👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from London and Happy Thanksgiving to those who celebrated. A busy week of meetings with founders, GPs, and LPs in London was highlighted by an AGM Dinner where I hosted a number of LPs and allocators. Our dinner group spanned a diverse range of allocator roles, from family offices to institutional fund of funds to private banks to investment consultants to GP stakers. We discussed trends in private markets and shared views on what’s top of mind for each of us. Included at the table and participating in a vibrant conversation were Jeannine Daniel of Cara Advisory, Catherine Haumesser of Armen, Phil Bickerton of Denlow Trust, and Benedict Nagle-Taylor of Coutts Private Bank.

A few themes emerged from the dinner, including one that jives with some of the notable news in private markets this week. The evolving nature of how LPs collaborate with GPs is top of mind for many allocators across the spectrum. It’s a topic that has many nuances. The continued innovation of the GP / LP relationship has the potential to take private markets even further into the mainstream, both through the inclusion of more private markets strategies in investors’ portfolios and to new constituents of investors.

The dinner conversation quickly migrated to one of liquidity — and no, I don’t mean an exhaustive review of the wine list. A few participants noted the importance of liquidity amidst a more uncertain investment world in part due to the current complexities of geopolitics and in part due to the potentially transformative platform shift that is AI. Concerns made way for a brainstorm on solutions. With some of the participants around the table who provide solutions for GPs, we discussed how more GPs are thinking about liquidity in ways that can benefit many LPs desire for liquidity while also enabling GPs to hold on to their winners. After all, many in private markets understand the ability to go long duration when possible can lead to outperformance. Investors need patience, but at other times, they need liquidity. Continuation vehicles were highlighted as a possible solution to solve for liquidity, as they can be a win-win for both GPs and LPs. There’s a reason they are increasing in popularity, particularly in venture. These vehicles provide a way for GPs to offer liquidity to LPs who are seeking distributions, offer GPs a way to show returns if they are out fundraising, and enable GPs to still maintain exposure to the company or companies that they feel have a longer, but possibly more accretive, journey in private markets.

The conversation continued (pun intended) to highlight the theme of LPs finding ways to do more — in more ways — with GPs. The family offices and private banks in the room shared a trend that’s becoming an important ingredient of private markets — a desire to do more direct investing, either via co-investments or by building out in-house capabilities. This has been an evolution that has only gone in one direction in recent years — up. The focus on this topic in our conversation illustrates the level to which sophisticated family offices and private banks see this as an important feature of their private markets activities. Funds recognize this trend, too, with many firms from large to small trying to find ways to partner with family offices and private banks. The continued challenge here is discovery. It can be hard for many funds — unless they have the size, scale, or brand — to systematically focus efforts on engaging the family office channel or partnering with private banks to end up on their investment platform. Both of these endeavors present different difficulties, but the commonality is their time-consuming nature. The advent of investment platforms that unlock access to private markets have provided a solution, but efficient and effective discovery of funds for LPs and helping GPs find new LPs remains a challenge. I’d love to see more innovation here (I know there are a number of interesting solutions being built, including by some who are subscribers to Alt Goes Mainstream), but this, to me, is a major unlock to take private markets to the next level.

Perhaps as an industry, we can look to some of the pioneers of the LP / GP relationship as a framework for how to approach the next wave of private markets. This week’s news highlights the innovative work that one of the world’s largest institutional investors, CalSTRS, does with managers. They’ve long had a Collaborative Model with GPs, partnering with them on more bespoke solutions such as separately managed accounts (SMAs), co-investment programs, and GP stake relationships. It’s also worth noting that they have built a portfolio that has around 40% exposure to private markets. Not feasible or suitable for all, but worth noting when it comes to thinking about asset allocation frameworks. [Listen here on Alt Goes Mainstream to hear how CalSTRS CIO Chris Ailman approaches managing one of the world’s largest pension plans].

