👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London. I’m excited to be back in Europe for a week of meetings and to speak at an event hosted by Aperture Capital in Geneva on the outlook for alts in 2024.

Well, 2024 has started off with a splash. This week was about the big getting bigger. A week that started with news of Blackstone raising its first private equity fund specifically designed for the wealth channel (and one of the largest of its kind) and Cinven closing on a fund 30% larger than its prior fund and the 10th largest buyout fund ever in Europe at $14.5B ended with Lexington Partners closing the largest ever secondaries fund at $22.7B and BlackRock making a “transformational” acquisition of $106B Global Infrastructure Partners for $12.5B in cash and stock.

Two common threads tie these newsworthy events together. One is that the biggest funds are leveraging their brand and scale to grow even bigger. And two, they are doing so in part due to an increased focus on tapping into the wealth channel for capital. All four of these developments point to each of these respective firms’ desire to work with HNW investors in a major way.

Blackstone’s new private equity offering for the wealth channel piqued my interest, but not for the reason one might think.

Beyond 2/20: The (downward) flight of fees

The most interesting takeaway from the launch of their fund? The fee structure.

Blackstone is charging a 1.25% management fee and a 12.5% performance fee above a 5% annual return hurdle (see Alex Steger’s article in Citywire for more detail here). Private markets has historically been known for its 2/20 fee structure (2% annual management fee, 20% performance fee).

There’s been plenty of evidence to suggest that private equity has moved beyond 2/20. Fees have been driven lower in more recent years, particularly with the rise in popularity of pensions and sovereigns (namely the Canadian pension plans) developing direct investment teams internally and / or institutional investors instituting co-investment programs with their GP relationships to blend down their total cost of fees. But to see this happen in the wealth channel is interesting for a number of reasons that enable us to unpack how the future of private equity might unfold.

The juice is worth the squeeze

(1) The wealth channel is the new institutional LP: Blackstone’s fee structure highlights just how important they view the wealth channel to be. They aren’t charging a fee structure that has been commonplace in private equity for years, 2/20. They are charging 1.25/12.5. Yes, it’s true that private equity has likely witnessed a departure from the 2/20 fee structure for some time now, but it’s a big deal to see this become commonplace across all investor types.

The takeaway? Firms like Blackstone view the wealth channel as being strategically important to AUM growth and also believe that the volume of participation from the wealth channel will make up for charging fees well below 2/20.

(2) Successfully managing operational costs and complexity: Blackstone’s fee structure signals that they have also figured out how to manage the operational costs and administrative burdens that come with enabling smaller investors to invest in private equity funds. This is both due to a concerted effort internally at large alternative asset managers to hire the right talent and design product structures that can handle the burdens of smaller investors as well as years of innovation coming to fruition from the key infrastructure players in the space like iCapital, who have helped enable alternative asset managers to manage these complexities. Perhaps this is a sign that private markets have reached their next level of maturation. In the past, smaller investors were resigned to paying higher fees to offset the challenges associated with forming funds and managing a larger number of investors at smaller allocation amounts.

BXPE showcases what is becoming a growing trend for large private equity platforms: a single access point — at lower investment minimums (in this case, $25,000) — for HNW investors to gain direct deal exposure across a firm’s entire platform of strategies via programmatic participation in all deals in an evergreen structure.

Different alternative asset managers are creating their own variations of an easy-to-access product structure for the wealth channel. iCapital’s Nick Veronis and Hamilton Lane’s Stephanie Davis shared an article recently highlighting how the “future is evergreen,” where the next generation of private market funds designed for the wealth channel will be evergreen, or “semi-liquid,” funds. Their analysis is spot-on and makes a very strong case for why private markets will see a transformational evolution in product structure as the focus turns to the wealth channel.

Solving the structural and operational challenges and costs associated with building private equity funds for the wealth channel is not without its issues.

But gosh, the juice is worth the squeeze.

