AGM Alts Weekly | 10.27.24

AGM Alts Weekly #75: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

In today’s data-intensive, fast-paced financial environment, alternative asset managers face overwhelming data volumes that challenge traditional valuation approaches and seriously hinder accurate, timely reporting to LPs.

73 Strings leverages proprietary AI algorithms to enhance transparency and efficiency by automating data collection, portfolio monitoring, and valuations. Their platform delivers faster, more accurate insights, ensuring data integrity, traceability, and auditability while boosting operational efficiency.

Discover how 73 Strings revolutionizes asset management with advanced technology and AI-driven workflows.

Good morning from Washington, DC. I’m back from a week of meetings in New York with alternative asset managers, private markets companies, and LPs in private markets and the latest recording of the Monthly Alts Pulse with iCapital Chairman and CEO Lawrence Calcano.

As access becomes table stakes in private markets for the wealth channel, customization and differentiation are becoming increasingly important.

Perhaps nothing is more emblematic of this trend than this week’s huge news of Hightower, the $156B wealth management platform, acquiring a majority stake in $1.7T AUA investment consultant and OCIO New England Pension Consultants (NEPC).

This transaction follows another big move earlier, when $85B AUM Cerity Partners acquired $17B OCIO Agility in April.

Why would Hightower make such a bold move?

As the wealth channel becomes an increasingly prominent LP in private markets and the wealth management landscape continues to undergo a period of consolidation by bigger platforms, wealth management firms will need to have both the resources and differentiation to serve clients in private markets.

Scaled wealth platforms want to be able to attract more UHNW clients. To do so, they must have institutional quality diligence, underwriting, and sourcing of private markets investments. Scale and relationships are required to succeed. Hightower’s Head of Alternative Investments Robert Picard has built a tremendous platform and team — and now the firm adds over 360 employees that advise on over $1.7T in assets and 400 clients, including a private wealth division that advises on $20B in assets for 45 clients.

Interestingly, both Hightower’s acquisition of NEPC and Pathstone’s acquisition of $45B AUM Hall Capital Partners bring not only wealth channel clients, but also large sets of institutional LPs as clients.

This merging of wealth and institutional channels might indicate that private markets has reached a new phase.

A convergence of public and private, a convergence of institutional and wealth?

At the Norges Bank Investment Management Investment Conference in May of this year, Apollo CEO Marc Rowan said something that might change how investors think about risk, return, liquidity, and asset allocation.

Perhaps private equity is just “equity that is private,” he said.

So, what is safe and what is risky? I wrote about Marc’s thought-provoking comments in the 5.6.24 AGM Alts Weekly:

“I grew up thinking public is safe, private is risky”

The investing world Marc grew up in is very different from the current investing world he paints for us. With the universe of public companies shrinking, an increasingly concentrated public market for investors, and a secular trend of de-banking, what if public is no longer as safe as it once was? “What if private is both safe and risky and public is both safe and risky,” Marc challenges us to think.

Risk, concentration, correlation, and liquidity take on a different meaning when thinking about the characteristics of today’s markets. Further, why shouldn’t the type of capital that’s required to fund certain markets or projects match the illiquidity profiles that investors have? Marc references energy transition, climate change, and infrastructure as projects and markets that need long-term horizons on capital invested. Why would it make sense for those markets to be funded on a daily liquid basis? The same goes for retirement accounts. If investors are not likely to need liquidity in those investment products until retirement, why wouldn’t it make sense for those investment products to be invested into private markets?

If investors are able to re-architect how they think about investing, perhaps it also reshapes their portfolio construction. While portfolios may still yet to be reoriented, the discussion has moved well beyond the notion of the 60/40 portfolio. I’ve written about how we’ve moved from pieces of the pie to buckets and spectrums.

If Marc is right that investors’ views on daily liquidity is going to change, then there will be a fundamental reshaping of the definitions of investments. It’s not at all far-fetched to think that Marc’s description of private equity as “equity that is private” will come to define how investors characterize certain types of investments.

With changing definitions will come re-architected portfolios; portfolios reshaped on new definitions of alpha and beta, liquidity and illiquidity, risk and return.

The notion of re-architected portfolios can perhaps help to explain why there’s a marriage between wealth management platforms and institutional investment consultants.

In the new world order of investing, portfolios will look different. Product structures will look different — both for individual investors and institutional investors.

