AGM Alts Weekly | 9.8.24: AGM's Next Wave

AGM Alts Weekly #68: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Modern technology is key to your private equity firm’s success. But before you implement any new tools, you need to evaluate your firm’s readiness.

Learn about the 3 key indicators of whether your firm is ready to adopt new technology.

Discover Intapp DealCloud — a powerful deal and relationship management system built for private equity professionals — that will give your firm a competitive edge so that you can source more deals.

Good morning from Washington, DC.

Earlier this week, Bloomberg’s Gillian Tan reported that HPS Partners has been discussing a potential IPO with prospective investors. This development follows news that the firm has confidentially filed paperwork with the SEC over the summer.

HPS, which spun out of JPMorgan in 2016, has had a rather rapid ascent to join the rarified air of the publicly traded alternative asset managers. The firm has grown to over $117B, punctuated by a $21.1B capital raise for its flagship Specialty Loan Fund IV this summer.

According to Preqin, the fund, which closed on $14.3B of commitments from investors (meaning that the $21.1B figure also includes bank loans as part of the capital to invest), was one of the largest funds ever raised by a traditional direct lending fund.

HPS has built quite a significant business in credit. Their $117B AUM includes $98B in private credit, in addition to another $19B in public credit.

With over 700 employees and 14 offices globally, they appear ready to take on the next phase of growth as a firm.

A public listing could be part of that natural evolution.

A rapid ascent

Just as AUM has grown, so too has HPS’ valuation. The firm, which was started by Goldman veterans Scott Kapnick, Scot French, and Michael Patterson to focus on credit and longer-dated, less liquid investment opportunities under the name Highbridge Principal Strategies as part of Highbridge Capital Management in JPMorgan’s asset management business in 2007, went independent via management buyout in 2016.

Along with new investors Dyal Capital (now Blue Owl GP Strategic Capital) and Guardian Life, management and investors valued the independent firm, HPS, at $1B. Eight years later? HPS is considering an IPO at $10B.

A HPS IPO would represent another major event in the continued maturation of private markets. Earlier this year, CVC Capital Partners, a €186B AUM alternative asset manager, went public, in a significant development for private markets.

These firms, both of which crossed the $100B AUM threshold in recent years, represent part of the next crop of alternative asset managers that could enter the ranks of public markets.

Going public

A defining feature of alts going mainstream over the past decade has undoubtedly been the evolution of funds to firms. That process culminated in a number of alternative asset managers going public, as illustrated by the AGM Index of publicly traded managers further down in this newsletter.

Part of the rationale for going public was to create a currency to retain and attract employees and to acquire specialized firms or strategies that could expand their platforms, in many cases.

Another reason for going public is something that’s becoming increasingly important as more alternative asset managers look to the wealth channel to grow their AUM: brand-building.

To resonate with the wealth channel means that firms have to take on a different mindset when it comes to marketing. Blackstone’s brand and marketing efforts are emblematic of the changing nature of how scaled platforms invest in brand to reach the wealth channel and individual investor.

Part of that effort? Going public as a way to extend the brand and visibility of the firm. The concept of going public now takes on a new meaning since alternative asset managers seem to be more well understood amongst investors.

In a piece from May 2023 about the evolution of alternative asset management (When funds become firms: Our partnership with Cantilever Group, a GP stakes firm), I wrote about how alternative asset managers have now proven themselves in public markets.

When Blackstone went public in 2007, many questioned how the public markets would value alternative asset managers’ business models.

How would investors look at management fees? How would an investor value carry, which is a highly variable, unpredictable and long-dated income stream?

17 years later, the weighing machine of markets have spoken.

Blackstone has close to a ~$167B market cap. Just a handful of publicly traded alternative asset managers alone represent over $617B of market cap, as the below AGM Index that tracks certain publicly traded alternative asset managers illustrates.

The public markets have proven that investors see value in the durable customer relationships and high-quality recurring revenue that alternative asset managers generate. There’s real scale and operating leverage with these types of businesses. Relative to the increase in AUM, the primary variable expense is headcount. That feature favors alternative asset managers, as the economies of scale are tremendous for firms that can grow AUM. Operating margins on management fees alone can be upwards 60%, along with low fixed expenses.

