The biggest story in crypto that everyone missed

One of the biggest untapped opportunities in crypto: the wealth management community

NFTs are very much the topic of conversation in cryptoland. And rightfully so. NFT sales hit record-breaking numbers in August with over $3B in volume.

NFTs are a major proofpoint that the consumerization of crypto is well underway. When a company in the NFT space, Sorare, raises the largest Series B ($680M) in European history, it’s a development that can’t be ignored. It’s certainly a necessary development for the crypto space to onramp consumers in order to go mainstream.

While today’s news about China’s evolving position on crypto has everyone’s attention, one of the most potentially impactful developments in the crypto space flew almost completely under the radar: alternatives platform iCapital Network partnering with Grayscale Investments to allow the nearly 7,000 advisors on iCapital to access Grayscale’s crypto investment products.

This iCapital-Grayscale distribution partnership itself won’t completely change the trajectory of crypto markets, but the idea of what the partnership represents —increased interest from the wealth management community allocating assets to crypto — certainly could have a long-lasting impact on crypto market capitalization and prices.

Why is this such a big deal?

Imagine if 2% of $10T rolled into crypto.

$200 billion of asset flows into crypto? That would be over 10% of the current overall crypto market cap of roughly $1.9T.

There is roughly $10T+ of assets held at wealth managers (both banks and independent RIAs), yet wealth managers are woefully underallocated to alternative assets, as discussed here and here numerous times on Alt Goes Mainstream.

While the average institutional investor (think endowment or pension) has a 30%+ allocation to alts, the average RIA might be closer to 1-5%.

So is it significant that investment platforms like iCapital and Grayscale are partnering to unlock access to cryptoassets for the HNW community? You bet it is. And we’ll likely see more partnerships to come.

If we examine the data, it’s not at all surprising to see institutional investor interest in cryptoassets. In fact, it makes me very bullish on the future of crypto investment platforms that serve the institutional investor as they should be well-placed to gather assets and build a differentiated brand.

A recent Fidelity survey (2021 Institutional Investor Digital Assets Study, September 2021) of 1,100 family offices and wealth managers globally found that 70% of all investors had a neutral to positive perception of digital assets. And 9 of 10 investors surveyed found digital assets appealing.

Do digital assets have a place in investors’ portfolios? 80% of respondents believe they do and 84% of US and European investors said they would be interested in institutional investment products that hold digital assets.

So, why should investment advisors care about allocating to crypto?

(1) Benefits to a diversified portfolio — and upside

I’ve talked in the past about the 60/40 portfolio no longer. Investors are building a 21st Century portfolio very differently from how their parents and grandparents did.

A number of guests on the Alt Goes Mainstream podcast have called the traditional 60/40 portfolio (60% equities / 40% fixed income) dead.

Armed with performance data on the impacts of crypto exposure to a 60/40 portfolio, one could argue that adding crypto to an investor’s portfolio could actually enhance returns.

A recent paper from Bitwise, a leading crypto investment manager, shows that crypto would have contributed positively to a diversified portfolio’s cumulative and risk adjusted returns in 100% of three-year investment periods, 97% of two-year investment periods, and 77% of one year investment periods since 2014 (assuming quarterly rebalancing). A 2.5% allocation to crypto would have increased median three-year cumulative return to a traditional 60% equity / 40% bond portfolio by 13.30%.

(2) Searching for yield (and client engagement)

Advisors have three main goals — protect and grow wealth, attract and retain clients, and be fiduciaries, which means searching for and identifying the best risk-adjusted investment opportunities for their clients.

From my experience at iCapital, we saw that a critical component for advisors to differentiate their offerings from competitors in order to attract and retain clients was access to high-quality alternative investment products and innovative technology solutions that provided a better user experience for clients.

If an advisor’s job is to find the best returns for their investors, ignoring crypto comes at their own peril.