Hightower’s Head of Alternative Investments Robert Picard shared a view into the future of private markets for the wealth channel in his predictions for 2024 in AGM’s private markets predictions back in December 2023:

As we approach 2024, two numbers stand out: 5% and 50%. The average billionaire and university endowment have over 50% allocated to private markets, while the average individual investor has only 5% allocated. We anticipate this gap to narrow in 2024 and beyond. This is due to better risk adjusted returns for portfolios with higher allocations to alternative investments.

Robert highlighted the gulf between some institutional allocators’ exposure and many individual investors’ exposure to private markets.

Perhaps an institutional investment consultant is the right cohort to help the wealth channel grow its private markets allocations in a meaningful and appropriate manner.

As wealth management platforms scale their AUM and client base, they begin to look more like institutional allocators to alternative asset managers. Thanks to innovation in investment infrastructure that enables these firms to handle the post-investment operational challenges associated with managing smaller investment amounts and aggregating them into feeders or by streamlining fund closings and investor reporting, wealth platforms can now focus on allocating to funds like an institutional investor.

Which brings me to the next dot to connect: fees.

The downward flight of fees

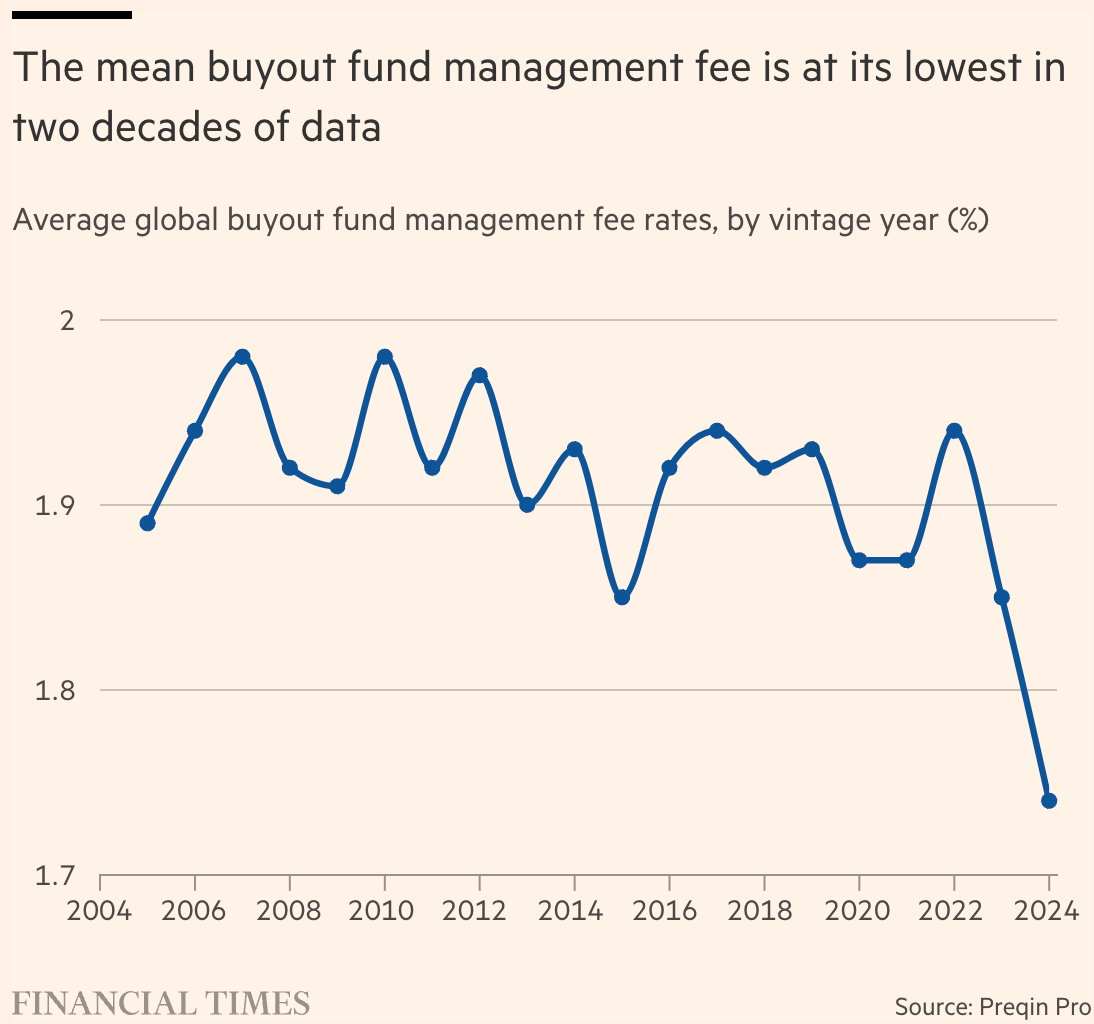

This week, Financial Times’ Alexandra Heal wrote about private equity management fees. Citing Preqin data, Heal noted that the average management fee for buyout funds has fallen to their lowest levels since 2005.