Family offices and the broader wealth community — wealth managers and private banks — have the opportunity to follow suit and be innovative as well. Single-family offices, which have fewer constraints than institutional investors at times, have a chance to partner with GPs in ways that can help them accelerate their business. An increased focus on GPs as founders and business builders may also lend itself well to LPs approaching partnerships from the mindset of being a solutions provider. I’m looking forward to seeing LPs devise and structure creative ways of working with GPs that will continue to push the boundaries of private markets more into the mainstream. Perhaps this shift will need to involve thinking about private markets strategies more holistically in the context of an overall asset allocation model, as both Shannon Saccocia of Neuberger Berman and Stephanie Drescher of Apollo, amongst others, have shared on Alt Goes Mainstream. It’s this type of sophisticated and nuanced thinking that will lead to better asset allocation decisions across both public and private markets, which should hopefully benefit everyone involved.

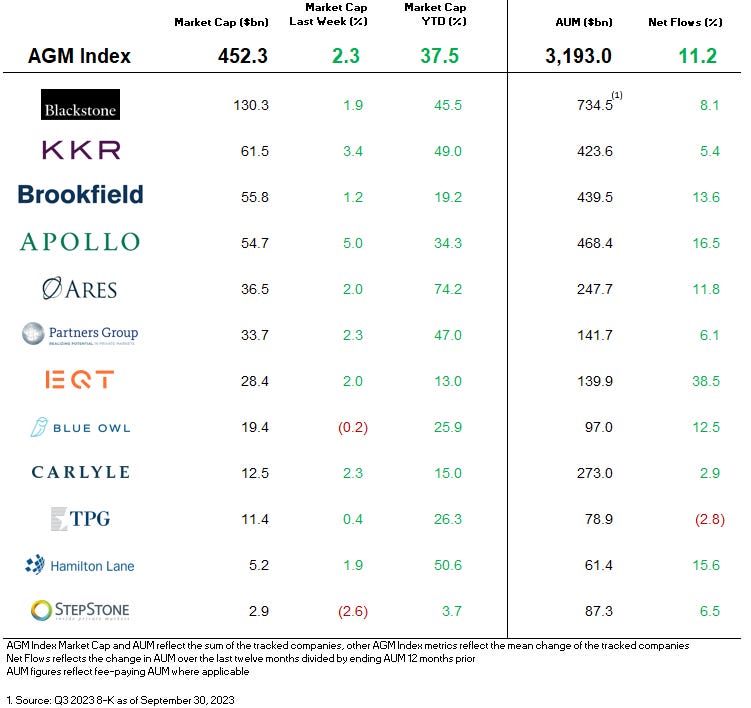

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 CalSTRS Leans Further Into Collaborative Model to Shrink Private Investment Costs | Alicia McElhaney, Institutional Investor

💡CalSTRS, one of the largest and most innovative pension plans, plans to focus on even more sophisticated cost savings efforts, according to Institutional Investor's Alicia McElhaney. CalSTRS was considered innovative for developing a model to save on fees through different ways of structuring their team and co-investment relationships with funds. Years ago, the $307.9B pension fund brought its public markets trading function in-house and partnered with external managers on co-investments and other structures to lower their overall fee load. That program was a success. The co-investment strategy alone saved CalSTRS $246.3M in 2022. Now, CalSTRS is at it again with an even more sophisticated version of its Collaborative Model as they ramp up their activities in private investments. Currently, CalSTRS manages 85% of its fixed income portfolio and 75% of its global equities book internally. On the private markets side, CalSTRS focuses on partnerships with managers, setting up separately managed accounts, co-investments, joint ventures, and taking minority or majority stakes in managers. CalSTRS’s board approved a new strategic asset allocation in the spring, moving four percent of its exposure from global equity to private credit, private equity, and infrastructure. This shift could mean higher fees, something that CalSTRS recognizes. “As you’re moving from public to private, you’re going to be increasing your overall costs,” said Deputy CIO Scott Chan. “The solution has been to extend the Collaborative Model into our form of direct investing into the private markets. We call this bending the cost curve.” In a bid to ensure they save on fees (while not sacrificing on quality), CalSTRS plans to increase its target on co-invests from 20-25% to 35% of the private markets portfolio. The fund will also do more “sophisticated” joint ventures, revenue shares, and GP stakes deals. CalSTRS is thinking holistically about partnerships with managers. This could mean investing in a fund, co-investing alongside the fund, and also taking a strategic stake in the firm itself. CalSTRS did just this with Just Climate, an investment firm that is focused on climate investing. CalSTRS recognizes that fees shouldn’t be the only focus. They understand that reducing fees don’t necessarily produce better returns in and of themselves, with Chan saying “[they’re] not pennywise pound foolish.” CalSTRS also recognizes the importance of being a good partner to funds. Chan said that “[they] really want to be the partner of choice to the degree that [they] want to be nimble and responsive to [their] partners.” This means providing funds with quick answers on re-ups and other decisions. It also means that CalSTRS is willing to partner with smaller, growing managers because they believe that trust and growing together are critical to building long-lasting relationships with funds.

