The Sports Stack

Why investing across the Sport Stack could be the next compelling alternative investment opportunity

Few things in life elicit such emotions as watching your favorite player hit an off-balance three pointer at the buzzer to win the NBA Finals or celebrate your favorite striker scoring the game winning goal in the World Cup to send millions of fans into pandemonium. More often than not, the memory is so intense that it’s etched into our brains and relived countless times over our lives.

Sports betting and fantasy sports have provided people with the opportunity to express their passions and interests in a real-time, engaging way where they can also make money.

We’re now reaching a tipping point in the collision of sports and investing that is a monumental development for the world of alternative investments.

Alts are taking hold, in many respects, because people are now able to invest into their interests and passions.

Different layers of the sports ecosystem are being financialized, which is creating compelling alternative investment opportunities for individual and institutional investors alike.

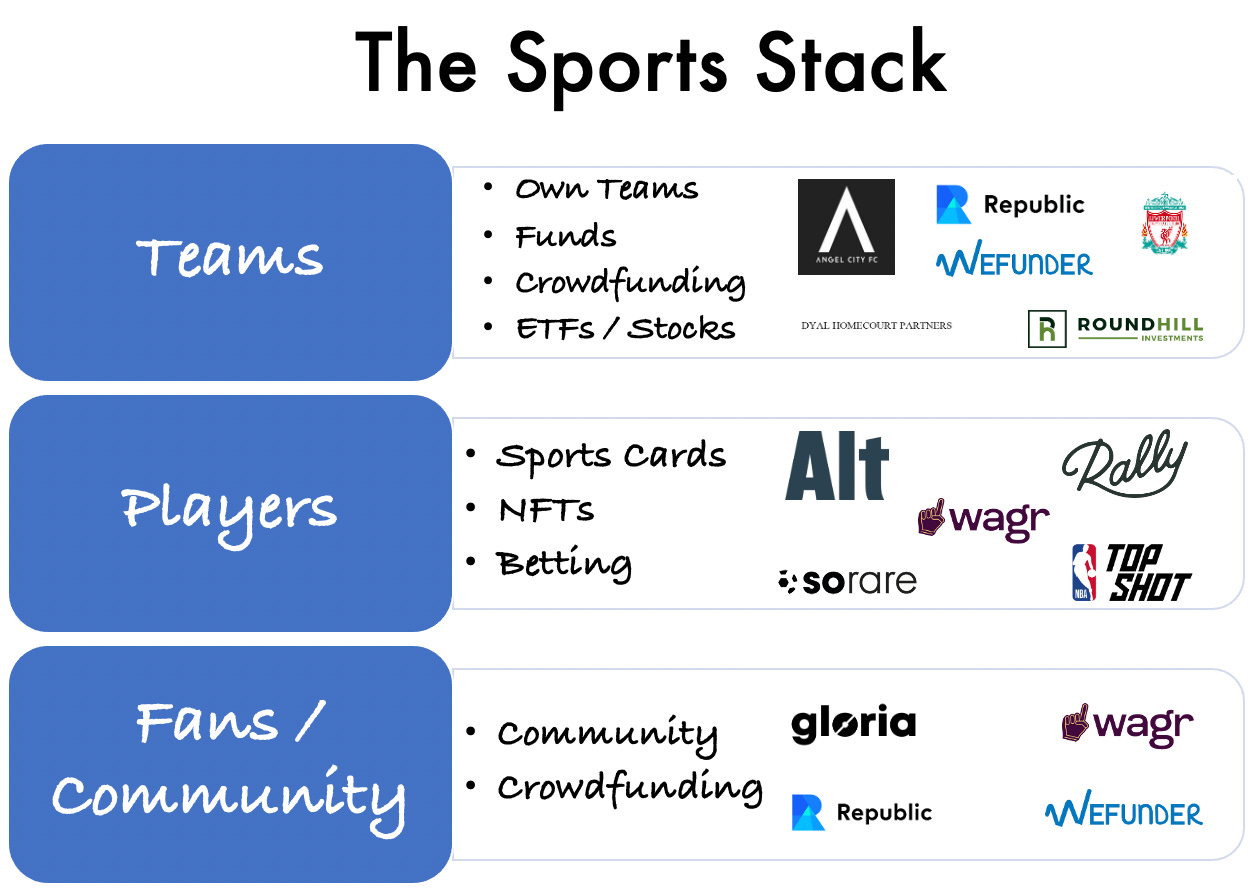

As I’ve attempted to wrap my head around how to think about investing into the world of sports, I’ve tried to develop a framework that breaks down the different layers of what I’ll call the Sports Stack.

