👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

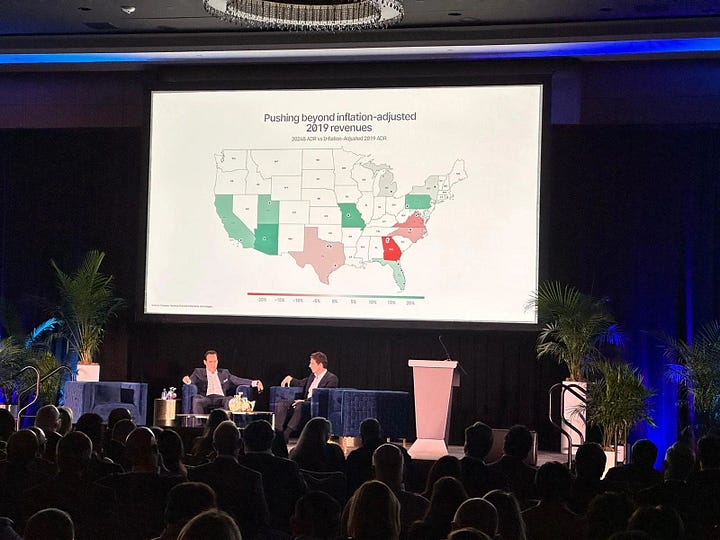

Good afternoon from DC. I’ve just returned from Miami, where I was invited to moderate the Driftwood Capital Annual Investor Meeting this past week. Driftwood, a leading hospitality real estate investment sponsor with over $3B in hospitality assets and 16,500 keys under management, hosted hundreds of their LPs for their AGM.

Driftwood was formed in 2003 after Co-Founder Carlos Rodriguez Sr. merged his hospitality investment sponsor, Cardel Hospitality Group, into Lehman Brothers-backed Driftwood Hospitality Management. Driftwood has since grown into one of the larger hospitality sponsors in the US, and in 2015, multiple generations of the Rodriguez family, Carlos Sr. and Carlos Jr., came together to form Driftwood Acquisitions & Development, a hospitality-focused private equity investment platform for accredited investors.

That Driftwood has successfully combined the experiences and viewpoints of multiple generations into building a large hospitality investment platform dovetailed well with a theme that was weaved throughout the entire Driftwood AGM: the merging of the physical and digital.

Hospitality investing is perhaps one of the areas of alternative investing where the marrying of physical and digital will feature prominently. Some of the discussion at the AGM highlighted how Generative AI and technology could be used to create better in-person experiences for travelers, particularly younger travelers who are seeking more immersive travel experiences and on-demand services from hotels. A better travel experience and more efficient customer service marketing and sales with conversational business intelligence insights can directly translate into investment performance for hospitality investors, where maximizing occupancy rates drives revenues and returns for the sponsor. That impact could be meaningful — McKinsey predicts that Gen AI’s impact on travel could range from $180-300B.

The theme of merging the physical and digital was also featured in the conversation that Driftwood President Carlos Rodriguez Jr. and I had about how technology is transforming private markets. Carlos is spearheading a number of innovative initiatives at Driftwood that are bringing together critical components of both physical and digital. Driftwood, to date, has mainly partnered with individual accredited investors, who invest on both a deal-by-deal basis and into their funds.

Driftwood has built a technology platform to enable investors to invest into their hospitality deals. With the recent addition of their CTO, Manny Babu, who was responsible for the Blackstone Insurance Solutions Group’s technology platform and One River Digital, which was acquired by Coinbase, Driftwood is aiming to continue to build on the technology innovation we’ve seen in private markets technology over the past few years to serve their accredited investor base and the broader real estate investment industry.

Devising a strategy for working with the wealth channel

What Driftwood has done in building out a community of individual accredited investors is no small feat. Anyone who has built or invested into an online investment platform or fund knows how challenging it is to both acquire and manage large numbers of smaller investors. Driftwood works with over 1,200 accredited investors.

Driftwood’s focus on building out private markets investment technology is part of a broader trend driving the alternatives industry forward. Fundraising in the new world of private markets is about successfully combining the physical and the digital. Successful fundraising combines high-quality, in-person interactions that educate and engender trust while leveraging technology more efficiently distribute and administer investment products.

