👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from London, where I’ve just returned from a trip to Italy. I started the trip in Rome, where I spoke at the Zero One Hundred Conference on VC / PE in the Mediterranean / SEE, and then ended the trip with meetings in Milan.

My meetings and dinners this past week with industry insiders have surfaced a number of interesting and important trends in the space due to a mix of perspectives from founders, asset managers, LPs, and VCs in the ecosystem.

I’ll start with the dinner I co-hosted with Fidelity International Strategic Ventures in London.

Liquidity, distribution, and digitization were featured on the menu.

We had the founders of 73 Strings, Yann Magnan & Abhishek Pandey, and LemonEdge, Gareth Hewitt, in the room, where they discussed how more modular, real-time middle and back office solutions can improve data capture and analysis for both GPs and LPs. These middle and back office solutions can play a critically important role in feeding back into front office success. Better and more real-time reporting can grease the wheels for liquidity, which can feed into helping LPs more effectively construct private markets portfolio, ultimately leading to future fundraising success for GPs.

We chewed on the concept of liquidity for quite some time. Product innovation, particularly as private markets are unlocked for more investors, is featuring products that are structured with more liquidity as some investors may not want — or be able to handle — the illiquidity of a closed-end fund for 10-12 years. There’s not yet a clear answer to this question. Increased exposure to private markets for more investors should be a net positive, but as Jenny Johnson, the CEO of Franklin Templeton, said on the Alt Goes Mainstream podcast, it’s “all about returns net of fees,” so net-net, let’s see if more structured products end up providing benefits for investors. Not to mention the challenges with the operational burdens for fund managers and wealth managers associated with subscribing, managing, tracking, and reporting on these products.

With Fidelity International’s Global Head of Private Asset Solutions, Nick Haaijman, joining us for dinner, we also discussed the challenges and opportunities around distribution of alts product to the HNW channel. Traditional asset managers and GPs all have this top of mind. Technology innovation will go a long way in enabling product manufacturers to create the right products for the wealth channel, but we are still very much in the early innings of GPs and asset managers understanding what the wealth channel wants from a product and structuring standpoint and how to best educate and distribute their products through this channel.

A similar topic was covered at the Zero One Hundred Conference on VC / PE in the Mediterranean. The question du jour was how can VC and PE can grow its size and scale in Southern Europe.

With Hamilton Lane’s Head of Italy, Anastasia Di Carlo, on the panel, both her and I cited the fact that private wealth, particularly the banking channel, has a major role to play in growing the ecosystem. As more private banks look to enable their clients to access private markets, they can be an enabler of capital flows into the ecosystem by backing local or regional funds who look to fund companies in the region. This has particularly high potential in Italy, where the private banks are increasingly involved in working with private equity funds and investment platforms providing access to PE and VC funds.

Institutional investors have a role to play in increasing the size and scale of private markets in Europe. That’s been a major topic of conversation in parliamentary chambers across Europe — and it’s making a big difference. Take the UK’s Mansion House Compact calling for pension funds to play a bigger role in funding the private sector. Strong pushes by political leadership is making an impact on institutional investor participation in growing VC ecosystems. But private wealth also has a role to play, an increasing one at that, and that became clear in conversations on stage, in meeting rooms, and at dinners over the past few weeks here in Europe.

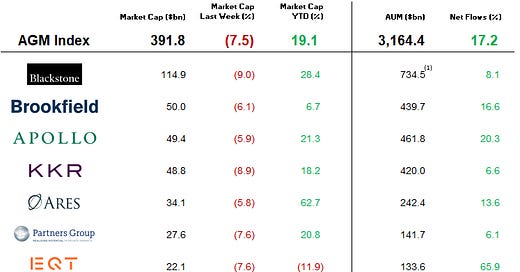

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable

.

