👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good afternoon from DC. Happy New Year and welcome to 2024. Wishing you all a healthy, happy, and exciting year ahead.

Earlier this week, I shared some thoughts on LinkedIn about the importance of educating both GPs (and their salespeople) and LPs on private markets after reading a fantastic article in the Financial Times by Madison Darbyshire. Madison’s article covered the challenges that asset managers face when trying to hire salespeople focused on distributing more complex, private markets investment products.

Developing distribution talent in private markets focused on working with the wealth channel is one of the most critical pieces that will enable alts to go mainstream.

Franklin Templeton CEO Jenny Johnson captured the nuances of working with the wealth channel well in the FT article: "In the wealth channel, [sales] is a blocking and tackling game. You have to get the right product in the right vehicle, then convince each gatekeeper to put it on their platform while educating your own salesforce."

The topic struck a nerve. A number of the industry’s sharpest minds, including the Chairman of the Global Private Equity Practice at Bain & Company’s, Hugh MacArthur, commented on my post to share their thoughts.

How does the industry collectively — GPs, wealth advisors and investors, and investment platforms — solve the education challenge? As Hugh notes above, there are a lot of complexities in educating advisors on private markets in a way that solves dealing with “millions and millions of households.” Figuring this out will fall on both the GPs and their distribution teams, who work with advisors and advisors themselves to become educated on private markets.

The education endgame

To reach the education endgame, perhaps we should start at the beginning. And I don’t mean the beginning of the private equity industry. I mean the beginning of a financial product innovation from the 1990s that really took flight in earnest in the early 2000s: ETFs.

ETFs were born out of the index investing phenomenon from the late 1970s and early 1980s. ETFs are now seen as one of the greatest financial innovations in recent history (read Marc Rubinstein’s Net Interest for a great deep dive into the rise of passive investing). But ETF AUM growth didn’t happen overnight. Quite the contrary, in fact. It took a long 14 years for the ETF industry to cross the $2T AUM threshold.

The uptick in ETF AUM growth between the early 2000s to 2014 in the above graph is notable. What’s clear from the graph is that AUM growth started to pick up steam between 2009 and 2014. That coincides with a number of key industry developments, notably BlackRock’s $13.5B acquisition of Barclays Global Investors, a leading ETF platform that had almost $500B of the $1T total industry AUM in 2009. Since 2009, ETF AUM has been party to staggering growth — 18% CAGR — making it an unquestionable breakthrough technology innovation that has reshaped financial services.

BlackRock and iShares, amongst others, became synonymous with ETFs. Why? Because they invested heavily in educating the market — from financial advisors to individual investors — about the merits of ETFs.

Effective education and marketing of the “why” of ETFs as a product construct were so critical in making ETFs go mainstream.

The why became the how. Education led to allocation. The why (invest in low-cost, passive investment products that are convenient and easy to use) became the how (invest in iShares ETFs).

What’s interesting about the rise in ETFs is that they aren’t new investment strategies for the most part, but rather they are new ways to invest. Investors, either individuals or intermediaries, have always invested in equities. ETFs gave them a new structure to invest vis a vis equities.

Alts appears to be on a similar path. If investors can understand the why, then the industry will solve the how.

What can the alts industry learn from the growth in the ETF industry?

(1) Selling alts is a strategic, consultative sale: Education, trust, and a holistic understanding of a client's portfolio are all critical components of a successful strategic and consultative sale. Why have Blackstone and Apollo invested heavily in education? Because they know that helping advisors and HNW clients understand private markets will create trust.

(2) Creating a framework for portfolio construction: The next big thing in alts education is tying in the why and the how of alts into broader portfolio construction. The industry has created the framework and content to help allocators move beyond the 60/40 portfolio. Apollo’s Stephanie Drescher highlighted this in her 2024 predictions on Alt Goes Mainstream here, saying, "We continue to believe that we are on a trajectory where alternatives in our definition could make up 50% of individuals’ portfolios in the next five years."

Helping advisors understand why and how alts fit into a client's portfolio is critical to sales efforts. The key is finding and training distribution professionals who understand alts.

(3) Training a salesforce with parallels to selling enterprise software in mind: Bain & Company (led by some of the sharpest minds in private equity Graham Elton & Hugh MacArthur) published a fantastic report in Dec 2023 on how asset managers should approach working w/ the wealth channel as if it's an enterprise software sale, borrowing best practices from Salesforce, Oracle, Cisco. Unsurprisingly, these software companies are also known as training grounds for enterprise salespeople (more on Bain’s report and this topic in general here from the AGM Weekly from December 10 2023).

