AGM Studio: The meeting place for private markets

Be in the room where it happens: The launch of the AGM Studio, a collaboration between Alt Goes Mainstream and Broadhaven Ventures

Today marks the launch of the AGM Studio.

The AGM Studio is a collaboration between Alt Goes Mainstream and Broadhaven Ventures to incubate, invest in, and help scale companies and funds in private markets.

Citywire’s Selin Bucak covered the launch of the AGM Studio today in Citywire Selector here. I’m thrilled that Selin, one of the most thoughtful and knowledgeable journalists in private markets, shared the why and the how behind the AGM Studio.

The private markets evolution

To fully understand what’s happening in private markets is to grasp the evolution of alternative asset managers as businesses.

Forty years ago, Blackstone was an idea with $300,000 from Founders Steve Schwarzman and Pete Peterson to do leveraged buyouts. Today, Blackstone has built a comprehensive private markets investment platform that spans private equity, private credit, real estate, insurance, secondaries, GP stakes, growth equity, and more. Blackstone now stands at $1T AUM, which has propelled the company to become more valuable than banks like Goldman Sachs and Morgan Stanley at over $230B market capitalization and entry into the S&P 500.

It's not just Blackstone that has grown into an industry behemoth (and public company). It’s KKR, it’s Apollo, it’s Ares, it’s Carlyle, it’s EQT, it’s Blue Owl, it’s TPG, it’s Partners Group, it’s CVC, it’s Brookfield, it’s Hamilton Lane, it’s StepStone, and many more. Funds are turning into firms.

A $40T market hiding in plain sight — and that’s only one piece of the puzzle

Not only do these firms invest in and own some of the world’s largest private companies, but they are increasingly playing a role in financing — with both equity and debt — major global trends, from digitalization to decarbonization. Private markets managers are very much playing for the $40T market in credit (or what’s on bank balance sheets as Apollo CEO Marc Rowan has said) hiding in plain sight.

A common thread? They are all multi-strategy private markets investing platforms that have amassed hundreds of billions in AUM. There are countless firms behind them, ready to cross the Rubicon to $100B AUM. And there are plenty more who have ambitions to be multi-hundred-billion-dollar asset managers.

