👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from DC, where I’m back from Europe and getting ready to head to Miami to moderate the AGM for Driftwood Capital, a real estate investment firm that manages over $3B in hospitality assets.

This week’s news is highlighted by a number of notable moves that, when viewed together, are strong signals that alts are moving into the mainstream. Two major announcements illustrate just how much private markets is encroaching on Wall Street’s territory. KKR bought the remainder of Global Atlantic, an insurer with over $150B in assets, that will now give them a captive insurance business. Global Atlantic will provide KKR with an annuities business and bolster their perpetual capital base, which will enhance their ability to continue to serve the wealth channel. Prior to the Global Atlantic acquisition, KKR’s perpetual capital stood at close to 40% of its $528B in AUM. They are following in Apollo’s footsteps, who bought and built Athene into a massive annuity firm that has enabled perpetual capital to make up over 55% of Apollo’s $631B in AUM. KKR’s transaction also coincided with their decision to split their business into different segments, reducing their compensation ratio on fees that will allow them to provide more fee-related earnings to shareholders and shift a larger portion of employee compensation to carry-related results in their private equity business.

As one firm (KKR) expands its abilities to bring alts to more investors through the complete acquisition of Global Atlantic, another firm (HPS) that has filled the vacuum left by Wall Street banks on the mezzanine financing side is considering a public listing. The rise of HPS, a private credit firm that has grown to $100B AUM since spinning out of JP Morgan in 2016, highlights just how much private markets are moving into Wall Street’s territory.

These moves have been punctuated by observation made by Apollo’s Marc Rowan that we are in the early innings of a secular trend of “debanking.” The growing presence of alternative asset managers in traditional finance has been years in the making. It may have seemed like alternative asset managers were on the fringes of finance, particularly relative to banks, but the largest players are now of the size and scale where they can compete with or fill the gaps left by banks in areas like private credit. This development may seem somewhat surprising because private markets appears to be different than more traditional financial services at first blush. But if we think about what private markets really are at its core — investors providing capital to alternative asset managers to earn a return on the capital they provide while the alternative asset managers earn a portion of the returns generated from investing — it’s not terribly different from more traditional financial services activities like banking.

When looking at private markets through this lens, it makes more sense why private markets are going mainstream. Private markets are following the evolution of both financial services and fintech.

Through the prism of market structure evolution, we’ve witnessed the electronification of other markets: equities, fixed income, and derivatives. Now, we are seeing the same happen with alts. Technology innovation is enabling investors and fund managers to more efficiently move money through the system, all the way from pre-investment with allocating capital to funds through to executing investments into alts at lower minimums.

From a fintech perspective, we’ve seen the digitization and innovation of categories like lending (Lending Club, Zopa), digital banking (Nubank, Chime, Revolut, Monzo), digital wealth management (Wealthfront, Betterment), and retail brokerage (Robinhood, Public, Coinbase). Now, we are seeing the fintech transformation come to alts. The same concepts that enabled these aforementioned categories of financial services to be impacted by technology are now making their way to alts. The evolution is far from over, but there are now more cost-effective and user-friendly ways for investors to invest into private markets.

Taken together with the moves of many of the largest players in private markets, it seems like we are hitting the point where alts are now very much a part of the conversation when it comes to how traditional asset managers and banks are thinking about the strategies they offer and clients they serve.

Traditional firms and Wall Street banks see the need to move into private markets. We’ve seen a number (at least 26 firms, according to Huw van Steenis, in his op-ed this week in the FT) acquire private credit managers to build out their alts capabilities and offer their investors a more comprehensive set of investment strategies. Goldman Sachs, for its part, has bet a considerable portion of its growth prospects on their newly combined Asset and Wealth Management (AWM) units (see: FT article from Nov 1 on this topic). AWM is looking to raise meaningful outside LP capital for their private markets strategies as they plan to compete with the likes of Blackstone and scale their AUM. Goldman’s new head of AWM, Marc Nachmann, said a month ago that AWM is on a path to reaching $225B in alternatives fundraising by the end of 2023, a big jump from its $40B figure in 2020. This figure falls short of Blackstone’s $1T AUM (and $735B of fee-paying AUM), but it would put them within striking distance of alts behemoth Carlyle, which boasts $273B AUM.