💸 AGM’s 2/20: We’ve talked a lot about how many GPs are continuing to innovate in private markets with the evolution of their firm, how they structure and offer investment strategies to different investors, and how they work with LPs. Much of this innovation is helping to drive private markets forward, making alts become more mainstream. This week’s article on CalSTRS in Institutional Investor highlights how critical continued innovation from LPs will be to the growth of private markets.

CalSTRS, one of the world’s largest pension schemes, has once again set the bar for innovation in private markets within the institutional investor ecosystem. Certainly, CalSTRS has the size and scale to operate with creativity in private markets. Their size affords them with the ability to do innovative partnerships with private funds, including taking stakes into managers that they seed or back as LPs.

The fee question has been an age-old question for LPs. CalSTRS and the Canadian plans have innovated long ago by either forging co-investment partnerships to blend down fees or bringing certain investment capabilities in-house. At the time, those were step-function changes in how institutional investors worked with alternative investment managers. Some, like Silver Lake, partnered with CPPIB on a co-investment program before it was commonplace. Now, many pensions look to co-invests as a way to expand their manager relationships and reduce fees while driving returns. CalSTRS has done a number of SMAs (separately managed accounts), including one in partnership with Invesco Private Capital dating back to 2008, to have access to smaller managers in the venture and private equity ecosystem, such as Union Square Ventures.

CalSTRS is now evolving once again. On an Alt Goes Mainstream podcast, CalSTRS CIO Chris Ailman discussed the importance of “catching the wave” and riding investment megatrends. Thus, CalSTRS’s strategic partnership with Just Climate, a climate-focused investment fund is notable. CalSTRS is not only investing as an LP, but also taking a stake in the firm. It’s not an entirely new phenomenon for LPs to seed and take a stake in a fund. That’s happened before — and will continue to happen. But what this does signal is a move towards the LP as a more strategic partner to funds. When leading institutional investors like CalSTRS begin to make relationships with funds more commonplace, we’ll likely start to see other LPs follow suit.

This move by CalSTRS highlights another trend amongst LPs. Being a good LP means more than being a passive source of capital. It means helping funds build and accelerate their firm from a business perspective. CalSTRS recognizes that this can manifest in a deeper partnership, whether with an SMA, co-investments to help funds size up commitments into deals, and by taking a strategic stake in a firm. A reputable institutional investor taking a strategic stake in a fund can send a signal to the broader market that the fund has passed muster with the most sophisticated of investors. In certain emerging areas of private markets or industries, like climate, that can be a huge accelerant to attracting more capital to the space. Pensions, as “real money” investors serve individuals, can play a critical role in growing investment into industries that will play a major role in our future, like climate.

Innovation from LPs will also make GPs begin to think about how they can work with LPs in different ways. The wave of co-investment partnerships with pensions and some pensions moving their private investment activities in-house caused private equity firms to think about how they partner with LPs — and the different types of LPs with whom they collaborate. CalSTRS’s continued innovation around their Collaborative Model will once again get the minds of GPs turning on how they can work with the LP community in a multitude of ways, which is yet another welcome development for the evolution of private markets.

