AGM Alts Weekly | 8.11.24: The middle is far from middling

AGM Alts Weekly #64: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In private capital, success isn’t just about the number of closed deals. It’s about deal velocity and profitability — and to measure that, you need robust deal intelligence and detailed, holistic data views and analysis.

Intapp DealCloud lets your firm measure, manage, and improve your dealmaking pipeline and speed. Discover more about how DealCloud can help your firm improve your dealmaking speed and quality.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

AGM helps companies, funds, and professionals get in front of the right people across multiple mediums — podcast, newsletter, and events — to help them build their business in private markets.

Fill out this form using the link below to explore partnership opportunities.

Good afternoon from Washington, DC.

Looking over the private markets vista

Earlier this week, Bloomberg’s Ryan Gould reported that Vista Equity Partners, the $100B+ AUM enterprise software-focused alternative asset manager, was shuttering its hedge fund, Vista Public Strategies Fund LP.

Vista’s rationale? The “center of gravity for technology and software has continued to migrate away from the public markets to the private equity and credit markets,” they noted in a letter to the fund’s investors.

If there’s an investor who has an understanding of technology and software markets, it’s Vista. Since its founding in 2000, Vista has become one of the largest and most active investment firms investing in enterprise software, data, and technology-enabled solutions. With a team of over 200 investment professionals and a track record that boasts over 600 private equity transactions that include a large number in the middle-market and lower-middle market of the technology sector, Vista would seemingly have a pulse on where the opportunity is in technology and software investing.

Does this mean private markets represent a more attractive risk-reward than public markets?

Yes, virtually all of Vista’s $100B AUM but the $550M in its hedge fund resided in private equity and private credit. So yes, they have certainly scaled their private markets businesses much more than they did their hedge fund.

But Vista’s move to focus on its private market strategies instead of its public markets-focused hedge fund illustrates a much bigger trend at play: the attractiveness of private markets, and in particular, the middle-market.

Vista doesn’t appear to be the only firm in private markets turning a focus to private equity and private credit in the current environment. iCapital, which has a good purview into much of the private markets trends both due to access to a large number of GP relationships and their performance data and LP / wealth channel flows, published its Q2 2024 Strategy Ratings in late July.

Private equity, particularly middle-market buyout and early-stage venture capital, and private credit both received “positive” ratings. Despite the fact that scale and size do matter in private markets — and that the biggest deals in both private equity and private credit can now really only be won by a handful of firms that have both the size and capabilities to bring the capital and resources to the table for those businesses — the middle-market is a really attractive category for GPs and LPs alike.

The middle is far from middling

Why would the middle-market be an area of focus for funds and LPs?

The proof is in the performance.

Earning a return

As the iCapital Strategy Ratings report notes, middle-market buyout funds outperformed all other buyout strategies in 2023, with over 11% in net return, according to Preqin data.

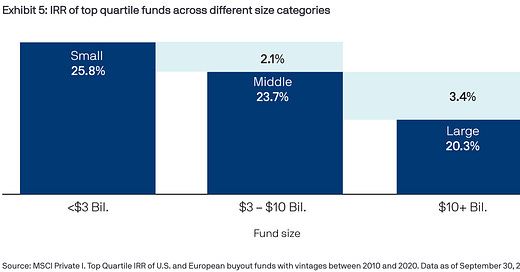

A June 2024 report by Alt Goes Mainstream podcast guest Tyler Jayroe from JPMorgan finds data from MSCI that top quartile US and European buyout funds that were sub-$3B meaningfully outperformed funds $3-10B and $10B+ during the 2010-2020 vintages. Return dispersions were not small — sub-$3B funds generated 25.8% IRR, 2.1% greater than funds $3-10B in size and 5.5% greater than funds $10B+ in size.

Pinebridge finds an even greater interquartile spread between upper-quartile middle-market funds relative to upper-quartile large-cap funds.

For the past 10 years, upper-quartile middle market funds posted net IRRs that were 719 basis points higher than upper-quartile large-cap funds, according to data from Preqin.

There are a few reasons why the middle-market, provided funds are able to pick well, can generate excess returns.

A larger universe

With a shrinking public market and a universe of around 153,000 private companies in the US with $10M or greater revenues (according to this chart from JPMorgan below), the private markets represent an opportunity set 25x+ the size of public markets.