Despite the increased use of technology in private markets by both GPs and LPs, fundraising and LP management still requires a heavy dose of physical, human touch. For an asset manager to successfully distribute their investment products, they need to have a deep understanding of their clients. Given the importance of trust when selling an investment product, a sales approach centered around a consultative sales process and meaningful time spent with a client is critical to success.

A report released by Bain & Company this week, “Taking Private Equity Fund-Raising to the Next Level,” highlights a number of key considerations for asset managers as they devise a strategy for working with the wealth channel. With Bain projecting that institutional capital allocated to alternative investments will expand by just 8% annually over the next decade, firms will face more serious competition to win a piece of the wealth channel’s pie.

Bain notes that the firms who are out-raising their counterparts have taken a page out of the playbook of companies who are highly effective at enterprise sales. The punchline from Bain’s report? Many of the tactics that successful fundraising functions rely on are similar to high-performing commercial organizations.

Working with the wealth channel, and advisors in particular, is very much an enterprise sale. Client segmentation is important — an alternative asset manager breaking down their prospective LPs into large, medium, and small-sized enterprises across private banks, large wealth platforms and aggregators, smaller wealth advisors, family offices, and individual investors will help them figure out which LPs are the right fit for their investment products based on fund size, track record, alignment on investment strategy with LPs’ objectives, and a host of other factors. This process is very similar to a B2B software company like Salesforce determining the various customer channels, segmenting those customers, and devising the right sales org structure to successfully work with each customer type.

Alternative asset managers can very much borrow concepts and best practices from enterprise sales companies when it comes to approaching distribution of their investment products. I wrote about product-market fit in the context of an investment strategy fitting into an investor’s portfolio back in 2021 in my piece about The Arc of Institutionalization and how investment platforms can segment their investor customer type as they grow AUM and institutionalize:

We don’t talk about product-market fit in the investment world as much as we do in the technology world, but there are many similarities. With each investor type, investment platforms have to figure out how they fit into an investor’s portfolio and why their investment offering adds value to their portfolio.

The Arc of Institutionalization

We’ve talked about the explosion of interest in alternative assets. This trend does not seem to be going away. If anything, dollars flowing into the space are only increasing. We are in the early innings of alt assets becoming mainstream. How can investment platforms in the alts space build out their investor networks and distribution capabilities so they…

What are some takeaways for successfully selling into the wealth channel?

(1) Know your customer: Understand that different investor types are the right fit for different investment products. Certain fund sizes will be prohibitive for specific types of LPs. A $100M fund will struggle to likely raise funds from an institutional investor (pension, endowment) because that investor may be looking to allocate $25-50M per fund commitment, which would be a prohibitively large portion of the fund’s total capital for the LP to be comfortable.

(2) Ingredients for a strategic, consultative sale: Education, trust, and a holistic understanding of a client’s portfolio are all critical components of a successful, strategic, and consultative sale. Many firms have heavily invested in education because they know that helping advisors and HNW clients understand private markets will create trust. Education has been a major focus area for many of the largest alternative asset managers and investment platforms. The likes of Blackstone, Apollo, KKR, and others have successfully executed on an education strategy that has both grown their footprint in private markets and created an environment of trust for investors in the wealth channel. The focus on education is similar to what BlackRock and other large asset managers did in the early days of the ETF industry. Their focus on education helped propel ETFs into the mainstream. The same will happen with private markets.

(3) Creating a framework for portfolio construction: The next big thing in education is tying in the why and the how of alts into broader portfolio construction. The industry has created the framework and content to help allocators move beyond the 60/40. The next step is helping advisors and their clients understand how certain private markets strategies and investment products fit into an investor’s portfolio in a hyper-personalized, real-time manner. Innovations like iCapital’s Architect, AltExchange, and Arch are all pushing the alts space forward by creating the connective tissue that ties public and private markets together so that private markets can realize the vision that Apollo’s Stephanie Drescher and Neuberger Berman’s CIO Shannon Saccocia highlighted at Future Proof and that iCapital’s CEO Lawrence Calcano discussed on our Monthly Alts Pulse show: that eventually an investor’s portfolio won’t be comprised of discrete stocks, bonds, and alternatives buckets, but rather the equities bucket of a portfolio will be a combination of public and private equities because investors can see and understand the impacts of liquidity and illiquidity on their portfolio.