What does the evolution of some of the largest companies in private markets mean for the future of alts and traditional financial services? Here are a few questions to consider:

1/ Who else will expand their platform and business model?: A number of the largest alternative asset managers have grown beyond their roots of either private equity or private credit to become a multi-strategy platform. This business model evolution has also meant, for some, a focus on perpetual capital. Apollo became the clubhouse leader with their prescient purchase of Athene, an insurance business. This week’s purchase of Global Atlantic by KKR shows another peer following suit. Many of the other large, publicly traded alts managers like Blackstone, Carlyle, Ares, and Blue Owl all have an increasing portion of their AUM in perpetual capital.

The question now becomes how many others will follow in their footsteps and grow their perpetual capital base or acquire insurance businesses?

2/ What’s the next business model evolution for alternative asset managers?: We know that many of the largest alternative asset managers have (1) prioritized the wealth channel from a distribution perspective and (2) like owning stakes in wealth management businesses due to their financial upside as rollups and platform plays. Is the next natural evolution for an alternative asset manager like Blackstone or Apollo to buy or build a wealth management business in-house? Sure, alternative investment funds have different fee models than wealth managers, but wealth management businesses can be relatively sticky business models with attractive revenue streams at scale. A firm like Goldman is doing this in reverse. They are looking to expand the capabilities of their wealth business by pairing it with asset management, hoping that the investment strategies they manufacture will see AUM growth from their private client wealth management business.

One might argue that a wealth management business works better when the investment decision-making is open architecture. There’s merit to that line of thinking — and it’s a big reason why the independent wealth management channel has grown so much. But one might point to a few trends in the evolution of the large alternative asset managers that could dispute the open architecture argument. Large alternative asset managers like Blackstone, Apollo, KKR, Carlyle, et al. have become diversified, multi-strategy investment platforms with a broad menu of funds globally. In the institutional arena, we witnessed institutional allocators like pensions and endowments shrink the number of GP relationships they had in exchange for lower fees and more co-investment opportunities. Why couldn’t a captive wealth manager within a large alternative asset manager work? Would a wealth manager only invest into Blackstone funds? They could, but they wouldn’t necessarily have to. Wall Street provides a precedent. Goldman products may end up on the Morgan Stanley platform. Why couldn’t it be the same in alts?

3/ How to invest in a new world order where alternative asset managers encroach on traditional financial services?: There’s nothing wrong with private equity evolving from a cottage industry into a more prominent part of the asset management world. With Blackstone entering the S&P 500 this year and a number of other firms performing well in public markets, it’s clear that these firms have business models that work. It also means that they have to continue to grow and expand their capabilities to see their stock price performance improve. As markets see more capital flowing in and funds grow larger, outsized returns become harder to achieve. That can be okay — every market has alpha and beta. And private equity may be moving toward a part of the market that’s more of a beta play versus alpha generation when it comes to manager selection. But it does call into question what part of the value chain an investor may want to own.

Much like Huw van Steenis predicted 20 years ago that investor flows would polarize into a barbell between public and private markets, I think we could see a similar phenomenon happen in private markets.

On one end, investors would allocate to passive and exchange-traded funds to gain exposure to benchmark returns cheaply and conveniently. At the other end, van Steenis predicted investors would aim for higher returns by allocating to specialist fund managers investing in private assets, hedge funds, and real estate.