With a larger universe of investable opportunities comes a more fragmented market. On one hand, that can make it more difficult for firms to find and source the best companies. On the other hand, it makes for a more inefficient market from a pricing perspective.

Lower entry prices

Purchase price matters, as Apollo would say. The entry multiple can have a major impact on the outcome of an investment, particularly in the middle-market. It’s not always the case, but oftentimes, paying a lower price can lead to a better return because there’s a lower threshold for a higher multiple required at exit to generate a return.

JPMorgan finds that the median acquisition multiple for companies valued at less than $1B has been 15% lower than those valued between $1B and $2.5B and 22% lower than companies valued at more than $2.5B.

Pitchbook data on US buyout deals between 2010 and Q3 2023 shows a 10.4x median EV/EBITDA multiple for companies between $100M-$1B enterprise value versus a 12.9x EV/EBITDA multiple for companies >$2.5B.

Data from Hamilton Lane’s Cobalt tells a similar story. Median EV/EBITDA for middle-market companies has been markedly lower over the past 15 years relative to mega and large cap deals.

It is worth noting that the median EV/EBITDA multiple at entry has been on a virtually secular increase for both middle-market and mega / large-cap deals. If entry multiples continue to stay elevated relative to the past 15 years, then returns could go down across the board.

Who has the leverage?

Not only are entry prices lower, but middle market deals tend to use significantly less leverage than large-cap deals to achieve target returns.

JPMorgan finds that companies that are valued under $1B have 20% less acquisition leverage than larger companies.

Hamilton Lane also finds marked differences in median Debt/EBITDA multiples between middle-market and mega / large-cap companies.

Less leverage means less risk. This is a particularly important feature in a higher rate environment, where there’s more uncertainty about rate cuts and the ability for companies to make good on their interest payments. Lower leverage also enables companies to free up cash to invest back into the business or return to shareholders.

Coupled with the opportunity for greater ability to influence change within management teams and processes in middle market companies, middle-market PE firms have an opportunity to generate faster and outsized value creation.

Resilient market fundamentals

Middle-market companies tend to have strong fundamentals and business performance, even in the face of a slower growth environment. iCapital’s paper cites data from the Golub Capital Altman Index, which found that sponsor-backed, middle market companies reported 5% and 11% year-over-year revenue and earnings growth, respectively, for the first two months of 2024. These results fared well to the S&P 500’s 4% increase in revenue and 6% increase in earnings for Q1 2024.

Hamilton Lane’s Kenneth Binick found that middle-market buyout deals have tended to have lower loss ratios than their mega and large-cap counterparts. Across the 2003-2023 vintages, Binick noted that 55.8% of realized deals in the middle-market exited at 2x TVPI or above versus only 47.7% for mega and large-cap deals.

There’s also the question of volatility. While critics of private markets cite the less frequent reporting cycles as an illusory tactic to make private markets investing seem less volatile than public markets investing (“volatility laundering”), others claim that private equity harbors lower volatility than public markets. This piece won’t go into the details of the argument on either side as that warrants an entire discussion of its own. But it is worth noting that Pinebridge cites Cambridge Associates, FactSet, and Bloomberg data that analyzed the correlation and standard deviation of returns generated under the middle-market, large market, and MSCI World index from 2013 to 2023 to find that middle-market private equity provides lower correlation to public markets and lower volatility than large market private equity.

