👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from Washington DC, where I’m back for the weekend before heading up to NYC to speak at SuperVenture and meet with a number of GPs and LPs to discuss various developments in private markets.

Speaking of developments in private markets, some of the industry’s largest alternative asset managers reported their Q3 earnings this past week. Apollo, Ares, and Blue Owl all shared rather strong results, highlighting some notable current trends in private markets.

Let’s dive in.

Apollo

Apollo clocked in a stellar Q3, resulting in record quarterly fee-related earnings of $472M. Their strong performance was driven by management fee growth, record quarterly capital solutions fees, and controlled expenses, all resulting in margin expansion.

Apollo achieved $33B of inflows in AUM, bringing their total AUM to $631B. Apollo’s AUM has grown a staggering ~$150B in the past two years, from $481B to $631B.

Athene, Apollo’s Retirement Services business, has been a major driver of growth for the firm. It continues to provide strong organic growth, with Athene’s organic inflows growing from $3B in 2014 to a high of $48B in 2022 (and $44B as of 3Q23). This astronomical growth represents a 16x increase from 2014-2022 and a 40% CAGR. 2023 is on pace to surpass 2022 for organic inflows into Athene, driven largely by American and Japanese clients. Athene has delivered a strong performance for clients over the past three years, with their alternatives portfolio generating 13% annually, higher than the 11% normalized return.

Why is Athene so valuable to Apollo’s financial performance and future growth? 55% of Apollo’s total AUM is perpetual capital (with a portion of this coming from Athene), making this highly scalable and diminishing Apollo’s reliance on cyclical fundraising dynamics.

Apollo also noted that distribution activities through financial institutions continues to expand. Fundraising from the individual investor channel is on track to exceed last year’s level, making good on Apollo’s strategic priority of growing its presence in global wealth.

Ares

Ares also had a strong Q3, driven by almost $22B in fresh capital raised and a major focus on credit from the global LP community.

Total AUM from 3Q22 to 3Q23 increased from $341.4B to $394.9B, representing a 16% YoY increase, and fee-paying AUM grew from $218.6B to $247.7B, representing a 13% YoY increase.

Like Apollo, Ares’ perpetual capital base grew meaningfully. Credit and direct lending strategies drove increases in Ares’ perpetual capital base, helping increase growth by over 17% from the prior year to $103.7B.

A credit-focused firm like Ares has been the beneficiary of LPs’ focus on the credit space. Credit carried the day for Ares in capital raising over the past quarter. Of the $21.9B in capital raised, credit — mainly US direct lending and BDC strategies — accounted for $19.1B.

Also notable in Ares’ earnings release is its focus on strategic acquisitions and distribution partnerships, particularly in other parts of the world. Ares acquired Crescent Point Capital, a $3.7B Asian-focused private equity firm. This acquisition is notable because it expands Ares’ footprint both from geographic and investment strategy / distribution standpoints. Ares also formed a strategic partnership with Vinci Partners Investments, a Brazilian alternative asset manager, to collaborate on distribution, product development, and other business opportunities in Latin America. It’s interesting to see Ares focus on both investment platforms and distribution partnerships in other geographies, as it follows the trend of global alternative asset managers looking to grow their footprint, distribution relationships, and AUM (and FRE) through internationalization.

Blue Owl

Perhaps after reading this far, it’s unsurprising that another credit-focused firm reported strong Q3 results. Blue Owl also saw meaningful increases in AUM and fee-paying AUM (FPAUM) over the past year, largely due to their credit business.

Blue Owl grew AUM 19% from 3Q22 to 3Q23, hitting $156.9B AUM. Their FPAUM grew 15%, up to $97B.

Permanent capital also helped drive Blue Owl’s strong performance. Blue Owl now has $123.1B of permanent capital, up 16% since 3Q22.

Like Apollo and Ares, private wealth helped drive the lion’s share of their inflows this quarter. Of Blue Owl’s $2.9B raised this quarter, private wealth represented almost 66% of that capital, cashing in at $1.9B.

While Blue Owl’s fundraising inflows are down almost 66% on an absolute basis from 3Q22 to 3Q23, AUM is still up on the year.