Preqin data found that the average management fee for buyout funds that closed this year or were still raising money in June was 1.74% of investors’ committed capital. That bested a previous low of 1.85% in 2023.

This trend is not a surprise. Funds have encountered a tougher fundraising environment, in part because distributions have dried up. They’ve had to make some concessions on fees. Some funds have grown in size and scale, so perhaps they’ve traded lower fees for a larger fund.

Larger limited partners also likely have the stick to negotiate down fees. Historically, that’s been the place where institutional LPs have exerted leverage on GPs, using large checks to either lower management fees or blend down their total fee load by getting free co-investments or getting both.

Now that the wealth channel is consolidating around large, scaled platforms, will they achieve the same fee compression as their institutional counterparts?

The big getting bigger isn’t just a trend in alternative asset management land. It’s also a trend in wealth management land.

DeVoe & Co. Founder and CEO David DeVoe said as much in a recent Family Wealth Report article by Charles Paikert about Pathstone’s now $100B AUM platform after acquiring $45B AUM Hall Capital Partners.

DeVoe said: “The UHNW space is hot, and we expect it to remain so for the mid-term. Forty percent of the largest firms in the industry are focused on this market. We’re receiving inbound calls from UHNW firms and multi-family offices every few weeks.”

Firms like Cerity and Rockefeller continue to add teams and AUM to their platforms. $24B AUM Lido Advisors, which has a minority stake from Constellation Wealth Capital, just bought $3.4B AUM Wisconsin multi-family office Pegasus Partners.

Wealth management firms of this size and scale have the ability to act like institutional allocators. They can, in aggregate, make meaningful commitments to funds.

Access is now available. These firms can leverage platforms like iCapital or CAIS to invest into private markets funds or Allocate to invest in venture funds. Wealth platforms and private banks have built out teams of diligence professionals at the home office to source, evaluate, and recommend private markets funds.

The question now? Implementation.

From interest to implementation

For the gulf to shrink between the roughly 5% allocation to private markets by the wealth channel and the roughly 50% allocation by some institutional allocators that Hightower’s Robert Picard referenced, advisors will have to move from interest to implementation.

Implementation requires education. Education isn’t just about the what and the how. It’s about the why.

The why of private markets is imperative to growing allocation to alternatives products from the wealth channel.

Yes, there is surely plenty to learn from how institutions have approached investing in private markets. And I’m sure the additions of OCIOs and investment consultants to wealth platforms will benefit the end client. However, first the following questions need to be answered. What is the investor’s goal? Why are they investing in private markets? An individual investor’s goals, may be very different from an institutional investor’s goal.

Once advisors and end clients have determined their why, then they can figure out the what and the how.

