AGM Alts Weekly | 8.4.24: Masters of scale

AGM Alts Weekly #63: Making private markets more public, every week.

👋 Hi, I’m Michael.

Welcome to AGM, the meeting place for private markets.

I’m excited to share my weekly newsletter, the AGM Alts Weekly. Every Sunday, I cover news, trends, and insights on the continuing evolution and innovation in private markets. I share relevant news articles, commentary, an Index of publicly traded alternative asset managers, job openings at private markets firms, and recent podcasts and thought pieces from Alt Goes Mainstream.

Join us to understand what’s going on in private markets so you and your firm can stay up to date on the latest trends and navigate this rapidly changing landscape.

Presented by

Intapp DealCloud is an industry-tailored, AI-powered platform that provides powerful deal and relationship intelligence, workflow management, and a central hub for collaboration and knowledge sharing.

And now, DealCloud users can unlock the power of generative AI with Intapp Assist for DealCloud.

Discover how Intapp Assist for DealCloud can help your teams work smarter — so they can focus on strategic work instead of manual tasks.

Good afternoon from Washington, DC.

Masters of scale

News this week of Ares closing on a record-breaking $34B for its latest private credit fund, Ares Senior Direct Lending Fund III had my mind turning about the concept of scale for alternative asset managers (note: the fund includes $15B in equity commitments and $34B in total when factoring in leverage and separately managed accounts, according to Mitch Goldstein, Co-Head of the firm’s Credit Group).

When is scale beneficial in private markets? When is scale less beneficial?

Private credit appears to be an area where the large firms are orienting themselves to be beneficiaries of scale. Recent milestones in the space would point towards the industry’s largest players looking for ways to obtain scale, whether it be through fundraising (as Ares and others have done), acquisition (as Blue Owl recently did with $10B AUM Atalaya), or investment / management buyout (as Arctos’ Keystone fund did this week with €30B AUM Hayfin).

There are plausible explanations for why scale provides a massive advantage for some of the industry’s largest firms, not to mention how the growth of private equity has helped fuel the growth of private credit.

Golub President David Golub, whose firm scaled from $7B to $60B from 2013 to 2023, shared three reasons why he believes scale is a “real sustainable competitive advantage.”

Relationships, trust, and reliability

Golub cited that a demonstrated track record of reliability with a sponsor would often lead to a deeper relationship with that sponsor over time. “[A firm] will get more opportunities from that sponsor — more first looks, more last looks, more proprietary looks,” he said.

Advantages of incumbencies

Half of Golub’s originations over the past decade were loans to existing borrowers. Not only is there a relationship advantage, but there’s also an information advantage. It’s easier and more efficient for a sponsor to go back to a lender with whom they already have a pre-existing relationship. Lenders have more visibility into the company and a history of working with the company.

Furthermore, firms that have the ability to be flexible solutions providers of capital to companies are at an advantageous position in the private capital marketplace. Scaled platforms that have multiple solutions housed under a single brand and firm stand to benefit from the trend of companies looking for flexible providers of capital.

Expertise

Golub noted that one of the advantages of a platform is that it will have a large underwriting team. With an expansive platform comes the ability for specialization. Investors and underwriters have the ability to focus on a specific industry, which creates more efficiency and effectiveness in evaluating transactions, according to Golub. This comment aligns with what WestCap Co-Founder & Managing Partner and former Blackstone CFO Laurence Tosi said on a recent Alt Goes Mainstream podcast.

L.T. highlighted where scale and skill intersect:

L.T.: I remember when Steve said that. That scale is niche. I'm going to add a second part, Michael, to that statement, which I guess gets less covered than he would say. He would also say that scale begets skill. And the more skill you can put against creating value, the more you can justify the scale [author emphasis]. So in the early days of Blackstone, shortly after we went public, there was a lot of confusion about, well, how's this different from The '40 Act shops that do mutual funds, et cetera. And the answer was we found businesses where skill really matters, i.e., finding businesses and knowing how to turn them around. And then we found a little bit of the golden rule that the more scale that we had, the more resources we would have at Blackstone to invest in creating alpha, if you want to call it that, or value creation. And so the scale actually made us more competitive. So, if I think back to when I joined the firm, I think our private equity fund was six billion, and our real estate fund was probably three billion. Those are about now both 30. That difference in those is not just adding more assets like you would to a mutual fund or a hedge fund. Those assets have translated to deep operating teams, asset management teams that can actually help create value during the course of the whole [author emphasis]. Also, going out and finding more deals, negotiating them. The golden rule in investing is where can you find a space that the more you invest in your returns, the greater the alpha you generate was. That's the right place to scale [author emphasis]. If you don't have that, then scale doesn't create what Steve said. It’s not your niche and doesn't create value. So that was the guiding force behind how that was built out.

Scale doesn’t just help on the investing side. It also helps on the fundraising side, which is becoming increasingly important as large firms look to work with the wealth channel. Brand arguably matters as much, if not more, in the wealth channel. The focus on brand could explain why Blackstone recently launched a TV commercial and why firms like Blackstone and Apollo invested in creating such thoughtful, catchy, and engaging holiday videos. Only a select handful of firms have the scale to invest into building wealth channel distribution teams, educational content, and marketing material, but in the war to win the wealth channel, this is a long-term winning strategy.

The proof is in the pudding, particularly for private credit as of late.