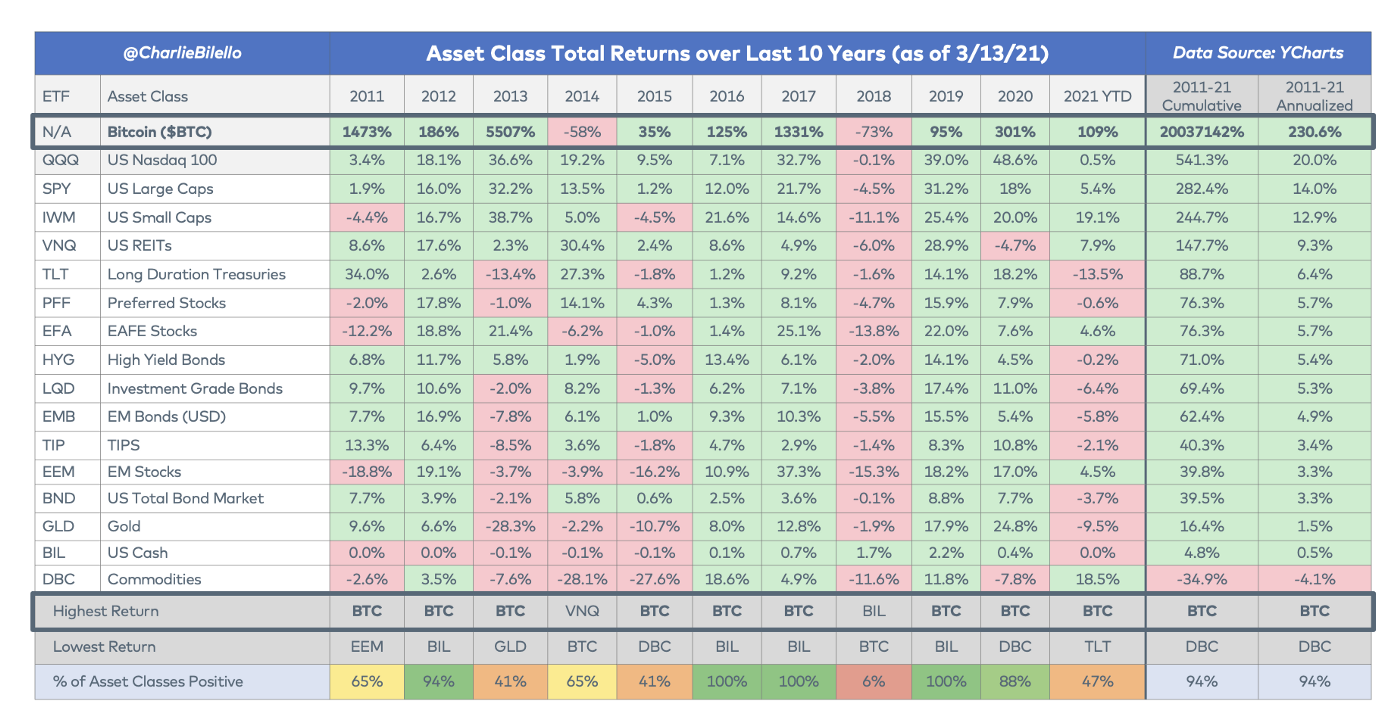

Over its brief 13-year lifespan, crypto has proven to be the single best performing asset over that period. As David Pakman, a Venrock partner who just left to join CoinFund, a top crypto VC fund, said in a recent blog post, “if you are a professional investor tasked with finding the best returns in the market and you ignored crypto over the past decade, you missed the best asset class returns in eight of the last ten years and cumulatively overall. In fact, Bitcoin’s 200% CAGR is unmatched in all of financial history. Not even Tesla (63.8%) nor Amazon (33.5%) come anywhere close in 10-year CAGR.”

Identifying high-performing investments goes hand in hand with attracting and retaining the client. Younger clients in particular have very different views as to what assets they want exposure. So to attract and retain the next gen client, advisors would do well to meet their clients where they are and work to understand and allocate to crypto on behalf of their clients in an intelligent, thoughtful, and educated way.

(3) Exposure to crypto means exposure to the next wave of the internet

We are less than 30 years into the development of the commercial internet. The first two waves of the internet built some incredibly important infrastructure (Microsoft, AOL, UUNet, Netscape) and consumer companies (Apple, Amazon, Google, Twitter, Netflix, and too many others to name) that have created meaningful value for the world and investors alike.

If one had invested in Apple, Amazon, or Google in the 1990s, they would have benefitted from a significant increase in those respective companies’ market capitalizations.

Crypto is the next wave. And we are still so early, as Alexis Ohanian recently said on a Community x Capital podcast, “Late, but long-term early.”

FAANG stocks combined market value alone represents over $7 trillion. Total crypto market value? $1.89T (CoinMarketCap).

Imagine what that number will look like as protocols continue to improve, crypto continues to commercialize, and more institutional capital flows into crypto.

(4) The institutions are marching in

When institutional investors begin to turn their attention to an asset class, investors take notice.

The crypto space has witnessed a number of big recent developments with institutional investors launching products or funds.

Galaxy and Invesco, one of the biggest operators of exchange-traded funds in the US, just yesterday announced their intent to build a suite of crypto ETFs.

Rick Rieder, the Chief Investment Officer of Global Fixed Income at BlackRock, the asset management giant, recently said that crypto has real upside potential and the firm already has some exposure to crypto.

And the smart money is piling in too. Point72, Steve Cohen’s hedge fund and investment firm, has made a number of crypto investments.

Just this week, Goldman Sachs, Liberty Mutual, and Coinbase all invested into One River Digital Asset Management, a cryptocurrency investment manager incubated by one of the top hedge fund managers in history, Alan Howard of Brevan Howard.

Accessing crypto investment products

So, how can investors access institutional crypto investment products?

There are a number of institutional quality investment products available to advisors and the HNW community that vary across fund type, risk, liquidity, and return profile.

Grayscale: Family of investment trusts for accredited investors that has amassed over $44B in AUM after being incubated by early crypto investor and holding company Digital Currency Group.

Pantera: One of the earliest fund investors into crypto that has a Bitcoin fund, a liquid token fund, and a venture fund with collectively over $1B in AUM.

Bitwise: Crypto index funds (including a recently launched ETF - BITQ) that comprises of $1.5B in total AUM.

21Shares: World’s largest issuer of exchange-traded products with over $2B in AUM.

CoinList: Market leader in new token issuance to enable accredited investors to access promising new projects, like Solana or Filecoin, before they are listed on an exchange like Coinbase.

Galaxy Fund Management: Diversified fund management platform that includes both index funds and fund of funds for accredited investors.

Fidelity / Wise Origin Bitcoin Trust: Bitcoin Index fund for accredited investors launched by one of the world’s largest asset managers, Fidelity, that has amassed over $100M in AUM in a year since inception.

CoinShares: Investment management platform with exchange-traded products and index fund products that has over $5B AUM.

One River Asset Management: Fund management platform founded and incubated by top hedge fund manager Alan Howard of Brevan Howard to provide accredited investors with exposure to BTC and ETH.

Crypto VC and Hedge Funds: There are too many to name, but there are a number of high-performing and successful crypto funds, including Paradigm, Polychain, a16z Crypto, Boost VC, Pantera Capital, CoinFund, Multicoin, and others more focusedon assets like NFTs, such as Snowcrash / Sfermion and 6th Man Ventures.

Check back for more in the coming weeks on the institutionalization of crypto and how it’s finding its way into the mainstream investment community.