AGM Alts Weekly | 9.22.24: An alternative definition is required

AGM Alts Weekly #70: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Intapp DealCloud is a ready-to-use solution built by industry experts for the way your teams work.

With our private equity blueprint, your DealCloud solution will come preconfigured with powerful tools and workflows based on industry best practices.

Let DealCloud take over tedious administrative tasks so your teams can focus on what matters most: sourcing opportunities, closing deals, and nurturing networks.

Good morning from Washington, DC.

I’ve just returned from Future Proof, which has unequivocally built one of the wealth management industry’s top conferences. They’ve captured the magic of balancing serious and casual, combining institutional and interesting, by building an event that is at the intersection of finance x fun.

Everything from advisor M&A to the evolution of the wealth management industry to practice management to private markets was covered on the boardwalk as over 4,200 industry professionals convened in sunny Huntington Beach.

Countless conversations, both on and off stage, centralized around private markets and how advisors can navigate the ever-growing space of products and strategies. One of those conversations was a discussion on private credit that I had the pleasure of moderating with Oaktree’s Danielle Poli and Cliffwater’s Phil Huber.

Private credit spans a number of different strategies as the secular trend of “debanking” continues to evolve the credit landscape. This trend forced us to define to the conference audience what private credit is (and is not), particularly given Danielle’s background investing across the public and private credit spectrums.

That aspect of the talk prompted a much bigger and critical question to emerge from the conversation on stage: if education leads to allocation, how should we define alternatives?

What’s in a name?

Names matter.

What we call something shapes how we think about it and how we react to it.

Take “Future Proof,” for example. The very name of the conference that is at the forefront of wealth management primes attendees to go into the conference geared to think about the future. With the psychological prompt of being forward-thinking that Future Proof connotes, attendees are mentally ready to think about what could be, not what has been.

Earlier this week, Apollo CEO Marc Rowan said something in a CNBC interview that cuts directly to the heart of the concept of definitions.

Rowan said, “I think we are going to start to change our nomenclature.”

He uses the example of liquidity to illustrate his point about why definitions matter. He goes on to say, “The notion of a liquidity discount, I believe, is going to disappear because there’s not going to be appreciable differences in liquidity [between public and private markets].”

Rowan questions how liquid some assets in public markets, like investment grade corporate bonds, are in reality. He has also suggested an important and interesting thought experiment in the past by positing the question of how much liquidity an individual or institutional investor needs the next day or in the next few days.

A different definition of what liquidity actually means and how much of it is required at a given time could perhaps yield a different answer about asset allocation.

In the same vein, much of the thought process of buying and selling investment products and asset allocation comes down to definitions.

We’ve discussed how and why brand matters in the 8.25.24 AGM Alts Weekly, examining how Blackstone so effectively built a brand in the wealth channel by making it easier for allocators to understand what they do (education), how they do it (showcasing their “edge”), and who it’s done by (engaging and regular social media posts with key leaders at the firm).

The next evolution in private markets is changing the definition of alternatives.

An alternative definition is required

A number of people and firms are on the frontier of evolving this nomenclature.

Just as the name “Future Proof” primes people to think about the future, the word “alternatives” primes people to think about something that is different.

Yes, it’s true alternatives can offer something different to a portfolio than the traditional 60/40 portfolio of stocks and bonds can provide (depending on the strategy). So, yes, in some senses, alternatives are an “alternative” to a 60/40 portfolio.

But, if we are to believe that alternatives are going mainstream and, like Rowan said, “that [we soon] won’t be able to tell the difference between public and private,” then maybe it’s time to stop thinking about alternatives as an alternative.

Given the growing presence of private markets both in public markets and in investors’ portfolios, it’s not a surprise to see a number of the industry’s largest firms re-define what alternatives are and what they mean.

Apollo has done this in credit with their now famous slide from their March 2024 Investor Presentation that illustrates their reasoning as to why private credit is now a $40T addressable market.

Whether or not one agrees with Apollo’s views on the size of the private credit market is a debate for another day. But, I’m sure others in private markets would agree that what private credit is and what it means could use a new definition when looking at the above slide.

Alternatives are being re-defined as private markets. KKR’s website is very clear about who they are and what they do: “a global investment firm investing across private markets in every asset class across the world.” Notice how KKR omits the word “alternative” in the description of its firm. That was surely not the case when they went public in 2010.