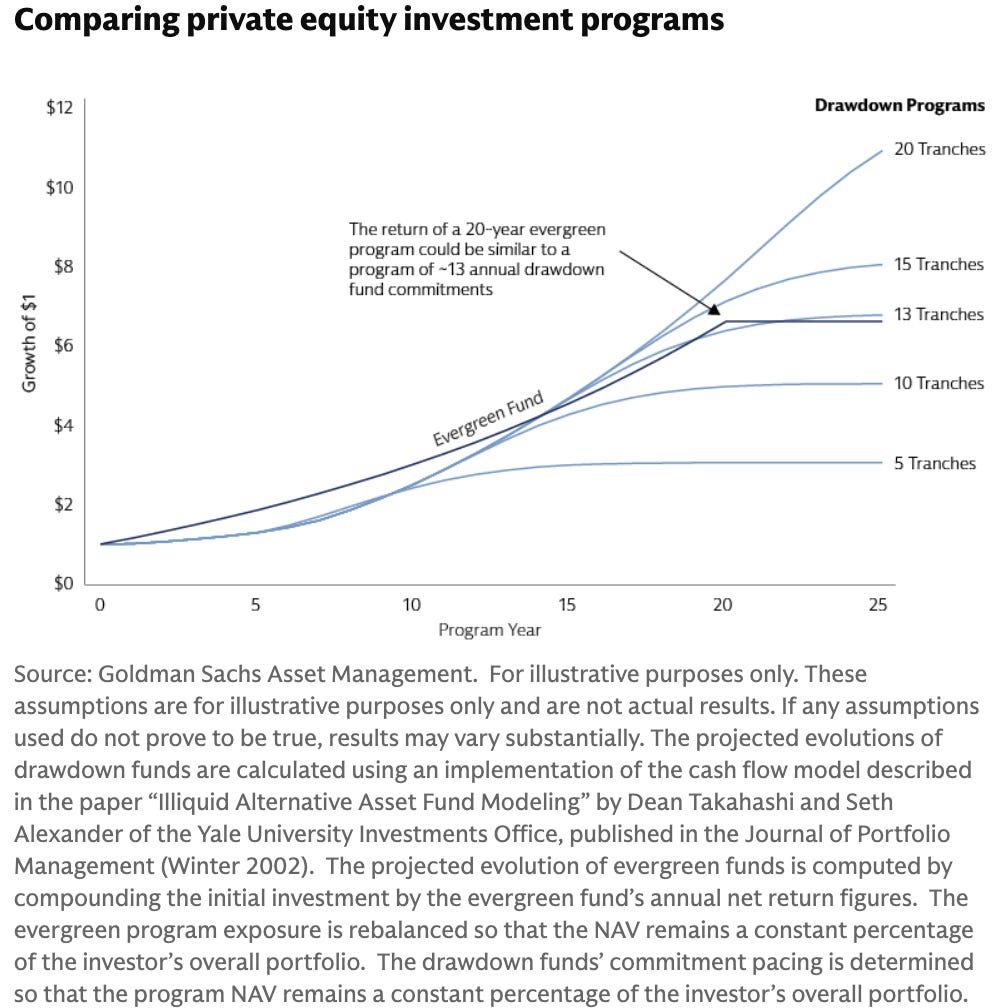

Goldman Sachs Asset Management released a helpful primer in Issue 10 of their “Perspectives” series on the how of private markets this past week. As private markets fund structures go through an innovation cycle to meet the needs of new investors in the space, Goldman posits that “the assessment [of the universal best choice between private markets fund structures] should reflect the outcomes of an investment program, rather than a single fund.”