Credit should go to Alexis Ohanian of Seven Seven Six, who has been investing across the Sports Stack for some time now and, off the cuff, we came up with the term “Sports Stack” on one of our Community x Capital podcasts, which greatly helped to articulate this framework.

There are opportunities across the entire Sports Stack – everything from investing into teams, players, and fan engagement that are all tied to the intersection of our passion for sports and the ability to generate a possible return on investment.

Having skin in the game is a very powerful thing – and leagues and teams would do well to enable both players and fans to have ownership at all layers of the Sports Stack to encourage deeper engagement, which can then be further monetized.

Whether you’re a VC, a wealth manager allocating client assets, a team owner, a player, or a sports fan, there are ways for you to invest across the Sports Stack as we enter the age of monetizing engagement.

What does the Sports Stack look like?

It’s investing into Sports Teams like Liverpool FC (like LeBron James did recently) or Angel City FC for value appreciation of sports team equity as they represent global brands that resonate around the world.

It’s investing into Funds like Dyal HomeCourt Partners that are buying up minority LP interests in NBA teams to provide liquidity to earlier investors and giving their investors access to scarce assets that are effectively multi-billion dollar enterprises.

It’s investing into physical sports cards on Alt or Rally Rd or digital sports cards on Sorare or moments on NBA Top Shot where investors can invest and trade like stocks.

It’s investing into community engagement platforms like Gloria that build community and enable players and teams to monetize engagement akin to other creators.

There are structural reasons as to the “why” sports are being financialized – and why new monetization models will be required for sports leagues, teams, and players and those who invest across the Sports Stack in order to generate return on investment.

There are a few major trends that are impacting monetization models in sports

1/ Decline in ticketing revenue: Ticketing revenue has been in secular decline as we’ve moved from the age of the local fan and into the age of the global fan. With downward pressure on ticketing revenue and the value of in-person attendance at sporting events, leagues and teams now face the challenge of competing for fans’ engagement in the Attention Economy, where social media and instant gratification reign supreme.

But all is not lost for teams and leagues. The transformation in media consumption and democratization of information online through social media platforms as a way to engage fans allows for the opportunity to capture a more global, fluid fanbase. There are also now investable opportunities related to teams, players, and fan engagement.

It just means thinking about monetization in different ways.

2/ Transformation in media consumption: The internet has changed media and consumption of content. Full stop. Like ticketing revenue, linear media is in secular decline as OTT (over the top) media, which bypasses cable, broadcast, and satellite TV, takes hold. Given the increase in online TV, it’s no surprise that we are seeing companies like Amazon look to livestream sporting events to connect directly with their audiences.

3/ Power of influence / social media: Social media has had an undeniable impact on the ability for athletes to connect directly and engage with their fans. Social media platforms like Instagram, Twitter, and others have globalized the game. Fans from around the world can interact with their favorite athletes, get a window into their lives, and buy products they recommend or use.

In some respects, the balance of power has shifted from teams to players. It’s individual players – like LeBron James with his 88.4 million Instagram followers or Alex Morgan with her 9.2 million Instagram followers (more than Microsoft and Amazon combined!) – who have built meaningful reach with fans and can impact their fandom and spending habits. Look no further than Cristiano Ronaldo’s (300 million Instagram followers) recent removal of two Coca-Cola bottles at a Euro 2020 news conference which led to a staggering $4B in market value wiped off of Coca-Cola’s stock price.

We’ve also entered an age where individuals want to own their experiences – and now they can. This applies to both creators (yes, athletes are creators) and fans who want to own things.

4/ Athletes are more than the names on the back of their jerseys (or the front); they are cultural icons: I’ve written about how investors don’t just want to own an asset, they want to be part of a movement.

Kimberley Martin talked about the power of athletes speaking truth to power. 2020 proved that what professional athletes do outside the lines can have as much impact on people as what they do in the game.

From NBA and WNBA stars foregoing their very commercial identity – the names on the back of their jerseys – to instead post social justice messages like “Black Lives Matter,” “Equality,” and “How Many More?” to NFL and NBA players forcing open their stadiums to voters for the 2020 elections, they are using their brands to catalyze their fans to action.

