AGM Alts Weekly | 9.21.25: Howdy, partner 🤝

AGM Alts Weekly #121: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets, where I’ve been writing and podcasting about the convergence of private markets and private wealth since December 2020.

Some testimonials about the AGM Sunday Alts Weekly newsletter include:

“Alt Goes Mainstream is category of one.” Global Head of Marketing & Communications, $X00B AUM alternative asset manager.

“When it comes to the intersection of alternative investments and wealth management, Michael just gets it.” CIO, $18B AUM RIA.

“This is our primary resource for learning and reading about alts.” Head of Marketing, $250B AUM alternative asset manager.

“The only email I never delete when clearing my inbox.” Senior distribution professional, $330B+ AUM asset manager.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends at the intersection of private markets and wealth management and navigate this rapidly changing landscape.

Presented by

A core benefit of the private equity asset class is its long-term, committed nature. With patient capital, management teams can prioritize driving lasting growth with a focus on terminal value, not short-term profitability. That’s why leading investors look to private markets for through-the-cycle performance.

At Permira, we apply the same mindset with the aim to build businesses that are not only bigger, but also better, in turn creating enduring value for companies and investors alike.

Find your investment partner at Permira Wealth and learn more about the secret to private equity outperformance.

Good morning from Washington, DC.

Another week, another major set of partnerships at the intersection of traditional and alternative asset management.

Two trillion-dollar asset managers have once again struck deals with private markets managers to create curated investment products across public and private markets investments.

PGIM, the $1.44T AUM asset management business of Prudential Financial, forged a partnership with Partners Group, the $174B AUM alternative asset manager, to deliver multi-asset portfolio solutions that span public and private markets exposures.

$1.6T AUM Franklin Templeton brought together three leading infrastructure investment firms — $106B AUM DigitalBridge, $37B AUM Copenhagen Infrastructure Partners (CIP), and $27B AUM Actis (a part of $114B AUM General Atlantic) — to deliver bespoke private infrastructure solutions to individual investors.

This partnership between Franklin Templeton, DigitalBridge, CIP, and Actis could signal a new era for private markets.

Dawn of a new era

Franklin Templeton was amongst the first to take note of this evolution of asset management.

They were an early mover, relative to many of their peers in traditional asset management, to acquire private markets capabilities. Over the past few years, they’ve made a concerted effort to build out its private markets capabilities through acquisition, growing its “family of specialists” with purchases of Benefit Street Partners in 2019 and then doubling the firm’s credit AUM at the time by its acquisition of BNY’s Alcentra, buying real estate investment firm Clarion in 2021, and adding private equity secondaries specialist Lexington Partners in 2022 to build out the firm’s private markets AUM to over $252B.

Those moves have largely paid off.

Franklin has seen an increase in long-term inflows in private markets assets over the past year, as a slide from its Q2 2025 earnings presentation illustrates.

The success that Franklin Templeton has had in buying specialist alternative asset managers is also what makes a recent quote from Franklin Templeton CEO Jenny Johnson in a Financial Times article by Antoine Gara so interesting.

Discussing Franklin Templeton’s partnership with DigitalBridge, CIP, and Actis, Johnson said, “in many ways [partnering] is kind of even better than acquiring.”

Johnson also noted something that shouldn’t come as a surprise to those following industry trends: “I think it’s hard for anybody who hasn’t made their move already because traditional asset managers don’t trade at particularly rich multiples. The alternative asset managers trade at really, really rich multiples … it’s just hard to buy scale if you haven’t moved early, like we did.”

