AGM Alts Weekly | 9.15.24: The intersection of alts x wealth

AGM Alts Weekly #69: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Combine the power of Intapp DealCloud, a deal and relationship management system, with DealCloud Automations. Dealmakers shouldn’t have to waste time and effort manually sending reminders and follow-ups to their team members to keep a deal on track.

DealCloud Automations is a workflow management tool that creates and updates data based on actions or outcomes within the platform. Automate workflows and data capture, reduce manual work, and enhance data quality — so your teams can improve collaboration, decision-making, and deal outcomes.

Good morning from Los Angeles. It’s Future Proof week. Today, the wealth management industry will gather for a few days in the warm climate of Orange County and meet on the boardwalk in Huntington Beach. There will be talks on stage, one-to-one meetings, dinners, yoga, and, yes, a music festival.

Finance x fun

Future Proof isn’t called the world’s biggest wealth festival for no reason. Founders Matt Middleton, Josh Brown, Barry Ritholtz, Michael Batnick, Ben Carlson, and the Future Proof team have done a tremendous job of bringing together the leaders of the wealth management industry to create an event at the intersection of finance x fun.

Sometimes a picture is worth a thousand words. Future Proof’s conference marketing, which could pass for a Coachella lineup poster, punctuates just how this team has inserted culture into a finance conference.

The collision of culture and finance

Taking a brand mainstream is something weighing heavily on the mind of alternative asset managers, as I wrote about in the 8.25.24 AGM Alts Weekly, where I highlighted how Blackstone, amongst others, has built brand by taking a consumer-oriented approach.

Part of taking a brand mainstream? Inject the brand into mainstream culture, as Blackstone and Apollo did brilliantly by weaving the work they do into their 2023 holiday videos.

Future Proof is very much at the forefront of the intersection of culture and finance, just as Alt Goes Mainstream has endeavored to do over the past four years (which anyone who has listened to the Alt Goes Mainstream podcast intro music that was composed brilliantly by Lenny Skolnik, aka Yung Spielburg, might have now memorized!).

The intersection of alts x wealth

Speaking of intersections, there’s another intersection that will be featured prominently at Future Proof: the intersection of alts x wealth.

The continued march of flows from the wealth channel into private markets is one of the biggest stories in the industry. It’s no surprise when looking at the numbers.

