👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is a deal network of 400+ investors — all who have exited a company or lead a family office.

3i was founded by Mark Gerson (3i Chair, Co-Founder of GLG), Billy Libby (3i Board, CEO/Co-Founder of Upper90), and Teddy Gold (CEO of 3i Members).

3i brings engaged private investors together to source alternative opportunities, share expertise, and build value that goes far beyond the deal.

Learn how 3i sources & diligences investment opportunities and how to get involved as a member here.

Good morning from Kansas City.

Yesterday, I joined my fellow road warriors to watch Angel City FC pay a visit to the Kansas City Current at CPKC Stadium.

As with any other match, the players and teams went about their routines. They arrived a few hours early, walked into the locker room, and set foot on the field to warm up in advance of the 2:30 pm CT kickoff. The fans streamed in through the gates to get to their seats. The players prepared for the match.

The kickoff time may have seemed trivial; it was anything but. The locker room may have seemed like other locker rooms; it was anything but. The game might have seemed like every other NWSL game; it was anything but.

This game was different. For the first time in North America, the women’s professional soccer league has a stadium that was built by an NWSL team, for an NWSL team.

Gone are the days that the NWSL KC Current would have to share a stadium with their men’s MLS counterpart, the Sporting KC, or arrange their schedule around other leagues.

The Kansas City players can now walk into the locker room and know they are no longer visitors. Their locker room, in this stadium, was built for them.

The $124M fortress stadium overlooking the banks of the Missouri River is a far cry from the high school football stadium in Overland Park, Kansas, that the Current’s predecessor, FC Kansas City (2013-2017), called home. A college soccer stadium represented an upgrade, as did the training facility of MLS’s Sporting Kansas City. But attendance was sparse and revenues were minimal.

When Chris and Angie Long bought the rights for the NWSL franchise in Kansas City to bring soccer back to the town in December 2020, they felt it was important to invest in the club to help the community and to help grow women’s soccer.

They also knew it made economic sense.

“It’s like buying the Boston Celtics in the 1960s”

As Co-Founders of a $29B AUM credit investment firm, Palmer Square Capital Management, Chris and Angie know a thing or two about investing.

That’s partly why they invested in the NWSL’s Kansas City Current. On a recent Alt Goes Mainstream podcast, Chris said investing in women’s soccer today is “like buying the Boston Celtics in the 1960s.”

He’s not speaking in hyperbole. Franchise values in the NWSL have skyrocketed in a few short years.

For good reason.

Sports, and in particular, women’s sports, represent a huge investment opportunity. Some of the world’s largest and most sophisticated investors have taken notice.

Just last week, Carlyle and the MLS’ Seattle Sounders acquired the NWSL’s Seattle Reign FC for $58M. The acquisition represented an ~18x increase from the club’s $3.51M valuation in 2019. The NWSL’s most recent deal comes on the heels of major private equity firms buying teams in the league.

Sixth Street, a $75B AUM alternative asset manager with investments into the likes of iconic sports clubs Real Madrid, FC Barcelona, and the San Antonio Spurs, backed the launch of the expansion franchise, Bay FC, last year with a $125M investment. $53M of that $125M investment went to pay the expansion fee. When Angel City FC and San Diego set up shop in 2020, the respective ownership groups paid between a $2-5M expansion fee.

Dollars and sense

Investors are taking notice because the numbers are making dollars and sense.

The NWSL’s new broadcast deal, which will show 118 matches nationally this year, up from six in the prior deal, is 40 times the value of the previous agreement. The four-year, $240M contract with CBS Sports, ESPN, Prime Video, and Scripps Sports will mean that matches are shown much more frequently and much more prominently than in years past.

That’s music to sponsors’ ears. Sponsors now have a front row seat to marketing to a new demographic, one that happens to be loyal, digitally native, and engaged.

According to data from Zoomph, fans of women’s sports are significantly more loyal than general sports fans to brands who invest marketing dollars into sports they follow.

Women’s sports fans are digitally native, savvy, care about purpose-driven topics, and crucially, often control household spending.