Investor interest in alternative asset managers has only continued to grow as AUM has flowed into private markets in spades.

Private markets AUM has grown almost 3x since 2008. PitchBook expects private markets AUM in closed-end funds to reach at least $20T, if not closer to $24T, by 2028.

What would another $5-10T of AUM do to the enterprise values of alternative asset managers? It could double or even triple firms’ AUM over a span of the next five years and would result in marked increases in enterprise value that accrues to the management companies of these firms.

Riding the wave of private credit

With private markets’ AUM increasing as part of a secular trend, it would not be surprising to see a growing number of firms look to capture incremental AUM.

A firm like HPS represents a prime candidate to ride the wave of the mainstreaming of private markets.

Private credit could very well be a major driver of the next wave of alternatives managers considering a public listing.

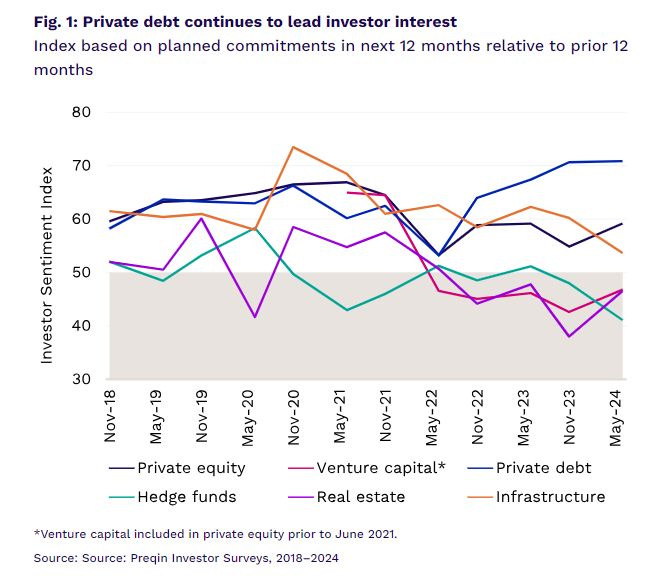

According to data from Preqin on investor interest over the next 12 months, private credit appears to be popular. That’s a positive sign for a firm like HPS, which will be banking on continued AUM growth once they are public.

Other firms on the cusp of a public listing based on AUM and scale seem well-aware of this trend. News this week that Clearlake Capital has acquired $5.1B pan-European private credit specialist MV Credit from Natixis Investment Managers furthers this notion. The acquisition will boost its credit AUM to over $28B and Clearlake’s firmwide AUM to over $90B.

Perhaps one way to predict which alternative asset managers will be next in line to go public is to take a look at the Blue Owl GP Strategic Capital portfolio.

Some of the firms in their portfolio, like Bridgepoint and CVC, have already crossed the chasm to public markets. Who could be next?

AGM’s next wave

HPS seems to be next in line. Silver Lake and Vista, both of whom are over $100B AUM, would appear to be likely candidates as well. Both are experts in technology investing, evolving into shining examples of the “scaled specialist” moniker. Both Silver Lake and Vista have evolved from their foundations as equity investors into platforms that have expanded beyond buyout investing to build out credit investing strategies and, in the case of Vista, create evergreen strategies.

Clearlake, mentioned above for acquiring $5.1B AUM MV Credit, could be soon be knocking on the door of public markets. At $90B, Clearlake is close to crossing the $100B AUM chasm, which appears to be an arbitrary, yet significant number that would matter from a brand-building perspective.

Other firms, such as Veritas, Sixth Street, Cerberus, and Stonepeak, all seem to be possible candidates in the future.

There are a number of other storied firms outside of the Blue Owl portfolio who I could envision entertaining a public listing sometime in the foreseeable future. Those include:

General Atlantic, which, at ~$96B+ AUM, is close to the $100B AUM mark and confidentially filed for IPO in December 2023, according to a Bloomberg article. GA has expanded beyond its successful roots in growth equity to launch a credit strategy in 2023 and also added an infrastructure strategy to its platform by acquiring Actis. Their hire of Goldman Sachs Partner Chris Kojima earlier this year in a newly created role of Global Head of Capital Solutions to continue to build the firm’s global client franchise also signals an intent to deepen its work in the wealth channel, another signal that going public could be on the horizon.

