👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from LA, where I’ve returned from a week in Huntington Beach for Future Proof, the world’s largest wealth festival, NYC for meetings, and then SF last night for a friend’s 60th birthday party of one of our alts founders.

Future Proof was quite the event. Props to the teams at Advisor Circle and Ritholtz Wealth for the community they’ve brought together to talk about what the future of wealth management looks like.

One of the big themes in wealth management is the intersection of wealth and alts. Wealth management itself is having its private equity moment — private equity firms and entrepreneurial advisors see the opportunity to grow their firms or platforms (or start new ones, as Joe Duran announced at Future Proof with the launch of his new firm Rise Growth Partners) as they seek to serve clients in a scaled fashion. There are pros and cons to this, as with any industry evolution and consolidation. But one thing that was clear from Future Proof was the energy in the room — the wealth community by and large seems invigorated by the rapidly changing market structure.

Wealth’s private equity moment is also driving growth in the alts space. We’ve discussed at length how the wealth channel is growing its clients’ allocations to alts. Platformization and consolidation in the wealth space is partially responsible for this trend. Private banks continue the drumbeat of allocating to alts — and many large GPs view the private bank channel as one that will continue to provide significant allocations to alts. Now, as wealth platforms consolidate and grow, they are offering independent or hybrid advisors a similar opportunity to allocate to private markets. GPs have responded in kind. They understand the importance of working with the wealth channel and they are investing meaningful resources of both financial capital and human capital into educating and working with the wealth channel, which is paving the way for increased allocation to alts.

Stephanie Drescher, Management Committee Member and Chief Client & Product Development Officer at Apollo, and Shannon Saccocia, CIO at Neuberger Berman both echoed this sentiment on our panel at Future Proof. They both see sentiment changing with how alts are viewed by wealth management allocators. No longer are alternatives a satellite part of the portfolio, but rather many investors see alts as a core part of asset allocation. Perhaps the most striking comment representative of this mindset shift is that an equities allocation now includes both public and private equity investments. Same with credit — credit allocations now represent both public and private credit investments. This type of thinking signals that we’ve moved beyond the 60/40 and alternatives have gone into the mainstream.

I had so many rich conversations with advisors who are thinking deeply about how to grow their firms and how they are approaching private markets. It’s clear that many view alts as a centerpiece of their growth as a firm.

At a dinner I co-hosted with Steph and her colleagues Daniel Flynn and Brett Fowler from Apollo along with a number of CIOs and executives from RIAs, how to thoughtfully approach allocations to alternatives was top of mind. We discussed the future of wealth management and how alts can play a role in the continued evolution of the wealth space, how and why advisors can and should add alts to a portfolio, and the challenges that remain with investors accessing private markets.

It’s great to see so many leaders in both the LP and GP communities thinking hard about the evolution of private markets — that’s what will ultimately make alts go mainstream.