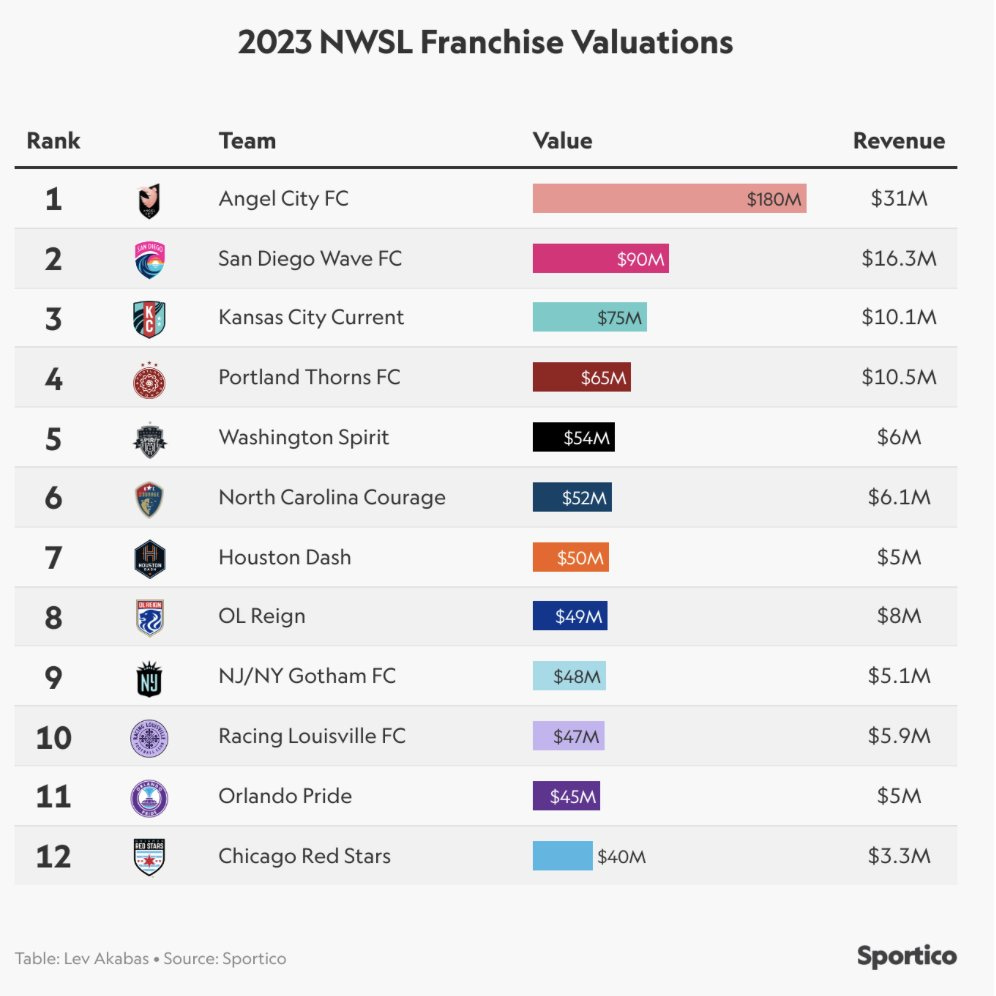

Perhaps it shouldn’t be a surprise that large consumer brands like DoorDash and Klarna feature prominently as sponsors of Angel City FC, the NWSL’s clubhouse leader in sponsorship revenue and overall revenue (note: some of the revenue figures for teams are outdated when this graphic was published and are higher than stated below).

NWSL team revenues have been turbocharged in part by sponsorship.

Some of America’s biggest brands have lined up to sponsor NWSL teams, with the likes of Mastercard, Nike, Verizon, Nationwide Mutual Insurance Co, Anheuser-Busch InBev, Delta, CBS Sports, CarMax, Deloitte, and others investing in marketing through the sport because they understand the value in associating with these teams and reaching their fans.

It’s no shock that the likes of Nike have focused on sponsorship of women’s soccer. They have seen results. Nike saw an 11x year-over-year increase in engagement with Nike’s brand. Similarly, Visa, who become a sponsor of the US Women’s National Soccer Team in 2019, saw a 27x increase in engagement with their brand after the sponsorship.

Taking women’s soccer mainstream

Julie Uhrman, Natalie Portman, and Kara Nortman started Angel City FC in 2020 with a bold idea: prove that women’s sports can be a viable investment opportunity by building a brand on and off the field that champions equitable recognition and pay and has a community impact.