Warburg Pincus has over ~$83B AUM and recently launched its first fund focused on structured capital solutions (i.e. credit). Their Capital Solutions fund closed on $4B in commitments, doubling its initial $2B target.

Ardian, which boasts ~$169B AUM and over 1,050 employees across private equity, secondaries, real assets, and credit, would appear to have the breadth and depth of a diversified platform to justify a foray into public markets. The firm started as part of AXA when AXA’s Chairman at the time, Claude Bebear, asked Dominique Senequier to build the private equity arm of the insurer. Senequier grew the platform with great success, growing to over $36B AUM/A before leading a management buyout in 2013 where 80% of the employees became owners of the firm. Perhaps as a new generation of leaders come into the fold at Ardian, they will consider a public offering as an alternative asset manager with deep European roots.

Bain Capital, with ~$185B AUM, has built a true multi-strategy platform since its founding in 1984. It organically expanded from private equity into other strategies like credit, real estate, venture, growth / tech opportunities, public equities, double impact, and even crypto. Bain Capital also partners with insurance companies to offer investment solutions tailored to the needs of an insurer’s asset / liability matching requirements.

HarbourVest, with ~$127B AUM and a 42-year history, has made a few moves that could suggest a public offering is in the cards at some point in the future. Like Ardian, they have built a diversified platform that includes fund-of-funds, direct co-investments, infrastructure, and real assets. They’ve also launched a suite of open-ended fund products and, in 2021, partnered with Vanguard to provide private markets access to qualified HNW investors.

Hellman & Friedman, a storied private equity firm that started in 1984 and has now grown to ~$120B AUM, could be an IPO candidate if there is appetite in public markets for a large-scale private equity firm or if H&F wanted to expand its platform into other strategies like credit, infrastructure, or real estate.

Thoma Bravo, a ~$160B AUM software-focused investor, has built out a platform that encompasses software buyout, middle market, lower-middle market, minority investments, and credit investments. It would fall into the scaled specialist category, like Vista, but with software becoming core to virtually every company, perhaps the public markets would look favorably on a business that is a software specialist.

Advent, which is one of the largest and longest-serving independent private equity partnerships, boasts over ~$94B AUM. It has focused exclusively on equity investments (buyout and growth), so if it were to consider a public offering, it would have to decide whether to be branded as a pure-play private equity investor or expand into other strategies.

Insight Partners, at ~$90B AUM across early-stage, growth-stage, and late-stage technology investing, would occupy the venture category on this list. There are probably other firms, of smaller size and scale in terms of AUM, such as NEA and General Catalyst, that have taken in GP stakes investments from Dyal and Petershill, respectively, who could also be on this list, in addition to a firm like Andreessen Horowitz, but Insight’s AUM is of greater scale. They’ve also made a concerted effort to focus on building out wealth channel partnerships, hiring Adam Vartabedian from Rockefeller Capital Management to lead Private Wealth Partnerships.

CD&R, at ~$60B AUM, has been a private equity focused investor since its beginnings in 1978. It has grown its platform as a monoline private equity firm. What makes them a candidate for a public offering, among other aspects of their business, is that they have a relatively diversified investor base and have a concerted effort focused on the wealth channel.

I’m sure there are a number of other firms that are worthy of inclusion and actively thinking about their future as a business, which possibly includes a public listing. The firms listed above come to mind given their size and scale, and in certain cases, either specialization that gives them differentiation or the breadth of offerings that make them well-positioned to expand AUM.

On that note, what will it take for the next wave of managers to go public?

Preparing for going public

Going public requires a well-thought-out framework that takes into account the current state of a firm and its unique capabilities and simultaneously looks into the future.

How can a firm navigate the here and the now and also think about what’s ahead?

