👋 Hi, I’m Michael. Welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

3i Members is an investing network of 400+ investors — all who have exited a company or lead a family office.

Members participate in monthly deal meetings, regional events, diligence discussions, and more.

3i deal flow is characterized by its high-yielding nature (15-20%+ IRRs), underwritable, uncorrelated, and off-market alternatives with asymmetric return profiles.

Join the waitlist and learn more about how 3i sources & diligences investment opportunities here.

Good morning from DC, where the sun is finally out. I’m getting ready to head to NYC this week to speak at an event on private markets hosted by Schroders and Pangea in what should be a busy week for the fintech scene in NYC (it’s New York FinTech Week!).

A lot can happen in ten years. That’s certainly been true for private markets — and Ares is a shining example of that sentiment. As they approach the 10-year anniversary of their IPO in May, their growth as a firm, AUM, and market capitalization have been astounding, though not surprising, given the development of private markets.

Ares released their 2023 Annual Letter this past week. I thought it would be interesting to dig into the finer print because, in many respects, trends that Ares covers in their Letter are representative of a number of themes that are defining private markets.

Let’s zoom in to zoom out.

The big are getting bigger

Ares had a strong year of AUM growth amidst a challenging year for fundraising in private markets.

Ares: Despite a difficult year for fundraising across the alternative asset management sector, we had our second-best year of fundraising and set an annual record for new capital raised from institutional investors.

The firm had its second-best year of fundraising in its history, hitting $74B in gross fundraising dollars. This figure fell just $3B shy of the firm’s record fundraising figure of $77B in 2021.

These fundraising results support the thesis that the big are getting bigger, which I wrote about in February 4th’s AGM Weekly.

AGM Weekly: From a business-building perspective, the trend is that the big are getting bigger. The incentives align too. The larger a firm becomes, the more fees they can generate from AUM scale, and the more likely that mega allocators invest in the big brands.

The largest firms stand to attract more capital, particularly in areas of private markets such as credit, where scale matters and it benefits the investment thesis. And as the private credit space continues to grow due to the secular trend of de-banking, credit seems to be an area where there’s certainly more opportunity to scale fund sizes relative to, say, private equity, which has a market size that may be more limited.

Blue Owl’s Global Private Wealth President & CEO Sean Connor echoed this sentiment on a recent Alt Goes Mainstream podcast, sharing where and why scale matters in private markets.

Let’s dive deeper into Ares’ impressive year.

Credit drove AUM growth

Credit represented the lion’s share of the fundraising dollars for Ares. $55B of the $74B raised in 2023 flowed into credit funds and strategies. LPs, both individual and institutional, seemed to favor private credit strategies.

Performance in private credit appeared to be attractive to LPs. Ares private credit strategies generated all-in yields at origination, exceeding 10%.

Ares expects credit to continue to drive both performance and AUM growth.

Ares cites the secular market trend of bank consolidation and retrenchment from middle-market corporate lending as a growth driver for private credit. Private credit has stepped in to fill the financing gaps in middle-market lending that banks have vacated.

Given their success in fundraising in 2023, Ares is awash with capital to deploy in an environment where private credit is becoming a larger part of the financial services ecosystem. They ended the year with a record $110B of available capital to invest, putting Ares in a good position to take advantage of the trend of “de-banking.”

You get credit, I get credit, we all get credit

The tailwinds in private credit appear to be strong.

Ares: We believe the strong secular growth for Private Credit will continue at a faster rate than Private Equity over the near-term.

Ares notes that private equity will continue to use private credit managers for financing transactions. In 2023, private credit managers captured 70% market share of new leveraged buyout transactions.

Private credit has also moved well beyond financing leveraged buyout transactions. Ares believes that there are ample opportunities — to the tune of $23T of “less capital efficient” assets sitting on bank balance sheets — for banks to partner with the alternative credit sector in order to relieve capital charges.

Much of these assets represent an opportunity for private credit to fill the void left by banks.

