👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from LA and happy Labor Day Weekend. I’ve just come back from a quick trip to Kansas City to watch the National Women’s Soccer League’s Angel City FC take on (and win a huge road match!) the KC Current with fellow road warriors, ACFC President & Co-Founder Julie Uhrman and ACFC GM Angela Hucles Mangano.

KC Current owners Angie and Chris Long are no strangers to the world of investing. They founded and own $27B Palmer Square Capital Management, a credit / fixed income alternative asset manager, and now they have invested into building the foundation — pun intended — for a successful sports and business organization. Before Friday’s match, we had a chance to see the first stadium, a $120M project near downtown KC, built specifically for women’s soccer.

Speaking of building, Angie and Chris have built an impressive asset management firm in Palmer Square. The business side of asset and wealth management is a theme I want to discuss today. There have been a number of notable developments recently related to the evolution of asset and wealth managers from a business perspective.

This week alone there were four newsworthy stories related to the business side of wealth and asset management:

$57B AUM private equity firm Clayton, Dubilier & Rice acquired $350B AUM Focus Financial Partners in a $7B, all-cash deal.

Goldman Sachs spun off its Personal Financial Management unit, a $29B AUM business, to $245B AUM RIA Creative Planning.

Blue Owl, a firm that invests into management companies of alternative asset managers or does revenue shares with these firms, reported inception-to-date returns on Funds III, VI, and V of 31.2%, 76.6%, and 52.9%, respectively, on a gross basis and 23.8%, 48.9%, and 27.7%, respectively, on a net basis as of June 30, 2023.

Blackstone, the world’s largest alternative asset manager, was added to the S&P 500. To qualify for the S&P 500, companies must have a market cap of at least $14.5B (Blackstone’s market cap as of Friday was $127.59B).

It’s no surprise that wealth and asset management businesses are in the crosshairs of private equity firms and investors who look to take ownership stakes into wealth and asset managers. They can be high-quality businesses with relatively steady revenue and return streams.

Both wealth management and asset management firms have a number of qualities that make them attractive to private equity investors.

1/ Owning a steady stream of revenue: Owning a portion of an asset manager’s management company or revenue stream means owning a portion of a steady stream of revenue. Both wealth managers / platforms and private equity firms charge investors a management fee on a yearly basis over the life of their fund. For alternatives funds, this generally lasts 7-10 years if it’s a private credit or private equity fund. And while wealth management firms have no guarantee that clients will continue to stay on year over year, generally they do and it’s a relatively sticky revenue base despite possible fluctuations in AUM.

Yes, management fees have come down as the alternatives industry has matured (and wealth management fee revenues are often even lower than alternatives managers fees), but 1-2% fees annually on billions of assets under management represents meaningful annual recurring revenues. To put this in perspective, Blackstone’s Q2 2023 earnings sheds light on the size and scale of management fees and fee-related earnings. Blackstone’s Private Equity unit had $295B of AUM. They generated $491M in management and advisory fees on that revenue.

