AGM Alts Weekly | 8.18.24: Specialty gets credit

AGM Alts Weekly #65: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Unlock the power of AI — without risking the security of your firm or client data.

Intapp DealCloud’s secure AI capabilities deliver timely, accurate intelligence straight to your professionals. You can improve data insights, strengthen relationships, and speed up firm workflows — all while meeting essential compliance requirements.

Discover more about Intapp’s Applied AI strategy, including these five key AI capabilities: zero entry, summarization, generation, recommendation, and conversational query. Find out how these capabilities can help your firm safely leverage the powerful benefits of AI.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

AGM helps companies, funds, and professionals get in front of the right people across multiple mediums — podcast, newsletter, and events — to help them build their business in private markets.

Fill out this form using the link below to explore partnership opportunities.

Good afternoon from NYC.

Earlier this week, Financial Times’ Will Schmitt reported that $361B AUM asset manager Janus Henderson reached a deal to acquire a majority stake in $6B AUM Chicago-based private credit firm Victory Park Capital.

Janus Henderson’s rationale? Acquire the expertise necessary to tap into the “significant market opportunity” that has emerged within private credit, according to their CEO, Ali Dibadj. That opportunity? Asset-backed lending.

Private credit is an ever-expanding universe. The now $1.7T asset class that is expected to grow to $2.8T by 2028 appears to show little signs of slowing growth. Apollo’s March 2024 investor presentation has called private credit a $40T addressable market that’s part of the broader, secular trend of debanking. Ares calls private credit a $20T market. Blackstone characterizes it to be a $25T market.

As the market keeps growing in size and scale, specialization appears to become increasingly valuable.

Specialty gets credit

Janus Henderson’s acquisition of a majority stake in Victory Park is notable for a number of reasons that highlight the key trends that are defining the current state of the evolution of private markets.

But one reason stands out: the focus that traditional and alternative asset managers have on building out or acquiring capabilities performed by specialist firms.

Victory Park Capital (VPC) is an example of this phenomenon. Founded in 2007 by Richard Levy and Brendan Carroll, VPC has specialized in asset-backed lending since 2010. The firm focused on small business and consumer finance, financial and hard assets, and real estate credit. They were amongst the early adopters of financing consumer and SMB loans via the fintech lending platforms that started to emerge in the 2010s. A focus and expertise in this category led to the growth of a firm that has invested over $10.3B and has over $6B AUM, according to a press release from this past week.

Janus Henderson certainly thought highly of Victory Park’s growth and specialization. JH’s Dibadj said as much to Michael Thrasher of Institutional Investor: “There aren’t many firms who do this. Certainly not as well. They definitely have the best brand name in the space … I’ve continued to hear about that, not just in our diligence, but today from clients, [and] from others who know this business.”

VPC wasn’t the only firm to enter the crosshairs of a larger asset manager or diversified alternative asset manager.

Just a few weeks ago, Blue Owl acquired a firm in Atalaya that also carved out a strong brand and growing AUM in private credit and asset-based lending. Atalaya, which started in 2006, grew its business to over $10B AUM. It didn’t come cheap, either. Blue Owl’s acquisition valued Atalaya at what could end up amounting to over $800M.

A few weeks before Blue Owl acquired Atalaya, Brookfield took a 51% stake in Castlelake’s fee-related earnings. Castlelake, a $22B AUM private credit firm, has been one of the longest-tenured investment firms focused on asset-based investments. Since 2005, Castlelake deployed $39B across 1,300 transactions globally, according to a press release from May 2024.

Despite boasting an expansive private credit franchise that already manages $300B, Brookfield thought it would be additive to their platform to partner with a specialist who has had expertise and a track record of asset-based finance.

Why are firms so focused on acquiring capabilities in asset-based finance?

A good asset to have

The private ABF market is a rapidly growing corner of the private credit universe. A number of structural tailwinds should only serve to increase the growth and popularity of ABF.

The continued trend of banks tightening lending standards should only serve to increase the need and popularity for private credit and asset-based finance solutions.

A chart from a Castlelake April 2024 whitepaper illustrates just how much banks have tightened lending standards since 2021. The percentage of banks that have increased their lending standards due to regulations and asset / liability liquidity mismatch was nearing 2008/2009 levels in 2023, as the chart below illustrates.