Performance, particularly in the GP Strategic Capital (Blue Owl’s GP stakes business), is also of note. Since inception, Blue Owl’s GP Stakes funds have generated strong performance, with gross returns for Fund III at 30.7% IRR, Fund IV at 71.3% IRR, and Fund V at 43.3% IRR.

Takeaways

When three of the world’s largest publicly traded alternative asset managers report earnings in the past week, it’s worth taking note of some themes that cross-cut each of their business performance and drivers of growth.

Focus on private wealth: Each of these three firms has made it a strategic priority to focus on private wealth to grow their AUM. The global private wealth channel has been a significant driver of growth for these firms’ increase in AUM, with Apollo and Blue Owl seeing strong quarterly results partly due to private wealth channel growth. It’s not a surprise to see private credit-focused alternatives managers garner meaningful interest from the wealth channel. It appears that the wealth channel is interested in allocating to credit products, so it makes sense that firms like Apollo, Ares, and Blue Owl are making partnerships with the private wealth channel a top strategic priority.

EQT, who reported Q3 results in mid-October, also highlighted their expanding private bank relationships as a growth engine for their AUM in their flagship closed-end funds, now partnering with 20 private banks on distribution.

As private wealth continues to allocate to alternatives and increase their overall dollar allocation over the coming years, I expect to see private wealth to be a driver of FRE for alternative asset managers.

Credit takes the credit: If the earnings reports from these three firms tell us anything, one major takeaway is that private credit has been popular amongst LPs over the past year. A large portion of AUM growth must be credited to private credit for all three of these firms.

Sure, all three firms who reported this past week have a credit DNA, so it’s somewhat unsurprising that they are seeing greater inflows into their credit strategies. But it’s still worth noting that it has meant that, over the past year, investor demand has been largely focused on private credit and direct lending strategies.

Perpetual / permanent capital is driving growth: All three firms have sought to create avenues to establish large bases of permanent or perpetual capital. This strategic decision has been a major driver of growth for all three firms.

Apollo’s decision to build out a Retirement Services segment through their partnership and, ultimately, merger with Athene has been transformative for the firm. Between Athene and other investment products, over 55% of Apollo’s current AUM is perpetual capital, meaning that Apollo isn’t subject to the vagaries of capital raising, which may change depending on how allocators view different strategies.

Ares and Blue Owl also have large — and growing — perpetual capital bases. The majority of Blue Owl’s AUM ($123.1B of $156.9B AUM) is in permanent capital structures. Ares also has over $100B in permanent capital, representing over 25% of their overall AUM.

Permanent / perpetual capital vehicles have done two major things for these managers: one, they have enabled these firms not to be entirely reliant on shifting fundraising dynamics, which should help these firms’ financial profiles, and two, they have enabled these firms to more easily partner with the wealth channel as these products can have lower minimums and be structured accordingly to fit the needs of private wealth investors.

Acquisitions and strategic partnerships are viewed as levers to drive growth: Ares’ acquisition of Crescent Point Capital, an Asian PE fund, and their partnership with Brazilian firm Vinci Partners Investments represent another important trend with the publicly traded alternative asset managers. They understand the need to go global to both build out their investment platform and expand their distribution channels.

With FRE a major driver of stock price and shareholder value, these firms recognize that a globally diversified and multi-strategy investment platform will increase the firm’s value.

EQT also highlighted the same in their presentation. They have prioritized relationships with private banks as a way to grow AUM. They also noted that they plan to evaluate M&A opportunities, which is something to keep an eye on for them and other large alternative asset managers as they view this avenue as a way to grow both their platform and distribution relationships.

I expect both organic and inorganic growth to drive these firms to new heights. Blackstone hit $1T of AUM earlier this year. At the pace these firms continue to grow and the continued and growing interest in alts from the wealth channel, I don’t think it will be too long before another firm, perhaps Apollo, crosses that milestone as well.

Note: AUM figures from AGM’s Index (below) are based on fee-paying AUM where applicable.