Perhaps the barbell framework can make sense in private markets, too. On one side of the barbell, invest into managers with smaller fund sizes in many parts of private markets as a LP to generate outsized returns. It’s worth noting that some private markets strategies benefit from size and scale. Private credit might be one such example. But areas like venture and mid-market buyout funds often see smaller funds outperform due to function of fund size relative to possible outcomes they can achieve. On the other side of the barbell, aim to own the cashflows, revenue streams, or stock either directly (via GP stakes) or indirectly (public company stock ownership) of mid to large-sized alternative asset managers. Larger alternative asset managers have a strong business model — and the ones that can scale AUM should continue to perform well as businesses, so owning a part of their growth story could very well make sense.

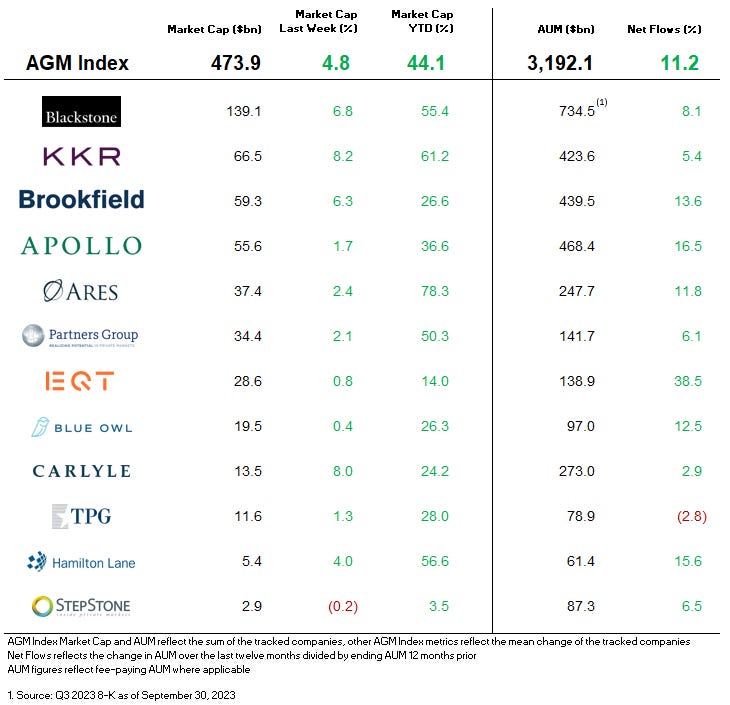

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Banking Escapees Make Billions from Private Credit Boom | Silas Brown and Davide Scigliuzzo, Bloomberg

💡Bloomberg dives into the rise of one of the firms that has been part of the private credit boom, HPS, as a microcosm of a larger story that illustrates how private markets are eating into the activities of traditional Wall Street banks. In 2016, private credit firm HPS bought itself out of JP Morgan Chase & Co. in a complex deal that valued the business at close to $1B. As HPS has grown into a $100B AUM firm, they contemplate their future, which could include going public. There’s talk that the firm could be valued at 8x as much as it was in 2016. HPS is but one example of the remarkable rise of private credit as an alternative to, and possibly a replacement for, traditional Wall Street lending. HPS’s founders Scott Kapnick, Scot French, and Mike Patterson have been at the forefront of transforming a niche area of finance, where “nonbank” funds lend money to riskier companies, into a growing area of private markets that’s now over $1.6T. Kapnick remarks that private credit is here to stay — and possibly be much more, saying: “You’re seeing the rebuilding of Western capital markets beyond the banking system.” There’s a heated debate as to whether or not the rise of private credit will make for a stronger financial system. Proponents of private credit argue that taking risky loans off the balance sheets of systemically important banks will preserve the health of these banks and offload some of that risk to specialist credit funds. But others, such as the International Monetary Fund and the Bank of England, question whether a “shadow banking” network creates its own issues of illiquidity and a less transparent ecosystem. UBS Group AG’s Chairman, Colm Kelleher, warned of a private credit “asset bubble.” And he’s not alone in that thinking. Irrespective of one’s views on private credit, it’s hard to argue with private credit’s entrance into the mainstream. Global private debt assets under management have increased more than threefold in the past ten years.