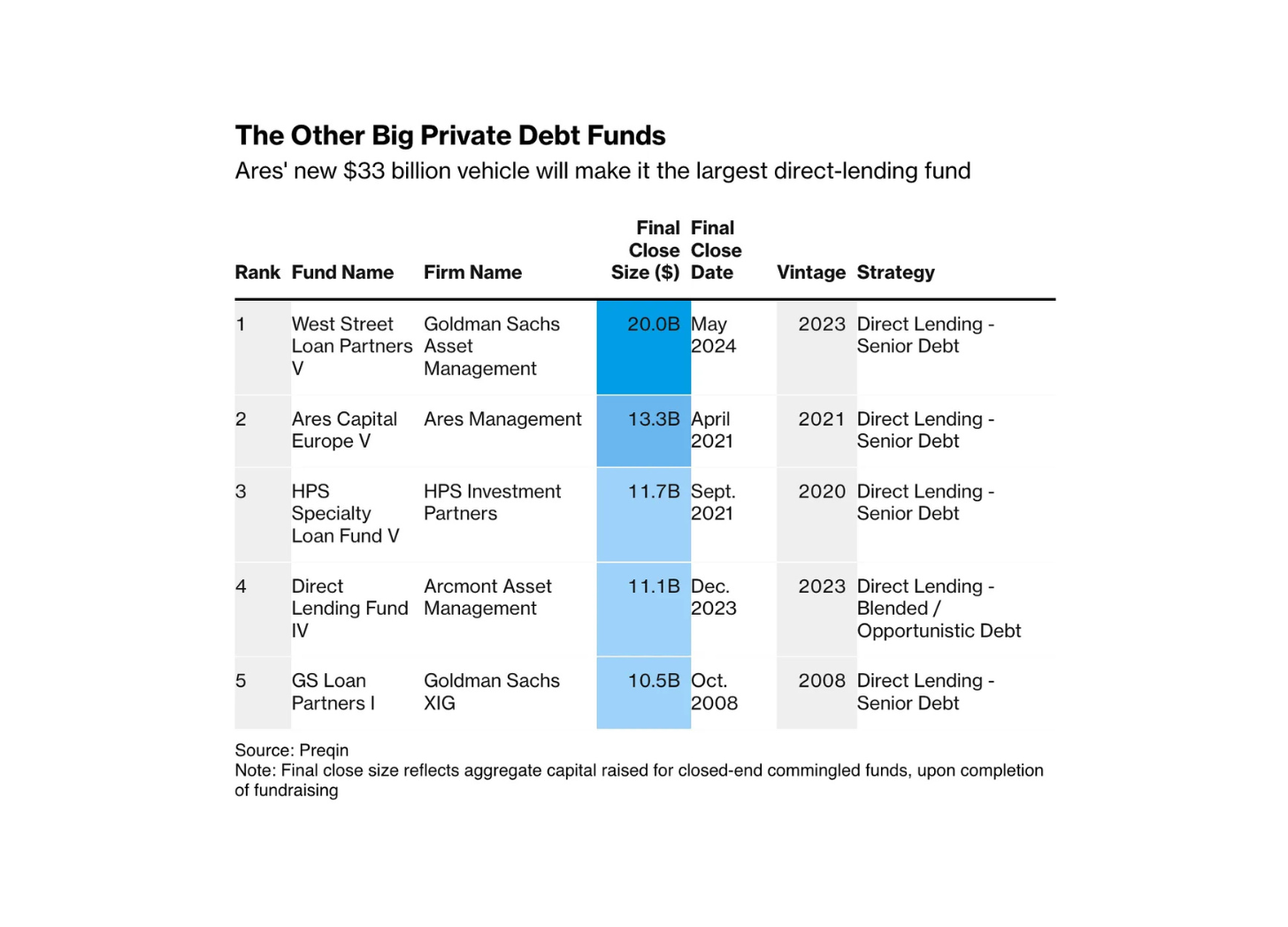

In addition to Ares’ behemoth, Bloomberg highlighted a number of recent fundraises in private credit. Goldman Sachs recently pulled in $13B of equity capital and $20B of total capital for its West Street Loan Partners V direct lending strategy.

While there are questions about private credit’s capacity on the deal side to consume all the capital that is flowing into new funds, it’s worth noting that (1) there’s a set of larger companies and bigger deals in the private markets universe that can be financed with some form of credit either instead of or in tandem with equity capital, so there could be a requirement for more capital, (2) the number of private companies is becoming larger, not smaller, so there are more financing needs in private markets, and (3) if private credit is seen through the lens of Apollo’s Marc Rowan’s commentary that many assets on a bank balance sheet can encompass private credit, then the market size is $40T, many multiples larger than the $1.7T that private credit stands at today. Even if the industry takes a more conservative estimate, say Ares’ projection of a $20T industry or Blackstone’s $25T estimate, there’s still plenty of room to run for private credit funds to deploy capital.