More exit off-ramps

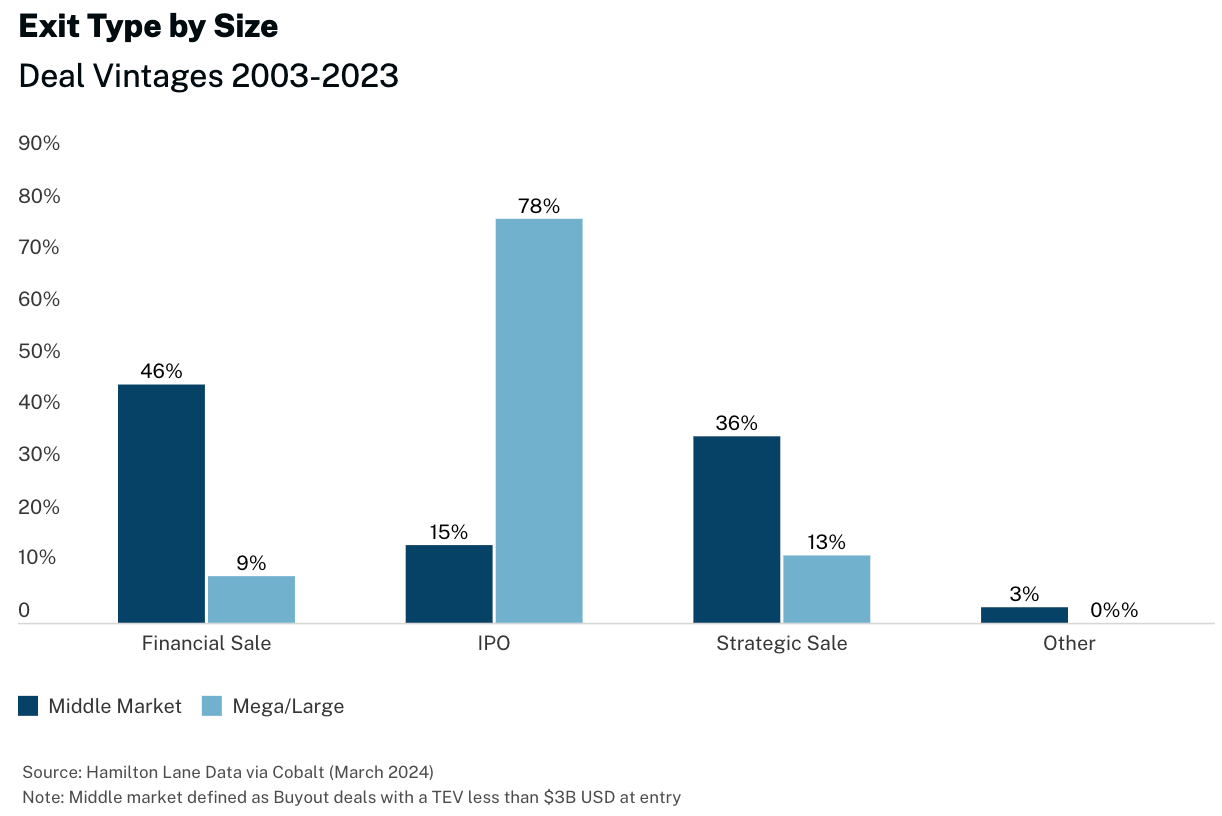

What could explain both lower loss ratios and higher returns in the middle-market? More optionality with exits. Hamilton Lane’s Binick cites the potential for a more diverse set of exit types for middle-market deals. With a weaker and shrinking IPO market, middle-market companies can still find other ways to exit, with many companies going down the path of sponsor-to-sponsor or strategic transactions.

iCapital’s Strategy Rating paper notes that over 90% of middle-market buyout exits are either sponsor-to-sponsor or strategic transactions. Hamilton Lane’s Binick comes to a similar conclusion.

Not only are exit options aplenty in the middle-market, but they tend to happen sooner. With DPI top of mind for LPs, the ability for a fund to achieve a quicker exit can be very attractive for both LPs and the GP as they look to raise a future fund.

A promising vista for middle-market private equity

The numbers appear to be very much in favor of middle-market private equity.

Entry EV/EBITDA multiples, as illustrated by iCapital’s Strategy Ratings paper below, appear to be stabilizing from a period of exuberance back to 2016-2017 levels. This makes for an attractive entry point for funds that are operating in an environment where public markets are fewer and farther between. The secondaries market is also growing in size and scale, so in addition to the plentiful exit off-ramps for middle-market PE managers with sponsor-to-sponsor transactions and strategic sales, they should be able to achieve liquidity through secondaries as well.

Middle-market private equity appears to be well-positioned going forward. As the big funds become bigger and duke it out for a smaller universe of deals, middle-market PE firms can fish in a pond with plenty of opportunities at attractive prices and still generate strong exits.

In a June 2023 paper, Preqin found that the average exit multiple for US mid-market deals still landed well above the average in 2022 at a 7x average exit multiple, above the 10-year average from 2012-2022 of 6.25x.

Yes, certain LPs, particularly institutional LPs, require a level of size and scale from their GPs because their required check size may preclude them from being very active investing in middle-market funds, but for those LPs that are able to invest in smaller fund sizes, it should certainly be on the menu.