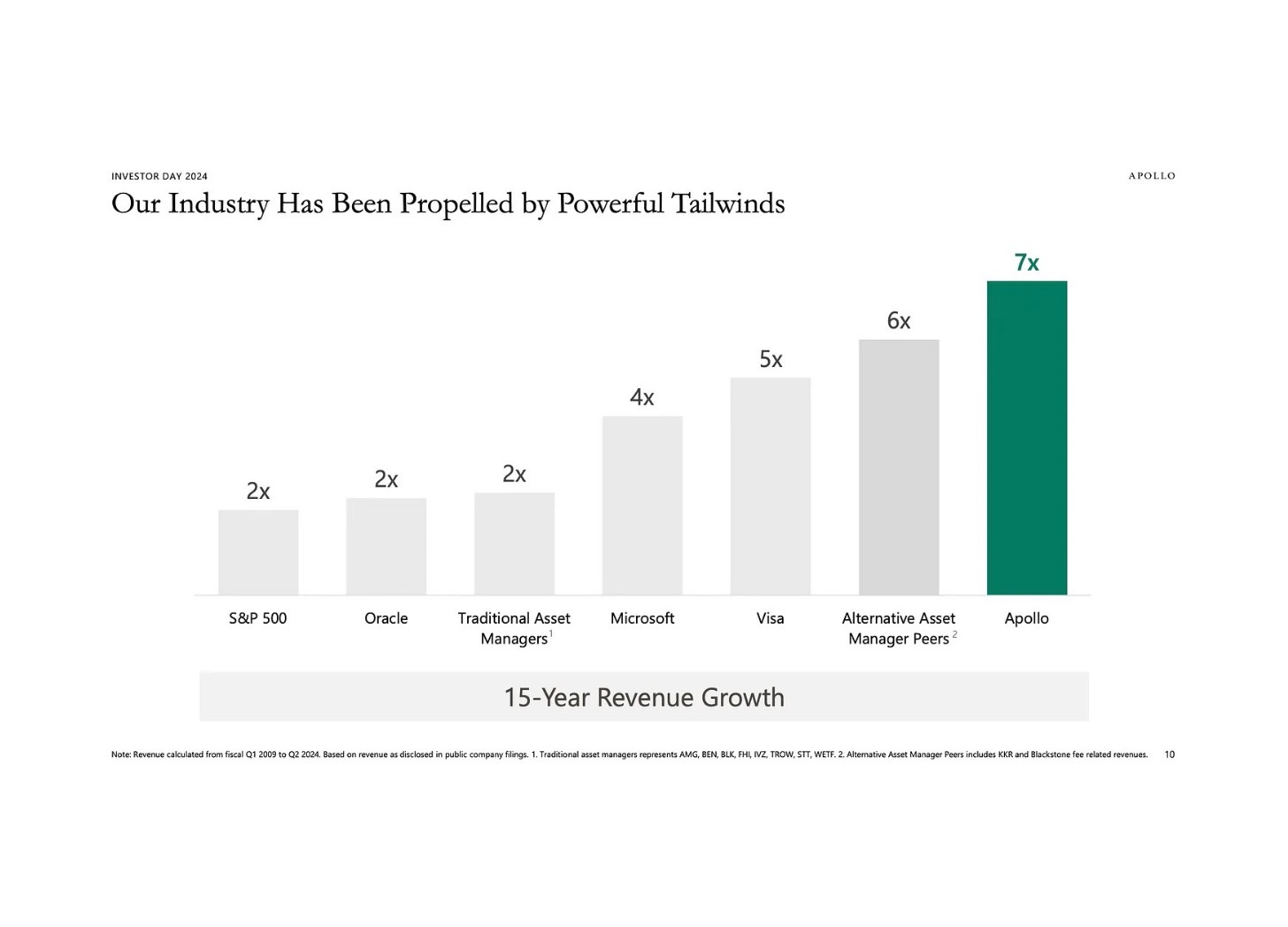

Johnson’s assertion is borne out in the data.

A slide from Apollo’s 2024 Investor Day presentation highlights revenue growth for traditional asset managers relative to alternative asset managers.

The delta in revenue growth is staggering, but perhaps not surprising.

Fee compression is largely the culprit for the headwinds that traditional asset managers have faced relative to their alternative asset manager peers.

Outflows, increased competition, the rise of retail brokerage, and indexed, correlated, and concentrated public markets have also put pressure on the asset management business model.

A secular decline in fees has defined the past 30 years of mutual funds and ETFs, as this below chart from Bain & Company illustrates.

As I wrote in the 7.13.25 AGM Alts Weekly, traditional asset managers do have an opportunity to make up for lost ground:

Private markets represent an opportunity for asset managers to balance out, in some cases, outflows in public market products with higher fees and stickier private markets products. Private markets also offers the ability to deliver a one-stop-shop solution to advisors looking to deal with less firms, not more.

Traditional asset managers have a structural advantage — they already possess large distribution teams, known brands, and existing relationships with the wealth channel. Many traditional asset managers have — or have had — a relationship with many, if not all, financial advisors in the US at some point.

If traditional asset managers navigate the education and distribution of private markets investment solutions effectively, they can leverage their existing footprint and known brands to their advantage in the wealth channel.

The complementarities between traditional and alternative asset managers were highlighted in a quote about the partnership by DigitalBridge CEO Marc Ganzi, who said: “By combining our sector expertise with Franklin Templeton’s reach in private wealth, we are creating a platform designed to deliver institutional-quality opportunities to a broader set of investors.”

Ganzi’s quote hammers home the point that traditional and alternative asset managers can rely on each other’s strengths to both benefit from partnership.

But perhaps the most interesting aspect of this partnership?

Curation at scale

It might represent the dawn of a new era: private markets has moved from balancing customization with scale to now focusing on curation at scale.

This partnership has brought together the capabilities of three high-quality and scaled alternative asset managers that are all specialists — DigitalBridge, CIP, and Actis — and combined it with Franklin Templeton’s expansive footprint in private wealth.

Perhaps this partnership marks the beginning of a wave of partnerships that focus on curation at scale, where traditional asset managers or generalist alternative asset managers look to partner with specialists to create and deliver products to the wealth channel.

I wouldn’t be surprised if the industry starts to see partnerships between best-of-breed alternative asset managers with traditional asset managers. And perhaps even best-of-breed scaled specialist alternative asset managers partnering with each other to form multi-asset portfolios that either offer best-in-class multi-asset portfolios or thematic portfolios to wealth channel investors.

Imagine a world where a large traditional asset manager lacks the capability of a specific investment strategy or asset class. Perhaps they would partner with a scaled specialist that is large enough to manufacture, productize, and manage evergreen products that can serve the wealth channel, but doesn’t have the expansive reach or distribution capabilities to reach broader parts of the wealth channel market, since the wealth channel isn’t monolithic.

Where could these types of partnerships start? With some of the alternative asset management industry’s scaled specialists or firms with a unique edge, such as some of the firms that are in AGM’s Next Wave, as I wrote in the 9.8.24 AGM Alts Weekly.

The industry is going through a partnership wave, whether its T. Rowe x Goldman, Blackstone x Vanguard x Wellington, BlackRock x Partners Group, Apollo x State Street, Capital Group x KKR, to name a few.

The next piece to the puzzle with partnerships could be more curation and more multi-manager partnerships that could even be focused on specific themes. After all, thematic ETFs experienced a rise in popularity after 2019 (although more recently there’s been a decline in AUM of thematic ETFs), so could private markets also see a rise in popularity of thematic products?

Another way for traditional asset managers to access partnerships with specialist alternative asset manager GPs? Asset managers might think about either building out their own GP Stakes capabilities to accrue more value from partnering with alternative asset managers on products and distribution or partner with existing GP Stakes firms (see AGM’s GP Stakes Market Map here) to gain access to smaller, specialist managers.

The DNA

Another reason why we might see an uptick in partnerships relative to acquisitions?

Integrating two different investment cultures can be quite challenging.

In some respects, an asset manager’s investment performance is a reflection of their investment culture. Their investment culture is driven in large part by their DNA.

A partnership rather than an acquisition allows each respective firm to preserve its DNA, which I wrote about in the 6.22.25 AGM Alts Weekly.

Creating evergreen structures is not just about productizing for the wealth channel. It’s also about productizing for yourself.

Partnerships could free up firms to focus on who they are, rather than who they might want to be, which is becoming an increasingly loaded — and expensive — question in the converging worlds of public and private.