AGM News of the Week

Articles we are reading

📝 General Catalyst in German VC Tie-Up as Part of European Tech Push | George Hammond, Financial Times

💡VC M&A rang in some big news this week in Europe. General Catalyst, a $25B AUM multi-stage VC firm, acquired La Famiglia, a Berlin-based $360M early-stage VC fund to expand their footprint on the ground in Europe beyond its own team already based out of London. La Famiglia has invested in a number of well-known early-stage European startups including generative AI company Mistral and defense group Helsing. Terms are being finalized, and the deal is expected to close in early 2024. La Famiglia has raised more than €250M ($264M) this year from family offices and companies behind brands such as Swarovski, Adidas, and Estée Lauder to invest in early-stage startups. General Catalyst, which has invested in Europe for more than a decade and opened a London office in 2021, believes that seed is a local game, so they’ve opted to partner with a local firm rather than follow in the footsteps of other peer firms who have set up offices in the region. “Seed investing is a local business and you have to be set up to interact with the founders,” said General Catalyst CEO Hemant Taneja. La Famiglia co-founder Jeannette zu Fürstenberg said, “Europe has always had really strong innovation at its heart. We’ve driven innovation but been so bad at marketing it and capturing the value from that. Now some of [that value] is coming back.” Zu Fürstenberg, a hereditary princess descended from a prominent family of German industrialists, is among the La Famiglia partners that will join General Catalyst’s investment team. Europe has produced a number of high profile startups including financial services companies Revolut and Klarna and music streaming platform Spotify. Although capital inflows into the region dropped precipitously over the past year, US investment firms continue to expand in Europe. Andreessen Horowitz plans to open its first office in London this year, joining Sequoia Capital, Accel, Bessemer Venture Partners, IVP, and others who have added boots on the ground. US investors spent €51B in European venture deals in 2021 compared to less than €3B in 2011.

💸 AGM’s 2/20: Seed and early-stage investing is very much a local game, particularly in a region like Europe whose local regulations and coterie of cultures can make investing across the ecosystem a difficult task for those not on the ground. This point has been hammered home from the conversations I’ve had with VCs, LPs, and fund of funds in the region. Seed is generally dominated by the local players on the ground who have the right networks, brands, and understanding of the local ecosystem to source deals early and help companies navigate the initial challenges of starting a company. That’s why General Catalyst acquiring a local firm in La Famiglia could end up being a smart move. It’s very hard to do a good job of covering the European market from Silicon Valley. In my view, either sector experts can invest from abroad if they can bring the right product knowledge and expertise or US based funds should either invest in a local team as a LP for deal sourcing or acquire a local fund. GC’s acquisition of La Famiglia is important for a few reasons: (1) it shows that US funds are very much taking the European ecosystem seriously. This move affirms that US funds want to do what they can to make sure they can access dealflow in Europe because they understand that successful regional and global companies can be built in the region. (2) it signals the start of the trend of bigger asset managers thinking strategically about their business to become either multi-sector or multi-stage via acquisition. I believe that this news is foreshadowing of more acquisitions of earlier stage VC funds by larger VC platforms, particularly in an environment where fundraising is a strong headwind for those who are less established or who don’t have long-standing LP relationships. It will be interesting to see if the GC strategy of acquiring a local team will win over the Sequoia, Bessemer, IVP, QED, et al strategy of hiring a team on the ground. Whichever model ends up being successful could have an impact on how larger US VC platforms approach Europe going forward.

📝 Asset managers hunt for private markets talent | Selin Bucak, Citywire

💡Traditional asset managers continue to turn a focus to private markets. Many firms initially made acquisitions in a bid to expand their private markets capabilities. Now, they are looking to hire talent in order to organically grow their alternatives strategies. A Citywire study found that 13 of the largest 25 traditional asset managers globally have made acquisitions in the last six years to add to their private markets product lineup, but many of those same firms are also looking to hire teams to expand their investment teams. Wellington Management, the $1.4T asset manager, is taking the approach of building out in house teams for private markets. As Wellington continues to invest in the growth of their private markets business, they are looking to possibly build out capabilities internally by hiring teams for strategies like infrastructure debt and real estate debt. “We’ve been actively building capabilities looking for any opportunity. So far, the growth path has been to hire mostly individuals that we think we can connect and combine, form high-functioning and diverse teams,” Shanna O’Reilly, co-head of private investments at Wellington, told Citywire. Product structuring and distribution are unsurprisingly top of mind of asset managers looking to grow their alts businesses. Gad Amar, Head of Western Europe and Switzerland at Natixis, said there is also significant competition for structuring expertise, as he noted: “once you start solutions and ways to distribute, you cracked the code.”

