👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Work smarter, not harder, with the power of AI.

Intapp Assist for DealCloud is an AI-powered solution that automates manual tasks, surfaces key insights, and updates firm intelligence — including market changes, client news, and client interactions. Using AI-powered workflows, your teams can work and collaborate more efficiently, saving focus time for strategic work.

Discover how your firm’s professionals can gain a competitive edge with Intapp Assist for DealCloud.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

AGM helps companies, funds, and professionals get in front of the right people across multiple mediums — podcast, newsletter, and events — to help them build their business in private markets.

Fill out this form using the link below to explore partnership opportunities.

Good morning from NYC.

Notable news this week came as the industry’s behemoth, $1T AUM Blackstone, will now be building with a new CMO. The Wall Street Journal’s Katie Deighton reported that Blackstone’s CMO, Arielle Gross Samuels, has left the firm to join General Catalyst, one of the VC industry’s largest players.

This news is a significant development for both firms — and for the broader industry.

Samuels came to Blackstone from one of the industry’s largest consumer tech companies, Meta, which itself was an interesting move when thinking about the evolution of Blackstone’s brand and its focus on the wealth channel. According to Deighton, Samuels spearheaded Blackstone’s first major advertising campaign and the creation of its brand platform, “Build with Blackstone.”

“Build [brand] with Blackstone”

Blackstone has seemingly made a concerted and thoughtful effort to build a brand that appeals to the broader population beyond the private equity industry. This evolution of their brand has appeared to coincide with a focus on working with the wealth channel. Over the past ten years, Blackstone has grown its AUM in the wealth channel to almost 25% of the $1T total AUM it has as a firm.

To effectively market to the wealth channel, they have had to prioritize a focus on building a brand that resonates with wealth managers and their clients. Blackstone has been innovative in their brand-building work, particularly on social media. Their short-form content on LinkedIn, both at the firm level and by individual partners, like President & COO Jon Gray (whose traveling running videos are becoming a trend) and Global Head of Private Wealth Solutions Joan Solotar (who is authentic and engaging in her posts that are about professional and personal developments), features engaging videos and sound bites that provide an inside look into the firm. Most importantly, they humanize what was once seen as a closed, elite, and rarified industry.

Initiatives like their “Alternatives Era” holiday video, a take on Taylor Swift’s Eras Tour, which I thought was a brilliant piece of marketing, by the way, illustrate a concerted effort to appeal to the individual consumer. The recent news of their first TV commercial only serves to further the notion that they are looking to work with the wealth channel.

Another notable development from this week’s news? The background of the person who will be filling Samuels’ shoes as CMO. Blackstone promoted Catherine McNulty, who previously ran the firm’s private wealth marketing efforts and has over 25 years of experience in product marketing of investment products and working with the RIA / wealth channel, to CMO.

If a company’s personnel moves signal what it views as a priority, then this move would certainly seem to indicate that the wealth channel is a major strategic imperative for Blackstone.

Catalyzing the next trend?

Samuels’ move is an equally significant move for the venture industry.

General Catalyst, the firm she will join as the Chief Marketing & Communications Officer, is already well into an evolution from a fund to a firm. GC, which reportedly has over $25B in regulatory assets, has morphed from a single early stage fund over 24 years ago to a global, multi-stage platform that spans incubation, early stage, and growth stage investing across industries. At one point, they even explored the idea of launching a credit fund in 2018 and more recently launched a new strategy, Structured Opportunities, to buy sales contracts from startups.

General Catalyst is a VC industry poster child for a scaled platform. It has expanded into different strategies. It has grown AUM. It has built out a footprint into new regions through acquisition, as it did by acquiring La Famiglia in Europe. It sold a GP stake to Goldman Sachs’ Petershill stakes fund.

When looking through Petershill’s annual presentation, I found it interesting — and telling — than Petershill characterizes General Catalyst somewhere between private equity and private credit when listing their partner firms.

The fact that GC has gone out to hire a CMO with experience building the brand of the world’s largest alternative asset manager signals a few things:

Investing in brand is critical

Brand has become a centerpiece of sourcing and winning deals and resonating with LPs, particularly as larger firms look to work with the wealth channel.