Align on ambition

HgTrust’s Chairman of the Board Jim Strang said on his Alt Goes Mainstream podcast that firms looking to scale first need to align on their ambition.

[00:15:01] : I think we'll get more because what's started to happen is two things. One is a prerequisite for this to happen is there has to be ambition. The firms that are scaling have to really want to become the next Bridgepoint, or take your pick, and they have to be set up for that. And that's not a given because not everybody wants to do that. But there have to be at least some that have that ambition to get there. And then, as they scale and grow, there's a bit of a pivot that has to somehow magically happen. In smaller markets or when you're in one market and you're doing relatively small deals, success is pretty much defined by who you know. As you start to scale and have aspirations to go into other markets, then you have to pivot. You have to start building a repeatable model that scales, that allows you to be able to cross these borders and build into adjacent markets and go on that pathway to get broader coverage. And that's the trick. That's what you have to master. I think that's what you'll see the successful firms doing. There's probably ten to fifteen that are on that journey now. No one's really gotten to the other end yet — to the promised land, but, there's a bunch that are on the path. And I think most will make it somehow, but it might be a while. And then they've got a chance of graduating into that original founding group.

Firms, particularly as they think about evolving as a business and growing and incentivizing the next generation of leadership, must have alignment on what they want to be. To follow the growth path of their larger peers, they need to figure out where they have a comparative advantage and how they can expand their firm’s capabilities.

For some, that could mean going a mile wide — expanding their platform horizontally by adding other investment strategies.

For others, that could be drilling deeper — continuing to build out their capabilities as a scaled specialist.

There’s no one right answer. It’s reasonable to think that the market can handle different types of firms.

Streamline the structure

Once a firm has aligned on ambition, it will need to figure out the right business structure.

The right business structure is important in a few different contexts. Some firms will have to evolve from a partnership into a governance model that is better equipped to handle a global business at scale and certainly one that can handle being a public company.

Jim discussed the importance of aligning on ambition on his podcast on AGM.

Jim Strang: Well, everyone's got it. The question is, is it clearly articulated and is it shared? Your ambition could be anything from I'd love to shoot 34 in golf to I want to be the next Blackstone. There's a real sort of art and there is a sort of a proper calibration of what it really means. And how it is that integrated into the strategy of the firm? And that's not trivial. And then the other one, which you see quite a lot when you work with these firms, is alignment, And this is where things start to get interesting because most private equity firms are set up as partnerships. Okay. Thank you. And partnerships are not the governance model of choice for alignment because it's a bit like the Knights of the Round Table. If you have to get everybody agreeing to want to go on a path, you first got to have the path clear. Then you're going to have to get everybody agreeing. And if you're thinking, what's the worst way I could set myself up to stop that happening, it would be a partnership. So solve that one. Certainly with some of the things I do with Bain, that's one of the things we always do first is say, okay, have we got a clear sense of ambition and can we write it down in words?. And then are we agreed? And that's often very insightful, right? And it stops things happening. That's one of the challenges.

As firms think about going public, one thing on their minds will certainly be how they structure their business so that they are ready for scale and what comes with being a publicly traded firm.

Another aspect of structure for firms to consider is how they expand their platform to grow and deepen LP relationships. The way to do that? Acquire specialists in specific investment strategies or build out a team to launch a complementary strategy on the platform. That could take the form of a firm acquiring another capability, as General Atlantic did with Actis to launch an infrastructure strategy. It could take the form of building out the capability in-house, as General Atlantic did with their credit business. Either way, once a firm has aligned on ambition, it needs to think deeply about the strategic imperatives behind its structure that will enable it to continue on a growth path.

One unique and complementary area to keep an eye on where firms have either built out or acquired capabilities? Sports investing. Ares Co-Founder Tony Ressler highlighted the opportunity in sports this week, noting that Ares views sports as a $2.5-3T asset class at Bloomberg Power Players in New York.