💸 AGM’s 2/20: The entire value chain matters when it comes to bringing alts to the wealth channel. As the race to provide alts to the HNW community heats up, asset managers recognize that it’s not just investment capabilities that will lead to winning results. Yes, performance is what matters at the end of the day (as it should), but the ability to effectively distribute investment products to the wealth channel requires specific skillsets and an understanding of both the customer and operational burdens associated with private markets. In talking with a number of the large asset managers, it’s clear that they have put building out the right — and educated — distribution teams at the top of the priority stack. There are certainly similarities to the growth of ETFs, where education and product structuring was paramount as asset managers had to prove the merits of why investors should buy those products. But it appears that many asset managers also recognize that selling alts into the wealth channel requires a deep understanding of not only the merits of different alts products, but how and why they should fit into overall asset allocation. This skillset means salespeople must have a true understanding of private markets, making it a challenge to find talent. So it’s not a surprise that many asset managers are very focused on getting the right people in the room to build the products, invest into private markets, and educate and distribute these products to the market. The competition for talent is quite real — and that’s not irrespective of geography. I’ve had a number of conversations in Europe recently with senior leaders across asset managers and alternative asset managers who have referenced the importance of bringing on talent that understands the complexities of working with wealth managers and family offices. The takeaway? They know it’s not easy, but it’s worth investing in the right talent to build teams to work with these channels because they know it’s a growth area for them.

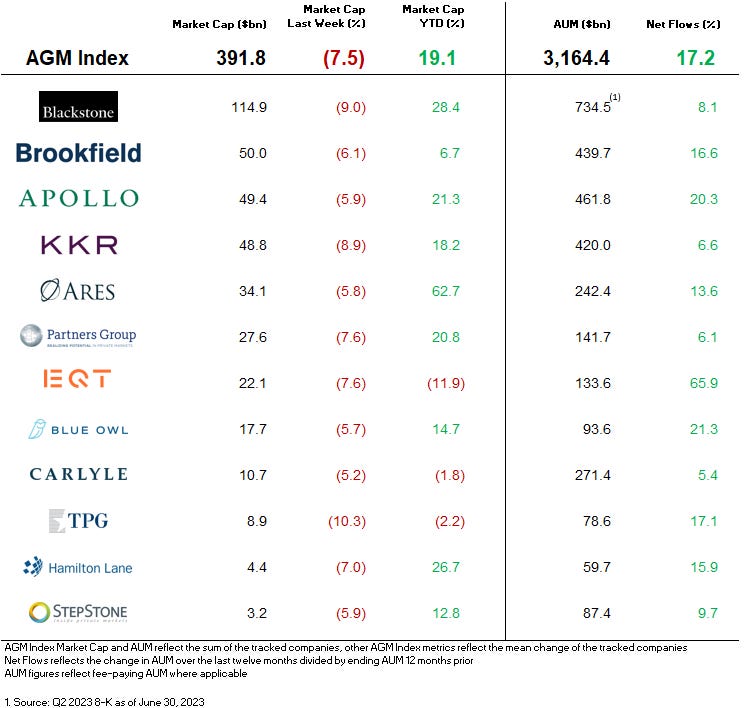

📝 VC Fundraising on Track for 67% Decline With Little Relief in Sight | Marina Temkin, PitchBook

💡 Marina Temkin from PitchBook reports that venture capital fundraising is pacing to close the year with $57B — 67% below the 2022 record. "[The] venture fundraising environment has been one of the worst in the first nine months of this year that we have seen in the past decade," said Brijesh Jeevarathnam, Global Head of Fund Investments at Adams Street Partners, an LP in many VC funds. "After [a] sluggish four, five months, things are picking up for the next six to 12 months." An increase in activity, however, doesn’t imply that total VC fundraising will be more robust in 2024. Kirsten Morin, Co-Head of Venture Capital at HighVista Strategies, said that VC funds are unlikely to raise more capital next year than they are this year. "It takes a certain conviction and confidence for a manager to come back for capital in this environment," Jeevarathnam said. LPs are more likely to back new vehicles in firms that have consistent and strong historic performance. After years of positive double-digit returns, one year IRR for VC plunged to -18.4% in Q4 2022, recovering only slightly to -16.8% in Q1 of this year. Increasingly, LPs are also pushing managers for cash returns — which will be difficult for newer managers to reach. "Paper gains can help raise the first successor fund, but by fund three, we typically expect to see some demonstrable returns on a realized basis," Morin said. She added that during the later years of the boom cycle, many emerging managers received a "hall pass" on cash returns when raising their third or fourth fund, but LPs will now hold them accountable. Many funds won’t fundraise until they have more significant cash returns (distribution to paid-in, or DPI), according to Beezer Clarkson, a Partner at Sapphire Partners. Exit activity is on track to be the lowest in a decade. “I’ve seen firms push [their fundraising cycle] from every two [years] to four years,” Clarkson added. Although it creates a difficult fundraising environment for GPs, Morin believes this is a net positive for the industry. "The breakneck pace of fundraising we observed in 2021 and 2022 wasn't healthy for the industry," she said. "GPs have rediscovered the value of vintage year diversification, and they've adjusted their capital deployment pace more in line with historical norms.