HPS, which grew from $34B to $100B in AUM since spinning out of JP Morgan in 2016, has been a central figure in private credit’s rise. They’ve also taken investments into their GP from Dyal Capital in 2018 and Guardian Life in 2022. What’s notable about HPS’s possible foray into the public markets is that the earliest of the listed firms first built their brands in private equity. More recently, credit focused firms like Ares and Blue Owl have gone public, so HPS could follow in their footsteps, signifying the rise in prominence of private credit as an investment strategy.

💸 AGM’s 2/20: HPS’s rise is emblematic of a much larger trend developing in private credit. Private credit firms, and, more broadly, diversified alternative asset managers are encroaching onto the territory of some of the more traditional Wall Street banks. Private credit firms are stepping into the void left by traditional lenders, who are retrenching in a more challenging economic environment. Private credit firms are also more willing to step up and take more risk, particularly with mezzanine lending. The returns are greater, but so is the risk. Some, like Apollo’s Marc Rowan, see this as the beginning of a secular trend of “debanking.” Others, such as UBS’s Colm Kelleher, worry that private credit is a bubble. The reality may be somewhere in between. Private credit continues to be a very popular investment strategy for investors allocating to private markets. Firms like Apollo, Ares, Blackstone, Oaktree, Blue Owl, HPS, and others are very much beneficiaries of this interest from investors. Others, such as TPG, which acquired Angelo Gordon, and Man Group, which acquired Varagon, are looking to add private credit expertise or strategies to participate in this market. In the current higher rate environment, the return profile of private credit, higher returns than in a zero interest rate environment with less risk than equity-oriented strategies, makes sense for investors. But if rates fall, then investors could be stuck in illiquid private credit strategies as returns come down. We could be a ways off from that happening, as the popularity of private credit has persisted amongst many in the LP community, but it certainly bears monitoring.

📝 Private credit boom will trigger a new squeeze | Huw van Steenis, FT

💡Vice Chair of Oliver Wyman and former Global Head of Banks and Diversified Financials Research at Morgan Stanley Huw van Steenis unpacks the challenges and nuances with the current growth of private credit in an opinion piece in the FT. He shares both sides of the coin, referencing the growth of private credit spurred on by higher interest rates and regional banking turmoil. Confidence that private credit firms will step in to fill the void that banks have left has led data provider Preqin to project the market to grow from $1.6T this year to $2.8T. BlackRock is even more bullish, forecasting growth to $3.2T. Executives from the largest alternative asset managers are calling this the time for private credit, van Steenis remarks, citing Apollo’s Marc Rowan saying we are in the early days of “debanking” and Blackstone’s Jon Gray calling this year the “golden moment” for private capital, and private credit in particular. Regulatory pressures are also an accelerant for the private credit boom. According to Oliver Wyman, under proposed Federal Reserve rules, the capital required to support the US wholesale banking industry could increase by as much as 35%. The opportunity in private credit is driving traditional and alternative asset managers to shift their focus to private credit. van Steenis notes that at least 26 traditional asset managers have bought or launched new private credit funds in the past two years. This shift highlights the evolving market structure of finance that van Steenis was so incredibly prescient about twenty years ago. While at Morgan Stanley, he argued (twenty years ago!) that investor flows would polarize into a barbell. On one end, investors would allocate to passive and exchange-traded funds to gain exposure to benchmark returns cheaply and conveniently. At the other end, van Steenis predicted investors would aim for higher returns by allocating to specialist fund managers investing in private assets, hedge funds, and real estate. His prediction played out — and the challenges have become even more protracted for traditional asset managers. The big have gotten bigger — and it’s giving them a moat as a business. Today, ten firms account for 40% of private credit fundraising over the past 24 months, according to Preqin. In private credit, in particular, size matters. Deals are getting larger, and the largest firms are less keen on syndicating deals, instead going solo and financing an entire private credit deal on a standalone basis. van Steenis highlights the prospective challenges with private credit in an uncertain rate environment, rightfully pointing out that certain firms will be winners, in large part due to their size and scale.