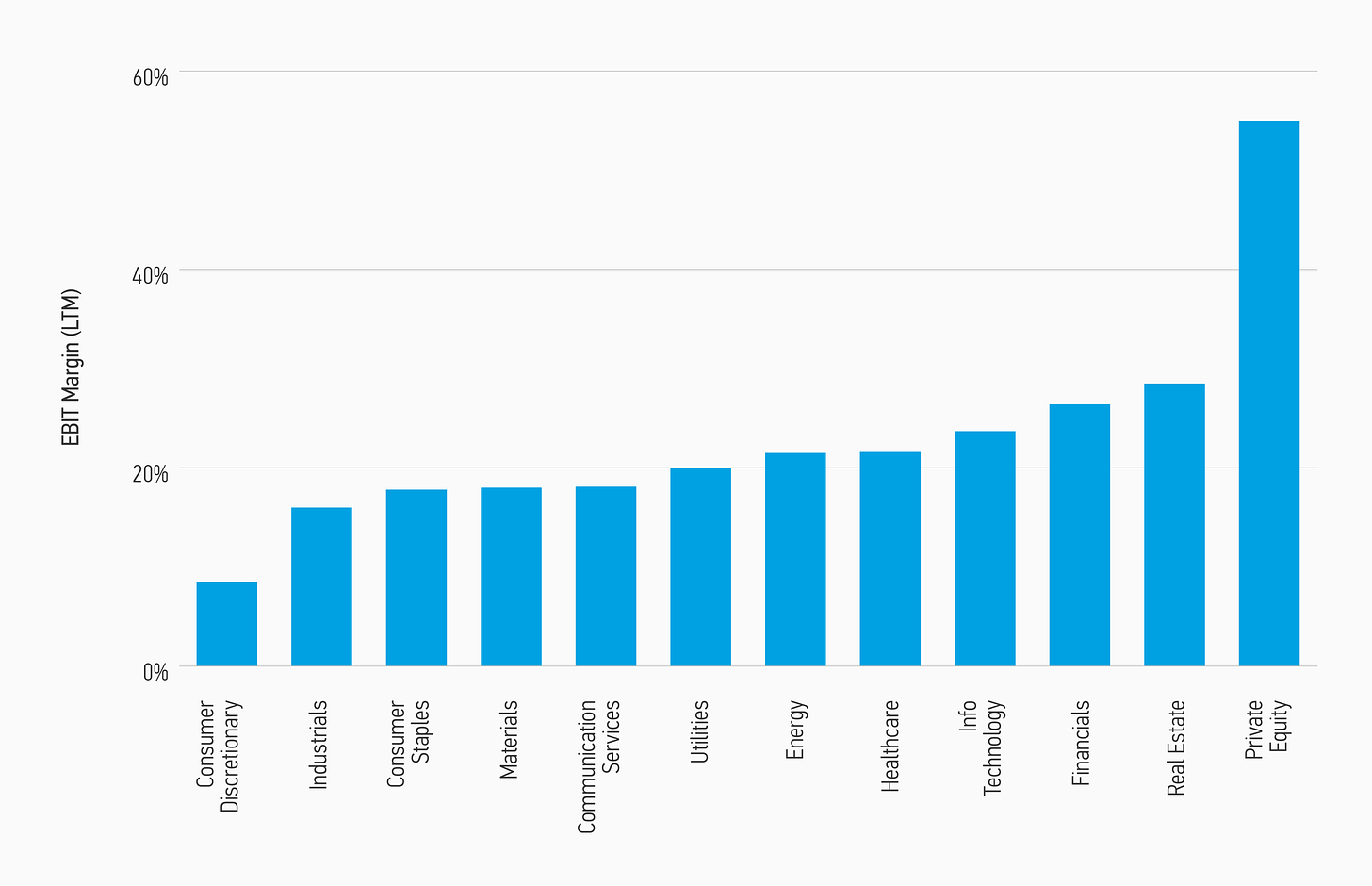

Furthermore, alternative asset managers tend to have high operating margins (40-70%) and high cashflow conversion since their businesses generally have limited capital expenditure needs (Morgan Stanley, “The ABCs of Private Equity GP Stakes”). The biggest expense for many investment firms is often human capital.

2/ “Good revenue”: Furthermore, LPs, many of whom are institutions like pensions and endowments, have assets earmarked on an annual basis to invest into these funds. Thus, they rarely default on capital calls, making management fees for alternatives managers “good revenue” that is very likely to be booked for the life of the fund.

3/ Potential upside from carry: Even funds that achieve much smaller size and scale relative to Blackstone’s $1T AUM can generate attractive returns for GP stakes investors. Once a fund is able to achieve one or two successful fundraises and begins to head down the path of achieving $1-5B+ AUM, they have the potential to return capital for revenue shares or stakes investors. Not to mention the possible upside from carry. While difficult to value early on in a fund’s life, carry / performance potential for alternatives managers represent further upside for investors and provides them with exposure to the fund’s investments.

4/ Continued and growing allocations to private markets means AUM growth: Private markets is no longer a cottage industry. Private markets AUM has almost tripled over the past decade — and growth is expected to continue. Preqin projects private markets AUM to reach at least $17.8T by 2026, up from ~$13T today. This trend is supported by two sub-trends. One is that the big firms are continuing to grow larger. According to a report from Blue Owl (2023 GP Strategic Capital Outlook), mega-funds ($1B+ fund sizes) accounted for 73.2% of capital raised through Q3 2022, with this trend continuing into 2023 as LPs look for a flight to quality and brand. This means that these larger firms can become attractive, cash-generative investments for GP stakes or revenue share investors given the size and scale of their AUM and fee-related revenues.