(4) All roads lead to the individual investor: Ultimately, the end client or beneficiary of an alternative investment is the individual investor. Even if an alternative asset manager is convincing a pension, endowment, or wealth manager to invest into their investment product, the endpoint is the individual investor. For a pension plan, that could be a firefighter or a teacher. For an endowment, that could be a student. For a wealth manager, that could be a family and their children. Private markets, whether an alternative asset manager or an investment technology platform, cannot forget that the ultimate beneficiary of an alternative investment is an individual. Therefore, investment platforms must build their platforms and user experiences with the end investor in mind. Even funds or investment platforms that have a B2B sales strategy will need to think about the end customer, the individual investor. I wrote about this concept earlier this year in January after moderating a panel at the LSE Alternative Investments Conference with executives from iCapital, Republic, and bunch. Innovation in private markets infrastructure will be critical to pushing the space forward. Here’s an excerpt from what I wrote:

🛒 Infrastructure, but with the end consumer, the individual investor, in mind: Infrastructure is key, but the most valuable alts businesses will combine critical B2B pipes and plumbing with a maniacal focus on providing the best tech and product experience for the end consumer — the individual investor. Building a business with a single customer archetype is hard enough. Building a business that must serve both B2B and B2C customers simultaneously in a much taller task. But the platforms that crack this code will build incredibly valuable businesses in the alts space.

B2B or B2C? How about both: Building the infrastructure for retail access to private markets

If you only have a few minutes to spare, here’s what you should know about the importance of serving the end investor in private markets: 🛠 Infrastructure businesses will power private markets: Picks and shovels businesses like iCapital, Republic, and

(5) Robust educational programs for distribution professionals: Many successful software salespeople learned their craft at some of the top enterprise sales organizations. Startups often look to hire people trained at training grounds for software salespeople: Oracle, Salesforce, Cisco, Google, Amazon, Asana, DocuSign, Snowflake, and many others. The alts space will need to undergo the same maturation process. We are still in the early days of educating distribution professionals on best practices for selling alternatives products into the wealth channel. But the space will do well to develop sales talent in the same way that the software industry did.

Alternative asset managers that have the resources and infrastructure to develop and grow salesforces will become training grounds in private markets in the same way that the top software companies became proving grounds for developing talent for the enterprise software startup ecosystem.

Creating the connective tissue between GPs and LPs: The next phase of AGM Collective

The largest fund managers have the resources to build and structure sales teams to match their fundraising ambitions. They have the ability to hire, train, and educate distribution professionals to help them effectively work with the wealth channel and grow AUM.

But what about smaller managers? How can they align their growth ambitions with their more limited resources?

I created Alt Goes Mainstream to provide connective tissue between GPs, LPs, and investment platforms. If AGM can play a role in educating all parties in private markets on how to best work with each other, AGM can contribute to helping alternatives feature in investors’ portfolios in a mainstream way.

The name, the AGM Collective, was no accident, either. An AGM for a fund represents capital, community, connections, and education. Everything that a fund’s AGM represents are areas that we focus on at Alt Goes Mainstream.

It’s fitting that this past week I moderated an AGM for a fund. Seeing investors come together to build connections, learn about Driftwood’s process and performance, and be educated on trends in the broader real estate investment market highlight how important it is to connect GPs and LPs.

In 2024, AGM will be launching a number of services to help GPs and LPs better navigate the fundraising process, learn about each other, and forge connections that can continue to help push private markets forward. Reach out to learn more — and watch this space. I’m excited by what 2024 will mean for the continued evolution of private markets.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Norway’s $1.5 Trillion Wealth Fund Recommends Adding Private Equity | Kari Lundgren, Bloomberg

