AGM Alts Weekly | 10.6.24: GP stakes - a maturing market?

AGM Alts Weekly #72: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Designed with GPs at heart and LPs in mind, the bunch operating system, coupled with an advanced workflow management tool, is designed to streamline and automate cumbersome back-office processes and become the single source of truth for you to collaborate with your service providers.

With over 50 fund clients and $3 billion in committed transactions across five jurisdictions in Europe, bunch has a proven track record of freeing up valuable time for fund teams by taking over the fund administration so you can focus on what truly matters: maximizing returns and enhancing the LP experience.

Good afternoon from London, where I’m in town to speak at the Preqin Future of Alternatives conference and to interview Blackstone’s Global COO of Private Wealth Solutions Todd Myers on the growing presence of the wealth channel in private markets at a fireside chat hosted by the Finimize team at their parent company, abrdn’s, office.

Earlier this week, I moderated a GP stakes panel hosted by Capricorn Investment Group (thanks Capricorn CIO Bill Orum for the invite to moderate). Capricorn is a $10B sustainable investment platform serving families, foundations, and institutional investors for over 20 years as a full-service OCIO and investment platform.

Capricorn’s construction of the GP stakes panel was perhaps a viscerally visual signal that the GP stakes space has matured beyond a cottage industry within private markets where the majority of the strategy’s capital has historically been aggregated in investments into the industry’s largest alternative asset managers.

The panelists were seated in an order that showcased the spectrum of different GP stakes strategies, from working with earliest stage fund managers to owning parts of the largest firms in the industry. To my immediate left was Pamela Pavkov from TPG Next, a seeding strategy for first-time fund managers within TPG’s broader platform. Then was Bill Orum from Capricorn, a middle market stakes specialist focused on funding firms with sustainable finance strategies. Then was Mark O’Sullivan of Blue Owl, the market leading upmarket stakes firm (and has also recently launched a middle market strategy).

A maturing market

Different flavors of GP stakes strategies are beginning to emerge. Allocators will begin to take note.

The takeaway for allocators? They can now begin to approach GP stakes on the spectrum of risk / return, much like any other part of private markets, and construct a portfolio of exposure to the GP stakes asset class across fund size and strategy to gain exposure to the different trends in the space.

Much of the capital raised for GP stakes investing to date has agglomerated into the largest funds, which has in turn been invested into the industry’s largest privately held alternative asset managers. Over 95% of the $60B raised by stakes funds resides in four firms: Blue Owl, Blackstone Strategic Partners, Goldman’s Petershill, and Wafra.

That phenomenon will likely continue to persist. If data from Blue Owl is any indicator, in virtually every strategy within private markets, the top 10 funds raise the lion’s share of the capital.

I’d expect the same to occur in GP stakes. However, I also anticipate firms focused on the middle- and lower-middle market and in specialized categories or themes will begin to emerge as more popular strategies.

Historically, many LPs have allocated to a single GP stakes fund, likely using that single firm and its corresponding strategy as their sole way of accessing GP stakes exposure.

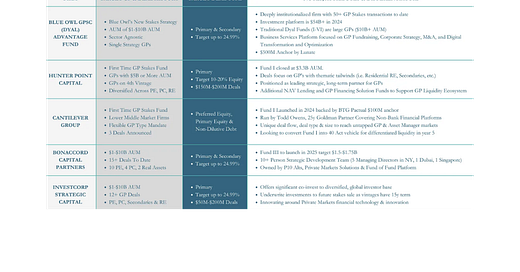

That is changing as more GP stakes funds look to focus on partnering with middle market alternative asset managers. The below slide is from Ryan Weisenberg and the team at Crest Capital Advisors, a wealth management firm affiliated with Hightower that invests in GP stakes funds and has a practice focused on working with General Partners on managing their wealth. This market landscape slide would have been much more sparse a few years ago.

An evolving allocation strategy in GP stakes

As I listened to the panelists’ comments, I began to wonder: now that there are more GP staking options in each segment of the market, is there a different way for LPs to think about their allocation strategy to the GP stakes space? Should LPs be thinking about allocating to different strategies as a way to gain exposure to specific types of risk and return profiles, just as they would in other strategies or markets, such as public equities (large-cap, mid-cap, small-cap) or private equity (buyout, middle-market, lower-middle market, growth, venture)?