Alternative asset managers would do well to borrow concepts and best practices from top enterprise sales companies.

What can alternative asset managers do, short of finding salespeople who have both alts knowledge and wealth management relationships? They can pair product specialists who have allocated or sold alts in the past with those who know wealth channel well.

(4) Key areas to focus on helping advisors and investors understand about features of alts products and strategies:

The why and the how of alts: What alts do to a portfolio holistically from a risk, return, and liquidity perspective will help allocators understand why and how they should include alts in an overall portfolio construction.

Liquidity: Understand where liquidity matters and where it’s ok for portfolios to have illiquidity.

Fees: Why and when it may make sense to pay the higher fees that many private markets products have.

Manager selection: Certain strategies within private markets, like venture, are more deeply impacted by manager selection. Different strategies have different levels of interquartile dispersion between first- and fourth-quartile managers. Understanding where it makes sense to focus on manager selection and where manager selection may not impact returns as much will help allocators figure out where to focus their time, sourcing, and diligence efforts.

Product innovation: The space is still figuring out how, within the constraints of administrative and regulatory hurdles, how to create product structures that fit different investor types. Allocators need to understand which products are the right fit for their portfolios across the spectrum of risk, return, liquidity, fees.

Keeping the end client in mind: Whether the decision-maker is the advisor or the individual investor, those looking to work with investors would do well to keep in mind that, ultimately, the end client is the individual. Keeping the end client in mind will help GPs and advisors focus on the why of a specific product within an investor’s portfolio.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Is private credit a systemic risk? | Robin Wigglesworth, Financial Times

💡The FT’s Robin Wigglesworth provides a fantastic — and balanced — view of the possible impacts of private credit on the broader financial services ecosystem. Much has been made of the large alternative asset managers (Apollo, Blackstone, et al.) encroaching on traditional banks’ territories, particularly when it comes to lending activities. On one end of the spectrum are those predicting that the next financial crisis will happen in shadow banking due to a blow-up by an alternative asset manager whose lending activities are too risky and unsustainable. Wigglesworth highlights comments in this vein made by UBS Chair Colm Kelleher at the Goldman Sachs 2023 Financial Services Conference this past December. On the other end of the spectrum are the alternative asset managers themselves, who argue that assets that move out of the traditional banking system and off their balance sheets is actually a de-risking activity. Apollo’s Marc Rowan shared his thoughts on Kelleher’s comments at the GS conference only a few hours later:

“I went on and someone said, Marc, what do you think of what Colm just said. And I said, well, let’s just go through the facts. Everything that is on a bank balance sheet is private credit. Let’s start with that.

Every dollar, every euro that moves off of a regulated bank balance sheet de-risks the system. And the room was like gasping. And I said, well, isn’t it, everything on a bank balance sheet is levered 10 to 12 times. When you move a client into a mutual fund, it gets zero leverage. When you move it to an institutional client, it gets zero leverage. When you move it to a BDC [business development company], it gets 1.5 times leverage. And so on and so on and so on. So, every time you move something out of a banking system, you de-lever the system.”

Wigglesworth then goes on to point out that there’s an important distinction between investors losing money and a financial crisis. Not everything is a “Lehman moment,” he says. He then unpacks a report published by Goldman Sachs’ credit analysts examining the possible systemic risks posed by private credit. Goldman notes that:

(1) the “size of the direct lending market is too small ($530B of deployed capital) and financial leverage is too low (both among GPs and LPs), which should limit the risk of contagion from one institution to another.”

(2) while the lack of diversification amongst issuers with their direct loan portfolios is higher than public debt markets and could cause direct lending funds to suffer meaningful losses, that alone doesn’t qualify as systemic risk. In fact, the risk of contagion could be muted because there’s no obligation for asset managers to share losses. This is an important point and part of a notable trend that a number of journalists covered last year: that the direct lending market was moving away from syndication to single funds taking entire deals down themselves, driven by private credit managers raising larger funds. Goldman’s report also cites the fact that evergreen funds impose caps on redemptions, removing the risk of a “run on the bank” and mismatches between assets and liabilities, a risk that banks are privy to.

