AGM Alts Weekly | 9.29.24: If you can't beat 'em, join 'em

AGM Alts Weekly #71: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Designed with GPs at heart and LPs in mind, the bunch operating system, coupled with an advanced workflow management tool, is designed to streamline and automate cumbersome back-office processes and become the single source of truth for you to collaborate with your service providers.

With over 50 fund clients and $3 billion in committed transactions across five jurisdictions in Europe, bunch has a proven track record of freeing up valuable time for fund teams by taking over the fund administration so you can focus on what truly matters: maximizing returns and enhancing the LP experience.

Good morning from Santa Barbara, California, where I’m in town for my cousin’s wedding. Congrats Jess and Chris!

This week’s news seemed to be dominated by private credit. This shouldn’t come as a surprise, given the explosive growth in private credit and some of the structural shifts happening in the market.

But there was something quite remarkable about this week’s news that appeared to send shockwaves through the industry.

Apollo and Citi announced a landmark partnership, a $25B private credit direct lending program focused on North America.

There have been plenty of questions as to how banks would react to the growing presence of alternative asset managers in the credit sandbox.

Some banks, such as Goldman Sachs, have looked to enhance their own presence in the private credit market. Goldman, for its part, recently closed on a $20B senior direct lending fund, West Street Loan Partners V, as part of a broader strategic initiative to grow its $130B AUM private credit business within their Asset & Wealth Management Division to over $300B AUM in the next five years. Others, such as JPMorgan, have evaluated acquiring private credit firms, as JPMorgan did earlier this year with a near-deal to acquire $19B AUM private credit firm Monroe Capital.

If you can’t beat ‘em, join ‘em

Apollo and Citi’s $25B partnership, as well as Apollo’s recent $5B tie-up with BNP, which will see the French bank commit to funding investment-grade, asset-backed deals originated by Apollo and its Atlas SP business that was acquired from Credit Suisse.

Apollo’s Co-President Jim Zelter called the BNP partnership “one of — if not the — largest-ever, long-term private credit financings.” That quote came just six days before the announcement of Apollo and Citi’s partnership.

This growing raft of partnerships between banks and alternative asset managers in private credit speaks to a number of changes that are afoot in credit markets.

Citi teaming up with Apollo is, in some respects, an admission that alternative asset managers are major players in the credit space. Citigroup’s Head of Debt Capital Markets Richard Zogheb acknowledged as much in his interview on Bloomberg earlier this week, saying, “private credit is going to be a larger part of the financing markets going forward, and our view is … that we need to embrace that and if we are going to be increasing our relevance to our clients, we need to offer that ...”

Private credit becoming a larger part of the financing markets is certainly a major trend. A recent McKinsey article, “The next era of private credit,” highlights just how much room private credit has to grow into the lofty market size expectations that many of the alternative asset managers have shared in recent years.

The chart below from McKinsey’s analysis suggests that the size of the addressable market for private credit, $34T, rivals the $20T market size figure stated by Ares, the $25T market figure size stated by Blackstone, and is a bit under the $40T market size figure stated by Apollo.

Notably, McKinsey’s analysis finds that the majority of the broad array of assets that could constitute as private credit’s addressable market are directly held on bank and non-bank balance sheets.

McKinsey envisions a number of assets, such as infrastructure, asset-backed finance, and higher-risk commercial real estate, as asset types that could transition to nonbanks.

Apollo’s March 2024 Investor Presentation also illustrates the expanding reach of private credit across a variety of categories that would have previously been the domain of banks.

This market structure evolution in credit means that banks have strategic decisions to make, just as Citi did by partnering with Apollo. Banks, which are constrained by regulations in a way that alternative asset managers are not, must face a new reality as they compete against scaled alternative asset managers that possess long-dated sources of capital, like insurance capital, private wealth capital, pension and sovereign wealth capital, and sources of permanent capital like BDCs.