Seeding managers is more akin to a venture-like investment. There are team / founder risks, and there’s an unknown as to the type of firm a manager will build. Firms like TPG Next can help lessen some of the challenges of starting a firm, particularly when it comes to raising capital for the first time. Access to networks and knowledge are key at this stage – and a seeder like TPG Next provides the platform that can serve as a launching pad for a manager to start and grow their business. There’s venture-like risk, but also the potential for venture-like upside.

Investing in the lower-middle market is a pathway to creating both a broadly diversified portfolio, since even capacity-constrained strategies that can’t achieve scale needed to make an investment work for a larger GP stakes fund can have a good outcome via yield and / or exit. And, a less correlated exposure to capital markets and interest rate cycles than other types of private markets investments. Lower middle market and middle market GP stakes funds like Blue Owl’s Advantage Fund, Hunter Point Capital, Cantilever, Kudu, Bonaccord, Invstcorp, Azimut, Armen, and others are focusing their attention in this relatively untapped, but burgeoning part of the stakes market that has a supply / demand imbalance between capital raised and number of funds that could consume minority GP stakes investments.

Investing in a specific category, like decarbonization, requires particular expertise and networks. There’s also an ecosystem play that can be required to make a space function better, which is why a specialist firm like Capricorn has chosen to invest across the value chain of different types of managers (equity, credit, infrastructure) that all have to be built in order to develop the financing market for a megatrend like the energy transition.

Investing in the industry’s biggest privately held alternative asset managers is like investing in blue-chip companies. These companies are often profitable, with incredibly high EBITDA margins (50-60%), which generally enables the GP stakes firm to provide a cash yield to investors due to the cashflows from the manager. Blue Owl has invested in many of the industry’s top firms. Those firms are not only highly efficient businesses, but they are also the firms that are able to grow their AUM in organic and inorganic methods that are often unavailable to smaller firms. Here, scale begets scale. Many of the firms in the upper end of the market are ushering in the trend of industry consolidation to add more strategies to their one-stop shop platform, add AUM, and expand their LP base or geographic reach.

Shining a spotlight on what’s next

These scaled firms are emblematic of the evolution of alternative asset management. Alternative asset managers used to account for only a small portion of financial services market capitalization in public markets in 2014, representing 4% of the $2.3T 2014 aggregated market cap figure. Today, the publicly traded alternative asset managers represent 12% of the current $3.4T financial services market capitalization, a 5x increase from 2014, as this chart from Apollo’s recent Investor Day illustrates.

With private markets only increasing in size, alternative asset managers, large and small. stand to benefit from growth in the market.