A $24.5T problem to solve in the US alone

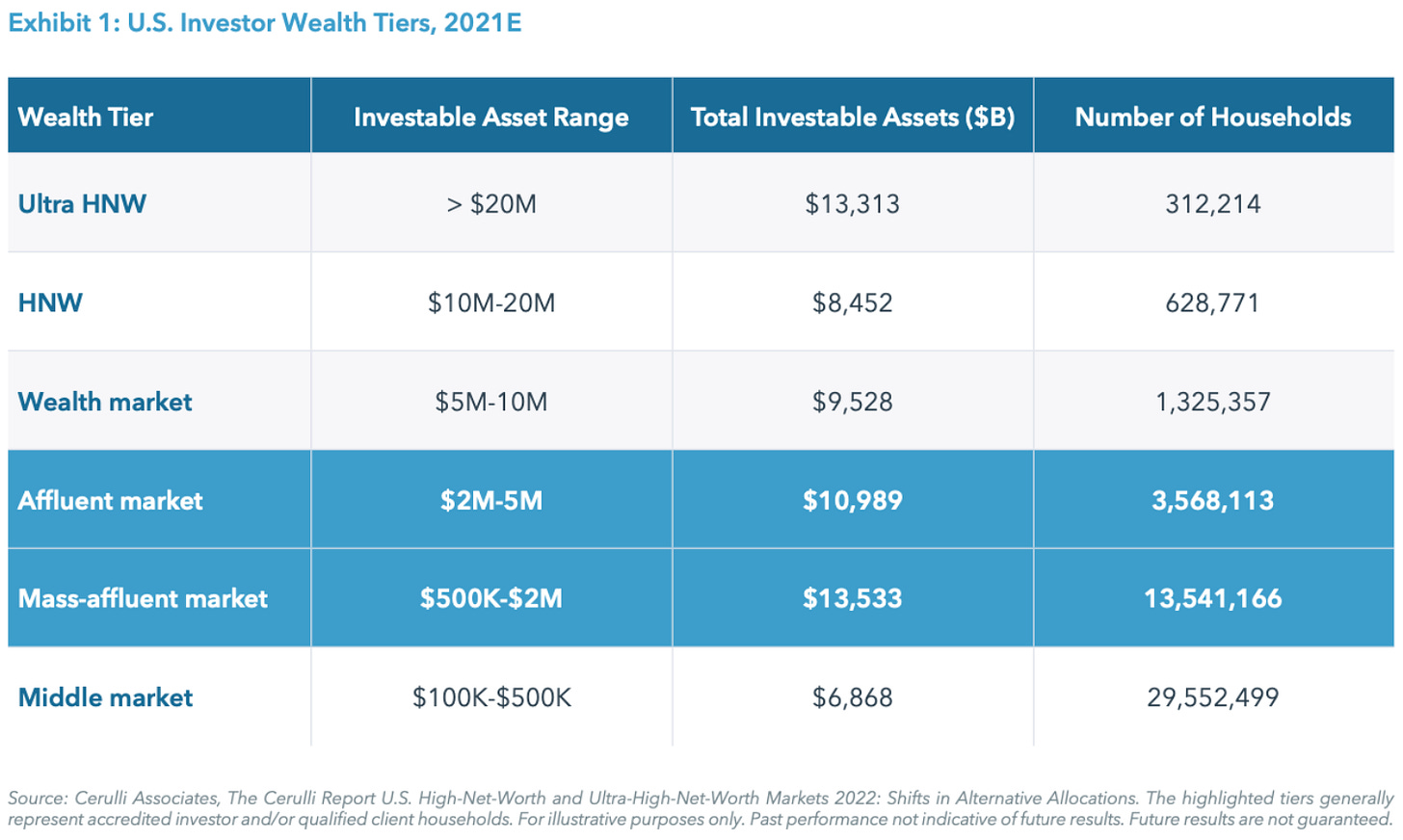

Cerulli Associates tabs the accredited investor (AI) market, the target market for many evergreen structures) between the affluent and mass-affluent market at over $24.5T of investable assets across almost 17 million households in the US alone (see graphic from the iCapital article below).

Seeing just how big the opportunity is within the various customers in the wealth channel, many firms have launched their own variations of registered or non-registered evergreen private equity funds. Virtually all of the large GPs, Apollo, Ares, Blackstone, Blue Owl, Carlyle, and KKR, amongst others, have devised structures to enable the wealth channel to access their funds at lower investment minimums.