Athletes are cultural icons. People want to follow their lead.

The data is bearing out this way too. Purpose-driven topics that engage the community in something bigger than sports leads to higher engagement rates. Data has shown that when brands across the NBA, WNBA, NWSL, NFL, MLB, NHL post purpose-driven content on social media channels, they have up to 8x higher engagement from fans.

And, interestingly, women’s sports led the way on purpose-driven content in 2020.

5/ Don’t sleep on women’s sports – in large part because of women’s fans

There’s often a truism in the startup world that incumbents can often learn from the new startup entrants if they want to do things better. Well, the same holds true for sports. Incumbent men’s leagues would do well to learn from the relative newcomers on the block, the women’s soccer league – the NWSL – and the women’s basketball league – the WNBA.

Fans of women’s sports have some interesting features that could determine the future of how sports leagues, teams, and players figure out how to monetize engagement.

43% of viewership of the 2019 FIFA Women’s World Cup came from digital channels (think OTT media), whereas only 8.9% of viewership of the 2018 Men’s World Cup came from digital channels. And remember, linear media is in secular decline.

Women’s sports fans are digitally native, savvy, care about purpose-driven topics, and, importantly, control household spending in some respects.

Brands who invest into women’s sports are benefitting from community-based commerce and brand affinity. Furthermore, fans of women’s sports are over 2x more loyal than general sports fans to brands who invest marketing dollars into sports they follow according to data from Zoomph.

Nike, who sponsors the US Women’s National Soccer Team, the NWSL, and the WNBA, saw an 11x year-over-year increase in engagement with Nike’s brand. Similarly, Visa, who become a sponsor of the US Women’s National Soccer Team in 2019, saw a 27x increase in engagement with their brand after the sponsorship.

So, there is reason to believe that investing in women’s sports is one of the most underrated opportunities out there.

How can investors invest into the Sports Stack?

Across the entire Sports Stack – from teams, to players, to fans – there are now opportunities for investors to express their passion and fandom in a way that also could generate financial return.

(1) Invest into sports teams

There are ways for both individual, non-accredited investors and HNW / institutional investors to gain exposure to sports team equity.

Owning a sports team has often been seen as an investment relegated to the domain of billionaires or the very wealthy who are investing for reasons beyond financial return.

Certainly, NBA, NFL, and soccer clubs have become quite valuable enterprises as some brands are valued at billions of dollars. Now, there’s no question that some sports teams have created tremendous personal wealth for the owners and investors – Dallas Cowboys Owner Jerry Jones purchased the Cowboys for $150M in 1989. The Cowboys are now worth $5.7 billion and delivered operating profits of $425M on over $980M of revenues in 2019. But financial return is not necessarily the primary goal for some of these owners who are looking for a trophy asset.

That mindset is changing, particularly in newer leagues like the MLS and NWSL. Joe Mansueto, the owner of the Chicago Fire and founder of Morningstar, purchased the Chicago Fire at a $400M valuation in large part because he views Major League Soccer as a “growth company … [where] you’re not paying for what exists today, but for where the puck is going.”

Mansueto isn’t the only billionaire thinking this way. And for good reason – MLS clubs rose in value by 30% from 2018 to 2019 to an average valuation of $313 million. For some owners, the growth has looked similar to a venture capital investment – Seattle Sounders owner, Adrian Hanauer, paid $30M to buy into the league a little over a decade ago and in 2019, the value of the Sounders was $405M, generating a 13.5x return.

So perhaps it’s no surprise that venture capitalists are looking at sports teams as more than just sports teams – they are viewing them as brand properties. In a world where Red Bull, which produces no assets of their own, generated $7.42 billion in revenue in 2020, maybe it’s not such a stretch to see sports teams as incredibly powerful brands that engage their community to create customer loyalty in ways that few others can.

Seven Seven Six’s Alexis Ohanian compares investing into a pro sports team much like a VC would look at investing into an Esports franchise – in his words, they are “consumer brands that build their community around the individual talents and celebrity of their athletes.” This is in large part why he invested into Los Angeles’ new women’s football club, Angel City FC, who is building a global sports and lifestyle brand that all sports fans can identify with for the values that they have and what they mean to their community.

And given the global reach and influence that many women’s soccer players have through social media and with their work product on the pitch, it will not be at all surprising to see the NWSL create multi-billion dollar women’s soccer franchises that are seen as global brands in the future.

So how can people invest into sports teams?