The other way in which structure matters lies in the power of the platform. Certain firms, including HPS, started within the confines of a larger platform. HPS was initially part of JPMorgan’s Highbridge Capital Management before spinning out. Ardian was formed as a unit of AXA, the large insurer. Both firms had a rapid growth path, in part because they were able to leverage the power of the platform and brand of their associated firm. Access to capital is critical for managers to grow their AUM — and having a relationship with a strategic investor like a bank or insurance company can accelerate a firm’s growth. Perhaps a firm like Churchill Asset Management, a private credit firm with $50B AUM that is part of Nuveen, which is owned by insurer TIAA, would be a prime candidate to eventually spin out and go independent (or even go public) once they achieve a size and scale where they feel it makes sense to do so.

Build the brand

Alternative asset managers understand the importance of building their brand. This is particularly true of the firms that are in public markets.

The next wave of alternative asset managers can take a page out of the playbook from firms like Blackstone, which has made a concerted effort to build its brand in a way that a consumer-oriented business might think about marketing. They might also look to what KKR did by partnering with Capital Group to expand its reach into the broader corners of the wealth channel.

One reason why firms choose to go public is to enhance its brand with the wealth channel and individual investor. If a firm has aligned on their growth ambition and structured its business in a way that equips it to go public, then building the brand through key marketing hires and a concerted brand-building effort is the natural next step to growing AUM.

Sports investing could be an interesting and novel way to build a brand with the wealth channel. Sports resonates with people in unique ways. An individual investor or consumer might know PSG or Chelsea, but they might not know Arctos or Ares (both of whom have investments in each of the aforementioned clubs, respectively). Blue Owl likely caught people’s attention by sponsoring tennis players at the US Open. They also happen to be minority investors in a number of NBA teams through their HomeCourt investment fund.

If a firm is able to effectively market their brand to individuals via a vehicle such as sports, which is global and engaging, then it might be able to build a brand in a way that would be otherwise unattainable for many alternative asset managers.

Deepen the distribution

Firms that have ambition to go public will likely invest heavily in marketing. They will also invest in distribution.

The publicly traded firms have all made meaningful investments in building dedicated distribution efforts focused on the wealth channel. With individual investors set to play a leading role in the growth of private markets, firms must invest in their distribution teams to capture this growing AUM opportunity.

A recent Bain & Company report illustrates just how important the wealth channel could be to AUM growth in alternatives. Bain projects a 12% CAGR within the retail channel as a percentage of global alternative assets under management, with 22% of the estimated $60T of global alternative asset AUM coming from the wealth channel in 2032. This would result in an increase from ~$4T of retail AUM in alternatives in 2022 to $13.2T of retail AUM in alternatives by 2032.

The next wave of firms, such as General Atlantic, with their hire of Goldman Sachs Partner Chris Kojima, are primed to grow their market share in the wealth channel — if they invest into the resources, people, education, and marketing efforts that it takes to successfully work with wealth.

Who will be the next firms to go public? Perhaps the answer lies in the strategic actions that these firms take to build their businesses.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 GP deals soar with efforts to diversify | Janelle Bradley, PitchBook