(3) An explanation for why traditional asset managers make for good acquirers of alternative asset managers: The above trend explains why traditional asset managers, like BlackRock and Franklin Templeton, make for the right type of acquirers to take alternative asset managers to the next level. Certainly not the only reason, but perhaps a very strong strategic rationale. The end clients for the likes of BlackRock and Franklin Templeton are the right fit for many of the products that are being created by alternative asset managers. Perhaps, looking at the evolution of traditional asset managers through this lens, it’s no surprise why BlackRock acquired GIP this week and why Franklin Templeton acquired Lexington Partners in 2022.

The entrance of liquid manager innovators should only serve to layer on innovation in the semi-liquid / evergreen and registered fund arena in private markets. The world’s largest and most sophisticated asset managers directing their strategic focus to enabling the individual investor and their advisors, one of their major existing client cohorts, to access alternatives? Game on.

(4) A convergence between liquid and illiquid?: There’s a bigger trend at play here. Traditional asset managers are converging on private markets’ territory by building or buying alternative asset managers to offer to their individual and institutional clients. Alternative asset managers are moving beyond closed-end fund structures to create semi-liquid and registered products to cater to the emerging wealth channel client.

Liquid is going semi-illiquid. And illiquid is going semi-liquid. Both groups appear to believe that the juice is definitely worth the squeeze.

The innovation in product structuring for the wealth channel has actually spilled over to the institutional world. My initial reaction about a product structure for illiquid private equity investments like BXPE is what this will mean for how allocators conceptualize portfolio construction. How should allocators think about a product that combines a number of private equity strategies with different risk / return profiles and liquidity features into a single fund with a single capital call and all capital being called upfront and deployed at once?

Buckets and spectrums rather than slices of a pie

Are we moving towards a world where allocators live in buckets and spectrums rather than slices of a pie? What I mean by this is that allocators will look at their equity bucket across the spectrum of public equity and private equity and allocate accordingly, rather than think about their private equity exposure as a different piece of the pie than equities. Same with credit. This sentiment echoes what a number of others in private markets, including Apollo’s Chief Client & Product Development Officer Stephanie Drescher and iCapital’s Chairman & CEO Lawrence Calcano have said.

It appears that these new product structures are changing the mindset of allocators. iCapital’s Veronis and Hamilton Lane’s Davis note in their article that some of these evergreen fund structures are attracting the interest of institutional investors because of their product structure. Apparently, it’s the very features that traditional closed-end funds lack that are drawing institutional investors to the product. The ability to have instant exposure to seasoned portfolios of private investments with compounding returns and all the capital invested upfront (rather than over a capital call structure that draws down capital over a few years) is appealing to institutions. As such, GPs have begun designing evergreen funds for institutional LPs.

The poetic arc of alternatives

If this is the way private markets are headed, it’s quite a poetic arc of what it means for alts to go mainstream. That the smaller, individual investors — the very investors who were once deemed too burdensome for GPs to work with — are now the cohort that’s driving innovation and product structures for the largest of investors is quite a feat that didn’t seem likely years ago. So, perhaps the wealth channel really is the new institutional LP.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 BlackRock to buy Global Infrastructure Partners for $12.5bn | Brooke Masters, Antoine Gara, Financial Times

💡BlackRock made the headlines this week in private markets — and no, it was not just because of the Bitcoin ETF. BlackRock bought $106B AUM infrastructure manager Global Infrastructure Partners for $12.5B in cash and stock. BlackRock’s tie-up with GIP makes BlackRock the world’s second-largest manager of private infrastructure assets. Moreover, it serves to boost BlackRock’s alternatives capabilities as they continue the trend of traditional asset managers looking to add to their private markets investing units. GIP’s portfolio includes assets that many of us know or have passed through in our travels, owning landmark assets of London Gatwick and Sydney airports, and the Port of Melbourne, amongst many others globally. BlackRock is paying $3B in cash and 12M of its shares to GIP’s six founders, with over half the shares going to GIP’s founders and team at closing. The transaction makes the members of GIP collectively BlackRock’s second-largest shareholders. Michael Brown, an analyst at KBW, called the deal “a game-changer for BlackRock’s alternatives platform,” but cautioned that the firm “paid a premium price for a premium asset.”