💸 AGM’s 2/20: The trend is clear: the market structure in private markets is changing rapidly. The growth of private markets and the corresponding headwinds that traditional asset managers and banks are facing make for an evolution in the firms who run financial markets. The process is still in motion as we are in the early days of “debanking,” as Marc Rowan of Apollo has said, but it’s hard to ignore the increasing influence and power that alternative asset managers are wielding. There’s little doubt that they are encroaching on Wall Street’s territory, and private credit is only opening the door for them to increase the footprint of their land grab. It may be a process impossible for banks to compete with. Whether due to regulatory changes or business pressures, banks are no longer in a position to pursue certain activities, like mezzanine lending, in the same ways that they used to. This change has opened the door for private credit firms to fill the gap, which will make for an interesting future ahead when it comes to what the financial market structure will look like in the years to come.

📝 Private markets firms raid asset managers and banks for talent | Selin Bucak and Margaryta Kirakosian, Citywire

💡Alternative asset managers are looking to private banks and traditional fund managers as they bolster their private wealth distribution capabilities. Selin Bucak and Margaryta Kirakosian from Citywire report that, since 2021, 15 of the biggest private markets firms have poached at least 68 people from private banks and traditional asset managers, Citywire research shows. Half of recent hires are members of wealth solution teams: 34 of the 68 have the word “wealth” in their new job titles. The likes of Blackstone, Ares, KKR, and Apollo have all set up dedicated business units to target private wealth clients. Some notable hires that Citywire highlights include Brian Feurtado joining Apollo from BlackRock to run their family office business. At BlackRock, he led their family office, foundation, endowment, and healthcare LP channels. Apollo has also brought on Dan Flynn as the Head of US Field Distribution, where he joined from Barings in 2021, Howard Nifoussi, who joined Apollo from Goldman Sachs to head up US Wealth Management, and Veronique Fournier, who is the Head of EMEA, Global Wealth in Apollo’s Client & Product Solutions Group. Firms such as Ardian, Ares, Blackstone, Brookfield, EQT, KKR, and Pantheon have also made a number of senior hires. It can be difficult to find, but some firms are looking for specialization in alts. KKR’s new Head of Global Wealth Solutions, Tomislav Culic, came from HSBC, where he was in charge of alternative investments in EMEA.

Why make the jump from a traditional asset manager to an alternative asset manager? A higher salary is apparently a major draw for those looking to make the switch to private markets firms. Citywire found that those firms can often offer 50-100% more pay to their distribution and sales specialists than traditional asset managers do. Max Heppleston, new Managing Director for alternative asset management at recruiting firm Fredriks, said the money private markets specialists can offer is significantly higher, even for the mid-level bankers with $400K salaries he spoke to in Switzerland and the U.K. “For these roles, just because of what they are selling and who they are working with, total compensation was going into seven figures, so it was quite an easy sell,” he said. But it’s not just the money that’s appealing. According to Debbie Eidelman, head of investor relations and fundraising at recruitment firm PER, private markets firms are often seen as an aspirational role for candidates. “It’s an opportunity for them to escalate and build something,” she said. “But it’s quite a selective pool, not everybody is getting the call.”

It can be a challenge for firms to find hires with the combination of knowledge, network, and skillsets across both alts and the private wealth channel. Part of this is due to how nascent the market is from the perspective of alternatives firms working with the wealth channel — and this makes private markets experience rare, particularly with salespeople.

Drilling down on the numbers, Brookfield Oaktree Wealth Solutions has made the most hires in the last three years after launching its wealth division in April 2021. Europe appears to be fertile hiring ground as well. 33 of the new hires are based in EMEA.