📝 European pension funds cool to private markets in 2023 | Marie Kemplay, PitchBook

💡European pension funds have scaled back their commitments to private funds in 2023, signaling that private markets remain challenging from a fundraising perspective. In 2023, PitchBook reports that pension funds have made just 60 commitments into funds in the region. That number is less than half of 2022’s figure of 113, according to PitchBook data. 2023’s figure also represents the lowest number of commitments since 2013, highlighting just how frosty this fundraising market has been for funds, particularly in private equity and venture capital. Pension funds have been called on to become more active across Europe, and in the UK in particular. Some pension funds, like the Greater Manchester Pension Fund and the Merseyside Pension Fund, have been active allocators to private markets funds between 2013-2023. UK policymakers have been trying to encourage certain pension funds to allocate to more private markets strategies as a way to boost the growth in the UK economy and open up funds to target higher returns. Their focus has been on defined contribution pension schemes, which historically have invested less into strategies like private equity compared to defined benefit schemes.

💸 AGM’s 2/20: Participation in private markets by institutional investors in Europe and the UK, particularly with respect to pension funds and endowments, has been top of mind. Europe has been quite successful in building teams, mechanisms, and incentives for a number of sovereign and pan-European funds that actively allocate to private markets funds. The EIF is a good example here. More recently, the UK’s new FinTech Growth Fund is inspired by calls for more pension fund participation into private markets that the Mansion House reforms have spurred on. Augmentum’s CEO Tim Levene, who built and runs the UK’s first and only publicly listed fintech-focused investment company, wrote a good piece in Citywire this past July on the need for more participation from pension funds into private investment funds. Tim highlights a very real issue. With over £2.5T AUM, the UK pension market is the largest in Europe and second largest globally after the US. Asset allocation choices, however, have differed meaningfully from global averages, with an under-allocation to equities at 27% versus the global rate of 45%. With returns sometimes being stronger in private markets, this allocation decision can perhaps, in part, explain the UK’s relative underperformance. Tim notes that the average 10-year annualized return from UK pension funds of 6.2% falls far short of comparable markets such as the Netherlands’ 7.6%, Australia’s 7.5%, and Canada’s 6.9%. These allocation decisions and investment results have a real impact on real money. Employees contributing to workplace pensions now could see a smaller pot of savings in 30 years’ time. That’s a marked difference and a gap that pension plans need to fill, particularly as there has been a move to defined contribution plans, which rely on the individual to contribute to the plan. If individuals don’t have confidence in schemes returning capital for them, then they may choose to take allocation decisions into their own hands, which may not yield better results and certainly challenges pension schemes by putting pressure on their AUM. Some pension plans, such as CalSTRS and the Canadian plans, have been quite innovative in how they operate to drive returns. More on CalSTRS’s innovation below, but it’s a welcome sight to see pension plans using their size and scale to drive returns for their investors, whether it be reducing fee loads or finding ways to partner with private markets managers in multiple ways to generate the most possible returns with their capital allocation. While not an indictment of other pensions’ activities, as I respect and understand that each scheme has its own structure, challenges, size, and internal team dynamics, but many would do well to follow the lead of firms like CalSTRS. CalSTRS’s focus on private markets has been a driver of returns for the fund, and as Europe’s venture and private equity ecosystems continue to grow and show promise, perhaps we’ll see more UK and European pension schemes follow suit.

The interesting question for many schemes and service providers like investment consultants who work with many pension plans will be how funds who are smaller in size and scale than a plan like CalSTRS can successfully execute on a private markets investment strategy like CalSTRS does. I will be curious to see how firms of different sizes navigate private markets, either by building out in-house teams or partnering with consultants and OCIOs to effectively allocate to private markets strategies. Perhaps leaders like CalSTRS or the Canadian plans, who have long been pioneers in allocating to private markets investing, would consider setting up a consulting arm themselves or partnering with smaller plans to bring them alongside into their investments? Maybe this concept has already been thought of or is too complicated to execute on, but continued innovation with pension schemes would do well to help private markets. Another point of note is that some of the challenges facing pension schemes are a driver for many alternative asset managers’ focus on the high net worth channel. With constraints and challenges facing pension schemes, many see the HNW channel as the arena of opportunity, as many individuals and wealth advisors are even more underallocated to alts in comparison to pension schemes.