Alternative asset managers’ structures — and investor bases — lend them (yes, pun intended) a helping hand in their quest to increase their market share in the direct lending market. So too is this more lucrative construct enabling private credit firms to pry bankers away from their leveraged finance jobs at banks.

Frenemies out of necessity

Direct lending, where a company borrows directly from a non-bank lender, matches well with the structure and investment mandate of a private credit firm or alternative asset manager.

The lender generally holds these loans to maturity, meaning that the investor is generally trading off liquidity in exchange for a steady current income and possibly lower risk since direct lending invests in the senior-most part of a company’s capital structure.

The recent trend in direct lending has been a move away from syndication, as alternative asset managers have reached a size and scale that enable them to be a single source of capital for borrowers. This evolution favors the largest firms, allowing them to become a one-stop shop solution to companies (in addition to being a one-stop shop solution for allocators, which I’ve written about in the past on AGM in the 3.3.24 AGM Alts Weekly).

Banks may not like this new normal, but this evolution has put both alternative asset managers and banks in a position where they may end up being frenemies out of necessity.

Some alternative asset managers, like Apollo, have found a way to create captive origination channels for their private credit investments (read: Apollo’s origination platform with 16 originators) and find the right type of capital to match that origination (read: annuities via insurer Athene and the private wealth channel). And yet, they have looked to partner with banks like Citi, as they did this week, to enhance their origination capabilities.

Different firms have different structures and competencies, so it would not be a surprise to see the private credit market structure continue to evolve.

McKinsey’s report highlights some of the developments that could take hold as alternative asset managers become increasingly bigger players in the marketplace.

A multipolar credit world

The shift to a multipolar private credit market structure could lead to more partnerships that look like Apollo and Citi’s tie-up, where open architecture business models will feature.

Banks might team up with asset managers and institutional investors to focus more on origination and cross-selling other businesses, like cash management, FX, and advisory services. Partnerships with alternative asset managers to create private credit vehicles or origination tie-ups seem to be a popular path forward for banks, as the below graphics from Bloomberg illustrate.

Some banks may look to compete directly with alternative asset managers’ private credit strategies, as JPMorgan, Goldman Sachs, and Morgan Stanley have done. But they, and other banks, may also look to partnerships with private credit firms, insurers, or sovereigns that want to put capital to work and are unburdened by the same regulatory constraints as banks.

If the goal for private credit (in addition to returns) is to match assets with institutions well-suited to handle specific durations and risk levels, then this market structure evolution could prove to be a boon for the space.

Speaking of returns, some would posit that private credit should be much more favorable for allocators than public credit.

Cliffwater CIO Stephen Nesbitt’s August 2024 whitepaper believes that illiquidity in private credit is worth the tradeoff with public credit for investors in exchange for higher returns. Nesbitt references the Cliffwater Unlevered, Net-of-Fee Direct Lending Index (below) to highlight the differences in risk and return between private credit and public credit investments.

Nesbitt finds that private credit offers 3-4% higher returns, after adjusting for fees. In Nesbitt’s words, “said differently, investors are picking up roughly 4% in added net-of-fee return from private credit (7.23% minus 3.31%) by paying 1% in additional costs (2% minus 1%), compared to public credit.”

This data from Cliffwater suggests something profound: if investors are searching for higher returns, perhaps private credit is a good place to look.

It also leads to an even bigger question. If private credit can continue to sustain its returns, does it become a way for investors to save for retirement?

Apollo’s acquisition of Athene has made them one of the largest providers of retirement income in the US.

Insurance balance sheets might be the right type of capital to tap into in response to this changing credit market structure, as this graphic from Apollo illustrates.

As passive funds have grown in size and scale in the public credit markets, investors have been forced to look for returns elsewhere in credit markets. That area? Private credit.