Related to this trend is that individual investor and wealth channel participation in private markets is growing. The wealth channel will more likely allocate to funds that are larger in size and bigger brand names, resulting in these firms growing their AUM, which will in turn grow their management fee streams.

GP stakes and revenue share investments in some senses represent the best of both worlds — a steady, fixed income / credit-like investment return on an annual basis (7-10% to mid-teens returns depending on the investment structure, size / scale, and growth and investment performance of the underlying asset managers) with a faster return of capital than only investing into a private equity fund as a LP that is subject to the J-curve. Add in potential upside from carry and incentive fees with these managers and these return profiles begin to look like a combination of strong returns on an annual basis with potential upside over the long-term as firms move into the carry and grow their AUM.

No wonder firms like Blue Owl ($50.9B AUM in their GP Strategic Capital unit), Goldman Sachs Asset Management’s Petershill ($12B AUM), Blackstone, Morgan Stanley, Investcorp, and others are having such success growing their own businesses to invest into asset and wealth managers.

They have the best of all worlds: a growing firm in a growing industry with growing AUM.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

AGM News of the Week

Articles we are reading

📝 Focus Closes on Sale to CD&R in Take-Private Deal | Diana Britton, WealthManagement.com

💡Focus Financial Partners, a wealth management platform that has stakes in over 90 wealth management firms globally representing over $350B AUM, is going private again. Private equity firm investors CD&R and Stone Point Capital and management believe that a take private is the best way to continue to grow the firm going forward that is one of the most aggressive acquirers of RIA firms in the market right now. Private equity firm Clayton Dubilier & Rice (CD&R) are acquiring fiduciary wealth management firm Focus Financial Partners in a $7B all-cash deal. Focus’ shareholders will receive $53 in cash per share, which represents roughly a 36% premium to Focus’ 60-day volume-weighted average price as of February 1, 2023. CD&R partner David Winokur said, “Focus represents an outstanding collection of leading registered investment advisers and business managers. Our investment is predicated on having greater financial and operating flexibility as a private company in order to support and drive collaboration amongst these entrepreneurial partners.” Funds managed by Stone Point Capital have agreed to retain part of their investment in Focus, and to provide new equity financing as part of the deal. Managing director of Stone Point Fayez Muhtadie said, “We are excited to be continuing the journey with the Focus partnership. We firmly believe in the secular tailwinds supporting the wealth management industry and that Focus, as a private company, will be even better positioned to capitalize and continue its track record of growth.” The deal is expected to close in the third quarter of 2023.

AGM’s 2/20: Wealth management represents a compelling opportunity for private equity firms due to continued growth and scale of the industry. The trend is that firms are going independent — and firms like Focus are enabling advisors to break away from wirehouses and own their firms while being part of a larger platform like Focus. Focus has established itself as one of the leaders in the space, growing to over $350B AUM, the highest valuation of the rollups in the space (Hightower, Dynasty) with a $7B EV, and a public listing. Perhaps they’ve now found it easier to continue growing with private equity capital or perhaps private equity capital sees the continued growth of the wealth management space as an attractive investment opportunity. Given the growth and scale of a platform like Focus, it’s no surprise that a firm like CD&R would find it attractive. Wealth management has been a major investment theme for many private equity firms. Some notable partnerships include:

RedBird Capital, who has backed Arax Investment Partners with a large sum of capital to buy and aggregate wealth management firms.

General Atlantic, who has invested into Creative Planning.

Reverence Capital, who has invested in Osaic (fka Advisor Group) and SEIA.

IGM Capital, a member of the Power Corp. of Canada, who has invested in Rockefeller Capital Management.

Genstar, who has invested into Cerity Partners.

The steady revenues of wealth managers, the ability to grow through acquisition due to generational transition from advisors who are looking to sell their business or generate liquidity, and the ability to offer alts to their clients as a way to generate additional revenues and provide another value-added service to clients are all driving the growth of the wealth space as an attractive investment opportunity, which highlights the growing intersection between wealth and alts.