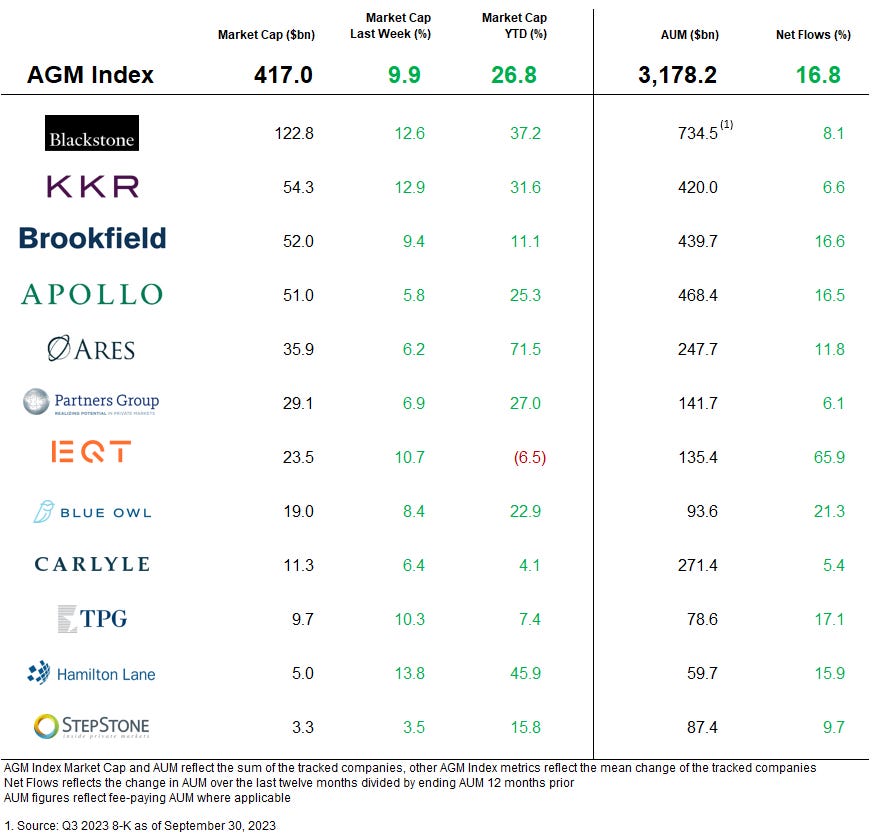

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable

AGM News of the Week

Articles we are reading

📝 CVC Capital Partners postpones plans for Amsterdam listing | Will Louch, Kaye Wiggins, Financial Times

💡European private equity group CVC Capital Partners has postponed plans to float until next year because of market uncertainty. The latest news extends a two-year saga over whether CVC would follow its peer firms to the public markets. Market and geopolitical uncertainty contributed to CVC’s decision to hold off their IPO, according to two people with direct knowledge of the decision. Poor earnings results from publicly traded peers EQT and Blackstone in recent weeks, coupled with uncertainty caused by conflict in the Middle East and concerns about the state of the economy all contributed to the decision to delay their listing. Postponing the IPO again is somewhat of a blow to CVC, which manages €161B in assets, as it looks to keep pace with rivals like EQT and both increase and diversify their AUM. EQT used the proceeds from its listing to expand through acquisitions. CVC is looking to emulate larger US peers like Blackstone and KKR, who also moved away from their leveraged buyout roots over the past decade. In 2021, CVC acquired Glendower Capital, a firm specializing in buying secondaries stakes from funds and LPs, and purchased a majority stake in Dutch infrastructure investor DIF Capital Partners this year in a deal worth €1B. CVC has also been growing its AUM in credit as they look to increase its overall AUM. Although CVC has not yet pulled the trigger on going public, all of its actions — such as continuing to grow AUM through acquisition or capital raising — point towards a public listing sometime in the near future. This point was affirmed by one of the people familiar with the matter, who said that CVC remains committed to going public in the near future when market conditions improve.

💸 AGM’s 2/20: Market uncertainty is delaying the listing of another alternative asset manager with a sterling reputation and a firm that is on the heels of raising a record number for a buyout fund. The market — and the alts space — will patiently await CVC’s listing, given its size, scale, and brand. But it should be worth the wait for the alts space as it would mean that yet another large platform is going public, further signaling the mainstreaming of alts. What’s interesting about the ongoing situation with CVC is that they continue to grow their AUM and expand their platform across asset classes. This should only strengthen their bid to go public since growing AUM — and fee-related earnings — should buttress their valuation. A CVC IPO should also be a boon for the GP stake fund space, as it would represent a successful liquidity event for Blue Owl, who took a 10% minority stake in CVC that valued the firm at $16.7B in 2021.