💸 AGM’s 2/20: Venture capital is coming off a fundraising high boosted by a bull market and low rates. Reality has set in — for both GPs and LPs alike. While painful in a number of ways for everyone in the ecosystem, companies, funds, and LPs, many LPs view this correction as a healthy reset. The pace of fundraising was unsustainable, which cascaded down to fundraising rounds. Round sizes got bloated, particularly at seed stage. This created a challenging dynamic for both companies and funds (and LPs) alike. Funds, many of which had become bigger, were forced to deploy larger initial checks to make the math on fund size work. The challenge? Exit outcomes. At the peak of the market, companies were getting funded at revenue multiples that were unsustainable, in hope that they could trade at exit for healthy multiples. With a major correction in public markets, companies are trading at much lower (and more reasonable) multiples. This means that exit outcomes have been more muted and the likely exit outcomes going forward appear to be lower. A $1B exit outcome will likely once again be a less common. This could spell trouble for many funds in recent vintages whose ownership sizes or entry valuations require bigger outcomes. This means that funds will have to be very cognizant of portfolio construction and fund math if they want to achieve a very challenging, but possible 3x net outcome. What’s interesting is that anecdotally I’m still seeing a number of seed rounds at $5M+ round sizes. In most cases, this is resulting in valuations that are clearing $20-25M pre-money on rounds of this size. For smaller funds, entry valuations at this quantum will be quite difficult to drive returns. The shifting landscape requires both LPs and GPs alike to think hard about the fund size and accompanying portfolio construction that will drive successful fund returns. Smaller funds will likely have to focus on even earlier seeds, trading off higher risk for lower valuations. Funds who can find $5-10M entry valuations should be able to find 1-2 companies that drive a fund’s returns if the fund is sub $50M. Some LPs are cognizant of this reality and focus on emerging managers. The next question is how do new entrants to private markets, and the wealth channel in particular, gain access to funds that can generate strong returns but may be more unproven or of smaller size? There are a number of funds and platforms creating solutions to address this challenge — and the ones who do so successfully could be rewarded by the time these vintages are all said and done.

📝 How Institutional Investors Are Reacting to De-globalization | Michael Thrasher, Institutional Investor

💡A Schroders survey of 770 pension funds, insurers, sovereign wealth funds, and other investors finds that the acceleration of de-globalization means an investor’s home country is a far bigger factor, and it’s impacting decisions in different ways. Michael Thrasher of Institutional Investor provides a fantastic analysis of what the de-globalization trend means for markets. Out of 770 institutional investors around the globe that are collectively responsible for $34.7 trillion in assets, 52% said in June that as de-globalization accelerates they will try to invest in companies with more localized supply chains, according to an annual study by Schroders. As it relates to private markets, almost half the institutions (49%) cited that they were seeking more opportunities in private markets and alternative investments in order to get exposure to technologies that are driving productivity. Included in this is artificial intelligence, which could be a driver of continued capital flows into private markets. While investors didn’t have a consensus view on what asset classes will represent the best investment opportunities, a number did cite private equity as an attractive investment. 22% said private equity and 24% said infrastructure and renewables. “Around the world, we are seeing a huge surge in the energy transition as nations move from fossil fuel reliance to greener energy sources. Countries are likely to rapidly accelerate the decarbonization of power generation as emissions need to fall by more than 40 percent in the next seven years as a vital step toward meeting net zero requirements by 2050,” Schroders said in its report. “The shift to net zero emissions represents a new key structural trend for the global economy. It will require a radical change in the energy system and in other key sectors of the economy.” This data bodes well for private markets, as much of the value creation for these types of investments will occur in alternatives. Now, it’s up to the GPs to find the right opportunities and the LPs to pick the right managers.