In four short years, Angel City has done just that. They’ve managed to grow the club to over $31M in revenues despite only having an on-the-field product for two seasons, propelling the club to become the highest-valued female sports franchise in the world.

There’s good reason that Angel City is currently holding court as the most valuable female sports franchise globally. The club has achieved double digit millions in contracted sponsorship revenue. Matchday attendance and ticketing revenues have rivaled — and even surpassed — some of its counterparts in the MLS, despite a much more truncated timeframe in building a club and a brand. For context, LAFC, the highest valued club in the MLS at over $1.2B valuation, has $140M in revenues in a league that has a TV deal with Apple that’s 10x the value of the new NWSL media deal at $240M.

The club has also achieved status as a global brand. Angel City merchandise has been sold in 51 countries, and 50 US states, proving that mission and capital can co-exist to create a brand that transcends a specific location or community, as Angel City FC Co-Founder and President Julie Uhrman shared on an Alt Goes Mainstream podcast in 2022.

Angel City’s rapid rise is part of a broader leaguewide trend. The NWSL saw a 36% increase in the number of fans that attended regular season games in 2023, with over 1.4 million fans attending a game last year.

What does this show?

Demand is aplenty for fans that want to watch and attend women’s soccer in the US (and globally).

Social media has provided a very powerful wind to the sails of women’s teams and players. The reach that social media platforms have to globalize the game and engage fans cannot be understated.

Digitally native teams like Angel City that have been built with the new paradigm for fan engagement in mind are poised to succeed in this brave new world of sports. Their ability to leverage the platform and brand they’ve built has proved to engage fans, enable players to connect directly with fans who believe in a shared vision of growing the sport, and prove to sponsors that being in front of fans is good business.

Sixth Street’s Alan Waxman said as much in a 2023 Bloomberg article after they purchased the NWSL’s Bay FC.

Waxman highlights two transformative trends that are driving the growth in women’s sports:

One is the emergence of streaming services, which has made it easier to reach viewers and know who they are.

Two is the power of social media to connect fans directly with players on a day-to-day basis. “You can follow them and see what they’re thinking,” says Waxman. “What are they eating? How are they training?”

Waxman’s comments, particularly on social media’s impact on fan engagement, highlight a transformation in sports that takes the business side of the game beyond the four walls of a pitch or a court one to two times per week and turns it into a 24/7 entertainment asset.

“You’ve got a media company, not just a sports team” (Marc Lasry)

Understanding why sports is such an interesting and viable investment opportunity is an exercise in realizing that sports is an entertainment asset — both online and offline.

An investment in a sports team or league can be thought of as something much bigger: a bet on the macro trend of entertainment occupying increasing mindshare and wallet share as societies become even more digitally native, have more discretionary income to spend, and have more free time due to advances with AI and automation.

Entertainment assets as a whole will benefit from the aforementioned macro trends. But it’s sports that holds a unique place in the entertainment world: it’s one of the few remaining entertainment assets that provides live, unscripted content.

Prolific investor, Marc Lasry, who co-founded and runs $12.5B AUM Avenue Capital Group and successfully steered the NBA’s Milwaukee Bucks into a championship team as the owner and then sold the club for $3.5B (representing almost a 7x increase in valuation from ten years earlier), hammered this point home when speaking at SALT’s iConnections Conference in May 2023, stating, “as more people watch sports, you’ve got a media company, not just a sports team.”

Even as traditional media declines, live sports continues to attract fans and viewership.

Sports media deals, long-term contracts that provide a steady stream of annuity-like revenues to teams and leagues, continue to rise. There has been secular growth in TV broadcast deals across major sports, with the likes of the NFL generating $10B in annual revenue in media rights from 2023 to2033.

If we think about sports teams as media companies, as Avenue’s Marc Lasry notes, we can think of sports as an investable opportunity across a number of vectors that make it an attractive investment:

Monopolistic content

Sports has a monopoly on live, original content. Live games represent an opportunity for fans to be fully engaged either in-person or online. Unlike a show, movie, or TV series, where viewers can access the content at a later date, there’s a unique value to owning the current moment. That’s partly because broadcast stations and streamers are paying top dollar to leagues to distribute games.

Sports also has plenty of adjacent content opportunities, including how teams and leagues leverage social media to engage fans and sponsors and how sport betting, gambling, and fantasy gameplay to keep fans thinking about the game 24/7.