Samuels said as much when she was interviewed about her move to GC.

“Brand is a key differentiator in terms of the ability to propel deal-flow across sectors, stages and geographies.”

To build a brand, firms have to invest in brand. That includes everything from building a website that showcases the brand, which Blackstone did with aplomb, to investing in the right team to engage with investors and create the most effective content to match the brand.

A visible brand means a firm is top of mind. In a world where consumers and businesses can leverage the power of social media to achieve near-instantaneous connectivity and provide a constant barrage of information, brand matters.

Scaled platforms know they need to invest in brand

Scaled platforms know they need to invest in brand in order to maintain a competitive edge versus their peers.

Hiring an experienced CMO is a clear signal that a firm is investing in brand.

Top Tier Capital Partners General Partner David York alluded to the importance of building a visible brand in today’s world of venture.

“It’s adding a lot of value in a way that guys who are in the trenches never, ever believed it would,” York said. “Now it feeds on itself—you have to keep up with the Joneses if you want to keep your visibility in the right spot.”

This hire likely means that GC is (1) looking to increase the visibility of its brand globally, (2) grow its presence within the wealth channel as it continues to grow AUM, and (3) continues its evolution as a firm to look more like a scaled alternative asset manager.

A relatively new industry

The alternatives industry is still relatively young, certainly compared to public markets. The industry’s largest firm, Blackstone, is only 39 years old. The idea of alternatives occupying a larger portion of an allocator’s asset allocation is still a nascent concept.

Ritholtz Wealth’s Michael Batnick and Ben Carlson asked me a very thoughtful question about why alternative asset managers have decided to work with the wealth channel on this weekend’s Animal Spirits podcast. They asked why the alternatives managers have decided to start to engage the wealth channel. Skepticism was embedded in Ben’s question — and rightfully so. Is there a hierarchy amongst investors in terms of the quality of the product that is offered to different types of investors? My answer centralized around the fact that the wealth channel is far from a second-class citizen in the world of LPs. In fact, I think many alternative asset managers consider them to be the new “institutional LP” (along with insurance companies).

Part of engaging with the wealth channel means building a brand and educating investors on that brand. Embedded in the process of building a brand is educating investors why a specific strategy or skillset is differentiated or unique. Therefore, an investment in education will be a critical component to engaging investors and bringing more investors into the asset class, while also serving as a tool to create differentiation.

Alternatives managers are also going through the evolutionary process of scale. When scale matters, so too does brand.

We’ve talked a lot about strategies for distribution on Alt Goes Mainstream. Building and scaling a distribution team focused on the wealth channel is critical to success for alternative asset managers. But distribution doesn’t work with people alone. Brand can help distribution succeed.

Brand doesn’t just matter for the largest firms, even though they will inevitably have the scale, resources, and ability to invest in building a brand and in education in a way that smaller firms won’t. Brand matters for all firms — and no matter the size, alternative asset managers can benefit from building brand and showcasing their unique advantage via thought leadership.

Tactics for winning the brand battle

What are tactics for alternative asset managers to win the brand battle?

Humanize private markets

Blackstone has put on a masterclass in humanizing private markets with their social media strategy. Their focus on making senior leaders from the organization visible on LinkedIn has made the firm — and the broader industry — seem more accessible and has helped make private markets seem less opaque.

The holiday videos from both Blackstone and Apollo also achieved a similar result. They highlighted companies in a manner that made it possible for viewers and consumers to understand that private equity is behind all sorts of businesses, consumer and enterprise, that touch people’s daily lives.

While a social strategy can be critical to building a brand that an alternatives manager wants wealth managers and individual investors to recognize, many advisors actually want to hear from a salesperson, according to Substance S&C, a creative agency that works with asset managers.

Substance S&C said:

As marketers, we expected to hear advisors say that they wanted to receive content via email, social media, or podcasts. While those vehicles weren’t off the table, the number one way advisors preferred to receive communication is through an internal or external salesperson.

