👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a global deal network for accomplished private investors.

Built on community, members uncover and diligence high-quality investment opportunities.

The network offers more than just investment opportunities, providing access to expert databases, legal services, international events and retreats, masterclasses, asset allocation workshops, family office structuring, among other resources.

Join the waitlist and learn how to get involved as a member here.

Good morning from DC. I’m on my way to NYC today to record the latest episode of the Monthly Alts Pulse with iCapital Chairman & CEO Lawrence Calcano. Ok, let’s get to it.

The year was 1981.

Private equity looked much different than it does today. Around $2.5B in annual investor commitments had flowed into the entire private equity industry in the year prior, 1980.

The business started out as the name’s lettering might suggest: a corporate venture capital arm as the European subsidiary of an American investment bank.

In 1993, Citicorp Venture Capital spun out of its namesake firm, Citigroup, to form CVC Capital Partners with $300M in commitments, $150M from Citigroup and $150M from outside LPs.

Just 43 short years ago, CVC was a division of a bank. This past week, it announced an intention to float on the Euronext Amsterdam Stock Exchange in the coming weeks.

CVC has matured and evolved from its more humble beginnings inside Citigroup to grow into a €186B AUM global private markets behemoth with 1,154 employees and 29 offices spanning the Americas, Europe, Asia.

But perhaps morphing from a fund into a firm was always the plan.

“When we founded CVC in the early 90s it was our ambition to create a multigenerational business that would continue to flourish long after the founders had gone. I believe we have achieved that. The business is in very good shape and in good hands,” CVC Co-Founder Donald Mackenzie said recently in the Financial Times.

Over the years, CVC has invested in industry-defining companies across a number of industries, and notably, sports. They were a pioneer of private equity firms investing in sports, paving the road with investments in Formula 1, the Spanish soccer league La Liga, France’s soccer leagues Ligue 1 and 2, Six Nations Rugby, the WTA, and more.

CVC’s fundraising success with its latest buyout fund in 2023 is perhaps a microcosm of just how much private markets have evolved over the past forty-plus years. Their record-breaking €26.5B CVC Capital Partners IX is more than 10x the total AUM that was raised in all private equity funds in 1980, one year before CVC set up shop within Citigroup.

This news marks a momentous event for both CVC and private markets. CVC’s Intention to Float Announcement provides some useful insights on private markets.

Let’s dive in.

Breaking down the business

CVC has evolved from a corporate investment arm housed within a bank into a global, diversified alternative asset management platform.

The Group has 1,154 employees, almost half of which are investment professionals, and is responsible for €186B across seven investment strategies in Private Equity, Secondaries, Credit, and Infrastructure.

How does CVC’s AUM break down?

Private equity: €116B AUM is spread across four private equity platforms — Europe / Americas, Asia, Strategic Opportunities, and Growth — that are focused on “fundamentally sound, well-managed businesses, principally via control-oriented investments.”

Secondaries: €13B AUM in strategies that provide tailored liquidity solutions for third-party general partners and limited partners.

Credit: €40B AUM across Performing Credit, which invests in US and European senior secured loans and high yield bonds, and Private Credit, which focuses on investing in originated financing solutions for financial sponsors and corporates across the capital structure.

Infrastructure: €17B AUM focused on mid-market infrastructure investments primarily across Europe, North America, and Australia.

CVC’s investment performance in certain funds has driven both returns to employees and shareholders as well as strengthened LP relationships. As of December 31, 2023, CVC Europe and Americas Funds I-VII have generated a combined weighted average realized gross IRR of 28% and a combined weighted average realized gross multiple on invested capital (“Gross MOIC”) of 2.9x, placing it amongst the top performing funds within their private equity peers, according to the data in CVC’s press release on their intention to float.

Their investment performance has enabled them to build and maintain relationships with LPs globally. CVC’s client base includes over 1,000 LP clients, including 14 of the 15 largest US pension funds and 12 of the 15 sovereign wealth funds. Many of these LPs have continued to invest across CVC’s fund vintages, with these clients reportedly investing in their funds on average for 17 years.

CVC’s investment performance and sticky, repeat, long-term LP relationships have fed into what CVC characterizes as a “resilient, scalable” business model in their press release.