(3) Growing market for secondary transactions in private credit for both GPs and LPs can reduce some of the risk. Goldman highlights the growth in the secondary market, which has seen AUM increase to over $500B as of the first quarter from $100B a decade earlier, according to Preqin data, as an offramp for investors to manage illiquidity and private credit exposure.

Wigglesworth concludes that private credit is “too small and too little leveraged to cause major wider problems.” In fact, he surfaces, that in accordance to Rowan’s broader point, “some of this lending is genuinely less risky … when it is done by a shadow bank.” He doesn’t forget to include that private credit is still very much in the midst of a major boom, which could lead to major losses or blowups. But whether or not its a systemic consequence lends itself to a different degree of consideration.

💸 AGM’s 2/20: Wigglesworth’s article surfaces a number of related trends as private markets continue to move more into the mainstream. There are several converging themes that, taken together, can provide answers as to why certain things are happening in private markets and also give rise to some important questions about the future of private markets and its participants.

(1) Large alternative asset managers are clearly encroaching on traditional banks’ territories, particularly in lending and private credit. There are a number of structural reasons as to why this is happening — and it makes sense in the context of recent events (SVB and FRB failures) and macroeconomic forces. Whether or not this is good or bad in the long run remains to be seen. But it sure doesn’t seem like this trend will continue to abate.

(2) Private credit markets are evolving in two notable ways. One, the increase in AUM as the big get bigger means that funds are moving away from syndication and leaning more heavily on doing deals themselves. This trend points in favor of what Goldman above argues as possibly a reduction in systemic risk since firms aren’t sharing risks. Two, the maturation of private credit markets means that the market for private credit secondaries is growing dramatically. Cleary Gottlieb found that the $17B in private credit secondaries volume transacted in 2022 represented a 30x increase from a decade earlier. Given the growth of private credit markets, it appears that private credit secondaries are in their early innings of growth, too. Increased activity in private credit secondaries should provide liquidity offramps that could reduce risk concentration for some of the larger lenders. Sure, some of these investments may end in tears if underwriting wasn’t done well, but Wigglesworth and Goldman both seem to note that this wouldn’t qualify as systemic risk.

📝 Private Equity Funds Are Borrowing Against Themselves, With the Help of Insurers | Miles Weiss, Bloomberg

💡Bloomberg’s Miles Weiss highlights a growing trend: insurers lending to private equity funds that are looking to borrow against their investments. Athene, Apollo’s insurer, is one of a growing list of insurance companies that’s increasing their use of net asset value (NAV) financing. NAV financing is becoming a popular form of borrowing for private equity funds looking for liquidity for LPs or to use the capital to help support existing portfolio companies. Weiss notes that demand for these loans are growing — at a time when US regulators are looking to impose higher capital requirements on the largest banks, which is making them more discerning about lending. Insurance companies appear poised to fill the void. They have different capital rules than banks and are looking for high-yielding, long-term assets. Bloomberg reports that around 20 insurers are investing in NAV loans to private funds, including Pacific Life, Allianz Life, and Protective Life. Others are joining the mix. In December, AllianceBernstein LP launched AB NAV Lending with an anchor investment from insurance firm Equities Holdings Inc. Athene is one of the highest profile insurers to enter the NAV lending market, making waves after acquiring large portions of NAV loans that its parent company, Apollo, arranged and syndicated for Softbank and Tiger Global Management. Athene / Apollo also lent to Warburg Pincus, providing a $1B NAV loan last December to pay down bank facilities involving an older fund. There are two sides to the NAV lending coin. On one hand, these “types of financings are very attractive to insurers,” said Leah Edelboim, a Partner in the fund finance practice at Cadwalader, Wickersham & Taft. They are seeing an increasing number of insurance providers either leading deals or taking part in syndications. However, not all LPs are thrilled with the use of NAV loans. Historically, NAV loans have been used to extend runways for portfolio companies or enable portfolio companies to make additional acquisitions. More recently, NAV loans are being used to pay out distributions to investors, something that is controversial in the eyes of LPs. The entrance of larger players and loan sizes is making the space evolve in a few ways. Like bank lenders in the NAV loan space, Apollo typically limits the size of its loans to no more than 10% of the assets pledged as collateral. Weiss cites that this both protects against losses and helps the NAV loans obtain investment-grade ratings. Insurance capital is pushing lenders to get credit ratings for NAV loans, reducing the amount of regulatory capital that must be held against the debt.