Winning in wealth

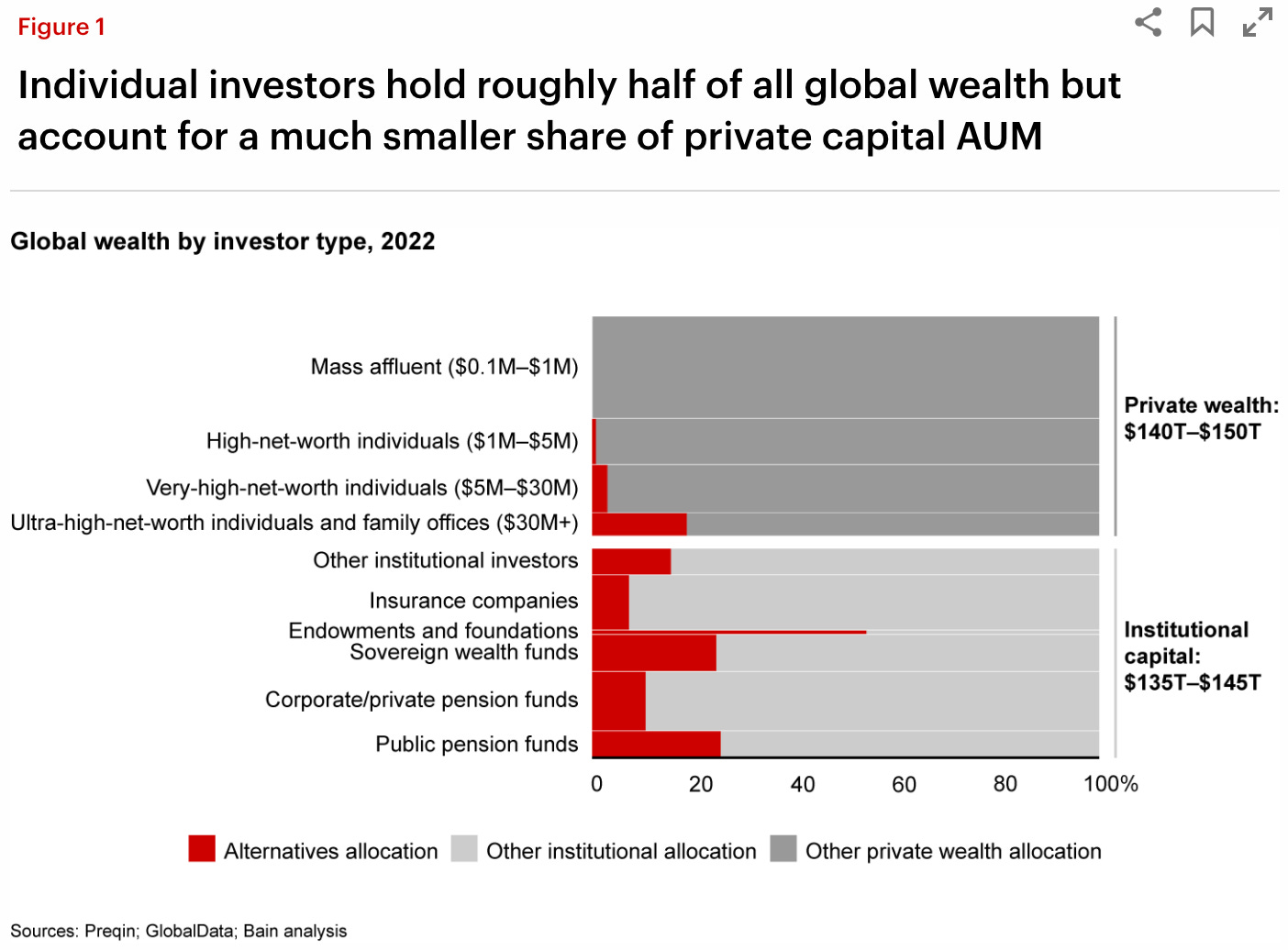

Their growth has been aided by both market forces and the gaping hole in allocations to private markets for much of the equally sized but much more underserved wealth channel.

It’s not just alternative asset managers who have had ambitions to become the biggest players in private markets; it’s been traditional asset managers, too. In part due to fee compression and a rise in passive investing which have dealt body blows to their revenues and earnings, and in part due to their expansive relationships in the wealth channel, traditional asset managers think they can play in private markets, too.

Traditional asset managers should certainly be a force to be reckoned with. They have the history, the brand, the scale, and the distribution relationships with the wealth channel to work with wealth. But it’s impossible to ignore the rise to prominence of alternative asset managers reaching an ever-expanding set of dimensions in the financial services ecosystem, as the graphic below from Apollo’s recent Investor Day presentation illustrates.

The opportunity

Today, private markets stand at around $15T in total assets. Preqin projects it will balloon to $30T by 2030. Bain projects double that figure by 2033.

The prize is massive.

Tikehau shared a graphic in a recent investor presentation that illustrates the size and scale of the revenue capture opportunity.

At $15T in total assets, annual management fee revenue capture would roughly be $225B (assuming an average 1.5% fee). At $30T? $450B in annual management fee revenue capture. Undoubtedly, a portion of those fees will go to improving operational efficiency with tech spend.

With roughly 12,500 private markets funds (according to research by Russell Investments), the potential revenue rake is huge. A growth in fee revenue means that alternative asset managers can invest more into technology to improve their operations. This need is particularly acute for the largest alternative asset managers, given the operational burden of managing more investors in the wealth channel.

As alternative asset managers and traditional asset managers alike look to build out their capabilities in the wealth channel, they are faced with technical and operational challenges that are front and center in their business evolution.

Distribution revolution and technology evolution go hand in hand

The distribution revolution is powered by the technology evolution in private markets market structure (read my post from June 2022 on how evolutions power revolutions).