The secular trend of de-banking represents the ability for private credit to grow in size and scale. Yet, both private credit AUM and dry powder are a fraction of private equity AUM and dry powder.

That leads Ares to assert that private credit should continue to grow at a faster rate than private equity. It’s hard to disagree with that statement.

The credit question: will you still love me tomorrow?

What happens if private credit is impacted by a downturn or a change in interest rates? That’s a question on the minds of many.

Ares CEO Michael Arougheti answered this question in an appearance on CNBC Money Movers last month.

Arougheti said that the “positioning of private credit portfolios today, generally speaking, they are more conservatively positioned relative to any other time in the asset classes’ history.”

Ares reduced its credit deployment year-over-year from 2022 to 2023 in the face of rising interest rates and a more uncertain economy. Ares’ total credit deployment was 10% lower than in 2022, with liquid credit deployment down 22% YoY, US direct lending deployment down 11% YoY, European direct lending deployment down 28% YoY, and Asia credit deployment down 42% YoY. Alternative credit deployment increased meaningfully, up 40% YoY.

Interestingly, but perhaps not surprising, alternative credit deployment increased in 2023 against the backdrop of the secular trend of de-banking. Private credit has become a much larger part of financial markets, with asset-based finance and alternative credit representing a massive opportunity for alternative asset managers.

While Ares is one of the larger players in the private credit space, data from their recent investor presentation illustrates that their total credit AUM represents a mere fraction of the $10.9T addressable market.

Wealth a growth driver of AUM, but don’t forget the institutional LPs

The above chart highlights both the size and scale of the Ares platform. At $419B AUM, Ares is one of the larger alternative asset managers in the industry. It also illustrates just how high the ceiling is for Ares — and other alternative asset managers — to grow their AUM and market share.

The wealth channel will help them grow AUM. Ares has dedicated resources to serving the wealth channel, which has paid dividends. The $5B raised across their suite of products from the wealth channel was good for placing third in overall wealth management fundraising among publicly traded alternative asset managers.

Becoming a one-stop shop

What was striking about their letter was the growth in both their relationships with institutional investors and the penetration of wallet share amongst this category. They grew their institutional investor base by 19% year-over-year, from 1,935 to 2,300 institutional investors.

What is perhaps even more impressive is how much they grew their relationships with existing investors across the Ares platform. The data reflects that Ares has figured out how to penetrate more wallet share of existing investors: in 2018, over half of direct institutional AUM was only invested in one investment product with Ares. Now, more than two-thirds of AUM is with investors who invest in at least two or more investment groups.

This trend is not just specific to Ares. Their peers are also transforming into one-stop shops for LPs. What firms like Ares and their ilk are competing for is to become the investment platform that serves LPs across different private markets strategies. As former Blackstone and Airbnb CFO and current WestCap Founder and Managing Partner Laurence Tosi said on a recent Alt Goes Mainstream podcast, repeating something that Blackstone CEO Steve Schwarzman used to tell the Blackstone team, “scale is our niche … and scale begets skill.” Tosi goes on to say “the more funds that Blackstone has, the more places they can raise capital against, and the more places they can put that capital against … more buyers mean more sellers and more sellers mean more buyers.” One-stop shops become powerful marketplaces because they can aggregate liquidity, data, and network effects. This structure plays into the hands of the likes of an Ares, a market leader in categories like private credit and other private markets strategies. It’s clear that their institutional LPs agree; they’ve entrusted them with increasing amounts of capital from when they commenced their relationship with Ares.

While a lot of the focus at Alt Goes Mainstream has been on the growth of the wealth channel and the size of the opportunity for more capital from an under-allocated cohort of investors, one-stop shops like Ares have a big opportunity in front of them to continue to grow the size and scale of their relationship with their institutional LP clients as well, which is also a major driver of continued growth of private markets AUM.

Growing the platform through acquisition and permanent capital

Scale is certainly something that Ares has continued to focus on — both in terms of product expansion and geographic footprint.