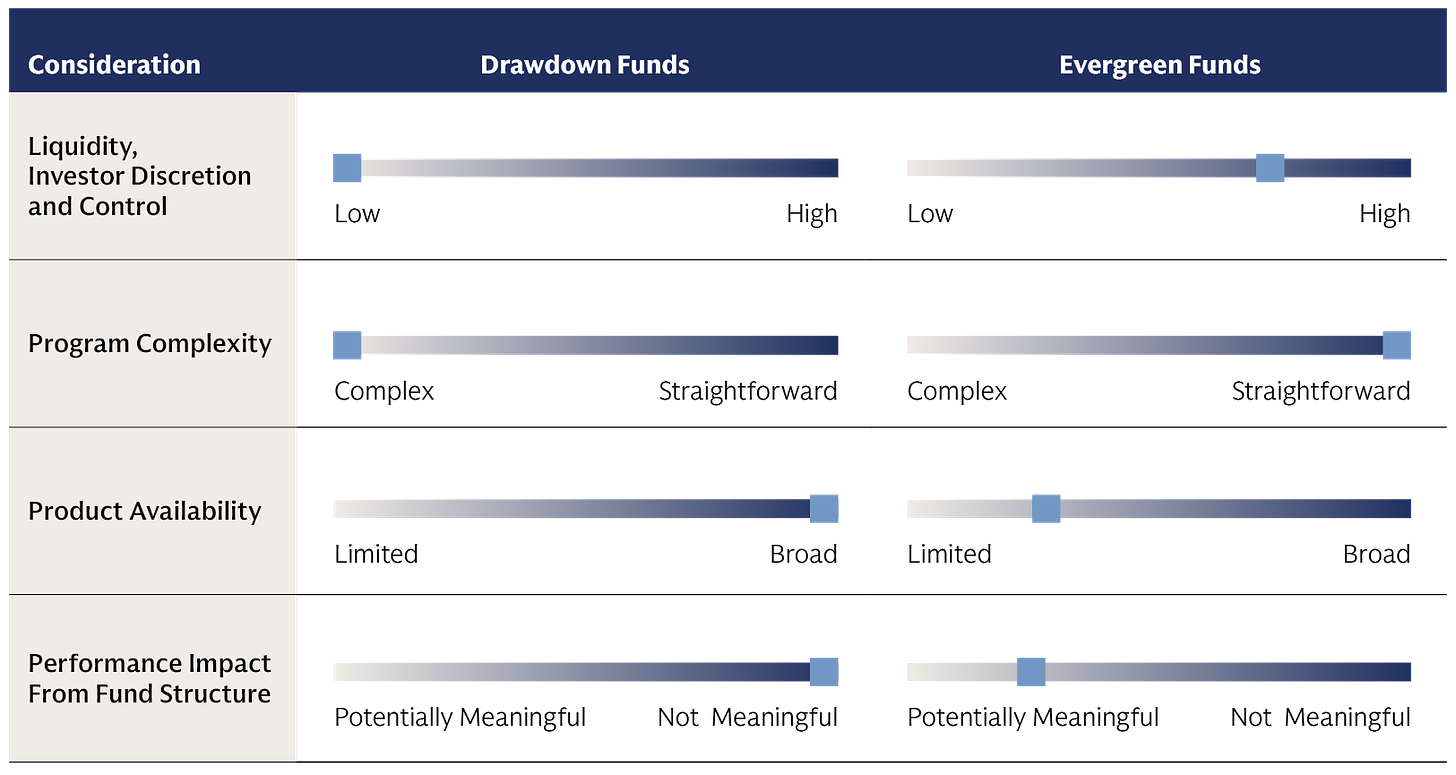

There is no “universal best choice,” says Goldman. Rather, they look at the decision tree based on a set of trade-offs on four key dimensions for investors: liquidity and investor control, program complexity, product availability and access, and performance impact.

Evergreen fund structures, which are quickly becoming a tool of choice for the wealth channel, have advantages with liquidity, investor control, and program complexity. Drawdown fund structures, the traditional tool for investors to access private markets, has advantages with product availability and access and performance impact. Goldman’s chart comparing evergreen and drawdown funds highlights these differences:

An article in the FT this week by Andrew Davis further highlights the fact that trade-offs may be the key question for allocators. Davis dives into Schroders’ new LTAF (Long-Term Asset Fund), the Schroders Capital Semi-Liquid Global Private Equity Fund, a £1.8B Luxembourg-regulated fund that holds stakes in around 280 small and mid-market private companies in Western and Asian markets.