Recurring revenue

I recently met with an investor (who is a minority owner in teams in two different sports leagues, one of the major four leagues and one of the emerging leagues) who characterized media deals as “SaaS-like” revenues. This characterization highlights the long-term, recurring nature of media deals. The above charge illustrates the length of these highly lucrative media deals that last for years. The revenues accrue to all the teams in the league, making this a locked-in, recurring revenue stream for owners.

Sports teams also offer investors a diverse set of recurring and variable revenue streams. In addition to the media revenues, sports teams generate revenues from sponsorship, ticketing, in-game concessions, merchandise, live events / concerts, and adjacent real estate opportunities, all of which can grow as viewership, teams, and leagues grow … and as teams win on the field.

Low correlation to public markets

Investments in sports teams have historically had a low correlation to other asset classes. DBRS Morningstar research found that the only times in the past two decades when any of the major sports leagues lost money were the peak of the Global Financial Crisis in 2008-09 and the COVID-19 pandemic.

There’s also scarcity value associated with sports team assets. There will only be a finite number of teams for capital allocators to invest in, so value could increase as both individuals and institutional investors look to own teams.

From offline to online: the reality TV opportunity

Sports have stories. And people love consuming stories that humanize characters and make them feel closer to the players on the field.

Docuseries successes with the likes of Ryan Reynolds and Rob McElhenney with Welcome to Wrexham and Netflix’s Sunderland ‘Til I Die highlight the opportunity for teams to engage fans outside of the one or two days per week that the team plays a match and expand the fanbase beyond its locale. Wrexham’s docuseries has propelled the club to record revenues, growing 75% for the year ending June 30, 2023 (listen to Wrexham’s Advisor to the Board Shaun Harvey share how the “Wrexham Effect” has spurred on- and off-the-field success on an Alt Goes Mainstream podcast here). This revenue figure represents a stark contrast in annual revenues before the Hollywood stars bought the club, where annual revenue typically ranged from $2-4M. Bringing more exposure to the club and the brand has its knock-on effects, with merchandise revenue growing over 200% year-over-year.

Monetizing physical and offline adjacencies

A real estate opportunity exists in tandem with sports team ownership. Teams have an opportunity to not only grow the value of the real estate in and around their stadium, but they can also drive impact and value creation for the cities in which they reside.

Kansas City Current will do an additional $20M in revenue this year from building and owning their own stadium, according to Co-Founder and Owner Chris Long. They are also growing and revitalizing the area next to the stadium, which has now seen apartments and restaurants spring up by the hundreds.

Avenue’s Marc Lasry did the same for the Deer District in Milwaukee after buying the Bucks. He and the team built out an indoor-outdoor sports, retail, and entertainment destination on the 30 acres surrounding the Bucks’ arena, Fiserv Forum.

Doing good for a city also happens to be good business. Average valuations of teams with an entertainment district are 26% higher across the major four leagues.

The “venture” opportunity with underinvested and emerging sports

Established leagues and teams offer a steady and stable stream of revenues due to the size and scale of their media deals. That feature makes sports investing attractive due to its predictability with a portion of its revenues.

There’s also a part of the sports market that has more of a “venture-like” opportunity: underinvested and emerging teams and leagues.

Let’s take the MLS as an example of what the growth in annual broadcast rights has meant for revenues and franchise values.

Founded in 1993 with ten franchises and an initial expansion fee buy-in of $5M, the MLS now boasts 30 franchises. The most recent franchise fee for an expansion team was 100x the amount 30 years earlier. San Diego’s expansion fee was $500M.

In 2007, the 14-team league had an average franchise value of $37M.

In 2023, the 30-team league had an average franchise value of $579M.

A big reason for this uplift in average franchise value? The delta in annual broadcast rights. In 2007, the league had $8M in annual broadcast rights. In 2023, that number had increased by over 31x to $250M.

It should therefore be no surprise that MLS franchise values (as well as franchise values for other sports where annual broadcast rights have increased) have far outpaced the S&P 500 as the below graphic from Yieldstreet illustrates.

What’s the next MLS? It could very well be the NWSL.