Private markets itself is still in the early stages of development as an industry. So, it’s no surprise that it is in its early innings of transforming from the Stone (Excel) Age to the Digital Age from a technology and automation perspective across the lifecycle of an alternative investment.

Now that the distribution revolution has begun — with companies like iCapital built for purpose to power asset managers’ foray into the wealth channel — data, operations, and infrastructure solutions must be built to help firms with their business operations from front to back office and across institutional and individual investor channels.

Where “fin” and “tech” rely on each other

Private markets is a unique space. It’s one where “fin” and “tech” very much rely on the other. That’s in large part why three interconnected themes and innovations are driving the growth in private markets.

Distribution and product innovation

The distribution revolution is driving product innovation. Products such as evergreen structures are being developed to meet the growing demand and unique requirements of the “new institutional LPs,” the wealth channel and insurance companies

The product innovation in the wealth channel is driving technology transformation to meet the needs of wealth channel investors from operational and servicing perspectives.

Technology innovation

Just as other markets, such as equities, fixed income, and derivatives, electronified as the need for speed, lower costs, and servicing became more acute, private markets is going through a similar technology market structure evolution from pre- to post-investment.

Technology innovation is required to better serve a new — and larger by numbers — cohort of investors. Operational complexities are rife as more investors enter private markets. The juice is certainly worth the squeeze due to the size and scale of the opportunity for AUM growth, but alternative asset managers require a new set of tools to handle the burdens of the wealth channel.

The intersection of alts x wealth

The wealth channel is becoming an increasingly important LP for alternative asset managers. Wealth management itself is also becoming a compelling investment opportunity for private equity firms. Private equity investment and consolidation is accelerating the wealth management business model and industry evolution, which in turn is driving adoption of alts from the wealth channel as wealth management firms evolve into platforms that need private markets offerings to attract and retain clients.

Alts going mainstream requires innovation in both technology and asset management

Tech and asset management industry evolutions go hand in hand. Transformation of and innovation in both technology and asset management is what will make alts go mainstream.

Investing in one of the trends reinforces the other. That’s why we do both.

We understand tech innovation and distribution tactics in private markets because we own and invest in asset managers through our ownership of and investment in Cantilever Group, a GP stakes fund built in partnership with BTG Pactual.

We understand the pain points and business needs for asset managers because we invest in the tech that’s making them more efficient and effective through our 21 investments in private markets businesses such as iCapital, Carta, Republic, 73 Strings, LemonEdge, AltExchange, DealsPlus, bunch, Brassica, Allocate, as well as my operating experience as an early, pre-product employee and investor at iCapital helping to build the sales team.

But tech startups and funds purpose-built for private markets require a different skillset and network to succeed.

There are challenges unique to private markets that can make it difficult for an entrepreneur to build a business of consequence without the right ingredients.

What are the challenges with building in private markets?

Companies building technology to service market participants must be built to work with the industry’s largest players.

Scale begets scale: The biggest industry players, like Blackstone, Apollo, KKR, can drive the industry and determine its trajectory. But it can be challenging to figure out how to work with them.

Partnering with the industry’s key players can drive success, but it can be hard to open the door

That’s why we see Apollo incubate companies in partnership with Motive that are purpose-built for private markets, like Vega, and see them take a minority stake in Motive Partners.

That’s why we see Blackstone invest in private markets leaders that are strategic to their business like iCapital, 73 Strings, LemonEdge, Canoe, and others, where they can be customers in addition to investors.

That’s why we see BlackRock invest in private markets leaders like iCapital, acquire private markets data businesses like Preqin and alternative asset managers like GIP, as well as create a partnership with Partners Group on a model portfolio.

Knowledge

Getting the right advice from the right people. It’s great that strategic investors are investing in and helping private markets companies and funds. But these firms aren’t independent. They may have strategic imperatives that don’t always align with the business that a founder is building.

Networks

Getting in front of the right people at the right time and opening the right doors can be challenging unless the founder and team are experienced, networked, and come from the industry.