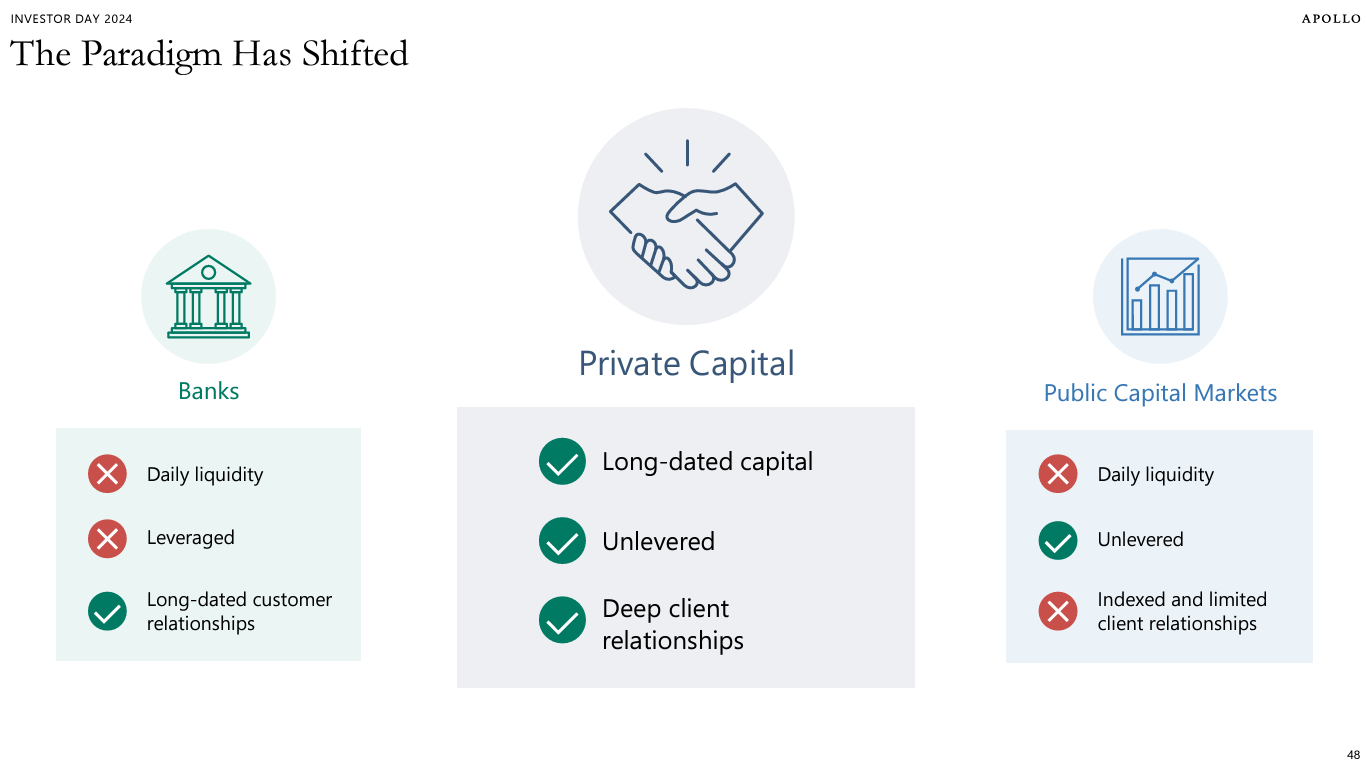

Why are private markets growing? In part because there’s increased interest in the various asset classes. But a bigger change is afoot. In the new world order of investing, investors must now rethink the interplay between public and private.

Some major structural shifts and secular trends are rearchitecting how portfolios should be constructed.

Apollo’s Investor Day presentation does well to shine a spotlight on these changes.

Let’s dig in.

A new world order

After watching (and re-watching / listening — it’s worth every second of the 20 minutes on YouTube) Apollo CEO Marc Rowan’s talk at the Norges Bank Investment Management Investment Conference earlier this year, it was hard not to think of what it means if the game on the field has changed.

In the 5.5.24 AGM Alts Weekly, I wrote:

The game on the field has undeniably changed. The playbook that has worked in the past will very likely not work in the future. A fresh game plan for a new world order in investing is required. The question is how will allocators adapt …

Marc is effectively asking the question: “How do we have success as investors when a series of things no longer exist?”

This thought experiment is one of the most important questions those in private markets on both sides of the GP / LP table can answer.

The new financial market structure that Marc details could very well be the most significant shift in our lifetimes for the next era of investing.

No longer is it just about proponents of private markets wanting alts to become more mainstream. Alts might have to go mainstream to provide many investors with both returns and diversification in a new world order.

This past week’s Investor Day presentation by Apollo shared some answers.

Things that were once the case about public markets no longer hold true.

Indexation and correlation have defined recent times in equity markets. Just ten companies equate to 36% of the S&P 500. And the S&P 500 is 85% of total market cap.

These figures about the S&P and public companies become even more profound in the face of a shrinking public company universe. Apollo’s presentation illustrates the steep decline in the number of public companies, a 42% decrease from 1998 to 2023, coupled with a sharp rise in indexation.

These datapoints only create a retirement issue that becomes even more acute as people live longer.

With 11,000 Americans turning 65 every day and a 40% increase in the number of people age 65+ over the next 25 years, Apollo believes that that “Silver Tsunami” hasn’t even yet hit fever pitch.

Yet, while more people are heading towards retirement every day, they appeared to be ever less prepared for retirement age. Apollo’s presentation highlights three alarming statistics about America’s retirement crisis:

75% of retiree households have income below $75,000.

~50% of American workers do not participate in a retirement plan (as part of the structural shifts in this market and the changing nature of the employer / employee relationship).

1/3 of pre-retirees are concerned about running out of money in retirement.