Their advice based on this feedback? That financial marketers should be integrated with the sales teams in order to create the strongest and most efficient feedback loops between what the sales team hears in the field and what they can then translate into impactful content.

This advice ties in well with the importance of creating and highlighting “edge.”

Showcase your niche and expertise

A few weeks ago, I wrote about the concept of “edge.”

“What is your edge?”

The most important question an LP can ask, yet, at times, the hardest for an LP to discern the difference.

How can a GP effectively answer this question from LPs? They can distill the meaning of edge by reframing the question: “What are we selling?”

To sell to LPs, GPs need to break down what they are selling to LPs. Are they selling a brand? Are they selling scale? Are they selling data and technology as a sourcing, evaluating, and investing advantage? Are they selling unique insights or experiences in a market?

All of these questions tie into marketing and brand-building. A winning sales strategy figures out how to answer these above questions since the results here inform how a distribution team will sell in the field.

A firm that is able to do effective brand-building will use education and content as a way to reinforce their brand — and their edge. A large, global, multi-strategy platform like Blackstone might showcase its scale as a selling point and unique advantage. A scaled specialist like Vista might highlight their deep expertise and understanding of enterprise software. A smaller, boutique venture firm like Union Square Ventures might lean into the personal brands that some of their partners, like Fred Wilson has done with his blog AVC, have created to showcase their thesis-driven approach and track record.

Invest in education

I’ve said before that education leads to allocation. Education is so critical, especially as there are so many new LP entrants in private markets. Education is the first step to helping investors understand how to conceptualize private markets investments in the context of a broader asset allocation strategy.

The largest firms have done well to invest in education. They’ve built education platforms, some of the most notable being Blackstone University, Apollo Academy. KKR’s white papers that highlight specific industries and structures, such as their evergreen paper, which dive into some of the details and nuances of evergreen fund structures and returns, appear to be the type of content that is helpful for the wealth channel. It’s educational but also helps provide actionable decisions.

Complement “enterprise sales” strategies with content and information

Ultimately, everyone is selling a product. But there are ways to sell that transform the seller of the product into a solutions provider rather than a product pusher.

Alternatives are still very much sold, not bought. It is also very much a consultative sale. Salespeople need to discern what the buyer is looking for in the context of a client’s broader asset allocation strategy. Therefore, education and content become a centerpiece of the strategy to help prospective clients better understand a product or strategy and how it best fits into a client’s asset allocation strategy. That’s because trust is at the heart of a sale that is often hundreds of thousands or millions (or hundreds of millions of dollars).

How distribution professionals sell, though, becomes crucially important in terms of what it means for the brand. The connection between what salespeople say in the field and how they represent the brand impacts their ability to sell successfully. Substance S&C provided an illuminating example of First Trust, an ETF issuer, a firm with perhaps what would be considered a less-than-desirable website. But that’s not what matters in the sale of their product. According to Substance S&C, it appears to be a firm that lives by their values, which comes through in the sales process in the field.

We’ve heard in a number of conversations with financial advisors that First Trust’s wholesalers are top notch. They are responsive, attentive, and they consistently communicate with the advisors they serve. The result is that whenever a financial advisor needs something, they know they can turn to a wholesaler at First Trust.

But wait, you may say, “Hey, that’s sales, not marketing!” Oh, how mistaken. Wholesalers are the number one preferred source of communication when it comes to interfacing with an asset management brand. That means they are your number one most important marketing channel. What they say, how they behave, and what they do has an impact on your brand. Look no further than First Trust to prove it.

Content and information can be a reinforcing tool in a sales process. If the content itself — and the tone of the content — matches how a firm presents itself both from a branding and sales perspective, then over time, it will create a brand and relationship of trust with the wealth management community. It can take time to build a brand, but a concerted effort and investment in creating the type of content that matches the values of the firm and the way the salespeople interact with the wealth community in the field will likely be worth the investment in the long run.

Leverage LinkedIn

LinkedIn is a powerful platform that meets a lot of customers where they are, particularly when it comes to connecting with wealth managers. Many wealth managers want to learn. They also want to showcase and amplify their knowledge to attract and retain clients.