📝 Private equity buyout funds show longest holding period in 2 decades | Karl Angelo Vidal, Annie Sabater, S&P Global

💡The trend of private companies staying private longer is even more protracted in an uncertain exit market. North American private equity buyout funds have held onto their portfolio companies longer in 2023. Exit activity has been muted due to a challenging economic environment that has caused a mismatch between buyers and sellers in asset pricing. The average holding period for buyouts among US and Canadian private equity funds is the longest hold period since 2000, according to Preqin Pro. Holding periods in 2023 grew to 7.1 years as of November 15, which is significantly longer than the 5.7 year average holding period during 2022. Historical trends show that average holding periods for buyout funds are on a secular trend upward. Between 2014 and 2023, the holding period averaged 5.8 years, compared with 4.9 years in the prior decade. The increase in hold period is in part due to a more muted exit environment. The number of global private equity exits is on a two-year annual decline. In the US, interest rate decisions are creating uncertainty for investors, according to Steve Zaorski, Asset Management Partner at Ropes & Gray. "This uncertain economic environment resulted in a mismatch in expectations between buyers and sellers and made assets harder to price, which resulted in private equity firms holding onto assets longer rather than selling at a less than optimal price in their view." Zaorski said that more clarity on interest rate movements could make it easier for private equity firms to price their assets, which could create an environment where hold periods begin to once again decrease as exits would start to occur.

💸 AGM’s 2/20: Private markets have been challenged by macroeconomic forces, chiefly geopolitical events and interest rate movements. A more uncertain economic environment has caused difficulties with exits for many private equity firms. This has meant that private equity firms have in a number of cases been forced to extend hold periods on their assets. This action is understandable, as many firms may not be able to receive what they believe to be fair value for assets in the current environment. This data hammers home another point, one of which is important for LPs, particularly those who have generally lacked access to private markets. As the number of public companies, particularly those with a growth profile, shrinks, private markets is where investors can go to gain exposure to growth. However, if investors are shut off from investing into private markets, then the total pool of possible investments available to them is just a fraction of the companies that are experiencing growth. That’s why all the innovation around enabling more investors to access private markets is so important for investors.

📝 Brazil’s Maturing Private Markets Attract U.S. Investment Firms | Luis Garcia, WSJ

💡Brazil’s private capital industry is attracting US asset managers looking to expand in new regions as it continues to mature and investment risks increase in other markets, including China. Ares recently formed a partnership with Brazilian private equity manager Vinci Partners that involves marketing new funds offered by both firms. As part of the deal, Ares invested $100M in Rio do Janeiro-based Vinci. “We’ve known the Vinci team for over a decade and are excited to collaborate on distribution, product development and other business opportunities in Brazil and across Latin America,” Michael Arougheti, Ares Chief Executive, said during an earnings call with analysts. “We believe that the Latin American markets are in the very early stages of shifting capital into the private markets, particularly within private credit.” In another deal, Claure Group, the investment firm of former SoftBank Group senior executive Marcelo Claure, acquired a stake in São Paulo-based private equity firm eB Capital. Claure is joining eB Capital as Vice Chairman and Managing Partner. International investor interest in Brazil, Latin America’s largest economy, has varied in recent decades as the country went through economic growth and recessionary cycles and had governments of different political leanings while weathering corruption. As many offshore investors retreated, the shortage of capital led to increased potential returns for those who stayed. As of last December, Brazil’s private investment funds raised from 1994 to 2022 generated an average profit of 2.2 times invested capital, including from unrealized investments, and produced a 12.7% mean net IRR, according to a study from Spectra and the Insper Institute of Education and Research, a São Paulo university. The study, which was published in August of this year, showed private equity and venture capital funds had paid out an average of 0.84 times invested capital to their LPs as of last December. The fact that the entire Brazilian private capital industry has already returned to investors almost the same amount that it called from then is indicative of how the industry is maturing, said Ricardo Kanitz, Managing Partner at Brazilian private markets firm Spectra Investments. Brazilian fund managers also point to a proliferation of credit and special situations fund managers in recent years, as well as an expanding secondary market, as additional signs of maturity. Brazil continues to pose risks for investors, particularly those who are unfamiliar with the local market, said Karyn Koiffman, a partner with the Akerman law firm who works in its mergers and acquisitions and private equity practices. Koiffman cited government red tape, the complicated legal system and costly tax policies in the country as examples. “Bureaucracy can make it difficult to do business in Brazil,” she said. Fluctuating currency values present another hindrance to investment. The real lost more than twice its value against the dollar in the past decade, undermining local asset values. As a result, the performance of private equity funds in Brazil declines markedly when measured in dollars. The proportion of funds that produced losses was 37% in dollar terms, versus 22% with the real, according to the Spectra-Insper study. There are also encouraging developments, Koiffman noted, including tax changes pending approval by Brazil’s National Congress. The idiosyncrasies of Brazil’s investment landscape are one reason why international asset managers looking to expand in the country frequently partner with a local firm.