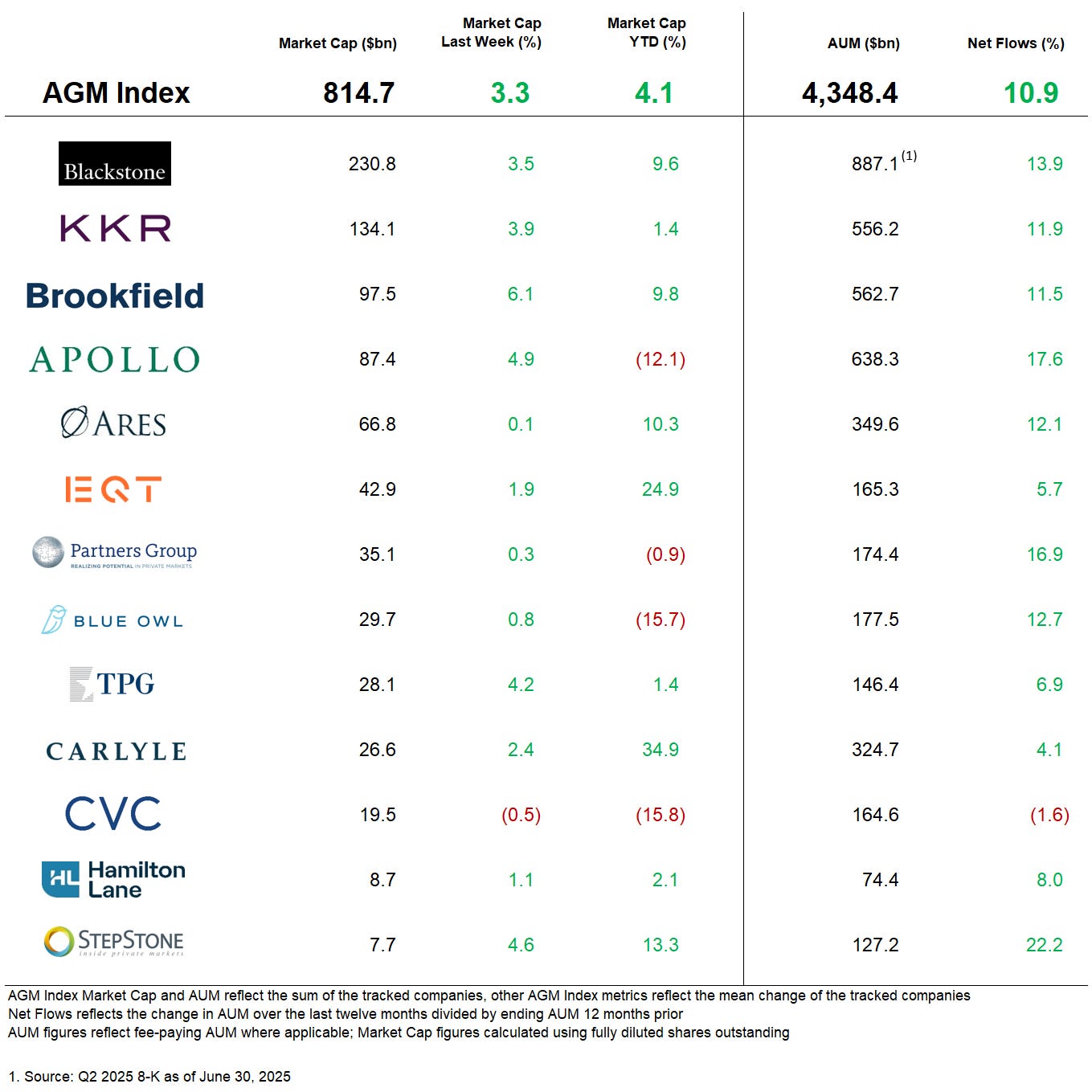

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

Chart of the Week

Brought to you by:

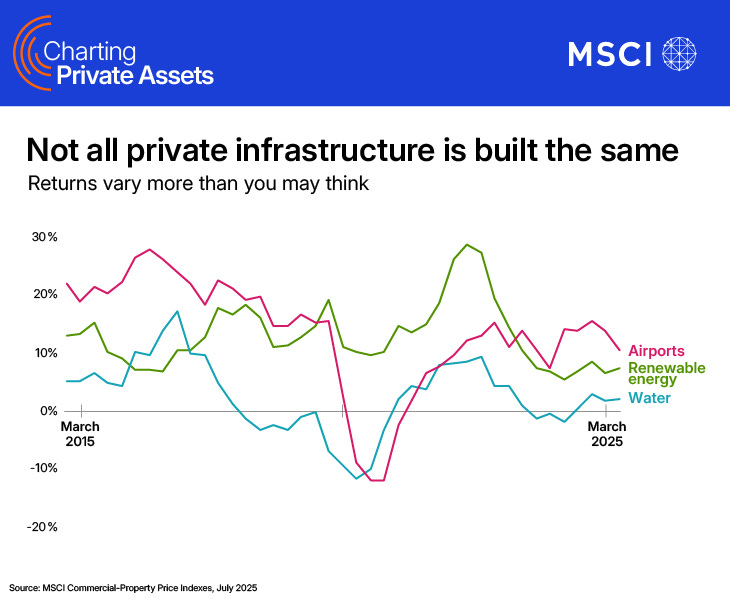

Not all private infrastructure is built the same

Private infrastructure has a reputation for stability, but a look beneath the hood tells a different story.

Industries within the asset class have experienced significant variability over the past decade. For the 12 months through Q1 2025, the performance differential between the strongest-performing industry (public facilities) and the weakest industry (water) was nearly 17 percentage points. Look at the chart and you’ll find an even wider gulf, with water and renewables driving a greater than 20 percentage-point gap in June 2022.

Sector-specific policy, investor sentiment and commodity dynamics can drive wide dispersion beneath the aggregate in private infrastructure. For investors, segment-level granularity is essential.

Disclaimer

(c) 2025 MSCI Inc. All rights reserved. Any use of this chart, data or any information contained in this section are also subject to the disclaimer located at: https://www.msci.com/legal/notice-and-disclaimer, which may be updated by MSCI Inc. from time to time.

AGM News of the Week

Articles we are reading

Retail brokers get in the game and European asset managers look to offer private markets to clients

📝 Trade Republic Teams Up with Apollo, EQT in Private Markets Push | Stephan Kahl, Bloomberg

💡German online brokerage firm Trade Republic is offering its customers access to private markets via fractionalized investing. With over €150B in AUM on the platform, Trade Republic boasts a customer base of 10 million Europeans across 18 markets on the continent. Trade Republic started as a brokerage firm for equities, enabling many customers who had never before bought a stock or invested in an ETF to access capital markets at lower minimums and via fractionalized investing. Today, they’ve partnered with Apollo and EQT to enable its users to access private markets with as little as €1 as well as monthly redemptions on Trade Republic’s internal secondaries marketplace, which is lower than the €10,000 investment minimum and quarterly redemption cycle that many evergreen funds offer directly.