With less guaranteed retirement income yet a growing retirement age population in the US, perhaps private credit is more of a necessity than just a nice-to-have.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 The barbell tolls for fixed income investing | Huw van Steenis, Financial Times

💡Oliver Wyman Vice Chair and former Global Head of Banks and Diversified Financials Research at Morgan Stanley Huw van Steenis discusses the profound shift in market structure in fixed income investing, just as it did in equity investing. Van Steenis cites the “barbell effect,” which was previously associated with equity investing, occurring in fixed income markets. Van Steenis notes that investors have allocated meaningful amounts of capital to private credit funds, with Ares raising a record private credit fund at $34B earlier this year. Investor interest in private credit is complemented by allocations to fixed income ETFs. Investors allocated almost $190B into US fixed income ETFs this year to August, according to Morningstar, which is 50% higher than this time last year. Van Steenis’ view is that investors’ views of both public and private credit would only serve to create a barbell. On one end, investors would allocate to passive and exchange traded funds to access benchmark returns cheaply and conveniently. On the other end, investors looking for higher yields would allocate to specialist managers investing in private equity, hedge funds, and private credit. It’s the “core” traditional active managers that would be caught in the middle, warns van Steenis. They would be forced to either build, buy, or partner to become more specialized and less commoditized as fees in passive products would see a race to the bottom or risk outflows, as he argued twenty years ago in a Morgan Stanley research note.

The money is in private markets. Van Steenis cites that over half of all the management fees in the investment industry will go to alternative asset managers in 2024, up from 28% in 2023, according to Morgan Stanley and Olive Wyman estimates. The barbell effect is behind this trend. Investors are rethinking how and where they allocate capital, particularly in credit, after 15 years of zero or negative interest rates. On the public fixed income side, traditional asset managers have faced a raft of fee compression. Active bond ETFs have a median net expense ratio of 0.40%, lower than the 0.65% of bond mutual funds, according to State Street Global Investors. In private credit, alternative asset managers are besting many traditional asset managers. Alternatives managers saw 21% net new money allocated into their credit strategies in 2024 through June compared to just 1% for all traditional firms.

Van Steenis cites a number of other reasons for this trend in addition to fees. He also mentions automation in public bond markets, which enables investors to have more choice in their bond ETFs. Regulation is another force that’s driving this disintermediation. Banks are forced to ship off the riskiest portions of debt to private credit funds, where those funds take on more risk, albeit for higher potential returns. And private credit firms are also looking for ways to reduce their cost of capital to enable them to compete with banks to handle some of the higher quality, investment grade assets on bank balance sheets, as Apollo is doing by owning an insurance business in Athene.

Van Steenis closes by acknowledging the immense pressure on traditional asset managers’ businesses. This pressure is forcing new ways of thinking, such as partnerships between traditional and alternative asset managers, including a number of which have occurred in recent months, such as KKR / Capital Group’s new hybrid public-private fixed income fund, BlackRock and Partners Group’s partnership to create a model portfolio, and Apollo and State Street’s hybrid public-private credit ETF.

💸 AGM’s 2/20: I’ve said before that evolutions power revolutions — and it appears that this market structure evolution in private markets writ large (and certainly here in credit) is turning into an investing revolution.

The market structure evolution that has occurred in other markets — equities, fixed income, and derivatives — is now happening in private markets (by the way, I don’t think they should be called “alternatives” anymore, as I wrote in the 9.22.24 AGM Alts Weekly).

I wrote in June 2022 about the market structure evolution in private markets in the context of prior market structure evolutions:

A well-functioning market works when there is efficient and effective data and technology across the lifecycle of a trade or investment. As new markets are built, market structure requires technology innovation to create transactional efficiencies. A functioning market structure enables investors to have price discovery, invest or trade efficiently, and process, custody, and value trades and investments.

As market structure evolves, so too does its liquidity. More participants come to a market that functions better. Liquidity begets liquidity, and the market grows. It happened with equities. It happened with listed derivatives.

When technology innovation is there, particularly in market data and managing and tracking investments, it unlocks the ability for product innovation in a market. That’s partly why the market has evolved to merge traditional and alternative, with public and private funds coming together to create new products.