💡One of the world’s largest institutional investors recommends increasing its exposure to private equity, reports Bloomberg’s Kari Lundgren. Norway’s $1.5T wealth fund, which owns almost 1.5% of listed stocks globally, has asked its finance ministry to add unlisted companies to its portfolio. Their rationale? Because a meaningful part of value creation happens in private markets. “An increasingly larger share of global value creation takes place in the unlisted market,” said Norges Bank Governor Ida Wolden Bache on Tuesday. “We believe that such an opening could give higher returns for the fund over time. We think it will be possible to invest in unlisted equities in a way that meets our expectations on transparency and responsibility.” CEO Nicolai Tangen sees the current market as an opportunity to enter into private markets at an attractive time. “I see this as a catalyst, similar to when we increased the proportion of equities during the financial crisis,” Chief Executive Officer Nicolai Tangen told reporters. “It is slower in the private equity market now than it has been,” he added, “which means we can enter the market with better terms.” Given the fund’s size and scale, Norway’s wealth fund would be allocating tens of billions of dollars to private equity. An unlisted equity portfolio of 3% to 5% of the total fund’s size, or about $40B to $70B at the fund’s current value, would provide both meaningful allocations and exposure to private markets and diversification. Norway would also add 10 to 15 people to manage their private markets allocations. This would follow the trend of many other large pension plans and sovereigns, such as Canada’s pension plans and sovereigns like GIC and Temasek, who have dedicated a meaningful portion of assets and have hired large teams to focus on private markets.

Not everyone agrees with this strategy. Finance Professor Karin Thorburn, who teaches at the Norwegian School of Economics and Wharton School of the University of Pennsylvania, believes the fund should focus on investing into liquid, listed equities that have a lower fee structure. “The success of the oil fund is based on its disciplined investing, holding a broadly diversified portfolio at a low cost,” Thorburn said in an interview Friday. “The fund was early to adopt a passive index strategy that has now become the gold standard of investing,” she said. “Why change a successful concept without a good reason?”

💸 AGM’s 2/20: News of Norway’s sovereign fund considering a large allocation to private equity surfaces a number of key trends in private markets. Their decision to consider the asset class is emblematic of just how much alternatives have entered the mainstream over the past ten years. A paper by Norges Bank Investment Management highlights the AUM growth in alts since 2010. Alts AUM growth has been staggering. The market has increased 12% annually since 2010, and, as a share of the public equity market, private equity has grown from 4% in 2010 to 9% in 2022. Part of the rationale for Norway’s sovereign fund considering private markets is due to this trend. Significant value creation is occurring in private markets because many companies are staying private. The universe of companies that are in private markets, combined with the trend of companies staying private longer, means that investors have to consider exposure to private markets. With the right approach and thoughtful manager selection (and co-investments or direct investments), investors can use private markets to generate strong performance with potentially lower volatility than their public markets exposure. But skeptics in Norway make strong arguments for not pursuing a private markets investment allocation strategy. Fees can be higher in private markets, so returns must far outstrip the fee load. That’s why we’ve seen many pension funds and large institutional investors work to lower their fees paid to managers through seeding new managers to developing co-investment or direct investment programs in private equity and venture. When done right, it can be an effective supplement to a public markets equities allocation. But executing on that remains the question.

📝 Competition To Manage Middle Eastern Sovereign Wealth Has Become Fierce | Alicia McElhaney, Institutional Investor

💡LPs are turning a focus to the Middle East as they tap into the region for fundraising, reports Institutional Investor’s Alicia McElhaney. As the Middle East becomes a focus area for LPs, some firms are going as far as setting up offices in Abu Dhabi and Dubai to have a presence on the ground. Funds are following the money. According to a recent Willis Towers Watson report, five of the top ten sovereign wealth funds by AUM are based in the Middle East, combining to manage almost $3T in assets. Many of these sovereign wealth funds have been active in allocating to private markets. And for good reason. Many of the Middle East’s SWFs generated their capital from the energy sector. They understand the need to diversify their holdings as the world transitions to clean energy — and they are turning to private markets to make that transition. Many firms have spent time in the Middle East, intensifying the competition for dollars. Fundraisers are seeing this occur in real-time. “Competition there is intense,” said James Clarke, Global Head of Institutional Business Development at Blue Owl Capital. He said he recently took an Emirates flight from the region and realized that seven of his fellow passengers also worked for credit funds. Blue Owl, which has been building its presence in the region for years, recently established a $1B partnership with Mubadala and has plans to open an office in Abu Dhabi. And they aren’t the only ones. Eiffel Investment Group and Vibrant Capital Partners announced this week that they are opening offices in Abu Dhabi. Bloomberg reported that Sagard is also opening an office in Abu Dhabi, while AllianceBernstein and GoldenTree Asset Management are planting a flag in Dubai. Fundraisers have noticed that the institutional investors in the Middle East are looking to forge partnerships and more customized relationships with GPs. Clarke said that Blue Owl has tried to replicate its mandate for CalSTRS with investors in the Middle East. Mubadala’s strategic partnership with Blue Owl is similar. Clarke noted that an investment of time and relationship-building is critical. “The model of fly in fly out, whilst it is a good way to establish a beachhead, it’s not a good way to build a presence,” Clarke added. François Aissa Touazi, Co-Global Head of Investor Relations at Ardian highlighted the importance of sharing co-investments with the LPs: “You have to show your ability to share these co-investments,” he said. “They appreciate the time dedicated to them.” Ardian would know. On Wednesday, the firm announced a deal with Saudi Arabia’s Public Investment Fund, in which the two acquired stakes in the holding company of Heathrow Airport.