💸 AGM’s 2/20: NAV lending is increasingly becoming a popular way for large private equity funds to finance their activities with portfolio companies, particularly in a more muted exit environment. It’s led to a more controversial topic: using NAV loans to provide liquidity for LPs. This trend is reflective of a number of market forces at play in private markets. LPs are looking for liquidity, particularly institutions that are facing the denominator effect and in need of rebalancing their portfolios. It’s also a way for GPs to provide distributions to LPs as they go out to fundraise, proving that they can generate DPI. Some LPs, however, take issue with this practice. They worry that it adds a second layer of leverage to a private equity fund. In an August article in Institutional Investor, Cambridge Associates’ Head of Private Investments Andrea Auerbach said that leverage is becoming an increasingly important topic to monitor with existing GP relationships and a major point of diligence on prospective GP commits, calling it “leverage on leverage.” The worry here is that interest rate changes or issues with the underlying companies can compound the risks associated with increased leverage. It also creates a situation where GPs collateralize certain companies with others, packaging together some of the struggling companies with the more successful ones. The trend here is that LPs are becoming more discerning in diligence to ask about NAV borrowing. The other notable trend is that insurance capital is now being used to finance NAV lending. This evolution makes sense as insurance capital is looking for returns with this profile. I’ll be looking to see how much the NAV lending space grows with the addition of insurance capital, particularly as both insurers and lenders are pushing for credit ratings on NAV loans, signaling yet another area where traditional banks are witnessing alternatives firms move into their territory.

📝 $250bn Edelman names new marketing exec | Payton Guion, Citywire

💡Payton Guion of Citywire reports that Edelman Financial Engines, a $250B RIA, bolstered its C-suite with the hire of Megan Hanley as Chief Marketing Officer. Warburg and Hellman & Friedman-backed Edelman looked to different industries to bring on a CMO, hiring someone in Hanley who was recently CMO at Forge Global, a private market investment platform. Hanley was also CMO at Achieve, Helix, Shoprunner, and Auction.com. She also spent almost four years at Microsoft.

💸 AGM’s 2/20: Why am I including news of a CMO hire at a large wealth management platform? Edelman’s hire of a CMO who has spent time at tech and consumer-facing companies, including one in the private markets space, signals a few notable trends that are relevant to the evolution in private markets and wealth management. One, it signals the growing trend that wealth and alts firms want to speak directly to the individual consumer. Blackstone and Apollo’s holiday videos also reflect this phenomenon. The marketing needs of individual investors (and advisors) have changed. So, too, does the approach of how to speak to consumers. Two, it highlights the focus that wealth managers are placing on private markets. Wealth managers are increasingly trying to figure out how to help clients navigate private markets. So, too, are GPs. I covered the importance of investing in education and communication of alternatives above in this newsletter. It will take a number of things to make alts go mainstream, but education and positioning of alts in a broader investment portfolio are amongst the main drivers of increased participation by the wealth channel in private markets.

Reports we are reading

📝 2024 Outlook: Private Equity & Venture Capital | Theresa Hajer, Petros Krappas, Aaron Costello, CFA, Vivian Gan and Nicolas Schellenberg, Cambridge Associates

💡Cambridge Associates released their 2024 Private Equity & Venture Capital Outlook, highlighting four main themes for the year:

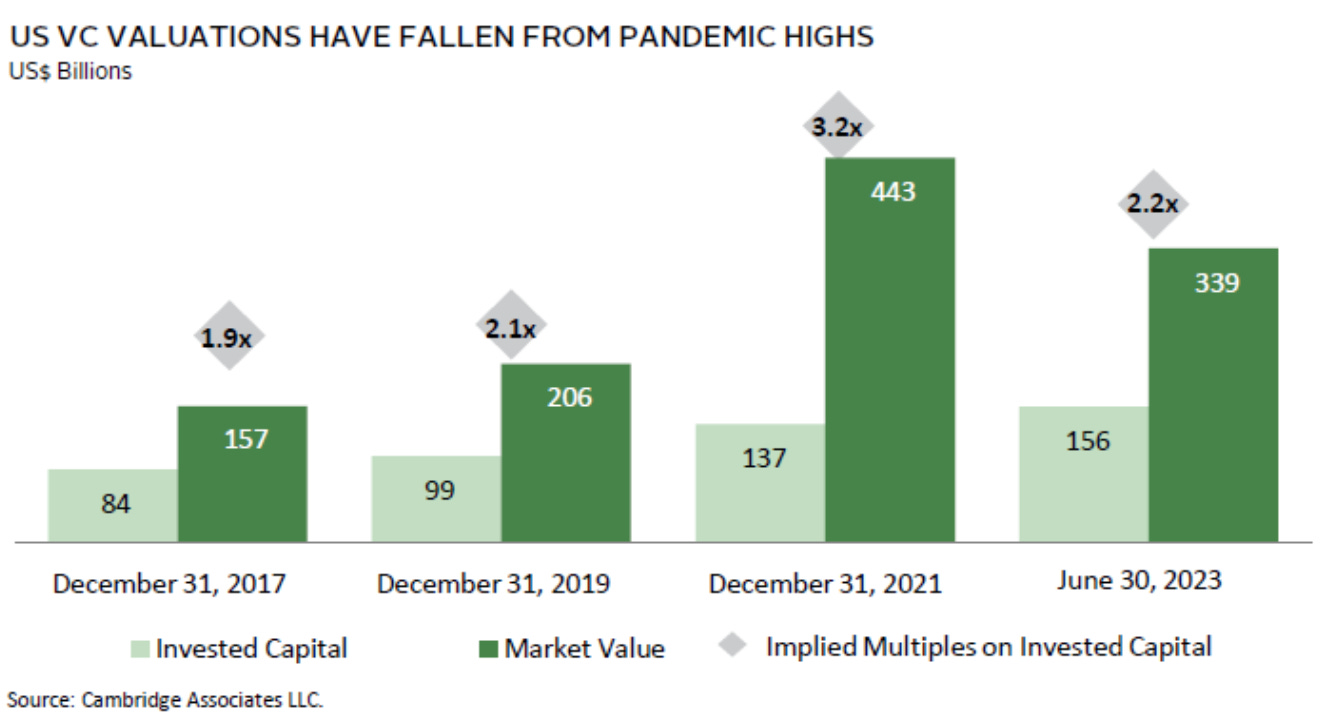

(1) US venture capital down rounds will increase, even as artificial intelligence continues to serve as a major area of interest for investors.

(2) Flows to European turnaround and value strategies will increase.

(3) Flows to China private investments will remain muted.

(4) Secondary transaction volume will increase to a record level.

Please see below for a more detailed breakdown:

Down Round U.S. Venture Capital Financings Should Increase in 2024, Amid Rising AI-Investment Exuberance:

Cambridge believes there will be an increase in down rounds as many companies face diminishing cash reserves and expiring runways.

