👋 Hi, I’m Michael and welcome to my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in alts so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Good morning from New York City, where it has been scorching hot for much of the past week.

Speaking of heat, private credit has been on fire recently — but could NYC’s rain today be a metaphor for dampened optimism due to potential storm clouds ahead? Read on below and share your thoughts.

This corner of private markets has been a recurring theme in the AGM Weekly. And for good reason. Alternative asset managers, like Man Group, are buying private credit funds (Varagon), to keep up with the fundraising and investment demand. What was not too long ago a cottage industry within private markets has quickly become a power player. Private credit has grown to over $1.5T of AUM, scaling at 10% CAGR over the last 10 years, representing almost 15% of the $10T private markets industry.

It’s hard to ignore what’s going on in private credit when exploring private markets — because virtually every large alternative asset manager either has an established presence in private credit or has set out to acquire that competency.

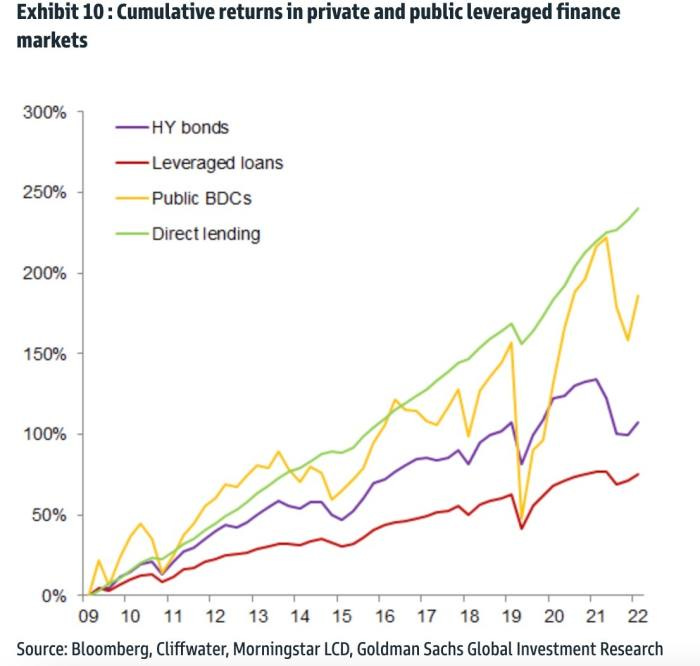

With cumulative returns in private credit virtually up and to the right since 2009, what’s not to like?

The FT’s Robin Wigglesworth recently wrote a fantastic — and balanced — piece on the growth and potential minefields looming in private credit.

Wigglesworth deftly dives into the nuances of what a booming private credit industry means for funds, borrowers, banks, and investors alike. Banks pulling back on certain lending activity has opened the door for private credit funds and non-bank lenders. But this type of lending can also present risks to the system.

His FT colleague, Mark Vandevelde, provides a window into how the private equity firms who have often relied on debt to finance their equity investments are now making their mark on credit markets themselves. Private credit is filling a gap in the market, much of which is necessary in the current state of debt markets and is creating an opportunity for the funds to generate returns for their investors. But this emerging corner of private markets still has unknown unknowns when it comes to what could go wrong.

Blackstone President Jonathan Gray said in April 2023 that they’ve seen the greatest LP demand for private credit solutions, which accounted for 60% of the firm’s Q1 inflows. A higher interest rate environment and wider spreads, coupled with a pullback in regional bank activity led Gray to call this a “golden moment for [their] credit, real estate credit, and insurance solutions teams.”

Certainly, private credit has attracted meaningful investor interest — and for good reason. But, as Wigglesworth and Vandevelde unpack in their recent articles, there are nuances here that make for an interesting question as to whether private credit will be on a long-term secular growth trend or tripped up by some of the complexities of the market and rising interest rate environment.

What do you think will become of private credit?

Drop a comment below and share some thoughts.

Next week, I’ll share the final poll results and a few of our reader’s thoughts in the weekly Newsletter.