2023 saw Ares acquire strategic assets in different geographies to expand their reach:

Crescent Point Capital (“CPC”): Ares acquired Asia-focused private equity firm CPC, which had approximately $3.7B in AUM and 50 investment professionals across China, Indonesia, the Philippines, and Vietnam. The CPC acquisition means that Ares Asia now has created direct sourcing and investment capabilities across credit, private equity, real estate, and infrastructure in the region.

Vinci Partners: Ares made a $100M convertible preferred investment into Brazilian publicly traded alternative investment firm Vinci Partners. Ares expects to partner with Vinci on product development, investment opportunities, and distribution as become increasingly focused to the emerging Latin American market.

BlueCove Limited: Ares acquired a minority stake in BlueCove, a London-based scientific fixed-income manager with the option to acquire a controlling interest in the future. BlueCove combines both quantitative and active management in the liquid fixed-income markets.

Ares also grew its insurance business through its affiliated insurance subsidiary, Aspida Financial. Aspida grew its AUM by 100% in 2023 to $12B AUM. Aspida scaled AUM in large part due to the sale of new annuity products.

The focus on growing an affiliated insurance (annuity) business to increase AUM has been a major driver for Ares and its peers. Blue Owl acquired Kuvare Asset Management this week for $750M (along with a $250M earnout and a $250M investment into Kuvare). Kuvare, which has become a top 20 fixed and indexed annuity writer in the US, will have its insurance companies become new asset management clients of Blue Owl, which will allow Blue Owl to deploy up to $3B of assets across its investment platform, and by the time of the closing of the acquisition, Blue Owl will be allocated up to $20B AUM.

Growing AUM via permanent capital, in some cases, through owning insurance companies or having relationships with insurance affiliates, is becoming a major driver of growth for alternative asset managers. I anticipate that firms will grow their AUM significantly due to the relationships they have with insurance companies.