The long-term nature of these “enterprise-like” commitments from LP clients have yielded steady and growing revenues.

Continued fundraising success drove revenues for CVC. During the year ended December 31, 2023, CVC generated Adjusted Aggregated Revenue of €1,094 million and management fees of €917 million. Adjusted Aggregated EBITDA was €650 million and Aggregated Management Fee Earnings (“MFE”) at €473 million, putting Aggregated MFE Margin at 52%. The scalability of AUM due to both organic growth from increase in fund sizes as well as inorganic growth through acquisitions means that there’s significant operating leverage.

Who are the winners?

CVC’s €1.25B IPO should create a number of winners, both within the team and external parties.

CVC is principally partner-owned. 74% of the firm is owned by Management Shareholders. There are 174 employee shareholders out of the firm’s 1,154 employees, making 15% of the firm’s employees shareholders.

CVC also took in multiple outside investors into their management company, with three global institutional investors acquiring an 18% interest in the firm in 2012 and Blue Owl’s GP Stakes fund acquired an 8% interest in 2021.

Blue Owl’s 2021 investment valued CVC at $11B, and at $15B including debt and carried interest, according to a Wall Street Journal article a few days ago. The Wall Street Journal reports that CVC is looking to achieve a valuation between €13-15B in the IPO, representing a win certainly for employee shareholders and for the minority investors in 2012 and 2021.

CVC also stands to gain further support from Blue Owl in the IPO. Blue Owl has reportedly agreed to invest in up to 10% of the €1.25B offering. Their investment will be comprised of €250M of primary capital to grow the business and the remainder in a sale of existing shares by existing shareholders. This should also serve as a vote of confidence in CVC on a forward-looking basis.

The GP stakes industry at large should also be a winner from the IPO. As a result of Blue Owl’s 2021 investment into CVC, this exit would represent yet another proof point that stakes investors can achieve liquidity for their LPs.

Public ambitions

CVC’s long-awaited public offering has given them a chance to contemplate the benefits and drawbacks of being private versus being public. After two forays with a public offering where it appears that market conditions dictated a decision to stay private, it looks like the third time will be a charm.

There are clear benefits of private going public.

Brand-building

A public company brand should serve to help CVC continue to grow its platform, particularly as they look to increase LP relationships and expand into different LP channels. This point is especially important if they want to grow their footprint within the wealth community. There’s a level of validation that occurs by being a public company that should help them with many allocators in the wealth channel. It’s worth noting that some LPs may be more skeptical of how being public could impact incentives for the investment team, which some would see as creating the potential for degradation of investment performance since the focus would appear to be greater on gathering assets than on outperformance. After all, fund size generally does matter for returns. But one could also point to the firms currently in public markets and see that many have not had issues fundraising despite being public. CVC would also likely argue that their historical focus on the incentive structure for its investment team should bode well for future performance as well as the structure they will carry over into public markets. In preparation for its public offering, CVC has apparently structured itself in a similar way to EQT, not entirely opening themselves up to public markets. 70% of profits from carry will remain in the hands of the CVC team. Deal teams will receive 40% of the profit and 30% of the profits will go to a private company that will maintain a separate board and will not play a role in the firm’s governance post-listing. With what CVC projects to be Performance Related Earnings of between €400-700M driven by carry between €2.3-4.1B that could be realized over the next five to six years, there’s a lot of earnings at stake here.

A continued focus on being acquisitive

CVC has prepared for a public offering in recent years by acquiring other strategies and capabilities in order to build a broadly diversified alternative asset manager. That has included buying secondaries firm Glendower in 2021 which had $8B AUM at the time, and, more recently, purchasing infrastructure manager €16B AUM DIF in 2023. Both strategies are seeing favorable fundraising tailwinds in the current market, so these acquisitions should continue to pay dividends for CVC as they grow their AUM. It’s possible that CVC looks to acquire other alternative asset managers where a specific strategy complements what they already have on their platform by, as they say in the IPO press release, “selectively pursuing other direct private markets adjacencies.”