💸 AGM’s 2/20: Hiring trends amongst the large alternative asset managers illustrate just how much of a strategic priority the wealth channel is for them. Many of the large GPs have made a number of key hires to build out or bolster their distribution teams that focus on the private wealth market. These actions signal a real commitment by GPs — both from human and financial capital perspectives — to private wealth. There are a number of notable data points in the Citywire article. Hiring trends suggest that many of the largest firms are going global. EMEA represented a large portion of new hires for these firms, illustrating that these firms are looking to other regions of the world, like EMEA and Asia, represent areas of focus from a capital raising perspective. While firms have grown their teams, the right talent is not always easy to find. Private markets firms working with the wealth channel is still very much in its infancy, so it’s not a surprise that the talent pipeline of senior professionals who possess both extensive knowledge of private markets and a large network of RIAs or family offices is not yet deep. The good news? As private markets continue to mature and engage with the wealth channel, the next wave of talent will be developed, and the pipeline of candidates will only grow.

📝 Private wealth helps fuel Pantheon's $3.25B secondaries close | Marie Kemplay, PitchBook

💡Pantheon has closed its largest-ever secondaries fund on $3.25B, $1.25B above its initial target, with the private wealth channel being a major contributor to its successful fundraise. Its flagship Global Secondaries Fund VII is the fifth largest secondaries fund to close this year and the second largest from a Europe-headquartered fund, according to Marie Kemplay of PitchBook. The private equity-focused fund, which will invest in both traditional LP stake secondaries and GP-led secondaries transactions, attracted commitments from institutional investors as well as what Pantheon describes as "significant inflows" from private wealth clients. The firm recently intensified its focus on its private wealth business, opening up offices in Geneva and Singapore to target such clients. They also recently launched their Global Private Equity fund, an evergreen fund open to both private investors and institutional clients.

Pantheon’s successful raise is part of LPs’ interest in secondaries funds. While the number of secondaries funds closed this year has been significantly lower than last year, the $22B in capital raised by funds this year has surpassed 2022’s totals. With IPOs and M&A subdued, both LPs and GPs have been turning to secondaries transactions as a means to generate liquidity. "Difficult market conditions and drops in public market valuations in 2022 left many investors simultaneously not receiving distributions and overallocated to private markets," said PitchBook Analyst Juliet Clemens in a recent analyst note. "The stalled exit environment left the secondary market as one of the only viable routes to liquidity for LPs."

💸 AGM’s 2/20: Three big takeaways emerge from the news of Pantheon’s secondaries fundraise, all of which follow broader trends in private markets. One, secondaries is very much a popular strategy amongst LPs right now. That’s both institutional LPs and private wealth LPs. For institutional LPs, secondaries offer a way to access an investment strategy with a reduced J-curve and a faster path to liquidity. For private wealth LPs, secondaries can be a great onramp to private markets and provide vintage year diversification as they look to increase exposure to alts. Two, Pantheon’s success fundraising from the private wealth channel illustrates that the wealth channel is becoming a more prominent part of many fund’s capital raises. This news follows a fundraise by secondaries fund Lexington Partners, where 10-15% of the capital (and possibly more) of their most recent secondaries fund will come from the wealth channel. Private wealth can no longer be seen as a bit part in a fundraise — the channel is very much a key feature to a successful fundraise and can represent a large portion of a fund’s LP base. Third, the big continue to get bigger. PitchBook’s data on secondaries fundraising illustrates just that. While fewer funds were raised this year, more dollars were raised than last year. That means the larger funds are having more success fundraising. Perhaps this isn’t a surprise when combined with the fact that many of these large firms are focused on bolstering their distribution teams, particularly in private wealth, so they are able to bring more firepower to fundraises and achieve larger fundraises.