The FT reports that Larry Fink, BlackRock’s founder, has been openly looking out for a transformational deal akin to the 2009 purchase of BGI from Barclays that provided BlackRock a dominant position in passive investing and ETFs in their journey to become the world’s largest money manager. It appears that BlackRock’s purchase of GIP means that they intend to do the same in private markets and infrastructure with this massive acquisition. The FT’s Masters and Gara astutely point out that this deal could lead to a cascading effect of broader industry consolidation. Many of the largest privately held alternatives firms are exploring stock market listings, and many traditional asset managers are looking for ways to bolster their alternatives businesses. For a number of reasons, this deal could serve as a harbinger of things to come with the impending wave of consolidation in private markets.

Read The FT’s Masters and Gara’s other article, “How the $12.5bn BlackRock-GIP deal is set to shake up investment management,” which goes into depth about the transaction and deal dynamics with the link above. One detail on the deal of note: BlackRock will receive 100% of the management fees on GIP funds and 40% of the performance fees from future funds. GIP employees will retain 100% of the carried interest in the existing funds.

💸 AGM’s 2/20: BlackRock’s acquisition of GIP is newsworthy for a number of reasons, both for the future of BlackRock and for the future of private markets. GIP gives BlackRock a marquee platform to take their private markets business to the next level. Already a significant participant in private markets with $275B AUM, many analysts and investors on the outside believe they are falling short in the area of private equity and closed-end funds as the majority of these assets are in hedge funds, currencies, and commodities. GIP’s $106B and 400 employees with their infrastructure private equity funds offer BlackRock a ready-built fulcrum asset to expand their private market capabilities that could rival other alternatives players. Not only will it enable BlackRock to offer private equity strategies to their institutional clients across their business, but it will also enable them to tap into the wealth channel’s appetite for both private equity and infrastructure exposure. It’s highly strategic for a traditional asset manager to buy a private markets fund or strategy-specific alts manager. First, it provides the traditional asset manager with a more robust and locked-in fee stream, which will likely start at hundreds of millions of dollars in revenue per year and grow significantly, likely to billions in annual fee revenue as BlackRock brings its client network and distribution capabilities to bear. Second, it unlocks these firm’s distribution capabilities in the wealth channel. Franklin Templeton’s acquisition of Lexington Partners provides a template for other traditional asset managers looking to buy and successfully integrate an alternative asset manager into their broader platform. Franklin Templeton astutely realized that the demand for secondaries from LPs would be high given secondary (and broader) market dynamics over the past few years. They also realized they could enhance Lexington’s distribution firepower, particularly in the wealth channel. This synergy proved to be true, as the recent close of Lexington’s largest ever fund at over $22B AUM included billions of dollars from the wealth channel, marking the wealth channel as a meaningfully sized LP constituent in their fundraise. BlackRock now has the chance to do the same with GIP. Infrastructure is in high demand, particularly by the wealth channel. As Citywire’s Selin Bucak highlights in her article this week about BlackRock’s acquisition of GIP, a number of private banks highlighted infrastructure as one of their top themes for 2024, in large part because it serves as a diversification tool away from equities and bonds and an inflation hedge. BlackRock can also use GIP’s platform as a way to more extensively partner with the wealth channel in private markets, similar to how Franklin Templeton used Lexington’s secondaries strategy as a way to work more closely with the wealth channel in this space.