Invest into a team: For now, this may be the domain of the ultrawealthy and VC fund investors who are able to buy majority or large minority stakes in teams and help to operate them as they would with any other company they are involved with. The fact that a VC fund led Angel City FC’s investment round represents a landmark moment for the world of sports and the world of VC – these trophy assets are no longer just trophy assets. They are scarce assets (like rare sports cards, Bitcoin, art, and collectibles where there are only a finite number of circulating assets) with meaningful brand value that have the potential to grow to a multi-billion dollar enterprise value.

Invest into a fund that invests into teams: That funds like Dyal HomeCourt Partners, Arctos Sports Partners, and Galatioto Sports Partners are being formed to invest into sports teams proves the point sports teams are investable assets. As we’ve seen with the evolution of the private company stock market, once companies like Carta and Forge were created to enable secondary trading of private company stock, the market became more liquid and more investors began to participate. I would anticipate that we will see a similar trend happen with sports teams, first with institutional investors like Dyal, Arctos, Galatioto and other funds and then with teams involving their community of fans with …

Invest into teams via crowdfunding platforms that enables fractionalized ownership for fans: As we’ve seen with the evolution of other private markets – retail brokerage with Robinhood and Public, private company stock with Carta and Forge, collectibles with fractional platforms like Rally, Otis, and Collectable – fractionalized ownership unlocks access to broader communities of fans. This can be an incredibly powerful way for teams to connect with their community – and turn their community into owners. We’ve seen this trend emerge in crowdfunding, with investment platforms like Republic and Wefunder providing companies with the opportunity to raise capital from their most engaged fans and customers. Republic and Wefunder have already had sports teams raise on their platforms. All four Fan Controlled Football teams raised capital on Republic. Detroit City FC, a NPSL team, raised almost $1.5M from over 2,700 fans on Wefunder. I would expect to see more sports teams leverage crowdfunding platforms to turn fans into owners as crowdfunding platforms can serve as a community engagement tool.

Invest into teams via public market ETFs: The easiest way for any investor to gain exposure to sports teams is via public markets. Sports properties, like Manchester United, New York Knicks and New York Rangers (via MSG Sports Corp.), Juventus FC, and Borussia Dortmund all trade on stock exchanges. Roundhill Investments recently created the first ETF, the MVP ETF, with dedicated exposure to sports teams through a composite set of holdings of publicly traded sports teams.

(2) Invest into players

Social media has unlocked access to players in ways that have elevated players to levels that make them incredibly valuable personal brands. Players are not simply athletes, they are cultural icons. And investing has become culture and culture has become investing.

The individual has been decoupled from the institution. In many respects, players have more reach and influence on fans than teams do.

Crypto has been a part of that movement, helping to usher in the age of decentralization where NFTs have put the power in the hands of creators to connect with and monetize directly from their fans.

The Sports Stack wouldn’t be complete without the financial market structure that’s being created by companies that are enabling fans to invest directly into players.

The market structure for people to invest into players is being built in both the physical and digital worlds.

Companies like Alt and Rally Rd. are enabling fans to invest into their favorite players’ cards or collectibles as they financialize cultural assets.

The market infrastructure for sports is being built before our eyes as fans look to invest into sports cards just as they would invest into stocks.

In traditional financial markets like equities or fixed income, investors know what to pay for an asset because they have market data providers like Bloomberg and S&P to understand the value of an asset based on the prices of prior trades.

Investors also have confidence that trades settle quickly, with trusted counterparties due to technology and a well-developed market infrastructure across the lifecycle of a trade. In recent months, we’ve seen a number of companies emerging to meet the growing demand in the asset class. eBay recently reported they saw a 142% increase in domestic card sales in 2020, which meant 4 million more cards changed hands over the past year. Not to mention that we’ve witnessed more $500,000+ card sales than ever before and a number of cards selling for over $1M.

And there is a case to be made for sports cards to be part of an investors’ portfolio. It’s an uncorrelated asset class that has outperformed equities. PWCC’s 500 Index shows that if you’d invested in trading cards in 2008 instead of the stock market, you’d have a 175% return vs 102% with the S&P 500.

Cards are seeing a renaissance as an investable asset because of the cultural relevance and a low interest rate environment where investors are seeking yield with alternative assets. But whether or not rates stay low, sports cards are investable assets are here to stay.

There are two more nuanced trends that lead us to believe that sports cards as an investable asset are here for the long-term.