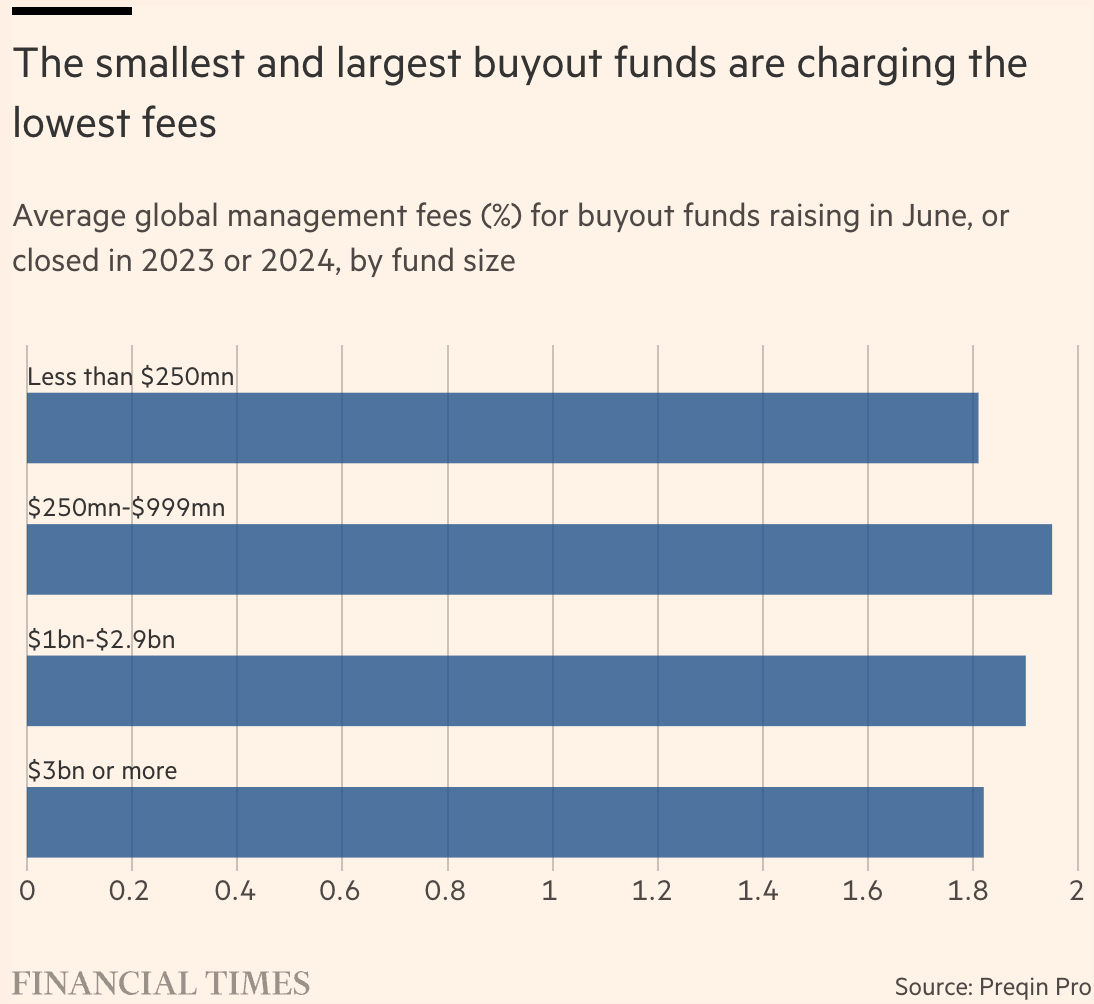

Davis surfaces the question of fees. The Schroders LTAF charges an annual 1.79% management fee, Davis writes. However, once fees charged by third-party managers in the underlying Luxembourg fund are included, the ongoing charge rises to 2.27%. Add in the performance fee and the overall fee load increases to 2.89%.

The question of fees gives rise to a bigger question: net of fees, will investors be better off than investing in the other available product alternatives? Factoring in illiquidity (because semi-liquid funds aren’t really “liquid” products), investors may very well be better off, in certain cases, allocating some exposure to private markets. That, of course, depends on the specific product and investment performance, but it brings us back to the why.

The why, then the what and the how

If the why is to enable investors to gain exposure to private markets because there are a new set of formations and obstacles on the investment field, then allocators need to play the game differently.

Goldman’s paper on private markets fund structures compares private equity investment programs. Evergreen programs and drawdown programs each have their benefits. They each have their drawbacks.

These charts show that there’s no one-size-fits-all solution for investors. It really does come down to the why.

What’s most important? Serving the client. One of the most valuable aspects of the maturation of the wealth channel’s approach to private markets is that the addition of OCIOs and investment consultants means they can serve clients in a way that meets their why. And then they can figure out the what and the how.