The result? What Apollo estimates to be a ~$4T retirement savings gap in the US.

The market expands by orders of magnitude when taking into account the global retirement crisis. Apollo estimates this to be a $45T total addressable market.

Meeting the moment

The problem set has been laid out. So, what’s the solution?

A re-architecting of definitions that reshape the way investors think about public and private, according to Rowan and Apollo.

Words matter, particularly when it comes to educating the increasing number of investors that are newer to private markets.

Apollo’s term for this shift from public to private? Replacement.

Risk, return, and liquidity are all going through an evolution in this market to the point where Apollo and others view private markets as a capable replacement for their more liquid, public counterparts.

Why?

The excess return that private markets can provide becomes crucially important in the context of the retirement challenge that populations face, as illustrated above.

Apollo sees private credit and private equity as “replacement” products that will be the vehicle that enables investors — institutional and individual — to generate the return targets they require.

Why now? The liquidity convergence and the shift from public to private to hit return targets are creating a new framework for portfolio construction.

Just how marked is this shift in allocations? Apollo believes it could well shift to 50/50.

Apollo’s Stephanie Drescher said it last December in her predictions for private markets in 2024 on Alt Goes Mainstream for what a new model of portfolio construction could look like:

In 2024, we believe that alternatives will continue to see increased adoption among wealth investors as a means of alpha generation amid higher rates, high inflation, volatile and correlated public markets, and headwinds around the traditional 60/40 portfolio. We believe that alternatives are defined as simply an alternative to publicly traded stocks and bonds, existing from IG credit to equity. As education around the role that alts can play in portfolios continues to increase, we expect alts strategies to resonate with investors and their advisors.

Continued investment in product innovation, technology, and education to create bespoke products tailored for the wealth channel with customized structures and access points as well as varying levels of liquidity will also be a key theme in 2024. We believe that managers who are investing for the long-term by developing a suite of offerings across asset classes will see stronger AUM growth vs. those focusing on single products.

We continue to believe that we are on a trajectory where alternatives in our definition could make up 50% of individuals’ portfolios in the next five years (author emphasis), driven by momentum in areas such as fixed income replacement, IG private credit, equity replacement, and real assets, not just higher-octane private equity and venture offerings that have historically been associated with alternatives.

Finally, as many expect continued volatility ahead in 2024, we may see greater dispersion in performance among managers and in certain asset classes like credit where those favoring senior secured, downside-protected portfolios will be better positioned to achieve outperformance.

Drescher’s predictions from earlier this year were illustrated in a slide in Apollo’s presentation.

A 50/50 portfolio? Perhaps it doesn’t seem as far off as it might have a year or two ago. This point could hold even more importance when one thinks about what needs to be financed with private markets — private credit (or “credit that is private”), private equity (or “equity that is private”), real estate, infrastructure, and real assets.

A new era, a new need

In a “new era,” there’s a new need. Financing megatrends such as the energy transition, digital and physical infrastructure, and AI and automation require a new way of thinking about portfolio construction and asset allocation.

So, perhaps it will take a shift in asset allocation to create this shift in capital allocation to trends, companies, and infrastructure that have a great need for financing in today’s world.

And, speaking of replacement, to tie things back to GP stakes, perhaps GP stakes investments can replace — or at least complement — other ways of gaining exposure to private markets since they provide investors with flavors of credit / yield, equity upside via ownership of carry and exit potential, and diversification across geographies and strategies all in a single solution.

As alternative asset managers prove to be a robust business model — as shown by their results in both public and private markets — they are taking on an increasingly important role in financial markets.

It’s right time, right place for alternative asset managers to become an even bigger part of the financial services ecosystem as they appear to have what’s required to meet the moment.