Leveraging the power of LinkedIn gives wealth managers the opportunity to share perspectives on private markets which can hep them both educate and deliver intelligent insights to existing and prospective clients

Short-form content will become an even more important engagement tool in an era where many wealth managers and clients have “grown up social.” The “TikTok-ification” (for better or worse) of a younger generation that has grown up consuming content on social media has left an indelible imprint on how people consume, digest, and engage with content. With attention spans shorter, firms delivering content need to understand that they must create engaging content that creates a level of trust and affinity.

It won’t be long before younger Millennial advisors are the decision-makers. They are — and will continue to be — managing investments and running client books, so they will be an important client type for alternative asset managers to reach when marketing.

This continued evolution in the client type (the quasi-consumer channel of wealth managers and their end individual clients) and consumptive behavior of the “retail” channel should give alternative asset managers a lot to think about when it comes to hiring the right marketing talent and building a winning marketing and branding strategy. Note that I use “retail” in this context for a very specific reason. I usually avoid using the term “retail” when describing the wealth channel because I don’t like to label the wealth channel as “retail” because that can insinuate a lack of sophistication. I use “retail” here to hammer home the point that alternative asset managers need to think of their marketing strategies as consumer-oriented to succeed in today’s world of private markets.

Bringing in marketing and branding talent like Samuels, who came from a consumer tech behemoth in Meta, might be a continued trend and a critical component to success as firms look to work with the wealth channel.

Oh, yes, and coming on the Alt Goes Mainstream podcast. Just kidding, but not entirely.