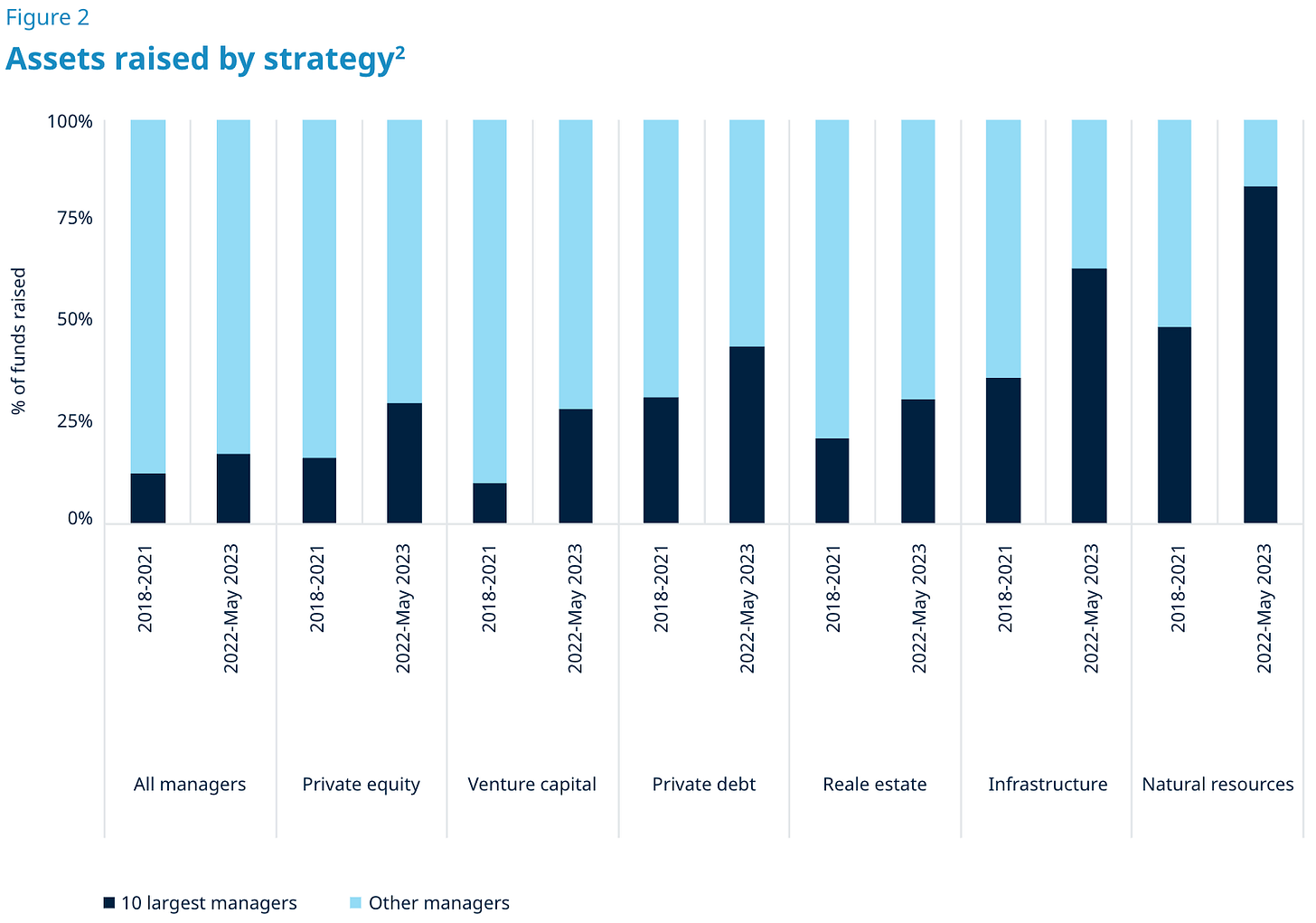

And it’s not just private credit where LPs have been attracted to scale. It’s virtually every strategy across the private markets spectrum. Blue Owl’s 2024 GP Strategic Capital Outlook highlighted how private markets have begun to move more towards a world of have’s and have not’s. Every private markets strategy has seen the top 10 funds in each category raise a meaningful portion of the assets raised by strategy. Furthermore, the past two years of fundraising have witnessed the top 10 funds in each strategy be an even bigger percentage of the capital raised in that strategy than the prior four years.

These datapoints highlight that scale does beget scale — and scale also begets skill. The largest firms have been able to invest resources into their investment teams, their platform / value creation teams, their fundraising teams to be able to raise more, invest more, and help more.

Scale has certainly played out in the largest managers’ favor when it comes to creation of enterprise value for the firms themselves.

But has scale hindered returns? An April 2024 whitepaper by the Institute of Private Capital found evidence to the contrary. The study showed that there was no data to suggest that overall growth of GP AUM is related to lower performance of private funds.

IPC’s study found that average returns for large funds are lower than average returns for small funds across all strategies and geographies they examined. The most significant negative relation between fund size and performance? Credit and real estate funds. But these results were driven by greater dispersion (positive skewness) in the performance of small funds, and they found no difference in the median performance of large funds versus small funds.

Bigger can be better

Let’s dive even deeper into the nuances of scale, performance, and fund size.

iCapital’s Nick Veronis and Kunal Shah published a whitepaper in July 2022 examining where and how scale matters for buyout funds. Post GFC, it was actually large buyout funds that outperformed all other fund size cohorts across pooled and median returns.

From 2010 to 2019, large funds ($7.5B+) generated the highest pooled IRR of any fund size.

Not only did larger funds generate better returns, but iCapital’s whitepaper found that larger fund cohort also had a higher floor of returns (i.e. even the bottom quartile funds generated better returns than bottom quartile funds of smaller size) and a thinner dispersion of returns, meaning that manager selection, while important, had less of an impact on returns than it did for investors who chose funds of smaller size.

Scale also puts certain firms in a rarefied air when for competing with deals. Only a small set of funds can access certain sized deals, which should persist as private companies stay private longer. Veronis and Shah found that LPs seemed to agree with this hypothesis. Funds raising over $7.5B accounted for 41% of capital committed to buyouts in the 2021 vintage. The number of funds that accounted for that 41%? Just eight funds, out of a total of 553 funds raised that year. Veronis and Shah astutely point out that not only does scale provide an access advantage to dealflow, but it also helps negotiate better terms for credit lines, including longer repayment durations, at both fund and company level.