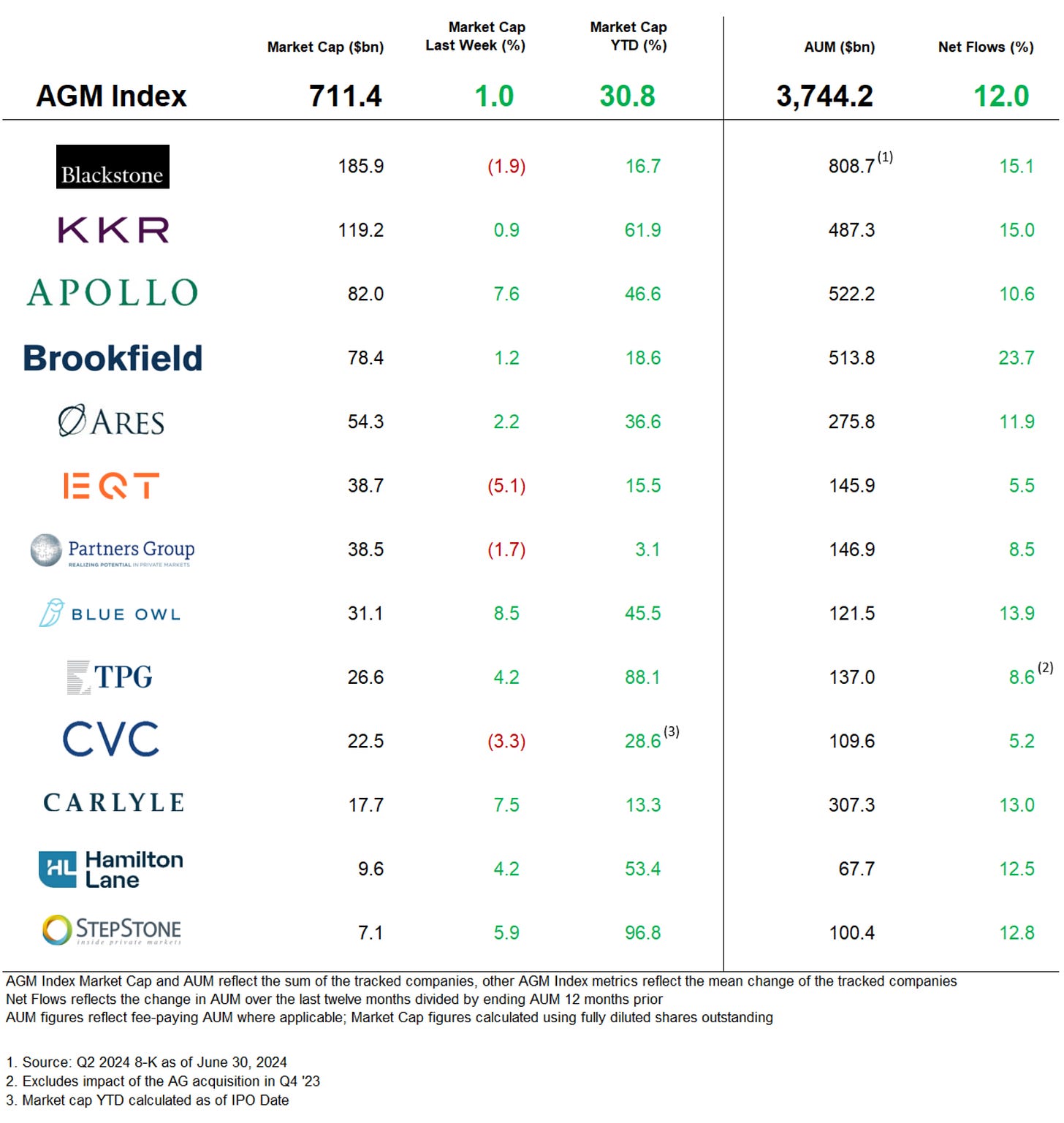

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 JPMorgan invites direct lending partners in continued private credit push | Olivia Fishlow, PitchBook

💡PitchBook’s Olivia Fishlow reports that JPMorgan will look to partner with a group of private credit lenders to invest side-by-side on its deals in exchange for fees. JPMorgan, which has set aside $10B of its own balance sheet to invest into direct lending, is amongst the industry’s largest banks that are looking for ways to take part in the growth in private credit. JPM will provide its origination capabilities to the lenders, sharing direct lending opportunities in non-sponsor backed companies (as opposed to private equity-owned companies). Partners in this arrangement include FS Investments, Cliffwater, and Shenkman Capital Management, amongst that have yet to be announced. This partnership continues the theme of bank and credit manager collaboration. Just last week, Citi announced a $25B private credit partnership with Apollo. Earlier this year, Wells Fargo announced a $5B partnership with Centerbridge.