💸 AGM’s 2/20: Latin America continues to be a burgeoning ecosystem for private markets, as more global alternative asset managers set their sights on expanding a footprint in the region. Ares made a notable move in the region, investing $100M into Brazilian private credit manager Vinci Partners earlier this year. The partnership will include co-marketing a fund together focused on Latin America. Ares isn’t the only firm to see potential in Latin America. Former Softbank Group executive Marcelo Claure recently took a stake in Brazilian private equity firm eB Capital, a firm with $5B BRL AUM across private equity, infrastructure, and real estate, through his family office, the Claure Group. Private markets in Latin America have experienced their fair share of ups and downs. But more recent times have been punctuated by some major exits, particularly from the venture world, with Nubank having a successful IPO a few years ago. Over the long run, the WSJ finds that private equity returns in Brazil have not been strong, but as Latin America continues its growth as a region, perhaps that will change.

📝 Private credit lenders shy away from club deals | Madeline Shi, PitchBook

💡Collaboration appears to be on the menu in private credit. Private credit club deals, where several direct lenders join together to provide a loan to a single borrower, grew in popularity over the past few years, according to Madeline Shi of PitchBook. Recent years witnessed direct lenders hungry to seize a larger share of the upper-mid-to-large-cap markets, so club deals were more prevalent. Today, however, increased risks and market uncertainties are making it more difficult for multiple private credit firms to be on the same page and work together on club deals, said Steven Ruby, the Co-Head of Originated Debt at Audax Private Debt. Ruby observed that there’s now an aversion to risk amongst many direct lenders, which has resulted in a smaller number of lenders willing to lead the syndication of a club deal. Q3 2023 highlighted the slowdown in club deals. Only 6% of LBOs financed in the private credit market were club deals involving three or more lenders, marking the lowest share since Q1 2022, according to data from PitchBook LCD. Single-lender deals, however, took up the lion’s share of LBOs financed by private credit firms this quarter, holding steady in comparison with the past few years. Private equity firms tend to prefer to engage multiple lenders to fund a new loan, since a lender group can ensure the capacity of incremental debt that may be used to fund prospective add-ons or other growth opportunities. Having several lenders can also prove beneficial to the sponsor when negotiations about restructuring covenants or adjudicating workout agreements. PE firms also generally like to provide their preferred direct lenders with access to deals for a relationship-building exercise. In the current market, many direct lenders are looking to involve less participants in their deals. As the lower middle market becomes an attractive place for many direct lenders to play, these direct lenders prefer to be the sole financing provider for companies with less than $50M in EBITDA, according to Chris Lund, the Co-Portfolio Manager at Monroe Capital, who oversees their direct lending strategy. There are benefits to being the sole capital provider; they have more control over negotiations on deal terms and spreads on the new loan. It appears that the private credit market is starting to bifurcate into two camps: the lenders who aim to be the sole capital provider or lead a syndicate and dictate deal terms and others who follow the leader in syndicates.

💸 AGM’s 2/20: Private credit is coming into its own as an industry, growing massively over the past few years. Private credit’s maturation is reflected in how deals are being done. As larger players continue to move into the space in size and scale, deal structures are evolving, too. Industry insiders are predicting that the industry will evolve into the “term makers” and the “term takers.” This industry transformation leads to some interesting questions, particularly in the middle market, where many direct lenders play. Many direct lenders are focused on smaller deal sizes as banks retrench from the riskier part of the market. This move means that many direct lenders are going at things solo. The big question on my mind is what happens with both club and solo deals when rates change, which could impact terms and renegotiations on covenants for lenders.