📝 This Miserable Market Could Be a Catalyst for Private Equity Firms | Michael Thrasher, Institutional Investor

💡 Private equity has gotten harder again — and some in the industry say that may be a good thing. Institutional Investor’s Michael Thrasher dives into a topic that Apollo’s Marc Rowan highlighted a few weeks ago, where he said that private equity would once again require more skill as investors can no longer rely on a low rate environment to drive returns. A tough market with higher interest rates means that we’ve reached the end of private equity firms’ ability to borrow money cheaply and juice short-term performance to generate returns. Elizabeth Traxler, Managing Director and senior member of the Private Investment Portfolios and Co-Investments team at Neuberger Berman said, “The traditional way to generate returns from financial engineering, including multiple arbitrage and highly levering companies, is no longer the norm. Managers have to focus more on creating value through more active management through the implementation of their well-honed operational playbooks.” Private equity firms are now being forced to become more hands-on with portfolio companies as a result, according to Joshua Maxey, co-founder of Third Bridge. “To ensure that distributions are flowing back to LPs, that means that you have businesses that are on track to have margin expansion. Multiple expansion is not something that we’re seeing in the market right now. Your only other real lever is to make sure that you’re getting the margin expansion that is in line with the equity story,” said Maxey.

Selling healthy companies has even been difficult. According to a Third Bridge survey of 100 private equity executives and other sources, buyers and sellers continue to be far apart on prices. Similarly, fewer deal opportunities are coming to private equity firms from external sources. Firms are, in turn, placing greater focus on in-house deal sourcing. They are also relying more on dedicated resources to manage relationships with private credit and bank lenders. More expensive financing and stricter covenants necessitate private equity firms being more flexible, particularly with add-on acquisitions. Spending more time with portfolio companies, personally sourcing more deals and needing to approach financing differently may be necessary long-term. Maxey later said, “Return expectations will be on a different scale, and therefore you have to find other levers to unlock value. The best way to do that, of course, is through portfolio enhancements.”

The industry is seeing a return to fundamentals. David Breach, President and Chief Operating Officer of Vista Equity Partners, said there has been a lot of discussion about “getting back to basics” in the industry, but the private equity firms that consistently perform well always had good operational capabilities.

All private equity firms will have to do the same for the foreseeable future. It may be harder, but the private equity firms that adjust and perform well in this environment may prove to be much stronger in the long run.

AGM’s 2/20: Market forces have made investing harder for everyone. I’d argue it was never easy to invest into truly enduring companies with strong fundamentals, but the low rate environment made average companies look good, in turn making investors look good by investing into average companies. A shift back to fundamentals, while painful for investors, founders, and LPs, is probably healthy in the long-run. Everyone will focus on what it takes to build and sustain a great business — and strong operating metrics will be front and center. In some respects, all of this may actually help LPs. It was harder for LPs to evaluate fund managers during recent vintages, in large part because everything looked good. That will change — and while it will be a more challenging fundraising environment for GPs, particularly newer GPs, they will have earned their allocations from LPs if they perform.

📝 Korea Pension Fund Bets on Private Credit to Fight Global Swings | Daedo Kim and Youkyung Lee, Bloomberg

💡Continued volatility in the stock and bond markets globally have led one of South Korea’s major pension funds, Government Employees Pension Service, to bet big on alternative assets. The fund, which has roughly $6B in assets, plans to raise aggregate investments in private credit and real estate to 34% by 2027. The goal for the fund this year is 28% allocation to the category. CIO Baek Joohun said, “alternative investments are attractive as a hedge against risk. It’s a lending-friendly environment.” He added that private credit offers better risk-adjusted returns in high interest rate environments. Private lenders, which increasingly include pension and sovereign wealth funds, are benefiting from both higher rates and fragile investor sentiment. According to a recent Preqin report, nine out of 10 investors said the $1.5T private credit market has met or exceeded their expectations over the past year. The fund had a $340M private debt position as of July, and plans to invest $70M in overseas real estate loans. This allocation would be GEPS’ first investments in the global property market, from which they expect a 7-8% return in developed countries. The fund also plans to cut its exposure to domestic equities to 12% of total assets by 2027, compared to 16.4% this year, and increase (mainly U.S.) overseas investments to 18% from 14.6%.