JP Morgan’s Global Head of Credit Financing and Direct Lending Jake Pollack captured the sentiment of the moment in an August 8 podcast, saying: “In particular, the lines between competitor and client have blurred and the reality is that in many cases, some of our best clients in one area are also competitors in others, and that’s okay, right?”

💸 AGM’s 2/20: Frenemies out of necessity. That was something I noted in last week’s 9.29.24 AGM Alts Weekly when characterizing the rapidly evolving competitive landscape of private credit. This multi-polar private credit market structure makes things increasingly complicated, but there will still be lines in the sand, mainly due to regulations. Banks will likely have to focus more on leaning into their strengths: network and deep capital markets relationships with businesses that enable them to be origination partners for private credit firms. Apollo’s landmark $25B partnership announcement with Citi for increased access to origination flow illustrates that even a firm that has built a unique and proprietary origination channel (below) is looking for more origination channels. It’s worth noting that Apollo’s partnership with Citi comes after they announced another partnership with with BNP Paribas.

Origination is key in a world where private credit is an ever-expanding universe. As banks continue to grow their involvement in private credit through origination, other corners of the private credit market will move into focus. Banks are not natural owners of some of the private credit risk on their balance sheet, and certainly not in the equity tranche of a company, so I imagine we’ll see increased activity in the SRT (“synthetic risk transfer”) space.

SRTs have been a more commonplace way for banks to transfer or offload risk from their balance sheets to other investors. Funds like Pemberton (backed by Legal & General) and Chorous (recently received a 16% minority investment from GP stakes fund Armen) have grown to meaningful size and scale in Europe, with Pemberton exceeding $20.5B AUM and Chorus growing to over ~$3B AUM, respectively.

SRTs hit record highs as European banks have looked to SRTs to boost profitability ratios. Global SRT issuance crossed $9.5B in the first half of 2024, compared to $7.2B in the same period in both of the previous years, according to Chorus.

As banks begin to play an increasingly prominent role in the private credit market in the US, I expect to see SRTs become a bigger part of the US credit ecosystem.

📝 Fidelity Raised Its First VC Fund — But Don’t Call It an Emerging Manager | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher reports on the news that Fidelity Investments raised $250M for its first-ever venture capital fund. But don’t call the fund an emerging manager, the fund manager in charge of the portfolio says. Fidelity, which has over $5.5T in discretionary assets, has been investing in growth-stage companies through some of its mutual funds for the past 15 years. At least half of Fidelity’s mutual funds own shares in at least one private company. Thrasher notes that this is in part due to the secular trend that companies are staying private longer. A few such examples are Fidelity’s investment in Facebook in 2011 at a $61B valuation and Spotify in 2012 at a $4B valuation. Karin Fronczke, the Portfolio Manager of the Fidelity Venture Capital Fund I and the Global Head of Private Equity at Fidelity, told Institutional Investor: “We’ve been doing this for a long time, we’re quite good at it, and we feel we should be allowing our customers pure-play access to these companies instead of just access in small portions within our public mutual funds. That’s kind of how we arrived at working on the fund and eventually launching the fund this year.” Fund I, which raised capital from HNWIs, family offices, and wealth management firms, will make direct, minority investments into mid to late-stage private companies globally. The fund has reportedly already invested $31M of capital across sectors, including SpaceX, CoreWeave, Anduril, and other companies in aerospace, defense, AI, data, and e-commerce companies.

Despite its size and scale, Fidelity only manages about $18B in private companies. Fronczke acknowledged that “it’s a drop in the bucket as a percentage of our AUM” but that “it’s crucial to our investment process. We have to understand what private companies are up and coming to disrupt the world? … How are all of these AI companies disrupting enterprise software? It is a key piece of our strategy.”

💸 AGM’s 2/20: Fidelity’s push into private markets shouldn’t come as a surprise for a few reasons. One, the trend of private companies staying private longer makes it harder to access the large pool of companies in public markets, which poses a threat to both diversification and returns in their mutual fund vehicles. Two, traditional asset managers are looking for ways to expand their business into private markets, in part due to fee compression in their traditional asset management businesses and in part due to client demand, particularly as the wealth channel becomes a more prominent investor in private markets. Fidelity, with $5.5T in discretionary assets, also made some notable statements in their press release about the launch of this venture fund and about their alternatives capabilities. They mentioned that they “manage a range of alternative investment vehicles, including private equity, private credit, real assets, liquid alternatives, and digital assets. Fidelity Investments’ alts lineup includes 50 funds, including funds for eligible investors and funds available to the firm’s investment team for portfolio construction, totaling $27.8B in AUM.” Fidelity also noted that they are a leading provider of custodial services of more than 5,000 alternative products to its institutional and intermediary clients and more than $80B in alternative investments under administration.”