NWSL franchise values have increased markedly over the past four years and appear to be on the rise. While valuation multiples best other leagues and sports around the world, team valuations still have plenty of room to grow. It’s also worth noting that both the NWSL and the MLS don’t have promotion and relegation league structures, like the larger and more lucrative English Premier League and other European soccer leagues do. This feature means that MLS and NWSL teams are able to attract higher valuation multiples because there’s no threat of a team’s poor performance resulting in relegation, which would mean that the team would lose out on the media deal and (likely) lower ticketing, merch, and sponsorship revenues from dropping down a level.

Sports, meet finance

With sports teams in major leagues changing hands for billions of dollars, it’s no surprise that private equity has become a major player in the game of sports investing. PitchBook reports that 63 North American sports teams, representing a combined value of $243B, have either private equity funds or owners with ties to private equity funds managing their franchises. This figure does not include the 32-team National Football League since the NFL has not yet allowed private equity funds to own either minority or majority stakes.

Private equity has become a major player in the world of sports. Established private equity firms, such as CVC Capital Partners (owners of Formula 1, Moto GP, Rugby, the French Football League, La Liga, IPL Cricket, and the WTA), have invested in sports teams and leagues because they see the business opportunity to grow leagues and teams in the context of the business of entertainment. Other established firms, like Blue Owl Capital (Dyal HomeCourt Partners), Avenue Capital Group, RedBird, and others, have set up sports-specific funds to have a dedicated team and pool of capital focused on the growing market of sports. And sports-specific funds, like Arctos, have been founded to invest into teams, leagues, and sports-related assets.

Private equity may be the right type of capital to help sports scale to new heights. Sports teams often require meaningful capital over longer periods of time in order to scale. Private equity firms are equipped to handle this capital requirement. Structured equity, credit, and real estate capital will also come into sports in a big way, meaning that funds that have an understanding of or competency in these other areas of finance should stand to benefit from both access to capital and knowledge.

The development of sports as an investment opportunity for institutional investors is changing the game. We haven’t even scratched the surface of what the institutionalization of sports as an asset class looks like. We are in the early innings at best right now. There’s ample time to continue to grow the game as the business of sports becomes the business of entertainment.

We’ll know we’ve reached added extra time when there isn’t another buyer for the sports assets that now have institutional investors, but for now, there’s plenty of time left on the clock.

Editor’s note: I’m an investor in Angel City FC.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Secondaries Had a Big 2023. This Year Could Be Bigger | Alicia McElhaney, Institutional Investor

💡Liquidity is on the mind of institutional investors, reports Institutional Investor’s Alicia McElhaney. Investors’ focus on generating liquidity from secondary transactions means that secondaries are coming in first. Industry experts predict that 2024 will be another record year for secondaries. Between $110-115B of stakes in private funds transacted via secondaries. According to a recent report on the secondaries market by BlackRock, 2023 represented the second-highest year of closed transaction volume on record. “Liquidity continues to be a core factor for all institutional investors,” said Adrian Siew, managing director of private capital advisory — GP solutions at Eaton Partners, a wholly-owned subsidiary of Stifel. A gridlocked IPO market over the past two years has been a contributing factor, as has widened spreads in the secondaries market. With PE firms calling more capital from investors than they distributed back to them in 2022 and the first half of 2023, LPs had to look to the secondary market to generate liquidity. Buyout funds were most popular, in large part due to LPs’ ability to price and underwrite buyout funds and their underlying assets better. According to Eaton Partners, buyout funds made up 83% of continuation fund deals (GP-led) and 76% of LP-led deals. Pricing on buyout fund secondaries came back in 2023, hitting 91% of net asset value, an increase of 4% in 2022, according to BlackRock. Venture capital deals have a wider spread, with VC secondary deals pricing at 68%. Quality matters in this secondaries market, as Eaton Partners notes that high-quality, newer vintage funds were more attractive for LPs to sell. This meant that these assets were less likely to be discounted. Who are the sellers of secondaries? Pension funds comprised the largest portion of sellers, which is not surprising given their need to meet annual return targets and balance out their portfolios.