Education

For funds, education of investors can be one of the most challenging aspects of building a brand and creating a consistent connection with prospective LPs, particularly for funds that don’t have the size and scale of the largest platforms, which can dedicate meaningful resources to marketing, branding, and distribution.

Building the right communications, marketing, and branding strategies to highlight differentiation and edge is critical, but it’s hard to do.

Media has evolved to a place where firms and their executives need to go direct (see Blackstone’s LinkedIn strategy and podcasts), but not every firm is equipped to handle the burdens of building a content business in-house.

Why does private markets need a Studio?

With the distribution revolution being powered by a technology evolution, companies and funds building in private markets require help and perspectives from all angles.

Just understanding enterprise software is not enough. It’s imperative to understand how funds run their firm operations and how wealth channel LPs evaluate and buy private markets investment products.

Just understanding how to run a fund and invest LP capital is not enough. It’s critical to have the knowledge and network required to help build out firm operations and connect with LPs.

We see the trends and transactions in private markets from every angle, on a daily basis:

Operating: Experience operating at one of the leading technology companies in private markets, iCapital, as an early employee, and our experience as a firm at Broadhaven in capital markets means we understand how to build technology solutions for capital markets at the forefront of market structure evolutions.

Investing: Investing early into 20+ companies in private markets, including iCapital, Carta, Republic, Cantilever Group, 73 Strings, LemonEdge, bunch, AltExchange (acq. by iCapital), Allocate, Brassica (acq. by BitGo), DealsPlus, Passthrough, and more, mean that we understand the space and combine the knowledge of the business of asset management with the understanding of the technology required to make private markets go mainstream.

Funds turning into firms: Our minority ownership and strategic partnership with Cantilever Group, the GP stakes firm taking stakes in middle-market asset managers, gives us an understanding of the business evolution of asset managers, as well as a channel for our technology companies to sell into when appropriate.

Advisory: Broadhaven’s independent investment bank has completed over $90B in M&A transaction volume, working on landmark deals in private markets, including Franklin Templeton’s $1.75B acquisition of Lexington Partners, Angelo Gordon’s $3B sale to TPG, a partial sale of Cambridge Associates, Wilshire’s sale to Motive Partners, Russell Investments’ sale to TA Associates, and Cerity Partners’ acquisition of Agility. Most recently, Broadhaven advised AltExchange on their sale to iCapital. Understanding the trends driving industry consolidation and M&A at the top end of the market provides us with the unique ability to help strategically guide companies and funds at any point in their journey.

Media: Distribution and amplification of education, brand, and messaging are critical for funds and companies in private markets to reach the right customers or partners. With 130 podcasts, 79 weekly newsletters written, and over 22,500 collective subscribers and followers across Substack and LinkedIn, Alt Goes Mainstream has helped companies and funds in private markets get in front of the people who matter at the right time.

The AGM Studio: A solution for companies and funds building in private markets

Being in the right room is critical to success in private markets.

The AGM Studio puts companies and funds in the room where it matters.

AGM has built a full-stack solution to help companies and funds build their businesses in private markets.

The three pillars of Alt Goes Mainstream — Content, Community, Capital — all come together with the AGM Studio.

AGM puts companies and funds in the right rooms — physically and virtually — across content, community, and capital.

Content

AGM’s podcast has produced over 130 episodes, which are now organized across four different shows:

AGM’s main show: Conversations with senior leaders in private markets discussing the biggest trends, challenges, and innovations at the intersection of alts and wealth.

Monthly Alts Pulse: A monthly collaboration with iCapital, where iCapital’s CEO & Chairman Lawrence Calcano and I discuss the trends shaping the industry and distribution flows from the perspective of the largest platform in the space.

Going Public: A quarterly show discussing trends and performance from the publicly traded players in private markets in collaboration with top-ranked equity research analyst Evercore’s Glenn Schorr, who has covered the publicly traded alternative asset managers since the early days they went public.

What’s Your Edge: A sponsored show that enables funds and companies to share their story and their “edge.”