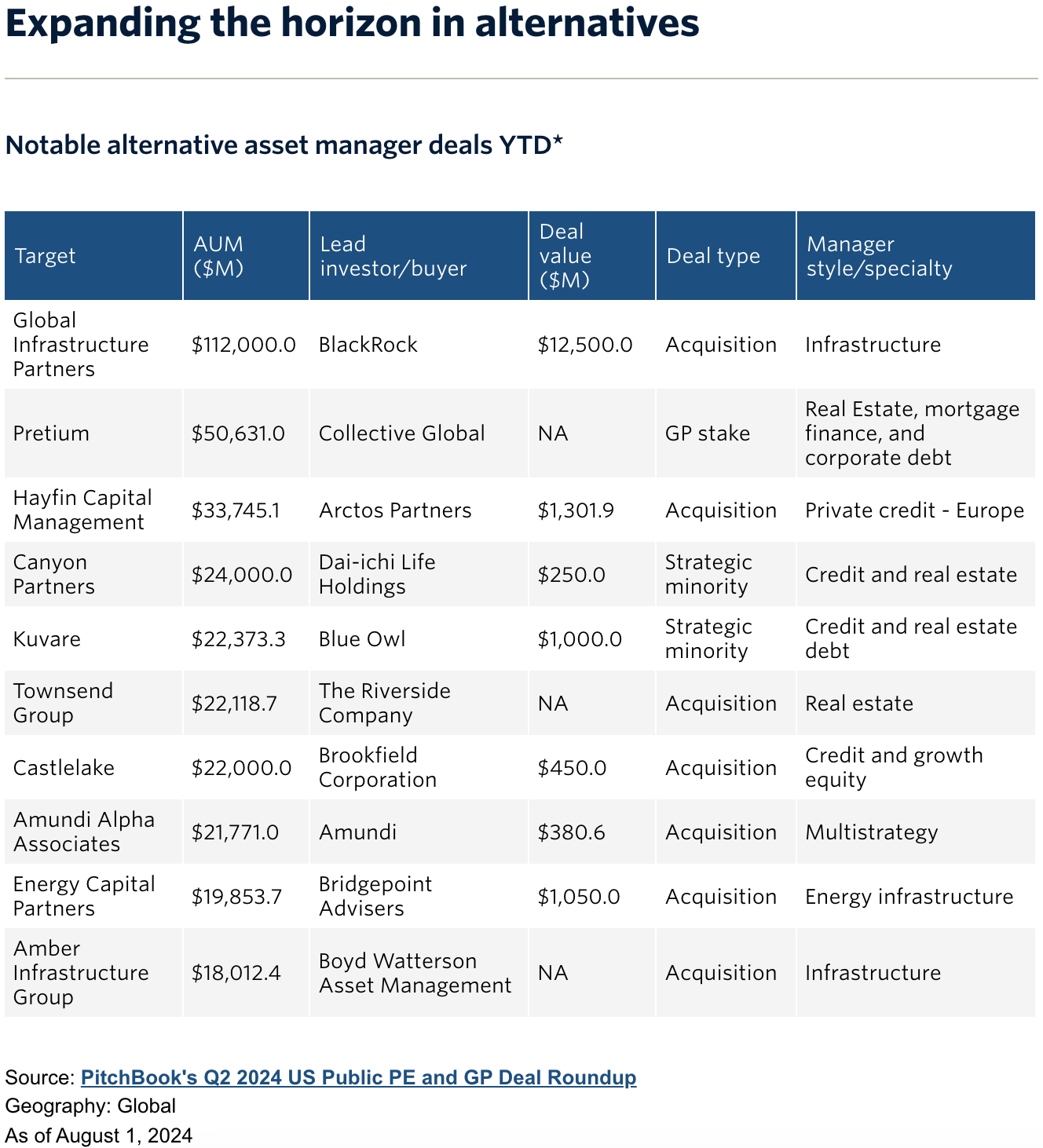

💡PitchBook’s Janelle Bradley dives into PitchBook data on GP acquisitions and stakes and finds that GP deal count is up 84% YTD. This figure is on track to surpass the record of 114 deals completed in 2021. This trend is influenced by alternative asset managers looking to transform into one-stop shops to make it easier to sell new LPs and deepen existing LP relationships, as I wrote about in the 3.10.24 AGM Alts Weekly.

PitchBook’s report finds that deal value is expected to reach $28B this year, almost doubling last year’s total of $15B. Deal run rate is expected to reach 150 deals for the year. “It’s a trend we noticed was increasing in recent quarters as GPs look to expand their operations into new asset classes to help their firm continue to grow its AUM and be more of a ‘one-stop-shop’ for LPs,” said Kyle Walters, a PitchBook Private Equity Analyst.

It’s worth noting that BlackRock’s $12.5B purchase of Global Infrastructure Partners has accounted for the lion’s share of aggregate deal value thus far in 2024. The landmark transaction hammers home the theme that larger platforms are looking to add specialist capabilities to grow their multi-strategy platforms.