All of this data taken together should indicate that middle-market private equity defies the very meaning of being in the middle: it’s performance over time would indicate that the best middle-market buyout firms are far from average.

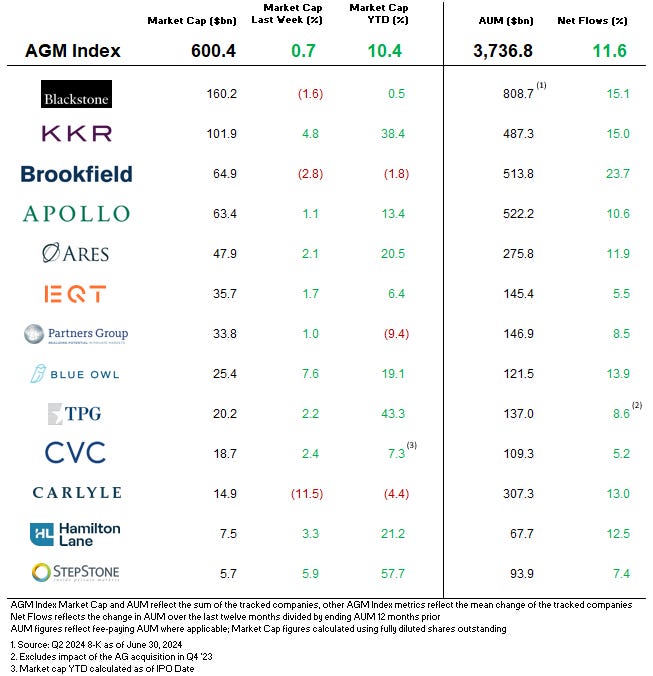

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Stonepeak beats target by raising $3.15bn infrastructure fund | William Bennett-Lynch, Preqin

💡Infrastructure fundraising appears to be picking up steam in the midst of a difficult fundraising environment for the strategy. Preqin’s William Bennett-Lynch reports on the success of Stonepeak, which closed its oversubscribed Opportunities Fund at $3.15B, 26% above its original target of $2.5B. Stonepeak Opportunities Fund is the seventh-largest infrastructure vehicle to close thus far in 2024, according to Preqin data. The $3.15B raised falls just short of the $3.3B Stonepeak raised for their first-ever Asia-focused infrastructure fund. Other funds raised this year include KKR’s Asia Pacific Infrastructure Investors II, which closed in February at $6.4B. KKR’s fund remains the largest fund closed year-to-date. Stonepeak is also targeting a much bigger raise for its flagship fund, looking to raise $15B for its fifth flagship infrastructure fund, according to publicly available documents from the State of Connecticut Retirement Plans & Trust Funds (CRPTF). This figure would mark an increase from the $14B it raised in Fund IV.

According to Preqin data, infrastructure has been mired in a muted fundraising environment thus far this year. Only $18.4B was raised in unlisted infrastructure funds in Q2 2024, which was 50% of the average quarterly capital raised in the preceding five years ($33.7B). This figure pales in comparison to the largest fund closed in 2023, when Brookfield Infrastructure Fund V closed on $28B in December 2023.

Yet investors appear to believe in the merits of infrastructure investing and its returns. According to Preqin's Investor Outlook H2 2024, 29% of infrastructure investors expect an increase in the asset class’ performance, compared with 17% at the same time last year.

💸 AGM’s 2/20: Infrastructure should be an attractive asset class for investors given the size and scale of capital required to fund megatrends like digitization (data centers) and decarbonization. Outside of the Brookfield raise, sentiment for infrastructure appeared to be muted in 2023. That trend has seemingly continued into 2024, with the first half of the year seeing low levels of fundraising activity. Perhaps that is starting to change with news of Stonepeak’s fundraise. UBS’ Head of Research and Strategy, Infrastructure Alex Leung published a paper in May 2024 citing that infrastructure is seeing early signs of the “return of ‘animal spirits.’” Despite a slowdown in overall dollars raised relative to years prior, the average fund size of infrastructure funds raised in 2024 has been markedly larger than in years past. Data from Infrastructure Investor through March 2024 illustrates that the average fund size was over $2B in 2024, a figure much greater than the strategy’s previous high of ~$1.7B average fund size in 2022.

Investor interest in infrastructure appears to be high. UBS’ Leung notes that investor surveys showed approximately 40% of institutional investors are still looking to allocate more capital into the infrastructure asset class.