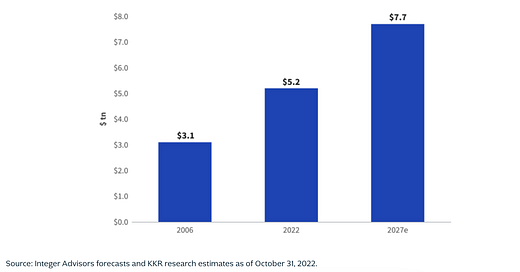

This development has meant that ABF has increasingly eaten into the public securitization market and government and federally sponsored funding markets over the past 18 years. A chart from a 2023 whitepaper by KKR on the ABF market highlights just how much market share ABF has captured.

Investors also like the attractive characteristics of ABF. It can generate yield premiums in certain cases due to its more complex structures. A recent whitepaper by Alliance Bernstein noted that specialty loan pricing for auto loans and credit cards in the US and UK could come in at 20% yield.

Yields on US direct lending, as measured by the Cliffwater Direct Lending Index, stood at about 12% at the start of the year, while public credit assets such as US and European high-yield debt hover between 6% and 7.5%.

Asset-based private credit is a compelling sub-category of the direct lending universe for investors, in large part due to the nature of the assets being lent against and the structure of the loans. ABF focuses on cash-flowing assets that have structural protection, with the lenders often putting the assets in SPVs that are bankruptcy-remote and non-recourse. A chart from the Castlelake whitepaper highlights some of the structural differences between asset-based lending and direct lending.

In addition to attractive returns, investors can benefit from low correlation to other relevant asset classes in public and private credit, according to the KKR whitepaper.

Direct lending has also tended to outperform other categories of credit, like leveraged loans and high-yield bonds, generating higher returns relative to volatility, according to a June 2024 Morgan Stanley whitepaper on private credit.

The why behind an acquisition

Why would a specialist manager want to be acquired by a larger traditional or alternative asset manager?

In past weeks, we’ve discussed the power of scale and why larger firms want to be a one-stop shop for LPs since it can enhance the ability to cross-sell LPs on different investment strategies in a bid to expand the LP relationship.

But if private markets AUM is likely to grow, which would stand to benefit many firms, both large and small, why would a specialist manager decide to join forces with a larger platform rather than go at it alone?

(1) Certainly, a monetization event is attractive for owners and investors in the firm. As GP stakes becomes a more prevalent feature of private markets, this will only become an increasingly popular path for firms.

(2) Chief among the other reasons is scale for distribution. VPC Founder, CEO, and CIO Richard Levy said as much in a statement on why they sold a stake to Janus Henderson. Levy said Janus Henderson can help VPC grow more quickly by augmenting its sales and distribution, particularly to insurance companies and the wealth channel.

Distribution is, to some extent, a numbers game and a brand game. Larger firms are more well-resourced, so they are better equipped to invest in hiring distribution professionals and building a brand. The wealth channel, in particular, requires boots on the ground. This competition will only intensify as more firms — both traditional asset managers and alternative asset managers — enter the wealth channel.

(3) Expansion of capabilities is another reason for becoming part of a larger platform. In this case, Janus Henderson has a large securitized assets business, with $36.3B in securitized assets under management. They have been a pioneer in active securitized ETFs. VPC’s private credit expertise and capabilities should serve to complement Janus Henderson’s business and also enable VPC to expand its geographic and product capabilities.

The big questions that come from a deal like this (and the others that will come as a result of continued consolidation)?

Will traditional asset managers that acquire capabilities in alternatives by buying or partnering with specialist managers ultimately win the distribution game in the wealth channel because they already have large teams of distribution professionals covering the wealth channel, existing relationships with wealth managers, and an established brand?