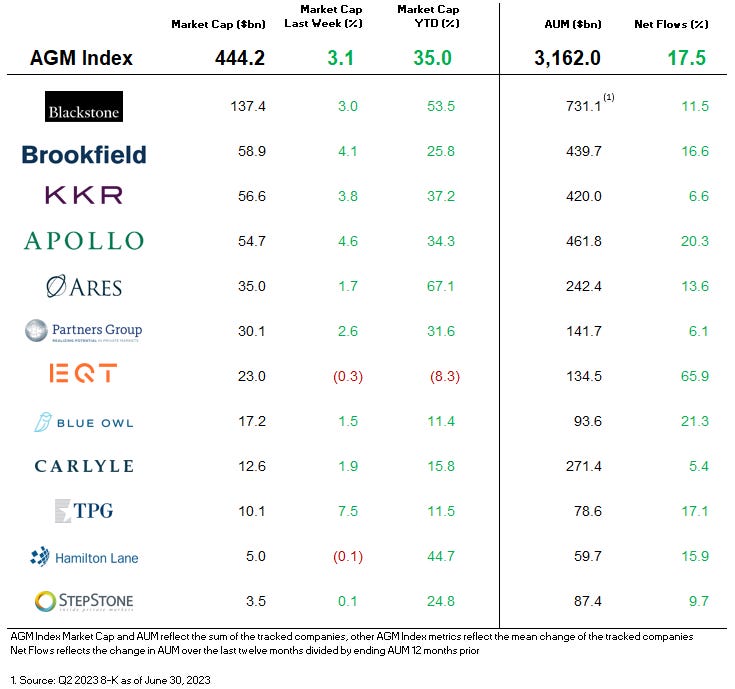

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

AGM News of the Week

Articles we are reading

📝 Blackstone Combines Internal Units as it Sets Sights on ‘Next $1T’ | Eric Platt & Antoine Gara, Financial Times

💡Blackstone is planning on combining its insurance and credit businesses, signaling that the world’s largest alternative asset manager believes its future growth prospects do not lie solely in the private equity buyout and real estate businesses that helped Blackstone achieve its current scale. CEO Steve Schwarzman said Wednesday that the new unit, which will be called Blackstone Credit & Insurance, could grow to manage $1T (up from $295B today) in the next 10 years. Combined, the two business lines have seen the most growth in fundraising and inflows over the past three years, accounting for almost 40% of the firm’s overall fundraising over the period and $41B in net inflows over the first six months of 2023. This move is indicative of a larger shift amongst the large alternative asset managers, who have focused on credit and insurance as interest rates rise. This shift also signals that large asset managers can now be seen as an alternative to the traditional banking system, leveraging their credit and insurance businesses to make large corporate loans and originate securitized assets. Broader business expansion has been a major growth driver for these firms. Apollo completed its acquisition of life and annuities insurer Athene last year as the firm has prioritized credit investments as the group’s primary source of focus and AUM growth. Peers KKR and Brookfield also bought large insurers in an effort to bolster AUM. Blackstone has taken a different approach — instead of buying an insurer, they have partnered with several large insurers like AIG and Allstate, where they provide asset management services to their insurance policies.

AGM’s 2/20: Blackstone’s decision to combine its credit and insurance business is a big deal in and of itself — it signals that Blackstone believes that this area will be a growth driver for the firm from both an investment and capital raising perspective. But it also represents a much larger trend in the alts space. As Blackstone and its peers, Apollo, KKR, Brookfield, amongst others, have looked to buy or partner with insurers, it shows that they are both prioritizing a new investment strategy within alts (credit) and now encroaching on territory that was previously the domain of banks. Insurers have become an apple in private equity firms’ eye — and for good reason. The attraction makes sense. The balance sheets of life and annuities businesses have significant assets to match the liabilities of future payouts and indemnities. Those assets need to be invested in order to generate returns, and in many cases, the cost of servicing the liabilities is lower than the potential investment return so the spread represents a healthy margin. Credit, in particular, is an area where an insurers balance sheet adds value to the private equity firm. Utilizing a life insurance book to provide long-term assets for a firm’s credit arm to invest is a much quicker way to reach scale than having to raise multiple credit funds. A 2022 McKinsey report highlighted just how popular origination of structured credit products were amongst PE-backed insurers. Collateralized loan obligations was a $760B market in 2022, fueled by a focus from PE-backed insurers on this asset class. Owning insurance balance sheets enables private equity firms to make loans and originate securitized assets. We can argue whether or not it’s a good thing that alternative asset managers are moving into the territory of providing multi-billion dollar loans or originating collateralized loan obligations, particularly as portfolio companies in private equity side of their business looks to take on loans from banks, but one thing is clear — with alternative asset managers moving into the territory of banks, alternative is becoming mainstream.

