👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from DC.

Last week’s post on the institutionalization of venture capital elicited a number of responses from readers that took the conversation to the next level. I’d be remiss not to cover some of those insights and thoughts about the why and how of the institutionalization of venture capital — and go deeper into what it means for the future of private markets.

So, time to open up the AGM Reader Mailbag.

One such response came from the former CIO of a $5B+ endowment (who gave me permission to post their email responses). This CIO, who was an active allocator to venture, made a number of interesting observations about why venture has undergone institutionalization and what it means for the future of venture capital.

Let’s go inside the mind of an institutional allocator.

Notes from an allocator

All that capital flowed to larger later rounds, enabling companies to stay private longer and achieve private valuations never seen before.

That created more FOMO and more capital flowing to strengthen that cycle ...

Venture’s private market cap today I’d guess is massively larger than historic norms for venture-backed companies in public markets.

There have absolutely been some extraordinary companies that are at mega valuations in the private markets, but I’d also say there are a ton of unicorns that lack the governance and discipline that the public markets would put on them. Yes, some things are easier to do in private hands, but it also can lead to sloppiness with overfunded companies not having their feet held to the fire.

So... I think the scale of the venture business really needs a caveat between what is historically been venture-stage companies vs. multi-thousand employee, >$25Bn companies. The huge uptick in AUM is in the latter category, and I don’t think that’s really venture investing.

I’d also note that the entrance of mega allocators with bad cases of FOMO is the marginal capital that has really mattered. The RIA crowd to a lesser degree, but still important in the bloat in the mega fundraises.

Will the mega allocators stay the course with mega venture? That’s going to be what defines the continued scale.

The other critical element of it is the ability of the mega firms / funds to connect with founders. Sequoia has shown the persistence of brand ... the Goldman of VC. But there is only one Goldman.

All a long way of saying, who knows! Fund managers are inexorably drawn to the siren song of scale ... but gravity eventually will express itself and things will find their natural level.

So much to unpack from this analysis.

Should venture have a more nuanced definition?

(1) The obvious question that remains the elephant in the room in 2024 is something that this allocator noted: “a ton of unicorns that lack the governance and discipline that the public markets would put on them.” One of the big questions in venture over the next 1-2 years will be what happens to many of the overvalued unicorns, which were funded by some of the mega funds, which are backed by some of the mega LPs.

(2) Should venture have a more nuanced definition? This allocator believes that there’s a distinction between “venture-stage companies vs. multi-thousand, >$25bn companies,” where “the huge uptick in AUM is in the latter category, and I don’t think that’s really venture investing.” Possibly so; however, a few aspects of the institutionalization of venture capital make the endeavor of defining “what exactly is venture capital” more difficult.

One, the largest VC firms that have turned into platforms have growth investing arms. Many of these firms participate in later-stage growth rounds. Are these firms still considered venture firms? Yes. Do these firms also participate in large, later-stage rounds with their growth funds? Yes. Are LPs still allocating to these funds? In many cases, yes. The interesting next question would be whether or not these LPs bucket their allocations to these firms’ growth funds as venture or something else. It’s not just that venture funds have been going upstream to later-stage investments. It’s also been private equity firms, particularly those with a software focus, moving downstream to participate in later-stage growth rounds. There are a number of private equity firms (and hedge funds / crossovers) who have made growth investments in recent years, whether they be majority or minority investments.

Two, the activity at the later stages of investing is, in many respects, a question of incentives. If a firm has billions in AUM and has the chance to get to a 2x fund by allocating to a safer and, in theory, more mature, less risky asset, would they do so to preserve the ability to raise a new multi-billion dollar fund? Likely yes. From a business perspective of the continued building out of an alternative asset manager, this makes sense.

(3) One plausible explanation for the growth of venture AUM lies in the fact that the big have gotten bigger. That’s a theme we’ve highlighted at Alt Goes Mainstream for some time in a number of different contexts. Here, according to the allocator, it’s “the entrance of mega allocators with bad cases of FOMO [that has provided] the marginal capital that has really mattered.” So, mega LPs had to allocate mega dollars to (increasingly) mega funds to be able to put dollars to work in venture at scale and get access to many of the large private companies within the private markets universe. I’d also note that the trend of private companies staying private longer has had an impact on allocators’ mindsets. In order for investors to have exposure to the large majority of companies, they’d have to allocate to private markets — either venture or private equity — to gain exposure to the many companies that are still in private markets.