1/ The collision of culture and capital is real. Culture has become an asset class. Whether it’s sneakers, collectibles, cards, or NFTs, investors, particularly younger investors, view culture as something they want to invest into. The gamification of investing also cannot be discounted here – younger investors want to be engaged in the game of investing – and what better exemplifies the gamification of investing than the game of sport?

Sports cards – and more broadly, sports betting and fantasy sports – represent the investment version of a sports bet. It combines the best of fantasy sports and sports betting, where people use their knowledge of sports and love of the game or team to make investment decisions.

2/ Fractionalization has unlocked investor access to the asset class. A card that would have been too expensive for many individuals to invest in themselves can now be accessed on a fractional investment platform like Rally Rd, Otis, or Collectable.

Fractional platforms unlock liquidity for premium assets. Much like fractional investing into equities unlocked greater retail participation, fractional platforms will do the same for the card space.

The next evolution in market structure for the sports card space is the creation of the Coinbase equivalent for cards – a platform that serves investors across the lifecycle of a trade, from pre-trade market data to trade execution to post-trade settlement and custody of assets.

Coinbase created the infrastructure – and the on-ramp to the cryptoeconomy for the mainstream investor. There are now platforms like Alt which are doing the same for the sports card asset class.

The other powerful force in investing into players is a result of the rise of NFTs. NFTs have changed the game with respect to player-fan engagement. NFTs are a tool that enables creators to connect with and directly monetize from their fans.

Companies like Sorare and NBA Top Shot have figured out how to combine the best of fantasy sports and investing into a blockchain-based NFT platform that has created massive fan engagement. NBA Top Shot has over 1.2 million users and over 500,000 spending at least $600M on NFT collectibles on their platform.

Innovative sports teams like Angel City FC have also figured out how to leverage the power of NFTs to enable fans to own a piece of the club (or, eventually, players’ sports cards).

Initiatives like what Angel City did with their NFT drop yesterday, enabling fans to own a piece of the club crest, can go a long way to create deeper levels of fan engagement, as well as a tradable market for the club assets that fans own.

So how can people invest into players?

Invest into physical sports cards: People can buy and sell sports cards on exchanges like Alt or buy fractional ownership into grail cards (and collectibles) on fractional investing platforms like Rally Rd, Otis, and Collectable.

Invest into digital sports cards: People can buy and trade digital football (soccer) cards on blockchain-powered NFT platforms like Sorare, which enable users to buy primary issuance digital collectibles of footballers around the world and then construct a fantasy football team where they can trade these players with other platform participants.

Invest into digital moments: People can buy and trade digital moments of NBA players that have varying degrees of value based on their scarcity on blockchain-powered NFT platforms like NBA Top Shot.

Invest into sports betting: People can bet on players and teams real-time with sports betting platforms like DraftKings, Wagr, and others. This is very much a real-time expression of one’s views on teams and players.

(3) Invest into Fans (aka Community)

Community is the tie that binds. Community is the x-factor that can enable teams and players to monetize engagement in ways that haven’t been done before.

Thanks to the creation of investment infrastructure with crowdfunding platforms like Republic, community can now be monetized.

Community can also be monetized by teams and players via verticalized communities that create the connective tissue to bring fans and teams together.

Verticalized communities like Gloria, which is building a global community for football (er, soccer) fans and players serve as an opportunity for creator monetization through player to fan engagement.

One might ask if the TAM (total addressable market) is big enough for a verticalized community to be built around the beautiful game. Is 3.5 billion people big enough? Over half the world is either interested or very interested in the game of football.

Community is a critical feature of the entire sports stack – the difference with passion investing is that it engages the community and stokes the fire of passions that are generally not found in traditional investing.

Teams and players who can figure out how to engage communities of fans will have a hugely powerful unlock – the ability to tap into the fandom of their communities that can lead to greater monetization than other brands not associated with something that people love as much as sports.

Changing the game. What’s next?

Sports is bigger than a game. Sports brings people together. It creates community. It creates memories. It creates impact.

We’re reaching an inflection point in the world of sports and investing where people don’t want to be on the sidelines. They want to be in the game. They want ownership – whether it be owning a team, a player’s card, or an NFT of a club crest.

The time is now for leagues, teams, and players to leverage the technological innovation around them to help build out the Sports Stack so that we can create a new model for fan engagement that benefits all stakeholders – from leagues to teams to players to fans.