📝 Brookfield, Societe Generale Join Forces on €10B Private Credit Fund | Marie Kemplay, PitchBook

💡Private credit appears to be going from strength to strength, particularly when it comes to fundraising. French bank Societe Generale and Brookfield Asset Management are teaming up to launch a €10B ($10.8B) private credit fund. A successful fundraise would make this the second-largest private debt fund ever in Europe, behind only Ares Capital Europe V, which closed in April 2021 at €11.2B. Private credit has been an asset class in favor in Europe — 24 private debt funds have closed in Europe thus far this year, totaling €27.8B in capital raised. While this is below 2022’s figures, which saw €51.4B raised it still represents a staggering figure and signals that investors are seeking private credit exposure. SocGen and Brookfield’s fund, which will initially focus on real assets credit across the power, renewables, data, midstream and transportation sectors as well as fund finance, is expected to launch by early 2024 with €2.5B in initial seed funding. A joint statement from SocGen and Brookfield said the fund is aiming to provide investment grade financing options for issuers and high-quality opportunities for investors. They believe that the fund should be of particular interest to insurance companies, with the fund’s assets matching the ratings and duration requirements for an insurer’s investments. The announcement of the tie-up between a bank and an asset manager in the private credit space is interesting for two main reasons. First, the most typical partnership over recent years has been between private equity firms and asset managers as both look to broaden their franchises. Second, the growth of the private debt industry can be largely attributed to banks retreating from the market in the wake of the global financial crisis and more restrictive lending regulations. SocGen CEO Slawomir Krupa said the partnership “represents a unique alignment of interests between two leading players in their respective fields” and “provides an entirely new answer to the growing demand for private debt.” Krupa, a former Head of SocGen’s Investment Bank as recently as April, has indicated previously he intends to change the way the bank does business.

AGM’s 2/20: Private credit continues to be a growth area within the alts space. What’s interesting about this announcement is that 1/ it highlights Brookfield’s continued push in the credit space, 2/ the fact that SocGen, a bank, is partnering with Brookfield shows that banks don’t want to get frozen out of the private credit boom, and 3/ it underscores the interest in insurance capital as an appropriate investor for private credit vehicles. Private credit has come under scrutiny in recent months, particularly in the EU, as there have been calls for more regulatory oversight given banks retrenching from some of their lending activities. This has been a boon for private equity managers who have large credit businesses, as they have been able to expand their footprint and raise significant capital for new funds. Investors see private credit as an attractive asset class right now, as evidenced by the amount of capital that’s been flowing into these strategies. There is certainly looming concern about the impact of higher rates on credit quality and defaults, but many remain bullish on private credit’s prospects, particularly investors who are searching for yield. The big question going forward is will a bank partnership with an asset manager in credit like we are seeing here with SocGen and Brookfield be more of the exception or the rule?Banks have begun to pull back from lending activities themselves and face a threat from alternative asset managers encroaching on their territory as a non-bank lender in certain parts of their business. Perhaps this is an elegant solution for banks and maybe we will see more banks follow SocGen’s lead here.

📝 Wealth Management Firms Need Scale to Help Advisors Thrive | Greg Cornick, Investment News

💡Wealth management is an industry undergoing transformational change — and with that change comes a number of different viewpoints. In an article for Investment News, Osaic’s (fka Advisor Group) President of Advice and Wealth Management Greg Cornick argues for the benefit of scale when it comes to the rapidly evolving — and consolidating — independent space. Cornick believes that many advisors today view scale as both an asset and a strength. He cites that a dwindling number of US brokerage firms — 3,394 last year, compared with roughly 4,800 in 2017 — render the advantages of scale more important than ever. And he believes that platforms should highlight scale as an advantage for both themselves and the advisors they are looking to bring on. Whereas scaled wealth management platforms “often downplayed their growth with platitudes like … providing a ‘boutique' feel’ where advisors get the best of both worlds, today, Cornick sees scale as the driver that provides the solutions, capital, and expertise to allow financial advisors to serve their clients well, irrespective of what model advisors choose. Scale, he argues, provides the solutions, capital and expertise to allow financial advisors to serve their clients well, irrespective of what model advisors choose. He added that Osaic “invested significant resources into rebuilding our service infrastructure and reimagining our technology platform because we know that delivering personalization at scale is essential.”