📝 Blue Owl’s Credit Strategy Drives Profit Gain | Rod James, WSJ

💡Blue Owl Capital reported double-digit gains in Q3 earnings and fee-paying AUM, avoiding the drag from a slow dealmaking environment due to its relative independence from asset sales. The New York-based firm, known for its private lending operations and acquiring equity stakes in other asset managers, saw an 18% increase to $247.8M from $209.9M in fee-related earnings year-over-year. Fee-paying assets rose 15% to $97B. Distributable earnings jumped 20% to $229.5M (16 cents per share) from $191.7M (14 cents per share) a year ago. The firm’s lending unit increased fee-paying assets by 20% to $54.3B. Co-CEO Marc Lipschultz said the firm has “the right kind of products” for the current economic environment, centered on “principal protection, yield orientation and inflation protection.” Blue Owl’s strategies of direct lending and investing in other asset managers don’t rely on selling businesses to create returns and have contractually guaranteed management fees instead of performance fees. The firm’s credit platform extended loans totaling $4.4B during Q3, exceeding their $3.25B quarterly average over the trailing 12 months. Lipschultz said the acceleration was partially due to converging pricing expectations between buyers and sellers. He added, however, that geopolitical uncertainty dims the potential for a significant increase in deal activity in the near term — and that the quality of deals that do get done now is very high. Blue Owl’s GP Strategic Capital unit reported a 12% decline in distributable earnings compared to the year prior, dropping to $139M from $158.5M. CFO Alan Kirshenbaum said a one-time increase in catch-up fees received last year created an anomaly that led to the pullback in the previous quarter. Blue Owl plans to hold an interim close for its Dyal Capital Partners VI fund during the current quarter, which will boost the year’s fundraising total.

💸 AGM’s 2/20: It’s no surprise that credit is carrying the day for Blue Owl. In a time when credit strategies are popular from a fundraising standpoint and also have generated healthy yields for investors, it makes sense that Blue Owl is made for the moment. Their direct lending and GP stake strategies rely on generating revenues from either lending to companies that they can underwrite or from contractually guaranteed management fees, in the case of GP stake investing. What’s the “so what” from an earnings call like this with Blue Owl? Whether it’s Blue Owl or other GP staking funds, there’s reason to believe that this could be one of the best ways to gain exposure to the growth of the alts space while not relying on exits in private markets to generate returns. Blue Owl’s earnings call also highlights something else: that credit strategies are popular amongst LPs. A 20% increase in fee-paying assets for their lending unit year-over-year is but another signal that credit is what LPs are looking to invest in. These current features of the alts space should bode well for Blue Owl — both as a firm and for their investing strategies. But big questions lie ahead. Blue Owl’s Co-CEO Marc Lipschultz alluded to geopolitical risk as an impediment to deal activity in the near future. That’s certainly possible — and it would impact Blue Owl’s credit strategies and, potentially, their fundraising prospects going forward, which could hurt their fee-related earnings in future quarters. They’ve had a fantastic year, with a 23% increase in market cap YTD and a 21% increase in fee-paying AUM. The road ahead could be a bit tougher, but they are clearly preparing for the future. Just this week, they acquired Cowen Healthcare Investments (CHI), a $1B life sciences investment manager, to build out their market presence with mid-to-late-stage equity investments into biopharmaceutical and healthcare companies. This is yet another proof point of large, diversified alternative asset managers finding ways to expand their platforms across strategies and geographies through acquisition to strengthen their platform, add different strategies, and additional and diversified sources of fee-related earnings and carry. While this $1B of AUM from CHI doesn’t make a big dent in Blue Owl’s $157B AUM, it does further add to their capabilities, which should continue the trend of valuing diversified alternative asset managers with more generous multiples than single-strategy asset managers.