The big question for continued growth in venture AUM? This allocator believes that will hinge on the question: “Will the mega allocators stay the course with mega venture?” It’s very likely that this trend will continue, mainly because mega allocators will often be unable to invest into smaller managers due to the sheer size of fund commitments. The only caveat here is that some larger allocators may look to invest in fund-of-funds to get their exposure to smaller, emerging managers within early-stage venture, which could reduce their likelihood of allocating to mega funds.

In response to the allocator’s initial thoughts above, I then asked this allocator three follow-up questions:

(1) How are institutional allocators thinking about allocating to VC? Has their mindset changed as the industry has changed?

(2) Have institutional allocators started to think more about larger VCs / platforms as a business and look to do things like stakes or do rev share deals so that they get the benefit of the "private credit" like exposure to private markets from them since their returns may go down by investing with those managers as LPs?

(3) Do you think an alternative asset manager will acquire a VC fund?

Here’s their answers:

I think there are very different experiences with venture based on those whose programs started in the 1990s vs. the 2000s vs. the 2010s. The overwhelming flows of capital that are the story of the last 15 years come from the latter two ... I don’t have the data to back that up, but I’d be willing to wager heavily it is the case. All LPs want to see more DPI, but those who have only had venture programs for 10-15 years are likely to have considerably less institutional patience than those who have seen the good across 25-30 years.

That said, most institutions are drowning in the venture exposure, particularly if they have a well-seasoned program. Over asset allocation targets, too much unfundeds, and limited prospects for liquidity.

Mega allocators think scale is the solution to most problems ... they kinda have to, as they can’t actually do niche things. No different for venture (or private credit). They have materially lower cost of capital than SFOs or endowments who can and do back niche-y things, and so are willing to accept the diminished returns that come with AUM bloat, overly focus on low fees as contributors to results, and think betting on future/further scale (via buying a stake in a mature firm) is a reasonable thing.

Yes, I think is entirely plausible Blackstone or someone else might try to acquire a VC fund. It would be more surprising if they hadn’t. If (more) scale is actually a good thing, then something like that would work ... but size is virtually always the (eventual) enemy of alpha.

The allocator shared another great set of observations that lead to a few themes that appear to be defining the current moment in venture.

(1) When an LP invested in venture matters. The allocator highlights this point: “I think there are very different experiences with venture based on those whose programs started in the 1990s vs. the 2000s vs. the 2010s. The overwhelming flows of capital that are the story of the last 15 years come from the latter two.” DPI is at the tip of the tongue of every allocator right now, yet the timing of when an LP started their venture program will likely have a major bearing on whether or not they’ve had DPI. The question is whether newer LPs to venture will have the patience to wait.

One such solution appears to be secondaries. VCJ’s Lawrence Aragon covered news this week of Primary Venture Partners closing on a $95M secondary sale of 30% of their Fund I portfolio to StepStone. Primary’s Founding Partner Brad Svrluga made an interesting point when discussing why they decided to sell a portion of their fund via secondary: “If it takes five years to generate a ton more liquidity, that may well be fine for StepStone because they just started the clock ticking, but that puts me 13 years out. And that’s not my job. My job is to deliver the whole damn thing back in 10-12 years.”

Brad’s quote highlights something of note that’s likely a major topic of discussion in the board rooms of LPs: patience. The patience of many LPs is beginning to wear thin as they both want to see liquidity and need to see liquidity, in large part due to the denominator effect.

(2) Patience may be waning, but mega allocators may not be able to change much about how they allocate to venture. The allocator noted that “mega allocators think scale is the solution to most problems ... they kinda have to, as they can’t actually do niche things. [They] are willing to accept the diminished returns that come with AUM bloat, overly focus on low fees as contributors to results, and think betting on future/further scale (via buying a stake in a mature firm) is a reasonable thing.”

The structural aspects of allocator dynamics mixed with the continued growth and institutionalization in venture could result in more of the same, even if returns, in many cases, don’t change much.