💸 AGM’s 2/20: News of Trade Republic offering private markets to individual investors follows other European investment firms opening up direct access to their individual investor customers. Just last week, UK’s largest “DIY” investment platform, Hargreaves Lansdown, partnered with Schroders Capital to offer two Long Term Asset Funds to HL’s two million customers.

HL and Trade Republic aren’t the only European investment firms to open up access to private markets in recent months.

Germany’s Scalable Capital, fresh off a €155M financing round led by Sofina and Noteus Partners in June of this year, recently teamed up with its investor, BlackRock, to launch an ELTIF with BlackRock’s Private Equity Fund for its customers with €10,000 investment minimums and quarterly redemptions.

French digital wealth management platform Ramify has also opened up access to private markets to its individual investors via its asset management business, Valhyr Capital, which has partnered with the likes of Blackstone, Goldman Sachs, EQT, Morgan Stanley, and Neuberger Berman to deliver a multi-manager private markets solution to clients across private equity, private credit, and liquid alpha strategies.

The race is on in Europe to deliver private markets to individual investors. News from the past few weeks highlights that the D2C individual investment platforms are swiftly expanding into private markets to deliver solutions to their customers beyond public equities and fixed income.

📝 Apollo in Talks for Private Markets Partnership with Schroders | Leonard Kehnscherper and Silas Brown, Bloomberg

💡The UK’s largest standalone asset manager, Schroders, is in talks with Apollo for a potential product partnership. Schroders has been focused on developing strategic partnerships with alternative asset managers as it looks to grow its footprint and distribution in private markets. Last year, Schroders stood up an investment manager with Phoenix Group Holdings Plc which aims to allocate billions of pounds in private assets on behalf of British pensioners. Schroders, which manages around £776.6B in total assets, had £71B in its alternatives unit in June 2025.

News of a partnership between Schroders and Apollo follows a raft of partnerships struck between traditional and alternative asset managers in recent weeks and months, as outlined in the main article in AGM this week.

One aspect that’s notable about the Schroders and Apollo tie-up? The focus that the industry’s largest alternative asset managers have on growing their footprint in Europe.

💸 AGM’s 2/20: Europe appears to be a growing area of focus for the industry’s largest alternative asset managers.

We wrote in the 6.15.25 AGM Alts Weekly about Blackstone’s focus on Europe in the coming years. As Blackstone cut the ribbon to celebrate its 25th anniversary in London in June of this year, Co-Founder Stephen Schwarzman said that the firm would be planning to invest “at least $500B” in Europe — roughly $50B per year — over the coming decade. Apollo’s Jim Zelter noted in June that the firm would be looking to invest as much as $100B in Germany alone over the next decade.

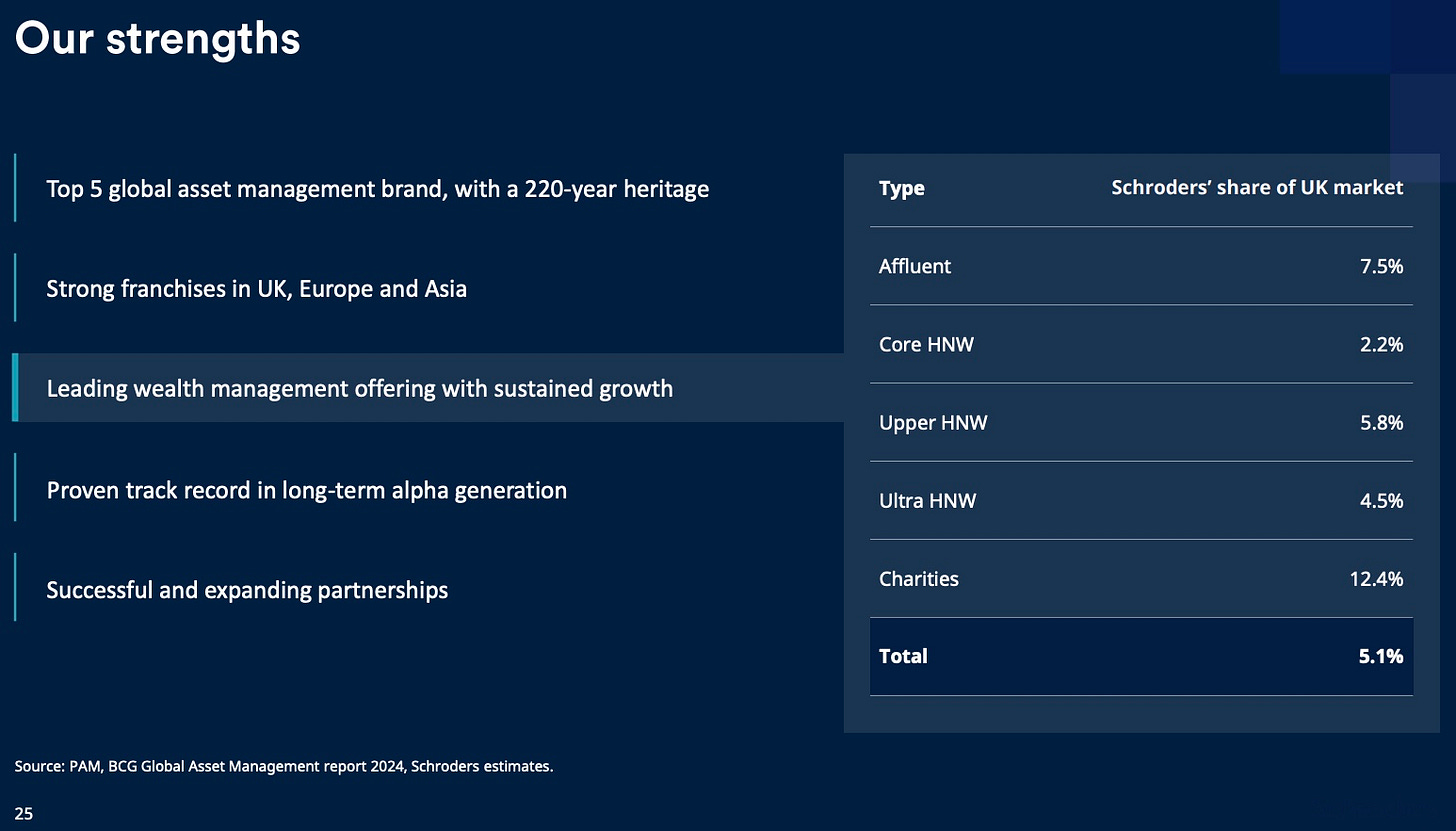

A partnership with Schroders would mean that Apollo would be affiliating with a firm that has a meaningful footprint in the UK wealth market.