The power of scale is something that the largest firms highlight when talking about their differentiators. In a 2023 LinkedIn post, Blackstone’s Chairman, CEO, & Co-Founder Steve Schwarzman called scale Blackstone’s “greatest advantage.” It’s hard to argue with this point when Schwarzman lays out the unique features they derive from their scale.

Schwarzman said:

There are many advantages that come from our unique scale. With our portfolio of over 230 companies, 12,000 real estate assets and one of the largest lending businesses in the world, we believe we have more information than anyone competing with us.

230+ portfolio companies, 12,000 real estate assets, tens of billions in lending capital deployed. Surely, there is plenty of data to mine from those points of presence across the world of private capital markets and private companies.

Asset managers as data companies

So, does that make Blackstone — and other large alternative asset managers — data companies?

Perhaps asset managers are data companies more than we might think. BlackRock would certainly say so, given the expansive and growing business they’ve built with Aladdin and, more recently, eFront and Preqin.

Blackstone could also be seen as a data company. Schwarzman went on to write:

We specialize in the production and analysis of enormous amounts of data, which we review every week in our Monday meetings with each of our major product lines. This process helps us identify trends before others and adjust where we invest our clients’ capital. Our focus on data aggregation and analysis also led us to establish our own data science group in 2015. We started building a team of exceptional data scientists, which numbers over fifty today, and we are rapidly and significantly expanding our capabilities in artificial intelligence. Blackstone fortunately is in an enviable position in the alternative asset world, with an eight-year head start in this field, and we are committed to further expanding our leadership position as quickly as possible.

The next frontier of scale: data

The tech industry has popularized the concept that “every company is a software company.” That’s certainly true to some extent. There are nuances to this characterization, as some companies still require human touch that augment tech-enabled processes. One of the greatest assets that an alternative asset manager possesses is its people. People can be supplemented by process, but talented investment and operations professionals will be always be core to an investment firm.

We appear to be entering a world where every company is now a data company. Funds will use data in different ways, but every fund, large or small, has data that they can analyze and leverage to make better pre-investment or post-investment decisions.

The concept of data management and data analytics has become a key strategic question that moves to the forefront of boardroom conversations for alternative asset managers.

Where should funds in-source? Where should funds outsource? Where and how can data be a competitive advantage?

I’d go so far as to argue that the CTO role will be one of the most important hires for alternative asset managers going forward, particularly for firms that are at the $50B AUM and above threshold (listen to Blackstone’s CTO John Stecher here and Hamilton Lane’s MD & Head of Technology Solutions Griff Norville here on the Alt Goes Mainstream podcast).

A 2023 report by S&P Global & Mergermarket / IHS Markit on fund managers’ operations illuminated some pressing questions that are top of mind for many alternatives firms as they scale. The report found that the two greatest challenges identified by fund manager respondents included scaling up technology systems (30% of first-choice votes) and resource allocation / limited budget (27% of first-choice votes).

Size and scale appear to play a big role in a manager’s decision to in-house operational competencies or not. Organizations with AUM below $50B cited insufficient in-house expertise or resources and inadequate funding to expand in-house skillsets. But, interestingly, firms managing between $10-25B AUM were the ones who most commonly reported considering bringing data collection back in-house, while 65% of firms with $25B+ AUM outsource data collection from portfolio companies.

This data would suggest that there’s plenty of room for private markets technology companies that help firms better analyze and manage data and processes have to play a huge role in the continued transformation of private markets. We certainly think so at Broadhaven Ventures, having invested in the likes of iCapital (*investment made prior to the formation of Broadhaven Ventures), Carta, Republic, 73 Strings, AltExchange, LemonEdge, bunch, Allocate, Passthrough, ModelML, and others, that are making pre- and post-investment processes more efficient and cost-effective for alternative asset managers.

Certainly, firms with more AUM will likely have more data on companies, as they’ll likely have more portfolio companies and possibly more investment strategies. The question then becomes how and where firms can use data and leverage AI to their advantage to do what everyone is looking to do: generate strong and consistent risk-adjusted returns so they can grow their AUM.

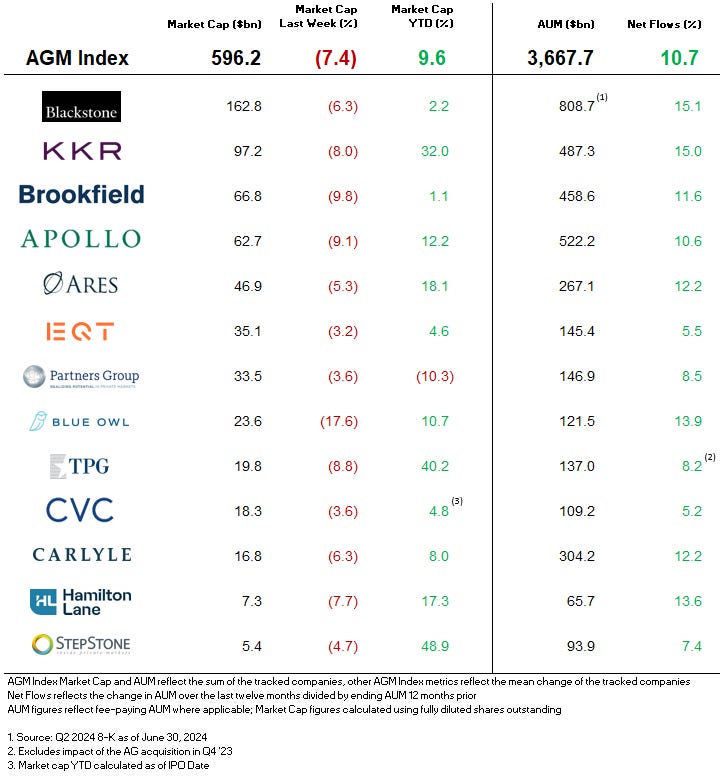

AGM Index

AGM has created an Index to track the leading publicly traded alternative asset managers.