A currency that can be used to grow

With fresh capital in hand, CVC could look to acquire other firms as a means of growing AUM. Once in public markets, fee-paying AUM becomes a North Star focus for firms in many respects. An ability to thoughtfully but swiftly scale AUM yields rewards for alternative asset managers from a business perspective. CVC should certainly have no issues raising capital for their flagship private equity strategy if their recent record-breaking fundraise is any indicator. However, private equity strategies have an AUM ceiling, so growth will have to come from other places. That’s why acquiring a secondaries manager in Glendower and an infrastructure firm in DIF look to be prescient moves, as both of these strategies are quite popular amongst LPs in the current market environment.

The additional capital should also serve as currency to go out and acquire talent, both on the investment side and on the distribution side. There’s a war for distribution talent to work with the wealth channel amongst alternative asset managers and traditional asset managers alike, so alternative asset managers are spending top dollar to bring on highly qualified and connected distribution professionals. As the focus on the wealth channel intensifies amongst alternative asset managers, and particularly those that are public, it looks like CVC will turn a focus towards private wealth. They said as much in their IPO press release, highlighting a focus on channel expansion and “increasing penetration of the wealth channel” as part of their growth strategy.

What does the future hold?

How does CVC expect to look in the future? Coming off a record private equity fundraise in what was a very difficult fundraising market, CVC appears to be going from strength to strength.

In their IPO press release, CVC states they expect to grow fee-paying AUM from €107B in 2023 to an illustrative run-rate of €136-151B. This level of FPAUM would seemingly put them close to public market peers EQT (~$138B FPAUM), TPG (~$137B FPAUM), Blue Owl (~$102B FPAUM), and Partners Group (~$146B FPAUM) (note, these are not run-rate FPAUM numbers for the firms listed here).

Management fees are also expected to grow from €1.02B in 2023 to €1.32-1.46B on a run-rate basis in 2024. Management fees should also drive the majority of revenue for CVC, with 65-75% of adjusted aggregated revenue in the medium to long term comprising of management fees. This would put Aggregated Management Fee Earnings margin at 55-60% going forward on an average 1% management fee.

CVC pegs their run-rate EBITDA between €1.16-1.54B, placing their valuation range at IPO well within reason if their current public comps are trading in the mid-teens (~14-15x) on a 2024E EV/EBITDA basis.

The so what

An “attractive and resilient” business model

CVC has a proven ability to grow its platform across multiple economic cycles. They’ve managed to both grow the fund sizes of their existing strategies as well as acquire specialized firms to enable them to expand into other private markets strategies.

They clearly know how to fundraise. Over the period 2020-2023, CVC achieved a 20% management fees CAGR and expanded its Aggregated MFE Margin by 14%. That also means they must be doing something right on the investment side, as investment performance is often a driver of success in fundraising.

Their investment performance has also led to expanded LP relationships. Their latest funds saw a +37% uplift in size relative to the prior vintage, in large part due to existing LPs committing in larger size to their newer funds.

The stickiness and long-term nature of these LP relationships make them look like enterprise software contracts, but perhaps even more favorable. The likelihood of re-ups when performance is strong in the prior vintage, particularly from the institutional investor cohort, is high, so for the big brands, it can be feasible to see continued growth in fund size.

The wildcard will be the wealth channel. Yes, firms like CVC should be able to attract capital from the wealth channel. Probably more likely so now that they are a publicly traded firm. However, what remains to be seen is whether the wealth channel has the same type of allocation consistency as institutional allocators. It may not be an issue for the next few years, but looking out on the horizon, will the wealth channel continue to commit to alternative asset managers at the same or greater size in future funds? If we go by the data that suggests the continued growth in private markets as a secular trend, then yes, absolutely. But it’s certainly fair to wonder if this story will unfold differently than it has in the institutional LP channel.

“Increased client demand” means one-stop shops will win

CVC cites increased client demand for private markets as a rationale for why they expect to see growth. This means there’s an expectation that (1) clients will increase their allocation to private markets in the future and (2) clients will consolidate their portfolios with a smaller number of leading private markets managers. If point two holds, I expect that we’ll see a rise of the one-stop shops — the big getting bigger — winning as they are able to serve the client across multiple investment strategies. Allocators will be picking the brand and, once they’ve picked the brand, they will invest across that brand’s different investment strategies on their platform. If this scenario is to unfold, the larger firms will be able to attract larger portions of LP wallet share, making these relationships sticky and enduring.