Credit markets are a massive prize given their size, particularly for alternative asset managers who are looking to continue expanding their business. Alternatives managers have — either by choice or by necessity — continued to evolve into multi-strategy, one-stop shop platforms as they have grown their respective businesses. That is particularly true for the publicly traded firms, where AUM growth is a north star. With a shifting focus on fees and new investor types, such as the wealth channel and insurance companies, these firms have found ways to evolve their business structure (as Apollo, KKR, and Blue Owl have done by acquiring insurance businesses).

But the path of alternative asset managers changing their business models to respond to a new world order due to investing and regulatory shifts cuts to the heart of something much bigger than simply growing AUM or product innovation. They are now getting to the size and scale after growing their businesses in this tiny corner of the market called “alternatives,” which is now becoming a much bigger part of investors’ allocations as alternatives move into the mainstream.

📝 Legal & General appoints new asset management boss in drive for growth | Ian Smith, Financial Times

💡Financial Times’ Ian Smith reports that Legal & General, the UK’s largest fund manager has brought over Eric Adler from Prudential to lead its asset management efforts. By choosing a US executive with expertise in private markets, this move could be a signal that L&G is looking to grow its alternatives business. L&G, which has over £1.1T AUM, has combined its fund manager with its private markets business unit. Adler joins L&G from Prudential, where he was President and CEO of PGIM Private Alternatives, the private markets business within insurer Prudential Financial, which is one of the largest insurance companies in the US. PGIM, which manages almost $320B in assets, has built out various private markets investment strategies either in-house or via acquisition. PGIM acquired Montana Capital Partners, a private equity secondaries specialist, in 2021 and bought a majority stake in private credit firm Deerpath Capital Management in 2023. Adler said his aim would be to drive L&G’s ambitions for “achieving profitable growth and mobilizing the power of investment to drive economic opportunity and positive social impact.” He cited the scale and global distribution as attractive aspects of L&G’s platform, stating "that “bringing together scale, global distribution and expertise across public and private markets and asset classes, L&G is well placed to address the full breadth of client needs, including the increasing demand for responsible, blended investment solutions.”

L&G’s hire of Adler highlights that private markets is a major area of focus for the firm. The insurer aims to almost double its private markets platform from £52B to £85B as part of its target of £500-600M in operating profits from its asset management business by 2028. This focus comes at a time when L&G’s investment manager was dealt a blow to its ETF business, suffering the largest outflows among Europe’s exchange traded fund providers in 2024. L&G Investment Management’s ETF lost over €2.7B in the first five months of 2024. L&G has been in the process of overhauling its asset management business, creating a single, unified asset management division by combining its investment management division with its private markets unit, Legal & General Capital.

💸 AGM’s 2/20: L&G’s move to bring in a seasoned private markets executive in Eric Adler touches on a number of key themes and trends in private markets today. Insurers are featuring as an increasingly prominent LP, which is not a surprise given the size of their asset pools and general accounts. With £52B AUM in private markets (£18.1B of which is third-party capital) and £1.1T AUM in the investment management business, L&G is positioned to be an active player in private markets. The firm’s ambitions to grow to £85B in private capital AUM highlights the growing trend of traditional asset managers looking to double down on their private markets capabilities because of better fee-related earnings, higher margins, and stickier, longer-dated revenue streams that serve to balance out the significant outflows that many asset managers are subject to in their public markets businesses. Insurance companies also need to find a way to provide income for their clients in retirement. Private markets investment products can deliver on this goal. L&G’s focus on growing its private markets capabilities should only serve to hammer home the point that insurance companies will be even more critical players in private markets as they look to serve pension scheme members. News of Adler’s hire comes after the July 2024 launch of a private markets access fund, a multi-strategy LTAF (long-term assets fund) that provides its 5.2M defined contribution pension members access to a single fund with diversified private markets exposure.