The industry’s largest alternative asset managers have certainly taken notice of stated investor interest in infrastructure. The large multi-strategy alternatives platforms have looked to grow their businesses by adding scaled infrastructure investment firms to the mix. A number of notable transactions, punctuated by BlackRock’s $12.5B acquisition of $100B AUM Global Infrastructure Partners in January 2024, have occurred in the past two years. Other landmark deals have included CVC’s acquisition of €16B AUM DIF Capital Partners, Bridgepoint’s acquisition of $19B AUM Energy Capital Partners, and General Atlantic’s acquisition of $12.5B AUM Actis.

I expect that we’ll see continued activity on the M&A front with infrastructure managers, given the size and scale of the opportunity and the ability of the large, scaled platforms to help sector specialist fund managers raise capital. I wouldn’t be shocked if Stonepeak, a $60B+ AUM manager that has a minority stake from Blue Owl, is next.

The continued intersection of alts and wealth: private equity investing in wealth management

📝 Creative Planning pursuing capital raise up to $4bn - sources | Ian Wenik, Citywire

💡One of the industry’s largest RIAs, $300B AUM Creative Planning, is pursuing a capital raise of up to $4B, according to Citywire’s Ian Wenik. Creative Planning, which has hired Goldman Sachs as its investment banker for the $1-4B capital raise, is looking to help its current private equity backer, General Atlantic, sell a minority of its position in the company. Creative is majority-owned by Peter Mallouk, who bought out the firm in 2004 when it had less than $100M AUM and has overseen astronomical growth in the business.

An InvestmentNews article from October 2023 highlights just how marked AUM growth for Creative planning has been since 2015. Unsurprisingly, a massive jump in AUM occurred from 2019 to 2021, when the firm went from $47.9B AUM to $133.8B AUM. That coincided with General Atlantic’s minority investment into Creative Planning in February 2020.

General Atlantic expects to retain a large portion of its investment in Creative Planning, according to Mallouk, who said he “expect[s] they will remain invested at many multiples beyond their initial contribution.” The inclusion of a new investor in Creative Planning represents a good run for GA, which has helped oversee AUM growth of Creative Planning from $47.9B AUM in 2019 to over $300B AUM in 2024. Creative Planning has historically leveraged referrals and word of mouth to acquire customers, using TD Ameritrade’s AdvisorDirect program and a partnership with motivational speaker Tony Robbins. They’ve been much more acquisitive as of late. They recently acquired $29.4B AUM Goldman Sachs’ PFM (formerly known as United Capital before it was sold to Goldman), retaining $20B in assets post-sale, and also acquired Meisrow Financial’s $13B retirement plan business.

Wenik reports that it’s not only Creative Planning that is in the market for a minority investor, but also one of its Kansas neighbors and largest competitors, Leonard Green & Partners-backed $230B AUM Mariner Wealth Advisors, is looking for a new investor. These developments don’t come as a big surprise as these large wealth management firms continue to look for ways to grow, particularly when it comes to inorganic growth via M&A.

💸 AGM’s 2/20: Creative Planning’s current capital raise highlights a continued trend in private markets and wealth management: private equity firms looking to allocate capital to large wealth management platforms that they see as AUM gatherers via organic growth and acquisition. The independent RIA channel is a massive and growing market, yet there’s meaningful concentration at the top of the market. The ~17,000 RIAs in the US manage around $8T of AUM, but only a fraction of the 17,000 RIAs manage over $1B AUM. Cerulli reports that 93% of all RIAs manage less than $1B AUM, whereas firms above $1B AUM manage 71% of channel assets. Therefore, it’s not a surprise that private equity is focused on the largest scaled platforms that can become consolidators through M&A, where the synergies of adding meaningful incremental AUM to a larger platform are very accretive and result in a higher multiple for the platform. These larger firms can have attractive EBITDA margins (30%+) and a steady cashflow profile given their size and scale, providing them with the ability to take on either equity or debt to finance the growth of their firms via M&A.