How will they grow?

CVC expects to grow by upselling, cross-selling, continued expansion in the wealth channel, and innovation with product structures like semi-liquid private equity, secondaries, and credit products. What’s the “read between the lines” takeaway? Most likely, they will acquire or build capabilities for other private markets strategies in order to upsell and cross-sell LP clients. With seven distinct strategies, CVC is well-placed to upsell and cross-sell. This configuration is, in large part, to the acquisitions of Glendower and DIF as well as a buildout of their credit business. I’d anticipate CVC continuing to look to acquire specialist strategies in order to add new LP relationships for incremental AUM and then look to cross-sell those LP relationships or provide their own existing LP relationships with additional strategies.

What are some areas where CVC could expand?

Sports Fund: While CVC has been actively in investing in sports, it doesn’t have a dedicated sports investment fund. With the likes of Arctos, Avenue, RedBird, Ares, Sixth Street, and others actively investing in sports, perhaps CVC decides their track record in sports warrants a strategy-specific fund that could cross-sell existing LPs or attract new LPs.

Venture Capital: Given the origins of their name, it would be quite the poetic arc if CVC were to acquire or build a venture capital strategy. While we haven’t seen private equity firms acquire venture funds, it would be an expansion of the platform beyond something many PE funds do at this point — growth equity investing. CVC has a Growth strategy, so venture could be the next natural extension of their Growth investing business.

Real Estate: CVC has built out a large (€40B AUM) credit business. They also have an infrastructure strategy thanks to their acquisition of DIF. Real Estate would be a natural extension of these two strategies and capabilities and put them on par with their publicly traded peers in terms of types of strategies they offer on their platform. Perhaps CVC also looks to leverage its expertise and experience in sports to create a differentiated, sports-focused real estate investing strategy given the opportunity to monetize physical and offline adjacencies with hotels, stadium, and mixed-use shopping real estate near sports clubs.

GP Stakes: This one is more unlikely as only a handful of publicly traded firms have dedicated GP stakes businesses, but it would be another extension of their platform that would enable cross-sell to existing LPs. While CVC doesn’t have any permanent capital as far as I know, they have invested in a few insurance businesses, so perhaps they would think about leveraging their relationships with their insurance investments or acquiring an insurer as a way to access permanent capital. It’s also worth noting that as a European domiciled firm, they may have an easier time building out a GP stakes strategy and accessing permanent capital at the fund level (like Goldman’s Petershill) to do so than some of their US counterparts.

Insurance: As Apollo and now KKR and Blue Owl have shown the market, owning an insurance business can be highly accretive to growing an alternative asset manager. Perhaps CVC would look to borrow from the same playbook and ultimately buy or own an insurer as a means of having captive origination and distribution of their investment products.

Who is next?

With CVC soon to cross the chasm to public markets, which alternative asset managers will be next to go public? General Atlantic and HPS have reportedly given thought to a public listing. Warburg Pincus apparently came close to being acquired by BlackRock. I anticipate that as firms near the $100B AUM mark, they will begin to contemplate a public listing or an acquisition by a strategic buyer, likely a traditional asset manager, that is looking to add alternatives capabilities. As Franklin Templeton has proved with its acquisition of Lexington Partners, the traditional asset managers can add meaningful value to alternative asset managers and help drive distribution throughput, particularly in the wealth channel given their brands and long-standing relationships.