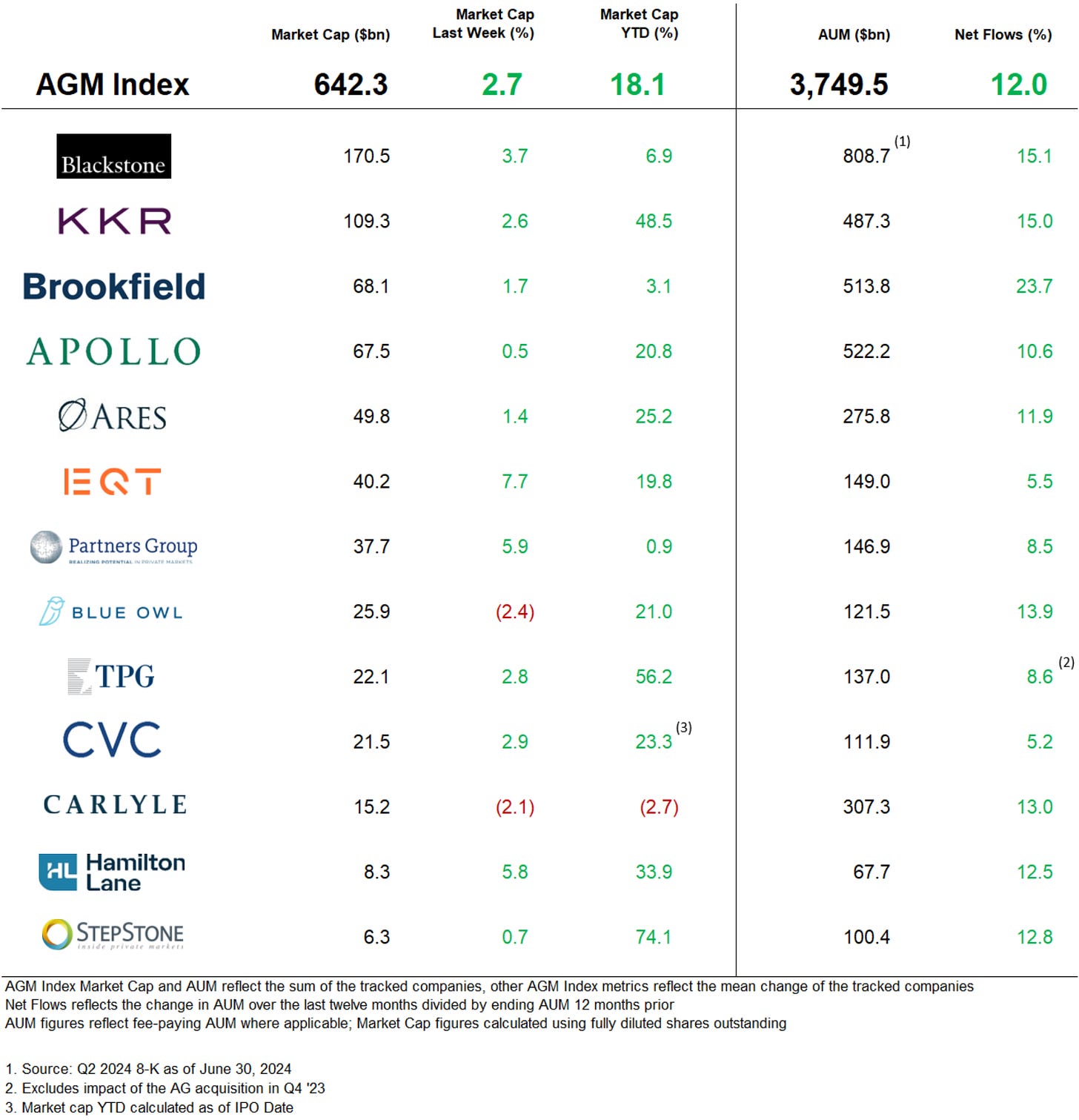

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Blue Owl’s GP Stakes Funds Bet on PE Consolidation | Paul Elias, Mergers & Acquisitions