Interestingly, but not surprisingly, KKR also states its aim to “help secure the futures of the institutions and individuals counting on us.” Some might brush this statement off as run-of-the-mill marketing, but to do so would be missing the bigger picture. Particularly when the estimated retirement population will swell to 80 million people in the US by 2040, yet they currently have significantly less guaranteed retirement income than ever before, as Apollo’s Platform Deep Dive presentation from November 2023 highlighted.

Perhaps then, would it be such a stretch to call firms like Apollo and KKR, both of whom have brought captive insurance businesses into the fold, retirement services companies? Certainly not for at least a portion of their business, where they will be originating investments that aim to help investors generate income for retirement.

Beyond alternative into the mainstream

To make something go mainstream, it must be easy for people to understand.

The industry and its largest firms have been evolving to this point as they move to serve the individual investor. Countless educational initiatives have been launched. Branding and re-branding campaigns have been undertaken. Decisions to go public have been made. Productions of holiday videos and social media campaigns have been crafted.

What’s left? Making it even easier for the mainstream investor and individual to understand the why behind their investments in private markets.

When people understand the intent, they can conceptualize the outcome.

What does private equity actually mean? What is private credit? Those words might not mean much to an individual who hasn’t spent much time in finance.

But what if they were told that private equity was investing in growth outside of public markets? Perhaps that would change how people think about private equity and spark a new conversation.

Same with virtually every category and asset class within private markets.

Riffing off of the story that former Blackstone CFO Laurence Tosi shared on his Alt Goes Mainstream podcast episode, I’ll attempt to re-define each private markets strategy in plain English. As L.T. said in his podcast, renaming their businesses made a material impact on their ability to work with the wealth channel:

We even renamed the businesses that we were in to make them more accessible and more understandable to the financial advisors. Real estate at the time was “Blackstone Real Estate Equity Partners” and private equity was “Blackstone Capital Partners.” We're like, that's too confusing. We're going to call it “Blackstone Real Estate” and “Blackstone Private Equity.” Believe it or not, that actually made a difference and would bring advisors in.

I’d love your thoughts and views on “alternative” definitions for alternatives so we can continue to refine these definitions so that everyone can understand the what and the why of private markets investing.

Here are some of mine:

Infrastructure: Steady cashflows and inflation protection in exchange for financing our built world.

Venture Capital: High risk, potentially high reward option on innovation.

Private Equity: Investing in growth outside of public markets.

Private Credit: Income generating investment … and almost anything that’s on a bank balance sheet (thank you, Marc Rowan).

GP Stakes: Owning a piece of asset managers’ businesses and their diversified revenue streams.

Secondaries: Diversified and seasoned portfolio of private companies.

Real Estate: Income generation from owning commercial and residential properties.

How would you describe each private markets strategy? What definitions would you use for each private markets strategy?

What we say matters. The words we use matter.

What we call things changes how we think about things. It’s certainly true for private markets.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 BlackRock and Microsoft plan $30B fund to invest in AI infrastructure | Brooke Masters, Antoine Gara, James Fontanella-Khan, Stephen Morris, Financial Times

💡 Financial Times’ Brook Masters, Antoine Gara, James Fontanella-Khan, and Stephen Morris report on a blockbuster deal, called the Global AI Investment Partnership, between BlackRock, Microsoft, Nvidia, and Abu Dhabi-backed MGX to launch a $30B artificial intelligence investment fund to build data centers and energy projects. The partnership, which will see BlackRock partner with Microsoft, Nvidia, and MGX, is one of the biggest vehicles ever raised on Wall Street. The $30B of equity will be supported by an additional $70B in debt financing.

BlackRock’s participation comes from its new infrastructure investment unit, Global Infrastructure Partners, which it acquired earlier this year. Microsoft and MGX are also general partners in the fund. Nvidia, the fast-growing chipmaker, will advise on factory design and integration. The investment vehicle’s size is in large part due to the scale required to invest into AI infrastructure. The computing power of AI requires significant energy and power.

The fund will mark GIP’s first big fundraise since the firm agreed to be acquired by BlackRock for $12.5B this year. BlackRock sees energy, and in particular digitalization, as a major growth area, which makes it no surprise that they would seek to build out a fund of such size and scale to invest into the infrastructure that will power the AI revolution. “Mobilizing private capital to build AI infrastructure like data centers and power will unlock a multi-trillion-dollar long-term investment opportunity,” Larry Fink, BlackRock Chief Executive Officer, said in a statement.