Some of the industry’s largest alternative asset managers are publicly traded — and their net inflows can serve as a window into how private markets are being perceived by investors and allocators who are allocating capital into alternative investments.

Note: AUM figures are based on fee-paying AUM where applicable.

AGM News of the Week

Articles we are reading

📝 Private capital groups deploy $160bn as they prepare for deal revival | Eric Platt, Financial Times

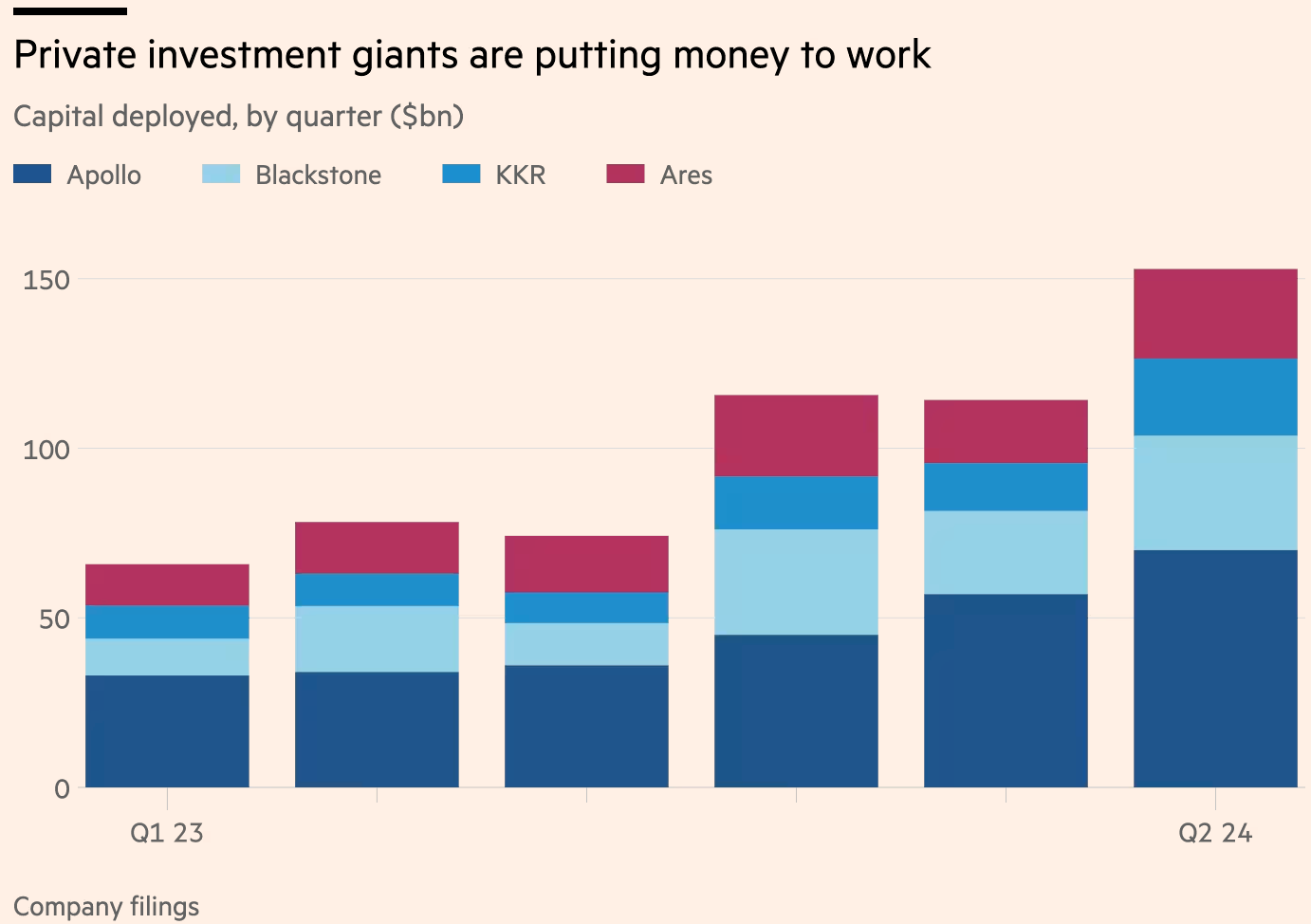

💡Is dealmaking back on the rise in private equity? Financial Times’ Eric Platt reports that four of the largest US alternative asset managers deployed over $160B of capital in the past quarter in advance of a dealmaking revival. Ares, Apollo, Blackstone, and KKR invested a combined $162B between April and June, with Apollo accounting for over 40% of that figure. Could this activity be in advance of the looming possibility of rate cuts? According to the FT’s Platt, executives at the firms said they were readying for an increase in both buyout and merger activity as the Fed comes closer to lowering rates. “The deal market is back,” said Scott Nuttall, the Co-Head of KKR. “This year, we not only have an open market, we have a pent-up supply of deals … coming to markets. So we are optimistic.” There’s monstrous levels of dry powder — to the tune of over $2T — waiting to be deployed, according to data provider Preqin. Perhaps this investment activity is a sign that markets are starting to open up, certainly a marked increase in capital deployment over prior quarters.