💸 AGM’s 2/20: Secondaries came in first in 2023 — and for good reason. Investors were seeking liquidity in a period that was defined by a slower exit environment and a closed IPO window. The amount of capital raised by secondaries funds hit record highs, meaning that a large sum of capital has to be deployed into secondary investment opportunities in the coming years. Secondaries play a critical role in leading LPs to water in what FoxPath Capital Partners, a specialist credit secondary investment firm, calls the “DPI Desert,” in recent research report on the evolution of the secondaries market. Private equity distributions dropped to a decade low in 2022 and 2023, with distributions as a percentage of NAV falling to 15% in 2022 and 11% in 2023. Those figures pale in comparison to 31% in 2021 and 2017 and rival that of the period of the Great Financial Crisis, where distributions as a percentage of NAV were 11% in 2008 and 9% in 2009. With private companies now staying private longer (see last week’s newsletter for more on this), secondaries can play a major role in helping LPs keep their portfolio hydrated with enough liquidity to deploy through cycles.

The question? With pricing for secondaries on certain strategies, like buyout funds, creeping up in NAV, as it did in 2023, are lower returns on the horizon? Secondaries investing isn’t just about discounts. Buying high-quality assets is often more important than buying cheap assets. But if the spread on discounts shrinks does this mute returns for all the secondaries investors who allocated to the strategy in 2023? It’s worth noting that secondaries are a great way for newer entrants to gain exposure to private markets in an efficient, cost-effective, and diversified way. Secondaries exposure provides instant diversification across multiple vintages and sectors. It also provides a shorter time to liquidity for investors, making this a good investment strategy for investors who have not yet had much exposure to private markets.

It’s also worth noting that private credit secondaries are also emerging as more capital flows into private credit. Private credit’s AUM growth has been astronomical over the past seven years, expanding from $560B AUM in 2016 to over $1.7B in 2023. It’s doubled in size since 2018. Growth appears to show no signs of abating, with Preqin and BlackRock projecting private credit AUM to reach between $2.8 (Preqin) to 3.5T (BlackRock) by 2028, which would mean the market doubles again from today’s market size. FoxPath Capital Partners recently released research suggesting that out of the $1.2T of unrealized NAV across the private credit market today, over $700B sits in fund vintages from 2018-2021. Seasoned credit portfolios appear to be ready for secondary market transactions, too. It will be interesting to see how private credit investors approach the environment if rates drop. Will they look to the secondary market to generate liquidity if rates go lower as returns might also go down?

📝 Private Credit Is Still a ‘Great Opportunity,’ Investcorp Says | Manus Cranny and Matthew Martin, Bloomberg

💡Bloomberg’s Manus Cranny and Matthew Martin talk with Investcorp Chairman Mohammed Al Ardhi about his continued excitement for private credit. The Executive Chairman of Bahrain-based Investcorp, which manages close to $13B in its credit unit, says investing in private credit is still a “great opportunity.” Al Ardhi’s rationale? Traditional banks will find it difficult to boost lending, which leaves private credit firms to fill the gap and continue growing. His comments echo Blackstone’s Chief Executive Office Steve Schwarzman, who said the industry would continue to expand and highlighted a low loan default rates. Private credit was amongst the biggest gains for Blackstone in the fourth quarter, according to Cranny and Martin. The $1.7T market has grown at a rapid clip since the 2008 financial crisis and ensuing capital restrictions on bank lending. Private credit has stepped in to fill the void, with the asset class doubling in size over the past five years. UBS’s Chairman Colm Kelleher said at the end of last year that private credit’s growth poses threats to financial stability. Private credit investors, such as Apollo CEO Marc Rowan, have argued the opposite (read more about this in the AGM Weekly from 1.7.23 here). Middle Eastern LPs have seemed to think that private credit is a good place to allocate capital. Mubadala and Abu Dhabi Investment Authority have partnered with private credit firms to grow their exposure to the strategy. Alternative asset managers like Blue Owl Capital and Hayfin Capital Management are amongst the firms that have expanded their presence in the Middle East to partner with LPs in the region. Investcorp plans to expand its private credit business, aiming to raise $1B for investments in Europe and the US, Co-Chief Executive Hazem Ben-Gacem told Bloomberg in January. The firm is still bullish on the outlook for investing in the US, Al Ardhi noted. “The US is the big game in town,” he said. “We continue to see a lot of opportunities,” and “so we are really bullish on the US market.”

💸 AGM’s 2/20: Private credit continues to attract polarizing views. Some argue that the rapid growth in the space is cause for concern. Others call the trend of “debanking,” as Apollo CEO Marc Rowan characterizes this evolution, something that’s healthy for the financial system. A few months ago, Rowan said:

“Every dollar, every euro that moves off of a regulated bank balance sheet de-risks the system. And the room was like gasping. And I said, well, isn’t it, everything on a bank balance sheet is levered 10 to 12 times. When you move a client into a mutual fund, it gets zero leverage. When you move it to an institutional client, it gets zero leverage. When you move it to a BDC [business development company], it gets 1.5 times leverage. And so on and so on and so on. So, every time you move something out of a banking system, you de-lever the system.”