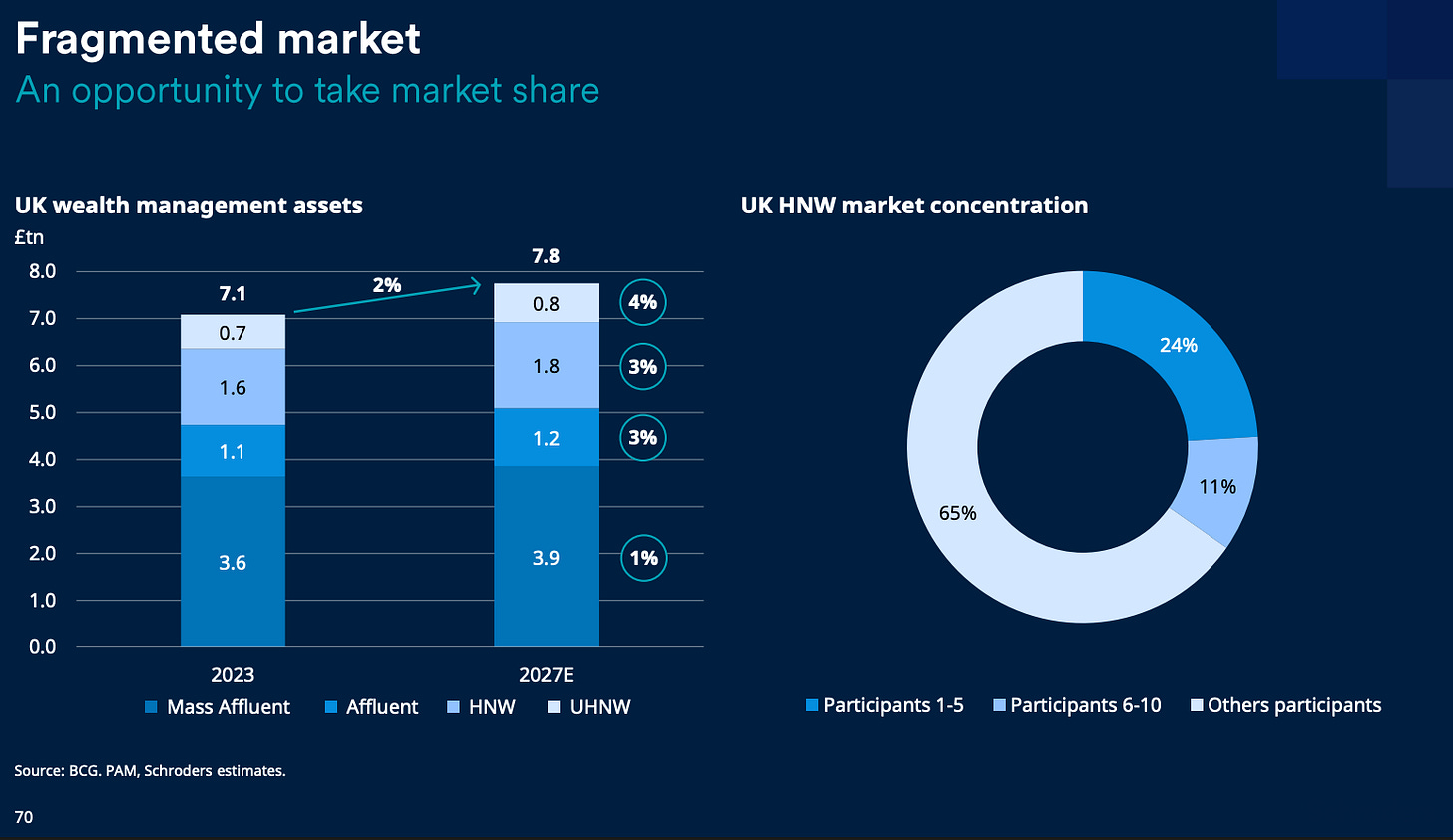

As a chart from Schroders’ Strategy Update and Annual Results 2024 illustrates, the firm has a wealth management offering that covers various segments within the UK affluent and HNW market.

In the UK wealth market, Schroders believes it has the ability to gobble up market share in a fragmented space.