💸 AGM’s 2/20: Private markets can be an engine for growth. Despite a challenging geopolitical landscape that only appears to be becoming more difficult to navigate by the day and a trend of de-globalization, private markets can represent an opportunity for investors to direct capital into innovation that can enhance productivity and drive value. It’s interesting, but not surprising, to see that climate is weighing heavily on the minds of investors. It appears that there’s a consensus that the amount of capital required to transition to net zero emissions is a massive trend, which will result in a big investment opportunity. In the VC world with regard to climate investment, there is a question of how much capital is too much capital to generate returns for investors. The space requires significant investment, which is good and absolutely necessary if we are to transition to a clean energy economy. But investors will also have to ask themselves how to best generate returns in this space. Another thing is clear — both GPs and LPs would do well to understand geopolitics in this rapidly evolving landscape. Surely, innovation occurs in every market and every cycle irrespective of broader macro forces, but I do believe that more than ever investors must take geopolitics into account when thinking about sectors, asset classes, and regions to invest into.

📝 British Billionaire Jim Ratcliffe Nears Deal to Buy Minority Stake in Manchester United | Ben Dummett, WSJ

💡It wouldn’t be an AGM Weekly without a bit of football news — especially when I’m in Europe. Another high profile sports-related deal may materialize in the near future, this time with one of the world’s biggest football (soccer) clubs. British billionaire Jim Ratcliffe is in exclusive talks to acquire a minority stake in Manchester United after Sheikh Jassim Bin Hamad al-Thani, Chairman of Qatar Islamic Bank, dropped out of the process. The proposed terms call for Ratcliffe to acquire 25% or more of Manchester United’s NYSE-listed nonvoting shares, which is equivalent to the amount of voting shares held by the much-maligned Glazer family. The team’s brand is valued at $1.4B, according to consulting firm Brand Finance. The price per share, while not specifically announced, will be a significant premium to Friday’s close of $20. If a deal is reached, Ratcliffe would oversee team operations and talent acquisition, while the Glazers would remain in charge of the commercial side of the business. The Glazers effectively invited bids for all or part of the team almost a year ago as part of a strategic review of the English Premier League soccer club. The move followed a tumultuous tenure of close to 20 years that had seen beleaguered fans turn against them and mount regular protests calling for the Glazers’ exit. Other recent sports transactions include an investment group led by private equity titan Josh Harris acquiring the NFL’s Washington Commanders for over $6B in April 2023 and an investor group led by Todd Boehly acquiring Manchester United rival Chelsea Football Club for $5.2B in May 2022. Ratcliffe made an unsuccessful effort last year to buy Chelsea in the same process that resulted in Boehly-led consortium ownership. Manchester United, which has won a record 20 English league titles, is considered one of the most widely known global sports brands. The team has not won the Premier League since 2013 — Ratcliffe will aim to reverse that trend while continuing to grow Manchester United’s brand off the pitch.

💸 AGM’s 2/20: Yet another massive global sports brand looks to be receiving meaningful investment. This possible move continues the trend of private equity funds and UHNW investors viewing sports teams as hugely valuable global entertainment brands. Manchester United, with a global reach, participation in arguably the best league in the world, and a brand value of over $1.4B, certainly qualifies. A theme that was hammered home in a meeting I had with another top global sports brand this past week in Europe was that these clubs see the globalization of sport as a big opportunity to bring in fans from other parts of the world. There are teams who are heavily invested in professionalizing the business side of their operations in order to go global. Teams certainly cannot forget about their home city and home country supporters. Without them, their community would lose meaningful value. But there’s a certain set of clubs, and an increasing number as more private equity money comes into sports, who are bringing in highly experienced Chief Commercial and Chief Revenue Officers as they look to partner with sponsors who can reach global audiences and resonate with fans around the world. This also has an impact on the sporting side when done well. The players are able to build their brand with a bigger audience, which can serve as a way to attract players to the club. We have all seen the recent impact of Messi in the MLS, so it’s clear that the sport and business sides are inextricably linked as more fans want to follow players, in addition to teams.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fourth episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.