The big question looming over the likes of Creative Planning and its peers is, what does the exit horizon look like? Perhaps they can continue to run these businesses as profitable, cash-generating enterprises. But eventually, private equity will need an exit and there are only so many investors that can invest the capital required to take out the existing private equity investors. Could sovereigns or pensions (like Canada’s Maple 8 or Temasek, which a few days ago told Institutional Investor that they plan to invest another $30B into the US in addition to the $63B already invested in the region) become the next likely buyer of wealth managers? It will be interesting to see how the wealth management market continues to unfold, particularly as across the pond, one of the UK’s largest investment platforms, publicly listed Hargreaves Lansdown, has just gone through with a take-private …

📝 Hargreaves Lansdown agrees to £5.4bn takeover | Emma Dunkley, Financial Times

💡A few weeks ago, I highlighted two Financial Times articles about reports on Hargreaves Lansdown entertaining private equity bids. This past week, Hargreaves Lansdown accepted a £5.4B takeover bid from a consortium of investors that include CVC Capital Partners, Nordic Capital, and Abu Dhabi Investment Authority, according to Emma Dunkley of the Financial Times. The consortium has agreed to pay £11.40 in cash per share, which also includes a final dividend of 30p for the last financial year. The deal has an “alternative” option for shareholders who want to stay invested in Hargreaves Lansdown, which allows them to roll over their stake into the unlisted company. Hargreaves, a FTSE 100 listed business, was founded in 1981 by Peter Hargreaves from his spare bedroom with Stephen Lansdown. The company grew, floating on the FTSE in 2007, as it continued to bolster its business of offering individuals low-cost access to funds, stocks, and shares. The deal makes Hargreaves Lansdown the latest company to delist from the London market, continuing the growing trend of private equity firms and other acquirers taking UK companies private since they view them as cheap and attractive assets to own. The private equity consortium said they would focus on growing the business by creating efficiencies in technology. They view Hargreaves Lansdown as requiring “substantial investment in technology-led transformation” to improve its “proposition and resilience” and to drive “the next phase” of growth and development. It appears that Hargreaves has faced stiff competition from more digitally native challengers like AJ Bell and Vanguard, in addition to neobrokers like Revolut, as this chart from a 2023 Financial Times article on Hargreaves Lansdown illustrates.

Staff costs ballooned relative to rivals, leading Hargreaves Lansdown to look to “automate the hell out of everything” to improve its aging technology infrastructure. In 2022, the company unveiled a plan to invest £175M in upgrading its technology systems.

Questions abound for one of the UK’s largest investment platforms. They built their reputation by selling investments directly to customers and offering tax-efficient products such as Individual Savings Accounts and self-invested personal pensions, growing to over £155B AUM and 1.9M customers. As they’ve faced attacks from competing platforms that have lowered fees, leaving Hargreaves Lansdown to be the more expensive option, some believe that the take-private offers an opportunity for a reset. Analysts believe that Hargreaves can reduce fees and improve technology to drive growth over time.

💸 AGM’s 2/20: As large US wealth platforms Creative Planning and Mariner Wealth look to bolster their roster of private equity partners, across the pond Hargreaves Lansdown was taken private by some of Europe’s biggest private equity firms and a sovereign. This development signals private equity’s continued involvement in the wealth management space. Hargreaves Lansdown doesn’t come without its issues. Despite its UK market dominance, it has run into challenges as rivals like AJ Bell have built much more nimble technology systems and created more efficient businesses. But there’s still plenty for CVC, Nordic Capital, and ADIA to work with. Hargreaves Lansdown boasts £155B AUM and 1.9M customers, which has resulted in £765M of annual revenue and a 52% EBITDA margin. Hargreaves will need to undergo a major digital transformation to create more efficiencies and grow its sales, which could be a challenge for revenue growth in the face of falling interest rates and competitors’ lower fees.

It’s also hard not to wonder if its new private equity backers will look at their own businesses, particularly CVC, which has acquired a number of alternative asset managers to grow their AUM and platform in advance of listing, and think that it could make sense for Hargreaves to launch private markets offerings to their clients in a bid to grow AUM and fee take.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - VP, Private Wealth Content Strategist. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 NewEdge Wealth (Wealth management) - Custodial Wealth Operations Manager. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse. We discussed the evolution of the industry through the lens of iCapital’s growth and maturation, which has most recently included the creation of iCapital Marketplace. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear New Edge’s CEO, Managing Partner, and Co-Founder Rob Sechan and CIO Cameron Dawson discuss growing a cutting edge $44B platform to serve the wealth channel and help them navigate private markets. Listen here.

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.