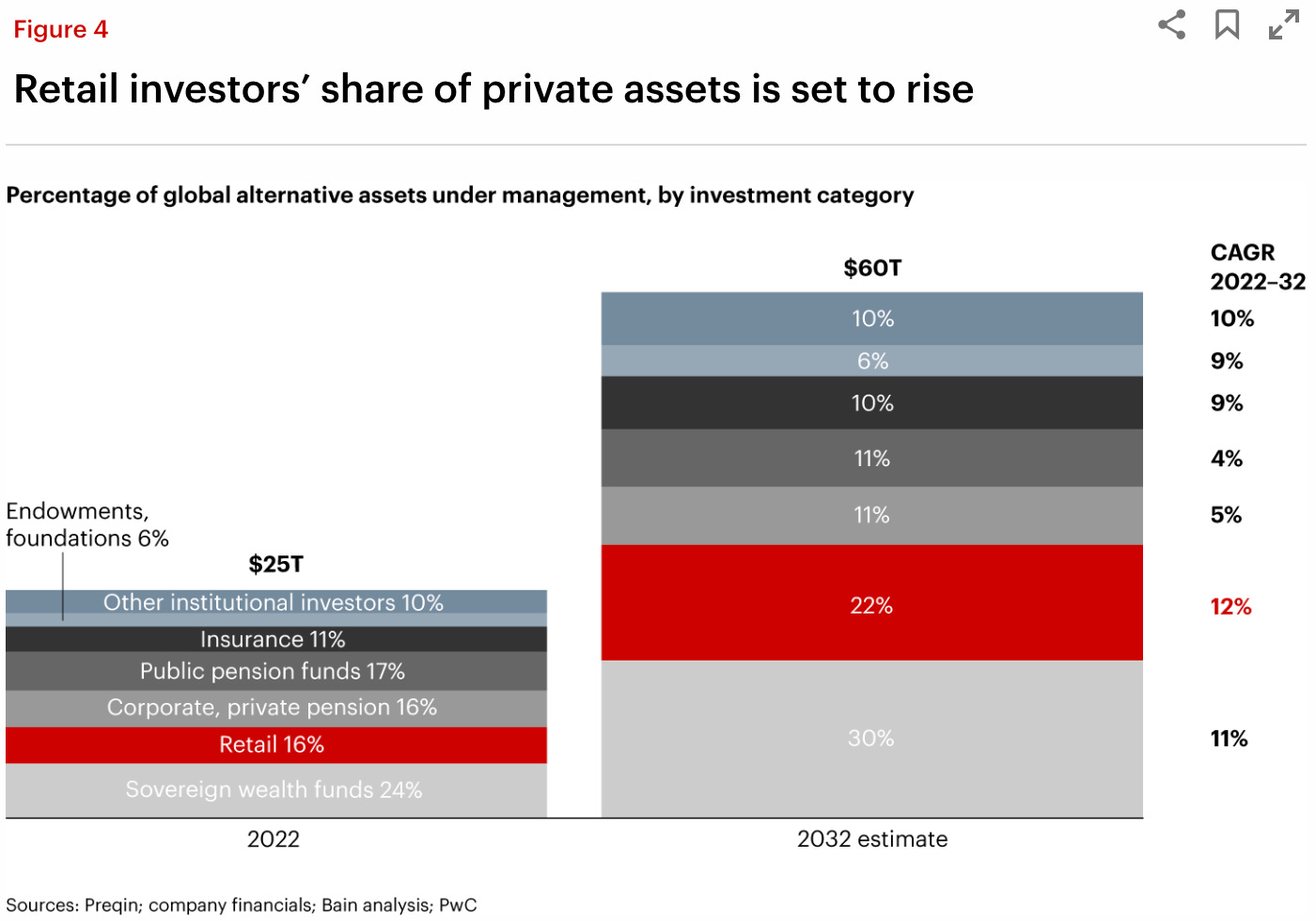

Bain & Company projects the retail wealth segment is expected to increase its share of private assets from ~$4T in 2022, where retail wealth represented around 16% of the $25T in global alternative assets under management, to ~$13T in 2032, where retail wealth would represent 22% of the $60T in global alternative assets under management. This growth would represent 12% CAGR in asset flows from the wealth channel into private markets.

Why would a flight to alternatives of such magnitude happen for the wealth channel? A severe underallocation to private markets relative to other investor types is a major catalyst.

The GP Strategic Capital segment of Blue Owl’s recently published Pulse Check: 2024 Market Outlook illustrates a smaller, albeit similar, story as the Bain & Co. analysis.

Blue Owl’s GP Strategic Capital business estimates that an additional $7.4T of assets could flow from the wealth channel into private markets by 2033.

The news keeps flowing in about the wealth channel allocating to private markets products. This past week, Apollo Co-President Scott Kleinman said at the Barclays Global Financial Services Conference that the firm is selling $1B a month to the wealth channel across its evergreen and interval fund products.

Apollo, which has expanded its team over the past three years to 200 people who work in wealth, has made a concerted effort to comprehensively work with the wealth channel. It’s something that Apollo’s Partner & Chief Client & Product Development Officer Stephanie Drescher discussed at length with Neuberger Berman Private Wealth CIO Shannon Saccocia at a panel that I moderated at Future Proof last year. Apollo’s focus on the wealth channel, including their increase in distribution headcount and fundraising targets, was highlighted in their May 2024 Investor Presentation.

Apollo’s Kleinman echoed a similar sentiment, noting that “We are only in the first or second inning of this global wealth revolution accessing alternatives.”

That would align with the action.

The firm is reportedly raising more than $200M per month for its flagship equity wealth product, Apollo Aligned Alternatives. Apollo’s CEO Marc Rowan said at the product’s launch in 2022 that he expects it to become the biggest fund across the Apollo platform.

Apollo is far from the only firm making moves in the wealth channel. KKR, which has also made a concerted effort to build out the infrastructure to serve the wealth channel at scale, recently partnered with $2.6T AUM Capital Group, one of the industry’s largest asset managers, to construct and distribute a hybrid, public-private investment solution for the wealth channel.

I’m sure Capital Group’s move to serve their clients with private markets investment products is something that Capital Group CEO Mike Gitlin will discuss on stage at this year’s Future Proof.

I’m sure I’ll also discuss this topic stage at Future Proof with Oaktree’s Danielle Poli and Cliffwater’s Phil Huber from the perspective of investing into private credit.

We’ll have a lot to discuss on the topic of intersection — and this week’s news provided no shortage of things to discuss.

The merging of traditional and alternative, public and private

Collaboration between some of the industry’s largest players provides even further proof of the rapid pace at which the worlds of public and private are colliding.

Apollo and State Street announced a partnership on an exchange-traded fund that will invest in both public and private credit. The fund, which is expected to hold mostly investment-grade debt (which will include private credit originated by Apollo), represents a tie-up between two industry behemoths.

In Apollo, State Street has found one of the industry’s largest alternative asset managers and one that has over $520B AUM in yield-oriented strategies.

In State Street Global Advisors, Apollo has partnered with a $4.37T ETF giant that has expansive distribution reach and brand, particularly with the wealth channel.