AGM’s 2/20: Private markets remain a focal point for institutional investors, particularly as they look to meet return hurdles. Private credit sees little signs of abating as an attractive investment opportunity for investors. Volatility in public markets remains a challenge for investors, so it’s no surprise that they will look to private markets to generate returns without as much volatility. This appears to be the case in private credit, with Preqin’s survey providing evidence that private credit remains a very popular investment choice for institutions. The bigger theme here is that investors — institutional and HNW alike — are beginning to think about alternatives as a core part of their portfolio rather than just a slice of the allocation pie. To many investors, private credit is just becoming a part of the credit allocation for investors and private equity is just becoming part of the equities allocation for investors. This mindshift is a huge driver of growth in alts and will continue to be a major proofpoint of alts going mainstream.

📝 Alternative Investments Lose Steam as Fundraising Slows Down | Madison Darbyshire, Financial Times

💡The anticipated boom this year in alternative investments has yet to arrive. Alternatives funds have raised $740B since the start of the year — down 27% year-over-year — according to Preqin. Drew Schardt, Head of Investment Strategy at Hamilton Lane, said, “Fundraising has been more challenging in the last 12 months than any time in the last 15 years.” He cited volatility, increased interest rates and geopolitical instability as the main causes. Falling stock prices last year led to some investors being overexposed to alternative investments. Alternatives funds have also had fewer distributions due to a slower exit environment. Managers are often unwilling to sell assets until valuations improve. Investors can’t reinvest capital that hasn’t yet been returned to them, further decreasing the capital stock that may otherwise be put back into alternatives. The need for liquidity for some institutional investors has been satisfied in the private equity secondaries market. While alternatives fundraising is down generally, sectors including private credit and some parts of commercial real estate are seeing more success than in recent years. Institutional investors may be pulling back their allocations to alts, but Jenny Johnson, the CEO of Franklin Templeton, notes that “interest from wealthy investors and wealth managers is growing.” The wealth channel represents an opportunity for continued growth of the space. “It’s still growth, albeit smaller growth for now. Even the managers who are struggling are just raising less rather than raising nothing at all, and it’s asset-class dependent,” said Alex Blostein, an analyst at Goldman Sachs. The number of alternatives funds raised in 2023 is down 53% compared to the same period last year. The average fund size, meanwhile, has increased nearly 50% to $600M compared to last year. The shift to more established managers is indicative of prevalent investor preference for decreasing risk this year more than in years past, with the big getting bigger and benefitting from their brand name.

AGM’s 2/20: While alts are on a continued upward secular trend of growing, there will be bumps in the road. This storyline isn’t anything new to those who are involved in or following the space, but it does highlight that more challenging market environments — such as 2023 — will mean a more difficult fundraising landscape for funds. A more challenging fundraising environment will also mean a flight to quality and brands. The fact that the number of funds raised this year is down 53% combined with the fact that the average fund size has increased nearly 50% suggests that LPs are prioritizing 1/ bigger, more established brands and funds and 2/ focusing on less GP relationships. As we’ve discussed before, the wealth management channel represents the opportunity for growth in the space. In an environment where institutions are either fee sensitive, overallocated, or reducing their number of GP relationships, the wealth channel is moving into focus. The large GPs with dedicated sales teams focused on the wealth channel are well-equipped to handle this shift in LP interest, but it brings into question how the mid-sized and smaller managers will engage the wealth channel if they don’t have the in-house resources to engage with the HNW community. Firms like iCapital, who recently launched Marketplace, should help these smaller managers with their efforts to work with the wealth channel in a scaled way but it remains a big question going forward for both GPs and LPs alike as smaller managers at times have been responsible for driving better returns and performance.

