sheet actually helps preserve the health of the financial system. There’s certainly some merit to that. But, as Friedman notes, meaningful inflows of capital means a loosening of underwriting standards, which could pose issues for funds that are being less discerning with their investment activity. The regulators are right to turn a focus on private credit, particularly as more individual investors begin to participate in private markets. Private markets can ill-afford to have new entrants to the space that have sub-standard investing experiences. Ensuring that they are investing in high-quality fund managers with track records of performance and the right alignment of interest with their investors (as the BIS report focuses on) are important. Both fund managers and investors see the opportunity alongside the risk. The focus on private credit is in part a response to what was discussed above in the changing nature of asset allocation. Bonds no longer provide the returns that many investors are looking for, so they’ve gone in search of higher yields. Private credit offers a more enticing return, but can come with more risk. Some investors are willing to take that gamble. The question is, for how long?

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Corporate Communications. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

🔍 Canoe Intelligence (Private markets data) - Director of Engineering. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear New Edge’s CEO, Managing Partner, and Co-Founder Rob Sechan and CIO Cameron Dawson discuss growing a cutting edge $44B platform to serve the wealth channel and help them navigate private markets. Listen here.

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Michael — terrific insights re: BlackRock and the broader implications around the recent Preqin acquisition. One observation you make is particularly prescient: “Better data will provide investors with the ability to make better and more well-informed allocation decisions.” Couldn’t agree more.