📝 Sports-focused Otro spins out of RedBird, preps for fund launch | Kirk Falconer, Buyouts Insider

💡Four former RedBird Capital Partners executives have spun out of the $9B private equity shop that focuses on financial services and media, entertainment, and sports to form a sports-focused private equity firm, Otro. Alec Scheiner, Brent Stehlik, Niraj Shah, and Isaac Halyard founded Otro to invest in sports, media, gaming, and entertainment assets. They’ve partnered with their old firm, RedBird, on their first deal. Otro invested alongside RedBird and Maximum Effort Investments, a consortium led by actor and Wrexham AFC owner Ryan Reynolds, to buy a minority stake in Alpine Racing, a Formula 1 team backed by Renault. The three firms invested $212M into the team for a 24% stake, valuing Alpine at $900M. Otro, leveraging its strong network in sports, welcomed a number of strategic partners into the round alongside them, including sports stars Patrick Mahomes and Travis Kelce from the NFL, Rory McElroy from golf, Anthony Joshua from boxing, Trent Alexander-Arnold and Juan Mata from the English Premier League, and Roger Erenberg from Eberg Capital. It appears that Otro completed this investment into Alpine through a dedicated co-investment vehicle, which houses over $107M for the deal. Otro is soon expected to roll out its flagship fund, according to sources who talked to Buyouts. Otro’s team is well-equipped to play in the sports investing arena. Scheiner was previously a Partner at RedBird, where he oversaw a number of their key sports assets, including Fenway Sports Group, a holding company that owned the Boston Red Sox and Liverpool FC. Prior to RedBird, Scheiner was President of the Cleveland Browns and an executive with the Dallas Cowboys. Stehlik was a RedBird Operating Partner, where he was President of Redbird portfolio company OneTeam Partners, a sports licensing company. He was previously the CRO and EVP of the Cleveland Browns. Shah and Halyard both worked in the sports and media business at RedBird.

💸 AGM’s 2/20: Otro’s entry into the sports investing market signals the continued rise of private equity investing into sports teams and leagues, which appears to be heading in one direction. Otro’s new fund adds yet another experienced sports investor to the game, which is a boost for the growing sports investment space. Private equity should serve to make sports more professionalized. There will undoubtedly be some unintended consequences — and possibly some unforeseen developments in how sports evolves for both players and fans. But the growing interest from institutional investors in sports assets makes one thing remarkably clear: sports properties are entertainment assets. One thing that investors have done for the game is find ways to monetize sports assets outside of the arena. By thinking about sports assets as entertainment assets, investors have found ways to bring the game global, attracting more fans to a team in some instances and leveraging both social media and technology to monetize sports assets the days or nights when teams aren’t playing. This is a departure from the past — when sports teams captured the attention of fans in the stadium or on TV during the few discreet hours where their team was playing. For a multitude of reasons, this has changed, turning sports into a 24/7 entertainment industry. The other interesting development from Otro’s first investment into Alpine Racing is that we are seeing continued participation from athletes investing into other sports. Athlete investing is a trend that we’ve seen and covered over the past few years, noting that athletes understand the value of ownership — and teams and leagues understand the value of having athletes bring their communities in the game to monetize sports properties further.

Reports we are reading

📝 The Continued Evolution and Growth of Mid-Sized GP Stake Investing | Anthony Maniscalco, Tim Osnabrug, Weston Wilkinson, Joshua Lyons, Investcorp

💡 GP staking is becoming more popular amongst both GPs and LPs — and the numbers suggest it’s for good reason. Investcorp, whose Strategic Capital Group (SCG) invests in mainly mid-sized alternative asset managers and manages over $1.3B, highlights why GP staking is on the rise in an October report on the case for minority equity investing in mid-sized private capital GPs.

1/ Favorable trends on fundraising, LP sentiment, and liquidity:

Over the past three years, four mid-sized GP staking funds raised inaugural vehicles greater than $500M. These are the first dedicated vehicles focused on mid-sized GPs.

LPs are generally positive on GP staking funds. A Coller Capital survey of 110 global limited partners found that 47% of LPs currently invest in or plan to invest in GP staking funds, which is an 11% increase from 2018.

Liquidity, previously a major question for LPs evaluation of GP stakes funds, is beginning to occur, with GP staking funds having 30 distinct liquidity events from 2020 to YTD August 2023.

2/ Mid-sized GP stake supply / demand dynamics favorable for GP stake funds:

$21 of supply in North American and Western European GPs that have yet to take investment from GP stake funds for every $1 of demand (mid-sized GP stake fund dry powder). This supply / demand dynamic should be in favor of GP stake funds focused on mid-sized GPs, giving them pricing power and access to high-quality managers who are looking to grow their businesses.