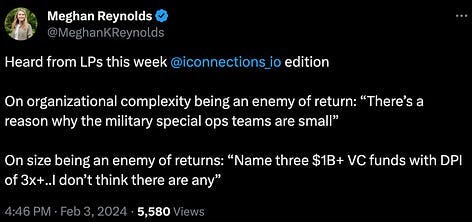

Judging by a tweet from Altimeter’s Meghan Reynolds from this past week, it appears that LPs recognize that smaller fund sizes and / or smaller teams generally make it easier to produce better returns, but the mega allocators often can’t do much about it, given their structural constraints from a deployment perspective.

The allocator also echoed what was said in Meghan’s tweet, highlighting the challenges of size: “size is virtually always the (eventual) enemy of alpha.”

There is likely a select set of larger, $1B+ brand funds whose performance has or will have 3x DPI, but that will be the exception, not the norm. As I said above, both GPs and LPs who have chosen to go down the path of scale understand the how and the why behind what they are doing. They are both willing, in many cases, to accept the potentially diminished returns that come with AUM bloat. It’s not necessarily a bad thing. It’s more of a fact of what makes for the right fit between LPs and GPs. There’s a fund that’s the right fit for the allocator based on their mandate.

That’s the business side of venture, which is only becoming more institutionalized as VC evolves from a cottage industry, which brings us to another point …

(3) The business-building side of asset management will likely become increasingly important to LPs as a way to generate returns. As the AUM of an alternative asset manager grows, the management fee stream becomes more attractive to the owners of that fee stream. The owners are those who own the GP and / or management company. So perhaps it’s no surprise we are seeing a rise in interest in GP stakes investing.

Mega allocators can use their size to their advantage to take stakes into mature managers, betting that continued scale can drive returns via owning part of the management fee stream. Or, as many investors across both institutional and wealth channels are beginning to do, they can invest in GP stakes funds that take stakes in these managers who are playing the AUM scale game.

What does the next wave of venture look like?

So, yes, venture has reached the point of institutionalization. It’s far from the cottage industry that it once was years ago. As I discussed last week, the AUM of some venture firms is larger than that of private equity firms. These mega funds are mega players — across the spectrum of early- to late-stage investing.

It will be interesting to see, as the allocator said, how the definition of venture evolves. Does late-stage investing into multi-thousand employee, >$25B+ private companies constitute as venture investing? Perhaps rather than answer yes or no to this question, maybe we should recognize that it’s just a sign that venture has institutionalized. Multi-stage venture fund platforms, in some cases, have invested in companies at this size and scale. It’s something that firms like Sequoia recognized in 2021, becoming a registered investment advisor (RIA) and moving to a “singular, permanent structure.”

TechCrunch’s Alex Wilhelm and Anna Heim covered why Sequoia believed the change in structure made sense in the context of the evolving venture landscape. Sequoia Partner Roelof Botha said at the time that “the IPO is a milestone” — not the finish line — for a company, so why “should the IPO be the destination for the investor?” The move to an RIA — and a single, permanent structure — meant that Sequoia could hold both private and public securities, with no rule on how much of the VC’s portfolio had to be in private companies versus other assets and meant that they no longer had any constraints on hold periods of their securities.

A more flexible structure that enables VCs to hold both private and public securities, as well as enable partial liquidity on an annual basis is a step towards another trend we are starting to see happen in both venture and private equity: the move to permanent capital structures.

A more permanent place in VC?

The past few years have seen a number of European venture funds go public in order to, one, offer exposure to venture to any investor and, two, create a permanent capital base to make investments.

This structure is not without its challenges, particularly for an asset class like venture where exits can be unpredictable and take longer than normally anticipated. But, what the permanent structure does do is open up the asset class to a swathe of investors who otherwise wouldn’t be able to access venture capital, namely individual investors.

There have been a few innovative funds in the UK, Augmentum FinTech, Molten Ventures, and Forward Partners, amongst others, who have gone the route of creating publicly traded permanent capital investment vehicles to perform their venture investing activities. Time will tell how the public markets view these investment vehicles, particularly with venture-backed companies that tend to have more volatile and longer-dated time horizons for successful outcomes and how they trade relative to NAV. But there’s no doubt that permanent capital structures are on the minds of fund managers.