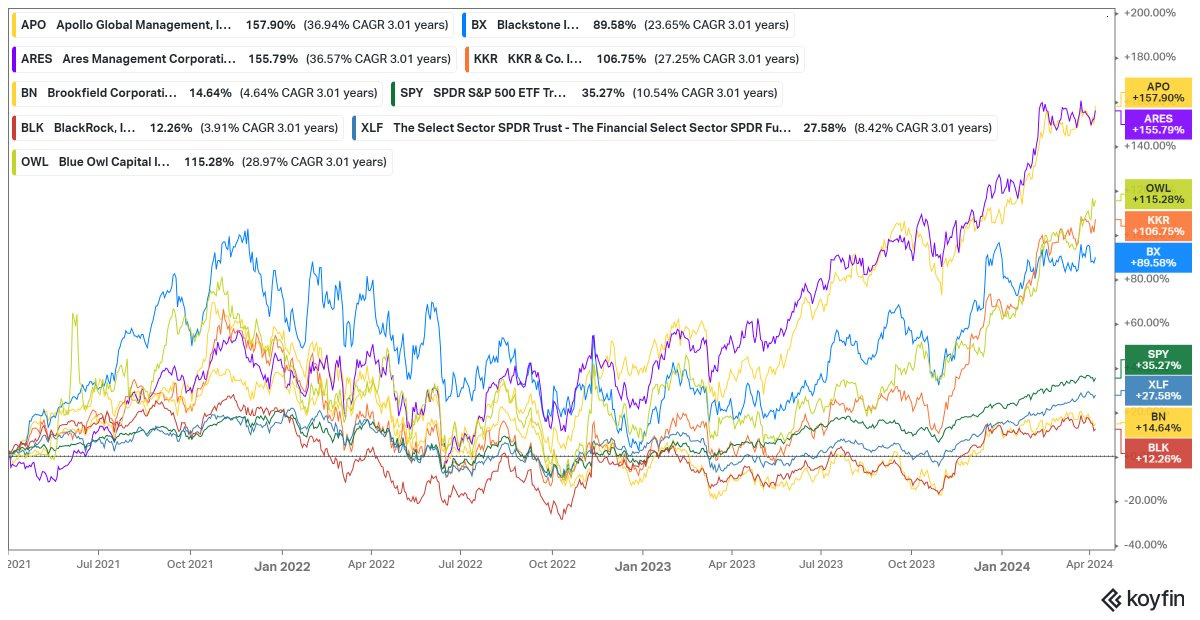

Stock price outperformance

AUM growth has had a direct impact on stock price performance, which has been tremendous over the past five years. Ares achieved a 79% total return in 2023 versus 26% for the S&P 500. Over the past five years, Ares stock generated an average annual return of 51.4% versus 15.9% for the S&P 500.

Why has Ares outperformed? Growth in AUM, driven by success in fundraising and investment performance. At $419B AUM and $262B in fee-paying AUM, Ares generated $2.6B in management fee revenues, $1.2B in fee-related earnings, and $1.2B in GAAP net income.

Ares has also continued to grow its credit franchise and has diversified across strategies and geographies.

Ares hasn’t been alone in achieving impressive stock price appreciation. Its fellow publicly traded alternative asset managers have all been enjoying the party together.

But there’s an interesting feature of stock price performance.

The best performing stocks over the past three years? The alternative asset managers that have a major focus on credit — Apollo, Ares, Blue Owl, then KKR and Blackstone (both of which also have large footprints in credit).

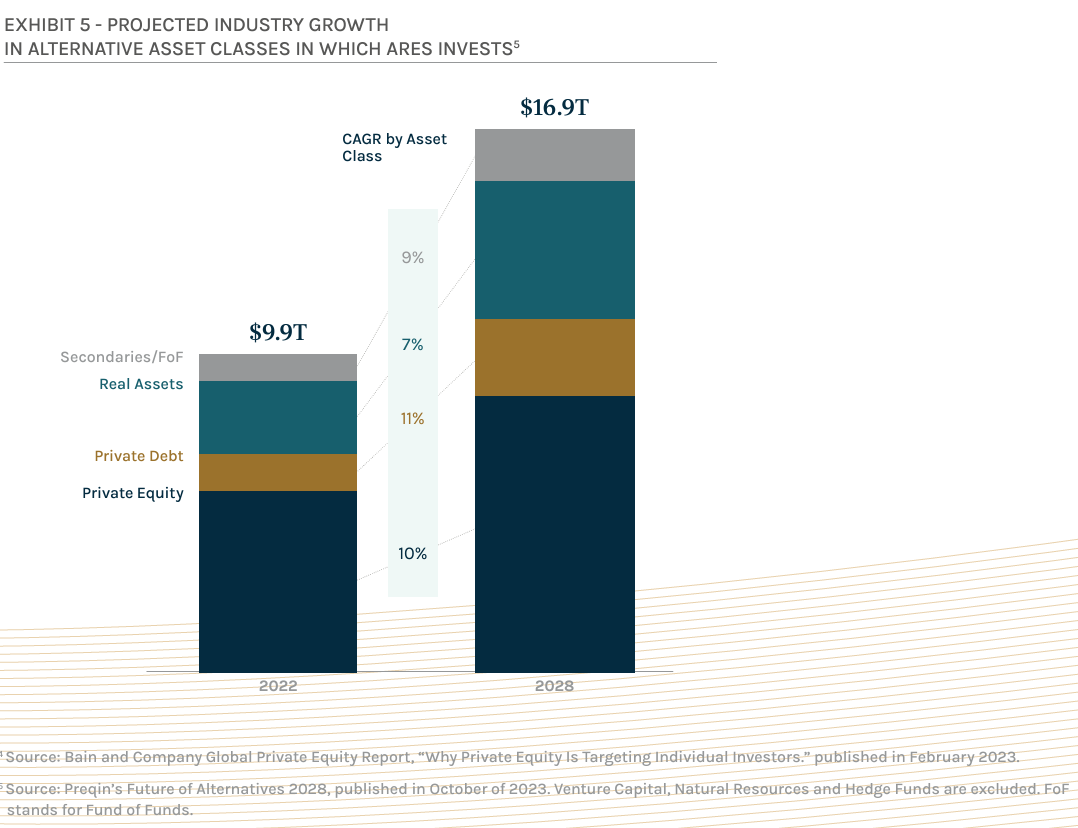

Will this growth continue? Ares makes a good case in their Letter as to why AUM growth should persist.