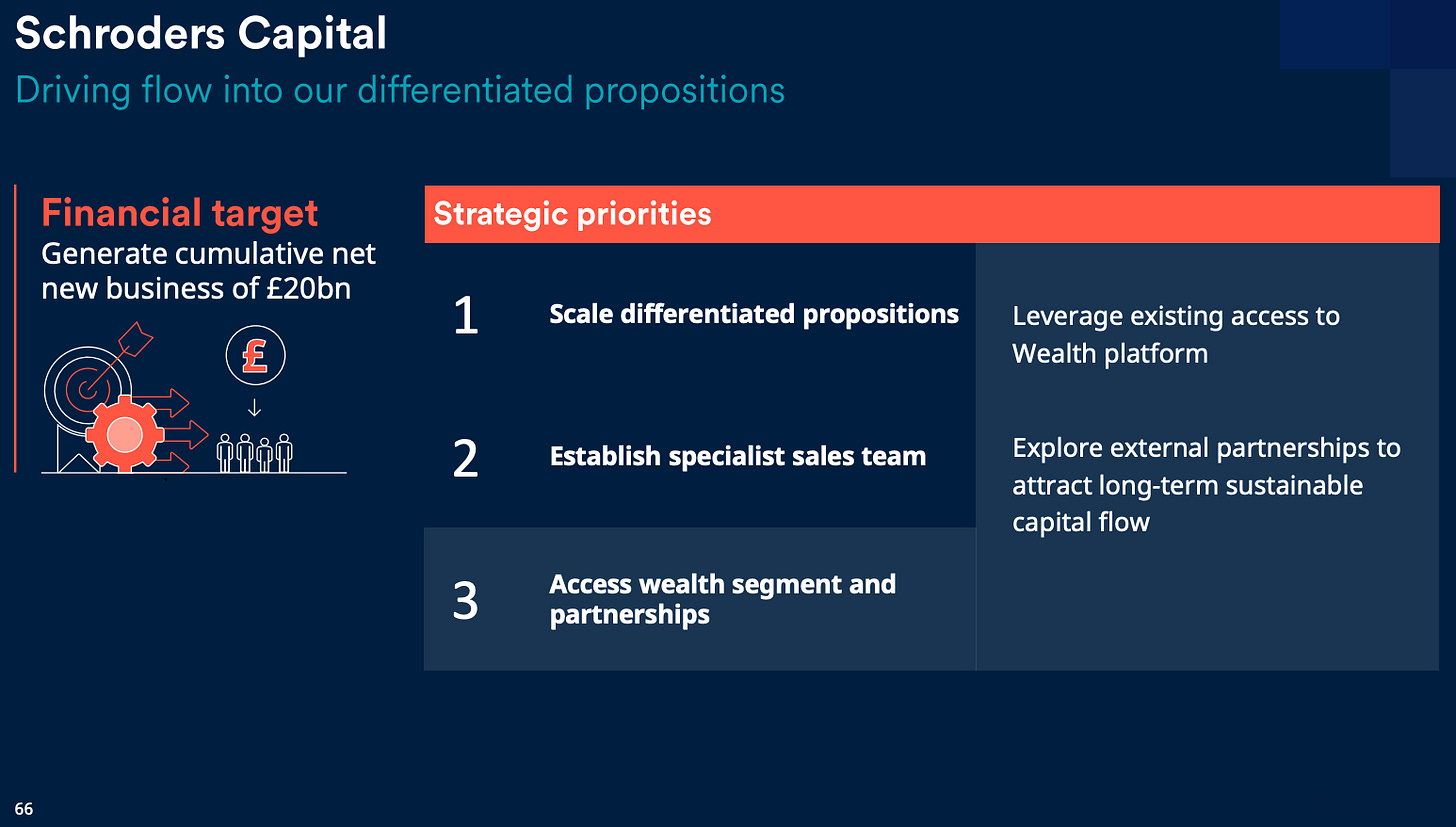

Taking market share in wealth could mean figuring out how to partner with the right alternative asset managers to deliver differentiated products to their wealth clients. Schroders notes that it is exploring external partnerships in its own private markets business, Schroders Capital, to drive capital flows into its business as it marches toward its goal of £20B in net new AUM.

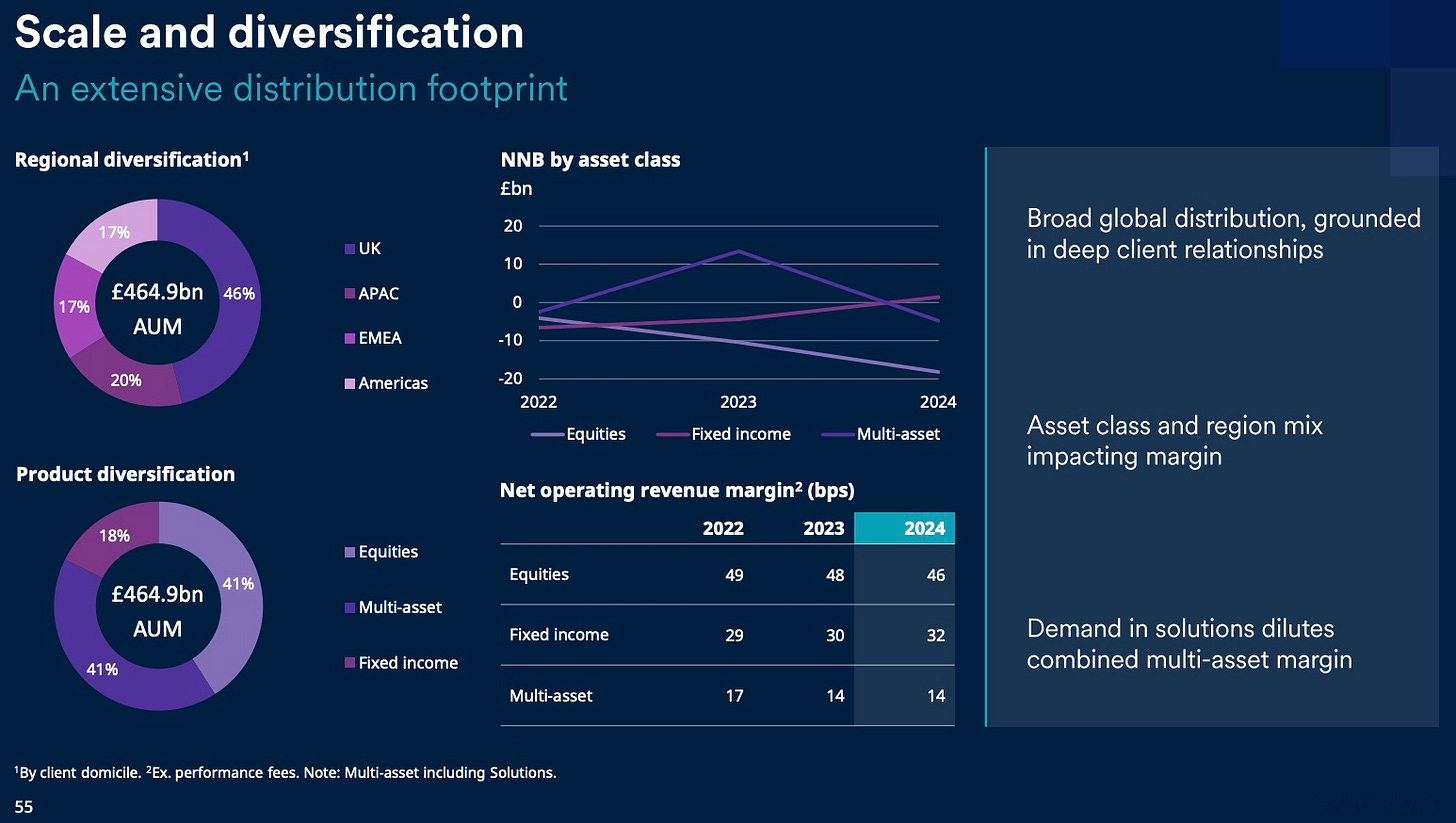

Schroders alternative asset management business, Schroders Capital, has £71B in AUM and its public markets business has “an extensive distribution footprint” and a heritage of creating multi-asset solutions in public markets, making it a prime candidate to partner with Apollo on creating hybrid and multi-asset products for the wealth channel.