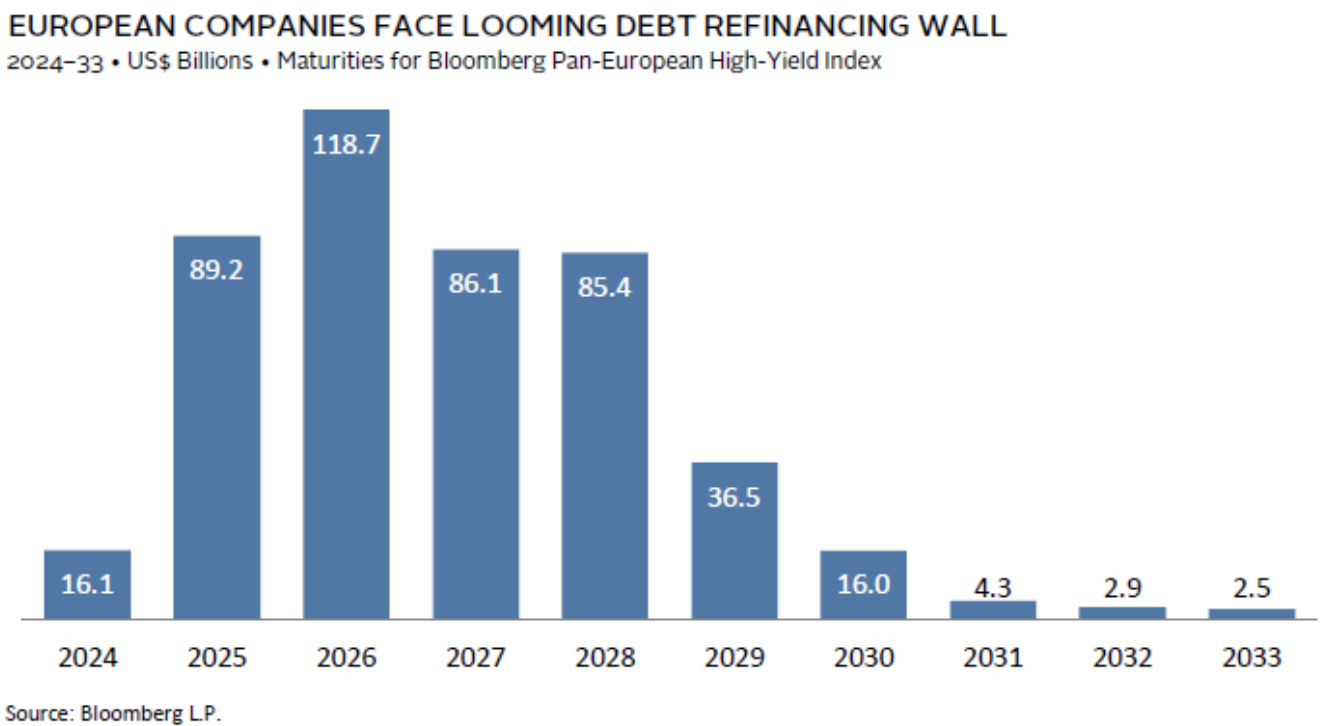

Capital Flows to Private European Turnaround and Value Strategies Should Increase in 2024:

Cambridge expects market conditions, particularly with conglomerates continuing to divest non-core subsidiaries and an increase in public-to-private transactions, will increase allocations to turnaround and value managers. Cambridge says that “managers with large operating teams and restructuring expertise, differentiated networks of intermediaries, and connections with large corporates to secure carve out deal flow will have an advantage in this market.”

Cambridge believes that adding high quality European turnaround and value exposure to portfolios in 2024 should serve investors well, in part because many European companies face an incoming debt refinancing wall.

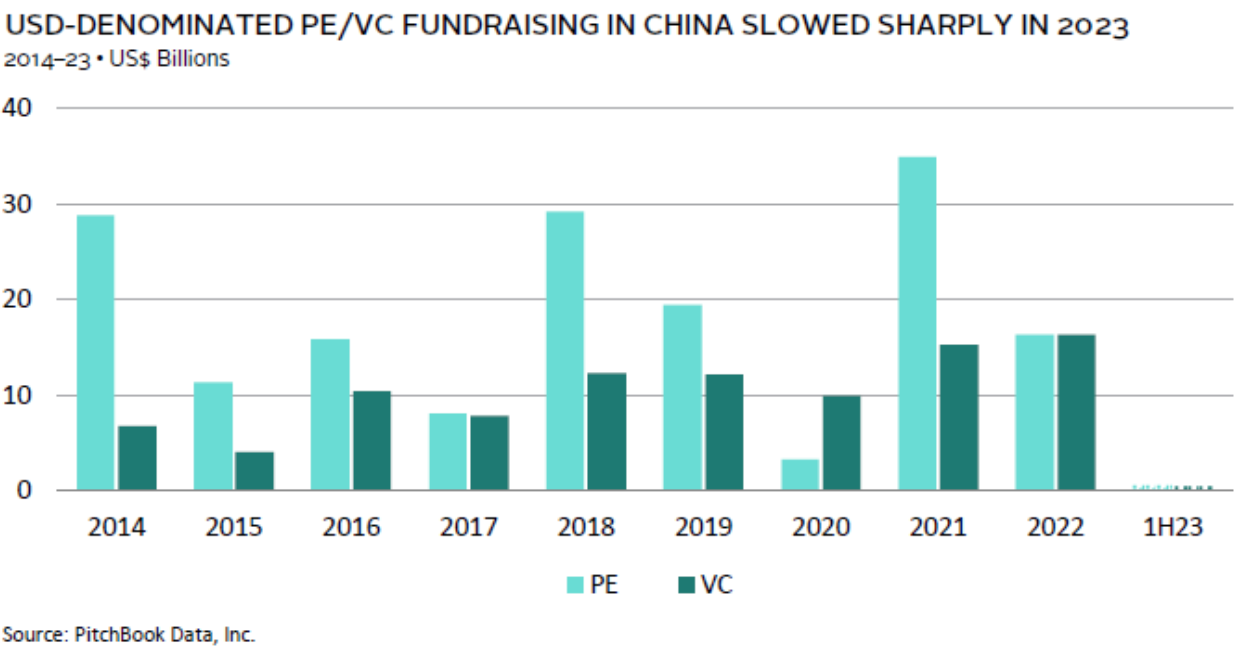

Foreign Capital Flows to China PE/VC Should Remain Muted in 2024

China USD-denominated PE and VC fundraising slowed dramatically due to geopolitical tensions between the US and China and pending US restrictions on advanced technology investments in China.