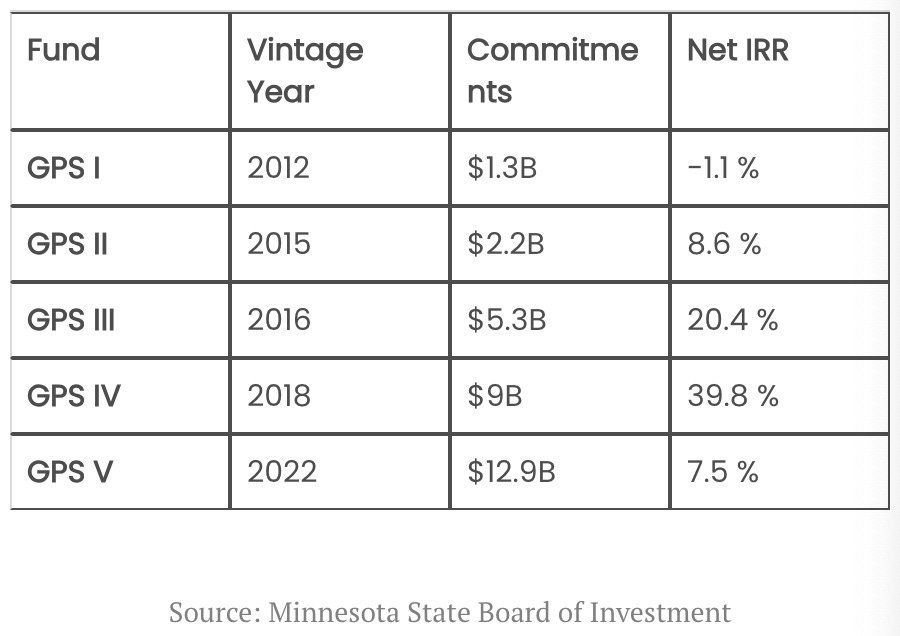

💡Mergers & Acquisitions Paul Elias notes that GP stakes market leader Blue Owl believes that increased private market allocations and consolidation within private markets will fuel the growth of a maturing asset class. Secular trends in private markets, highlighted by continued consolidation amongst alternative asset managers, the transformation of firms into large, multi-strategy platforms, and AUM inflows into the space, stand to benefit many of the large firms, which should provide a tailwind to Blue Owl’s GP stakes business. “In our GP stakes, our partner managers continue to benefit from two meaningful secular trends, growing allocations to alternatives and GP consolidation,” Co-CEO Marc Lipschultz said on an earnings call earlier this month. Blue Owl has raised five funds dedicated to the GP stakes strategy, amounting to over $30B in capital raised. Blue Owl claims that they own 60% of the GP stakes market, which shouldn’t come as a surprise given the size and scale of the funds they’ve closed to date. Their fifth fund, which was raised in 2022, was the largest fund in GP stakes history, closing at $12.9B. Blue Owl is targeting an even bigger fund the next time around, hoping to close on $13B of capital in 2026, Lipschultz said. The new fund, Fund VI, has raised more than $3.5B since launching late last year, including a $1B commitment from CAZ Investments, one of the market’s most active allocators to GP stakes funds. Lipschultz noted that Fund VI raised $1B in the second quarter. This figure included a $175M commitment from the Minnesota State Board of Investment. The $124.7B pension fund has committed over $625M to Blue Owl’s three prior GP stakes funds. Minnesota State Board of Investment apparently found the investment into Blue Owl attractive from a cash yield perspective. “Blue Owl’s underwriting does not ascribe significant terminal value or exit multiples to the manager,” a Minnesota investment staff memo states. “Rather, Blue Owl expects to generate attractive returns solely from cash flow.”

Blue Owl’s most recent fund, Fund V, has invested in 17 firms, including CVC Capital Partners, H.I.G. Capital, KPS Capital Partners, Lead Edge Capital, MBK Partners, and PAI Partners, amongst others. Blue Owl recently launched a middle-market focused GP stakes strategy in partnership with Abu Dhabi-based Lunate, where they will target firms with less than $10B AUM. Their first investment out of the new fund came in May, where they took a minority stake in Chicago-based Linden Capital Partners, a healthcare specialist with $8B AUM. Lipschultz expects the middle-market fund to close on a few more deals over the next few months.

In addition to launching their middle-market fund recently, Blue Owl has also created a continuation fund vehicle to provide liquidity to investors in Fund III. They reportedly plan to move 5% of the 10 positions held in that fund into a new vehicle, which is expected to generate $365M in liquidity for Fund III investors.

💸 AGM’s 2/20: Blue Owl’s continued evolution of their GP Strategic Capital (i.e., GP stakes) business highlights a few key trends that are defining the current state of private markets. The continued consolidation in private markets as larger firms look to expand their platforms bodes well for both aspects of Blue Owl’s GP stakes business. Consolidation puts managers at the upper end of the market in a strong position to acquire specialist firms, as some of their managers, like CVC, have done. This trend should help Blue Owl’s flagship funds as AUM appears to concentrate with the largest managers. This move should only continue as the wealth channel becomes a bigger part of the LP pie since brand matters with the wealth channel. Blue Owl was also wise to create a middle-market focused strategy to take advantage of likely consolidation from the other end — it’s certainly feasible to expect some of the middle-market managers they partner with to become consolidated into larger GPs, perhaps some that they are already investors in. Blue Owl’s acquisition of $10B private credit firm Atalaya, which their GP stakes fund had previously invested in, is one example of the path that middle-market specialists could take.

The other trend of note in this article is the increasing focus on liquidity for LPs. Blue Owl’s Fund III is reportedly selling 5% of its assets to another fund managed by Blue Owl, GP Stakes Atlas Fund I. Bloomberg describes the vehicle as a “continuation fund-like” structure. The deal, set to be completed in three stages, will generate an expected $365 million in proceeds and allow GP Stakes III to accelerate cashflows back to investors while retaining majority positions in its investments, people with knowledge of the matter said. The first of the transactions, which was completed last week at 100% of the fair value of the investments, generated about $179 million, or a 3.85 times gross realized return on the portion of the assets sold, the people said. The two other transactions will occur in May 2025 and 2026. PEI also reported that the vehicle is backed by capital from long-term yield-oriented institutions rather than traditional secondaries firms. This move appears to be necessary to offer liquidity to investors in a strategy that is more or less perpetual. It’s a balancing act that Blue Owl will have to continue to walk going forward, creating liquidity solutions for investors while also continuing to leverage their strategic advantage at the firm (and stockholder level) of virtually perpetual capital in funds like GP stakes, where their investors’ capital will be very long-dated. Evercore’s Glenn Schorr wrote about this structural advantage in one of his research reports a few months ago. This balancing act is critical to Blue Owl’s business model. In the 6.16.2024 AGM Weekly, I referenced Schorr’s research, highlighting some notable figures:

Schorr’s research highlights just how much of Blue Owl’s management fees come from permanent capital. It turns out that 100% of the earnings base is from fee-related earnings, and 92% of their management fees come from permanent capital. The result? Fee-paying capital that stays around for a long time and earns steady and consistent management fee revenues.

Blue Owl Co-CEO Marc Lipschultz echoed this sentiment on their Q1 2024 earnings call:

Said plainly, our earnings consist almost entirely of management fees, so we're not subject to the volatility and uncertainty of revenues tied to realized gains and capital markets activity. And having long-duration capital means very little leaves our system, providing us with a resilient asset base that grows faster than our peer group for the same number of dollars raised.

From a business perspective, it’s not hard to see why Blue Owl likes permanent capital. They also understand they have to provide liquidity to some of their investors in their GP stakes funds. Perhaps they’ve found a solution in their vehicle that enables them to continue to manage portions of their stakes while simultaneously offering earlier liquidity options to certain LPs.

📝 Are Continuation Funds Losing Their Allure? | Michelle Celarier, Institutional Investor

💡Institutional Investor’s Michelle Celarier dives into whether or not continuation funds are struggling to generate interest from investors as they have a “love-hate” relationship with these types of secondaries. Last year, volume reportedly dropped by $17B as investors became concerned with conflicts of interest and other issues with GP-led continuation vehicles. In 2023, GP-led secondaries achieved $51B in volume, well-below the $68B from 2022, according to a new report by Churchill Asset Management. Nick Lawler, Managing Director and Head of Secondaries at Churchill, said investors have a “love-hate” relationship with the asset class. “Skeptics point to conflicts of interest in asset valuation, similar economic structures to equity co-investment programs but with fees or adverse selection,” he said in the report. The GP-led secondaries market came onto the scene in recent years, with over half of the 100 largest private equity firms completing a GP-led transaction. Around 80% of the GP-led transactions are continuation vehicles, which involve a private equity firm moving a single asset or a set of assets into a different vehicle to enable certain LPs to achieve a liquidity event. The asset manager still maintains control and generates fees on the vehicle. Recent activity in the continuation fund market suggests that there’s a level of LP unrest. Deals are apparently falling through or stalling for a number of reasons. “Maybe those terms aren’t as LP friendly as originally stated or the pricing on those deals hasn’t been as attractive as the GP first thought when they started the process in the first place,” suggested PitchBook senior strategist Hilary Wiek. ILPA’s Director of Industry Affairs Brian Hoen noted, “over the past six, eight and 12 months or so, our members have been seeing continuation funds less frequently than they were in 2021, 2022 and 2023.” Churchill’s Lawler explained that GPs are inherently conflicted in continuation funds since they are both a buyer and seller in the transaction. Lawler acknowledged that continuation funds were “arguably born out of necessity, not opportunity, and viewed as a lifeline for assets that could not otherwise be sold.” But after 2018, GPs “began to recognize these innovative structures represented an attractive solution to extend the investment period for their highest performing assets.” They became the fastest growing segment of the secondaries landscape as a result. Another issue cited by investors is the treatment of valuation and carry. These assets are often marked at a conservative valuation when they are pulled out of the original fund, which boosts the gain — and carry — when they are sold into the continuation vehicle. A recent Whitehorse Liquidity Partners’ analysis of more than 1,000 transactions sold by continuation funds found that they were valued an average 28% higher than where the GP was valuing the business six months earlier. Critics of continuation funds highlight the fees as an issue. Ludovic Phalippou, the Oxford University’s Said Business School finance professor, has argued that investors who opt into a continuation fund will likely pay a higher performance fee on these investments than they would have in the original structures. Private equity funds may not have been able to charge a performance fee if the other companies in the original fund did poorly, and the average return was below the hurdle rate that private funds have to beat. “[Investors] are going to effectively pay a higher fee overall for these assets,” he told Institutional Investor last year.