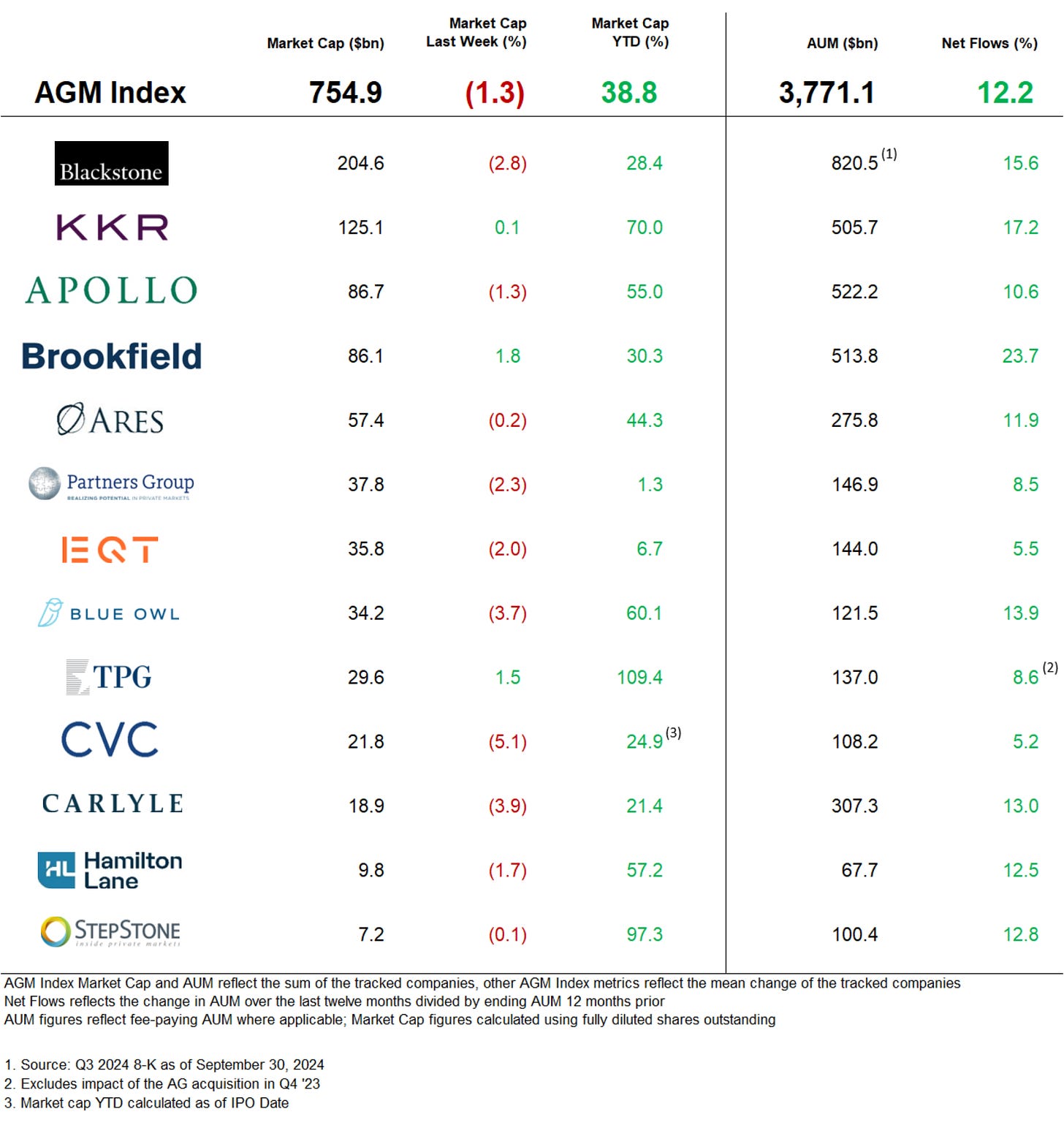

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Post of the week

Pitcairn ($8.1B multi-family office) Managing Director, Alternative Investments Rob Mileff commented on the 10.13.24 AGM Alts Weekly about the various segments of the wealth channel.

Words matter. How we define things matters. Working with the wealth channel isn’t easy. It requires investment in resources and education. It also requires a deep understanding of the client.

AGM News of the Week

Articles we are reading

📝 Silicon Valley’s General Catalyst raises $8B in global push | George Hammond, Financial Times

💡Financial Times’ George Hammond covers the massive fundraising haul by General Catalyst. GC, which exceeded its fundraising target to raise $8B across three funds, raised the largest fund by a venture capital group in over two years. This sum is the largest since Tiger Global closed on a $12.7B vehicle in March 2022, besting large funds raised by Andreessen Horowitz and Thrive Capital, according to PitchBook. General Catalyst, which has been an early investor in the likes of Stripe, Snap, and Mistral, will put the $8B in fresh capital to work across three different strategies: $4.5B of new capital into its core VC funds, $1.5B into creating new companies, and $2B towards deepening its involvement in strategically important businesses. GC’s CEO Hemant Taneja said that the orchestration of their platform is due to a specific view of venture capital: “Behind the moves that we’re making is the fundamental observation that venture capital doesn’t scale. There are the same number of outlier [companies] whether you make funds bigger or make funds smaller.” That’s in part why GC launched a strategy to build companies, particularly in industries that require high levels of capital intensity. Earlier this year, GC announced plans to acquire a hospital system in Ohio. Tenaja’s view? The only way to transform healthcare systems is “go and acquire one and do it the hard way.” GC has also launched a $1B continuation fund to be able to hold on to companies they continue to believe in and roll up other businesses in a sector to achieve scale. Another ingredient of GC’s scale ambitions is its expansion to other regions through acquisition. GC merged with smaller regional firms like La Famiglia in Europe and Venture Highway in India. The FT reports that GC is planning to make its first investment in Saudi Arabia through Venture Highway.