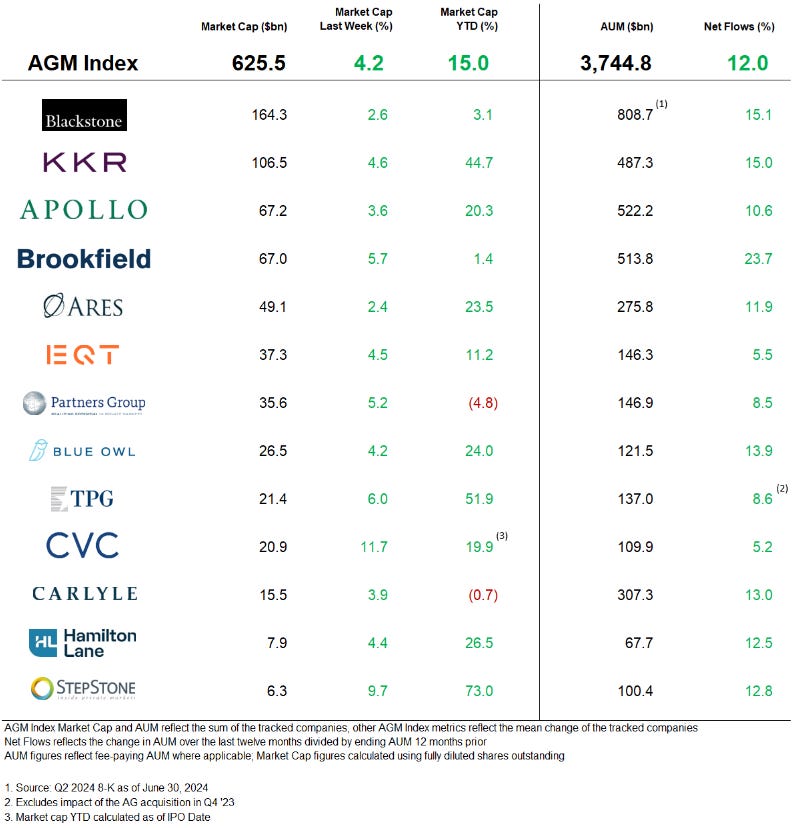

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Gamblers Are Dumping Stocks to Bet on Sports, New Study Says | Lu Wang, Bloomberg

💡Bloomberg’s Lu Wang reports on a worrisome trend plaguing many individual investors based on the finding in a recent working paper titled Gambling Away Stability: Sports Betting’s Impact on Vulnerable Households. The study finds that a number of Americans appear to be taking money out of their stock brokerage accounts to fund online betting activities, in large part because they view gambling as a money-making opportunity. The working paper claims to find evidence that for every dollar spent on gambling, net investments in stocks and other financial instruments dropped by just over $2. The phenomenon is apparently even more acute amongst the most financially strained households. The paper’s co-author, Jason Kotter, an assistant professor of finance at Brigham Young University, said: “It’s not just an innocuous rise of a fun entertainment industry, although it is surely that to some types of households. There’s a real cost particularly to constrained households here that I think should concern policy makers.” The counterargument from those who defend casinos is that the study draws false comparisons between investing and gambling, as gambling competes for entertainment, not investment, dollars. However, as the memefication and gamification of financial markets have become more commonplace, some might consider retail trading, which includes speculative options trading, to be like gambling. Bloomberg’s Wang posits that these “thrill-chasing retail pursuits,” when framed this way, “can be seen as two sides of the same coin.” Retail investing platforms like Robinhood are aiming to try to move individual investors off of more speculative single-stock investing or options trading into popular retail stocks like GameStop by offering index-tracking investment products.

There’s plenty of debate as to whether or not stock investing and trading by individual investors should be treated as gambling. Vice President of Research at the American Gaming Association David Forman claimed that the paper exaggerated the effect of gambling on households’ financial health. “They talk about spending on sports betting as a negative expected value investment compared to other positive expected value investments,” he said. “That’s just not how consumers think about spending their entertainment dollars on sports. It is not an investment, it’s an entertainment option.” The paper’s author, Kotter, counters that point by arguing that a “person’s natural proclivities for risk-taking … affect their decisions across both gambling and investing.” The gaming industry is aware of the financial risk that gambling can have on the financial health of American households. In March of this year, seven of the largest US online gaming companies formed an alliance to foster responsible gaming.

💸 AGM’s 2/20: How does an article about gambling behavior and trends relate to private markets? More than we might think — and for a number of reasons.

Sports betting is a major driver of a trend that is growing in private markets: increased participation by institutional investors in investing in sports properties. The revenue opportunity and sports teams as entertainment properties are a large part of what’s making sports an investable asset for investors. Gambling is a driver of increased interest and engagement in sports, particularly as sports teams and leagues continue to look for ways to engage fans outside of the stadium and outside of the hours that the teams play their games / matches. For leagues and teams, it all comes down to dollars and cents. A 2018 research report by the American Gaming Association posited that the NFL’s annual revenue could increase by $2.3B per year due to legal, regulated sports betting. This prediction has played out for teams and leagues. An American Gaming Association report from 2023 found that sports betting generated a record $10.92B in 2023 revenues, up 44.5% from 2022. Certain live events capture the attention and mindshare of fans and bettors. AGA projected that Americans would bet $23.1B on Super Bowl LVIII. With media contracts generating billions of dollars annually (and only continuing to grow), sports betting revenues add eye-popping figures to the revenue share available to sports teams and leagues. It’s no surprise that institutional investors, including large private equity firms with expertise in media and entertainment, like CVC, Sixth Street Partners, Ares, RedBird Capital, and others, are taking a keen interest in sports investing.