Larger deals appear to be occupying a good portion of new deal activity. Apollo invested $11B to finance Intel’s construction of a chip manufacturing plant in Ireland. That figure represented a bit over 1/7th of the $70B they deployed last quarter. Blackstone similarly concentrated capital into a large deal, with 13% of their $34B invested last quarter used to anchor a $7.5B debt financing package for technology company CoreWeave. KKR announced buyouts of broker dealer Janney Montgomery Scott, the $4.3B acquisition of edtech business Instructure, and entered a JV with T-Mobile to buy broadband provider Metronet.

It wasn’t just the industry’s largest firms doing big deals. This week, TowerBrook Capital Partners and Clayton, Dubilier & Rice won a $9B takeover bid of US healthcare IT provider R1 RCM, which could end up being one of the largest buyout deals of the year. We’ll see if that doesn’t end up being bested later in the year, as Blackstone’s President Jon Gray said that his “briefcase indicator continues to be getting full and indicates that there should be increasing solid levels of transaction activity.” Gray cites the looming possibility of rates coming down, markets “being more conducive,” and investors thinking about selling assets as the IPO window reopens as a driver of increased activity on the buy and sell side.

💸 AGM’s 2/20: Large alternative asset managers look to have an advantage in the current market, where they can leverage their size and scale to win the big deals that are coming back to market after a quieter period of deal activity over prior quarters. Deal activity appears to be following the outline of what was discussed in this week’s main piece on AGM — that large alternatives managers can be flexible solutions providers of either equity or debt capital to big companies. That appeared to play out in the deal activity this quarter, with both Apollo and Blackstone investing north of 10% of their capital deployed over the past quarter into a single deal.

It’s also notable to read the tea leaves on the deal activity of the largest managers. In a sense, they are barometers for the industry. Their increase in deal activity could be a leading indicator that they expect rate cuts and more exits over the coming quarters, which would suggest that putting stakes in the ground in advance of a shifting market would put those investments in a good position going forward. The largest funds should be in a strong position in a market with increased deal activity. These firms are sitting on mountains of dry powder — so they can make their determinations to compete for the best assets at the highest prices or find attractive entry prices for smaller assets … or do some of both. That’s one reason why I’m a believer in scaled platforms having an advantage in today’s private markets landscape.

📝 Private Credit Sells Funds for Small Investors as Big Ones Balk | John Sage, Bloomberg

💡Bloomberg’s John Sage reports that private credit firms are intensifying their efforts to work with the wealth channel and capture a portion of the estimated $178T private wealth market with ramping up interval fund distribution activity. Sage cites interval funds as a product that is being pitched to RIAs as an easy onramp into direct lending, with minimum investment amounts as low as $1,000 that can be purchased online through brokerage accounts. KKR and Capital Group’s recently announced partnership will lead to the 2025 launch of hybrid public-private interval funds. Blackstone is reportedly considering the launch of an interval fund that will include private credit. Traditional asset managers that have added alternatives capabilities, like T. Rowe Price (via its acquisition of Oak Hill Advisors), are also intensifying new product development efforts. They filed with the SEC to launch their first private credit interval fund. They join the likes of Ares, which partnered with Cion Investment Group, Carlyle, KKR, and Cliffwater, all of whom have interval funds. The sector has grown almost 40% per year in the last decade, swelling to $80B, according to Morningstar. Making for an easy user experience is top of mind for both the product manufacturers and the wealth managers. “With other fund types, investment advisors have to do two things. They need to bring the fund to their clients for approval and then ask them to fill out a bunch of documents,” said Adam Kertzner, Senior Partner at Oak Hill. “With interval funds, they can potentially buy and sell them on a discretionary basis for their clients and avoid unnecessary paperwork, making for a more user-friendly experience.”

Alternatives managers have wanted to expand their reach into the wealth channel in order to grow their investor base and AUM. Preqin data found that quarterly inflows from the largest investors have been near multi-year lows, so smaller investors are becoming an increasing priority for alternatives managers. “There has been a ton of interest from private credit managers in interval funds lately,” said Jonathan Gaines, a Partner at Dechert who advises registered funds. “It’s an attractive offering for funds that want more investment flexibility and a way to easily broaden their distribution channel to areas like RIAs.” While interval funds make it more seamless for the wealth channel to allocate to private markets, some are concerned about the liquidity mismatch problem in a time of distress.“Interval funds carry a higher risk of having a liquidity mismatch problem as they can’t turn off redemptions like a BDC can, which will hold them indefinitely if needed,” said John Cox, Founder and Chief Investment Officer of Cox Capital Partners, referring to business development companies, the type of non-traded investment fund offered primarily to high net worth individuals and institutions. “Interval funds facing redemptions in a distress scenario might be forced to sell assets at the worst possible time to generate cash.” Interval funds have structures in place that could prevent some of these cited issues from arising by holding more liquid assets and being more broadly diversified across the credit investment landscape. It certainly seems that RIAs are interested and intrigued to learn more, with many private credit firms looking to work with the channel. “We are targeting US retail RIA advisers and not looking to sell into the more crowded wealth channel,” said Matthew Pallai, Chief Investment Officer at Nomura Capital Management. “We were looking at the growth in the space over the last few years and view BDCs as starting to mature.”