💸 AGM’s 2/20: It’s no surprise that manager consolidation is a major trend that’s propelling private markets forward. Multi-strategy platforms are looking for ways to expand their businesses and deepen relationships with LPs. Acquiring specialist managers is a very effective way to do so, provided that there’s a strong culture fit. It’s notable, but not surprising that many of the acquisitions this year have been focused on infrastructure or credit. Both strategies are large and growing (I wrote about the opportunity in infrastructure investing in the 6.23.24 AGM Alts Weekly) — and often benefit from scale. The larger firms in credit and infrastructure are more likely to be the firms that will win deals and put capital to work in high-quality investment opportunities, so capital should agglomerate to these managers. Thus, it’s no surprise that larger alternative asset management platforms are looking to acquire managers in these categories that have the ability to scale and leverage the brand and distribution firepower of the acquiring firm.

This trend should also bode well for the GP stakes industry. Industry consolidation should only continue, in large part due to the reasons mentioned above about the next wave of firms that are looking to go public. So, minority investors in both larger alternative asset managers and specialized middle-market firms should stand to benefit from the trend of continued consolidation.

📝 Secondaries Are Pacing for a Record Year Thanks to These Investors, BlackRock Says | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher reports that secondaries deal volume is on pace for a record year. Thrasher cites BlackRock’s midyear report on secondaries to note that halfway through 2024, there was already $72B in total closed transaction volume. BlackRock projects that figure to top $140B by year-end. The previous record, set in 2021, was $132B. It shouldn’t come as a surprise that secondaries deal volume is on the rise, particularly as the private equity industry grapples with record amounts of dry powder juxtaposed with lower rates of exits and distributions.

Bain & Company’s Private Equity Midyear Report highlights some of these figures to show a sobering reality — one that has created the second-order effects for a blossoming secondaries market.

While exit count is expected to match figures for 2023, exit value might be marginally higher than last year. But 2023 and 2024 exit value figures pale in comparison to 2021 and 2022 exit value figures, giving rise to secondary markets so that investors can achieve liquidity.

Thrasher notes that both GPs and LPs are contributing to the banner year in secondaries. LP-led volume comprised 57% of the total during the first half of 2024, reaching a record $41B of deal volume. This figure represents 64% year-over-year growth. “As many LPs are still experiencing net negative cash flows, there is an increasing appetite to transact on partial commitments or newer vintages to maintain GP relationships and maximize price,” the BlackRock report says. It’s notable that 45% of the LPs that have been sellers of stakes in the first half of 2024 have been first-time secondary sellers.

There are also meaningful demand side pressures that are driving secondary activity. $190B of dry powder, which has been supported by fundraises and the entrance of evergreen / 40 Act vehicles, have had an impact on volume. “Additionally, the influx of dry powder, supported by fundraises at the large-end of the market, as well as new ’40 Act’ vehicles, has intensified competition for large-scale portfolios and those with favorable characteristics, such as minimal unfunded requirements and potential near-term distributions,” the report says. BlackRock also highlighted the increasing use of continuation vehicles, a tactic many GPs have employed to hold onto their top-performing investments for longer while enabling existing LPs to achieve some level of liquidity.

💸 AGM’s 2/20: Much of the current state of private markets revolves around structural trends and themes. Just as consolidation is a structural trend that’s due to the evolution of alternative asset managers as businesses, so too is the continued growth of secondaries. There are structural reasons why secondaries are growing — and likely will continue to grow. With LPs waiting for distributions, secondaries can be a way for both GPs and LPs to benefit from the continued advances in this market. Generating liquidity can allow GPs to provide distributions back to LPs so that they can re-up in future funds. It can serve as a way to help their fundraising efforts. It also allows LPs to think about redeploying some of the capital they are returned into opportunities they think make sense in the current environment. The other aspect of secondaries that make it an attractive area of private markets is that it can provide newer entrants to private markets, particularly the wealth channel, with exposure to private markets across vintage years, strategies / sectors, and geographies in a way that reduces the J-curve. I’d anticipate that secondaries continue to be a popular strategy for much of the wealth channel, either via closed-end secondaries funds or evergreen structures, which will enable them to gain access to private markets in a relatively turnkey fashion.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director — Marketing & Communications, Private Wealth. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Vice President Corporate Finance. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.

As every Sunday, the best round up and analysis of global alternative news. Keep it up Michael