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

AGM News of the Week

Articles we are reading

📝 Blackstone Sees Openings for Private Credit as Tech Growth Slows | Ellen Schneider, Bloomberg

💡Blackstone Credit's Global Head of Technology Investing, Viral Patel, spoke with Bloomberg’s Ellen Schneider and acknowledged the attractiveness of private credit as a solution to bridge the funding gap for tech firms during a sluggish IPO market and increasing demand for growth capital. Patel highlights the challenges faced by tech companies, including access to capital, macroeconomic uncertainty, longer sales cycles which is slowing growth, and the need to balance growth and profitability. He notes that the credit story has gotten more attractive as companies focus more on profitability over growth and he endorses private credit as a suitable option for mature late-stage tech companies since it offers confidentiality, efficiency, and certainty of execution. Another key theme that he is seeing play out is consolidation — customer demand is higher for comprehensive solutions rather than point solutions, many of which have been built over the past decade. Patel reveals that Blackstone focuses on cash flow-based loans, so ARR based loans, which have become popular with the rise of businesses like Capchase, Pipe, and others, have never been a big focus for Blackstone. Despite the current market conditions, Patel remains optimistic about IPOs, citing a healthy backlog of businesses waiting to go public. He also expresses Blackstone's interest in defensive sectors like cybersecurity and software companies dealing with increasing data volume, while avoiding lower-quality tech businesses with slower growth and poor unit economics.

AGM’s 2/20: As one door closes, another one opens. As equity markets have tightened and the IPO window has been closed, the opportunity has opened for credit to fill the funding gap. Patel highlights three trends that are defining the current state of private markets — a lack of access to capital, particularly on the equity side, means companies are facing a tougher fundraising environment and broad macroeconomic uncertainty causing software sales to come under more scrutiny, resulting in longer sales cycles (and, thus, slower growth). Lack of access to equity capital, slower growth, and a focus on profitability has paved the way for credit to become a funding method of choice. But credit only works where companies can be confident in paying back their loans. And credit investment firms like Blackstone are focused on cashflow loans to business that are often profitable. In the tech space, this limits the universe of companies that can access debt capital from firms like Blackstone, so companies either need to focus on profitability to expand their universe of possible funding options or swallow the bitter pill of a down round.

📝 Canada's Large Pension Funds Expanding in APAC Region | Leo Kolivakis, Pension Pulse

💡 Ontario Teachers’ Pension Plan setting up shop in India marks the third Canadian pension plan to build a local presence in the region. Canadian pension funds Ontario Teachers' Pension Plan, Caisse de dépôt et placement du Québec (CDPQ), CPP Investments, OMERS, BCI and PSP Investments have all been increasing their investments in India, citing the attractiveness of a large and growing economy. Other Canadian pension plans have turned a focus to India. Ontario Teachers' has already invested over C$3B in India across equities, infrastructure, and capital markets. CDPQ plans to deploy around C$15B in additional investments in the APAC region over the next five years, with its current assets in the region totaling C$56B. CPP Investments has 26% of its total assets allocated to the APAC region. OMERS aims to triple its assets in the region over eight years. BCI has 5.5% of its portfolio invested in APAC, while PSP Investments has 11%. India is not the only area of focus in APAC for some of the world’s largest state investors. OTPP is also looking to double its headcount in Singapore for Asia expansion, so they can expand their footprint in Southeast Asia and Australia. OTPP and other state funds are establishing offices in key APAC locations as they up their APAC-focused investments. CDPQ has a similar percentage of its assets in APAC (11%) as it does in Europe (13%). CPP Investments remains the biggest investor in APAC, with 26% of its total assets in the region, placing APAC only second to the US (36%) and ahead of Europe (16%) and Canada (16%) in terms of their global asset allocation.

AGM’s 2/20: Last week, we highlighted how US and European funds are turning a focus to APAC as an avenue to raise capital. This week’s article about Canada’s large pension funds highlights how investors are investing into APAC. It’s particularly interesting to note the efforts of CPP in the region — APAC trails only the US in their global asset allocation figures. While interesting, it’s perhaps not particularly surprising given the growth trajectory of much of the region. India’s nominal GDP growth has been 6% from 2017-2022 and is projected to have 9% GDP growth over the next five years (IMF WEO October 2022). Vietnam, Indonesia, Philippines, Malaysia, and Thailand are all projected to have GDP growth over 6% from 2022-2027. According to research from Asia Partners, Southeast Asia is in the “golden age” of per capita income. GDP per capita is in the strikezone of an emerging middle class that has the purchasing power, discretionary income, and savings rate to aid the creation of multi-billion dollar outcomes following in the footsteps of the likes of Sea, Grab, Buakalpak, Carsome, and others.