💸 AGM’s 2/20: This article highlights the importance of having a strategy for partnering with LPs. Many funds have recognized the growing presence of the Middle East in allocating to private markets — and their distribution strategies have focused on figuring out the best way to work with LPs in the region. A number of fundraising learnings are evident in how some of the sizable alternative asset managers have navigated the region. They’ve identified and mapped out the customer types. With sovereigns, they recognize that the approach must be tailored to an enterprise sales process. They understand the importance of relationship-building and educating the LPs on private markets. Some firms have decided to open up an office to provide a high touch, on the ground, regional presence. As Blue Owl’s James Clarke said, establishing a local presence is critical in the region. GPs understand that many LPs in the region require a meaningful amount of time spent on the ground build to relationships. They will do well to adopt an enterprise sales strategy if they want to have success fundraising in the Middle East.

📝 Arctos takes stake in Paris Saint-Germain to value club at more than €4bn | Samuel Agini, FT

💡Soccer continues to be a popular investment for both sports funds and sovereigns. This week, Arctos, a $6.6B AUM alternative asset manager focused on taking minority stakes in sports teams and leagues, purchased a minority stake in Paris Saint-Germain (PSG). The deal values PSG at more than €4B ($4.3B), illustrating how investors continue to be excited by the potential of sports teams. Arctos’ investment for a 12.5% stake in PSG follows sovereign-backed Qatar Sports Investment into PSG in 2011. They paid €70M to acquire the team in 2011 and have since invested an estimated €1.5B to recruit forward Kylian Mbappé and build a new €300M training center. QSI’s capital injection has propelled the club to success on and off the pitch. PSG has won the Ligue 1 title nine out of the past 11 seasons, and PSG has transformed into a lifestyle brand, which resulted in €654M in revenue in 2021/2022, according to Deloitte’s Football Money League. But PSG will have fans yearning for more. They’ve failed to win the coveted UEFA Champions League, Europe’s most prestigious club tournament. And their spending has not come without intense scrutiny from authorities and rivals. In September 2022, the UEFA body responsible for overseeing financial regulations said PSG was among eight clubs that had not complied with its “break-even requirement” and imposed a penalty of up to €65M.

💸 AGM’s 2/20: Investing into sports teams continues to pique the interest of institutional investors. Arctos’ recent investment into PSG highlights how minority stakes are becoming an increasingly popular trend in sports investing. Qatar Investment Authority made a similar move earlier this year, investing $200M for a 5% stake into Monumental Sports & Entertainment, the parent company that owns the NBA’s Washington Wizards and the NHL’s Washington Capitals. News like this gives rise to a few key questions for the future of sports: One, what will exits look like? As teams become increasingly expensive from a valuation perspective and sovereigns and institutions become investors, who are investors in the next round of financing? Two, what will sports teams and leagues look like in the future when sovereigns are investors? Will it be good for the game? We’ll only know what the score looks like in the future.