The fund is the latest vehicle by a large asset manager created to meet the growing demand for energy infrastructure to power AI and cloud computing. Earlier this year, Microsoft agreed to back $10B in renewable electricity projects built by Brookfield Asset Management. “The country and the world are going to need more capital investment to accelerate the development of the AI infrastructure needed. This kind of effort is an important step,” said Brad Smith, Microsoft’s President.

MGX was formed earlier this year with the backing of Abu Dhabi’s sovereign wealth fund Mubadala to help the country invest in AI. The firm has also been in talks about another blockbuster AI deal: OpenAI’s latest funding round, a $6B round completed at a $150B valuation, which some believe is on a path to building a trillion-dollar company.

Other alternative asset managers have also raised large infrastructure funds that have included major backing from Middle Eastern sovereigns. In 2017, Blackstone announced plans for a $40B infrastructure vehicle with backing from Saudi Arabia, and, just last year, Brookfield raised what was reportedly the largest infrastructure fund ever, at $28B.

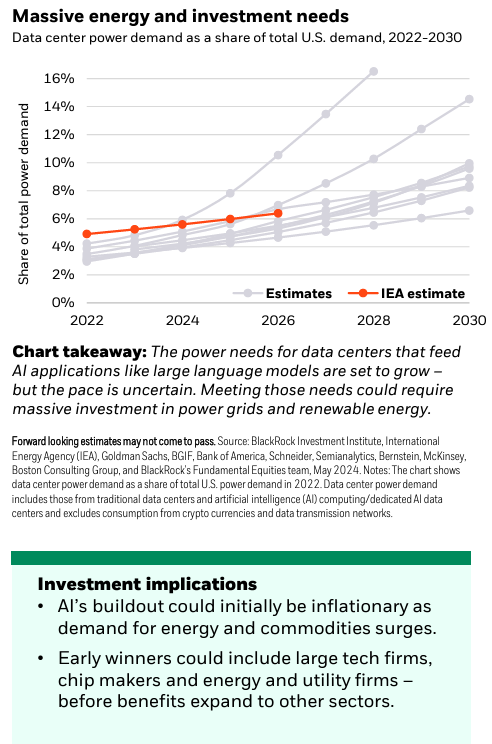

Capital appears to be required to meet the demand for global electricity consumption by data centers. The International Energy Agency estimates that global electricity consumption by data centers could surpass 1,000 terawatt-hours by 2026, more than double the amount used in 2022. These energy-intensive facilities are putting significant strain on electricity demand. Investment in infrastructure is required to fund data centers — and private capital is at the epicenter of funding this infrastructure required for the AI revolution.

💸 AGM’s 2/20: The transition to AI seems to be inevitable, but it will require massive amounts of capital invested in the infrastructure to enable growth in the industry. That capital will very likely have to come from scaled firms since they are the investment platforms that have the size and scale to direct the quantum of capital required to finance the transition to AI. BlackRock’s Mid-Year Outlook Report highlights the large capex requirement needed to fund the AI and low-carbon transition.

Data center power demand is increasing rapidly. The investment opportunity? Invest in the infrastructure (i.e., data centers) that powers this demand. That’s precisely what BlackRock and others, like Blackstone and Brookfield, have done by raising large funds to invest into data centers and infrastructure that will help build out the market for AI.

Large language models (LLMs) require data to train their models and make them better. The more data that’s ingested, the more likely the model will be well-trained. Data centers will be key in enabling AI companies to ingest more data. It’s not a surprise to see companies like OpenAI and its competitors raise significant amounts of capital. They require meaningful investment in cloud computing — CPUs and GPUs — to train and run their models. In a sense, companies like OpenAI are investing in digital “real estate.” The race is on to ingest as much data as possible in order to most efficiently and effectively train AI models. Companies that spend the capital required to ingest and handle the computing power necessary to train the models will likely stand to benefit. That’s, in large part, why capital and scale matter in AI. BlackRock’s November 2023 whitepaper on AI illustrates the infrastructure required to finance and develop AI applications.

From a private markets perspective, the alternative asset managers that will be able to invest in the infrastructure and data centers that form the building blocks of computational power should stand to benefit. To do that, these firms require scale. Not all areas of private markets require scale to win, but infrastructure is one area that does. That’s one reason why BlackRock’s acquisition of GIP was so critical to their long-term private markets strategy, particularly if they want to play the AI investment trend by investing into data center infrastructure.