While sports betting represents an opportunity defined by dollars and cents for investors in sports teams and leagues, it might not make dollars and sense for those individuals gambling their money. The worrisome trend highlighted in the paper is a very real concern for individuals — in two ways. One, according to the study, individuals who employ risk-taking behavior in the stock market and extrapolate that behavior to gamble on sports may impact how much money they invest in financial products. Two, this type of speculative behavior, whether it be in equities investing or in gambling, is indicative of a bigger problem: that the current generation may view investing as a speculative activity. The memeification and gamification of financial services is in full force. The retail trading activity into meme stocks like GameStop, Reddit, and others or into many speculative cryptoassets is, in my opinion, a wholly unhealthy activity for both investors and markets. Furthermore, it’s hard to see this type of activity abating since many individual investors appear to want to engage in speculative, risk-taking trading and investing activity. The retail trading platforms certainly don’t help. Their appealing user interface and ease of use to enable investors to buy and sell stocks and investment products almost instantaneously only make it easier for investors to speculate on stocks as easily as they buy a pair of shoes on Amazon.

Where can private markets play a role? To preach the power of patience. I’ll start with the disclaimer: not every private markets investment is suitable for everyone and nor are the fees or illiquidity features. But, at times, illiquidity can be a feature rather than a bug — and private markets investment products can play a role. The inability of investors to sell and enable their capital to compound over time can be a positive for their investment portfolio, even if it’s less engaging for the investor since they can’t trade in and out of a position as easily.

I’m not saying that investors shouldn’t have the choice and agency to do what they wish with their disposable income and investable assets. If they want to invest in meme stocks or crypto, that’s their prerogative. If they want to gamble and bet on sports matches, that’s their prerogative, too. But I do think that it would be prudent to have a portion of their capital invested in investment products where they can’t trade in and out of the asset and benefit from the compounding effects of quality assets growing over time. An illustration of returns on evergreen funds from a recent JPMorgan presentation on their Private Markets Fund highlights just how powerful patience can be. An evergreen fund that generates ~12% net asset return (TWR) provides the same net MOIC of 3.1x as traditional, draw-down private equity funds that have to generate a much higher net asset return (IRR) of ~28% to yield the same MOIC over that 10 year period from the initial investment.

It might be much less exciting than the thrill of watching a meme stock oscillate over the course of a few days or months or bet on the outcome of a sports game over the course of a few hours, but when we think about the power of time and how to balance patience with urgency, perhaps it’s prudent to take a long-term view on investing with (large) portions of an individual’s investable capital.

The embedded subtext in the aforementioned point is that the behavior of individual investors, particularly those who are younger and have a more risk-on investing and speculating mindset, should drive the regulators to think hard about how they can help preserve individuals’ capital over the long term. Yes, individuals should have autonomy over how they invest or spend their money. That’s their choice. But it would behoove all of us not to think hard about how we can match the right investment instruments with the right types of duration for an investment. Private markets products could theoretically fit very well in retirement accounts. Perhaps we can help help individual investors by providing more avenues to invest into private markets via retirement accounts and products like IRAs and 401(k)s. Then they can still invest in the stock market and allocate some of their discretionary assets to speculative entertainment activities like sports betting while also preserving some of their investments for the longer term.

📝 Private Credit Firms Find $1 Trillion Target in Rich Australians | Sharon Klyne, Bloomberg

💡Bloomberg’s Sharon Klyne reports that some of the industry’s largest alternative asset managers are going down under. Klyne reports that Ares, Blue Owl, and Muzinich & Co. are among the firms touting private credit investments to Australian HNWs and spending a lot of time and resources working with the wealth channel in Australia. According to Klyne, they are pitching private credit as a defensive play against equities markets, positing that the strategy can offer an alternative to the traditional 60/40 portfolio. Private banks in Australia also appear to be keying in on the virtues of private credit. Gillian Gordon, Head of Alternative Investments and Responsible Investing at JBWere, which has over A$58B ($38B USD) of funds under advice from HNWs and family offices, said, “The ability to earn low double-digit returns in credit, net of fees, as opposed to taking on higher risk in equity is why the asset class is so popular currently.” Gordon went on to call private credit a defensive rather than a growth asset. Private credit investment opportunities in Australia were previously limited to institutional investors — super funds and pensions — due to high investment minimums and the operational complexities of managing a large number of smaller investors. Australia’s HNW market size makes it understandable as to why alternative asset managers are spending time in the region. Australians had investable assets over $1T at the end of last year, up almost 8% from the end of 2022, according to a Capgemini report published in June 2024.