Reports we are reading

📝 VC Investor Ranking – EMEA 2023 | Yoram Wijngaarde, Dealroom

💡Dealroom put out an insightful report on the state of European Venture, ranking the 10,057 investors active in EMEA. This figure represents a 5x increase in the number active in VC in the ecosystem from a decade ago. Early-stage is a very active part of the market, with over 50% of the investors investing from Seed stage onwards.

There’s some very interesting datapoints that Dealroom’s Founder and CEO Yoram Wijngaarde shared on Twitter this weekend (see the entire thread and a link to the full report here).

At Seed stage, only two funds have ten or more EMEA unicorn investments: LocalGobe and Point Nine.

At Series A, only six investors have ten or more EMEA unicorns. Accel leads the pack with 26 unicorns, followed by Index Ventures with 17 unicorns.

The data illustrates just how hard it is for a startup to make it. Only 25% of the 3,500 new startups that raise their first VC round each year make it to Series A. And only 1-1.5% make it to unicorn status. Half that number — 0.6% — see a $1B+ exit within 20 years after their first round of financing.

What are Yoram’s punchlines? Picking winners in VC is tremendously challenging. And picking the right investor can help tilt a startup’s odds in favor of success.

💸 AGM’s 2/20: VC is a difficult endeavor. We all know that. But when you see the numbers, it’s apparent just how hard it is. Power law is a very real thing and manager selection is what matters above all. The funds who are generally hardest to access are at times the ones who also outperform since the top funds often win the best deals. There’s probably a bit of both causation and correlation, but it pays to be in the best funds, particularly in venture. This presents an access challenge for many investors. How do they find their way into the hardest to access funds? There are some solutions — finding the great emerging managers who build the next brands in venture. But that’s hard to know and hard to find for many LPs. There are also platforms that aim to provide access to investors into high-quality funds. Skeptics would argue that these platforms can’t provide access to the best funds because they don’t need net new LPs. That can be the case, but there are some platforms that have managed to find a way to gain access to high-quality funds.

(Some) fundraising news

📝 DoorFeed raises another €7M for its platform allowing large-scale investors to hoover up family homes | Mike Butcher, TechCrunch

💡Institutional investors have taken a serious interest in single-family homes. Many private equity funds have, in different ways, become owners of large single-family home portfolios. Now, there are a number of startups in Europe that are looking to make it easier for institutional investors to access the single-family home market. Europe’s players include Immo Capital, a platform for managing residential real estate portfolios, which has raised $90.7M. Bricklane is another platform for rental housing, raising £6M out of London. And Casafari in Spain/Portugal has raised $20.5M. Another firm has begun to knock on the door. Newcomer DoorFeed, founded by James Kirimy, an early Uber UK employee, just raised a new funding round of €7M Seed extension round led by Motive Ventures, with participation of Stride VC and Seedcamp. The firm previously raised a €3.5M seed led by Stride and Seedcamp in 2021 and a €1.5M debt financing by BPI France in 2022. DoorFeed provides a data platform and operational tools for investment funds so that they can assemble and manage large-scale portfolios of apartments and houses. They’ve also integrated an ESG component, helping investors determine which houses have poor energy performance so they can renovate them to possibly unlock ESG credits from governments. Real estate is a large market in Europe, with investment in European living assets exceeding all other real estate asset classes in the second quarter, according to JLL.

💸 AGM’s 2/20: Real estate is continuing to become more institutionalized, particularly single-family homes. As more institutional investors look to the SFR space for investment, it’s no surprise that there will be solutions that help them to do so. DoorFeed is amongst the growing number of companies that are aiming to help institutional and HNW investors access this market, which appears to be quite popular from an investment perspective. Real estate is a massive asset class and, in some cases, an onramp to alternative investments for many investors. The interest in the real estate space in Europe from institutional investors makes DoorFeed one to watch.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Epic Funds (Private markets investment platform) - Director of Investor Relations. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Client Associate, Relationship Management (Remote). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fourth episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.