AGM’s 2/20: Wealth management is in the midst of a period of rapid evolution. With this change comes challenges. As private equity dollars flow into the space, acquisition is leading to consolidation. Consolidation presents the opportunity for advisors to access scale. But that scale comes with a cost — in terms of ceding their independence to a larger platform, giving up equity in their business, or running their firm the way that they want to. On the other side of the coin, scale gives advisors and their clients access to services and solutions that they might not otherwise have as a fully independent advisor. What’s the right model in the independent wealth management space is a nuanced question. It depends on what wealth management founders, advisors, and their clients want. There are still plenty of firms that stay at wirehouses and private banks too — and there area number of good reasons why they do so. Scale can be an advantage for clients and the advisors who serve them. Platforms in the independent and hybrid space offer some of the scale for advisors who want to be independent but have access to some similar services or products that private banks offer to them and their clients. And now thanks to innovations in wealthtech, advisors who wish to remain fully independent can leverage technology to run their business well. There’s no right answer. It depends on what advisors want to do for their business and their clients and how they wish to grow. I. think we’ll continue to see consolidation in the wealth space as multiples remain attractive for many advisors to transact their businesses to larger firms. When the math changes, perhaps we’ll see an unbundling once again. But, by that time, the technological innovation in wealthtech and alts tech should be relatively advanced to the point that advisors should be able to access private markets whether they are at a firm that gives them the scale of a larger platform or not. What I do know is that it’s great that there are different options for advisors who want to be entrepreneurs and that’s a good thing for the space.

📝 Private Equity Plunges into US College Sports with Learfield Deal | Sara Germano & Antoine Gara, Financial Times

💡Private equity is increasingly becoming involved with sports — and now college sports are no exception. With the commercialization of college sports thanks to the NIL, there’s now a growing investment opportunity at the collegiate level. While private equity investments into professional sports teams have become commonplace, this week’s news of household name private equity firms Fortress, Charlesbank, and Clearlake taking over the pre-eminent US college sports marketing group Learfield reflects institutional capital’s interest in a growing $14B university sports industry. Learfield handles multimedia deals for universities, including college sports giants University of Alabama and University of Texas (🤘). They control much of their merchandise sales, stadium sponsorships, ticketing, and content development. Learfield will see their debt burden reduced by over $600M, receive a $150M equity investment, and see ownership transfer over to the three new investors. Learfield struggled after a 2018 merger left them with a $1B debt burden and then Covid-19 exacerbating financial pressures on the company. Learfield was able to avoid bankruptcy, according to CEO Cole Gahagan, who told the Financial Times that the company was recently able to renegotiate terms of five large college sports contracts. This deal comes at quite an interesting time in college sports. Recent NCAA rule changes that have allowed athletes to profit from their name, image, and likeness (NIL) have opened college athletes to levels of sponsorship and sources of revenue that were only previously possible by entering the professional ranks. Content appears to be a major driver of growth for Learfield as more student athletes seek brand deals with partners and monetize sponsorship deals. College sports is in its early days of digesting the impacts of the NIL, so it won’t be surprising to see private equity continue to move into the space.

AGM’s 2/20: The collision of culture and finance continues. Sports has become increasingly investable by private equity, in large part due to the value of media — both social and traditional media. College sports is no exception. Already an incredibly lucrative endeavor for the universities and media partners, the NIL is now changing the game. College sports looks less and less different from professional sports now, so therefore it’s no surprise that private equity is making its move. One reason why sports is such an investable asset is due to engagement. Traditional and social media channels have tapped into how to monetize engagement. Social media has been a powerful driver. We’ve seen the value that someone with a large social following — such as Leo Messi or Cristiano Ronaldo — can bring to a league or a team, as Messi and Ronaldo have done with the MLS and the Saudi leagues, respectively. One could argue that college sports has engagement in spades, and in some respects, may have even more customer loyalty than some professional sports. Now, this is just supposition, but the ties that bind a college graduate to a university are often quite strong. so customer loyalty and engagement can be quite high. Perhaps this is one reason why private equity is so interested in the long-term value of college sports and their media rights.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Allocate (VC infrastructure investment platform) - Managing Director, Alternatives (Sales). Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent episodes and blog posts on Alt Goes Mainstream:

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the third episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

🎙 Hear Alto CEO Eric Satz discuss how anyone can invest in alternatives through their IRA. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.