The rate of growth of the Australian HNW channel has surely caught the eye of alternative asset managers. Ares has raised over A$1B ($654M) from Australian HNW clients for private credit investments since 2020. Ares isn’t the only firm to focus its efforts on Australia. Blue Owl, which already has offices in Hong Kong and Singapore, is seeking to expand further in Australia to tap the growth of private credit in the country. In April, the firm hired Alicia Gregory from Australia’s sovereign wealth fund to be the Managing Director of its operations in the nation. Blue Owl’s Global Private Wealth President & CEO Sean Connor (and Alt Goes Mainstream podcast guest) highlighted the strategic importance of Australia for their wealth channel distribution business: “As we look to expand into markets like Australia, partnership and the right product for the investor are our focus.”

💸 AGM’s 2/20: As the private wealth channel grows in size and importance for alternatives managers — and as alternatives managers expand internationally and grow their distribution teams — it’s not surprising to see them focus on different regions that could become major sources of AUM growth. Where the largest alternatives firms spend time on the ground, fundraising seems to be a good leading indicator of where they think wealth channel flows will come from. Ares and Blue Owl’s focus on Australia, with hires on the ground and spending time in the region, illustrate that they view Australia as a place worth investing time and resources. Japan has cropped up as another region where wealth investors are underallocated to private markets, but private banks are seeing the possibilities of alternatives products and looking to work with many of the industry’s largest alternatives managers. The punchlines? Read the tea leaves by following where the alternatives managers are spending time and resources to work with the wealth channel. And this could be yet another reason why the largest firms that have the resources to hire distribution professionals on the ground in these growing regions will stand to benefit from their scale.

📝 Institutions Are Deferring Hedge Fund Investments Until 2025 | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher reports that Preqin’s latest investor outlook report finds that institutional investors are less enthusiastic about hedge fund allocations in the current market. However, there’s hope for hedge fund capital raising next year, as the June survey of 185 institutional investors finds they are holding back allocations to these strategies until next year. Preqin’s report finds that 7% of public pension assets and 18% of large endowment assets are invested in hedge funds. Why? For diversification, low correlation to other asset classes, and risk-adjusted returns. Diversification was high on the priority list for investors. 68% of institutions surveyed said that was their main reason for investing in hedge funds. That figure was a greater number than those who said the same about private equity (60%), venture capital (59%), and private debt (57%). Nearly half of the institutions noted low correlation to other asset classes as appealing. But institutions aren’t using hedge funds to protect against inflation. Only 7% considered hedge fund strategies to be an inflation hedge. 47% of institutions said they plan to hold tight on their current allocation to hedge funds, but 35% plan to decrease their allocations, a 25% increase from last year’s survey. Asset flows tell the same story. According to Preqin, there were $25.2B in net redemptions from hedge funds between March 2023 and March 2024.. It’s worth noting that critics of this data posit that there may be flawed data. Most hedge funds over $1B in assets don’t share their data to commercial databases.