Private credit’s growth certainly shows now signs of abating. Investors vote with their wallets and many seem to believe that allocating to private credit in the current rate environment is a good place to allocate capital on a risk-adjusted basis. If one believes the growing market size of private credit to be a $40T market that includes all sorts of assets to lend to, many of which are asset-based, then it’s not hard to see why investors are keen to gain exposure to the category. A change in interest rates appears to be the big question on the horizon for private credit going forward. It doesn’t seem like uncertainty in the rate environment is stopping investors from being positive on private credit today.

📝 CalPERS favoring growth and venture over buyouts; active up across fund | Arleen Jacobius, Pensions & Investments

💡Pensions & Investments’ Arleen Jacobius reports that the largest pension fund in the US is favoring venture and growth over buyouts. According to a recent board presentation, CalPERS plans to reduce its exposure to large buyouts in its $68B private equity portfolio to allocate more capital to growth equity and venture capital. Buyouts represented 70% of the PE portfolio for the $492.8B AUM, compared to 20% allocated to growth equity and expansion stage private equity and 0.9% in venture capital as of December 31, 2023. CalPERS Managing Investment Director, Private Equity, Anton Orlich, said in the Investment Committee’s March 18 meeting that the plan expects to reduce its private equity exposure in buyout funds to 60%. The beneficiaries will be growth equity and venture funds. Co-investments will also take up more capital, in part due to the lower fee structure than commingled funds. CalPERS had $6.3B, a shade under 10% of its PE portfolio, in co-investments and direct investments. CalPERS plans to commit $15-16B per year to private equity, up from $3-5B per year between 2016-2018. In 2023, CalPERS already significantly outpaced that figure, committing over $20.3B to private equity. Notably, 47% of that capital went into no- or low-fee investment vehicles, according to the report by their investment consultant, Meketa. The focus on co-investments and direct investments is in part due to aiming to blend down overall fees in the strategy. Orlich also said that co-investments could help them solve the “liquidity puzzle” because co-investments in the future would be “self-sustaining” with distributions used to make new commitments.

💸 AGM’s 2/20: If Sacramento has an uptick in foot traffic through its airport this year, we’ll know why. It’s probably growth equity and venture managers flying into town to try to get a piece of CalPERS’ growing growth equity and venture allocation. It’s interesting to see CalPERS' current approach to private equity. Their strategy highlights a few hot-button issues in private markets. A focus on growth equity and venture makes one wonder if 2023, 2024, and 2025 vintages for these strategies will be attractive relative to buyout. There’s probably good reason to believe that the current vintages are a smart time to allocate to growth equity and venture. Valuations have been lower over the past few years and fundraising has been a challenge. That means a capital-rich allocator like CalPERS can choose which funds it wants to allocate to (not that they didn’t already have their pick of funds) and also drive good terms of co-investments and seed / stake deals with funds. As institutional investors look to allocate to funds that often consume less capital than strategies with bigger funds, it’s always interesting to think how these LPs will approach the market and what it means for the funds and fund sizes. I’d imagine that CalPERS will commit to the larger managers in each of these categories while also committing to fund-of-funds or doing separately managed accounts to gain access to smaller managers on a diversified basis that can help drive outperformance. Their focus on co-investments and directs to lower the overall fee load for the program is also notable and on trend. There’s been a secular trend in the institutional LP community of reducing fee exposure to private markets by doing co-investments or directs. This is showing no signs of abating. The coming years should be interesting for private markets, particularly private equity, as some of the industry’s behemoths, like CalPERS and Norges Bank Investment Management, are looking to move into private equity in a big way.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Chief People Officer. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP, Private Wealth Distribution Business Manager, Americas. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Senior Product Manager. Click here to learn more.

🔍 73 Strings (Portfolio monitoring and valuation) - Associate Vice President - Private Credit. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the 8th episode of our monthly show, the Monthly Alts Pulse. We discuss how product innovation, particularly with evergreen funds, is enabling the wealth channel to invest in private markets. Watch here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.