AGM’s newsletter has now completed 79 weekly newsletters. The newsletter includes written content, data on the biggest firms in the space, job postings, and links to prior podcasts and newsletters.

Community

AGM has moved from online to offline. Over the past year, AGM has hosted dinners between GPs and LPs, companies and customers.

We’ve also done live podcasts in collaboration with asset managers and industry groups, like we’ve done with former Global Head of Product at T. Rowe Price’s Cheri Belski and Pangea, with Pangea and Schroders, and with CAIA and ALTSLA.

Expect more offline community events and conferences in 2025 to bring together the AGM Community, a collection of senior-level executives across private markets funds, companies, and allocators, together so they can find ways to collaborate and solve the industry’s most pressing issues.

Capital

Broadhaven Ventures has been one of the most active investors in private markets to date, with over 20+ investments into private markets companies that are innovating the infrastructure of private markets from pre- to post-investment.

AGM Studio members have the ability to access capital from Broadhaven Ventures to incubate, build, or scale their private markets company or fund.

The ability to help companies and funds across Content, Community, and Capital means that the Studio is bespoke in its nature.

Every company and fund building for private markets has unique needs at certain points in time. They each have different challenges at various points in their company-building journey.

The AGM Studio is far from a factory. Just as Savile Row tailors like Ozwald Boateng put an immense amount of thought and care into every angle and every thread, so too will the AGM Studio provide the tailored experience required to navigate the challenges of private markets. The Studio is made to measure based on what’s required — and we believe that focus is what will create the most value for founders in private markets.

Our Studio members thus far — Cantilever Group, AltExchange (which we helped from the start all the way through to their acquisition by iCapital), and DealsPlus — have felt the impact.

Who is the AGM Studio for?

The AGM Studio is for both companies and funds. And not just for venture-backed startups either. We believe there are plenty of bootstrapped businesses (like AGM) to be built for private markets.

The AGM Studio is for:

Founders building in private markets tech

Experienced private markets executives who want to incubate or build a business in private markets.

Founders with less experience in private markets who require access to a privates market network and help navigating the space.

Existing founders and companies where AGM can provide specialized and unique access to customers and branding amplification via the AGM Content and Community pillars and where Broadhaven can provide targeted help, intros, strategic advice, and / or capital for growth initiatives.

Fund managers building or growing their firm

Connections: Getting in front of the right LPs.

Content: Educate the market on the fund’s strategy and “edge” / differentiation.

Community: Build relationships with LPs, companies, and other GPs to develop the fund.

Capital: Access capital from Broadhaven that can be invested into the fund as a catalytic LP investment or into the GP to drive business-building initiatives.

We are different

At AGM and Broadhaven, we are different.

We invest our own capital.

We are industry experts.

We help from incubation to exit or IPO.

We have unique content, distribution, and networks.

We can leverage our investments into asset management and services businesses in private markets to accelerate the growth of private markets tech companies — and vice versa.

We are builders in private markets ourselves, having built or helped build Alt Goes Mainstream, iCapital, and Cantilever Group.

The next phase of private markets

We are excited for the next phase of private markets — where innovation across technology and asset managers will unlock more access to private markets in a responsible and thoughtful way.

We have been lucky enough to be a part of building some of the foundational companies in private markets and we are excited to play our part in helping to continue to grow private markets as it becomes more mainstream.

We already have a number of business ideas across various categories of private markets.

If you want to build in private markets and be in the room where it happens, don’t hesitate to reach out or check out the AGM Studio website.

Speaking of websites and speaking of bespoke, this couldn’t have been possible without the incredible and thoughtful work of Zach Hagen and Cassie Braun of Hagen Creative and Ariana Machado. Their ability to balance institutional and irreverent, cutting-edge and a capital markets ethos made for a unique creation. They were the perfect design team to bring the AGM Studio creation to life — to symbolize and enliven the stage of where we are in private markets: a space that is institutional yet innovative and one that is moving quickly from insular to inclusive. I’ve already introduced them to some of our companies because, simply put, they are amazing.