Partnerships are in many respects about fitting together pieces of the puzzle. There will be plenty of areas where traditional and alternative asset managers can find common ground to help enhance their respective businesses — even if they might be competitive with each other at times as well.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Content Marketing, Vice President - Tokyo. Click here to learn more.

🔍 KKR (Alternative asset manager) - Head of AI Product Management. Click here to learn more.

🔍 Apollo Global Management (Alternative asset manager) - Managing Director, Head of Investment Grade Research. Click here to learn more.

🔍 Ares (Alternative asset manager) - Vice President, Product Management & Client Services, Wealth Management Solutions, APAC. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - Private Wealth, Tax Advantaged Strategy - Principal. Click here to learn more.

🔍 Franklin Templeton (Asset manager) - Head of Marketing - France, Benelux, and the Nordics. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA, Family Office Business Development - Vice President. Click here to learn more.

🔍 Goldman Sachs Alternatives (Alternative asset manager) - Asset and Wealth Management, Client Solutions Group, Retail Alternatives Specialist, New York - Vice President. Click here to learn more.

🔍 Partners Group (Alternative asset manager) - Investment Leader, Private Equity, Services vertical. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - SVP, Business Development. Click here to learn more.

🔍 Cerity Partners (Wealth management platform) - Head of Talent, Principal. Click here to learn more.

🔍 JPMorgan Chase (Asset manager) - Asset Management - Private Equity Associate - Program Associate. Click here to learn more.

🔍 SageSpring Wealth Partners (Wealth manager) - Team Financial Advisor. Click here to learn more.

🔍 MSCI (Data services) - Vice President, Program Management - Private Assets. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Permira Co-CEO Dipan Patel discuss how to scale an €80B alternative asset manager. Watch here.

🎥 Watch Morningstar CEO Kunal Kapoor cover the most pressing topics in private markets today, including the convergence of public and private, liquidity vs illiquidity, investor education, the importance of transparency, and the why, what, and how behind evergreen funds. Watch here.

🎥 Watch The Compound and Friends (TCAF) Co-Hosts and Ritholtz Wealth Management Partners Downtown Josh Brown and Michael Batnick and I go back and forth about private markets on TCAF Episode 207. Watch here.

🎥 Watch Stonepeak Co-President Luke Taylor discuss what it takes to be a great infrastructure investor. Watch here.

🎥 Watch Arcesium MD and Head of Client and Partner Development David Nable discuss how to architect private markets technology infrastructure for the future. Watch here.

🎥 Watch Juniper Square CEO and Co-Founder Alex Robinson on balancing AI with the human element in fund administration. Watch here.

📝 Read the latest AGM Op-Ed — “Retail and the City #2” with former Pantheon Partner Susan Long McAndrews on five takeaways from the Executive Order that could see private assets in 401(k) plans. Read here.

🎥 Watch Hg Senior Partner and Executive Chairman Nic Humphries discuss how Hg has grown into a $100B scaled specialist and how one of the industry’s leading private equity technology and services investors is “navigating investing at an inflection point in history.” Watch here.

🎥 Watch EQT Partner, Head of Private Wealth Americas Peter Aliprantis live from Miami on how EQT is bringing global local. Watch here.

📝 Read The AGM Op-Ed with Arcesium SVP, Business Development - Private Markets Jean Robert on why asset managers need to rethink reporting as a strategic advantage. Read here.

🎥 Watch SageSpring Private Wealth CEO Winston Justice share how he went from protecting star quarterbacks as an NFL tackle to protecting families’ wealth. Watch here.

🎥 Watch Blue Owl Co-President and Global Head of Real Assets Marc Zahr share the story of how he built Oak Street from $17M in AUM in 2009 to what is now Blue Owl’s $67.1B AUM Real Assets business in a live Alt Goes Mainstream podcast at Future Proof Citywide. Watch here.

📝 Read The AGM Op-Ed with former Pantheon Partner Susan Long McAndrews on why everything we need to know might be in Sacramento (where CalPERS is located). Read here.

🎥 Watch Hg’s Partner and Head of Hg Wealth Martina Sanow discuss how Hg has unlocked opportunities for the wealth channel to invest in Europe’s largest portfolio of software and services businesses. Watch here.

🎥 Watch Goldman Sachs’ Partner and Global Co-Head of the Petershill Group at Goldman Sachs Robert Hamilton Kelly discuss the evolution of the GP stakes industry and how Goldman has become a market leading GP stakes investor. Watch here.

🎥 Watch Blue Owl’s MD, Head of Alternative Credit Ivan Zinn unpack private credit and why ABF has become a prominent part of the private credit ecosystem. Watch here.

📝 Read The AGM Op-Ed with Blue Owl Head of Alternative Credit Ivan Zinn on why “asset-based finance today mirrors the evolution of corporate direct lending from over a decade ago.” Read here.

🎥 Watch Lincoln Financial’s EVP and CIO Jayson Bronchetti discuss the role of insurance companies in private markets as he discusses how he manages a portfolio of $300B in assets. Watch here.

🎥 Watch Krilogy’s Partner and CIO John McArthur discuss how an RIA can chart a growth path by building out its private markets capabilities. Watch here.

🎥 Watch New Mountain Capital’s Founder & Chief Executive Officer Steve Klinsky discuss how $55B AUM New Mountain has built a business that builds businesses. Watch here.

🎥 Watch Arcesium’s Private Markets Head Cesar Estrada discuss data silos and technology integrations in private markets. Watch here.

