Welcome back to Going Public with Evercore’s Glenn Schorr.

On the latest episode of Going Public, we dive for the loose balls in private markets’ March Madness as Glenn shares his thoughts on why it’s important to separate the forest from the trees when it comes to why certain firms make his “Final Four.”

We cover some of the most pressing topics in alternative asset management, including:

Separating the forest from the trees — dissecting alternative asset manager stock performance versus long-term business performance.

Views on the exit environment and what it means for alternative asset manager stock performance.

Where and why does scale matter?

Are banks and alternative asset managers enemies, frenemies, or collaborators, particularly in areas like private credit?

Why does Glenn believe the secular growth trends of private markets and how that impacts alts managers is a fat pitch?

In the spirit of March Madness, Glenn shares his bracketology on which firms make his “Final Four.”

Making private markets more public — with expert analysis

Alt Goes Mainstream has partnered with an expert who has seen the evolution of alternative asset managers from their early days.

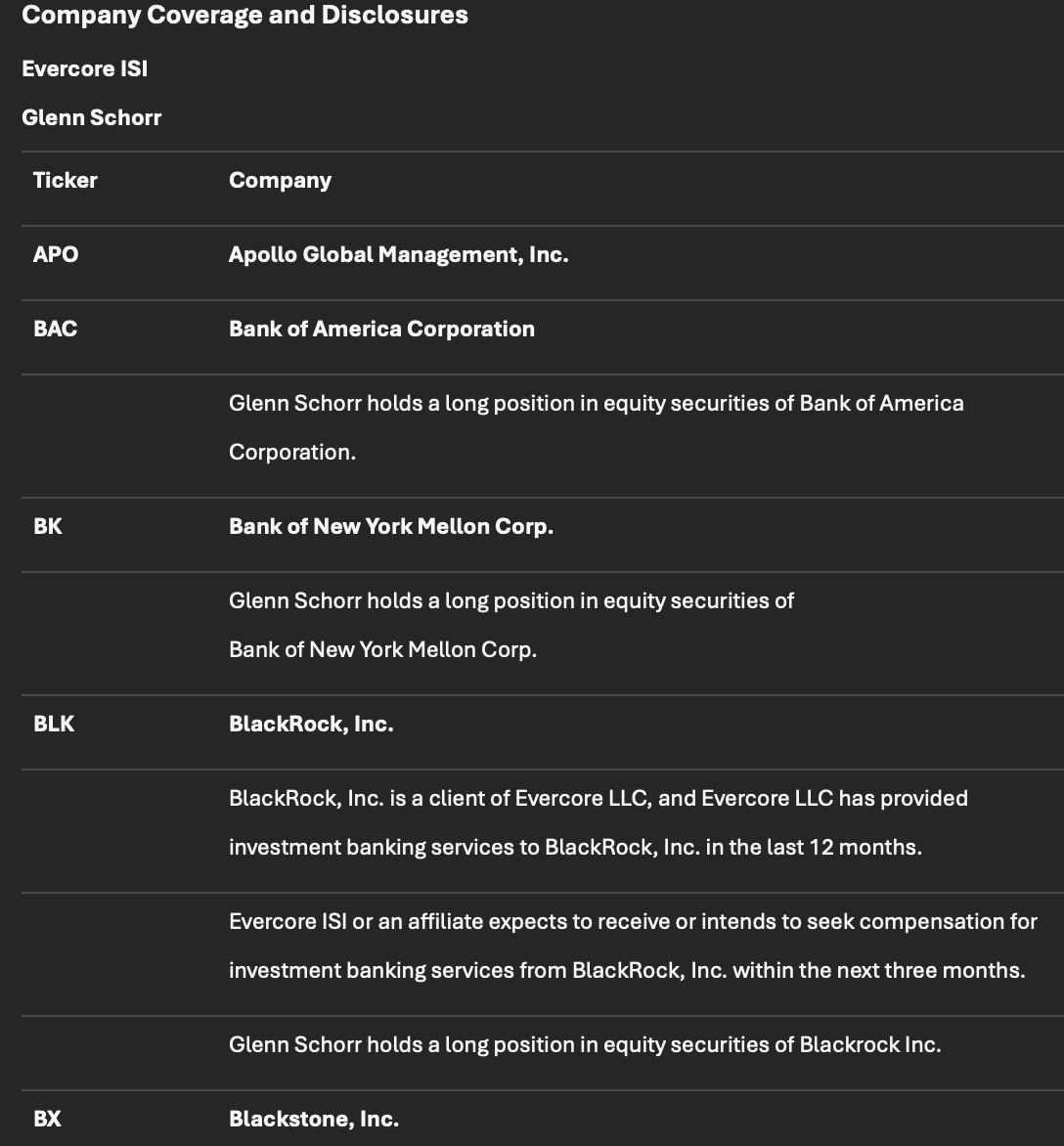

Glenn Schorr is a Senior MD and Senior Research Analyst at Evercore ISI, where he covers brokers, banks, asset managers, and trust banks as an analyst.

He has covered financials since 2000 and started coverage of alternative asset managers when the first firms went public.

He’s consistently come up as one of the most thoughtful and well-respected analysts in the space. He balances deep research with a creative flair (just read one of the titles of his research reports and you can see his love of the game). He’s been named to Institutional Investor’s All-America Research Team for his coverage, most recently ranking #2 and runner up in 2023, #1 and #2 in 2022. Prior to Evercore, Glenn was a Senior MD at Nomura, serving as the lead financials analyst.

Listen in as Glenn shares market stories, the evolution of alternative asset managers as businesses, the biggest and most exciting trends in private markets based on what the industry’s largest players are doing, and we go “around the horn” for his analysis on the publicly traded firms.