3/ Continued growth and outperformance of private markets:

Global alternative assets AUM is expected to grow from $26T in 2022 to $61T in 2032 (Bain & Company).

Growth of AUM from the private wealth channel (projected to grow from $4T in 2022 to $13T in 2032) will drive meaningful growth of alternative asset manager AUM, but there are valid questions as to whether this capital will go to larger GPs or mid-sized GPs.

Private equity, private credit, infrastructure, and natural resources have all outperformed public market equivalents over the past 15 years (Hamilton Lane).

The growth and maturity of private markets from large cap to mid-sized and emerging manager categories coincides with the maturity of the GP stake space, as GP stake funds can now diversify across geography, strategy, sector, and fund size.

💸 AGM’s 2/20: GP staking represents an exciting and growing corner of private markets. In some respects, GP staking is but another signal of] the mainstreaming of private markets, as the space is far from a cottage industry. Private markets are now mature enough for funds to attract investment from other funds.

Increased interest in GP staking also highlights another growing trend: that investors view fund managers as founders. Fund managers are founders. They just happen to be founders of asset management businesses. And just like founders have investors — VC or PE funds — who help them grow their businesses, why, too, shouldn’t fund managers.?

There are a few reasons why GP stake investments can make sense for LPs:

1/ Insulated cash-on-cash income provides returns similar to private credit. Staking funds often generate current income that is partially insulated from the vagaries of markets and exits required for private equity funds to generate returns on carry due to generating returns from “in the ground” contractual management fees of GPs, making stakes relatively easy to underwrite. This creates a path to DPI for GP stake funds that are not dependent on asset realizations. Most GP stake funds target 8-12% annual net cash on yields, which is similar to senior secured private credit strategies.

2/ Indexing to the growth of private markets means that GP stake funds are a way for allocators to participate in the growing AUM of private markets as an asset class and achieve diversification across private markets strategies. Private markets are projected to grow meaningfully in size and scale over the next decade. That’s no secret. The question is how do investors gain exposure to private markets, particularly private equity, without allocating to strategies that take time to generate DPI? GP stake investing can enable LPs to benefit from the growth of private markets while generating DPI more quickly than other private markets strategies.

3/ Increased liquidity activity for GP stake funds proves that there’s a business model for the space. There have been 30 liquidity events in the past 3 years, with 12 liquidity events coming in 2022. With only ten funds dedicated to GP stake investing, these represent meaningful numbers that should grow over time as the space grows. These data points prove that LPs can generate liquidity and DPI from investing in GP stake funds.

4/ The argument that GPs prioritize growing AUM at the expense of returns after they take a GP stake investment has not panned out, according to the data from Investcorp. In the mid-market, GP stakes transitions rarely involve “cash out” proceeds. And returns have often not suffered. Proceeds are typically used for growth and reinvestment into the business through outsized GP commits, so at times, GPs can, in fact, be even more aligned with LPs in growing their business, which can be a net positive for both the GP growing their investment platform and for generating returns with a bigger footprint or stronger investment team.

5/ The mid-sized GP market is becoming an increasingly attractive part of the stake investing market. There are real supply / demand imbalances and, in certain areas, like middle-market private equity and venture, smaller fund sizes tend to outperform due to lower valuation multiples at entry (lower and middle market PE). This bodes well for the carry portion of GP stake investments, where capital appreciation can drive returns beyond the management fee revenue component.

GP stake investing is in its relatively early innings. Firms like Dyal, Blackstone, Petershill, Investcorp, and newcomer Hunter Point have helped to pave the way for the GP stake space to become a growing area of importance for private markets. I anticipate that we will continue to see increased interest from both GPs and LPs in GP staking as private markets continue to grow — and that’s a good thing for the space.

If you’re in Zurich for SuperInvestor, catch my talk on November 17 on the GP stake space with Nicolas von der Schulenberg, Managing Director at Portfolio Advisors, Catherine Haumesser, Managing Director, Investment at Armen, and Thomas Liaudet, Global Head of GP Capital Advisory at Campbell Luytens.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Commercial. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Client Associate, Relationship Management (Remote). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fourth episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.