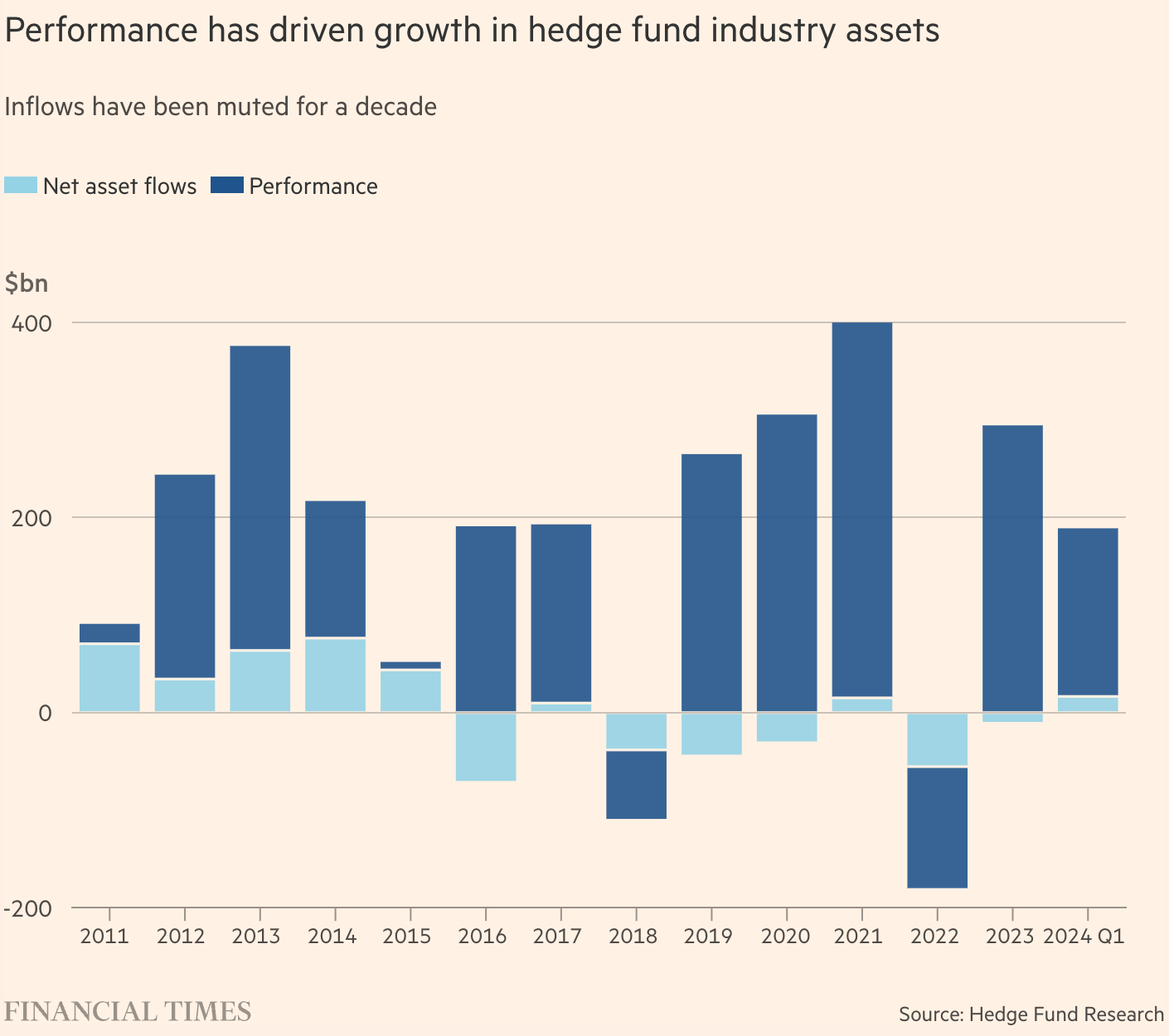

💸 AGM’s 2/20: Hedge funds have appeared to have had a tougher time of fundraising over the past few years. The Preqin survey from earlier this summer highlights that trend. Allocators have gone cold on hedge funds. But it’s not just hedge funds themselves — or their strategies — that are responsible for a more challenging fundraising environment for the strategies. It’s also that private equity’s lower rate of distributions has made it harder for investors to allocate to hedge funds. An FT article from May 2024 illustrated how these two asset classes are inextricably linked. Global Head of Capital Advisory at JPMorgan Chase Michael Monforth said “the lower raite of distributions from private equity, [private] debt and venture funds is having a knock-on effect, leading some allocators to pause on new investments into illiquid funds and reduce new investments in more liquid hedge funds.” This trend highlights that for the majority of allocators, private equity and hedge funds come out of the alternatives bucket. While they are different asset classes with distinct risk / return profiles, private equity and hedge funds are competing for the same assets in fundraising. Hedge fund inflows have been relatively muted for the past decade, with investors pulling out cash from hedge funds on a net basis in five out of the past 10 years, according to Hedge Fund Research.

Let’s see what 2025 brings. If the market is in line for more distributions and increased liquidity if the IPO market opens up and secondaries continue to increase, then that will be a true test for hedge fund capital raising. Based on the past few years and the growing expanse of categories like private credit and infrastructure, it’s far from a sure bet.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Arizona Public Safety Personnel Retirement System (Pension plan) - Senior Portfolio Trader Manager. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - VP, Private Wealth Content Strategist. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.