📝 Goldman Sachs Unloads Another Business Acquired Under CEO David Solomon | Hugh Son, CNBC

💡Goldman Sachs offloaded its personal financial management unit to a fellow wealth management firm, Creative Planning, a $245B AUM RIA. Goldman acquired $25B AUM United Capital with the idea of serving the broader wealth market beyond the UHNWI cohort with its existing PWM business in 2019. While Goldman was able to sell Creative Planning for a gain on its $750M acquisition price, the sale reflects a failed foray into the broader wealth market. Goldman said in February that they only had about 1% of the HNW market, clients representing $1-10M in net worth. Goldman will turn its focus to their UHNW wealth management (PWM) and workplace growth strategy (Ayco), while giving Creative Planning an even bigger footprint in the RIA channel. Notably, Goldman and Creative Planning already have a business relationship, meaning that advisors will be able to continue to use Goldman investment products. The deal is the largest to date for General Atlantic-backed Creative Planning, which will add a stable of W2 advisors to its team, resulting in a transaction where the big get bigger in the RIA space and Goldman focusing on its core offering in wealth management that it’s executed on so well over the years.

AGM’s 2/20: This is a landmark transaction in the wealth space — and one that strengthens each firm’s value proposition in what both firms are characterizing as a win-win. Creative Planning will add a stable of advisors and a large national footprint to its already massive ($245B AUM) practice. Goldman will retrench from the HNW segment of the wealth channel to focus on its core business, UHNW clients, and will apparently be “margin accretive” to Goldman according to Marc Nachmann, Goldman Sachs Global Head of Asset & Wealth Management. This transaction represents a continued focus from industry giants on the wealth space. While the acquisition arguably didn’t work out for Goldman, it did signal that one of the world’s largest banks and wealth management firms was taking the RIA space and HNW segment seriously. That was a big proof point for the space. Now, Creative Planning takes over a large business as the private equity backed firm continues to grow its footprint and AUM. Chalk this up as a win for GA-backed Creative Planning as the race for PE-backed wealth management platforms to continue to grow their AUM and client coverage capabilities heats up and likely makes for yet another good investment by a private equity firm into a wealth management platform.

Reports we are reading

📝 US Public PE and GP Deal Roundup | PitchBook’s Institutional Research Group

💡PitchBook did a teardown on recent developments with US publicly traded PE and GPs. Some highlights are below:

GP deal activity picks up: GP stake and M&A activity in the alts manager space has finally matched 2022 totals. Control transactions proved popular, at over 45% of deal count clocking in its highest share in more than a decade. TPG’s $3.1B deal for Angelo Gordon was a landmark transaction amongst control deals, while Blue Owl’s GP stake in Stonepeak, an infrastructure specialist with $55.7B AUM, was a highlight amongst the non-control deals.

PE performance stays afloat: The top seven US publicly traded alts managers posted positive returns in their respective PE portfolios, with a median gross return at 3.1%. This represents the third consecutive quarter of single-digit positive returns. Returns still lagged below the total return of the S&P 500 on a trailing twelve-month basis, with these managers posting a median gross return of 9.0%, trailing the S&P’s total return of 13.0%.

Deployment activity remains low: Deployment is still low, with many PE firms waiting to pull the trigger on deals. Trailing twelve-month value has been down 22.3% YoY, but PitchBook expects to see higher deployment levels in the second half of 2023 as interest rate volatility moderates.

Fundraising remains challenging: Unsurprisingly, fundraising is still not easy for GPs. Q2 was better than Q1, with a 6.4% increase from Q1 for the top seven public PE firms, but it still lagged behind 2022 by 57.4% YTD. Apollo topped the league tables with $3.5B in gross inflows in Q2, while Blackstone secured $30.1B. Notably, Blackstone surpassed the $1T AUM mark this quarter, representing a major milestone for the industry.

Will a mega firm enter the S&P 500?: The answer to this one is a yes — and it came after PitchBook released their report. Blackstone entered the S&P 500 this week as it continues a strong performance this year. Blackstone has stated that its the largest company by market cap not included in the index. Apollo has also indicated that it’s ready for prime time and merits consideration for the Index after four consecutive quarters of positive GAAP earnings.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 73 Strings (Valuation and portfolio monitoring for alternatives funds) - EMEA Senior Sales Representative. Click here to learn more.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - West, Regional Director, Vice President / Senior Vice President. Click here to learn more.

🔍 Allocate (VC infrastructure investment platform) - Managing Director, Alternatives (Sales). Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent episodes and blog posts on Alt Goes Mainstream:

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the third episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

🎙 Hear Alto CEO Eric Satz discuss how anyone can invest in alternatives through their IRA. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.