💸 AGM’s 2/20: Interval funds are beginning to take hold in the wealth channel in a big way. Alt Goes Mainstream covered some of these trends in recent weeks in the Weekly newsletter here and here. There are countless reasons why these products make sense for both GPs and LPs. We’ve now reached the stage where there needs to be places where investors can go to better understand the nuances of structure and returns. Aditum Alternatives’ Ken McGuire recently compiled return data and NAV breakdowns of SEC-registered PE and private infrastructure vehicles as of March 31, 2024. This helpful aggregation of funds’ exposures to co-investments, direct investments, primaries, secondaries, short-term investments, unfunded commitments, other private markets funds is illuminating when paired with the why behind different aspects of different interval fund structures and portfolio construction. Cliffwater’s Phil Huber recently wrote a fantastic paper on fee and expense breakdowns in evergreen private equity structures. Given the structure and nature of portfolio construction of evergreen funds, fees and expenses do matter. Especially when some investors could go with an alternative, closed-end vehicles. Huber found that while the average and median total expense as a percentage of NAV is 2.91%, there is a meaningful spread between the least and most expensive funds. Some funds have total expenses of 0.96% and 5.49%, respectively. Huber’s analysis of the data also shows no relationship between fund size and the level of “other expenses” for evergreen PE funds. There’s also another question of fee comparisons between evergreen and closed-end funds. Huber concludes that, in many cases, evergreen structures have meaningfully lower fees than closed-end 2/20 PE fund structures, in large part because evergreens can often allocate heavily to direct co-investments in their portfolios, which keeps costs down.

The continued development of evergreen funds shines a light on a number of important questions for allocators. What is the optimal portfolio construction for an evergreen fund? How much direct co-investments relative to secondaries and funds are in the portfolio? How much liquidity is really available? What are the fees? As evergreens become increasingly popular fund structures, particularly for the wealth channel, and move to a place where investors can buy theme at the click of a button, tools and research that enables advisors and wealth clients to compare and contrast evergreen funds will be critical to increased distribution throughput and transparency for the space.

📝 BNP Paribas in talks to buy Axa’s asset management arm for €5.1bn | Ian Smith, Harriet Agnew, Sarah White, Financial Times

💡Financial Times’ Ian Smith, Harriet Agnew, and Sarah White report on a massive transaction for the asset management and alternatives worlds. French insurer AXA has entered exclusive talks to sell its investment management arm to BNP Paribas for €5.1B in cash, which would create one of the largest asset managers in Europe. The anticipated transaction would create a €1.5T AUM business at BNP while also continuing to provide investment services to Axa through a long-term partnership. If completed, the transaction would mark continued consolidation in the asset management space as firms face fee pressures and an increasing push to expand into private markets. BNP CEO Jean-Laurent Bonnafe said its asset management business would have a “critical size in public and alternative assets,” allowing it to “serve its customer base of insurers, pension funds, banking networks, and distributors more efficiently.” The combined firm would not top the largest pure play investment management business in Europe, Amundi, which boasts almost €2.2T AUM. But it would sure come close, and it would provide BNP with the ability to grow AUM across both public and private markets. AXA CEO Thomas Buberl said the decision was made “in the context of a rapidly consolidating and highly competitive asset management industry … [and create a] global asset manager with a wider product offering and a mutual objective to further their leading position in responsible investing.”

💸 AGM’s 2/20: A landmark deal between BNP and AXA would continue to hammer home the theme of asset management consolidation. What’s driving this consolidation? In large part, it’s a push into private markets for many of these firms. AXA Investment Managers has over €184B AUM and a 30-year track record in private markets investing, with core strategies like real estate equity, private debt and alternative credit, and private equity and infrastructure covered. AXA also has a GP stakes arm, a hedge fund investing arm, NAV financing capabilities, OCIO solutions, and a GP-led secondary solutions after acquiring secondaries firm W Capital Partners. Their comprehensive platform should serve to bolster BNP’s broader platform, particularly its institutional and HNW client base, which should benefit from this tie-up. Morningstar Senior Equity Analyst and Banking Expert Johann Scholtz cited AXA IM’s alternatives arm as a “key attraction” for BNP. The €218B (around 30 percent of assets under management) of alternative assets that AXA IM manages represents a large pool of fee-paying AUM and cross-sell ability to the BNP wealth channel, which could grow their AUM meaningfully to aim to rival Amundi. This acquisition also highlights the trend of platforms looking to become one-stop shops across public and private markets. BlackRock is another example of this trend, as they bolstered its private markets capabilities and AUM with its $12.5B acquisition of $100B AUM Global Infrastructure Partners. I’d expect to see continued consolidation in asset management, with alternatives being a major driver of this industry trend.

Who is hiring?

In order for alts to continue to go mainstream, we need the best talent to go into the space. Here are some openings at private markets firms. If you’d like to connect with any of these teams, let me know, and I’m happy to facilitate an introduction if appropriate. If you’re a company or fund in private markets, feel free to reach out to share a job description you’d like to be listed here to highlight for the Alt Goes Mainstream community.

🔍 Blackstone (Alternative asset manager) - Private Wealth Solutions - Educational Content Strategist, Vice President. Click here to learn more.

🔍 Apollo (Alternative asset manager) - Distribution & Wealth Services Associate. Click here to learn more.

🔍 iCapital (Private markets infrastructure investment platform) - RIA Marketing Manager - VP / SVP. Click here to learn more.

🔍 Hamilton Lane (Alternative asset manager) - VP, Private Wealth Content Strategist. Click here to learn more.

🔍 Blue Owl (Alternative asset manager) - VP / Principal, Private Wealth Market Leader. Click here to learn more.

🔍 73 Strings (Private markets data and valuation software) - Project Manager. Click hear to learn more.