Actions and words signal intent. These actions and words by Fidelity tell me that this is just the start of a bigger push that they will make into alternatives, both on the custody and investment side. They could look to partner with alternatives firms on products, just as Apollo and their Boston neighbor State Street have done and how KKR and Capital Group did earlier this year. They could manufacture and build themselves, as they are doing here with this venture fund and as they did with digital assets custody, as Tom Jessop, now President of Brokerage at Fidelity, came on the Alt Goes Mainstream podcast to share Fidelity’s work in digital assets. They also acquired Shoobx, an equity management platform, to create Fidelity Private Shares, an all-in-one equity management platform, which represented their first acquisition in seven years at the time of the transaction. Historically, Fidelity has been inclined to build rather than buy or partner. It will be interesting to see if private markets, which represent their own set of unique challenges and competencies, proves to lead them down a different path or if they decide to build as they’ve done in the past.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Marketplace - Vice President. Click here to learn more.

🔍 KKR (Alternative asset manager) - Infrastructure Team - Portfolio Implementation Associate. Click here to learn more.

🔍 StepStone Group (Alternative asset manager) - Director - Business Development - Private Wealth (EMEA). Click here to learn more.

🔍 Carlyle (Alternative asset manager) - Vice President, Client Relationship Manager, Wealth Management (Southeast). Click here to learn more.

🔍 Fidelity Investments (Asset manager) - Director, Alternatives Product Marketing - Fidelity Institutional. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Associate/Senior Associate - Fund Investment Team. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 Ultimus Fund Solutions (Fund administrator) - Manager, Fund Accounting. Click hear to learn more.

🔍 Neuberger Berman (Asset manager) - Business Associate - CIO Office, Private Wealth. Click hear to learn more.

🔍 bunch (Private markets infrastructure investment platform) - Head of Product. Click hear to learn more.

🔍 Capricorn Investment Group (Alternative asset manager) - Investment Analyst. Click here to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Data Management. Click here to learn more.

🤝 Interested in partnering with Alt Goes Mainstream? 🤝

Alt Goes Mainstream is a community of engaged experts and executives in private markets.

Fill out this form using the link below to explore partnership opportunities.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Eileen Duff, Managing Partner & Chief Client Success Officer at iCapital on episode 12 of the latest Monthly Alts Pulse as we discuss the future of AI and automation in private markets. Watch here.

🎥 Watch Co-Founder & Managing Partner of Cantilever Group and former Goldman Sachs and Broadhaven Capital Partners Partner Todd Owens discuss the middle market opportunity in GP stakes investing. Watch here.

🎙 Hear Intapp’s President, Industries, and Co-Founder of DealCloud by Intapp Ben Harrison discuss how data and automation are transforming private markets. Listen here.

🎙 Hear how a $1.59T AUM asset manager is approaching private markets with T. Rowe Price’s Global Head of Product Cheri Belski in a special live episode of the Alt Goes Mainstream podcast at a Pangea x AGM Breakfast in London. Listen here.

🎙 Hear Bernstein Private Wealth Management’s CIO Alex Chaloff discuss how a $125B wealth manager navigates private markets. Listen here.

🎙 Hear me discuss why and how alts are going mainstream on The Compound’s Animal Spirits podcast with Ritholtz Wealth’s Michael Batnick and Ben Carlson. Listen here.

🎙 Hear Mercer Investments’ US Financial Intermediaries Leader Gregg Sommer and CAIS’ MD and Head of Investments Neil Blundell on following the fast river of alts. Listen here.

🎙 Hear Manulife’s Global Head of Private Markets Anne Valentine Andrews share how to approach building a private markets investment platform at an industry behemoth and the merits of infrastructure investing. Listen here.

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse as we discuss the evolution of the industry. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with both a macro and VC lens. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.