📝 Lexington breaks records with $22.7bn flagship raise | Madeleine Farman, Secondaries Investor

💡Lexington Partners has made it into the record books, reports Secondaries Investor’s Madeleine Farman. Lexington Capital Partners X, which launched its fundraise in 2021, far exceeded its $15B target close, hitting $22.7B in capital raised. This fundraise sets the record for the largest secondaries fund ever raised, reflecting LP optimism in secondaries. LCP X will focus on acquiring LP-led portfolio from large institutional LPs. The fund will also look to find smaller opportunities for LP-led transactions where Lexington has industry relationships, as well as execute GP-led transactions. The fund has already been quite active as the secondaries market has been ripe for dealmaking. The 2022 vintage vehicle is already at over 40% committed across 50 transactions. LPs in the fund include a number of large institutional investors, including Cathay Life Insurance, Fubon Life Insurance, the New York City Employees’ Retirement System, the New York City Pension Fund, and the Minnesota State Board of Investment. But the fund also marks the inclusion of a meaningful amount of investors from the wealth channel, in large part driven by Franklin Templeton’s distribution capabilities. Franklin Templeton acquired Lexington Partners in 2022 for over $1.75B in a bid to build out their private markets capabilities. The tie-up has proved to be fruitful, resulting in a record fundraise that was in part driven by significant commitments from the wealth channel. Lexington believes that the secondaries market is still in its early innings. Farman reports that Lexington estimates that 2023 will be the third consecutive year where secondaries volume will have crossed $100B. “We believe we’re in the early stages of a generational secondaries buying opportunity in private markets that will take multiple years to play out,” Lexington Partner Pal Ristvedt said in a statement. “During times of economic uncertainty and slowing portfolio company exits, the secondaries market can be an important release valve to provide liquidity to investors.”

💸 AGM’s 2/20: Secondaries are coming first in the current fundraising environment. And for good reason. Market dynamics have made for an attractive secondaries investing opportunity. The combination of LPs, particularly institutions, seeking liquidity with a desire for both GPs and LPs to hold onto existing assets even as fund lives extend into their latter years gives many of the large secondaries funds a hand up in the market. LPs are a part of this equation, too. They view secondaries as an attractive investment opportunity, so they are piling capital into the space. This trend dovetails — and is in some respects buttressed by —the increasing role that the wealth channel is playing in private markets fundraising. Secondaries represent an elegant way for newer investors to the asset class to quickly gain access to immediate vintage diversification, a large number of underlying funds and private companies, and a likely reduced J-curve. The news of Lexington’s record raise hammers home a number of current themes that are driving private markets. One, this raise reflects that the big are getting bigger. This trend appears to be coming an increasing feature of private markets. The largest brand-name funds in each respective strategy appear to be raising record funds. It’s no coincidence that this trend is continuing at a time when the newest entrance to private markets is the wealth channel. The wealth channel represents a large, untapped pool of investor capital that can be allocated to private markets. Given that trillions of dollars are in the hands of intermediaries — wealth managers and private banks — it will be the brand-name funds who stand to benefit the most. A recent report by Arctos highlights that in certain strategies, such as infrastructure, where BlackRock just bought market leader GIP, the top 5 funds represent 34% market share of AUM raised in that strategy. As the wealth channel continues its march into private markets, I expect the big to get bigger as the largest funds that have the best brand recognition will attract the lion’s share of the capital to be allocated in this space. As the saying goes, “You don’t get fired for buying IBM.” This sentiment certainly rings true for private markets — and in some strategies, it will be the biggest funds that are able to leverage their size and scale to be outperformers.

📝 Apollo Targets $2 Billion for Next Fund Dedicated to Secondary Credit Investments | Allison McNeely and Silas Brown, Bloomberg

💡Speaking of secondaries, credit secondaries are a growing corner of the market. Bloomberg’s Allison McNeely and Silas Brown report that Apollo is readying to launch its next fund dedicated to secondary credit investments. Apollo is targeting $2B for its second credit secondaries fund. This figure would double the size of their credit secondaries platform, which they launched in 2021 with a $1B fundraise. McNeely and Brown point out that credit secondaries combine two of the hottest strategies currently within private markets: private credit and secondaries. Apollo has heavily invested in growing out its credit secondaries business. In 2022, the firm hired Veena Isaac, Steve Lessar, and Konnin Tam from BlackRock to grow this business.