VCs — and other funds — haven’t just turned to public markets to create permanent capital vehicles. A number of investors, whether VC or hedge fund managers, have closed down their funds to outside investors to create a permanent capital structure to invest their own capital. Homebrew, a successful early-stage VC fund, made news by doing so a few years ago. A number of prominent hedge fund managers have done so as well. I wonder if we’ll start to see more venture managers do the same after making it through a great cycle over the past ten years up to 2022 and then facing more challenging times to fundraise in the past year.

Only time will tell if permanent capital structures will feature prominently in venture, but regardless, moves like Sequoia turning its fund into a permanent capital vehicle and other funds listing on exchanges highlight that venture’s place as a major part of private markets is certainly much more permanent than it was a decade ago.

The road ahead for VC

What lies ahead for VC cuts to the heart of what’s happening in alternative asset management right now. One of the sentences from the allocator (below) sticks out.

Fund managers are inexorably drawn to the siren song of scale ... but gravity eventually will express itself and things will find their natural level.

From a business-building perspective, the trend is that the big are getting bigger. The incentives align too. The larger a firm becomes, the more fees they can generate from AUM scale, and the more likely that mega allocators invest in the big brands. The allocator made an astute observation about mega allocators and mega venture.

Will the mega allocators stay the course with mega venture? That’s going to be what defines the continued scale.

There’s data from a Blue Owl report on GP stakes that highlights how the ten largest managers are raising the majority of the dollars of funds raised. This data has proven out over the past two years in venture, with a significant increase in % of funds raised by the top ten largest managers relative to other managers.

So, whither venture. Will venture AUM continue to grow because mega allocators allocate to mega venture? Or will venture retreat to a more natural level, as this allocator asks?

Perhaps, the answer will lie somewhere in between as venture looks to find equilibrium between firms growing AUM and funds right-sizing for returns.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Artisan Partners in ‘early innings’ with alts | Eva Thomas, Citywire

💡 Citywire’s Eva Thomas covers Artisan Partners’ quarterly earnings results, where she highlights that the traditional asset manager is making a push into alts. A focus on private markets was at the center of Artisan’s quarterly earnings report, where CEO Eric Colson said during Wednesday’s earnings call that it is in the “early innings” with alternatives. After launching their alternatives distribution team last year, the $150.2B AUM asset manager now has over $2.8B of AUM in alternatives. Artisan has built out a distribution team focused specifically on alts, with Colson confident that their process will work out. “In the same way that we have methodically built our equity and fixed income businesses, we are building our alternative capabilities.” Artisan President Jason Gottlieb added that they “believe [their] alternative strategies will be every bit as successful and sustainable as [their] equity and fixed income strategies.” If Artisan’s alts business proves to be as successful as their equities and fixed income businesses, then it will prove to be another case of a traditional asset manager successfully moving into private markets. Artisan’s current business in traditional asset management is not small, either. They ended 2023 with $975.1M in revenue, a 2% year-over-year decrease from 2022, in large part due to gross inflows remaining well below historical levels.