📝 The Road Ahead: Of Rocks and Hard Places | Henry Neville and Graham Robertson, Man Institute

💡In the current investment landscape, long-only beta investors face a challenging set of circumstances in a search for returns. The average pension fund needs to generate 9% annualized returns to meet their pensioners’ needs. Man’s models of a US 60/40 portfolio suggest it will generate 5.5% return per year. Why is this so and what to do? Stocks are expensive, with a US forward price / earnings (P/E) ratio of 19x, which clocks in at 89th percentile compared to history. Combined with an expected operating margin of 16% at the 75th percentile, stocks have little room for error. Bonds, while relatively cheaper, are not expected to generate sufficient returns to meet institutional requirements over the next decade. At the time of the article, the US 10-year Treasury yield is 3.8% and the theoretical fair-value yield is 4.4%. That 60 bps spread is the lowest in 20 years. A traditional 60/40 equity/bond portfolio is expected to generate a 5.5% nominal compound annual growth rate (CAGR) over the next decade, while a risk parity approach could yield a 4.4% return. The authors, Henry Neville and Graham Robertson, suggest three solutions: equalizing volatility between stocks and bonds, leverage in a controlled manner, and diversifying with alternative strategies like trend-following.

AGM’s 2/20: The 60/40 portfolio has been oft discussed on here — and it looks to be dead. The challenges with the 60/40 portfolio is a reason why so many investors have turned to private markets in one form or another to generate returns in a world where the 60/40 falls short. Man’s report does well to capture the current climate: “2022’s inflationary burst, with corresponding falls in both equities and bonds, revealed the Achilles’ heels of both 60/40 and risk parity portfolios.” Allocators can no longer rely on the 60/40 to meet their return requirements. So there’s only one alternative — they must look to alternatives (whether it be hedge, private equity, venture, private credit strategies, etc.) to fill the gap.

📝 UK Chancellor Jeremy Hunt has unveiled plans to overhaul the UK pension system by increasing pooled assets and upping private equity allocations | Michael Rodwell, With Intelligence

💡UK Chancellor Jeremy Hunt has announced plans to revamp the UK pension system, with a focus on increasing pooled assets and raising allocations to private equity. The proposed changes could potentially result in Local Government Pension Schemes increasing their private equity allocations to 10% by 2030, which could unlock around £25B in funding for private equity and venture capital managers. This would be a huge fundraising boost for funds who’ve long been looking for more institutional investor support from local institutions. Additionally, nine leading defined contribution funds in the UK have committed to injecting £50B into private equity and venture capital, aiming to enhance pension returns and support unlisted equities in the country. These voluntary initiatives are inspired by the successful investment strategies of Canadian and Australian pension schemes, which have allocated between 35% and 50% of their assets to unlisted investments. The implementation of these proposals by UK pensions, the revitalization of the UK start-up scene and the potential for replicating the returns of Canadian and Australian peers are subjects of keen interest for observers.

AGM’s 2/20: Another topic that has been discussed before here on AGM — and an important one. The UK (and Europe more broadly) is looking to increase institutional investor allocations to private markets, aiming to model itself after the Canadian and Australian pension schemes. Relative to its Canadian, Australian, and US peers, the UK’s institutions fall short when it comes to private markets allocations. That could change with Chancellor Hunt’s proposal to unlock pension capital for UK VC and PE managers. As we’ve seen with France (the Tibi proposal), government support is a big reason why institutional investors have upped their allocations to private markets. Perhaps we will see the same happen in the UK, which would be a boon for the European tech ecosystem.