💸 AGM’s 2/20: Credit secondaries represent a growing segment of a growing market. With the explosion of growth within private credit to over $1.5T AUM in recent years, it’s not surprising that credit secondaries have grown meaningfully. Just how rapidly credit secondaries has grown reflects its rapid rise to prominence. Cleary Gottlieb reports that the $17B in reported credit secondaries transaction volume in 2022 was over 30x greater than the volume transacted a decade earlier. Many of the industry’s largest secondaries firms and alternative asset managers see the opportunity to build a credit secondaries practice. Coller, Ares, Apollo, Pantheon, and Tikehau have all dedicated credit secondaries strategies. The majority of credit secondaries transactions have been LP-led transactions, but GP-led deals are now becoming increasingly popular. This trend should only serve to increase the size of the credit secondaries market, which should grow in lockstep with the continued growth of the private credit market. I expect that we will see a number of large GPs launch credit secondaries efforts, as well as independent funds focused on credit secondaries enter the market.

📝 Inside AI Unicorn’s Anthropic’s Unusual $750M Fundraise | Alex Konrad and David Jeans, Forbes

💡Forbes’ Alex Konrad and David Jeans cover the details behind AI unicorn Anthropic’s unusual $750M fundraise at a reported $18.4B valuation, highlighting how the advent of the SPV is changing venture capital. Anthropic’s round, which remains in progress, is reportedly being led by noted VC and existing Anthropic investor Menlo Ventures. Menlo is using what is becoming an increasingly popular tactic when VCs want to double down on an investment, but the investment size would outstrip the amount they could allocate through their fund: the special purpose vehicle (SPV). Konrad and Jeans point out that it’s easy to see why a deal structure like this makes sense for both sides. For Menlo, it gives them an opportunity to double down on a high-conviction position before a larger round in the future. For Anthropic, it’s a simple, high-resolution way to add to its capital base with minimal time and effort spent on a full-blown fundraise. Apparently, some investors were caught off guard by Menlo’s move to pre-empt a round. The deal structure, via SPV, has enabled Menlo, a firm that raised their most recent funds totaling $1.35B in November 2023, the ability to invest a far greater quantum of capital on their own than their fund size would allow. Menlo isn’t the first firm to leverage SPVs for later-stage deals. Konrad and Jeans report that Thrive Capital used SPVs for several deals, including their recent investment into OpenAI’s tender offer. This development is symptomatic of a broader trend that speaks to the current state of VC. With many larger late-stage, pre-IPO and crossover funds pulling back their commitments to private companies, startups at growth stage may look at other avenues to fill the capital gap.

💸 AGM’s 2/20: News of Anthropic’s round highlights a much bigger trend at work in private markets (and venture in particular): how venture is increasingly becoming a multi-polar world, where firms of varying size and scale, if they have access to capital, can compete for deals across stages. In part, this trend has been supported by technological innovation in private markets infrastructure with the improvement of forming and digitally managing SPVs. While not the only reason why SPVs have gained in popularity, the technology innovation from the likes of AngelList, Carta, and others that have popularized the SPV as a way for everyone from angels and solo capitalists to larger funds to spin up deal-by-deal carry vehicles to raise capital and access a funding round has quickened the pace of adoption of this trend. Historically, VC funds stayed in their lanes — seed funds did seed rounds, Series A funds did A rounds, growth funds did growth rounds, and so on. Venture is now becoming more multi-polar, where firms can play across various stages irrespective of their firm’s size in part thanks to the SPV. This trend has been in the works for some time. Hedge funds launched crossover vehicles to invest in late-stage private markets years ago. This move would prove to be a foreshadowing of things to come. Conversely, some early-stage funds have become multi-stage and multi-strategy funds, increasing the surface area of stages where they participate in rounds. This dynamic has created a more competitive venture market — both for GPs looking to access companies and for LPs trying to discern which funds to allocate into. LPs are also increasingly looking to reduce their overall fee load with their GP relationships, so they often look for opportunities to co-invest, which in turn, gives GPs a green light to pursue co-invests. For an LP, should they invest in a stage-specific manager who may be smaller in size, or should they work with a multi-stage brand who might be able to win access to deals by virtue of their brand name and track record? There’s no easy answer to these questions — for LPs, GPs, and founders. The Anthropic fundraise highlights a trend that has featured prominently in venture over recent years yet leaves a number of questions currently unanswered.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Vega (Digital wealth manager with a focus on alternative investments) - Senior Software Engineer (Backend / Frontend). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.