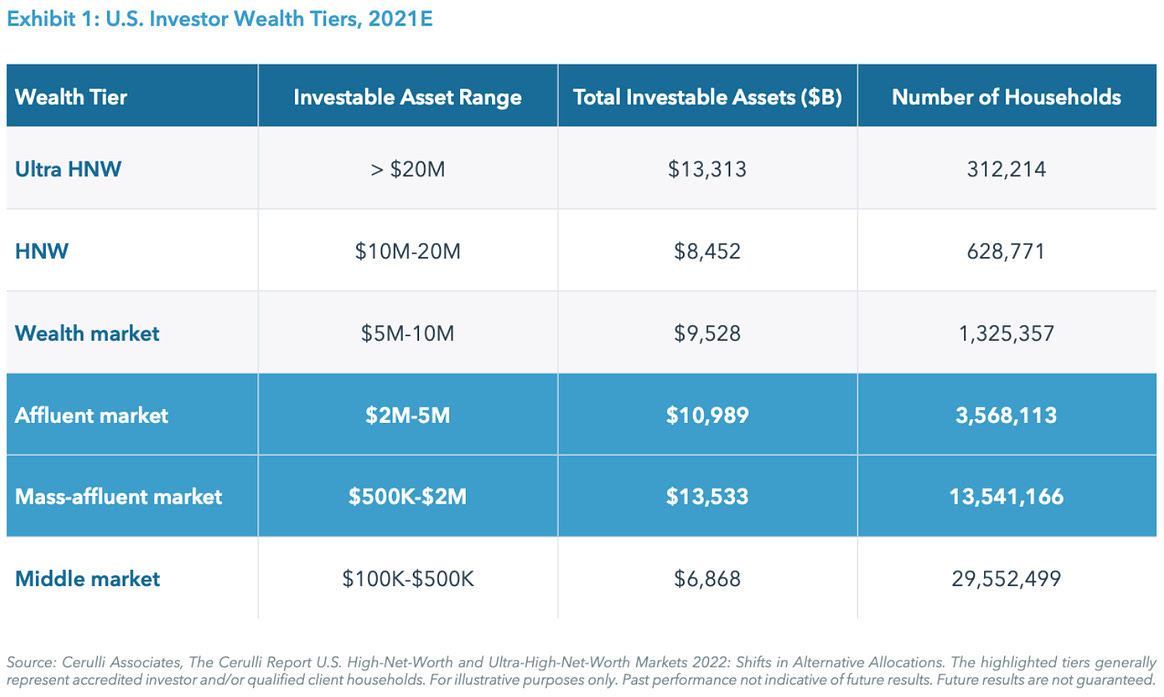

💸 AGM’s 2/20: Numbers often tell a story — and that’s certainly the case with Artisan’s quarterly earnings. The asset manager saw a year-over-year decrease in inflows and revenues in their traditional — public equities and fixed income — businesses. So it’s not surprising that like many traditional asset managers, Artisan is turning a focus to alts to grow their business. Artisan’s management has made it very clear that they are investing resources into growing their alts distribution team as they search for growth in asset inflows. We know the why — alternatives products have higher fees, can have higher margins, and provide new products to investors — all of which should increase revenues and ultimately increase enterprise value. But the question will be the how. Whether or not they will succeed will hinge on the how of building an alts distribution team. The wealth channel has been difficult for many firms to crack open for a number of reasons. The juice is certainly worth the squeeze, particularly given the total prize of over $24T AUM of virtually untapped accredited households in the US alone, as I wrote a few weeks ago based on data from an iCapital and Hamilton Lane article (see graphic from iCapital article below).

But it’s not easy to distribute alternatives products to the wealth channel. Building out alts distribution teams focused on wealth is a challenge — both for talent reasons and for channel coverage reasons. Some firms have figured it out. Those who do will accelerate the growth of their business. Be sure to stay tuned for an upcoming AGM podcast with President & CEO of Global Private Wealth at Blue Owl, Sean Connor, where he will discuss how Blue Owl has built a sales organization focused on working with wealth.

📝 Wall Street Unleashes Quants to Grab Private-Market Billions | Justina Lee, Bloomberg

💡 Bloomberg’s Justina Lee highlights how Wall Street’s biggest firms are turning to data science to gain an edge as they look to grow their private markets capabilities. Both traditional asset managers, like BlackRock, who have made it a point to grow their private markets business both organically and with landmark acquisitions like $100B AUM Global Infrastructure Partners, and fast-growing alternatives firms like Ares, are leveraging the power of quants to give themselves an advantage both with internal firm operations and with portfolio companies. The opacity of private markets makes for a more challenging endeavor to gather and analyze data. However, firms like Ares are investing heavily in quantitative research capabilities to help them analyze investment performance and educate LPs on the risks and rewards of private markets investments. “You will still see people in private markets who will just look at absolute returns,” said Avi Turetsky, head of quantitative research at Ares. “On the other hand, you do have institutional investors who are increasingly getting at the questions: ‘What are the factor exposures? Can I separate alpha and beta?’” Ares leverages quant models to evaluate the skill of external managers and inform secondary investment decisions as well as provide investment teams with insights as to which industries or sectors can yield more alpha. Ares’ Turetsky came to the firm through their acquisition of secondaries firm Landmark Partners, which has helped grow the number of quants at Ares to over 30 FTEs from fewer than 10 in 2020. Recruitment firms are seeing an uptick in both traditional and alternative asset managers hiring data scientists. Dartmouth Partners Executive Director Stuart Wilson noted that firms are looking to hire data scientists to aid portfolio companies with analyzing trends and making decisions on growth.