📝 Don't Trust Your Gut. Smaller Funds Are Safer | Adam Shapiro, East Rock Capital

💡East Rock Capital’s Adam Shapiro outlines his belief of why investing in smaller funds can provide higher returns and lower risk compared to larger funds, despite the common belief that larger funds are safer. An analysis of private equity data in a report by Reiner Braun, Nils Dorau, Tim Jenkinson, and Daniel Urban reveals that in a multi-fund portfolio, investing in smaller funds yields superior results. On average, the smallest funds make 10 investments per fund, while the largest funds make 21 investments. However, both groups offer similar 10th percentile PME (Public Market Equivalent) performance. This suggests that smaller funds make better investments and / or invest in less correlated opportunities, reducing risk. A comparison of two of the smallest funds with one of the largest funds reveals a higher median (1.79 compared to 1.62) and mean (2.14 compared to 1.76) PME and a lower risk of PME being less than 1.05 (<10% compared to 10%) for the smaller funds. Shapiro concludes that a portfolio of smaller funds over larger ones allows for higher returns and lower risk. Investors that care about risk should diversify more rather than switch to larger managers. This strategy works for investors with sufficient diligence resources and a manageable capital deployment size.

AGM’s 2/20: Shapiro’s article and Braun, Dorau, Jenkinson, and Urban’s research highlight an important topic — the performance of smaller fund managers and how to best diversify a portfolio of managers when trying to balance risk and return. Smaller managers are often less proven or have a shorter track record of investing as a team and, therefore, theoretically present more risk to LPs. But smaller funds sizes generally present an easier opportunity to have a RTF (return the fund) investment, which can drive outperformance. This topic begs a few interesting questions for the future of private markets. (1) we may be entering the moment for private markets where there’s beta in the search for alpha. Bigger firms may begin to represent private equity beta — strong enough performance, particularly for larger allocators, but also low enough levels of allocation risk from a team, track record, and brand perspective. This will put the onus on allocators to find alpha in smaller funds — and those who do will carve out a reputation for themselves as adept investors and pickers of funds in the lower middle market, which is no easy feat. Now, it’s important to note Shapiro’s point that a portfolio of smaller funds may in fact reduce risk. That is a point well taken (and something we agree with since we allocate to smaller managers in most cases) but it’s also something that’s not always feasible for larger institutional allocators to achieve. Perhaps we’ll see more institutional allocators invest into lower middle market PE and VC fund of funds or build out their own portfolios of these funds to capture both the higher returns with lower risk that Shapiro discusses. But there’s also been structural reasons why it’s historically been harder for larger allocators to invest into smaller funds. (2) top performing smaller funds will soon face an existential question — do they raise larger funds? As these funds have success, they will likely be more in demand by LPs, giving them the ability to raise more capital. But will they be able to maintain the same outperformance if they grow fund size? Data suggests that it might be harder to hit similar returns as they did with prior funds. So what should they do? Go for the alpha as a smaller fund or shoot for the beta as they grow into a larger fund? Given that fund managers are building a business, where management fees alone can be quite lucrative as fund sizes scale, I can’t knock a fund manager for deciding to grow their fund size in order to grow their business. But as an allocator to funds where I’m searching for the highest returning funds possible, I’d certainly prefer managers to stay within a size range where they can generate returns consistently fund over fund. And I’m sure many allocators would say the same.

📝 Private Company Valuations Show Signs of Recovery | Hannah Zhang, Institutional Investor

💡Private market valuations appear to be bouncing back. Private company stocks are now trading at levels that are close to the valuations achieved during their second-most recent funding rounds, according to Kelly Rodriques, CEO of the private market trading platform Forge Global. Rodriques said that Forge is “seeing some indications that things are improving.” Companies are increasing their percentage of exercising ROFRs. The first quarter of this year saw 8% of companies exercising their right to buy back shares, compared to 6% in the fourth quarter of 2022 and 4% in the third quarter. Institutional investors have also shown strong interest in buying private market shares in the past six weeks, according to Nasdaq Private Market CEO Tim Callahan. The surge in buyer interest reached 42.3% in June, the highest in 10 months. The revival of private market valuations is driven by improved macro conditions, a return of investor risk appetite, and growing confidence in successful exits, particularly through IPOs. Additionally, the AI sector is witnessing exceptionally high valuations, representing a boon for private market valuations.