Reports we are reading

📝 State of European Tech 2023 | Tom Wehmeier, Sarah Guemouri, Hanna-Stina Sonts, Atomico

💡Atomico released its annual State of European Tech Report this past week. The report had a number of interesting data points. I’ll highlight a few:

Outside of 2021 and 2022, Europe has seen an 18% increase in capital invested into startups in the region when comparing 2023 ($45B) versus 2020 ($38B).

Publicly-listed tech companies are showing signs of recovery, with the 10-year average on the median multiple almost back to pre-2020 levels.

Median Series A and Series B valuations are still higher than pre-2021 and 2022 levels but they are inching closer to 5- and 10-year averages. Median Series A pre-money valuations in Europe are now at $22M, which is closer to the $19M 5-year average and $15M 10-year average. This figure is contrasted with the US median Series A valuation of $34M. Median Series B pre-money valuations are now at $50M, which is lower than the $61M 5-year average and slightly higher than the $43M 10-year average. This figure is contrasted with a US median Series B valuation of $81M.

Europe’s public and private markets ecosystem is now back to over $3T in total value. This figure today compares to $0.5T in 2014.

Europe’s total capital invested across early-stage and growth-stage in 2023 is now back to levels higher than in 2020.

Europe is winning over international talent, with significant talent migrating from the US. Europe has seen a 10k net talent gain from other parts of the world. This data is supported by anecdotal evidence I’ve seen, where I’ve had a number of friends and colleagues who worked at high-quality US startups move to Europe to join the European startup ecosystem.

Europe is now besting the US in new tech startup formation.

Talent is flocking to areas like sustainability / climate, health, digital care, supply chain and logistics, and hardware. All of these categories are areas where Europe has the potential to excel, thanks to a combination of strong research universities, robust government support, and a number of funds focused on solving these issues.

Europe has more AI talent than the US, with over 120,000 active AI roles in Europe. This data is buttressed by the fact that AI is the top theme at Seed stage by capital invested in 2023.

(Some) fundraising / acquisition news

📝 Yieldstreet to acquire real estate investment platform Cadre | Mary Ann Azevedo, TechCrunch

💡Multi-asset alternative investment platform Yieldstreet announced this week that it has agreed to acquire Cadre, an online real-estate-focused investment platform. TechCrunch’s Mary Ann Azevedo reports that financial terms were not disclosed. Yieldstreet and Cadre were founded at similar times, albeit taking different paths to building alts-focused investment platforms. Yieldstreet was founded in 2015 to enable individuals to invest into real estate, marine / shipping, commercial loans, and other private markets investment opportunities previously only available to institutional investors. Cadre was founded in 2014 to enable accredited individual investors to invest into commercial real estate deals. Cadre raised $133M in debt and venture funding from investors including Andreessen Horowitz, General Catalyst, Khosla Ventures, Goldman Sachs, Thrive Capital, and others. While the financial terms were not disclosed, The Information reported earlier this year that an acquisition by Yieldstreet could value the company at $100M. Collectively, the two companies have a combined investment value of $9.7B in capital into alternative investment opportunities. Investors have allocated a combined $5.3B in capital and received $3.1B in returns to date. Yieldstreet and Cadre will serve over 500,000 members, with 450,000 coming from Yieldstreet and 50,000 coming from Cadre.

💸 AGM’s 2/20: Yieldstreet’s acquisition of Cadre may be a sign of things to come in the alts space. Consolidation could be on the horizon, particularly for investment platforms that have a single strategy focus. Much like multi-asset alternative asset managers at the top of the market have benefitted from diversification, the same theory could apply for fintech startups in alts. Cadre was impacted by challenges in commercial real estate. Without other investment opportunities to offer, they found that partnering with a multi-asset investment platform like Yieldstreet made sense. I anticipate that we will see continued consolidation in the midst of a difficult fundraising environment, as there are a number of single-asset platforms across various categories of alts that may be better off as part of a large platform with more clients.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Strategy & Operations Manager. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Client Associate, Relationship Management (Remote). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.