Ares: The total addressable market for both institutional and retail investors is estimated to be more than $280 trillion, and we believe both institutional and retail investors remain under allocated to alternative assets. While institutional investors began this transition to alternative assets decades ago, retail investors are further behind. It is estimated that only ~3%, or just over $4 trillion of individual investors’ AUM, is allocated to alternatives, which is expected to grow to nearly $13 trillion by 2032.

If we take the view that roughly $7T in AUM is added to the alternative asset classes in which Ares invests and combine it with data from Blue Owl that the 10 largest alternative asset managers in each asset class will raise the lion’s share, then that plays to the benefit of the large firms.

I expect the big to continue to get bigger as scale begets scale.

“Even more mainstream”

Ten years after its IPO, 5x growth in AUM and 10x increase in market cap later, Ares concludes the Letter by stating that they are “even more excited about the growth opportunities ahead of us.”

Why?

“Acceptance and utilization of alternative assets should become even more mainstream for both institutional and retail investors,” they say. The mainstreaming of private markets is happening before our eyes. In fact, it’s only really just begun.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Lender Blue Owl Capital Pushes Into Insurance | Laura Cooper and Miriam Gottfried, WSJ

💡 WSJ’s Laura Cooper and Miriam Gottfried cover one of the biggest trends in private markets: large alternative asset managers acquiring insurance businesses as a way to access permanent capital. This week, yet another alternative asset manager acquired an insurance business to bolster its ability to grow AUM. Blue Owl Capital bought Kuvare Asset Management, an asset manager tied to the insurance industry. Kuvare manages the assets of Kuvare UK Holdings, a life-and-annuity insurance company, and the assets of other insurers. Kuvare’s acquisition came at a price, but seemingly a worthwhile one. Blue Owl is paying $750M for Kuvare Asset Management and buying $250M of preferred equity in Kuvare UK Holdings, but the transaction will grow Blue Owl’s AUM by $20B. The additional $20B AUM is a meaningful addition to the platform that has $166B. The acquisition provides yet another avenue for Blue Owl to grow AUM, which has more than tripled its AUM since going public in 2021. Blue Owl’s purchase of Kuvare continues the trend of alternative asset managers buying up insurance companies as a way to grow AUM. Apollo led Wall Street’s push into insurance when it helped create insurer Athene and built a large credit business to manage its assets. KKR, Blackstone, and Brookfield followed suit by either buying insurers or managing insurance company assets. Annuities are a hot topic amongst alternative asset managers — and for good reason. Fixed annuities, which pay policyholders a guaranteed minimum income, are attractive to alternative asset managers because they must only earn a return that is higher than the specified payout rate to policyholders. This feature makes this product a good fit for investment strategies like credit and GP stakes. Blue Owl’s Co-CEO Marc Lipschultz hinted in a recent interview that Blue Owl lacked exposure to the insurance industry relative to its peers. So Blue Owl went out and acquired a firm in Kuvare that will provide them with expertise in lower-risk and lower-return investment strategies that are well-suited to annuities customers.

💸 AGM’s 2/20: Another week, another alternative asset manager stepping into the insurance space in a big way. Blue Owl’s acquisition of Kuvare is a huge deal for the future of the firm. Not only does the deal add $20B of AUM to Blue Owl’s growing capital base, but it also provides them with the type of capital that should be synergistic with the types of alternative asset classes they focus on. The deal should further buttress Blue Owl’s permanent capital base, which is a good fit for a platform that has the market-leading GP stakes business, GP Strategic Capital, Credit, and Real Estate. All three investment groups stand to benefit from the type of capital that Kuvare’s annuity business offers to Blue Owl.