📝 As Private Credit Surges, Banks and Alternative Asset Managers Turn Frenemies Rather Than Foes | Jonathan Kandell, Institutional Investor

💡Private credit has become one of the hottest topics in private markets for a number of reasons. It’s also been weighing heavily on the minds of executives at many of the world’s largest banks. JP Morgan CEO Jamie Dimon claimed over the summer that banking regulations had both made their job more challenging and opened the door for private credit firms to encroach on their territory in what would be considered an unsafe way. Institutional Investor’s Jonathan Kandell dives into the challenges and nuances of what he calls “arguably become the most powerful transformational force in the financial world since the 2008 economic crisis.” Banks have reacted by treating private credit firms, like Blackstone and Apollo, more as frenemies than foes. Wall Street lenders are building up their own private credit units by partnering with lenders or hedge funds — and they are inviting alternative asset managers to acquire assets from their balance sheets, which will boost their capital reserves. But banks may have had little choice. Firms like Blackstone and Apollo are growing in such size and scale that it’s hard for banks to ignore them. Alternatives firms would argue that they have also aided banks’ businesses. “Banks get to keep their relationships with their clients, and we let them free up some of their capital,” says Blackstone President and Chief Operating Officer Jonathan Gray. Apollo CEO Marc Rowan told analysts: “There’s actually been dancing on both the bank and private credit sides,” pointing out that banks have enjoyed strong performance this past year. There are a number of questions that come into play for private credit now that rates have risen. No doubt, there are risks ahead for both borrowers and lenders, particularly as Treasury bonds have yields of over 5%. But Apollo’s Rowan remarks, “almost everything in our business works better with higher rates.” And proponents of private credit note that banks and private credit funds shouldn’t be lumped together simply because they both lend. “Removing bank deposits just takes a click of the phone, while our liabilities are match-funded to our assets,” says Blackstone’s Gray. “So we really shouldn’t be regulated the same way.”

💸 AGM’s 2/20: Private credit encroaching on Wall Street’s territory has become one of the biggest stories of 2023 — and it is pushing private markets into the mainstream. Firms like Apollo and Blackstone have built out models that give them unique structural advantages. Apollo’s pioneering use of annuities through its insurance business, Athene, means they can operate off their balance sheet rather than rely on fundraising for their private credit activities. Blackstone has relied more heavily on the wealth channel to fund private credit activities, raising large BDCs, the privately held Blackstone Private Credit Fund (BCRED) and publicly listed BXSL. Banks are certainly reading the tea leaves. They are building out their own private credit operations so that they can join the fray. With the intense focus on firms raising private credit funds — and large alternative asset managers relying on private credit as a major accelerant of their AUM — it might be private credit that brings alternatives into the mainstream.

Reports we are reading

📝 Taking Private Equity Fund-Raising to the Next Level | Or Skolnik, Brenda Rainey, Greg Callahan, Mónica Oliver, and Alexander De Mol, Bain & Company

💡Amidst the backdrop of the toughest fundraising environment in years, Bain & Company wrote a report on how private equity firms can level up their fundraising efforts.

Preqin reports that almost 14,000 alternative asset managers are out raising, seeking $3.3T in capital. However, 2023 full-year fundraising totals will likely cash in around $1T. The 3.2x gap between supply and demand is the widest spread that the industry has witnessed since the GFC.

Bain argues that traditional approaches to fundraising won’t work in the new age of private markets where LPs are more sophisticated.

Continued evolution of how firms fundraise — and an institutionalization of funds’ fundraising functions and strategies — will help propel private markets forward.

Bain lists a number of actionable questions for funds to ask themselves as they devise a sound fundraising strategy for the future:

Do you have a clear ambition for fund-raising and growth, and is it linked to a detailed, actionable strategy?

Do you really know what your share of wallet is with each of your core LPs, how they build portfolios, and how you will continue to be additive?

Beyond these core “customers,” is it clear who the next tier is, and do you have a specific set of strategies to approach them? How good are you really at scouting new LPs?

Do you know how LPs look at you, who they consider your competitors, and how you compare? Have you used those insights to develop a clear, differentiated value proposition that will increase mindshare with clients?

Given your ambition, do you have the right organization and structured processes in place to execute the commercial motions that will help you win with specific types of LPs in specific geographies?

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Strategy & Operations Manager. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Midwest, Regional Director, Senior Vice President. Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Allocate (Private markets infrastructure investment platform) - Client Associate, Relationship Management (Remote). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.