💸 AGM’s 2/20: Continuation vehicles represent one of the more interesting trends in private markets. They hit on a few hot-button issues and themes currently present in private markets. Their intent, in part, is to solve for LP liquidity challenges, which has become particularly acute for many institutional investors over the past few years as the’ve experienced the denominator effect. CVs also highlight a question that GPs have been looking to solve: how can they hold onto their best assets without being a forced seller? CVs have become a solution that can stand to benefit both GPs and LPs, provided that the fees are not exorbitant. They certainly solve problems for both parties. LPs can generate liquidity (or choose to roll over into the new vehicle) and GPs can continue to hold on to (and generate fees from) their best assets. This trend also brings an interesting question to the forefront of the discussion about CVs: are evergreen funds the solution? Evergreen structures allow a GP to hold an asset in perpetuity rather than sell (in most cases). Could the rise of evergreen funds be the answer to a flagging GP-led CV market?

And a continuation of the prior topic of wealth management consolidation …

📝 TPG considering bid to invest in $300bn Creative Planning - source | Ian Wenik, Citywire

💡A few weeks after reporting that Creative Planning engaged Goldman Sachs to pursue a capital raise of up to $4B, Citywire’s Ian Wenik reports that TPG is considering an investment in $300B AUM Creative Planning. The capital raise is intended to enable existing minority investor, General Atlantic, to sell a portion of their position in Creative Planning. CEO Peter Mallouk will retain control of the company after this transaction. Wenik highlights why this capital raise could serve as a barometer for the wealth management industry: “The firm’s capital raise may be the biggest test case yet of how institutional investors view the independent wealth management industry, which has few public companies to serve as points of comparison and has garnered heavy recent interest from middle-market-focused private equity investors.” TPG is one of the small number of private equity firms capable of writing a sufficiently large equity check on a standalone basis. TPG raised almost $12B for its most recent flagship fund at the end of 2023. While TPG has invested in the wealth management space, they’ve been less active of late compared to their peers. They did team up with Hellman & Friedman in 2005 to acquire a majority stake in the nation’s largest independent broker-dealer LPL Financial, which they took public in 2010.

💸 AGM’s 2/20: A transaction with Creative Planning could very well serve as a good barometer for how some of the private equity industry’s largest firms view the wealth management space. There’s no doubt that industry tailwinds favor some of the larger wealth management platforms. Consolidation continues to march onward, and firms can aggregate AUM are able to benefit from a level of scale that can help them maintain or increase margins as they continue to grow. Osaic’s President of RIA Solutions Ed Swenson (and Alt Goes Mainstream podcast guest) highlighted the importance of scale in a recent interview with WealthManagement.com:

“I think we bring a unique scale to the marketplace. And scale matters more now than it ever has in wealth management. And I think if you think about us like a wealth management platform, my job is to leverage that scale on behalf of the RIA ecosystem out there.”

In Ed’s view, “scale matters more now than it ever has in wealth management.” This is an important observation. Scale enables firms to do things like acquire other wealth managers, offer alternatives options, build an in-house investment bank for advisor M&A, tap into debt capital markets to finance growth, and spend on effective marketing and branding, all with the idea of reinforcing and enhancing the strong business characteristics exhibited by wealth management platforms. These firms indeed have compelling attributes. A combination of market growth, generally very high client retention rates, and organic client acquisition, in addition to inorganic M&A growth, mean that these firms benefit from increasing scale, much like alternative asset managers do in their own way. The 30-40%+ EBITDA margins and strong and relatively dependable cashflow profile certainly don’t hurt the cause either.

The big question? Will private equity — and other large institutional investors — continue to invest big money into the wealth management space? And if so, for how long?

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Arizona Public Safety Personnel Retirement System (Pension plan) - Senior Portfolio Trader Manager. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - VP, Private Wealth Content Strategist. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Vice President Corporate Finance. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.