📝 Firms jostle to sell alternative assets to wealthy investors | Brooke Masters, Financial Times

💡Financial Times’ Brooke Masters dives into the race to work with the wealth channel. The latest entrant? BNY, the custody bank behemoth, announced plans for a platform, Alts Bridge, to connect GPs and LPs with an integrated solution across the lifecycle of an alternative investment. This news follows three major partnership announcements, including two from the prior week, that signal a major focus on the wealth channel — BlackRock and Partners Group launching private markets model portfolios, State Street and Apollo teaming up on a public / private credit ETF, and Capital Group and KKR partnering on a public / private fund for the wealth channel. Banks and traditional asset managers appear to see the importance of working in private markets as more companies stay private and private markets firms continue to grow. “For an investor who wants to own the whole market, more and more of the market is private,” said Brian Moriarty, strategist at Morningstar. Just 13% of alternative asset manager assets came from the wealth channel in 2023, but that figure is expected to rise to 23% by 2026, according to data firm Cerulli. Traditional asset managers see the client demand for private markets products and are looking to serve that demand. “This is something the market is asking us for,” said Holly Framsted, Capital Group’s Global Head of Product Development. “We are aiming to create a new space here and a new category for wealth investors.”

BNY’s platform will be another addition to the infrastructure enabling the wealth channel to access private markets products. They will allow RIAs and independent broker-dealers to buy, value, and manage alternative investments. BNY has signed up almost two dozen alternative asset managers, including Apollo, KKR, Carlyle, Lexington Partners / Franklin Templeton, Blue Owl, Partners Group, Coller Capital, Goldman Sachs, Hunter Point, 26 North, and others. BNY plans to leverage its distribution team with its wealth custody and clearing capabilities as one of the largest custody firms to the wealth management community in an effort to provide a comprehensive solution to find, access, and custody private markets assets.

Questions arise both with some of the new infrastructure developments (will advisors that custody elsewhere now choose BNY, or will alternative asset managers want to work with a platform that is agnostic with its custody relationships?) and with new product developments, like model portfolios (what’s the skillset required to handle rebalancing illiquid exposures within a model portfolio and deal with liquidity in evergreen and public / private hybrid structures?). The initial answer? “Education is hugely important,” said KKR Partner Eric Mogelof. “It’s really important for advisors and their investors to fully understand the structures … How they work, how they could help investors, what the liquidity conditions are, and obviously understanding the overall risks as well.

💸 AGM’s 2/20: Innovation abounds as alternative asset managers and technology providers look to find ways to work with the wealth channel. One size doesn’t fit all in the wealth channel, so it was inevitable that there would be innovation to serve the various types of investors in the wealth channel. As alternatives firms staffed up to be able to handle the burdens of working with wealth advisors and individual investors, they’ve also had to evolve their product offerings. More recently, that’s meant creating evergreen vehicles. The latest creation? Public / private hybrid products and ETFs, as State Street and Apollo recently partnered on. These types of innovations certainly make sense from a business strategy perspective. Traditional asset managers have the distribution capabilities, but in many cases, there is pressure on fees in their current businesses and asset outflows. Private markets products might help reverse some of those trends, both in terms of fee take rate and asset inflows. The next innovation? Model portfolios. The creation of a holistic asset allocation solution that’s pre-baked to enable advisors to offer a turnkey product for private markets exposure across strategies and asset classes to clients appears to be the most scalable way to bring private markets more mainstream.

Speaking of turnkey, BNY’s launch of Alts Bridge aims to be another end-to-end infrastructure solution for GPs and LPs in the wealth channel. The significance of this development shouldn’t be understated. BNY oversees almost $50T in assets under custody and / or administration and $2T in AUM. They possess both the custody and distribution capabilities to provide a full lifecycle solution to advisors. By virtue of their custody business, they have relationships with much of the wealth management and broker-dealer industry. That should enable them to plug into these relationships in a way that will make advisors comfortable with the operational complexities of private markets investing. In many respects, it’s the operational and post-investment challenges that have prevented advisor uptake of private markets investments. Connecting the dots for advisors by providing advisor education, a fund discovery center, home office and asset manager tools, automated document preparation, simplified order entry, and integrated reporting and investment management capabilities should help ease those challenges. BNY’s launch of Alts Bridge also brings questions to bear. Will advisors that custody elsewhere now choose BNY because of the end-to-end alts capabilities? Will alternative asset managers want to work with an infrastructure provider that is agnostic with its custody relationships? All of these questions remain to be seen, but it’s certainly a major development for private markets.