State Street, which has watched its share of the ETF industry undergo a marked decline, as Bloomberg’s Katie Greifeld wrote earlier this week, sees private markets as a major growth area.

Adding private markets offerings to the mix might provide a welcome boost to State Street’s business. CEO Ron O’Hanley noted in the Financial Times that “private assets are one of the fastest growing sectors of the financial industry … This relationship combines the strengths of two market leaders to allow even more investors to participate.”

The ETF, which will invest up to 15% of its assets in private credit investments, will be a relatively new experiment in the ability to straddle public and private investments in a way that handles the illiquidity challenges. There are questions that the filing addresses and that Morningstar’s Brian Moriarty and Ryan Jackson highlight — as to how much liquidity the portfolio might actually have.

Apollo’s Marc Rowan, who has spoken at length about liquidity and illiquidity, shared with investors in August that “there is no real liquidity in public fixed income markets. So, the trade-off of liquidity is not that immense.”

The Apollo-State Street credit ETF was one ground-breaking product launch this week. The BlackRock-Partners Group model portfolio was another.

BlackRock and Partners Group announced a partnership to launch a private markets model portfolio for the wealth channel.

Together, BlackRock and Partners Group will create a “single, managed account with unified portfolio construction and management,” according to Mark Wiedman, Head of BlackRock’s Global Client Business.

Structure matters in private markets, particularly for the wealth channel. In fact, it could be argued that structure and ease of use are (almost) as important as the product itself. BlackRock and Partners Group appear to understand the importance of structure, creating a single multi-private markets model portfolio solution that will create diversification across manager and asset class. This solution will likely be powered by BlackRock’s Aladdin technology, where they’ve implemented model portfolios.

BlackRock is no stranger to model portfolios. They are the largest model provider, with $84.3B in model assets as of June 2023, according to research by Morningstar. Capital Group is the second largest model provider, making it perhaps unsurprising that they would partner with KKR to build out a set of model portfolios together as well.

Model behavior

Model portfolios are becoming an increasingly popular trend in private markets.

iCapital introduced its first model portfolio, iMAP, which includes allocations across private credit, private equity, and real estate investments through exposure to established managers across those strategies.

The model portfolio offers a turnkey solution to wealth managers and their clients. It simplifies the entire process from end-to-end, from due diligence and manager selection to investment, construction, and ongoing monitoring. Through iCapital’s portfolio construction tool, Architect, wealth managers are able to analyze volatility, conduct risk factor analysis, and do historical portfolio monitoring, taking into account the appropriate smoothing (or de-smoothing) of volatility for private markets investments.

Whether it’s iCapital or BlackRock and Partners Group, the direction of travel appears to be headed toward innovation around structure — and, eventually, a “buy button” to make it easy for advisors to add model portfolio solutions to client portfolios.

The wealth channel has already witnessed innovation with BDC, evergreen, and interval fund structures. That’s created more access in a simpler fashion from pre- to post-investment.

Model portfolios are the next evolution in the private markets revolution. The industry might be in the Model T phase of model portfolio adoption, but the gears could start to turn with increasing velocity in the not too distant future as structure might matter above all as the intersection of alts and wealth only intensifies further.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Ares Said in Advanced Deal Talks With GLP Capital Partners | Manuel Baigorri, Dawn Lim, Gillian Tan, Cathy Chan, Bloomberg

💡Bloomberg’s Manuel Baigorri, Dawn Lim, Gillian Tan, and Cathy Chan report that Ares is in advanced talks to buy GLP Capital Partners operations outside of China. An acquisition would represent a move by Ares to continue to expand its multi-strategy platform in a bid to grow AUM and its reach. If the deal is to go through, it could rank as one of the biggest recent acquisitions in the alternative asset management space.

According to people familiar with the matter, Ares and GLP are finalizing details of a transaction that would feature a $3.5B upfront payment, with total value growing to $5B over time if certain milestones are achieved. Ares is considering using a mix of cash and stock to fund the acquisition of GLP, which has $66B AUM outside of China and spread across Japan, Southeast Asia, Europe, the US, and Brazil.

If this deal is to go through, it would best recent deals, including TPG paying $2.7B for credit specialist Angelo Gordon & Co., T. Rowe Price’s 2021 acquisition of Oak Hill Advisors for $4.2B, and Franklin Templeton’s acquisition of secondaries firm Lexington Partners for $1.75B.

Infrastructure is top of mind for both alternatives managers and LPs. Ares’ prospective deal with GLP would add a large infrastructure manager to their arsenal. GLP has had a focus on real estate tied to logistics, digital infrastructure, and renewable energy. The firm grew out of Singapore-based GLP Pte, a developer and operator of warehouses that benefited from the growth in e-commerce. GLP initially set up a fund management arm to invest third-party capital in the sector, and it ultimately became a separate entity — GLP Capital Partners — after a series of transactions in 2022.