L&G’s LTAF is structured as a fund of funds across private markets strategies, enabling investors to gain access to L&G and external private markets funds. This product innovation could be a foreshadowing of what’s to come, particularly within retirement plans and defined contribution schemes.

📝 StepStone’s $4.8 billion fund bets on a lasting liquidity crunch | Jessica Hamlin, PitchBook

💡PitchBook’s Jessica Hamlin covers the close of StepStone Group’s fifth secondaries-focused flagship fund. The fund, which received $4.8B in commitments, closed at double the size of its predecessor fund. StepStone’s successful fundraise illustrates the high level of interest in secondaries from LPs. Secondary transaction volume was 58.1% higher in 2024 than last year, according to PitchBook’s Q2 2024 Global Private Market Fundraising Report, totaling $68B of volume in H1 2024. Secondaries are increasingly becoming a necessary avenue for liquidity as IPO markets have been relatively frozen, and more traditional exit paths, like sponsor-to-sponsor sales, have been muted due to large pricing gaps between buyers and sellers. StepStone has parlayed this interest in secondaries from LPs into a successful fundraise.

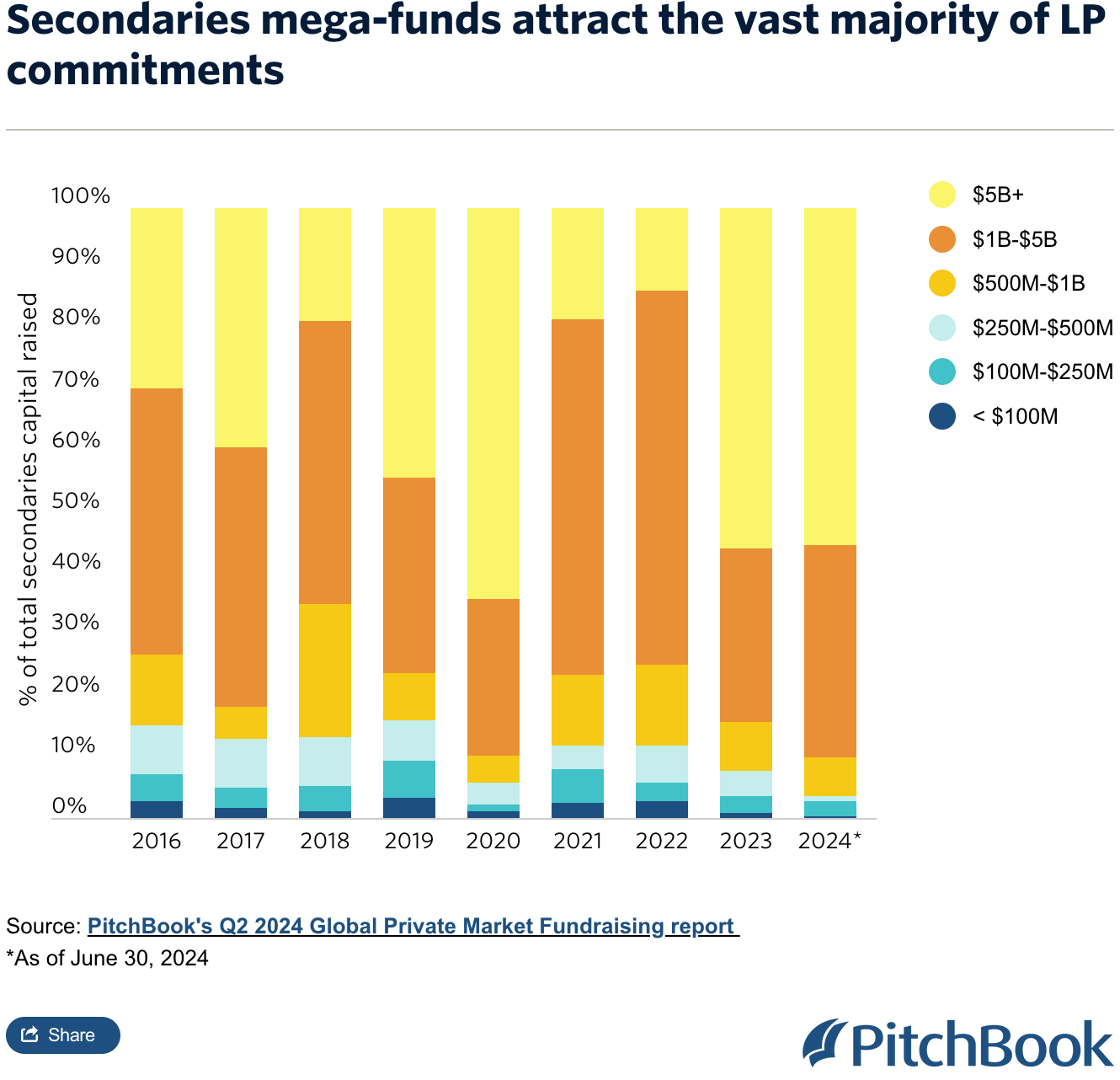

StepStone’s large raise is emblematic of a broader trend: mega-funds have attracted the majority of the capital from LPs in secondaries funds.

90.1% of the total secondaries capital raised this year has gone into funds $1B or greater in size. StepStone’s private equity secondaries vehicle is not alone in cashing in on a large secondaries fundraise. They also closed on a $3.3B fund to invest in VC secondaries. Some of their competitors, Hamilton Lane and LGT Capital Partners, closed on mega-funds this year. Hamilton Lane raised $5.6B, and LGT Capital Partners raised $3B.

Secondary deal volume picked up in 2024, in part because of a rebound in public equities and a record amount of dry powder, according to data from Jefferies. The average price of LP-led transactions, which accounted for almost 60% of total secondary deal volume, increased by 300 basis points. Activity was also driven by motivated pension fund sellers, many of whom were plagued by the denominator effect and needed to rebalance portfolios with distributions and liquidity. This trend is expected to continue as major pension plans, like Ontario Teachers’ and APG, are reportedly looking to sell portfolio stakes over $1B in H2 2024.