🎥 Watch GeoWealth President & COO Jack Hannah and iCapital SVP, Partnerships Michael Doniger discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch Goldman Sachs’ Managing Director, Global Head of Alternatives, Third Party Wealth Kyle Kniffen discuss how they are “standing on the shoulders of Goldman Sachs to be a complete partner” for the wealth channel. Watch here.

🎥 Watch Fortress Investment Group Managing Director & Co-Head of Private Wealth Solutions Adam Bobker discuss how Fortress has built a wealth solutions business from a whiteboard, leaning on the firm’s pioneering history of innovation. Watch here.

🎥 Watch Constellation Wealth Capital President & Managing Partner Karl Heckenberg on why there will be a $1T independent wealth management firm. Watch here.

🎙 Listen to Ted Seides, Founder of Capital Allocators, and I discuss the convergence of the institutional world and the wealth world as we dive into the intersection of private markets and private wealth to kick off a Capital Allocators mini-series on Private Wealth. Listen here.

🎥 Watch BlackRock Managing Director, Co-Head of US Wealth Business, Senior Sponsor for Retirement Business Jaime Magyera and iCapital Chairman & CEO Lawrence Calcano discuss the ground-breaking BlackRock, iCapital, and GeoWealth unified managed account partnership live from iCapital Connect. Watch here.

🎥 Watch EQT Partner & Head of Private Wealth Americas Peter Aliprantis discuss how the firm is bringing EQT’s success to the US wealth market. Watch here.

🎥 Watch KKR Partner & Co-CEO of KKR Private Equity Conglomerate LLC (K-PEC) Alisa Wood discuss how the firm has innovated in private markets, why KKR came up with the Conglomerate structure, and how evergreens can play a role in investors’ portfolios. Watch here.

🎥 Watch Cantilever Group’s Co-Founder and Managing Partner Todd Owens in a live podcast from BTG Pactual’s NYC office share why GP stakes can be the best of all worlds. Watch here.

📝 Read The AGM Op-Ed with Arcesium Private Markets Head Cesar Estrada on the rise of asset-based finance and why it’s the next growth engine for private credit. Read here.

🎥 Watch BlackRock’s Head of the Americas Client Business Joe DeVico, Head of Product for US Wealth & Head of Alts to Wealth Jon Diorio, and Partners Group's Co-Head of Private Wealth Rob Collins discuss their landmark private markets model portfolio partnership that could be the industry’s “iPhone Moment.” Watch here.

🎥 Watch Brookfield Oaktree Wealth Solutions CEO John Sweeney discuss how to build a high-performing wealth solutions team and why the word “solutions” matters when working with the wealth channel. Watch here.

🎥 Watch Cerity Partners’ Partner & Chief Client Officer Tom Cohn and Partner Amita Schultes talk about how and why they have combined a leading OCIO with a $100B AUM wealth management practice. Watch here.

🎥 Watch Marc Lipschultz, Co-CEO of Blue Owl, talk about how they have aimed to skate where the puck is going as Blue Owl has grown its AUM to $265B in nine years. Watch here.

📝 Read The AGM Q&A with Blue Owl Co-CEO Marc Lipschultz, where he highlights some of the trends that have propelled alternative asset management into the mainstream: scale, a focus on private credit, and a focus on private wealth. Read here.

🎙 Listen to Stephanie Drescher, Partner & Chief Client & Product Development Officer of Apollo, discuss what is safe and what is risky as she dives into both the convergence between public and private and the nuances of asset allocation. Listen here.

🎥 Watch Eric Satz, Founder & CEO of Alto share thoughts on why retirement assets could be the next frontier for private markets. Watch here.

🎥 Watch Mike Tiedemann, CEO of $72B AUM AlTi Global share why being a global wealth manager can be a differentiator. Watch here.

🎥 Watch Joan Solotar, Global Head of Private Wealth Solutions at Blackstone share why it’s not even early innings, but that it’s “spring training” for private markets adoption by the wealth channel. Watch here.

🎥 Watch Venkat Subramaniam, Co-Founder of DealsPlus on building a single source of truth for private markets. Watch here.

🎥 Watch Yann Magnan, Co-Founder & CEO of 73 Strings discuss the opportunity for AI to automate private markets. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO of iCapital on episode 14 of the latest Monthly Alts Pulse as we discuss whether or not private markets has moved from access as table stakes to customization and differentiation. Watch here.

🎥 Watch Hamilton Lane Managing Director, Co-Head US Private Wealth Solutions Stephanie Davis and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the third episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch KKR Managing Director, Head of Americas, Global Wealth Solutions (GWS) Doug Krupa and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the second episode of the Investing with an Evergreen Lens Series. Watch here.

🎥 Watch Vista Equity Partners Managing Director, Global Head of Private Wealth Solutions Dan Parant and iCapital Co-Founder & Managing Partner Nick Veronis discuss the evolution of evergreen funds on the first episode of the Investing with an Evergreen Lens Series. Watch here.

📝 Read about a year in the book of alts — a compilation of the 1,000+ pages written in weekly newsletters on Alt Goes Mainstream in 2024. Read here.

📝 Read about the launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets. Read here.

🎙 Hear Balderton Capital General Partner and former Goldman Sachs Partner Rana Yared discuss why Europe can build global companies out of the region. Listen here.

🎥 Watch Stepstone Private Wealth CEO Bob Long discuss StepStone Private Wealth’s edge and nuances with their evergreen structures in the first episode of “What’s Your Edge.” Watch here.

🎙 Hear $5B AUM Ritholtz Wealth Management’s Director of Institutional Asset Management Ben Carlson bring a wealth of common sense to asset allocation and private markets. Listen here.

🎙 Hear Blue Owl, Inc. Board Member and Blue Owl GP Strategic Capital Senior Managing Director Sean Ward on how $57.8B AUM Blue Owl GP Strategic Capital has pioneered GP staking and transformed GP stakes into an industry. Listen here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me and Alt Goes Mainstream on LinkedIn (and AGM’s LinkedIn page), Twitter (@michaelsidgmore), and YouTube to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Ryan McCormack, Nick Owens, and Michael Rutter for their contributions to the AGM Index section of the newsletter.