This acquisition raises a broader question for the industry: how many insurers are there to buy? And, further, how many insurers focused on retirement services have a strong balance sheet, ample regulatory capital, and a high-quality rating? The answers to these questions will play a major role in determining just how many alternative asset managers can employ the accretive strategy of acquiring or partnering with an insurer as a way to grow AUM and create an avenue for their investment products to be consumed by insurers. I anticipate that publicly traded alternatives managers will continue to find ways to either buy insurers, as Apollo did with Athene, KKR did with Global Atlantic, and Blue Owl did with Kuvare, or partner in a bid to grow AUM. Will the next wave of alternative asset managers that are preparing to go public do the same?

📝 Manulife completes CQS acquisition, expanding its fixed income offering | Claudia Preece, The Trade News

💡On a week when an alternative asset manager, Blue Owl, acquired an insurer, Kuvare, the reverse happened as well. Manulife, an insurer, completed the acquisition of a multi-sector alternative credit manager, CQS. The deal, which was announced five months ago, was approved by the UK Financial Conduct Authority (FCA) this past week. Bringing CQS into the fold gives Manulife Investment Management the opportunity to tap into growing investor interest in alternative credit. Paul Lorentz, President and Chief Executive of Manulife IM, said as much: “With this acquisition, Manulife Investment Management is well-positioned to capitalise on the increased investor interest in alternative credit and accelerate the growth of our global business.” CQS, which boasts $13.5B AUM, will continue to employ its alternative credit strategies under a joint brand, Manulife | CQS Investment Management. Manulife, a $746B AUM investment manager, had been looking to expand its private credit offering amidst growing investor interest in the strategy. The deal will also expand Manulife’s footprint among institutional investors in the UK and Europe, where CQS had LP relationships.

💸 AGM’s 2/20: Private markets are undergoing a great convergence. Alternative asset managers are expanding their footprint to cover a broader set of investment opportunities across private markets, particularly as it relates to private credit. Blue Owl Co-CEO Marc Lipschultz highlights this trend in a recent video, talking about how private markets are “not really just a road, it’s a superhighway, it has quite a few lanes in it.” Alternative asset managers now cover a multitude of lanes within the alts superhighway — and growing a presence in areas like private credit either by acquiring firms that focus on a specific investment strategy or acquiring insurers only serves to cover more of the highway. Traditional asset managers and insurers also see the need to expand their offerings to cover alternative assets. It’s why firms like Franklin Templeton acquired $75B AUM secondaries manager Lexington Partners, BlackRock acquired $100B AUM infrastructure manager GIP, and it’s why Manulife acquired $13.5B AUM CQS. CQS gives Manulife an increased footprint in private credit, an area that is of high interest to investors, and makes for a good fit for insurance investment products, like annuities, given its return profile.

This convergence isn’t just about creating a platform with more AUM and increasing an asset manager’s enterprise value. It’s also about providing a suite of investment products that address the growing need to help meet the challenges of an aging society.

Apollo CEO Marc Rowan hit on the importance of helping to build investors’ savings over the long term in the firm’s Q4 2023 Earnings Call:

Finally, we can't escape that we're all getting older. Our society is getting older. Europe is getting older, Japan is getting older, Australia is getting older. Most Western markets are getting older. Most markets have done a very poor job of retirement savings. The retirement savings crisis in the US is particularly acute. The numbers are well known. And I believe there is a substantial role for firms such as ours to play in buffeting investors' savings and allowing them to provide – allowing us to provide them guaranteed lifetime income.

Whether it’s alternative asset managers moving into insurance to create investment outcomes for investors’ savings in retirement or insurers expanding into alternatives, what the industry is really solving for is helping investors have more money in retirement at a time when people are living longer. That’s a worthy aspiration for everyone involved.