BlackRock, the world’s largest asset manager, has been using data science to aid investment decision-making in private markets. Their $218B systematic unit has built a model to help identify late-stage venture investments with the highest odds of paying off at exit. BlackRock’s Global Head of Systematic Equity Research, Ronald Kahn, highlighted how he only began thinking about private markets a few years ago. Now, his team is playing an integral role in the firm’s goal of aiming to double revenue from private markets over the next five years. Late-stage venture is an area where data science can have a major impact on sourcing, decision-making, and picking investments. According to Kahn, BlackRock’s ability to cover the market via data can offer an advantage. “One of the advantages that systematic approaches have is this idea of breadth. We do get the advantage of being able to follow thousands of companies and then having a view of which are the best ones to look at.” The BlackRock team built a model that helps guide the few private investments in its systematic equity funds and is now also used by the firm’s private equity arm to help determine what companies might be worth meeting. BlackRock doesn’t plan on stopping at late-stage venture. Kahn says they are turning attention to private real estate next, another area where BlackRock has large amounts of data and can leverage its scale and resources to evaluate another opaque market.

A focus on data is becoming a centerpiece of many alternative asset managers’ investment strategies. Hedge fund AQR is leveraging its quant DNA to decompose private-market returns, as is Two Sigma, who leverages alternative data for its private-assets arm. Private equity and venture firms are also building out data science teams to aid their investment process. Private equity and venture firm EQT Partners has an artificial intelligence program that uses data to search for promising investment opportunities and VC fund Correlation Ventures employs an AI model to write checks into startups. These endeavors follow in the footsteps of data-driven VC firms like Goodwater and Signalfire, to name a few, who have used data science models to drive investment decisions in early- and growth-stage venture.

💸 AGM’s 2/20: Data science is becoming an increasingly important competitive advantage for investment firms as they look for any sort of edge to generate additional alpha. The fact that the industry’s largest asset managers are heavily investing in data science teams highlights just how important they view the technology function within their firms. Technology is far from a back-office function at many of the largest and most sophisticated asset managers. Asset managers who are investing into technology teams to leverage data science to improve investment processes like sourcing, diligence, reporting, and providing tools to portfolio companies are highlighting just how integral technology teams are to the direct revenue-generating activities of investing and capital raising. Private markets offer an opportunity to gather, analyze, and make decisions on vast amounts of data. Yes, it’s been more challenging to do so in private markets for a number of reasons, in large part due to a market that is more opaque and has less uniform, standardized structures around reporting on investment data and valuations. But as the market structure for private markets evolves to look more like public markets, that is changing. And the firms that have the most data will have the biggest advantages. One of the biggest drivers of enterprise value at an investment manager is the quality of decision-making. If data and technology can help alternative asset managers make better investment decisions, that will drive investment performance and grow enterprise value. Technology is becoming core to the DNA of many investment firms — from venture to buyout — so I’d bet on firms that invest heavily in technology to be successful in the new age of investing, where AI will increasingly become a tool that firms can leverage to make better investment decisions and understand performance and valuations. Be sure to stay tuned for upcoming podcasts with Blackstone’s CTO John Stecher and Hamilton Lane’s Head of Technology Griff Norville on how each of their respective firms use technology both internally and externally and why technology is so critical to their investment processes.

📝 Adams Street ‘doubling down’ on European venture | Amy Lewin, Sifted

💡 Sifted’s Amy Lewin reports that Adams Street, one of the world’s largest VC fund of funds, is bullish on European venture. Lewin sat down with Adams Street’s Ross Morrison, where Morrison noted that they “are looking to do even more in venture.” Morrison said they are “trying to double down” on the ecosystem. The head of a firm that has invested over $1.5B into European venture across 50 funds highlighted a number of reasons why Adams Street likes the European venture landscape. “Europe is globally producing a third of all startups — it’s on par with the US. For many years, Europe lacked deals, capital, knowhow … now it’s mushroomed in a positive way.”