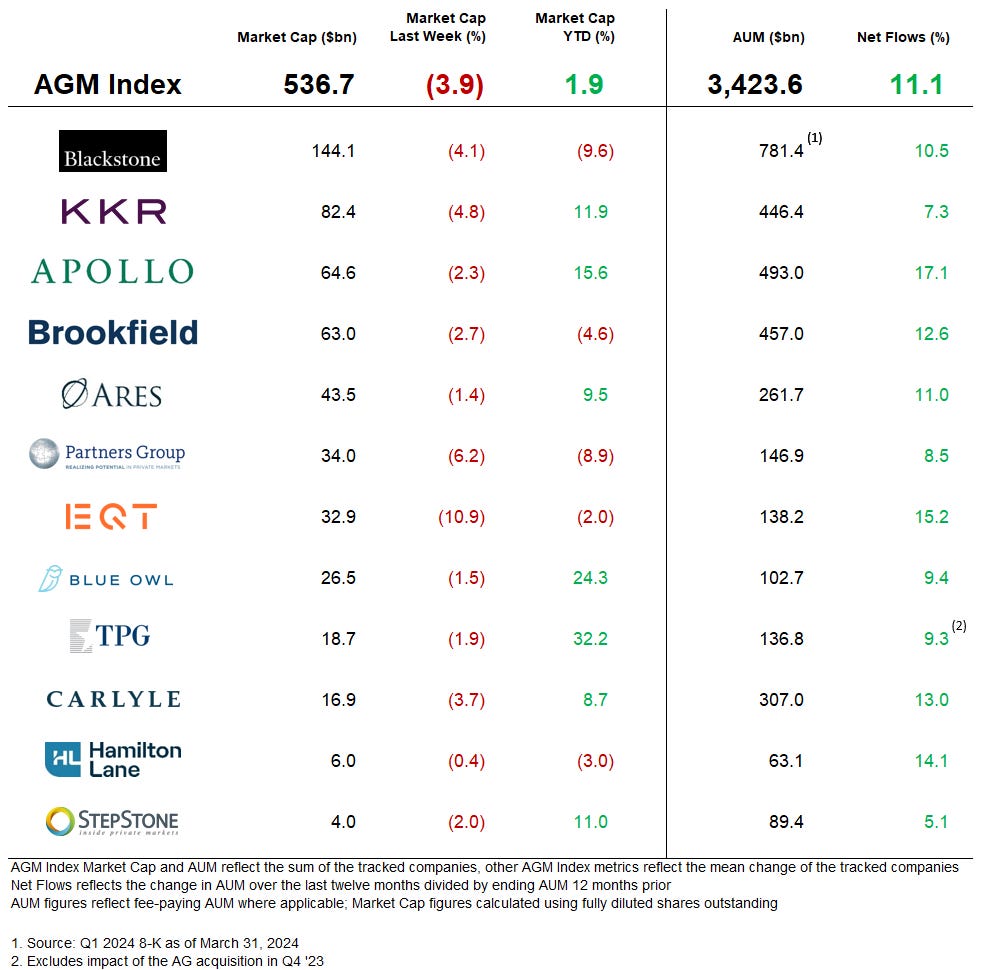

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Private investment bank Lazard set to partner with French VC Elaia to launch a European growth fund | Daphne Leprince-Ringuet, Sifted

💡Sifted’s Daphne Leprince-Ringuet reports that French early-stage VC fund Elaia and $247B asset manager and private bank Lazard are teaming up to raise a growth fund to back European deeptech startups and scaleups. Elaia, a $700M AUM VC fund with a 20 year history of backing tech and deeptech startups, will move into growth investing with the partnership with Lazard. The fund, which will be 75% owned by Lazard and 25% by Elaia, would become amongst France’s largest venture investment vehicles at the growth investing stage. Lazard’s move into VC investing marks the 175-year-old firm’s first foray into doing VC investing leveraging its own brand’s name. As part of the partnership, Lazard has acquired a minority stake in Elaia. Lazard will also have a provision to purchase up to 100% of the firm in the future. Elaia sees this partnership as an opportunity to expand their investment strategies and grow their AUM with a partner that has the capital to enable them to do so. “Health and decarbonisation are themes that we already focus on and that deserve ad-hoc strategies,” Elaia’s Xavier Lazarus said. “We will need a key partner, and the means to finance that through this partnership.”

💸 AGM’s 2/20: While we talked above about one firm (CVC) spinning out of an investment bank to form an independent alternative asset manager that today will go public, Lazard and Elaia are doing the opposite. The Lazard-Elaia tie-up, while a complicated structure for banks and asset managers to effectuate for a number of reasons, should become more commonplace in the future for a few reasons. In a more difficult fundraising environment, VC and private equity firms, particularly those that are mid-sized, will need to find creative ways to fundraise. Private banks and wealth management firms offer a solution. They are armed with large pools of capital from an investor cohort, the wealth channel, that is looking to further expand their footprint into private markets. Development and Strategy Director at Lazard Freres Gestion, the asset management company of Lazard in France, Sophie de Nadaillac, said as much in the Sifted article: “There was demand from our clients that Lazard support them in their unlisted investments … What’s at stake for our clients is to diversify.”