💸 AGM’s 2/20: Similar to private credit, structural dynamics in the secondary market are driving increased interest and fundraising activity. A need for liquidity and distributions, particularly from institutional LPs and from GPs that are looking to go back out into market for a new fundraise, is driving a desire for selling positions via secondary. These structural trends are creating an opportunity for secondaries funds to raise large pools of capital. It’s also creating an opportunity for three other trends to emerge:

(1) evergreen funds are very active in secondaries, enabling them to source a steady stream of investments to put capital to work, which is particularly important as they raise capital on a continuous basis.

(2) the wealth channel’s increasing participation in private markets is good timing for secondaries funds. The wealth channel, particularly newer investors to private markets, can gain access to vintage diversification and a reduced J-curve by investing in secondaries, making this strategy a compelling option for those newer to private markets. Secondaries can be a reasonable way for newer investors to gain exposure and build a private equity program more quickly, providing an on-ramp to private markets.

(3) fundraises in the secondaries market are emblematic of a broader trend in private markets: scale matters, and the largest funds are raising the majority of the capital. Secondaries is a strategy where size and scale can be beneficial. Firms like StepStone and Hamilton Lane are at an advantage due to the scale of their respective platforms. They also have fund-of-fund businesses, as well as robust data platforms, both of which provide them with ample access to quality datapoints on the pricing of underlying assets. This gives them an advantage when understanding how to price an asset that they are looking to buy, providing them with better price discovery than other buyers due to the breadth and depth of their market coverage. Therefore, it’s no surprise that larger funds have been able to attract the majority of the capital in the secondaries space.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 Fidelity Investments (Asset manager) - Director, Alternatives Product Marketing - Fidelity Institutional. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Capricorn Investment Group (Alternative asset manager) - Investment Analyst. Click here to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

Another great weekly letter, thank you.