Cambridge expects a more muted fundraising environment for Chinese GPs and for US-linked GPs and LPs who were (or are) active in China.

Private Equity Secondary Transaction Volume Should Increase to a Record Level in 2024

Cambridge anticipates a resurgence in secondaries deal volume that should look more like 2021 levels given the high levels of dry powder, a narrowing bid-ask spread in secondaries, the continuing need for liquidity among LPs, and ongoing market innovation.

Dry powder in the global secondaries market is projected to be around $200B (1.7x - 2.2x recent transaction volume), and pricing is expected to see modest increases, with average discounts of ~10%.

Valuation adjustments by GPs will reduce the bid-ask spread, facilitating more transactions as sellers become more comfortable with discounts.

The GP-led market is becoming an increasingly large part of the secondaries market.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Alternative Investment Fund Origination - Vice President / Senior Vice President. Click here to learn more.

🔍 Vega (Digital wealth manager with a focus on alternative investments) - Senior Software Engineer (Backend / Frontend). Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

🔍 Northzone (Global early-stage VC) - Investment Team, Stockholm office. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the sixth episode of our monthly show, the Monthly Alts Pulse. We discuss what will make the industry move forward in 2024. Watch here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the fifth episode of our monthly show, the Monthly Alts Pulse. We discuss the rising interest of alts around the world. Watch here.

🎙 Hear how Shannon Saccocia, the CIO of $67B AUM Neuberger Berman Private Wealth, thinks about the changing role of alternatives in client portfolios. Listen here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear Chase Griffin, a QB at UCLA and the NIL Male Athlete of the Year, share thoughts on how private equity and the NIL are changing the game for collegiate and professional sports. Listen here.

🎙 Hear Jamie Rhode, Principal at family office Verdis Investment Management, on how to drive the most meaningful returns in early-stage venture as a LP. Listen here.

🎙 Hear Maelle Gavet, CEO of Techstars, take the pulse of seed and how Techstars has created an actively-managed index of innovation. Listen here.

🎥 Watch a roundtable on the European institutional LP vantage point on the current fundraising environment for VCs in Europe. EUVC, a top podcast championing European venture and fund syndicate platform, brought together leading institutional LPs in the European ecosystem, David Dana, Head of VC Investments at EIF, Joe Schorge, Co-Founder & Managing Partner at Isomer Capital, Christian Roehle, Head of Investment Management at KfW Capital, and me to discuss how GPs in Europe can navigate a difficult fundraising environment. Watch here.

🎙 Hear Joe Schorge, Co-Founder & Managing Partner at one of Europe’s most active LPs, Isomer Capital, discuss why now is Europe’s time. Listen here.

🎥 Watch Marc Penkala, Co-Founder & Partner at Altitude, and I do a first-of-a-kind live podcast on EUVC. EUVC, the leading podcast championing European venture and fund syndicate platform, brought together one of their portfolio GPs, Marc Penkala of Altitude, and me for a VC / LP pitch session. Watch here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear sustainable investments pioneer Bill Orum, Partner of $9B AUM OCIO Capricorn Investment Group, discuss how Capricorn has proven that doing well and doing good don’t have to be mutually exclusive. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

🎙 Hear investing legends John Burbank and Ken Wallace of Nimble Partners provide a masterclass on investing with a macro lens from John’s background as a leading macro hedge fund manager at Passport Capital and on micro VC from Ken’s background backing some of the top emerging VCs at Industry Ventures. Listen here.

🎙 Hear $40B AUM Cresset Co-Founder & Co-Chairman Avy Stein and Director of Private Capital Jordan Stein live from the Allocate Beyond Summit discuss how private markets are changing wealth management. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Bain & Company’s Partner & Chairman of EMEA Private Equity Graham Elton discuss how the evolution of private equity and how large private equity firms have evolved as businesses. Listen here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, approaches alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.