Welcome back to Going Public with Evercore’s Glenn Schorr.

On the latest episode of Going Public, we drop the beat on F.R.E.A.M.

Paying homage to Wu-Tang Clan’s song “C.R.E.A.M.” (“Cash rules everything around me”), Glenn discusses why “Fees rule everything around me” in asset management.

We cover some of the most pressing topics in alternative asset management, including:

How alternative asset managers balance fee generation with returns.

Does major growth still lie ahead for alternative asset managers?

Why “fees rule everything around me,” but so does alpha generation.

Why does distribution (almost always) win in asset management?

What’s the most valuable aspect of a publicly traded alts manager having a public currency?

What is Glenn keeping his eye on for next quarter?

Making private markets more public — with expert analysis

Alt Goes Mainstream has partnered with an expert who has seen the evolution of alternative asset managers from their early days.

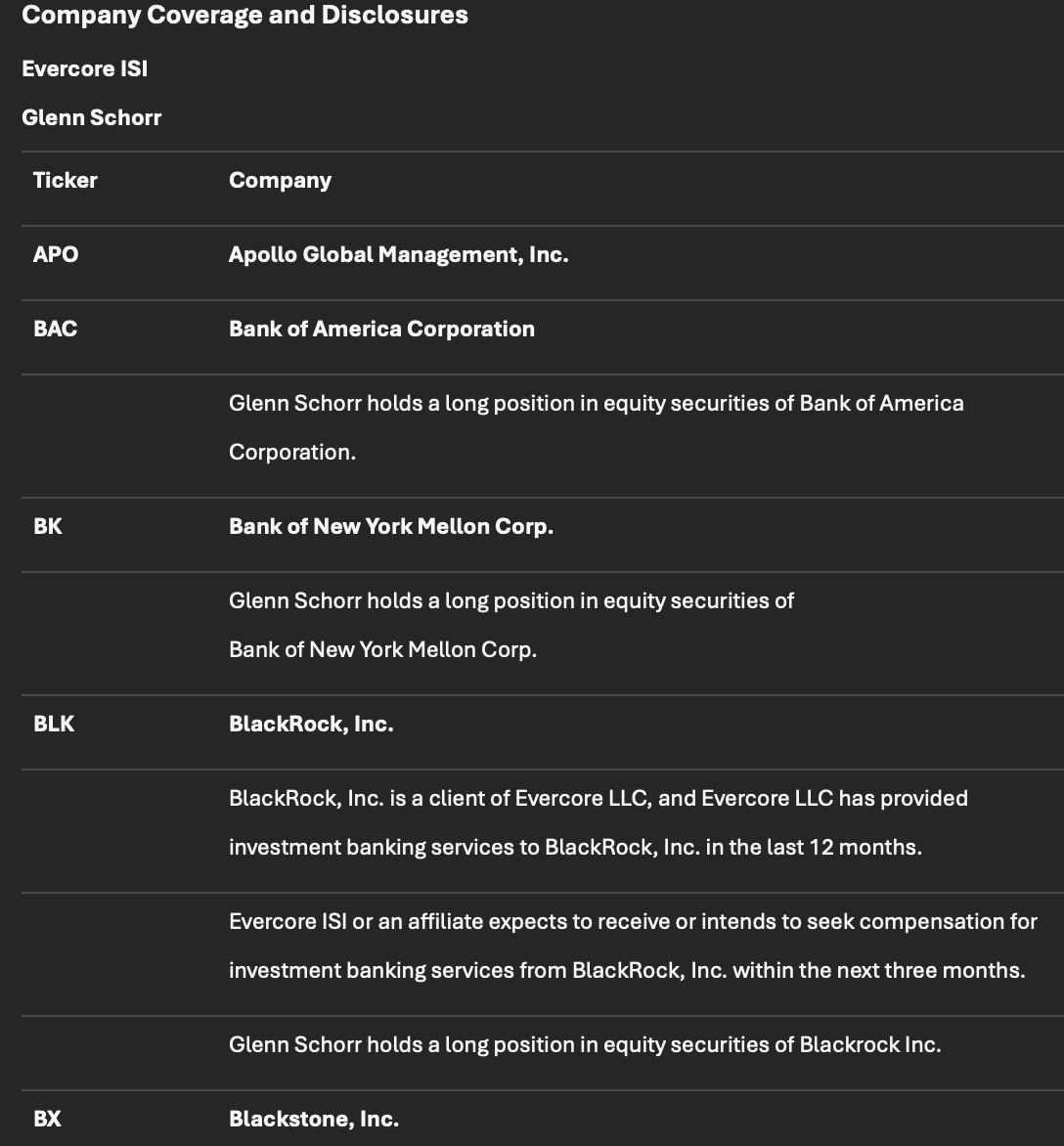

Glenn Schorr is a Senior MD and Senior Research Analyst at Evercore ISI, where he covers brokers, banks, asset managers, and trust banks as an analyst.

He has covered financials since 2000 and started coverage of alternative asset managers when the first firms went public.

He’s consistently come up as one of the most thoughtful and well-respected analysts in the space. He balances deep research with a creative flair (just read one of the titles of his research reports and you can see his love of the game). He’s been named to Institutional Investor’s All-America Research Team for his coverage, most recently ranking #2 and runner up in 2023, #1 and #2 in 2022. Prior to Evercore, Glenn was a Senior MD at Nomura, serving as the lead financials analyst.

Listen in as Glenn shares market stories, the evolution of alternative asset managers as businesses, the biggest and most exciting trends in private markets based on what the industry’s largest players are doing, and we go “around the horn” for his analysis on the publicly traded firms.

Clip #1: F.R.E.A.M. (Fees rule everything around me).

Clip #2: Don’t mistake cyclicality for the structural growth ahead in private markets.

Clip #3: Distribution rules the world … and Sheryl does too.

Clip #4: What are you looking for next quarter?

Show Notes

00:00 Introduction

00:38 Meet Glenn Schorr

01:52 Wu-Tang Clan and Asset Management

02:40 F.R.E.A.M.: Fees Rule Everything Around Me

02:49 Public Investors and Revenue Streams

03:47 Balancing Fee Growth and Investment Returns

05:50 Talent Migration and Fee Justification

06:38 Migration to Private Markets

07:07 Deregulation and Its Impact

09:31 Structural Challenges for Banks

09:58 Growth in Alternative Asset Management

12:19 Wealth Channel and Private Markets

13:13 Private Equity Performance

15:37 Education Process for Investors

16:27 Perpetual Private Equity Products

17:35 Model Portfolios: The Next Frontier

21:00 Distribution and Asset Management

24:24 Corporate Strategy and Partnerships in Asset Management

27:10 Public vs. Private Firms

29:56 Acquisitions and Growth Strategies

31:09 Specialty Managers and Market Trends

33:12 Big TAMs and Investment Opportunities

36:15 Consolidation in the Industry

38:16 Surprises and Trends in the Quarter

39:44 Deployment and Investment Grade Private Credit

40:03 Credit Cycles and Market Concerns

41:15 Data Centers and AI Investments

41:54 Size and Scale in Asset Management

45:19 Bank and Asset Manager Partnerships

46:15 Looking Ahead: Thoughts on the Next Quarter

47:10 Conclusion and Final Thoughts