📝 Private Credit Remains a Hot Item for Insurance Companies | Michael Thrasher, Institutional Investor

💡Institutional Investor’s Michael Thrasher highlights the increasing interest in private credit amongst insurance companies. Thrasher cites a Goldman Sachs Asset Management survey of 359 CIOs and CFOs at insurance companies, which finds that “risk appetite remains healthy” at insurers this year. Despite 59% of insurers stating uneasiness about the credit cycle, 35% look to increase credit risk in their portfolios over the next 12 months. Over half (53%) of the insurers surveyed ranked private credit among the top five asset classes with the highest expected return in 2024. The survey finds that insurers appear to be ready to lock in on higher rates in 2024 and increase both duration and credit risk.

“Insurers remained aggressively allocating to private credit,” Matthew Armas, Global Head of Insurance at GSAM, said during a conference call about the report. “This is the first time we’ve seen a fixed income asset as the highest expected return asset class in our survey.” Allocations to investment-grade private debt remain high: 33% of insurers plan to increase their allocations to the asset class. A large number of the insurance companies surveyed invest in private credit from different parts of their portfolio. 42% of private debt investments comprise insurers’ traditional allocations to private equity. 16% was shifted into private credit from general alternatives allocation. 13% of insurers had private credit as its own dedicated allocation. It’s not just private credit that has insurers interested. Insurance companies also plan to increase their allocations to other asset classes, with almost 33% planning to invest more in infrastructure and 27% planning to invest more in private equity.

💸 AGM’s 2/20: Insurers are looking for ways to increase returns, and they are turning to private markets to do so. This sentiment follows the theme that private credit appears to be an attractive asset class for many investors participating in private markets. Connecting the dots, it is not a surprise that firms like Ares and Apollo have seen growth in the AUM of their insurance captives or affiliated insurers, and it makes sense why Blue Owl would want to acquire the asset management arm of an insurer in Kuvare, as they did this week. Insurance companies are looking to deploy assets to private markets, and the risk / return profile of private credit appears to fit the bill.

As insurers shift allocations into more illiquid investment products, the question becomes, what happens from here? Alternative asset manager CEOs have stated that they are hyper-aware of the risks posed by the more illiquid nature of private credit and private equity, particularly as it relates to their insurance company assets. Barings issued a report in 2023 that life insurance companies are the ones to watch for impending liquidity challenges. Barings cites the possibility of policyholders halting the payment of their premiums under different economic conditions, particularly when they can get something better from another insurer or higher returns on bank deposits. There’s also the possibility of higher rates impacting defaults and returns in private credit. Both of these possibilities pose a threat to the private credit ecosystem as more investors gain exposure to this asset class. That may be the case, but I’d also be surprised if the largest alternative asset managers, particularly those that have been operating in private credit markets for multiple cycles, weren’t hyper-focused on risk management and high-quality underwriting. In some respects, the future of private markets depends on how well they do this.

📝 Hunter Point Capital raises record $3.3B for debut GP stakes fund | Business Wire

💡GSO Capital Partners (now Blackstone Credit) Co-Founder Bennett Goodman and Easterly LLC Managing Principal Avi Kalichstein have teamed up to close on the largest-ever debut GP stakes fund dedicated to private market strategies. Founded in 2020 by Goodman (Executive Chairman) and Kalichstein (CEO), Hunter Point Capital announced the close of $3.3B in permanent capital commitments, exceeding its initial $2.5B target. Hunter Point aims to be an investor in middle-market alternative asset managers, helping them grow their franchises faster through capital, tailored advice, and tactical support. Hunter Point, which invests in GPs across private credit, private equity, real estate, and infrastructure, has already formed partnerships with eight investment management firms, including Coller Capital, L Catterton, Pretium Partners, MidOcean Partners, The Vistria Group, Inflexion, Iron Park Capital, and SLR Capital Partners. Hunter Point has already expanded beyond its initial investment product for GPs, launching a separate but complementary platform called GP Financing Solutions, which offers net asset value-based loans and preferred financing solutions to established GPs.