🔍 Hightower Advisors (Wealth management) - Executive Director, Operations. Click here to learn more.

🔍 Goldman Sachs (Asset management) - Alternative Investing & Portfolio Management - Chief Financial Officer, Infrastructure. Click here to learn more.

The latest on Alt Goes Mainstream

Recent podcast or video episodes and blog posts on Alt Goes Mainstream:

🎥 Watch Dan Vene, Co-Founder & Managing Partner, Head of Investment Solutions at iCapital on episode 11 of the latest Monthly Alts Pulse. We discussed the evolution of the industry through the lens of iCapital’s growth and maturation, which has most recently included the creation of iCapital Marketplace. Watch here.

🎙 Hear Partners Group’s Co-Head of Private Wealth, Head of the New York Office, Member of the Global Executive Board Rob Collins share the how and why of one of the most exciting trends in private markets: evergreen funds. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, on the AGM podcast discuss driving efficiency across the entire value chain to transform private markets. Watch here.

🎙 Hear VC legend New Enterprise Associates’ Chairman Emeritus and Former Managing General Partner Peter Barris discuss how he transitioned from operator to VC and transformed NEA into a venture juggernaut in the process. Listen here.

🎙 Hear New Edge’s CEO, Managing Partner, and Co-Founder Rob Sechan and CIO Cameron Dawson discuss growing a cutting edge $44B platform to serve the wealth channel and help them navigate private markets. Listen here.

🎥 Watch live interviews with European alts leaders on 2024 European private market trends with Spencer Lake, Partner, 13books Capital, Toby Bailey, VP of Sales EMEA, Canoe, Rezso Szabo, General Partner, Illuminate Financial, Dan Kramer, Strategic Advisor, ex-CEO, Jaid AI, Tom Davies, Managing Director and President, Forge Europe, Levent Altunel, Co-Founder, bunch, Jay Wilson, Partner, AlbionVC. Watch here.

🎙 Hear Ritholtz Wealth Management’s Managing Partner Michael Batnick share views on how wealth managers are navigating private markets. Listen here.

🎙 Hear HgT’s Chairman of the Board Jim Strang provide us with a masterclass in private markets. Listen here.

🎥 Watch Lawrence Calcano, Chairman & CEO at iCapital, and I welcome special guest Robert Picard, Managing Director, Head of Alternative Investments at Hightower Advisors, as we take the pulse of private markets on the 10th episode of our monthly show, the Monthly Alts Pulse. We discuss the operational challenges and solutions in private markets. Watch here.

📝 Read about the evolution of GP stakes, why alternative asset management business models are better than SaaS, and our partnership with Todd Owens and David Ballard at Cantilever, a mid-market GP stakes firm anchored by BTG Pactual. Read here.

🎙 Hear 3i Members Co-Founder Mark Gerson share how to build engaged investing communities. Listen here.

🎙 Hear Yieldstreet Founder & CEO Michael Weisz discuss how to deliver private markets investment opportunities directly to consumers. Listen here.

🎥 Watch internet pioneer Steve Case, Chairman & CEO of Revolution and Co-Founder of America Online, share lessons learned from building the first internet company to go public and an investment firm built for the Third Wave of the internet. Watch & listen here.

🎙 Hear Carlyle Operating Partner & Net Health CEO Ron Books discuss lessons learned from growing ECi Software Solutions to $500M revenue and $200M EBITDA and working with private equity. Listen here.

🎙 Hear Blue Owl’s Global Private Wealth President & CEO Sean Connor share insights and lessons learned from working with the wealth channel. Listen here.

🎙 Hear Blackstone CTO John Stecher discuss how technology is transforming private markets. Listen here.

🎙 Hear how Chris Long, Chairman, CEO, and Co-Founder of Palmer Square Capital Management has built a $29B credit investment firm and a winning NWSL soccer franchise, the KC Current. Listen here.

🎙 Hear stories from building market-defining companies Blackstone, Airbnb, and private markets from Laurence Tosi, former CFO of Blackstone and Airbnb and Managing Partner & Founder of $7.6B investment firm WestCap. Listen here.

🎥 Watch me talk with David Weisburd of 10X Capital Podcast about why the wealth channel is becoming a centerpiece of the LP universe, drawing on my experience helping to build the wealth channel at iCapital as an early, pre-product employee and our investments at Broadhaven Ventures in private markets technology. Watch here.

🎙 Hear Chris Ailman, the CIO of $307B CalSTRS, discuss how he manages a portfolio with ~40% exposure to private markets. Listen here.

🎙 Hear wealth management industry titan Haig Ariyan, CEO of Arax Investment Partners, share his thoughts on the private equity opportunity in wealth management and why the intersection of wealth and alts is one of the biggest trends in private markets. Listen here.

📝 Read how 73 Strings CEO & Co-Founder Yann Magnan and team are leveraging AI to build a modern and holistic monitoring and valuation platform for private markets in The AGM Q&A. Read here.

🎙 Hear Robert Picard, Head of Alternatives at $117B AUM Hightower, discusses how they approach alternative investments. Listen here.

Thank you for reading. If you like the Alts Weekly, please share it with your friends, colleagues, and anyone interested in private markets.

Subscribe below and follow me on LinkedIn or Twitter (@michaelsidgmore) to stay up to date on all things private markets.

If you have any suggestions, would like me to feature an article, research, or would like to recommend a guest or topic for the Alt Goes Mainstream podcast, reach out! I’d love to include it in my next post or on a future podcast.

Special thanks to Michael Rutter and Nick Owens for their contributions to the newsletter.