AGM’s 2/20: The increase in secondary market activity appears to be a positive signal for the market. With the successful IPO of Cava and talk of the window opening for a few other companies that have been readying to go public, perhaps we’ll see a stronger second half of the year for private market valuations. Anecdotally, Series A, B, and C valuations have also started to increase a bit, so there are some signs that point to a market that’s improving. The secondary market data coming out of Forge and Nasdaq Private Market would suggest that sentiment may finally be turning, although it’s hard to tell in a market like this.

Reports we are reading

📝 Asset and wealth management revolution 2023: The new context | PwC

💡 PwC's 2023 Global Asset and Wealth Management Survey reveals significant challenges and opportunities for the industry. By 2027, 16% of existing asset and wealth management organizations are expected to have been disrupted, twice the historical turnover rate. Key imperatives for survival include navigating market upheaval, getting closer to customers in a wealth transfer era, embracing technological experimentation, delivering at scale amid cost pressures, and standing up to scrutiny regarding ESG and societal considerations. The industry's total assets under management (AUM) fell to $115.1T in 2022 but are projected to rebound to $147.3T by 2027. Asia-Pacific is anticipated to outpace North America in AUM growth and the industry is embracing digital transformation and alternative investments like private markets and ETFs. Consolidation is expected, with the top ten asset managers projected to control around half of global mutual fund assets by 2027. The industry faces fee pressures, regulatory scrutiny, and demands for ESG expertise. However, by adapting to changing market conditions and leveraging technology, AWM organizations can thrive and drive long-term growth. Notably, PwC projects alts AUM to grow to anywhere between $22.3T-25.3T by 2027.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 73 Strings (Valuation and portfolio monitoring for alternatives funds) - Senior Sales Representative. Contact me or 73 Strings to learn more.

🔍 bunch (Private markets infrastructure investment platform & SPV infrastructure) - Head of Growth. Click here to learn more.

🔍 Goodwater Capital ($4B AUM consumer tech VC) - Director, Seed Investments. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - West, Regional Director, Vice President / Senior Vice President. Click here to learn more.

🔍 Allocate (VC infrastructure investment platform) - Managing Director, Alternatives (Sales). Click here to learn more.

🔍 Republic (Multi-strategy alternative investment platform) - Chief Technology Officer. Click here to learn more.

🔍 Isomer Capital (European VC fund of funds) - Investor, Secondaries. Click here to learn more.

The latest on Alt Goes Mainstream

Recent episodes and blog posts on Alt Goes Mainstream:

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I take the pulse of private markets on the second episode of our monthly show, the Monthly Alts Pulse. Watch here.

🎙 Hear $18B AUM Savant Wealth’s award-winning CIO Phil Huber talk about how LPs can build a strategy for investing in private markets. Listen here.

🎙 Hear Avlok Kohli, AngelList’s CEO, talk about how they are building the company of companies that is powering private markets. Listen here.

🎙 Hear John Avery, VP Digital Assets, Tokenization, Web3 at fintech giant FIS talk about how evolutionary changes can lead to revolutionary changes in private markets. Listen here.

🎙 Hear Seyonne Kang, Partner and member of the private equity team at $134B AUM StepStone, discuss how the VC industry is dealing with today’s venture market. Listen here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear 44th Vice President of the United States and Chairman of Cerberus Global Investments Dan Quayle share his insights on geopolitics and investing. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Riley Robinette for his contribution to the newsletter.

it is hard to take a view that seems to go against the current, in particular when the charge is led by the like of Blackstone President Jonathan Gray or Oaktree's Howard Marks.

BUT when I hear that private credit may return more than private equity something does not look right to me. Yield may be higher but total return? Higher yields lead to higher interest charges to private equity, increasing the risk of defaults. So private credit now (heading into a recession?) carries IMHO the much higher tail risk of becoming dstressed equity, hence principal may not be returned in full. So total return may be lower.

I also expect that private equity will use less debt, more equity (now, and perhaps refinance later at better rates) and valuations will go down, raising expected returns. BTW PE fundraises are proceeding at a much lower scale (overall funds in the market) than in the past, compared to private credit.

I see now the balance in favor of PE and suspect the golden age of credit is behind us (but private credit secondaries may florish).