We talked last week about Cerity’s integration of $15B OCIO Agility as a foreshadowing of a trend where we could see banks and large wealth platforms find ways to build and grow in-house capabilities to enable their HNW and UHNW clients to access private markets. Customization and differentiation will be a defining feature of the next wave of private markets. Bringing specialist alternative asset management firms in-house is certainly one way to achieve this goal of providing clients with access to private markets in a differentiated way. It also fits well with alternative asset managers who are looking to find ways to grow AUM in a difficult fundraising environment.

📝 Blackstone’s winning quarter for infrastructure | Jessica Hamlin, PitchBook

💡PitchBook’s Jessica Hamlin reports that infrastructure led the way for Blackstone in Q1. It was infrastructure investment funds that bested Blackstone’s other funds in terms of performance. In Q1 2024, President and COO Jon Gray noted that Blackstone infrastructure vehicles appreciated 4.8%, the highest gross rate of return of any of the firm’s strategies. Gray said that investor interest in infrastructure should lead to AUM growth within this strategy. “This is an area where we’re still seeing investors show a lot of enthusiasm. We see this growing to be a triple-digit AUM business.” Last year, Blackstone closed its Green Private Credit Fund III, a $7.1B fund focused on energy transition infrastructure debt and completed a number of digital infrastructure deals, including a $7B joint venture with global data center platform Digital Realty to develop four data center campuses in Germany, France, and Northern Virginia. Many investors view infrastructure as an attractive strategy within private markets in the current environment. It is generally less correlated to equity markets and can be a hedge against inflation. According to PitchBook’s Q1 2023 Global Fund Performance Report, real assets achieved the best one-year performance of strategies tracked by PitchBook, with a horizon IRR of 11.1%. A chart from Brookfield Oaktree’s Wealth Solutions business highlights infrastructure investment returns in periods of above-average inflation.

It’s not just Blackstone that has seen success fundraising and generating returns in infrastructure. Its peers have also focused heavily on growing their infrastructure practices to meet both growing LP demand and the need to finance capital-intensive infrastructure projects, particularly in areas like data centers and the clean energy transition. Brookfield closed the largest-ever infrastructure fund at $28B AUM. Earlier this year, BlackRock acquired $100B AUM infrastructure manager Global Infrastructure Partners in a $12.5B deal. KKR has seen its infrastructure business grow from $17B to $60B in AUM over the past three years. Apollo launched Apollo Infrastructure Company, an entity which will act as owner and operator of the firm’s infrastructure assets.

💸 AGM’s 2/20: Infrastructure should be a popular asset class for both GPs and LPs going forward. It appears that the current environment will make for a favorable investment opportunity in the infrastructure space. Between the world’s increasing adoption of AI, where data centers will be an integral part of enabling the transition to AI, and the pressing need to solve the climate transition, infrastructure assets should be in high demand. Add in the fact that infrastructure assets tend to offer an inflation hedge, as the Brookfield Oaktree chart above illustrates, and has proven to be less volatile than other asset classes, and infrastructure starts to look attractive for LPs.

This trend should benefit the largest GPs, as infrastructure investing usually requires scale, which means that fund sizes will have to be large enough to be able to sufficiently capture the investment opportunity. This feature plays into the hands of the larger alternative asset managers, as it will provide them with the opportunity to continue to grow and scale their AUM and infrastructure’s investment characteristics of inflation hedge and lower volatility provide a good compliment to other strategies on their investment platform, making this a good investment strategy to cross-sell.