Morrison would have a well-developed view on the evolution of European venture since, according to its website, Morrison sits on the advisory board of over 20 companies, including Index Ventures, Highland Capital, Keensight, Livingbridge, and Vitruvian. Emerging managers are a focus for Morrison and Adams Street, but they are highly selective about the types of emerging managers they back. The emerging managers they back are generally “graduates” from top-tier firms, as Morrison said that those who leave from top firms in Europe are where they have seen the best returns emanate from. “When we look at our returns, 10% of companies drive 100% of returns; and unless you’ve seen it first hand, unless you’ve worked at a VC that’s generated those kinds of returns, it’s difficult to understand that’s how it works … That mindset — that nothing else matters apart from that 10%, and that’s what world class looks like — once people know what that is, and have a route to get there, that gets us excited.” To date, Adams Street has invested in 30+ such “spinouts” in Europe, says Morrison, and has made new commitments to funds like this already in 2024.

Morrison also noted that VCs who figured out how to “get liquidity on the way up” have positioned themselves well going forward. VC is very much about timing exit markets correctly, in his view: “It’s hard within VC — it’s more structurally difficult than buyout — the best returns are driven by a receptive IPO market. A lot of it is predicated on being able to get out during the window, and being disciplined and realising liquidity in that window.”

💸 AGM’s 2/20: European venture appears poised for takeoff for a number of reasons that we’ve highlighted on Alt Goes Mainstream dating back to March 2023, starting off with a post discussing the “Continued Rise of European Venture.”

The continued rise of European venture

I’ve long been fascinated with the European venture ecosystem. I vividly remember sitting in a library at the London School of Economics, where I did my undergrad, reading about the launch of Passion Capital’s new Seed fund in 2011. An operator like

Morrison’s comments don’t come as a surprise given the data coming out of the European startup ecosystem. Europe has a number of fundamentals in its favor: leading research universities, a shared value system, engaged policymakers, embedded transport infrastructure, and strong talent. Over the course of the past year, a number of multi-stage US VC platforms have also committed to planting a flag in Europe. A16Z and IVP are two large VC firms that have opened up offices in London. It’s hard not to be excited by the dynamics of European venture. Sure, there are geopolitical challenges, economic headwinds, regional fragmentation, and a questionable local exit market that create headwinds for the region. But recent years have proven that global tech winners can be built anywhere — Nubank in Latin America and Spotify and Klarna in Europe represent a few such examples. So why can’t Europe, with many of the features that Morrison covered in the Sifted article and Isomer’s Joe Schorge (AGM podcast here) and Cherry Ventures’ Filip Dames (AGM podcast here) discussed in their podcasts on Alt Goes Mainstream, continue to become a thriving startup ecosystem that creates great outcomes for founders, GPs, LPs alike? Count me as a believer.

📝 M&A in alternatives loom large in GP staking in 2024: Blue Owl | Kirk Falconer, Buyouts Insider

💡 Buyouts Insider’s Kirk Falconer dives into a report released by Blue Owl, the largest GP stakes firm, where they predict that alternatives M&A will feature in 2024. Blue Owl’s 2024 GP Strategic Capital Outlook report, written by Michael Rees, Head of GP Strategic Capital, and Sean Ward, Senior Managing Director, state that large managers acquiring smaller GPs will be a key theme in the stakes market.

💸 AGM’s 2/20: Why? Big firms are seeking to grow both their product lines and AUM. Rees and Ward cite “multiple motivations” behind why large GPs are looking to be acquisitive: enhanced scale, global presence, and “filling product gaps through targeted acquisitions or team lift-outs.” M&A also supports expansion into new markets and geographies “more quickly and efficiently.”

The above chart from the Blue Owl report highlights a few recent acquisitions by large GPs. Big getting bigger is a theme that’s occurring across private markets — and the larger managers see this “resilience” as a display of strength that serves to help fundraising. Blue Owl’s report notes that a slower fundraising environment is “partially offset by shifts in assets to larger, more established brand-name firms.