💸 AGM’s 2/20: The GP stakes space received strong validation this week, between Hunter Point exceeding its target close and Blue Owl acquiring Kuvera, which should result in increased capital flowing into their GP Strategic Capital business. As private markets continues on its growth trajectory, it’s no surprise that GP stakes are an attractive investment product to LPs. Investment performance for a GP stakes fund is directly tied to the growth in AUM of an alternative asset manager. With growth in private markets expected to march on, GP stakes investments are, in some senses, a belief that AUM growth will persist both in private markets and in specific managers that a stakes firm owns. With private markets projected to add trillions in AUM over the coming years, GP stakes firms and the alternative asset managers they own should stand to benefit from growth in fee-related earnings. Hunter Point has built an impressive platform in a short period of time, which is not surprising given the team behind the business. Notably, in a market where one of the big questions is exits for GP stakes firms, Hunter Point has already achieved one in their three years in operation. General Atlantic bought Hunter Point portfolio company, Iron Park, in 2023.

GP stakes firms like Hunter Point are well-positioned to help the firms they invest into expand their footprint into other asset classes and strategies, as L Catterton, historically a private equity firm, is doing with the launch of a private credit strategy.

This trend follows a theme that we’ve been covering for a while now at Alt Goes Mainstream (here and here): the evolution of alternative asset managers into one-stop shops. While not every firm needs to expand into every asset class, large, multi-strategy alternative asset managers stand to benefit from being a solutions provider for LPs. This structure is particularly beneficial to the newest entrant into private markets, the wealth channel, where it’s important to understand the buying behavior of a wealth manager. Wealth managers have so many different aspects of their business that require their focus, making allocations to alternative investments on a portion of what they do. That aligns well with the offering that a trusted brand that is a one-stop-shop can provide. And, it’s not just the wealth channel that seeks to allocate to multiple investment strategies within an alternative asset manager’s platform. Ares’ Annual Letter highlights that institutions may also exhibit a similar desire.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Neuberger Berman Private Wealth (Investment and wealth management platform) - Head of Investment Platform. Click here to learn more (and a chance to work directly with AGM podcast guest, NB Private Wealth CIO Shannon Saccocia).

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - Chief People Officer. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP, Private Wealth Distribution Business Manager, Americas. Click here to learn more.

🔍 AltExchange (Alternative asset management data) - Inside Sales Rep for MFOs / RIAs / SFOs. Click here to learn more.

🔍 Goldman Sachs (Asset manager) - Asset & Wealth Management - Alternatives Distribution for Wealth - Vice President (London). Click here to learn more.

🔍 Canoe Intelligence (Alternative asset management data) - Growth Marketing Manager, Wealth Management. Click here to learn more.

🔍 73 Strings (Portfolio monitoring and valuation) - Associate Vice President - Private Credit. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - Vice President, Private Wealth Solutions. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the 8th episode of our monthly show, the Monthly Alts Pulse. We discuss how product innovation, particularly with evergreen funds, is enabling the wealth channel to invest in private markets. Watch here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎙 Hear Patrick McGowan, MD and Head of Alternative Investments, and Oksana Poznak, Director of Strategic Partnerships of $28B Sanctuary Wealth on working with the wealth channel. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎥 Watch the replay of the fireside chat at Future Proof decoding the rise of alts with some of the most influential players in private markets: Stephanie Drescher, Partner, Chief Client & Product Development Officer, and member of the Leadership Team at Apollo, and Shannon Saccocia, the CIO at Neuberger Berman Private Wealth. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear the incredible story of “tech’s most unlikely venture capitalist,” Pejman Nozad, Co-Founder & Founding Managing Partner of Pear VC, on how they’ve built a seed investing powerhouse. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.