Clip #1: Just because the stock price went down 25%, is the company truly worth 25% less than what it was last week.

Clip #2: Glenn’s bracketology: his “Final Four.”

Clip #3: Are private markets “a fat pitch?”

Show Notes

00:00 Introduction and Opening Remarks

00:47 Welcome to the Alt Goes Mainstream Going Public Series

01:00 Meet Glenn Schorr: Your Guide

01:34 Market Stories and Trends

01:59 Live from Evercore: Earnings Discussion

02:10 Market Volatility and Earnings Impact

03:47 Alternative Managers and Market Trends

04:47 The Importance of Infrastructure and Private Credit

06:07 Valuation Challenges and Market Corrections

07:27 Investment Opportunities in Market Downturns

08:17 Fundraising and Capital Raising Challenges

09:56 Super Alts Firms: Multi-Strategy Platforms

12:48 The Role of Brand in Asset Management

13:57 Acquisitions and Market Positioning

16:14 Banks vs. Alternative Managers in Private Credit

17:34 The Evolution of Direct Lending

19:54 Banks' Strategic Moves in Private Credit

20:51 JP Morgan's Private Credit Expansion

23:00 Banks Acquiring Private Credit Firms

24:49 Partnerships and Strategic Alliances

25:28 Unique Situations in Finance

25:45 Public vs. Private Market Financing

26:01 Moving and Storage Business Analogy

26:11 Duration and Loan Management

26:38 Regulatory Arbitrage in Banking

27:10 Flexibility in Private Markets

27:40 Impact of Stock Prices on Acquisitions

28:12 Stock Deals and Currency Differences

29:35 Accretive Acquisitions and Growth

32:20 Scale Benefits in Private Markets

32:24 Wealth Channel Penetration

33:13 Large Transactions and Scale

34:33 Investor Perception of Scale

36:13 Challenges in Understanding Alternative Managers

38:34 Long-Term Trends in Private Markets

39:56 Risks in Private Markets

40:54 Transparency and Regulation

41:57 Private Markets vs. Public Markets

45:43 Geopolitical and Economic Risks

47:39 Final Thoughts and March Madness Final Four Picks

Editing and post-production work for this episode was provided by The Podcast Consultant.

Share this post