A chart (below) from Blue Owl’s report highlights that the largest managers are raising the lions’ share of capital across virtually every strategy of private markets. Scale matters

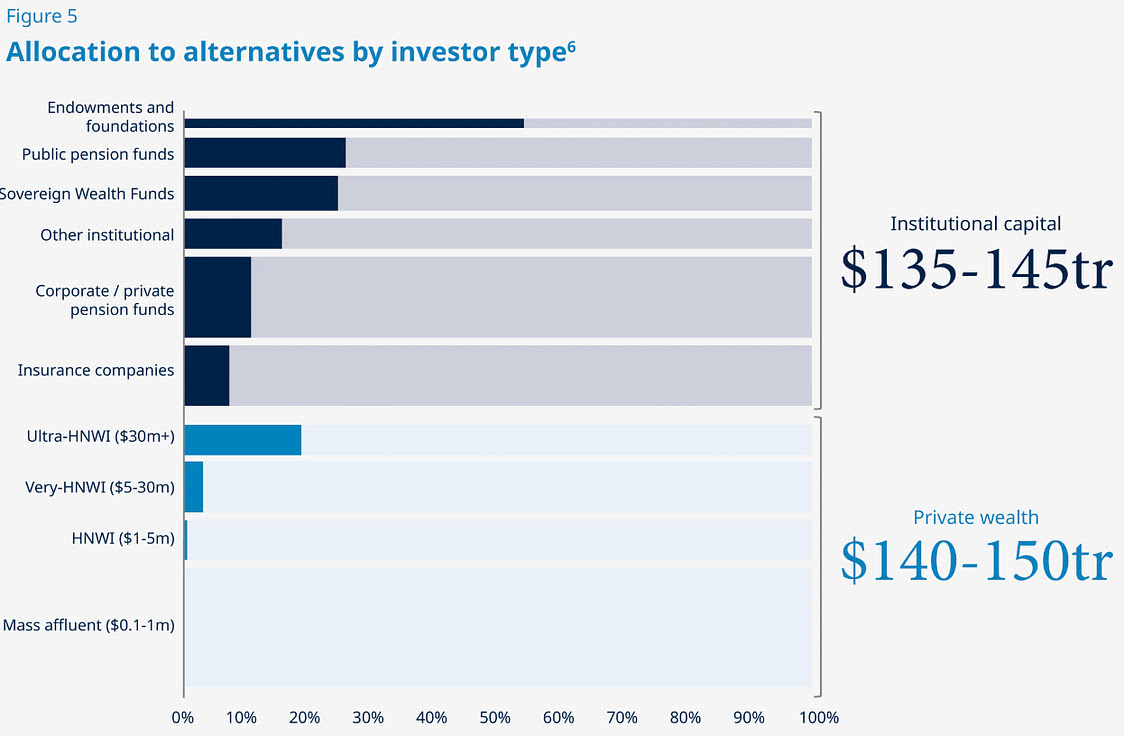

Another reason larger managers are the recipients of a larger portion of the capital raised is their ability to work with the wealth channel. Large GPs are investing in building out the distribution teams to cover the “vast, largely untapped” wealth channel. The largest GPs have the resources and ability to work with the wirehouses and open up that channel for capital raising. That’s another reason why consolidation benefits both the smaller firms and the larger firms. The larger firms end up expanding their coverage across strategies or geographies, and the smaller firms can scale their AUM within a larger platform.

What does this mean for the stakes space? The middle market stakes space should be an opportunity for GP stakers who are targeting the smaller alternative asset managers who can both grow their AUM and also become acquisition targets for larger GPs. Perhaps, then, it’s no surprise that Blue Owl recently announced the launch of a $2B middle-market stakes fund to compliment their $51B AUM in their GP Strategic Capital unit.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 73 Strings (Alternative asset management data / valuations) - Enterprise Account Executive - Private Credit. Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 LemonEdge (Fund accounting) - AVP Sales. Click here to learn more.

🔍 bunch (Private markets infrastructure) - Product Manager. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Tyler Jayroe, MD and Portfolio Manager in J.P. Morgan Asset Management’s Private Equity Group, discuss how one of the world’s largest financial institutions approaches private equity. Listen here.

🎙 Hear Fred Destin, the founder of Stride VC, discuss how to build trust in a competitive, chaotic world. Listen here.

🎙 Hear why Chris Douvos, the founder of Ahoy Capital, believes there’s always room for a Bugatti in a market full of Fords and Toyotas as he dives into the micro and emerging VC landscape. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good doesn’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.