💸 AGM’s 2/20: Blurring of lines appears to be a theme this week. We covered above the blurring of lines between the institutional LP and the wealth channel LP and the blurring of lines between public and private (“I used to think public is safe and private is risky,” as Apollo CEO Marc Rowan said). Venture and private equity appear to be in the midst of a blurring of lines, too. Is GC a venture fund? Perhaps yes, perhaps no. Yes, early-stage venture is one of their investment strategies. But they also have continuation funds, and they are putting billions of capital to work to incubate businesses in hard tech industries, like healthcare, defense, and climate. GC’s recent investment into the $900M Series A of Pacific Fusion is one such example. Sure, GC is taking more risk than a private equity firm would by investing into pre-product or early-stage businesses that are not yet profitable. But at $30B in AUM, does GC look terribly different from its scaled relatives in private equity? As investment strategies, sure. As an alternative asset management firm, not so much. This shouldn’t come as a surprise to those who have been following the evolution of alternative asset management as a business. Goldman’s GP stakes business, Petershill, bought a minority stake in General Catalyst in 2018. GC’s AUM in 2018? $5B in total capital raised. This past week, GC raised $8B alone across multiple funds to bring their AUM to over $30B. Further, the firm has expanded into other ways to generate fees and monetize on its platform and community. They brought over wealth advisors from First Republic Bank in 2023 to launch Catalytic Wealth, a wealth management business that provides those in the GC ecosystem with wealth management solutions. This initiative appears to be not too dissimilar from what Sequoia has done with Sequoia Heritage. The thinking seems to be to become the one-stop shop, allowing the firm to keep assets that would otherwise go to wirehouses or RIAs when there are liquidity events.

Two questions emerge from the evolution of a firm like GC: One, will we see more venture firms go the route of GC and take in capital from GP stakes firms in an effort to scale into a platform that might bleed into private equity and even possibly wealth management? Two, will venture and private equity become more blurred — and will returns in venture come down in certain areas of the market where more capital is required up front to invest? Or are the opportunities so great, like in AI, decarbonization, healthcare, and defense, that the outcomes will be even bigger, justifying the larger fund sizes and capital raises?

📝 Millennium considers launching first new fund in more than three decades | Harriet Agnew and Costas Mourselas, Financial Times

💡Financial Times’ Harriet Agnew and Costas Mourselas report that one of the industry’s largest hedge funds, Millennium Management, is considering launching its first new fund in over three decades. The reason? Target less liquid assets, including private credit, according to people familiar with the matter. A final decision on whether to establish a new fund has not yet been taken, but this news underscores just how much private credit is weighing on investors’ minds. This potential move also indicates that Millennium is looking to sustain the growth that helped the firm grow into a $69.5B AUM business since it was founded by Izzy Englander 35 years ago. Millennium has been one of the major players in the “pod shop” evolution of edge funds, competing with other multi-manager funds such as Citadel and Point72. Millennium has over 330 investment teams operating as part of one flagship fund, all under the umbrella of strict risk controls across fundamental equity, equity arbitrage, fixed income, commodities, and quantitative strategies in liquid markets. The firm has gained around 14% per year since it was started. The bulk of capital in Millennium’s flagship fund is in a long-term share class, meaning investors are locked up for five years, which is longer than the typical hedge fund redemption period. Other hedge funds have also tried to enter private credit. Man Group, the world’s largest listed hedge fund, acquired US private credit firm Varagon.

💸 AGM’s 2/20: News of Millennium looking to extend its reach into private credit continues the theme of the blurring of lines. This is yet another example of the blending of public and private. And why not try to be a one-stop shop for investors with a platform and brand the size of Millennium? It makes sense that multi-strategy hedge funds, which have played in the liquid credit space, mull over the possibility of playing in the illiquid credit space. And, with fund lockups that are more akin to private equity than hedge funds (Millennium has a five-year redemption period in their long-term share class, where the majority of their capital resides), investing in more illiquid securities may fit the structure. This trend occurred before in the hedge fund world when some hedge funds began to invest side pocket funds into private companies that were in the pre-IPO stages. While this is not a new phenomenon, some hedge funds ran into challenges when private tech companies had issues exiting. That led to the creation of separate venture fund vehicles that a number of hedge funds launched over the past ten years, with the most notable being Tiger’s $12.7B fund in March 2022. Will we start to see the same in private credit? Only time will tell, but hopefully, the match between investment period and exit timeframe doesn’t have the challenges that private company investing posed for some hedge funds over the past decade.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 State Street (Asset manager) - Head of Corporate Strategy, Senior Vice President. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting - InvestOne. Click hear to learn more.

🔍 73 Strings (Private markets data) - Account Executive. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director of Compliance Review. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch HGGC Partner, Chairman, Co-Founder & Former NFL Hall of Fame Quarterback Steve Young and True North Advisors CEO & Co-Founder Scott Wood discuss how “the score takes care of itself” on the field and in investing / wealth management. Watch here.

🎥 Watch the first episode of Going Public on Alt Goes Mainstream with Evercore ISI Senior MD and Senior Research Analyst Glenn Schorr as we discuss trends and business models for the publicly traded alternative asset managers. Watch here.

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.