Ares noted at an investor day earlier this year that Asia-Pacific real estate equity, global infrastructure equity, and digital infrastructure equity were high priority areas of growth for the firm. In a few weeks, they could turn that talk into reality by closing on an acquisition of one of the region’s largest alternative asset managers.

💸 AGM’s 2/20: Ares’ prospective acquisition of GLP hammers home the theme of alternative asset manager consolidation with a big exclamation point. After BlackRock’s $12.5B acquisition of $100B AUM GIP, Ares’ acquisition of GLP would represent one of the largest transactions in recent time. The deal would serve to highlight a few major trends:

The largest alternative asset managers are looking to expand the capabilities of their platforms by acquiring specific skillsets or expertise across sector, strategy, and / or geography.

Sector and geographic specialists are well-positioned for this period of industry consolidation if they are looking to monetize the value of their firm and exit. Firms that have built expertise and edge will certainly be in the crosshairs of larger managers looking to expand their platform by adding specific capabilities that might prove to be more difficult to build internally.

An acquisition like this serves as a reminder as to why a scaled platform would look to go public. The public company currency of cash and stock to acquire another manager benefits the larger publicly traded firm.

Infrastructure and Asia appear to be popular categories for both GPs and LPs. Infrastructure is becoming increasingly interesting to investors, particularly as infrastructure investing expands to include data centers and decarbonization. Asia is also a rapidly-growing region for increased LP interest in private markets, so it’s no surprise that managers will look to acquire regional funds and expand their footprint to build distribution teams and relationships.

📝 Sixth Street Buys TPG Partners’ Stake at $10 Billion Valuation | Gillian Tan, Bloomberg

💡Bloomberg’s Gillian Tan reports that Sixth Street has repurchased a stake in the firm owned by partners at TPG. The transaction values the $75B AUM alternative asset manager at $10B. Sixth Street paid over $1B last month as it exercised an option to repurchase the stake. Sixth Street reportedly raised capital from outside sources to buy back the stake, according to Liz Hoffman at Semafor, but none were strategic investors like TPG. The buyback was prompted by TPG becoming a direct competitor to Sixth Street through its $2.7B purchase of credit firm Angelo Gordon. This deal marks the final stage of uncoupling from TPG’s former credit arm, allowing both TPG and Sixth Street free reign to build businesses in areas where they were previously unable to go full bore. Sixth Street has built an expansive platform over the years, growing its capabilities beyond credit investing to include growth investing (equity, debt, and structured solutions), real estate, energy, renewables, infrastructure, direct lending, insurance solutions, asset based finance, sports and media investing as both equity and debt investors, and public markets.

Sixth Street was launched in 2009 when a group of former Goldman Sachs investors joined to form TPG’s dedicated credit and credit-related investing platform. Sixth Street built the business to over $34B AUM and committed capital before deciding to become an independent, unaffiliated business from TPG in 2020. As part of the deal, TPG retained a passive minority economic stake in Sixth Street. Now, they may very well compete.

💸 AGM’s 2/20: Sixth Street is a fantastic case study, amongst a number of other firms that have had a rapid ascent as they’ve grown their business into multi-strategy platforms, in how a firm can grow to scale. There’s no single way to build a successful alternative asset manager. But Sixth Street provides one such blueprint. Their origin story highlights the power of starting out at an established platform. Is this the way? Perhaps. Surely, the platform, brand, balance sheet, LP relationships, and network of TPG had to have provided Sixth Street with a running head start in building an investment platform. That’s not an entirely new phenomenon, as large established investment platforms will often incubate, seed, or hire for new strategies, with the trade being access to an established platform in exchange for the brand and economics. But Sixth Street has succeeded in growing its business to a size and scale that has enabled it to end up on a similar playing field to the firm that helped it get started. This result may be more of an exception than the norm, but it does bubble up a bigger theme at play. As much as alternative asset management is undergoing a period of consolidation, it’s also going through a collision course.

As the big get bigger, it will be hard for firms to stay in their lane. That will benefit the smaller specialist firms and the largest platforms, as they can collaborate through consolidation. The lower middle-market and middle-market alternative asset managers that have built high-quality niche businesses will come into focus for larger platforms.

But for firms in the middle, they will have to think hard about what they want to evolve into as the competitive challenges of the industry become more pronounced.

And, just as we saw this week with the Apollo / State Street, BlackRock / Partners Group, and Ares / GLP news, the discussions inside the board rooms at both large alternative asset managers and traditional asset managers, the questions of build, buy, or partner loom large as all the options are on the table in an industry where the prize is large — and growing.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director — Marketing & Communications, Private Wealth. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Vice President Corporate Finance. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 J.P.Morgan (Asset management) - Outsourced Chief Investment Office - Executive Director. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.