Reports we are reading

📝 Preqin forecasts global alternatives AUM to rise to $29.22T by 2029 | Laura Messchendorp, Preqin

💡Preqin’s Laura Messchendorp dives into Preqin’s Future of Alternatives 2029 report, which finds that global alternative assets under management could hit $29.22T by the end of 2029. This figure would mark a 74.1% increase from the $16.78T at the end of 2023. This direction of travel is, in large part, accelerated by the growing interest of private wealth in private markets. Preqin’s Global Head of Research Insights Cameron Joyce said: “Global alternatives markets continue to evolve rapidly, especially as individual investors’ access opens up, as the private wealth channel’s growth continues to gather pace.”

While private markets is expected to continue its rise over the coming years, the industry’s growth could be slower due to a challenging macroeconomic and geopolitical environment. Joyce astutely pointed to a number of factors that could contribute to a more challenging landscape for fundraising and investing: “While policy rates are expected to decline, macroeconomic conditions are likely to remain more challenging than during the pre-pandemic era, and our forecast of slower industry growth reflects that. Investors are navigating evolving geopolitical risks as we move towards a multipolar world order — which presents a new set of investment opportunities and risks.”

Preqin’s report covers AUM growth forecasts on each private markets strategy:

Private Equity: $5.8T (2023) —> $11.97T (2029).

Fundraising is likely to be buttressed by the wealth channel.

Venture Capital: $1.85T (2023) —> $3.59T (2029).

Early-stage is expected to experience the most annualized AUM growth at 13.2%, followed by the “venture (general)” category, at 11.1%.

Late-stage VC is expected to have more muted interest.

Private Debt: $1.5T (2023) —> $2.64T (2029).

Average IRR of 8.1% from 2017-2023 is expected to rise to 12.0% over 2023-2029 for the asset class, with distressed debt forecasted to average 13.4%.

Hedge Funds: $4.53T (2023) —> $5.73T (2029).

The nominal growth rate of 4.0% is the lowest growth rate of all the main alternative asset classes.

Real Estate: $1.61T (2023) —> $2.66T (2029).

Annualized fundraising growth of 5.1% is forecasted to best broader private capital by 0.9%.

Infrastructure: $1.27T (2023) —> $2.35T (2029).

Infrastructure is currently experiencing a prolonged slowdown in fundraising as the asset class digests a flood of capital in 2022 and higher interest rates, but Preqin forecasts a more robust fundraising environment and better performance from 2026 onwards.

Secondaries: Annualized growth of 13.1%, in large part due to private wealth interest and a weak exit market.

Along with their Future of Alternatives report, Preqin also published a report on GP Stakes. The report, written by Victoria Chernykh, highlights an industry that has current AUM of $60B, mainly controlled by four fund managers: Blue Owl, Blackstone Strategic Partners, Petershill Partners (part of Goldman Sachs Asset Management), and Wafra. Preqin’s Future of Alternatives 2029 report projects global private equity AUM to grow at 12.8% from 023 to 2029, so Preqin’s expectation is that the GP stakes industry will benefit from AUM growth in private equity and private markets more broadly.

What we are listening to

🎙️The Next Stage of the Credit Cycle with Oaktree’s Danielle Poli | Danielle Poli, Oaktree with Tracy Alloway and Joe Weisenthal, Bloomberg Odd Lots

💡Danielle Poli, Managing Director and Assistant Portfolio Manager within Oaktree’s Global Credit strategy and a founding member of the Global Credit Investment Committee, sat down with Bloomberg’s Odd Lots podcast hosts Tracy Alloway and Joe Weisenthal at Future Proof in Huntington Beach. Danielle also spoke at Future Proof on a panel on private credit with Cliffwater’s Phil Huber that I had the pleasure of moderating. On the Odd Lots podcast, Danielle discussed her outlook on the credit cycle and how to approach credit from both a public and private credit investment perspective.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Fidelity Investments (Asset manager) - Director, Alternatives Product Marketing - Fidelity Institutional. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 J.P.Morgan (Asset management) - Outsourced Chief Investment Office - Executive Director. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

I have been of the opinion for several years now that the concept of alternatives is outdated. Back in the day it was often used to identify anyone in the investment management industry that was not a traditional long only mutual fund manager. As the investment management world continues to evolve arguably there is little fundamental difference between a mutual fund manager investing in the public markets and a hedge fund manager doing the same. What has become relevant are those managers who focus on investing in the public markets vs those who focus on investing in the private markets

Michael, when we spoke a while back, we discussed what you referred to as "alt alts," e.g., investments in watches and certain collectibles, non-listed REITs and BDCs, etc. I'm curious about how we define this category going forward, especially since there are now legitimate secondary markets to buy and sell them.