📝 Sports investor Arctos to focus on US deals after raising $4.1bn fund | Josh Noble & Samuel Agini, Financial Times

💡Financial Times’ Josh Noble and Samuel Agini report that Arctos Sports Partners plans to focus its efforts on finding more deals in the US sports market, in part due to the financial unpredictability of European football according to Arctos Co-Founder and Managing Partner Ian Charles. Arctos, fresh off of closing its second dedicated sports fund at $4.1B, stated that they are far more likely to invest in the US, where Charles noted that there is “no shortage of opportunities” for generating reliable returns from sports investments. “We want to invest behind global brands that have the predictability and the durability and resiliency and the dynamics that are commonplace in North American sports assets. Finding those outside of North America is difficult,” Charles said. Arctos has been active in Europe, recently buying a 12.5% stake of Qatar-owned French football club Paris Saint-Germain (“PSG”), valuing the global brand at over €4B. Arctos also invested in UK-based motorsport team Aston Marton F1 at a £1B valuation last year and has an indirect shareholding in Liverpool FC and a small stake in Italian side Atalanta. While Charles said it would be “fantastic” if Arctos could unearth more opportunities outside the US that are similar to PSG and Aston Martin, he said it’s unlikely. “Our firm’s data advantage, brand advantage, operational advantage … is in North America,” he said. “And where private equity firms often run into trouble is when they move outside their zone of competency.” There’s another reason why North American teams happen to be more attractive than many European sports teams. Promotion and relegation and broadcast money distributed based on league placing in European leagues make the investment much more volatile than in North America. These in part explain why valuation multiples are significantly higher in North American leagues, according to EV/Revenue multiple data from Sportico than they are in European leagues.

LPs seem to agree with Charles. Arctos ultimately exceeded their $2.5B fundraising target by over $1.5B, in large part due to popularity of institutionalized sports investing.

Charles’ comments are also interesting in light of news this week out of the NFL that NFL owners are expected to approve minority institutional investment as soon as next month, according to an article this week in the Financial Times by Sara Germano and Antoine Gara.

If the NFL, which to date has not let any institutional investors access teams for investment, opens up to funds, it could represent an attractive investment opportunity for these institutional investors. The league has an 11-year, $110B media rights deal and a revenue-share agreement amongst its 32 teams, making the revenue streams from team ownership attractive given the predictable and long-term nature of the media rights deal. The league has also looked to continue to grow its global presence, investing in internationalization of the sport with regular season games played across Europe and Latin America.

💸 AGM’s 2/20: Sports investing continues to institutionalize. The NFL’s decision to consider minority institutional investment signals a few things. One, it’s a reflection that valuations are reaching the point where there are only a small pool of individuals that can finance the purchase of teams on their own. Two, it’s an opportunity to continue to grow the valuations of teams and offer liquidity options to certain owners. Firms like Arctos are filling the gap and LPs are meeting that demand. Sports investments offer an interesting return profile for investors, both in terms of stable returns if structured in the form of preferred equity or debt, and upside due to growth of certain leagues and teams. As I wrote a few weeks ago, sports investment possess a number of features that make it worthy of an institutional investment:

Monopolistic content since sports is, in effect, the last frontier of live unscripted content.

Recurring revenue thanks to consistent and growing contractual media deals.

Low correlation to public markets and scarcity value of a finite number of teams and leagues.

Additional monetization opportunities, such as reality TV shows, as Welcome to Wrexham and Sunderland ‘Til I Die, have shown.

The ability to monetize physical and offline adjacencies.

These features not only make sports investing an interesting and attractive proposition for the funds investing in this space, but it also provides these funds with the opportunity to expand into a variety of other adjacent strategies, such as real estate, credit, infrastructure, sports tech investing / venture that could help them grow their AUM and create a network effect and synergies due to these related investment theses.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - US Asset Management Channel, Business Development - Managing Director. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Inside Sales Rep for MFOs / RIAs / SFOs. Click here to learn more.

🔍 Brown Advisory (Independent investment management & strategic advisory firm) - Alternative Asset Specialist. Click hear to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 73 Strings (Portfolio monitoring and valuation) - Associate Vice President - Private Credit. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Allianz SE (Asset manager) - Strategist, Group Strategy and Portfolio Management (Munich). Click here to learn more.

🔍 PitchBook (Private markets media, data, analytics) - Reporter, Private Equity (London). Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Hamilton Lane Managing Director & Head of Technology Solutions Griff Norville share why he believes private markets are moving from the Stone Age to the digital age. Listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the 8th episode of our monthly show, the Monthly Alts Pulse. We discuss how product innovation, particularly with evergreen funds, is enabling the wealth channel to invest in private markets. Watch here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.